The Impacts of Exchange Rate on Economic Growth in Cambodia

Long Vorlak1*

Ignatius Abasimi2

Yang Fan3

1,2,3School of Economics, Northeast Normal University, Changchun Jilin, China. |

AbstractThis research paper assesses the impact of exchange rates on the economic growth of Cambodia's. The study used variables such as gross domestic product (GDP) indicating Cambodia's economic growth, as well as some explanatory variables such as exchange rate (EXR), broad money (M2), and openness to trade (TOP), rate of inflation (IFR) and foreign direct investment (FDI). The study used an ordinary least squares (OLS) regression model to estimate the effects of exchange rates on Cambodia's economic growth. The research data was downloaded from the World Bank database. According to estimates, the results show that the impact of exchange rate (EXR) and openness to trade (TOP) on GDP is 1%. Exchange rate is positively correlated with GDP, while trade openness is negatively correlated with GDP. During the period of study (1995-2017), other variables such as broad money (M2), inflation rate (IFR), and foreign direct investment (FDI) possess not significant effect on Cambodia's GDP |

Licensed: |

|

Keywords: |

|

Accepted: 23 October 2019 |

|

| (* Corresponding Author) |

Funding: This study received no specific financial support. |

Competing Interests:The authors declare that they have no competing interests. |

1. Introduction

Currently, many foreign investment inflows came to Cambodia purposely for running business, and other capital investments, this has therefore seen a lot of foreign currency flow into the Cambodia economy. According to Im and Dabadie (2007) after the 1991 Paris Peace Accord, The Cambodian economy has moved from a centralized calculated economy to an open market economy basically to strengthen its management at the National Bank of Cambodia (NBC). The main task is to define and guide monetary policy to maintain price stability.

Cambodia has experienced strong economic growth over the past decade. Between the years 2000 to 2010, Cambodia saw its GDP grew from 7% to 8% on annual average bases. The sectors which accounted for most of the growth include clothing, construction, tourism real estate, and agriculture sectors. Dollarization of the economy has made it difficult for the Cambodian financial authorities to execute monetary policy effectively. The main purpose of the monetary policy carries out by the Cambodian central bank (NCB) has been to maintain price stability with the crucial purpose of facilitating economic improvement inside the structure of Cambodian financial and economic policies.

Cambodian inflation has been largely influenced by exchange rates, international oil prices, different seasonal factors, import price.

In Cambodia, exchange rates are influenced by tax payments and the purchased of agricultural products. The exchange rate between the U.S. dollar and Cambodian Khmer Riel is determined at the market. In the Cambodian economic, the exchange fluctuations are due to excess supply or shortage of Riel, compared to the demand for riel. Generally, the demand for Riel increased around the new year by the Khmer calendar,

Cambodia is a rapidly developing country, growing at a rate of over 7%. Nevertheless, its inflation has been maintained at a relatively low level. Such price stability is expected to have positive effects on consumption and investment by creating a favourable macroeconomic environment to accelerate Cambodian economic growth. From 2002 to 2016, Cambodia recorded and average annual rise in the consumer price index (CPI) of less than 5%. This is a remarkable outcome in that high economic growth is generally accompanied by high-level inflation. Exceptionally in 2007 and 2008 Cambodian prices increased at a comparatively great ratio as a result of world price phenomenon that food and oil price increased.

The simplest definition of exchange rate is the price of one currency relative to another. Therefore, it uses another economics to measure the value of the domestic economy.

In the long run, exchange rate volatilities are determined via several macroeconomic fundamentals, for instance, inflation rate, money supply, real income, real interest rate, trade balances and other significant variables (Laganà & Sgro, 2007).

Therefore, this study aims to empirically study the impact of exchange rates on economic growth in the Cambodian economy. The study will further investigate the robust and unpredictable influences that inflation and money growth have on the economy. FDI and openness to trade are two significant parameters and serve as a vehicle for economic development and trade liberalization, the research paper will practically justify the influence of these parameters on the Cambodia economy as well.

