Exchange Rate and Trade Balance in Nigeria: Testing for the Validity of J-Curve Phenomenon and Marshall-Lerner Condition

Innocent. U. Duru1* --- Millicent Adanne Eze2 --- Abubakar Sadiq Saleh3 --- Abubakar Yusuf4 --- Kelechi Uzoma5

1,5Department of Economics, Rhema University Nigeria, Aba, Abia State, Nigeria. |

AbstractThis study examined the validity of the J-Curve Phenomenon and Marshall-Lerner Condition in the Nigerian context using data from 1982-2020. The Autoregressive Distributed Lag Bounds test method of cointegration was employed for the analysis of short-run and long-run effects of exchange rate uncertainty on the trade balance. The long-run result endorsed the validity of the Marshall-Lerner Condition in Nigeria. Thus, a depreciation of the Naira improves the trade balance in the long run. However, the results of the short-run dynamics revealed that there is no J-Curve phenomenon in Nigeria. The study recommends diversification of exports to improve the performance of Nigeria’s non-oil exports. In addition, fiscal, monetary and exchange rate policies should be properly harmonized to tackle trade deficits. Furthermore, there should be more investment in Research and Development in Nigeria to improve the value of goods exported and the competitiveness of its exports in the arena of international trade. |

Licensed: |

|

Keywords: JEL Classification: |

|

Accepted: 14 March 2022 |

|

Funding: This study received no specific financial support. |

Competing Interests: The authors declare that they have no competing interests. |

1. Introduction

The nexus between exchange rate and trade balance have been studied comprehensively by policymakers, intellectuals, economists and researchers in both the emerging and developed economies of the world. To date, the mounting trade deficit is among the main challenges of the Nigerian economy. Dependence on exports of primary products, a large percentage of agricultural goods in total exports during the pre-1986 era, slow development of industries in the post-1986 era, the heavy dependence of industries on imported inputs, large import of refined fuel and manufactured goods, weak exchange rate policies and poor economic reforms strategies are some of the factors responsible for this. This development had resulted in rising trade imbalances for Nigeria. Bhattarai and Armah (2013) stated that ‘’the exchange rate has been used as a tool for regulating flows of trade and capital by many developing economies, which tend to have persistent deficits in the balance of payments’’ (p. 1126). This is a precondition for stable and sustainable economic growth in these emerging economies.

This implies that devaluation of the exchange rate could be utilized by these developing countries as a normal policy prescription to survive trade deficits by improving the competitiveness of exports thereby guaranteeing some extent of macroeconomic stability in their countries. Thus, depreciation of the domestic currency in these economies makes export cheaper while imported goods become expensive, therefore, exports would increase and imports would decrease. However, the opposite effect would result from the appreciation of the domestic currency. Even though trade deficits could be tackled through the exchange rate, World Bank (2020a), maintained that the competitiveness benefits of a devaluation or real depreciation have not been adequately utilized by economies in Africa.

For an emerging economy like Nigeria, serious policy issues arise from the link between exchange rate and trade balance. Thus, this study would give empirical ideas to policymakers about whether depreciation or devaluation of the Naira is an efficient means of mending the trade deficit. As was documented by Nusair (2017), the link between exchange rate and trade balance is very vital since it gives ideas to policymakers regarding the formulation and application of a regional policy of trade. Furthermore, information on the nexus between trade balance and exchange rate in Nigeria would arm policymakers with weapons of trade negotiations resulting in good trade agreements with trading partners.

Also, knowledge of the link between trade balance and exchange rate helps policymakers in Nigeria to realize desired macroeconomics results through designing and managing exchange rates and policies of trade. The outcome of this study could also serve as a foundation stone in the formulation of policies of trade. One of the policy measures introduced in Nigeria between 1986 and 1988 as a result of the introduction of the Structural Adjustment Programme (SAP) was the export promotion strategy. This was a result of the drawback of the import substitution strategy. It was meant to transform the Nigerian economy from an inward-oriented one to an outward-oriented one through the competitiveness of trade.

Theoretically, numerous methodologies have been used in the investigation of the relationship between trade balance and exchange rate. Those are the elasticity technique, the absorption method and the monetary method. However, the elasticity approach serves as the cornerstone for these other approaches. From the perspective of theory, the Marshall-Lerner condition postulated that devaluation of currency improves the trade balance of an economy in the long run if the sum of the price elasticities of exports and imports is greater than unity. Conversely, the J-curve hypothesis advocates that devaluation of a country’s currency deteriorates the trade balance first before improving it afterwards (Magee, 1973). Hence, from the point of view of theory, the devaluation of the real exchange rate is anticipated to result in an enhancement of the trade balance in the long run following a deterioration in the short run.

In the contention of Marwah and Klein (1996), many economies drifted to the flexible exchange rate with increased interests in the impact of devaluation on the trade balance of both emerging and developed countries following the collapse of the Breton Woods Agreement in 1973. Despite the export-oriented policies and successive exchange rate reforms introduced in Nigeria to enhance trade balance, trade deficits had continued to persist. Furthermore, regardless of the mushrooming of literature on the link between exchange rate and trade balance from both developed and developing economies employing various econometric methods, the evidence remains diverse and inconclusive. Thus, as a result of the lingering trade imbalance in Nigeria, an investigation of the connection between exchange rate and trade balance is imperative.

The questions that would be addressed in this study are: Is the Marshall-Lerner Condition valid in Nigeria? Does the J-curve phenomenon hold in Nigeria? Hence, the main objective of this study is to investigate the validity of the J-Curve Phenomenon and Marshall-Lerner Condition in Nigeria. The study is organized into five sections as follows: Following the introduction in section 1 is the literature review and theoretical framework in section 2. Section 3 discusses the methodology. Data presentation, analysis and discussion of results would be the focus of section 4 whereas the conclusion and recommendations would be presented in section 5.

2. Literature Review and Theoretical Framework

2.1. Empirical Literature

Several studies have employed diverse datasets and methodologies to examine the short-run and long-run connection between real exchange rates and trade balance for numerous developing and developed economies. However, the findings of this empirical literature have been conflicting. Furthermore, the practical evidence on the J-Curve Phenomenon and the Marshall-Lerner Condition remains unsettled. Some of these papers are:

Adeniyi, Omisakin, and Oyinlola (2011) employed data from 1980Q1-2007Q4 and the Autoregressive Distributed Lag (ARDL) technique to cointegration to probe the presence or otherwise of the J-Curve Phenomenon in four West African Monetary Zone (WAMZ) economies of Sierra Leone, Nigeria, Ghana and the Gambia. The results of cointegration tests revealed that a long-run relationship exists between trade balances and the explanatory variables for all economies. In addition, the results showed that the J-Curve hypothesis is valid for Sierra Leone and Nigeria.

