Macroeconomic Determinants of Interest Rate Volatility in Indonesia: A Structural VAR Analysis

Agus Salim

School of Economics and Business, Northeast Normal University, Changchun, China. |

AbstractThe determination of interest rates is not only influenced by inflation rate but also the sharing of factors of other macroeconomic variables. The study of the determinants interest rate has developed based on the variability and the methodological concept. Since the purpose of this study is to analyze the effect of macroeconomic variables on the interest rate volatility in Indonesia, we apply ordinary least square to estimates the empirical model of interest rate determinants statically, and the structural VAR analysis dynamically. The result of the estimation reveals that the coefficient estimates of money supply, exchange rate, and the GDP growth have negative and significant effect in the long-run. However, the risk premium shock has positive and significant effect on the interest rate and inflation rate in Indonesia. |

Licensed: |

|

Keywords: |

|

Accepted: 4 November 2019 |

Funding: This research received no external funding. |

Competing Interests: The author declares no conflict of interest. |

Acknowledgement: The views expressed herein are that of author and do not necessarily reflect those of School of Economic and Business, Northeast Normal University. |

1. Introduction

Determination of interest rates carried out through monetary policy is a very important thing, because this is indirectly related to the problem of economic stability and economic growth of a country. After the decline of the Indonesian Rupiah vis-a-vis the US Dollar, the economy in general has destroyed, including financial aspect. Inflation is one of the effects of a prolonged economic crisis that hit a country. An increase in prices that takes place continuously in an extended period, would be followed by a decline of real value of a country's currency (Brailsford, Jack, & Lai, 2006; Chow & Yoonbai, 2006). Generally, the reason of the economic crisis in Indonesia were not caused by weak economic fundamentals, but because of the declining Rupiah exchange rate against the US Dollar. Short-term private foreign debt since the early 1990s has accumulated very mostly, which is primarily unprotected against foreign currencies. It is what then adds pressure to the Indonesian rupiah exchange rate because there is not enough foreign exchange to pay maturing debts and interest rate.

Determination of interest rates, especially the interest rate of credit, is based on the monetary policy implemented. There are several monetary policies carried out in this matter by Bank Indonesia as the central bank, namely controlling money supply and controlling the inflation rate and concerning the problem of the stability of the Indonesian Rupiah. Furthermore, the monetary crisis that occurred in 2007 due to the decline in the value of the Indonesian rupiah vis-a-vis the United States dollar has a significant influence on the economy in Indonesia, including banking. It affects domestic inflation. Inflation is a condition where there is a sharp increase in prices (absolute) which takes place continuously in a long period of time which is followed by a decline in the real (intrinsic) value of a country's currency (Chow & Yoonbai, 2006; Huang & Lev, 2011; Toyoshima, 2012; Tumwine, Samuel, Edward, & Nixon, 2018). In order to prevent the monetary crisis, one alternative approach taken is to implement a monetary control system that is characterized by the policy of raising interest rates on bank deposits by the government.

The monetary sector has an important role, not only as a financial intermediary but also as a party that limits, assesses and distributes the risks faced. Financial deepening guarantees the occurrence of lower transactions, more optimal risk distribution, allocation and which is increasingly focused on the best investment options. Thus, financial deepening encourages increased economic efficiency. Before the deregulation of the financial system was marked by a number of regulations that did not encourage financial deepening, such as the determination of interest rates by the monetary authority, the establishment of a credit ceiling, high mandatory minimum reserves (Chou, 2018; Duarte, 2008; Sensoy & Cihat, 2014). One of the efforts made by the banks to help the government in dealing with inflation is to suppress the money supply both in the narrow and broad sense or economic liquidity. The effect of this policy, both private banks and state banks are competing to raise interest rates (Haughton & Emma, 2012; Kiptui, 2014). With the hope that the interest given by banks to the public is the main attraction for the public to save their money in the bank, while for banks, the higher the amount of society that can be collected, will increase the ability of banks to finance their operational operations, which are mostly in the form of providing loans to the public.

