Influence of Companies’ Governance Process on Sustainability Reporting in Nigeria

OTUYA Sunday1*

AKPORIEN Fidelis2

OFEIMUN Godwin3

1,3Department of Accounting and Finance, Faculty of Humanities, Social and Management Sciences, Edwin Clark University, Kiagbodo, Delta State, Nigeria. |

AbstractThe study investigated the influence of companies’ governance process on sustainability reporting in Nigeria. The study was anchored on the stakeholders’ and information cost theories and adopted the ex post facto research design. The population of the study was made up of all listed oil and gas companies in Nigeria. Data were obtained through manual content analysis of corporate financial statements using a modified checklist based on Securities and Exchange Commission (2018)Sustainability Reporting Guidelines to examine the level of disclosures by sampled firms for the period 2016 to 2018. The study deployed descriptive, correlation and regression analyses as data analytical techniques. Findings of the study revealed no significant positive association with board activity, board globalizing, executive compensation and profitability but a negative association with audit committee strength. The study concludes that good company governance practices promote sustainability reporting and recommends amongst others the internationalization of corporate board rooms for effective managerial expertise and technical collaborations. |

Licensed: |

|

Keywords: |

|

Accepted:25 September 2019 |

|

| (* Corresponding Author) |

Funding: This study received no specific financial support. |

Competing Interests: The authors declare that they have no competing interests. |

1. Introduction

Companies are increasingly getting involved in sustainability reporting practices. The awareness is partly due to the realization that the environment is an asset to be managed and preserved for today and future generations. However, while social and environmental reporting disclosures in some developed countries are mandatory (Gray, Kouhy, & Lavers, 1995; Johnson & Greening, 1999; KPMG, 2015) those in the developing countries like Nigeria seem to be evolving (Adekoya & Ekpenyong, 2009; Iyoha, 2010; Ofoegbu, Odoemelam, & Okafor, 2018). In Nigeria for instance, there have been continuous efforts by the government to protect the natural environment.

These have been in form of legislations such as the Federal Environmental Protection Agency (FEPA) Act of 1999, the Department of Petroleum Resources (DPR) Environmental Guidelines and Standards for the Petroleum Industry in Nigeria (EGASPIN) Act of 2002 and indeed the National Environmental Standards and Regulations Enforcement Agency (NESREA) Act 2007 aimed at enforcing compliance with provisions of regulations, protocols, conventions and treaties on environmental matters (Etale & Otuya, 2018). In November 2018, Nigeria’s Securities and Exchange Commission (SEC) approved the Sustainability Reporting Guidelines which was fallout of a stakeholder’s engagement meeting to discuss the business value of sustainable investment, enhancing corporate transparency and ultimately performance on Environmental, Social and Governance (ESG) issues.

The NSE/SEC Guidelines provide the value proposition for sustainability. With the sustainability guidelines, companies listed on Nigeria Stock Exchange are required to include information on five focal areas of social and environmental sustainability, namely, the community, workplace, employees, environment and governance (SEC, 2018). For this reason, reporting on companies’ sustainability activities is increasingly becoming vital for businesses to demonstrate their commitment to social and environmental issues.

In addition, companies’ governance process has been considered an important factor in corporate sustainability reporting (Baba & Abdul-Manaf, 2017; Ofoegbu et al., 2018; Okaro, Ofoegbu, & Okafor, 2018; Otuya & Ofiemun, 2018). It is argued that companies project their corporate governance effectiveness in promoting sustainability, accountability, and transparency by disclosing the impact of corporate activities on the environment in which they operate. Accordingly, there is an increasing pressure on corporate organizations to be responsible corporate citizens by accounting for and disclosing transparently how their operational activities positively or negatively affect the natural environment (Edike and Otuya, 2018). This concern on part of the firms, hinges on legitimacy thus companies tend to accomplish this legitimacy through social and environmental accounting disclosures.

Further, the introduction of the Global Reporting Initiatives (GRI) and the recent implementation of the Securities and Exchange Commission (SEC) Sustainability Reporting Guidelines (2018) have all reinvigorated firms to report their social, economic and environmental activities in Nigeria. In view of this, sustainability report has become a parcel of corporate reporting which encompasses profit (economic), people (society) and planet (environment) (Etale & Otuya, 2018; GRI, 2014; KPMG, 2015).