In another study, Chiloane (2012) used the Johansen Cointegration and Vector Error Correction Modelling (VECM) techniques and quarterly data from 1995-2010 to examine the short and long-run impacts of the Rand real exchange rate on the manufacturing trade balance of South Africa. The validity of the J-Curve effect in South Africa and the existence of the Marshall-Lerner Condition in the manufacturing sector of South Africa were investigated as well. The findings revealed that Real Effective Exchange Rate (REER), foreign and real domestic incomes are vital determinants of the trade balance in the manufacturing sector.

Also, there is a presence of cointegration among these variables. The real domestic income and REER exerted a negative relationship with the trade balance in the long run. However, real foreign income had a positive relationship with the trade balance of the domestic manufacturing sector in the long run. The results of the short-run model showed that a devaluation of the domestic currency leads to a deterioration in the trade balance of the manufacturing sector. This fact with the results of the long-run indicates proof of the presence of the J-Curve effect in the trade balance of the manufacturing sector of South Africa. Evidence from the long-run dynamics shows that the Marshall-Lerner Condition holds. Evidence from this study revealed that the Rand devaluation is needed to improve the trade balance of the manufacturing sector.

Similarly, Saqib (2013) used the Engel-Granger co-integration approach to examine the long-run link between exchange rate oscillation and trade balance in Saudi Arabia. The result revealed a positive and significant long-run relationship between the exchange rate oscillation and trade balance in the long run but not in the short run. Piskin (2014) in a related study employed data from 1987Q1-2013Q3 and ARDL methodology to test the existence of the Marshall-Lerner Condition and J-Curve Hypothesis in Turkey. The findings revealed that a long-run relationship exists among trade balance, domestic income, real exchange rate and foreign income. The long-run result showed that the Marshall-Lerner condition is valid in Turkey. However, the result of the short-run dynamics revealed that there is no J-Curve effect in the Turkish economy.

In addition, Eke, Eke, and Obafemi (2015) utilized the Error Correction Model (ECM) and annual data from 1970 to 2012 in another study to examine the impact of exchange rate on the trade balance in Nigeria. The result of the test of co-integration showed the presence of a long-run relationship between trade balance and the explanatory variables. The finding revealed that the exchange rate had a negative and significant impact on the trade balance. This finding implies that depreciation of the domestic currency leads to improvement in the trade balance.

Utilizing cointegration, VECM and data from 1980 to 2013, Anning, Sunday, and Pacific (2015) as well investigated the impact of exchange rate on Ghana’s trade balance and tested the presence of the Marshall Lerner Condition. The findings revealed that REER is negatively linked to trade balance in the long run. In the short-run, the coefficient of REER at lag two (the previous year) was negative and significant. However, the coefficient of REER at lag one was negative and not significant.

This defies the J-Curve phenomenon that states that depreciation may not make trade balance improve in the current period but will meaningfully influence the trade balance thus making it improve in later periods. Thus, the J-Curve hypothesis does not hold in Ghana. However, the negative and significant relationship between the REER and trade balance, in the long run, implies that a devaluation of the cedi would result in an improvement in the trade balance of Ghana. This result confirms that the Marshall Lerner condition holds in Ghana.

Likewise, Matlasedi, Ilorah, and Zhanje (2015) used the ARDL methodology to investigate the relationship between REER and trade balance of South Africa and whether the J-Curve Phenomenon and the Marshal-Lerner Condition hold in South Africa. The results showed the presence of a long-run equilibrium relationship among trade balance, REER, terms of trade, domestic GDP, foreign reserves and money supply. Furthermore, the findings revealed that the devaluation of the ZAR improves the balance of trade in the long run. This evidence shows that Marshal-Lerner Condition holds in South Africa. However, in the short run, depreciation of the ZAR results in a deterioration of the trade balance. This evidence confirms that the J-curve effect holds in South Africa.

Akosah and Omane-Adjepong (2017) employed linear and Threshold ARDL, threshold regression and impulse response functions (IRFs) techniques to investigate the impact of real exchange rate on external trade performance in Ghana. The validity of Marshall-Lerner Condition, the J-Curve and Kulkarni Hypotheses in Ghana were evaluated as well. The result revealed a steady long-run association between movements of real exchange rate and trade balance in Ghana. However, the real exchange rate exerted an asymmetric effect on the trade balance in Ghana. Empirical evidence in support of the Marshall-Lerner Condition (MLC), the J-Curve effect and the Kulkarni Hypothesis in Ghana were found during the eras of marginal real depreciation or a tranquil government. However, during the eras of unwarranted real depreciation or an intemperate government, there was less noticeable proof of the J-curve effect.

Using data from 2000Q1-2016Q4, the Vector Auto-Regressive (VAR) model and the Granger causality test, Man (2018) in a similar study, examined the relationship between REER and trade balance in Vietnam. The finding of the Granger causality test showed that the uncertainty of REER causes the oscillation of export-import value in Vietnam. Furthermore, the results of the impulse response function test showed that the J-curve Phenomenon holds in Vietnam. Furthermore, Onakoya, Johnson, and Ajibola (2019) used the Johansen Cointegration technique, the Granger causality test and data from 1981-2016 to examine the existence of the J-Curve effect in Nigeria. The results revealed that the exchange rate had a positive and significant impact on the trade balance in the short-run and long-run respectively. Furthermore, there was no evidence to support the existence of the J-Curve effect in Nigeria.

Employing linear and nonlinear ARDL and data from 1980 to 2018, Shuaibu and Isah (2020) investigated the link between exchange rate and trade balance in five African economies of Algeria, Cameroon, Nigeria, South Africa and Uganda. Findings based on the linear model showed that the J-Curve Phenomenon is valid in Uganda in the short run. However, evidence supporting the J-curve effect, in the long run, was only found for Algeria. On the other hand, the results of the nonlinear analysis revealed that the J-Curve Phenomenon is valid in South Africa and Uganda in the short run. However, evidence in support of a J-Curve effect, in the long run, was only found in Algeria and Uganda.

In the same vein, Kansel and Bari (2020) utilized data from 2003Q1-2018Q4 and the ARDL methodology to examine the impact of exchange rate uncertainty on the trade balance of Turkey after she drifted to the floating exchange rate. The results showed that the J-Curve Phenomenon does not hold in Turkey. Thus, the impact of the exchange rate on trade balance defies expectations of theories. In another similar study, Mhaka (2020) used the ARDL and Pooled Mean Group (PMG) estimators to investigate the relationship between exchange rates and bilateral trade balances of Southern African Customs Union (SACU) member countries of Swaziland, South Africa, Namibia, Lesotho and Botswana with their trading partners. Furthermore, the existence of the Purchasing Power Parity (PPP) theory, the Marshall-Lerner condition and the J-curve effect in the SACU economies were tested in this study. Data from 1995M01-2017M11 was used to test for the evidence of the PPP.