A higher deposit rates than those formally reported in the hope that the raised interest rates will cause the amount of money in circulation to decrease because people prefer to save rather than turn their money around productive sectors or save them in cash at home (Bhattarai, 2011; Obeng & Daniel, 2017; Saunders & Liliana, 2000; Tumwine et al., 2018). Hainz, Roman, and Michal (2014) reveal that high-interest rates will encourage depositors to save their money in banks rather than invest in the production sector that has a higher level of risk. Thus, the inflation rate can be controlled through an interest rate policy (Fang, Sohel, & Chien-Ting, 2012; Fornari, Carlo, Marcello, & Massimo, 2002; Kim & Jeffrey, 2000; Kiptui, 2014; Tennant & Abiodun, 2009). However, in reality, Ozdemir and Cuneyt (2012) reveal that the determination of interest rates is not only influenced by inflation, but also the sharing of factors that can cause a bank to determine the size of the interest rate whether it is deposits, savings or credit. Thus, our purpose is to examine the effect of money supply, inflation rate, exchange rate, and economic growth on the interest rate volatility in Indonesia.

The result shows that all of the macroeconomic variables have a significant effect on the interest rate volatility in Indonesia. Moreover, the risk Premium shock has negative effect on the money supply, exchange arte, and the GDP growth. However, in the long-run, it has positive and significant effect on the interest rate and inflation rate in Indonesia. To this end of this section, we introduce the next section is the literature review. In section 3, we present the analysis method. The empirical result and discussions are provided in section 4. Finally, we conclude the result in section 5.

2. Literature Review

The interest rate has linkages to the volatility of other macroeconomic variables. The good news of macroeconomic variables would encourage the public's expectation of the interest rate increase. Kim and Jeffrey (2000) examine the effect of macroeconomic news on interest rate volatility in the US and Australia. They find that monetary policy announcement has a significant effect on interest rate both in the short-run and long-run. The conditional volatility of the Australian interest rate changes was also significantly influenced by lagged US interest rate shocks, as well as by surprises in US macroeconomic announcements.

Interest rate volatility is also determined by other external country's variables, which is the exchange rate. Chow and Yoonbai (2006) study the effect of exchange rate movement on interest rates in Indonesia, Korea, Philippines, and Thailand after the Asian Financial Crisis. The used bivariate vector auto regression-generalized autoregressive conditional heteroskedastic (VAR-GARCH) to estimate the weekly data stream from 1 January 1990 to 30 April 2005. The result shows that there is evidence in the post-crisis period that an increase in exchange rate variability affects the short-term decrease in interest rate volatility. However, they did not find a robust long-term relationship between exchange rate flexibility and interest rate variability. Similarly, the application of GARCH to estimate the interest rate determinants was explained by the study of Fang et al. (2012) study the impact of macroeconomic surprises on interest rate swap spreads in Australia during the economic expansion and contraction periods. The result of employing the exponential generalized autoregressive conditional heteroskedasticity (EGARCH) specification shows that there is a different effect of the macroeconomic announcement on swap spread based on the size of the state of the economy. The inflation rate has a significant effect on the swap spreads across all maturities during the contraction and remains the critical news announcement through the business cycle in Australia.

The study of interest rate determinants developed due to the variability of interest rate in the financial sector. Ying, Carl, and Maximo (2008) analyze the determinants of the Japanese Yen interest rate swap spread. They used a smooth transition vector autoregressive (STVAR) impulse response function model to estimate weekly data from August 8, 1997, to April 15, 2005. The result shows that the government bond model is indicated as a transition variable control of the smooth transition from high to low volatility regime. Overall, their result describes an effect on the shorter maturity spreads, whereas the term structure shocks play an essential role in the longer maturity spreads.

Bhattarai (2011) tests the impact of the exchange rate and money supply on macroeconomic variables, especially the impact on interest rate in the UK. The analysis based on the indirect lest square (ILS), two stages least square (2SLS), and three stages least square (3SLS) to estimate quarterly data from 1970.II to 2006.I. The result shows that the money supply has a positive and significant effect on the interest rate. It means that higher liquidity in the financial system, a higher interest rate. However, the exchange rate has an inverse effect on the interest rate. A higher exchange rate of the UK pounds vis-à-vis the US dollar will deteriorate the volatility of interest rate in the UK.Smales (2013) analyzes the impact of macroeconomic announcements on interest rate futures in the case of Australia and its reaction towards the global financial crisis in 2007-2008. The analysis uses big frequency data on Australian interest rate futures (30-day interbank, 90-day bank bill, and 3- and 10- year government bond future) over the period from January 6, 2004, to December 31, 2010, with a total of 1,795 trading days. The result shows that consumer price index and gross domestic product have a positive and significant effect on the volatility of 30-day interbank, 90-day bank bill, and 3- and 10- year government bond futures in Australia. Moreover, the GFC has significantly affected the response of Australian interest rate futures to major macroeconomic announcements.