The governance structure and process of an organization holds a strategic responsibility in promoting the level of sustainability reporting (Baba & Abdul-Manaf, 2017; Ofoegbu et al., 2018). Given the vital role the board performs in influencing corporate disclosure, this study, seeks to examine the relationship between governance structure and the perceived variations in sustainability reporting among oil and gas companies listed in Nigeria.

The study also addresses a gap in the literature by looking into the industry sensitivity context using the newly promoted SEC Sustainability Reporting Guidelines 2018. It is imperative because cases of environmental pollution seem to be predominant in Nigeria’s oil and gas sector. The study is also significant in view of recent public outcry in the Niger Delta region of Nigeria about environmental pollution and land degradation caused by large scale oil production activities in the area.

2. Literature Review and Hypothesis Development

2.1. Board Activity and Sustainability Reporting

The level of activity of a corporate board is a determinant of how corporate directors conduct their responsibilities. The implication is that activity of directors on corporate board may influence the ability of the board to monitor and assess management practices and procedures.

Otuya, Donwa, and Egware (2017) noted that the frequency of board meeting reflects the vigilance and care of corporate board in conducting their monitoring roles. Liu, Harris, and Omar (2013) have used board activity as a proxy for measuring the effectiveness and intensity of board monitoring and discipline.

The effect of board activity on corporate sustainability reporting has been investigated by several studies. However, the findings were conflicting. Studies that indicated positive relationship include Staden and Chen (2010), Barros, Boubaker, and Hamrouni (2013), Hu and Loh (2018) and Ofoegbu et al. (2018). However, Rodríguez-Ariza, García-Sánchez, and José-Valeriano (2011) and Giannarakis (2014) show no significant association between board activity and sustainability reporting practices. Based on the foregoing, we frame our first hypothesis thus:

The level of sustainability reporting is positively associated with board activity.

2.2. Board Globalizing and Sustainability Reporting

Board globalizing refers to the inclusion of foreign nationals from outside the firm's base country as members of board of directors of a local firm. It is believed that firms dominated by foreign directors are more vigilant in monitoring behaviors and decision making of the company (Otuya & Ofiemun, 2018; Oxelheim & Randøy, 2003). The contribution of foreign board members to firms typically goes beyond financial contributions and extends to provision of non-financial resources such as managerial expertise and technical collaborations. It is argued that the role of foreign board members in a company may differ according to their nationality. Studies regarding board globalization and sustainability reporting are scarce in developing countries. However, a few studies such as Bushee and Noe (2000); Ghabayen (2012); Habbash (2015); Zeitun and Gang Tian (2007); Setyawan and Kamilla (2015) have reported mixed results. Baba and Abdul-Manaf (2017) reveal that the presence of foreigners in corporate boardrooms improves the relationship with stakeholders, increase accountability, shows greater concern for the environment and prompts more ethical behavior. Based on this, the second hypothesis is formulated thus:

The level of sustainability reporting is significantly influenced by board globalization.

2.3. Audit Committee Strength and Sustainability Reporting

The strength of an audit committee can be assessed in terms of how effective it is in carrying out its responsibilities of promoting the credibility of financial reporting, monitor management decision and performance, enhance auditors’ independence and support the board of directors to meet their financial reporting responsibilities (Otuya et al., 2017). In view of this, members of the audit committee are expected to be competent and financially literate.

Soliman and Ragab (2014) show evidence that the audit committee effectiveness increases disclosure quality and quantity. It has also been empirically verified that an effective and efficient audit committee made up of the requisite expertise and independent directors are more likely to influence management to disclose more environmental information which enhances reporting quality (Madawaki & Amran, 2013; Soliman & Ragab, 2014). However, Eriabie and Odia (2016) found a positive but insignificant relationship between audit committee activity and level of corporate social and environmental disclosures. Therefore, the study’s third hypothesis is:

The level of sustainability reporting is positively associated with audit committee strength.

2.4. Executive Compensation and Sustainability Reporting

The link between board executive incentives and sustainability disclosures has become important in the corporate reporting literature. This relationship, according to Kartadjumena and Rodgers (2019) can be viewed from two perspectives – shareholder and stakeholder perspectives. From the point of view of the shareholders, executive pay is a governance issue which tends to encourage managers to pursue and report social and environmental activities properly for the purpose of reducing information asymmetry.