The organization of the study is as follows. The first part introduces Cambodia’s exchange rate and economic development and the second part introduces the literature review (theoretic review and empirical research). The third section introduces methods, data and samples, the fourth section will discuss estimation results and discussion, and the last part is the conclusions and recommendations of the study.

2. Literature Review

2.1. Theoretical Review

Exchange rate is an important economic indicator in managing the international trade. It expresses the units of domestic money relative to foreign money and vice versa. Exchange Rates are very important partly because they help us to compare goods and services produced across the globe.

Exchange rates play an important role in spending choices as they allow you to convert prices in different countries on comparable terms. Under all other conditions, the downgrading of a country's currency against overseas currencies (the increase in domestic currency prices in terms of foreign currency) has led to lower export prices and higher import prices. The appreciation of the renminbi (falling local currency prices) led to higher export prices and lower import prices (Paul & Maurice, 2009).

Ajakaiye (2002) the impact of exchange rates on economic development in many developing countries, and the increase in foreign exchange earnings: a country’s foreign exchange reserves have an effective effect on the cost-effective development of a country’s economy, once a country's monetary value increases leading to an increase in exports, this will increase the country's foreign exchange assets in its central bank.

The exchange rate is an important meter of economic progress because it mainly reflects the benefits of the physical and commodity sectors and creates competitiveness in relation to the global economy. According to the Cambodian currency market, this is a standard transaction between buyers and sellers of foreign currency. Forex traders will sell stocks, and buyers (buyers) of foreign currency will make inquiries. Foreign currency supply is motivated by non-oil exports, oil exports, expenses of foreign tourists in the Cambodian economy and remittances from foreign residents of Cambodia.

Azid and Jamil (2005) the humble definition is that the exchange rate is the price of one currency against another. Therefore, he uses a different economy to measure the value of the domestic economy. According to economic theory, the exchange rate as a currency parameter should affect long-term development and growth, this is considered to some degree mysterious, particularly the deleterious impact.

3. Exchange Rate Policy in Cambodia

Cambodia National Bank's exchange rate strategy is one of the major NBC monetary instruments. The goal is to achieve price solidity and stability. The National Bank of Cambodia (NBK) will continue to implement a balanced flat-rate surveillance system that will interfere in the foreign exchange market to retain exchange rates cantered at set targets. The NBC's official exchange rate and Riel's Khmer sales (KHR) exchange rate for third-party trade, which is a guide for the private sector. The NBC determines the exchange rate. The NBC Official Exchange Rate Decision Committee, composed of employees from significant subdivisions, such as banking, issuance, foreign exchange board, the international cooperation department, as well as statistics and economic enquiries.

3.1. Empirical Review

In this section, an empirical study is reviewed to understand the link among gross domestic product (GDP) and economic exchange rates that indicate economic growth.

Ayodele (2014) pointed out in his studies entitled, Empirical Evaluation of the Impact of Exchange Rate on the Economy of Nigeria that Nigeria’s Stock Exchange (NSE) and the Nigerian Securities and Exchange Commission as well as inflation possess a significant influence on the economy of Nigeria. The data for data was sourced from the central Bank of Nigeria. The multiple regression analysis was used to estimate the coefficients of the variables considered.

Ignatius, Agus, and Long (2018) a lesson on the dynamics of inflation, money growth, exchange rate and interest rate in Ghana. The study used the Distributed lag (ARDL) model for experimental analysis, and the study period was from 1998 to 2018. It was found that the exchange rate and inflation rates markedly affacts money growth in both the short and long term and in the same direction.

Barguellil, Ben-Salha, and Zmami (2018) examined the impact of exchange rate fluctuations on economic growth. The experimental studies were carried out using observations from 45 emerging and embryonic countries during the period 1985-2015 and this time was evaluated using generalized differences and methods of moments. Their findings show that the measurement of the nominal exchange rate and the volatility of the real exchange rate are based on heterogeneous summaries default conditions which have a negative correlation with economic growth. More to that, the impact of exchange rate variations rest on the exchange rate regime and financial openness, thus, when countries adopt flexible exchange rate regimes and financial openness, volatility is likely to be less destructive.