The results revealed that there was no evidence of PPP in SACU member countries based on their Nominal Effective Exchange Rate (NEER). However, there was evidence of the PPP condition in only South Africa from the perspective of the REER. Furthermore, unit root examinations were executed applying the panel data. The findings of the Fractional Frequency Flexible Fourier Form (FFFFF) test using panel data revealed a strong indication of the PPP. However, evidence of the PPP theory using the SACU's NEER was rejected by the standard Dickey-Fuller (DF) test. Both the standard DF and the FFFFF investigations indicated strong proof of PPP theory from the angle of SACU’s REER. Furthermore, annual data from 1980-2017 was employed to test for the presence of the Marshall-Lerner condition.

The ARDL (PMG) model was employed to examine the time series data. However, the panel data utilized the panel ARDL, Fully Modified Ordinary Least Squares (FMOLS) technique and the Dynamic OLS (DOLS) technique of estimation. The short-run result of the PMG/ARDL model displayed no proof to support the presence of the Marshall-Lerner condition for all SACU member countries. On the other hand, just two outside the five economies revealed evidence of the Marshall-Lerner condition in the long run. In the long run, the PMG/ARDL model showed robust proof of the Marshall-Lerner condition in Namibia and Botswana. Likewise, the panel models (PMG/ARDL, the FMOLS and DOLS) demonstrated no proof of the Marshal Lerner condition in the SACU states.

Finally, annual data from 1995 to 2016 was utilized to test for the presence of the J-curve effect in the SACU economies. The findings indicated that devaluations of the exchange rate would be helpful in 8 outside the 19 trade industries in the SACU area whereas 11 industries left over would be hurt. From the angle of theory, J-curve effects were unearthed in 6 out of the 19 industries that depreciation of exchange rate originally ruined trade balances and subsequently adjust to positive long-run effects. Ibrahim and Bashir (2021) in another study used the ARDL, Granger causality test methodology and data from 1978 to 2017 to investigate the impact of real exchange rate uncertainty on the external trade balance of Sudan. The results showed that exchange rate depreciations do not affect the trade balance. Hence, J-Curve Phenomenon does not hold in Sudan. The result of the Granger causality test revealed a unidirectional relationship from trade ratio to the real exchange rate.

Using the ARDL method of cointegration, Keho (2021) in a similar study investigated the association between real exchange rate and trade balance in Cote d’Ivoire from 1975-2017. The findings revealed that domestic income had a negative and significant impact on the trade balance in the short-run and long-run respectively. Furthermore, a devaluation of the real exchange rate results in an improvement in the trade balance in the short and long run respectively. Thahara, Rinosha, and Shifaniya (2021) utilized data from 1977-2019, ARDL methodology and Granger causality test to examine the short-run and long-run link between the exchange rate and trade balance in Sri Lanka. The short-run results revealed that inflation had a positive effect on the trade balance. However, in the long run, the exchange rate and the GDP had adverse impacts on the trade balance. In addition, the results showed that the J-Curve Phenomenon exists in Sri Lanka. Furthermore, the findings revealed that the Marshall-Lerner Condition holds in Sri Lanka. The results of the Granger causality test revealed a unidirectional causality from exchange rate to trade balance and from GDP to trade balance.

Evidence from the growing literature from developing and developed economies reviewed indicates that the short and long-run connection between exchange rate and trade balance has been explored widely using diverse econometric methodologies and datasets. The considerable empirical literature on the Marshall-Lerner Condition and J-curve Phenomenon is flooded with contradictory results contingent on the country, stage of development, models, period of estimation and the technique of estimation utilized for investigation. While some empirical studies found no support for the J-curve phenomenon (Adeniyi et al., 2011; Bahmani-Oskooee & Brooks, 1999; Bahmani-Oskooee & Ratha, 2004; Bahmani-Oskooee, Economidou, & Goswami, 2006; Bahmani-Oskooee & Cheema, 2009; Bahmani-Oskooee & Gelan, 2012; Halicioglu, 2007; Halicioglu, 2008; Hsing & Savvides, 1996; Meniago & Eita, 2017; Moodley, 2010; Oyinlola, Omisakin, & Adeniyi, 2013; Perera, 2011; Saqib, Ahmad, Faraz, Muhammd, & Shehzadi, 2014; Singh, 2004; Umoru & Eboreime, 2013; Wilson, 2001; Ziramba & Chifamba, 2014) , others (Adeniyi et al., 2011; Anju & Uma, 1999; Anning et al., 2015; Bahmani-Oskooee & Alse, 1994; Bahmani-Oskooee & Kantipong, 2001; Bahmani-Oskooee & Goswami, 2003; Bahmani-Oskooee & Kutan, 2009; Bahmani-Oskooee & Fariditavana, 2015; Bahmani-Oskooee & Fariditavana, 2016; Bhattarai & Armah, 2013; Chiloane, Pretorius, & Botha, 2014; Doroodian Sr, Jung, & Boyd, 1999; Hacker & Hatemi-J, 2003; Hussain & Haque, 2014; Iyke & Ho, 2017; Iyke & Ho, 2018; Kulkarni, 1996; Kyophilavong, Shahbaz, & Uddin, 2013; Marwah & Klein, 1996; Matlasedi et al., 2015; Narayan, 2004; Onafowora, 2003; Petrović & Gligorić, 2010; Rawlins, 2011; Schaling & Kabundi, 2014; Shirvani & Wilbratte, 1997) found support for the J-curve phenomenon.

On the other hand, while some empirical studies found no evidence supporting the Marshall-Lerner condition (Alege & Osabuohien, 2015; Bahmani, Harvey, & Hegerty, 2013; Dong, 2017; Loto, 2011; Lucy, Sunday, & Pacific, 2015; Meniago & Eita, 2017; Sek & Har, 2014; Shahbaz, Awan, & Ahmad, 2011) , others (Arize, 1994; Bahmani-Oskooee, 1998; Bahmani-Oskooee & Niroomand, 1998; Bahmani-Oskooee & Kara, 2005; Brahmasrene & Jiranyakul, 2002; Cambazoglu & Gunes, 2016; Eita, 2013; Hooy & Chan, 2008; Hsing, 2010; Jamilov, 2013; Mahmud, Ullah, & Yucel, 2004; Matlasedi et al., 2015; Mwito, Muhia, Kiprop, & Kibet, 2015; Pandey, 2013; Rafindadi & Yusof, 2014; Reis Gomes & Senne Paz, 2005; Sastre, 2012; Smal, 1996) found evidence supporting the Marshall-Lerner condition.

However, facts from this expanding literature remain diverse and unconvincing due to the data employed, methodology of investigation and the period studied. Besides, the practical proof on the J-Curve Phenomenon and the Marshall-Lerner Condition is still unsettled. Given the contradictory results, the efficacy of exchange rate depreciation in correcting trade balance remains a debatable issue. The majority of these studies reviewed are on developed economies and developing economies of the world besides Africa. The link between the exchange rate and trade balance of Nigeria remains a research area that few scholars have probed (see, for instance, (Adeniyi et al., 2011; Eke et al., 2015; Loto, 2011; Onakoya et al., 2019) ). Also, the empirical studies investigating the J-curve Phenomenon and the Marshal-Lerner condition in Nigeria are inadequate. Hence, this study intends to strengthen the empirical literature on Nigeria in particular and Africa in general by investigating the case of Nigeria using data from 1982 to 2020.