On the other hand, stakeholders view show that corporate management will get high incentives for not only maximizing shareholders wealth but promoting the interest of other stakeholders such as host communities, employees, customers, regulatory agencies, etc. Thus, the stakeholder’s viewpoint assumes that corporate managers are compensated as agents for not only improving the financial performance of the firm but managing social and environmental activities in line with stakeholders’ interest which also ensures legitimacy position of the company.

Some findings (Callan & Thomas, 2014; Kartadjumena & Rodgers, 2019; Mahoney & Thorn, 2006) show that high executive compensation positively affects social and environmental disclosures. On the contrary, Miles and Miles (2013) and Cai, Jo, and Pan (2011) have documented that a negative relationship exists between executive compensation and corporate social responsibility disclosures. Given the foregoing, our fourth hypothesis is stated thus:

The level of sustainability reporting is positively associated with Executive Compensation

2.5. Control Variables

2.5.1. Profitability and Sustainability Reporting

Corporate financial performance is an important variable in assessing long term stability and growth of a firm. It is believed that a more profitable firm will have the tools at its disposal to embark on sustainability reporting issues.

The level of profit a company makes is also a determinant of expenditures on corporate social responsibility which are seen as image laundering activities. A number of previous studies (Bendell & Kearins, 2005; Esa & Anum Mohd Ghazali, 2012; Richardson & Welker, 2001) have found that profitability does not significantly influence the level of sustainability disclosures.

However, Campbell (2007) argues that weak financial performance may force companies to abandon social and environmental matters. Etale and Otuya (2018), Mgbame and Mgbame (2018) and Emeka-Nwokeji and Ossisioma (2019) also found that financial performance (profitability) is a key determinant of sustainability reporting.

2.6. Theoretical Framework

This study is anchored on two theories: the stakeholders’ theory and the information cost theory. On one hand, the stakeholder theory is a vital hypothesis for explaining how governance structures influence the level of sustainability reporting. The stakeholders’ theory explains how the company management interacts with its diverse stakeholders other than the shareholders. It posits that companies have an extensive responsibility to different stakeholder groups, including suppliers, customers, employees, government and the host communities.

Given this situation, a company needs to maintain a cordial relationship with its various stakeholders so as to enable it function and carry out its economic activities effectively. The theory supports the notion that companies need to carry out their business activities in a socially responsible manner towards satisfying the interest of its diverse stakeholders, and the best way to achieve this is through sustainability reporting initiatives (Haladu, 2016).

Further, the stakeholders’ theory can be seen from the viewpoint of the board members. Members of the board of directors are representatives of shareholders whose responsibilities include ensuring that diverse interests of the shareholders are duly protected. The board members comprising of chairman, managing, executive, non-executive and independent directors make it a point of duty to promote corporate accountability and transparency at all times by not only preserving and maintaining the environment but also reporting the effect of its activities on it.

As regards the information costs theory, information costs have the potential to influence sustainability reporting practices. There are several users of the information reported by a company. Users’ of such information make decisions based on such disclosed information. Companies are usually motivated to reduce information asymmetry between managers and stakeholders such as investors (Otuya, Ofiemun, & Akporien, 2019). Such companies usually disclose more information so as to reduce the gap between the managers and investors (Otuya et al., 2019).

Consequently, provision of this information reduces the information cost incurred by shareholders and potential investors to gather and evaluate additional data. For companies with large ownership concentration, management is directly accountable to many shareholders, thus providing incentives for disclosing more extensive and high quality social and sustainability issues to many who need such information for decision making.

According to Cormier and Magnan (2003) the information cost theory further enhances the cost/benefit trade off that arises when private information is publicly disclosed thus benefit is spread out among many stakeholders. In contrast, the cost of disclosure may well outweigh the benefit for some companies, especially for smaller firms and closely held companies.

3. Empirical Methodology

3.1. Design

The study adopted an ex-post facto research design as archive data were used. The study involves the analysis of corporate annual reports hence content analysis approach which has been widely used by previous researches (Emeka-Nwokeji & Ossisioma, 2019; Ofoegbu et al., 2018) in social, environmental and sustainability reporting is considered suitable for this study.

3.2. Population and Sampling

The population of the study comprises of all oil and gas companies listed in the Nigeria Stock Exchange. However, 10 of the 14 oil and gas companies listed in the Nigeria Stock Exchange as 31st December, 2018 were selected. The data collected covered the period 2016 to 2018 making a total of 30 year-end observations. Data collected were subjected to analysis through descriptive statistics, correlation and linear regression analysis.