Notwithstanding the above, literature, Hussaini, Aguda Niyi, and Davies (2018) studies examined the Effects of Exchange Rate Volatility on Economic Growth of West African English-Speaking Countries. Data for the study was sourced from the world bank databased and used for the empirical estimations. Their research used GDP per capita as the regressand and real exchange rate as the regressors. The configuration test showed that heterogeneity problem does not exist in the data extracted. The Hausman test was also in support of the fixed effect technique against the random effect model, however, the results from OLS, and the fixed and random analysis displayed that real exchange rate has a negative coefficient with economic growth. The conclusion was that real exchange rate has a negative causality with economic growth in these countries.

Kenneth, Jonathan, and Kenneth (2016) investigated exchange rate regime for Nigerian economic growth and its impacts. The study used the generalized moment method (GMM) to guesstimate economic growth from 1970 to 2014. The study found that, the relaxation of the exchange rate system would stimulate Nigeria economic progress throughout 1970-2014 period and the fixed exchange rate system in the unseemly distant future. The estimation output suggested further that, the fixed exchange rate will at some point in time limits the general welfare of the Nigerian economic enhancement because the real exchange rate reflects the opposite correlation of economic progress throughout the age of the fixed exchange rate system.

Agus, Ignatius, and Long (2018) An Evidence Analysis of the Exchange Rate Disconnect Puzzle in Indonesia. The study established a connection between exchange rate and macroeconomic fundamentals. The time of the was study from 1990 to 2017, By using ARDL model, the research established that, in the short- term, Dornbusch- Frankel sticky price model explained better the refusing of the puzzle evidence which provided macroeconomic fundamental that affect exchange rate. Frekel-Bilson, according to the hypothesis was support that in the long-run flexible price model provides a little support in the refusing of the puzzle evidence.

Peter and Isaac (2017) used the yearly statistics from 1984 to 2014 to study the causal connection amid Ghana's real exchange rate and economic growth. Their research literally combines parameters and economies indicators, for instance, government spending, real effective exchange rates, fixed capital formation, real GDP growth, labor force, openness to trade, and foreign direct investment. The descriptive estimations indicated that all the regressors except for foreign direct investment have positive means. The unit root test displays two levels of trend and first difference, approximately most of the regressors were stationary and while some were non-stationary. By using the ARDL cointegration estimation technique, the paper established that, the real exchange rate possesses a firm cointegration relationship with economic growth. The long-term estimates of ARDL further indicate that total fixed capital formation, and labor have a positive and significant impact on economic growth, whiles real effective exchange rates, government expenses, real gross domestic product (GDP), openness to trade and foreign direct investment versus economic growth has a substantial adverse impact. Short-term output again shows that foreign direct investment, openness to trade, real effective exchange rate and total fixed capital formation have a robust and significant impact, while other variables have an adverse influence on economic growth.

Ehinomen and Oladipo (2012) noted in their paper entitled the impact of exchange rate management on Nigerian manufacturing growth that exchange rate depreciation was an integral part of the 1986 Nigerian Structural Adjustment Policy (SAP). The paper also indicated that exchange rate in the Nigerian economy was closely related to domestic output in the Nigerian economy and this has yielded an unseemly result. On the bases of this proof, the authors suggested that a pragmatic measure should be put into place to promote exchange rate appreciation which may enrich and reduce cost of local manufacturing industries that frequently import overseas inputs. In conclusion, Ehinomen and Oladipo urged the government to completely barred or reduced merchandize products and intermediate imported products.

Akpan and Atan (2011) studied the impact of exchange rate changes on Nigeria's economic progress. The study investigated the impact of exchange rate changes as the Nigeria's actual output grow. Using a quarterly sequence of data from 1986 to 2010, Akpan and Atan (2011) examined the potential unswerving and unintended relationships among exchange rates and GDP increased through the generalized method of moments (GMM). The outputs of the research work showed no exiting proof of close unswerving association among exchange rate variations and output growth. In contrast, Nigeria's economic progress is unswervingly influence by currency indicators.