Kiptui (2014) analyzes the determinants of the interest rate spread use the banking perspective in Kenya. The analysis employs two methods, such as decomposition technique and panel data analysis. The decomposition analysis combines data from income statements and consolidated balance sheets of commercial banks to analyze the spread. The result shows that GDP growth and exchange rate variability have a positive and significant effect on the interest rate spread in Kenya. It means that an increase in the GDP and exchange rate would increase the spread of interest rates due to the excellent condition of the economy. Moreover, an appreciation of exchange rate instability/variability (measured in standard deviations from mean) by 1 percent results in an upward adjustment of interest margins by 0.06 percent.

3. Research Method

3.1. Data Source

This study uses quarterly data from 2002: I to 2017: I due to the availability of the data. The original dataset is mainly gained from the official site of the International Monetary Fund (IMF), the Organization for Economic Co-operation and Development (OECD), and the Indonesian Statistical Bureau. The dependent variable is the interest rate volatility. The independent variables are M2 to represent the money supply, consumer price index to represent the inflation rate, the IDR vis-à-vis USD to represent the exchange rate between Indonesia and the US, and total GDP of Indonesia as a proxy of growth rate in both countries.

3.2. Empirical Model

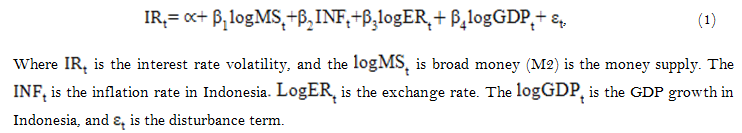

Since the main purpose of this study is to analyze the effect of money supply, inflation rate, exchange rate, and GDP growth on the interest rate in Indonesia, we adopt the previous macroeconomic model from the study of Obeng and Daniel (2017). We improved the model by applying the exchange rate variable, as suggested by Chow and Yoonbai (2006), and the GDP growth rate to represent the business cycle, as suggested by (Kiptui, 2014). The original model of this study is outlined by Equation 1:

| Variable | Data | Description | Source | Expectation |

| The interest rate of the money market | Indicator of the rate of return in ASEAN-5 countries | International Financial Statistic of the International Monetary Fund (IMF) | ||

| Broad money (M2) | Money supply | Organization for Economic Co-operation and Development (OECD) | - |

|

| Consumer price index | Indicator of the inflation rate | International Financial Statistic of the International Monetary Fund (IMF) | + |

|

| the Indonesian Rupiah vis-á-vis the US dollar | Indicator of the exchange rate volatility | International Financial Statistic of the International Monetary Fund (IMF) | - |

|

| Real GDP | The indicator of GDP growth in Indonesia | World Bank | + |

The interest rate is represented by the interest rate of the money market in percent per annum is obtained from the official site of the International Financial Statistic of the International Monetary Fund (IMF). Broad money using M2 of Indonesia to represent the money supply, and we gained this data from the Organization for Economic Co-operation and Development (OECD). The consumer price index as a proxy of the inflation rate gained from the International Financial Statistic of the International Monetary Fund (IMF). The exchange rate of the Indonesian Rupiah vis-á-vis the US dollar has also obtained from the official site of the International Monetary Fund (IMF). The real gross domestic product (GDP) variables are measured in the current US dollar in which obtained from the official site of the World Bank. Since the data provided in yearly frequency, we employed the linear interpolation method.

3.3. Estimation Strategy

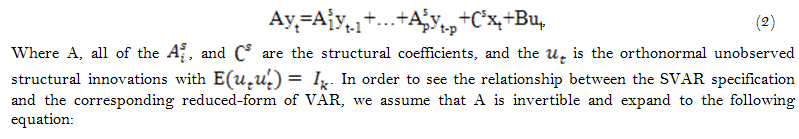

The estimation begins with a descriptive statistical analysis of the data used in this study. We estimate the model of Equation 1 use the ordinary least square (OLS) by estimating the t-statistic for partial analysis and F-statistic for simultaneous analysis. Besides, we also apply the dynamic model to make a robust checking of our estimation. We estimate the model of Equation 1 use the structural vector autoregression (SVAR). The estimation also reports the result of the Johansen cointegration test and summary statistic. We also apply for the time series properties for each macroeconomic variable. We begin with the SVAR specification as follows presented in Equation 2:

Where ![]() . SVAR estimation uses

. SVAR estimation uses ![]() is obtained from the reduced form of VAR in Equation 6. The challenge of SVAR estimation is that only k(k+1)/2 moments in

is obtained from the reduced form of VAR in Equation 6. The challenge of SVAR estimation is that only k(k+1)/2 moments in ![]() and more than k(k+1)/2 elements in A, B, and S. Thus, the matrices are not identified unless additional restrictions are provided.

and more than k(k+1)/2 elements in A, B, and S. Thus, the matrices are not identified unless additional restrictions are provided.