2.2. Theoretical Framework

Three main approaches have been employed in the investigation of the link between exchange rates and trade balance. These are the elasticity approach, absorption approach of Sydney Alexander and the monetary approach to the balance of payments adjustment. However, Harberger (1950); Meade (1951) and Alexander (1952); Alexander (1959), modelled the absorption approach at the start of the 1950s to examine the impacts of devaluation on national income. Thus, they brought new insights in terms of analysis with regards to the absorption approach (Kenen, 1985; Krueger, 1983). The absorption theory of balance of payments adjustment is also known as the Keynesian approach. The advocates of the absorption and monetary approaches to adjustment in the balance of payments elucidated, reframed and integrated the shortcomings of the elasticity approach in arriving at their approaches.

For instance, the absorption approach resolved some of the initial flaws of the elasticity approach thereby modifying the focal point of this method which is analysing the balance of payments from the economic angle (Hernan, 1999). The absorption approach dwelled on economic aggregates which Keynes is known for in terms of its analysis against the elasticity approach that based its findings on the impacts of exchange rate uncertainties on individual microeconomic behaviour. However, the central point of this approach is that a rise in income above overall national expenditures is a sine qua non for any improvement in the trade balance.

However, the theoretical foundation of this study would be anchored on the elasticity approach. This is because it can be applied to the trade balance or balance of payments on the current account. The ground-breaking article of Bickerdike (1920) was the first attempt to model the link between exchange rates and trade balance. However, it continued with the papers of Robinson (1947) and Metzler (1948) respectively. This resulted in the emergence of the Bickerdike-Robinson-Metzler (BRM) model or the elasticity approach to adjustment in the balance of payments. Hence, the elasticity approach laid the foundation stone in terms of investigating the link between exchange rates and trade balance. Furthermore, Marrewijk (2005) maintained that the elasticity approach dwells on the link between real exchange rates and the movement of goods and services.

The volume effect and price effect of devaluation or depreciation on the current account balance is the foundation of the elasticity approach (Piskin, 2014). In the first place, devaluation or depreciation of the local currency in contrast to the foreign currency results in comparatively cheaper local goods for both local populations and aliens. Comparatively, commodities imported would become more expensive. The resultant effect would be a rise in the volume of exported commodities and a decline in the volume of imported commodities known as the volume effect. Because of this, there would be an improvement in the trade balance.

However, owing to devaluation or depreciation extra money comparatively would be dedicated to the purchase of imported commodities and this condition is termed the price effect (Piskin, 2014). Even though there is an improvement in the balance of trade as a result of the volume effect, the price effect worsens it. Ultimately, the net impact of devaluation or depreciation on the balance of trade would depend on which of the two effects (volume or price effect) dominates the other based on elasticities of imports and exports demand (Pilbeam, 1992). The contributions of Marshall (1923) and Lerner (1944) brought the elasticity approach to the limelight. They opined that a real devaluation or a depreciation of the local currency would improve the trade balance if the sum of the price elasticities of exports and imports exceeds one.

3. Methodology and Model Specification

The ARDL bound test methodology was used to unearth the short-term and long-term effects between exchange rate and trade balance. The annual time series data employed in this study was from 1982 to 2020. The period of study was informed by the different policy episodes of the exchange rate in Nigeria. CBN (2016) maintained that the regime of the exchange rate from 1957 to 1985 was fixed. However, 1986 to 2014 was a period of the flexible exchange rate. Finally, from 2014 to date was a period of managed float characterized by intentional Central Bank of Nigeria (CBN) intervention, realignment of the Naira and Bureaux De Change (BDC) reforms. Except for the World GDP (Constant 2015 US$ in millions) obtained from the database of the United Nations Conference on Trade and Development (UNCTAD), the rest of the data were derived from the World Bank Development Indicators database.

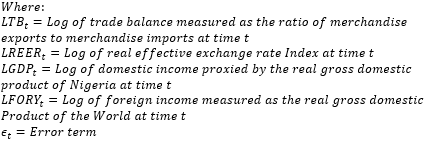

The time series characteristics of the variables were checked for unit root using the Augmented Dickey-Fuller (ADF) test. Since there were more trade deficits than surpluses during the sample period, following (Baharumshah, 2001) and to ensure that our model was stated in logarithm form, the trade balance was measured as the ratio of merchandise exports to merchandise imports. This would not be possible with the conventional trade balance expressed as exports minus imports characterized by negative values indicating trade deficits that are incapable of being logged. Under this situation, the estimated coefficients would be considered as elasticities. The model used by Eke et al. (2015) and Bahmani-Oskooee and Brooks (1999) would be utilized in this study with modification in Equation 1 as follows:

The model is specified in logarithm form. The logarithm sign is denoted by L. The world real industrial production index used as a proxy for income of trade partners was dropped from the model. We incorporated foreign income that is proxied by the real gross domestic product of the world. Furthermore, contrary to the trade balance measured as the difference between exports and imports in the adapted models, our trade balance was measured as the ratio of merchandise exports to merchandise imports.

The effect of REER changes on the trade balance is ambiguous. It is anticipated to be positive or negative. Theoretically, the J-Curve suggests that a devaluation of the local currency deteriorates the balance of trade in the short run. However, it enhances it in the long run.

The link between domestic income and trade balance is anticipated to be negative. Thus, growth of the domestic income in Nigeria would raise imports than exports thereby deteriorating the balance of trade. In addition, foreign income or trading partners' income is expected to have a positive link with the trade balance. Hence, as the income of trading partners’ increases, the exports of Nigeria would increase and consequently enhance the trade balance.

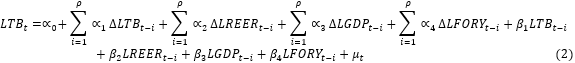

Stating Equation 1 in ARDL form yields:

Where p, Δ, α0, µt, α1-α4 and β1-β4 denote the lag length, difference operator, the drift, disturbance term, parameters of the short-run dynamics and the parameters of the long-run relationship respectively. Under the bounds testing approach to cointegration, the Wald-test would be utilized to unearth the presence of cointegration relationship between TB and its determinants in levels with a null hypothesis of absence of cointegration.

against:

If the F-statistic is greater than the upper critical value bound, then there is cointegration among the variables. However, if it is below the lower critical value bound, then there is no cointegration. If it falls between the lower and upper critical value bounds, then the results are inconclusive.

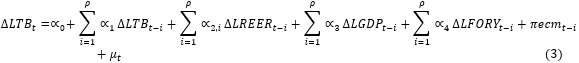

The error correction form of the ARDL model is stated in Equation 3 as:

Where π and ecmt-1 denote the speed of adjustment and the error correction term respectively.