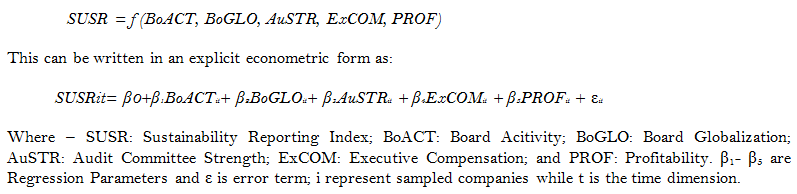

3.3. Empirical Model

In order to achieve the objective of the study, a linear and multivariate regression model which expresses sustainability reporting as a function of company governance structure is stated in functional form as follows:

3.4. Measurement of Variables

3.4.1. Dependent Variable

The dependent variable for this study is sustainability disclosure score. Three steps were involved in measuring the disclosure scores. First, a checklist was constructed based on the Nigeria Security and Exchange Commission (SEC) 2018 Sustainability Reporting Guidelines comprising six major categories namely, economic (3 categories), environmental (5 categories), social (7 categories) and Governance (5 categories). Secondly, content analysis was used to examine the corporate report to determine the quantity disclosed against the checklist for each of the sampled firms. If an item is disclosed based on the checklist, ‘1’ is assigned otherwise ‘0’.

Thirdly, the total number of items disclosed for each firm year-end observation is computed as a percentage of the total number of checklist items.

3.4.2. Independent Variables

Board activity: Board activity is measured as the number of times board of directors held meetings in a financial year.

Board globalizing: This variable is measured in terms of absolute number of foreign nationals in the company’s board.

Audit committee strength: This is measured as proportion of independent directors in audit committee.

Executive compensation: This variable is measured as a natural logarithm of total compensation (including bonus and severance pay) paid to the directors for the year.

3.4.3. Control Variable Profitability: It is a proxy for the firm’s financial performance measured as the ratio of profit after tax scaled by total assets.

4. Presentation of Results and Discussion

4.1. Discussion of Descriptive Statistics

SUSR |

BOACT |

BOGLO |

AUSTR |

EXCOM |

PROF |

|

| Mean | 0.546000 |

3.466667 |

3.666667 |

0.404000 |

298.5800 |

0.092667 |

| Median | 0.410000 |

3.500000 |

4.000000 |

0.385000 |

53.20000 |

0.065000 |

| Maximum | 0.710000 |

4.000000 |

5.000000 |

0.560000 |

1386.000 |

0.320000 |

| Minimum | 0.290000 |

2.000000 |

0.000000 |

0.230000 |

3.600000 |

-0.150000 |

| Std. dev. | 0.137128 |

0.571346 |

0.994236 |

0.086646 |

420.4129 |

0.102786 |

| Observations | 30 |

30 |

30 |

30 |

30 |

30 |

| Key: SUSR: Sustainability Disclosure Score; BoACT: Board Activities; BoGLO: Board Globalization; AuSTr: Audit Committee Strength; ExCOM: Executive Compensation; PROF: Profitability. |

Table 1 shows the descriptive statistics of the variables in the model. The mean for SUSR is 0.546 which indicates an average 54.6% of sustainability disclosures of the sampled oil and gas firms during the period. The highest and lowest level of disclosures is 71% and 29% respectively. The standard deviation of 0.137 indicates a substantial dispersion from the average disclosure value. The descriptive statistics also show a mean of 3.466 for BoACT which indicate board of sampled firms met at least three times during the year. The standard deviation of 0.571 is high from the mean and indicates much variations in terms of board meetings. Board globalizing has a maximum of 5 and a minimum of 0 foreign directors on board of sampled firms. The implication is that there are some corporate boards in Nigeria without foreign representation.

Further, audit committee strength and executive compensation have mean values of 40.4 percent and 298.5 million naira respectively. The standard deviation also stood at 0.086 and 420.4 for AuSTR and ExCOM respectively also indicating a significant dispersion from their mean values. The control variable profitability has mean values of 0.092 with standard deviation of 0.012.