Finally, to arrange the six variables and ten long-run restrictions in the matrix of long-run multipliers, we derived the form as follows:

4. Result and Discussion

4.1. Statistic Descriptive Analysis

The analysis begins from the correlation matrix for each variable and the summary statistic of data that used to estimate the Equation 1. Generally, we employed the same number of observations for dependent and independent variables. Some of the variables are converted into the logarithmic due to the different spread. The correlation analysis of each variable is presented in Table 2.

| Correlation | |||||

1 |

-0.782062 |

0.513895 |

-0.412920 |

-0.796458 |

|

-0.782062 |

1 |

-0.425262 |

0.742235 |

0.992256 |

|

0.513895 |

-0.425262 |

1 |

-0.157251 |

-0.384393 |

|

-0.412920 |

0.742235 |

-0.157251 |

1 |

0.759134 |

|

-0.796458 |

0.992256 |

-0.384393 |

0.759134 |

1 |

The result of correlation matrix analysis shows that interest rate has negative correlation with all of macroeconomic variables, except the inflation rate. It indicates that an increase in the inflation rate will be responded by the increase in the interest rate. However, it has an inverse correlation with money supply variable. The exchange rate and the GDP growth have a positive correlation; however, the inflation has negative correlation to the money supply. Similarly, the exchange rate and the GDP growth have negative correlation to the inflation rate. Finally, the result of correlation analysis revels that the GDP growth has positive correlation with the exchange rate of IDR vis-à-vis USD.

| Statistics | |||||

| Mean | 13.60895 |

4.526627 |

6.854737 |

9.210476 |

14.53211 |

| Median | 13.13000 |

4.527190 |

6.380000 |

9.135002 |

14.50995 |

| Maximum | 18.42000 |

5.389020 |

17.78000 |

9.536104 |

14.97554 |

| Minimum | 11.44000 |

3.670101 |

2.590000 |

9.040888 |

14.04646 |

| Std. Dev. | 1.721448 |

0.558338 |

3.277933 |

0.148500 |

0.265530 |

| Skewness | 1.018885 |

-0.017469 |

1.666071 |

0.984490 |

-0.113834 |

| Kurtosis | 3.476770 |

1.655814 |

5.840239 |

2.574848 |

1.977401 |

| Jarque-Bera | 10.40206 |

4.294132 |

45.52905 |

9.636882 |

2.606662 |

| Probability | 0.005511 |

0.116826 |

0.000000 |

0.008079 |

0.271625 |

| Sum | 775.7100 |

258.0177 |

390.7200 |

524.9971 |

828.3301 |

| Sum Sq. Dev. | 165.9495 |

17.45750 |

601.7114 |

1.234928 |

3.948355 |

| Observations | 57 |

57 |

57 |

57 |

57 |

According to Table 3, the using of logarithmic term for money supply, exchange rate, and interest rate data have low differences between variables. The minimum value of interest rate and other macroeconomic variables have not high different spreads. The mean of each variable is quite close from each other which lie below the 15. Table 3 also reports the standard deviation for each variable that has similar spread which lie between 0.25 to 3.30, especially between the exchange rate and GDP growth variables.