4. Data Presentation, Analysis and Discussion of Results

4.1. Results of Augmented Dickey-Fuller (ADF) test.

The results of the ADF unit root test in Table 1 revealed that the variables were either I(0) or I(1).

| Variable | Augmented Dickey-Fuller (ADF) |

||

Level |

First Difference |

I(d) |

|

| LTB | -2.9052** |

- |

I (0) |

| LREER | -3.2964** |

- |

I (0) |

| LGDP | -0.8806 |

-5.0803*** |

I (1) |

| LFORY | -1.8728 |

-3.1351** |

I (1) |

| Note: *** and ** indicate statistical significance at the 1% and 5% levels. |

| F-statistics | Significance Level |

Lower Critical Value Bound I (0) |

Upper Critical Value Bound I (1) |

| 5.5161 | 1% |

4.29 |

5.61 |

5% |

3.23 |

4.35 |

|

10% |

2.72 |

3.77 |

| Note: Critical value bounds for the F-statistic from Pesaran, Shin, and Smith (2001). |

4.2. Results of Bound Test

The results in Table 2 revealed that the calculated F-statistics was greater than the upper critical value bound I(1) at a 5% significance level. This implies the presence of cointegration or long-run relationship among the variables. The long-run link among the variables was estimated as a result of the presence of cointegration.

| Test | Type of Statistic |

Test Statistic |

P-value |

| Breusch-Godfrey Serial Correlation LM Test | 𝜒2 |

5.3056 |

0.0705 |

| Ramsey RESET test | F |

0.1890 |

0.6677 |

| Jarque-Bera normality test | 𝜒2 |

1.2845 |

0.5261 |

| Heteroskedasticity Test: ARCH | 𝜒2 |

6.2899 |

0.8533 |

4.3. Results of Diagnostic Tests

In Table 3, the results of the diagnostic tests revealed that the model passed all the diagnostic tests. Based on the findings, there were no problems of serial correlation and misspecification in the model. Also, the residual was normally distributed. Furthermore, the result showed that the model had no problem with heteroscedasticity. The probability values exhibited by these tests were greater than the 5% level of significance.

| LREER | LGDP |

LFORY |

C |

| -0.2129 | -0.118 |

-0.0564 |

3.0194 |

| [-2.6526***] | [-0.3799] |

[-0.2365] |

[1.2408] |

| -0.0137 | -0.7072 |

(-0.815) |

-0.2262 |

| Note: Probability Values are in bracket - ( ). t-statistics are in []. *** denote statistical significance at 1% level. |

4.4. Results of Estimated Long-run Coefficients

Based on the long-run result represented in Table 4, the REER had a negative impact on the trade balance. This corroborates that as the REER declines, there will be an improvement in the trade balance. Thus, a devaluation of the Nigerian Naira by 1% would result in a 0.2129-unit expansion in the trade balance. Since the long-run coefficient of the REER was negative and significant, the Marshall-Lerner condition holds. Thus, the Marshall-Lerner Condition is valid in Nigeria. This finding suggests that depreciation of REER leads to an enhancement of trade balance.

This finding agrees with the submissions of Thahara et al. (2021); Bahmani-Oskooee (1998); Bahmani-Oskooee and Niroomand (1998); Bahmani-Oskooee and Kara (2005); Hsing (2010); Sastre (2012); Chiloane (2012); Pandey (2013); Piskin (2014); Rafindadi and Yusof (2014); Anning et al. (2015); Matlasedi et al. (2015); Cambazoglu and Gunes (2016); Thahara et al. (2021). However, it violates the results of Loto (2011); Shahbaz et al. (2011); Bahmani et al. (2013); Sek and Har (2014); Lucy et al. (2015); Alege and Osabuohien (2015); Meniago and Eita (2017) and Dong (2017). The domestic income had a negative and insignificant impact on the trade balance. Furthermore, foreign income had a negative and insignificant impact on the trade balance.

| Dependent Variable: LVEXP | ||||

| Variable | Coefficient |

Std. Error |

t-Statistic |

Prob. |

| Δ(LTB(-1)) | 0.1390 |

0.1551 |

0.8965 |

0.3786 |

| Δ(REER) | -0.1994 |

0.1356 |

-1.4706 |

0.1539 |

| Δ(REER(-1)) | 0.2128 |

0.1192 |

1.7855* |

0.0863 |

| Δ(LGDP) | 4.4183 |

1.1407 |

3.8732*** |

0.0007 |

| Δ(LGDP(-1)) | 0.7364 |

1.3734 |

0.5362 |

0.5966 |

| Δ(LFORY) | 9.3899 |

2.3994 |

3.9134*** |

0.0006 |

| Δ(LFORY(-1)) | 2.5729 |

3.5129 |

0.7324 |

0.4707 |

| ECMt-1 | -1.1477 |

0.2595 |

-4.4225*** |

0.0002 |

| ECM = LTB – 0.2129*LREER – 0.1180*LGDP - 0.0564*LFORY + 3.0194*C | ||||

| Note: *** and * denote statistical significance at 1% and 10% levels. |

4.5. Results of the Short-run Dynamic Model

Table 5 shows the results of the short-run dynamics. The coefficient of trade balance in the past year was positive and insignificant. In addition, the REER at lag 1 was positive and significant. This implies that during that time, a 1% appreciation of the Nigerian Naira results in a 0.2128 unit’s appreciation in the trade balance. This is not in harmony with the J-Curve phenomenon, which states that devaluation may not instantly improve trade balance in the immediate time but will exert a significant effect on the trade balance thus making it improve in the following periods. Hence, the J-Curve Phenomenon does not exist in Nigeria. However, the REER was expected to exert a negative impact on trade balance at lag 1 and a positive impact on it in the current period for the J-Curve Phenomenon to hold.

This result agrees with the findings of Piskin (2014); Anning et al. (2015);Onakoya et al. (2019); Kansel and Bari (2020);Ibrahim and Bashir (2021). On the other hand, it violates the results of Adeniyi et al. (2011); Matlasedi et al. (2015); Man (2018) and Thahara et al. (2021). The GDP of the current short-run era had a positive relationship with the trade balance. This implies that GDP had a positive impact on the trade balance in the short run. Furthermore, the foreign income of the current short-run period had a positive effect on the trade balance. A 1% increase in foreign income resulted in a 9.3899-unit increase in the trade balance. According to expectation, the Error Correction Term (ECT) of -1.1477 had a negative sign and was also highly significant. This implied that the speed of adjustment towards long-run equilibrium would be at 114.78%.

5. Conclusion and Recommendations

This study utilized the ARDL bounds testing methodology to cointegration to analyze the short-run and long-run impacts of exchange rates uncertainty on the trade balance in Nigeria from 1982-2020. The long-run findings showed that devaluation or depreciation of exchange rates results in improvements in the trade balance of Nigeria. However, the short-run results showed that the J-Curve Phenomenon does not exist in Nigeria. The study recommends diversification of exports to improve the performance of non-oil exports. In addition, fiscal, monetary and exchange rate policies in Nigeria should be properly harmonized in the country to tackle trade deficits. Furthermore, there should be more investment in Research and Development (R&D) in Nigeria to improve the value of goods exported and the competitiveness of its exports in the arena of international trade.