4.2. Correlation Analysis

SUSR |

BOACT |

BOGLO |

AUSTR |

EXCOM |

PROF |

|

| SUS | 1.000000 |

|||||

| BOACT | 0.226224 |

1.000000 |

||||

| BOGLO | 0.242805 |

0.404689 |

1.000000 |

|||

| AUSTR | 0.054039 |

0.093338 |

0.212148 |

1.000000 |

||

| EXCOM | 0.234705 |

0.220301 |

0.054555 |

0.200153 |

1.000000 |

|

| PROF | 0.179620 |

-0.174586 |

-0.554501 |

0.063421 |

-0.055789 |

1.000000 |

| Key: SUSR: Sustainability Disclosure Score; BoACT: Board Activities; BoGLO: Board Globalization; AuSTR: Audit Committee Strength; ExCOM: Executive Compensation; PROF: Profitability. |

Table 2 shows the correlation matrix adopted to check the level of relationship between the dependent and independent variables on one part, and among the independent and control variables on the other.

The correlation statistics shows that SUSR has a positive relationship with BoACT (r=0.0226), BoGLO (r=0.242), AuSTR (r=0.054), ExCOM (r=0.234) and PROF (r=0.179). The correlation also shows that BoACT has a positive relationship with BoGLO (r=0.404), AuSTR (r=0.093) and ExCOM (r=220). However, BoACT has a negative relationship with PROF (r=-0.174).

Further, BoGLO is observed to have a positive relationship with AuSTR (r=0.212), ExCOM (r=0.054) and a negative association with PROF (r=-0.554). The matrix also shows that AuSTR has a positive relationship with ExCOM (r=0.200) and PROF (r=0.063). Finally, ExCOM is observed to have a negative correlation with PROF (r=-0.055).

4.3. Analysis of Findings

Findings of the study using results of the regression estimates are discussed below:

| Variable | Coefficient |

Std. error |

t-Statistic |

Prob. |

| C | 0.268092 |

0.208104 |

1.288261 |

0.2099 |

| BOACT | 0.025997 |

0.051468 |

0.505111 |

0.6181 |

| BOGLO | 0.019365 |

0.035609 |

0.543812 |

0.5916 |

| AUSTR | -0.035693 |

0.322684 |

-0.110613 |

0.9128 |

| EXCOM | 6.94E-05 |

6.53E-05 |

1.063806 |

0.2980 |

| PROF | 0.124476 |

0.315215 |

0.394891 |

0.6964 |

The regression Table 3 shows the relationship between individual board governance processes and sustainability reporting index. BoACT is found to have a positive but insignificant association with the level of sustainability disclosures at 5% significant level (β1BoACTit =0.0259, t-Statistic=1.288). The result met our a priori expectation and is in tandem with Staden and Chen (2010), Barros et al. (2013), Hu and Loh (2018) and Ofoegbu et al. (2018).

Further, the coefficient of the variable BoGLO is observed to be positive but not significant (β2BoGLOit = 0.019, t-Statistic=0.543). This indicates that the level of sustainability disclosures is not significantly influenced by foreign membership of the board of directors. The result met our a priori expectation and is consistent with previous studies such as (Bushee & Noe, 2000; Ghabayen, 2012; Setyawan & Kamilla, 2015; Zeitun & Gang Tian, 2007) that find no significant positive association between board globalization and level of social environmental disclosures.

The regression result on AuSTR variable shows a negative association but not statistically significant at 5% (β3AuCEit=-0.0356 t-Statistic=0.110). This position did not meet our a priori expectation although it agrees with studies such as Madawaki and Amran (2013); Soliman and Ragab (2014). With respect to ExCOM, the result show a positive but no significant association with environmental disclosures (β5ExCOMit=6.93, t-statistic = 1.063).

This result is consistent with previous studies (Callan & Thomas, 2014; Kartadjumena & Rodgers, 2019; Mahoney & Thorn, 2006) we expected a significant positive association based on the fact that high executive compensation can be an incentive for board members to engage in more sustainability activities.

With respect to the control variable, PROF is observed to have a positive relationship but not statistically significant at 5% (β6PROFit=0.124, t-Statistic=0.394). The implication of the result is that profitability cannot be deemed a significant determinant of sustainability reporting. Previous studies have shown that more profitable firms have the capacity to invest and report on social and environmental activities (Emeka-Nwokeji & Ossisioma, 2019; Etale & Otuya, 2018; Mgbame & Mgbame, 2018).