Korkmaz (2013) deliberate on the impact of exchange rates on economic development by employing yearly facts from nine randomly selected European countries for the period 2002-2011. In their study, they attempted to analyze whether the exchange rate had an impact on macroeconomic variables of economic growth (GDP) in randomly selected European countries. The exchange rate used is well-defined as the effective exchange rate, GDP is well-defined as the yearly growth rate (%), exchange rate data is taken from the OECD's prospective internet environment, and GDP data is taken from the Wold Bank data. The study found that nine European countries have a causative association from exchange rate to economic growth.

Mori, Asid, Lily, Mulok, and Loganathan (2012) examined the impact of exchange rates on economic growth: an empirical test of nominal and actual. The paper employed time sequence data from 1971 to 2009 to study the impact of exchange rates on Malaysia's economic growth. To estimate the impact on Malaysia's economic growth, the study used variables such as real GDP (RGDP) as a proxy and a meter of economic growth, the real exchange rate (RER) and nominal exchange rate (NER) as independent variables. ARDL threshold test results show that there is a long-term cointegration association among the nominal exchange rate and the real exchange rate and economic growth, in which the real exchange rate shows a substantial positive coefficient. Another result of ECM-based ARDL also shows the two exchange rates to possesses comparable causative relations to economic growth.

Ahmad, Ahmad, and Ali (2013) scrutinized the association between exchange rate and economic growth in Pakistan by using yearly time series data from 1975 to 2015. The study used multiple regression method based on the Ordinary Least Square (OLS). The study concludes that exchange rate adversely had an impact on the economic progress in Pakistan.

4.Methodology

This study used yearly data from 1995 to 2017; the data was downloaded from World Bank. The parameters employed in the study are, Gross Domestic Product (GDP) which indicated the economic growth in Cambodia, and independent variables that were included in this study are exchange rate, inflation rate, money supply, TOP and FDI. The estimation was performed using ordinary least squares (OLS) Model. The data was analysed with the help of statistical Stata Software. The model of estimating the impact of exchange rate on economic growth is stated as fellows:

Where Β0, β1, β2, β3, β4, β5 are coefficients. GDP is the gross domestic product that indicates Cambodia's economic growth and is expressed as a dependent variable. The independent variable is: EXR is the exchange rate, IFR is the rate of inflation calculated using the consumer price index, M2 is the broad money, TOP is the trade openness calculated by dividing imports and exports by GDP, FDI is foreign direct investment, and ɛ is the wrong item.

5. Results and Discussions

5.1. Residuals Diagnostic Test

The residual test was configured to determine whether the data and the variables are stable and cascaded, the Breusch-Godfrey serial correlation LM test was executed. Table 1 displays the sequence correlation results for the Breusch-Godfrey test. The P-Value was larger than 5% significance levels (0.1920> 5%), in this case we fail to reject the null hypothesis without sequence correlation and settled that the model and data may not have categorization or sequence correlation.

| F-statistic | 1.256599 |

| Obs*R-squared | 3.300571 |

| Prob.F(2,15) | 0.3129 |

| Prob.Chi-square(4) | 0.1920 |

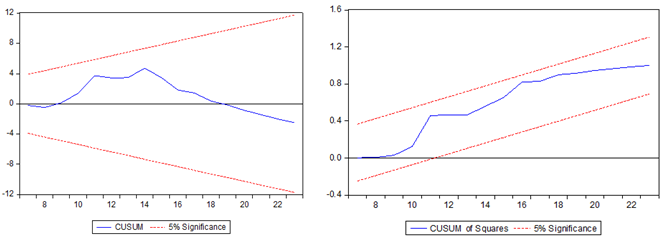

5.2. Stability Diagnostic Test

Figure 1 displays the stability of the CUSUM test and the CUSUM square test for the variables considered. It is clear from the CUSUM and CUSUM of squares test that since the blue line does not exceed the 5% significance line (red line), the variables are very stable during the period under study. Therefore, we believe that all variables and data are well adapted.