References

Adeniyi, O., Omisakin, O., & Oyinlola, A. (2011). Exchange rate and trade balance in West African Monetary Zone: Is there a J-Curve. The International Journal of Applied Economics and Finance, 5(3), 167-176.Available at: https://doi.org/10.3923/ijaef.2011.167.176.

Akosah, N. K., & Omane-Adjepong, M. (2017). Exchange rate and external trade flows: Empirical evidence of J-Curve Effect in Ghana. MPRA Paper No. 86640.

Alege, P. O., & Osabuohien, E. S. (2015). Trade-exchange rate nexus in Sub-Saharan African countries: Evidence from panel cointegration analysis. Foreign Trade Review, 50(3), 151-167.Available at: https://doi.org/10.1177/0015732515589440.

Alexander, S. S. (1952). Effects of a devaluation on a trade balance. Staff Papers-International Monetary Fund, 2(2), 263-278.

Alexander, S. S. (1959). Effects of a devaluation: A simplified synthesis of elasticities and absorption approaches. The American Economic Review, 49(1), 22-42.

Anju, G.-K., & Uma, R. (1999). Is there a J-curve? A new estimation for Japan. International Economic Journal, 13(4), 71-79.Available at: https://doi.org/10.1080/10168739900080029.

Anning, L., Sunday, R. J., & Pacific, Y. K. T. (2015). Exchange rate and trade balance in Ghana: Testing the validity of the Marshall-Lerner condition. International Journal of Development and Emerging Economics, 3(2), 38-52.

Arize, A. C. (1994). Cointegration test of a long-run relation between the real effective exchange rate and the trade balance. International Economic Journal, 8(3), 1-9.Available at: https://doi.org/10.1080/10168739400000001.

Baharumshah, A. Z. (2001). The effect of exchange rate on bilateral trade balance: New evidence from Malaysia and Thailand. Asian Economic Journal, 15(3), 291-312.Available at: https://doi.org/10.1111/1467-8381.00135.

Bahmani-Oskooee, M., & Alse, J. (1994). Short-run versus long-run effects of devaluation: Error-correction modeling and cointegration. Eastern Economic Journal, 20(4), 453-464.

Bahmani-Oskooee, M. (1998). Cointegration approach to estimate the long-run trade elasticities in LDCs. International Economic Journal, 12(3), 89-96.Available at: https://doi.org/10.1080/10168739800080024.

Bahmani-Oskooee, M., & Niroomand, F. (1998). Long-run price elasticities and the Marshall–Lerner condition revisited. Economics Letters, 61(1), 101-109.Available at: https://doi.org/10.1016/s0165-1765(98)00147-5.

Bahmani-Oskooee, M., & Brooks, T. J. (1999). Bilateral J-curve between US and her trading partners. Review of World Economics, 135(1), 156–165.

Bahmani-Oskooee, M., & Kantipong, T. (2001). Bilateral J-curve between Thailand and her trading partners. Journal of Economic Development, 26(2), 107-118.

Bahmani-Oskooee, M. M., & Goswami, G. G. (2003). A disaggregated approach to test the J-curve phenomenon: Japan versus her major trading partners. Journal of Economics and Finance, 27(1), 102-113.Available at: https://doi.org/10.1007/bf02751593.

Bahmani-Oskooee, M., & Ratha, A. (2004). The J-curve dynamics of US bilateral trade. Journal of Economics and Finance, 28(1), 32-38.

Bahmani-Oskooee, M., & Kara, O. (2005). Income and price elasticities of trade: some new estimates. The International Trade Journal, 19(2), 165-178.Available at: https://doi.org/10.1080/08853900590933125.

Bahmani-Oskooee, M., Economidou, C., & Goswami, G. G. (2006). Bilateral J-curve between the UK vis-à-vis her major trading partners. Applied Economics, 38(8), 879-888.Available at: https://doi.org/10.1080/00036840500399388.

Bahmani-Oskooee, M., & Cheema, J. (2009). Short-run and long-run effects of currency depreciation on the bilateral trade balance between Pakistan and her major trading partners. Journal of Economic Development, 34(1), 19-41.

Bahmani-Oskooee M., & Kutan, A. M. (2009). The J-curve in the emerging economies of Eastern Europe. Applied Economics, 41(20), 2523-2532.Available at: https://doi.org/10.1080/00036840701235696.

Bahmani-Oskooee, M., & Gelan, A. (2012). Is there J-Curve effect in Africa? International Review of Applied Economics, 26(1), 73-81.

Bahmani-Oskooee, M., & Fariditavana, H. (2015). Nonlinear ARDL approach, asymmetric effects and the J-curve. Journal of Economic Studies, 42(3), 519–530.Available at: https://doi.org/10.1108/JES-03-2015-0042.

Bahmani-Oskooee, M., & Fariditavana, H. (2016). Nonlinear ARDL approach and the J-curve phenomenon. Open Economies Review, 27(1), 51-70.Available at: https://doi.org/10.1007/s11079-015-9369-5.

Bahmani, M., Harvey, H., & Hegerty, S. W. (2013). Empirical tests of the Marshall-Lerner Condition: A literature review. Journal of Economic Studies, 40(3), 411–443.

Bhattarai, K., R., & Armah, M. K. (2013). The effects of exchange rate on the trade balance in Ghana: Evidence from cointegration analysis. African Journal of Business Management, 7(14), 1126-1143.

Bickerdike, C. F. (1920). The instability of foreign exchange. The Economic Journal, 30(117), 118-122.Available at: https://doi.org/10.2307/2223208.

Brahmasrene, T., & Jiranyakul, K. (2002). Exploring real exchange rate effects on trade balances in Thailand. Managerial Finance, 28(11), 16–27.Available at: https://doi.org/10.1108/03074350210768130.

Cambazoglu, B., & Gunes, S. (2016). Marshall-Lerner Condition analysis: Turkey case. Economics, Management and Financial Markets, 11(1), 272-283.

CBN. (2016). Foreign exchange. Central Bank of Nigeria Education in Economics Series No. 4.

Chiloane, M. L. (2012). Modelling the relationship between the exchange rate and the trade balance in South Africa. An Unpublished Magister Commerce in Economic Development and Policy Issues Thesis of the University of Johannesburg.

Chiloane, L., Pretorius, M., & Botha, I. (2014). The relationship between the exchange rate and the trade balance in South Africa. Journal of Economic and Financial Sciences, 7(2), 299-314.Available at: https://doi.org/10.4102/jef.v7i2.142.

Dong, F. (2017). Testing the Marshall-Lerner condition between the US and other G7 member countries. The North American Journal of Economics and Finance, 40, 30-40.Available at: https://doi.org/10.1016/j.najef.2017.01.003.