5. Conclusion and Recommendations

The study investigated the influence of companies’ governance process on sustainability reporting in Nigeria. The study adopted the ex post facto research design and used content analysis of corporate financial statements and a modified checklist based on SEC (2018) Sustainability Reporting Guidelines to examine the level of disclosures by sampled firms for the period 2016 to 2018.

Findings of the study revealed that board activity, board globalizing, executive compensation and financial performance (profitability) have positive but insignificant association with level of sustainability reporting. Moreover, the study finds that audit committee strength has a negative but insignificant relationship with sustainability reporting level. The study concludes that good company governance practices promote sustainability reporting.

In line with the findings of this study, it is recommended that governance processes of companies be strengthened. In this regard, the regulatory agencies should enforce the audit committee membership, number of meetings and the professional expertise of members. It is also imperative to encourage internalization of corporate board rooms for effective managerial expertise and technical collaborationsReferences

Adekoya, A., & Ekpenyong, E. (2009). Corporate governance and environmental performance: Three point strategy for improving environmental performance among corporations in Africa. Paper presented at the IAIA 09 Conference Proceedings, Impact Assessment and Human Wellbeing.

Baba, B. U., & Abdul-Manaf, K. B. (2017). Board Governance mechanisms and sustainability disclosure: A moderating role of intellectual capital. Asian Journal of Multidisciplinary Studies, 5(10), 163-189.

Barros, C. P., Boubaker, S., & Hamrouni, A. (2013). Corporate governance and voluntary disclosure in France. Journal of Applied Business Research (JABR), 29(2), 561-578.

Bendell, J., & Kearins, K. (2005). The political bottom line: The emerging dimension to corporate responsibility for sustainable development. Business Strategy and the Environment, 14(6), 372-383.

Bushee, B. J., & Noe, C. F. (2000). Corporate disclosure practices, institutional investors, and stock return volatility. Journal of Accounting Research, 8(2), 171-202.

Cai, Y., Jo, H., & Pan, C. (2011). Vice or virtue? The impact of corporate social responsibility on executive compensation. Journal of Business Ethics, 104(2), 159-173.

Callan, S. J., & Thomas, J. M. (2014). Relating CEO compensation to social performance and financial performance: Does the measure of compensation matter? Corporate Social Responsibility and Environmental Management, 21(4), 202-227.

Campbell, J. L. (2007). Why would corporations behave in socially responsible ways? An institutional theory of corporate social responsibility. Academy of Management Review, 32(3), 946-967.

Cormier, D., & Magnan, M. (2003). Environmental reporting management: A continental European perspective. Journal of Accounting and public Policy, 22(1), 43-62.

Emeka-Nwokeji, N. A., & Ossisioma, B. C. (2019). Sustainability disclosures and market value of firms in emerging economy: Evidence from Nigeria. European Journal of Accounting, Auditing and Finance Research, 7(3), 1-19.

Eriabie, S., & Odia, J. (2016). The influence of corporate governance attributes on corporate social and environmental disclosure quality in Nigeria. ESUT Journal of Accountancy, 7(1), 228 – 235.

Esa, E., & Anum Mohd Ghazali, N. (2012). Corporate social responsibility and corporate governance in Malaysian government-linked companies. Corporate Governance: The International Journal of Business in Society, 12(3), 292-305.

Etale, L. M., & Otuya, S. (2018). Environmental responsibility reporting and financial performance of quoted oil & gas companies in Nigeria. European Journal of Business and Innovation Research, 6(6), 23 – 34.

Ghabayen, M. A. (2012). Board characteristics and firm performance: Case of Saudi Arabia. International Journal of Accounting and Financial Reporting, 2(2), 168.

Giannarakis, G. (2014). Corporate governance and financial characteristic effects on the extent of corporate social responsibility disclosure. Social Responsibility Journal, 10(4), 569-590.

Gray, R., Kouhy, R., & Lavers, S. (1995). Corporate social and environmental reporting: A review of the literature and a longitudinal study of UK disclosure. Accounting, Auditing & Accountability Journal, 8(2), 47-77.

GRI. (2014). G$ sustainability reporting guideline. G$ Standards. Sustainable Development and the Transparency Imperative. Retrieved from: www.globalreporting.org.

Habbash, M. (2015). Corporate governance, ownership, company structure and environmental disclosure: Evidence from Saudi Arabia. Journal of Governance and Regulation(4), 460-470.

Haladu, A. (2016). Arguments for adopting only environmentally sensitive firms in assessing environmental information disclosures. International Journal of Management Research & Review, 6(9), 1204-1212.