4.2. Empirical Analysis and Discussion

4.2.1. The Result of Ordinary Least Square (OLS) Analysis

Determinants of the interest rate in Indonesia are mainly estimated through the structural vector autoregressive (SVAR). Before we estimate the dynamic model of SVAR, we apply the static analysis based on the ordinary least square (OLS). We analyze the effect of money supply, inflation rate, the exchange rate of IDR vis-à-vis USD, and the GDP growth on the volatility of interest rate in Indonesia. Table 4 presents the estimation result of the Equation 1 by using the ordinary least square (OLS). The coefficient estimates of the money supply variable are 4.821453, which has a positive and significant effect on the interest rate. It implies that a one-point increase in the money supply in public, it would be responded by 4.5 times an increase in the interest rate. Our result supports the study of Bhattarai (2011) who tests the impact of the exchange rate and money supply on macroeconomic variables, especially the impact on interest country has a positive and significant effect on the volatility of the interest rate. According to the impact of foreign affairs on the domestic interest rate in Indonesia, we employ the exchange rate variable. We follow the study of Bhattarai (2011); Chow and Yoonbai (2006) and Kiptui (2014) Kiptui (2014) that the exchange rate correlates with the volatility of the interest rate. According to the result of the exchange rate is 4.761336, which means that it has a positive and significant effect. It implies that an increase in the exchange rate of the IDR vis-à-vis USD around 1 point, it would be responded by the increase of the interest rate in Indonesia around 4.7 times. Our finding is similar to the result of Chow and Yoonbai (2006) Chow and Yoonbai (2006) and Kiptui (2014). However, it differs from the finding of Bhattarai (2011), who found that an increase in the exchange rate variable will decrease the interest rate variable. Rate in the UK. However, it differs from the study of Obeng and Daniel (2017), who reveals that the money supply does not correlate with the volatility of interest rate in the long-run.

The result of the inflation rate's coefficient implies that an increase in one point in the inflation rate due to the increase of money supply in Indonesia would push the Central Bank of Indonesia (Bank Indonesia) to increase the interest rate of around 13.6209 percent. This result has similar thought to the study of Bhattarai (2011); Fang et al. (2012); Kim and Jeffrey (2000) and Smales (2013) that the dynamic of the inflation rate in a

| Test | C |

||||

| t-statistic | 188.2039*** (44.44310) |

4.821453*** (1.750757) |

0.136209*** (0.040785) |

4.761336*** (1.190872) |

-16.59826 (3.680185) |

| F-statistic | 46.04561*** [0.000000] |

||||

| Adjusted R2 | 0.762895 |

||||

Figures reported in the parenthesis ( ) are the standard errors and the parenthesis [ ] is probability. An asterisk ***, **, and * indicate rejection of the null hypothesis at 1, 5, and 10 percent of significance level, respectively.

We follow the study of Kiptui (2014); Kiptui (2014) and Smales (2013) that GDP has a significant effect on the interest rate. Since we use the GDP variable as a proxy of the business cycle in Indonesia, the result of the coefficient of GDP variable is -16.59826 with has a negative and significant effect. The result implies that an increase in the business cycle, around 1 percent, will decrease the interest rate in Indonesia around 16.6 points. Our finding does not support the previous finding of Fang et al. (2012); Kiptui (2014); Smales (2013); andTennant and Abiodun (2009) who conclude that an increase in the business cycle will be responded by the similar sign or increase in the interest rate volatility.

4.2.2. The Result of Structural Vector Autoregressive (SVAR) Analysis

In order to present the dynamic analysis of the effect of money supply, inflation rate, the exchange rate of IDR vis-à-vis USD, and the GDP growth on the volatility of interest rate in Indonesia, we estimates Equation 7 by applying the structural vector autoregressive (SVAR) estimation. The relationship between the interest rate and the macroeconomic variables is mainly estimated using the structural VAR (SVAR). The estimation result of long-run responses in the SVAR model is presented in Table 5. Since we arrange that ![]() are risk premium shock, demand shock, supply shock, foreign shock, and aggregate spending shock respectively, and we estimate the long-run response of SVAR model from the Equation 7.

are risk premium shock, demand shock, supply shock, foreign shock, and aggregate spending shock respectively, and we estimate the long-run response of SVAR model from the Equation 7.

| Type of Shock | to: |

Coefficient |

Std. error |

z-Statistic |

Prob. |

| Risk premium shock | 9.162458 |

0.873485 |

10.48954 |

0.0000 |

|

-3.866692 |

0.376107 |

-10.28083 |

0.0000 |

||

11.68261 |

1.165765 |

10.02141 |

0.0000 |

||

-0.686490 |

0.077654 |

-8.840386 |

0.0000 |

||

-1.811686 |

0.177578 |

-10.20221 |

0.0000 |

||

| Demand shock | 0.553736 |

0.052797 |

10.48805 |

0.0000 |

|

0.440912 |

0.341790 |

1.290008 |

0.1970 |

||

0.221954 |

0.036047 |

6.157437 |

0.0000 |

||

0.289602 |

0.030691 |

9.436010 |

0.0000 |

||

| Supply shock | 2.515534 |

0.239847 |

10.48809 |

0.0000 |

|

0.067599 |

0.028460 |

2.375269 |

0.0175 |

||

0.056641 |

0.012261 |

4.619707 |

0.0000 |

||

| Foreign shock | 0.205579 |

0.019601 |

10.48808 |

0.0000 |

|

0.074393 |

0.008417 |

8.838142 |

0.0000 |

||

| Aggregate spending shock | 0.033609 |

0.003205 |

10.48809 |

0.0000 |

This study uses standard error that indicates the rejection of the null hypothesis at 1, 5, and 10 percent of significance level.