Doroodian Sr, K., Jung, C., & Boyd, R. (1999). The J-curve effect and US agricultural and industrial trade. Applied Economics, 31(6), 687-695.Available at: https://doi.org/10.1080/000368499323904.

Eita, J. H. (2013). Estimation of the Marshall-Lerner condition for Namibia. International Business & Economics Research Journal (IBER), 12(5), 511-518.Available at: https://doi.org/10.19030/iber.v12i5.7826.

Eke, I. C., Eke, F. A., & Obafemi, F. N. (2015). Exchange rate behaviour and trade balances in Nigeria: An empirical investigation. International Journal of Humanities and Social Science, 5(8), 71–78.

Hacker, R. S., & Hatemi-J, A. (2003). Is the J-curve effect observable for small North European economies? Open Economies Review, 14(2), 119-134.

Halicioglu, F. (2007). The J-curve dynamics of Turkish bilateral trade: A cointegration approach. Journal of Economic Studies, 34(2), 103–119.

Halicioglu, F. (2008). The bilateral J-curve: Turkey versus her 13 trading partners. Journal of Asian Economics, 19(3), 236-243.Available at: https://doi.org/10.1016/j.asieco.2008.02.006.

Harberger, A. C. (1950). Currency depreciation, income, and the balance of trade. Journal of political Economy, 58(1), 47-60.Available at: https://doi.org/10.1086/256897.

Hernan, R. C. (1999). Testing the short-and-long-run exchange rate effects on the trade balance: The case of Colombia. ESPE Magazine - Essays on Economic Policy, Bank of the Republic of Colombia, 0(35), 87-121.

Hooy, C.-W., & Chan, T.-H. (2008). Examining exchange rates exposure, J-curve and the Marshall-Lerner Condition for high-frequency trade series between China and Malaysia. MPRA Paper No. 10916.

Hsing, H.-M., & Savvides, A. (1996). Does a J-curve exist for Korea and Taiwan? Open Economies Review, 7(2), 127-145.Available at: https://doi.org/10.1007/bf01891900.

Hsing, Y. (2010). Test of the Marshall–Lerner condition for eight selected Asian countries and policy implications. Global Economic Review, 39(1), 91-98.Available at: https://doi.org/10.1080/12265081003696429.

Hussain, M. E., & Haque, M. (2014). Is the J-Curve a Reality in Developing Countries? Journal of Economics and Political Economy, 1(2), 231-240.Available at: https://doi.org/10.1453/JEPE.V1I2.67.

Ibrahim, A. A. A., & Bashir, M. S. (2021). The effect of real exchange rate changes on external trade balance in Sudan: Testing J-curve hypothesis. Nile Journal of Business and Economics, 6(16), 3-23.Available at: https://doi.org/10.20321/nilejbe.v6i16.01.

Iyke, B. N., & Ho, S.-Y. (2017). The real exchange rate, the Ghanaian trade balance, and the J-curve. Journal of African Business, 18(3), 380-392.Available at: https://doi.org/10.1080/15228916.2017.1315706.

Iyke, B. N., & Ho, S.-Y. (2018). Nonlinear effects of exchange rate changes on the South African bilateral trade balance. The Journal of International Trade & Economic Development, 27(3), 350-363.Available at: https://doi.org/10.1080/09638199.2017.1378916.

Jamilov, R. (2013). J-Curve dynamics and the Marshall–Lerner condition: Evidence from Azerbaijan. Transition Studies Review, 19(3), 313-323.Available at: https://doi.org/10.1007/s11300-012-0240-8.

Kansel, Z. C., & Bari, B. (2020). Testing j-curve effect on trade balance in Turkish economy. Financial Studies, 24(1), 53-69.

Keho, Y. (2021). Real exchange rate and trade balance dynamics in Cote d’Ivoire. International Journal of Economics and Financial Issues, 11(1), 61-70.Available at: https://doi.org/10.32479/ijefi.10857.

Kenen, P. B. (1985). Macroeconomic theory and policy: How the closed economy model was opened. in R. Jones and P. Kenen (eds.), Handbook of International Economics (Vol. 2, pp. 625-677). Cambridge: MIT Press.

Krueger, A. O. (1983). Exchange-rate determination. Cambridge: Cambridge University Press.

Kulkarni, K. G. (1996). The J-curve hypothesis and currency devaluation: Cases of Egypt and Ghana. Journal of Applied Business Research (JABR), 12(2), 1-8.Available at: https://doi.org/10.19030/jabr.v12i2.5821.

Kyophilavong, P., Shahbaz, M., & Uddin, G. S. (2013). Does J-curve phenomenon exist in case of Laos? An ARDL approach. Economic Modelling, 35, 833-839.Available at: https://doi.org/10.1016/j.econmod.2013.08.014.

Lerner, A. (1944). The economics of control. London: Macmillan.

Loto, M. (2011). Does devaluation improve the trade balance of Nigeria?(A test of the Marshall-Lerner condition). Journal of Economics and International Finance, 3(11), 624-633.

Lucy, A., Sunday, R. J., & Pacific, Y. K. T. (2015). Exchange rate and trade balance in Ghana: testing the validity of the Marshall-Lerner condition. International Journal of Development and Emerging Economics, 3(2), 38-52.

Magee, S. P. (1973). Currency contracts, pass-through, and devaluation. Brookings Papers on Economic Activity, 1973(1), 303-325.Available at: https://doi.org/10.2307/2534091.

Mahmud, S. F., Ullah, A., & Yucel, E. M. (2004). Testing Marshall-Lerner condition: A non-parametric approach. Applied Economics Letters, 11(4), 231-236.Available at: https://doi.org/10.1080/13504850410001674867.

Man, D. T. (2018). recommendations to improve trade balance in Vietnam: An empirical study of relationship between exchange rate and trade balance. Journal of Finance and Economics, 6(3), 75-86.

Marrewijk, V. C. (2005). Basic exchange rate theories. Discussion Paper No. 0501. Center for International Economic Studies. Australia: University of Adelaide.

Marshall, A. (1923). Money, credit and commerce. London: Macmillan.

Marwah, K., & Klein, L. R. (1996). Estimation of J-curves: United states and canada. Canadian Journal of Economics, 29(3), 523-539.Available at: https://doi.org/10.2307/136248.

Matlasedi, T., Ilorah, R., & Zhanje, S. (2015). The impact of the real effective exchange rate on South Africa’s trade balance. Paper presented at the The Biennial Conference of the Economic Society of South Africa, University of Cape Town, 2 - 4 September 2015.

Meade, J. E. (1951). The balance of payments. Oxford: Oxford University Press.

Meniago, C., & Eita, J. H. (2017). The effects of exchange rate changes on Sub-Saharan Africa trade. International Journal of Sustainable Economy, 9(3), 213-230.