Hu, M., & Loh, L. (2018). Board governance and sustainability disclosure: A cross-sectional study of Singapore-listed companies. Sustainability, 10(7), 2-14.

Iyoha, F. (2010). Social accounting: An imperative for enterprise development. Nigerian Accountant, 43(1), 4-8.

Johnson, R. A., & Greening, D. W. (1999). The effects of corporate governance and institutional ownership types on corporate social performance. Academy of Management Journal, 42(5), 564-576.

Kartadjumena, E., & Rodgers, W. (2019). Executive compensation, sustainability, climate, environmental concerns, and company financial performance: Evidence from Indonesian commercial banks. Sustainability, 11(6), 1-21.

KPMG. (2015). The KPMG survey of corporate responsibility reporting. Retrieved from: www.kpmg.com/sustainability.

Liu, J., Harris, K., & Omar, N. (2013). Board committees and earnings management. Corporate Board: Role, Duties and Composition, 9(1), 6-17.

Madawaki, A., & Amran, N. A. (2013). Audit committees: How they affect financial reporting in Nigerian companies. Journal of Modern Accounting and Auditing, 9(8), 1070-1080.

Mahoney, L. S., & Thorn, L. (2006). An examination of the structure of executive compensation and corporate social responsibility: A Canadian investigation. Journal of Business Ethics, 69(2), 149-162.

Mgbame, C.-A. M., & Mgbame, C. O. (2018). Discretionary environmental disclosures of corporations in Nigeria. International Journal of Disclosure and Governance, 15(4), 252-261.

Miles, P. C., & Miles, G. (2013). Corporate social responsibility and executive compensation: Exploring the link. Social Responsibility Journal, 9(1), 76–90.

Ofoegbu, G. N., Odoemelam, N., & Okafor, R. G. (2018). Corporate board characteristics and environmental disclosure quantity: Evidence from South Africa (integrated reporting) and Nigeria (traditional reporting). Cogent Business & Management, 5(1), 1-27.

Okaro, S. C., Ofoegbu, G. N., & Okafor, G. O. (2018). Corporate governance and sustainable development in Nigeria. Perspectives and challenges. International Journal of Academic Research in Business and Social Sciences, 8(9), 90-104.

Otuya, S., Donwa, P. A., & Egware, N. (2017). Earnings management and quality of corporate governance in Nigeria: A review of executive compensation and audit committee characteristics. Journal of Accounting and Financial Management, 4(4), 1-15.

Otuya, S., & Ofiemun, G. (2018). Effects of board globalizing on financial performance of banks in Nigeria. International Journal of Academic Research in Accounting, Finance and Management Sciences, 7(4), 1-10.

Otuya, S., Ofiemun, G., & Akporien, F. (2019). Does financial statement information still matter? Research Journal of Finance and Accounting, 10(13), 16-22.

Oxelheim, L., & Randøy, T. (2003). The impact of foreign board membership on firm value. Journal of Banking & Finance, 27(12), 2369-2392.

Richardson, A. J., & Welker, M. (2001). Social disclosure, financial disclosure and the cost of equity capital. Accounting, Organizations and Society, 26(7-8), 597-616.

Rodríguez-Ariza, L., García-Sánchez, I. M., & José-Valeriano, D. S. (2011). The role of the board in achieving integrated financial and sustainability reporting. XV encuentro AECA, Ofir-Esposende.

Securities and Exchange Commission. (2018). Sustainability reporting guidelines.

Setyawan, H., & Kamilla, P. (2015). Impact of corporate governance on corporate environmental disclosure: Indonesian evidence. Paper presented at the International Conference on Trends in Economics, Humanities and Management (ICTEHM'15) August 12-13, 2015 Pattaya.

Soliman, M. M., & Ragab, A. A. (2014). Audit committee effectiveness, audit quality and earnings management: An empirical study of the listed companies in Egypt. Research Journal of Finance and Accounting, 5(2), 155-166.

Staden, C. V., & Chen, X. (2010). Stakeholder pressure, social trust, governance and the disclosure quality of environmental information. Paper presented at the In Conference Proceeding APIRA.

Zeitun, R., & Gang Tian, G. (2007). Does ownership affect a firm's performance and default risk in Jordan? Corporate Governance: The International Journal of Business in Society, 7(1), 66-82.