Figure-1. CUSUM tests and CUSUM of squares test.

| Variables | Coefficients |

Standard error |

t-statistics |

P-value |

[95% Conf. interval] |

|

| logGDP | Coef. |

Std. err. |

t |

P>|t| |

95% Conf. interval] |

|

| logEXR | 3.33378 |

.6198011 |

5.3 |

0.000*** |

1.994781 |

4.6727798 |

| logM2 | .171813 |

.1184993 |

1.45 |

0.171 |

-.0841891 |

.4278152 |

| logFDI | -.1159743 |

.0862286 |

-1.34 |

0.202 |

-.3022599 |

.0703113 |

| logTOP | -2.170839 |

.1671143 |

-12.99 |

0.000*** |

-2.531867 |

-1.80981 |

| logIFR | .0041148 |

.0689773 |

0.06 |

0.953 |

-.1449016 |

.1531312 |

| _cons | -16.98361 |

4.886868 |

-3.48 |

0.004*** |

-27.54105 |

-6.426173 |

| Asterisk *** and ** indicates 1% and 5% significance levels respectively. Ln= natural log. |

| Source | SS |

df |

MS |

Number of obs. = 19 |

| F (5, 13) = 41.30 | ||||

| Model | 19.1028218 |

5 |

3.82056436 |

Prob > F = 0.0000 |

| Residual | 1.20253023 |

13 |

.092502325 |

R-squared = 0.9408 |

| Adj R-squared = 0.9180 | ||||

| Total | 20.305352 |

18 |

1.12807511 |

Root MSE = .30414 |

In the result of the regression in Table 2 and 3 show that the R-squared 19.1028/20.3053=0.9407 about 94%, the extraordinary significance of coefficient of determination (R2) indicates that about 94% of the regressand (GDP) was elucidated by the regressors while remaining 0.06 or 6% is elucidated by external variables or indicators of the model.

Prob > F = 0.0000 mean that the probability that improvements of 5 variables model is less than 1% 5%10% so we can reject null hypothesis.

On the above analysis, we can specify and outline the empirical equation as fellows;

From model above, for every additional amount of Exchange rate the anticipated value of GDP increase by 3.33 on average holding all other variables constant. According to the P-Value of exchange rate is smaller than 1% so we reject the null hypothesis. Broad money (M2) have the positive relationship with GDP, the degree of M2 expected number of GDP increase by 0.17, but the P-Values of M2 is 0.171>10% >5%>1% so we cannot reject the null hypothesis and perhaps it possesses no robust effect on economic growth. Foreign Direct Investment (FDI) holds an adverse association with GDP, the expected number of GDP decrease by 0.115, and the P-Values of FDI= 0.202>10% >5%>1% so we cannot reject the null hypothesis. The TOP and GDP holds negative relationship with each other if the number of TOP decrease by one the expected number of GDP will decrease by 2.170. The P-Value of TOP is 0.00; a strong signification effect less than 1% 5% and 10%, so we reject the null hypothesis and conclude that trade openness has great impact on Cambodia economy. The inflation rate (IFR) has positive relationship with GDP, for every 1 Riel increase in inflation rate (IFR) value, Gross Domestic Product (GDP) will affected by 0.004, the P-Value= 0.953>10% >5%>1% so we cannot reject the null hypothesis and we conclude that inflation rate has no effect on economic growth in the period investigated.

6. Conclusion and Recommendation

This study investigated the impact of exchange rate on economic growth in Cambodia. The employed the ordinary least squares (OLS) Model for empirical analysis. According to the result above it was found that, the exchange rate (EXR) and Trade Openness (TOP) have 1% significance influence on GDP (proxied as economic growth). The Exchange Rate has positive correlation with GDP while the Trade Openness has negative correlation with the GDP. Other variable such as broad money (M2), inflation rate (IFR), foreign direct investment (FDI) possess no significant effect on Gross Domestic Product in Cambodia.