Metzler, L. (1948). A survey of contemporary economics (Vol. I, Richard D. Irwin, INC.: Homewood, IL). Homewood, IL: Richard D. Irwin, INC.

Mhaka, S. (2020). The effects of exchange rates on bilateral trade balances of SACU member states with their trading partners. Doctoral Dissertation, Nelson Mandela University, South Africa.

Moodley, S. (2010). An estimation of the J-Curve effect between South Africa and the BRIC Countries. Master Dissertation, The University of Pretoria, South Africa.

Mwito, M. M., Muhia, R. N., Kiprop, S., & Kibet, L. (2015). Does the Marshall-Lerner condition hold for Kenya’s bilateral trade? A dynamic panel data approach. European Journal of Business and Social Sciences, 4(6), 40-58.

Narayan, P. (2004). The J-Curve: Evidence from Fiji. International Review of Applied Economics, 18(3), 369-380.Available at: https://doi.org/10.1080/0269217042000227088.

Nusair, S. A. (2017). The J-curve phenomenon in European transition economies: A nonlinear ARDL approach. International Review of Applied Economics, 31(1), 1-27.Available at: https://doi.org/10.1080/02692171.2016.1214109.

Onafowora, O. (2003). Exchange rate and trade balance in East Asia: Is there a J-curve. Economics Bulletin, 5(18), 1-13.

Onakoya, A. B., Johnson, S. B., & Ajibola, O. J. (2019). Exchange rate and trade balance: The case for J-curve Effect in Nigeria. KIU Journal of Social Sciences, 4(4), 47-63.

Oyinlola, M., Omisakin, O., & Adeniyi, O. (2013). An empirical re-examination of exchange rate-trade balance nexus in Nigeria. African Journal of Economic Policy, 20(2), 31-61.

Pandey, R. (2013). Trade elasticities and the Marshall Lerner condition for India. Global Journal of Management and Business Studies, 3(4), 423-428.

Perera, W. (2011). Bilateral J-curve between Sri Lanka and its major trading partners. Staff Studies, 39(1), 69-85.Available at: https://doi.org/10.4038/ss.v39i1.3154.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289-326.Available at: https://doi.org/10.1002/jae.616.

Petrović, P., & Gligorić, M. (2010). Exchange rate and trade balance: J-curve effect. Panoeconomicus, 57(1), 23-41.Available at: https://doi.org/10.2298/pan1001023p.

Pilbeam, K. (1992). International macroeconomics. London: Macmillan Press, Ltd.

Piskin, S. (2014). Short-run and long-run dynamics of trade balance: Testing for the validity of Marshall-Lerner Condition and J-curve Hypothesis in Turkey. Master Thesis, Lund University, Sweden.

Rafindadi, A. A., & Yusof, Z. (2014). An econometric estimation and prediction of the effects of nominal devaluation on real devaluation: Does the Marshall-Lerner (ML) Assumptions fits in Nigeria? International Journal of Economics and Financial Issues, 4(4), 819-835.

Rawlins, G. (2011). Currency depreciations and the trade balance: The case of Sub-Sahara Africa. Journal of Applied Business and Economics, 12(6), 132-148.

Reis Gomes, F. A., & Senne Paz, L. (2005). Can real exchange rate devaluation improve the trade balance? The 1990–1998 Brazilian case. Applied Economics Letters, 12(9), 525-528.Available at: https://doi.org/10.1080/13504850500076908.

Robinson, J. (1947). Essays in the theory of employment. Oxford: Blackwell.

Saqib, N. (2013). The effect of exchange rate fluctuation on trade balance: Empirical evidence from Saudi Arab Economy. Journal of knowledge management, economics and information technology, 3(5), 1-11.Available at: https://doi.org/10.2139/ssrn.3288744.

Saqib, S., Ahmad, R. C. D., Faraz, R. M., Muhammd, Y. M., & Shehzadi, A. (2014). Time series investigation of J-curve of Pakistan with Saudi Arabia. Journal of Finance and Economics, 2(6), 210-214.Available at: https://doi.org/10.12691/jfe-2-6-2.

Sastre, L. (2012). Simultaneity between export and import flows and the Marshall–Lerner Condition. Economic Modelling, 29(3), 879–883.Available at: https://doi.org/10.1016/j.econmod.2011.10.011.

Schaling, E., & Kabundi, A. (2014). The exchange rate, the trade balance and the J-curve effect in South Africa. South African Journal of Economic and Management Sciences, 17(5), 601-608.Available at: https://doi.org/10.4102/sajems.v17i5.727.

Sek, S. K., & Har, W. M. (2014). Testing for Marshall-Lerner condition: Bilateral trades between Malaysia and trading partners. Journal of Advanced Management Science, 2(1), 23-28.Available at: https://doi.org/10.12720/joams.2.1.23-28.

Shahbaz, M., Awan, R. U., & Ahmad, K. (2011). The exchange value of the Pakistan rupee & Pakistan trade balance: An ARDL bounds testing approach. The Journal of Developing Areas, 44(2), 69-93.Available at: https://doi.org/10.1353/jda.0.0108.

Shirvani, H., & Wilbratte, B. (1997). The relationship between the real exchange rate and the trade balance: An empirical reassessment. International Economic Journal, 11(1), 39-50.Available at: https://doi.org/10.1080/10168739700080003.

Shuaibu, M., & Isah, A. (2020). Exchange rate dynamics and trade balance in selected African countries. Journal of African Trade, 7(1-2), 69-83.Available at: https://doi.org/10.2991/jat.k.201218.001.

Singh, T. (2004). Testing J-curve hypothesis and analysing the effect of exchange rate volatility on the balance of trade in India. Empirical economics, 29(2), 227-245.Available at: https://doi.org/10.1007/s00181-003-0162-8.

Smal, M. M. (1996). Exchange rate adjustments as an element of a development strategy for South Africa. South African Reserve Bank Quarterly Bulletin, No. 200.

Thahara, A. F., Rinosha, K. F., & Shifaniya, A. J. F. (2021). The relationship between exchange rate and trade balance: Empirical evidence from Sri Lanka. Journal of Asian Finance, Economics and Business, 8(8), 0037-0041.

Umoru, D., & Eboreime, M. I. (2013). The J-Curve hypothesis and the Nigerian oil sector: The ARDL bounds testing approach. European Scientific Journal, 9(4), 314-332.Available at: https://doi.org/10.1016/j.rser.2016.11.236.

Wilson, P. (2001). Exchange rates and the trade balance for dynamic Asian economies—does the J-curve exist for Singapore, Malaysia, and Korea? Open Economies Review, 12(4), 389-413.Available at: https://doi.org/10.1007/s11079-018-9510-3.

World Bank. (2020a). African Pulse: An analysis of issues shaping Africa’s economic future. Washington, DC: World Bank.

Ziramba, E., & Chifamba, R. T. (2014). The J-curve dynamics of South African Trade: Evidence from the ARDL Approach. European Scientific Journal, 10(19), 346-358.