Therefore, the study suggests that the government should carry out strict domestic economic transformation (monetary policy, trade liberalization etc.) and export promotion to strengthen the economic base, thereby attracting foreign investors into the economy. The National Bank of Cambodia (NBC) should give specific importance particularly to exchange rate and interest rate volatility to guarantee that confidence is embedded in both investors and the financial sectors.References

Agus, S., Ignatius, A., & Long, V. (2018). An evidence analysis of the exchange rate disconnect puzzle in Indonesia. Journal of Business Manaagement and Economic Research, 2(5), 47-60. Available at: https://doi.org/10.29226/tr1001.2018.33.

Ahmad, A., Ahmad, N., & Ali, S. (2013). Exchange rate and economic growth in Pakistan. Journal of Basic and Applied Scientific Research, 3(8), 740-746.

Ajakaiye, D. O. I. (2002). Economic development in Nigeria: A review of experience during the 1990s (No. 1): Nigerian Institute of Social & Economic Research.

Akpan, E. O., & Atan, J. A. (2011). Effects of exchange rate movements on economic growth in Nigeria. CBN Journal of Applied Statistics, 2(2), 1-14.

Ayodele, T. (2014). An empirical evaluation of the impact of exchange rate on the Nigeria economy. Journal of Economics and Sustainable Development, 5(8), 11-19.

Azid, T., & Jamil, M. (2005). Impact of exchange rate and its volatility on growth and economic performance: A case study of Pakistan. 21st Annual General Meeting & Conference, Pakistan Institute of Development Economics, Islamabad (Pakistan). Pakistan Development Review, 44(4), 749-775.

Barguellil, A., Ben-Salha, O., & Zmami, M. (2018). Exchange rate volatility and economic growth. Journal of Economic Integration, 33(2), 1302-1336.

Ehinomen, C., & Oladipo, T. I. (2012). Exchange rate management and the manufacturing sector performance in the Nigerian economy. IOSR Journal of Humanities and Social Science, 5(5), 1-12. Available at: https://doi.org/10.9790/0837-0550112.

Hussaini, U., Aguda Niyi, A., & Davies, N. O. (2018). The effects of exchange rate volatility on economic growth of West African English-speaking countries. International Journal of Academic Research in Accounting, Finance and Management Sciences, 8(4), 131-143.

Ignatius, A., Agus, S., & Long, V. (2018). The dynamics of inflation, money growth, exchange rates and interest rates in Ghana Journal of Business Management and Economic Research, 2(6), 21-32. Available at: https://doi.org/10.29226/tr1001.2018.39.

Im, T. N., & Dabadie, M. (2007). Dollarization in Cambodia. National Bank of Cambodia.

Kenneth, O. O., Jonathan, O. O., & Kenneth, U. N. (2016). The impact of exchange rate regimes on economic growth in Nigeria. Journal of Economic and Sustainable Development, 7(12).

Korkmaz, S. (2013). The effect of exchange rate on economic growth: Balikesir University: ResearchGate.

Laganà, G., & Sgro, P. M. (2007). The exchange rate disconnect puzzle: A resolution? Asia-Pacific Journal of Accounting & Economics, 14(1), 43-68. Available at: https://doi.org/10.1080/16081625.2007.9720787.

Mori, K., Asid, R., Lily, J., Mulok, D., & Loganathan, N. (2012). The effect of exchange rates on economic growth: Empirical testing on nominal versus real. The IUP Journal of Financial Economics, 10(1), 7-17.

Paul, R. K., & Maurice, O. (2009). International economics: Theory and policy (pp. 706). Pearson Addison-Wesley, 2009 -Business & Economics.

Peter, Y. M., & Isaac, K. O. (2017). Real exchange rate and economic growth in Ghana. MPRA Paper No. 82405.