Table 5 presents the estimation result of the Equation 7 by using the structural vector autoregressive (SVAR) model. The coefficient estimates of money supply, exchange rate, and the GDP growth on the first line are negative and significant. It indicates that the risk Premium shock has negative effect on the money supply, exchange arte, and the GDP growth. However, it has positive and significant effect on the interest rate and inflation rate in Indonesia. The second line of Table 5 explains the effect of demand shock on the money supply, inflation rate, exchange rate and the GDP growth are positive. However, only the inflation rate is not statistically significant affected by the demand shock in the long-run.

Supply shock, foreign shock, and the aggregate spending shock are responded positively by macroeconomic variables engaged. Inflation rate, exchange rate, and the GDP growth have positively response to the supply shock; however, the exchange rate has the lowest significance. Exchange rate and the GDP growth have positive to the foreign shock. Finally, the GDP growth has also positive response on the aggregate spending shock in the long-run.

Figure-1. Accumulated impulse response to the structural shocks. Shock 1, shock 2, shock 3, shock 4, shock 5, are risk premium shock, demand shock, supply shock, foreign shock, and aggregate spending shock respectively.

Figure 1 presents the accumulated response to the structural macroeconomic shocks such as risk premium shock, demand shock, supply shock, foreign shock, and aggregate spending shock. The first line of Figure 1 shows the response of interest rate to the macroeconomic shocks. Some of the interest rate response are negative except the response of interest rate on the risk premium shock is positive at all of horizon. The second line presents the response of money supply variable to the macroeconomic shocks. Almost all of the shocks are negatively responded by money supply variable, except the effect of demand shock on the money supply.

Line 3 of Figure 1 above explains the positive response of inflation rate on the supply shock effect at all quarter of horizon. However, other shocks are responded negatively by the inflation rate in the long-run. The effect of risk premium shock, demand shock and foreign shock are positively responded by the exchange rate of IDR vis-à-vis USD. It similar to the response of the GDP growth to the demand shock, supply shock, foreign shock, and the aggregate demand shock. Finally, the GDP growth negatively response to the risk premium shock in the long-run.

5. Conclusion

The consensus of the study of the interest rate determinants, we need to estimates the effect of money supply, inflation rate, exchange rate, and the business cycle on the volatility of the interest rate in Indonesia both partially and simultaneously. We improve the pervious study of that analyze the effect of macroeconomic variables on the interest rate volatility. Our result of analysis explains that money supply, inflation rate, exchange rate, and the GDP growth have a significant effect on the interest rate. The coefficient estimate of GDP growth suggests an inverse relationship between the GDP and the interest rate in Indonesia. The result indicates that an increase in the GDP growth would be followed by the decreasing in the interest rate in Indonesia. According to the result of SVAR analysis, the coefficient estimates of money supply, exchange rate, and the GDP growth have negative and significant to the response of the risk premium shock. However, the shock has positive and significant effect on the interest rate and inflation rate. Moreover, the response of interest rate to the macroeconomic shocks. Some of the interest rate response are negative except the response of interest rate on the risk premium shock is positive at all of horizon.

References

Bhattarai, K. (2011). Impact of exchange rate and money supply on growth, inflation and interest rates in the UK. International Journal of Monetary Economics and Finance, 4(4), 355-371. Available at: https://doi.org/10.1504/ijmef.2011.043400.

Brailsford, T., Jack, H. W. P., & Lai, C. D. (2006). Effectiveness of high interest rate policy on exchange rates: A reexamination of the Asian financial crisis. Journal of Applied Mathematics and Decision Sciences, 1-9. Available at: 10.1155/JAMDS/2006/35752.

Chou, Y.-H. (2018). Understanding the sources of the exchange rate disconnect puzzle: A variance decomposition approach. International Review of Economics & Finance, 56(7), 267–287. Available at: https://doi.org/10.1016/j.iref.2017.10.029.

Chow, H. K., & Yoonbai, K. (2006). Does greater exchange rate flexibility affect interest rates in post-crisis Asia? Journal of Asian Economics, 17(3), 478–493. Available at: https://doi.org/10.1016/j.asieco.2006.04.005.

Duarte, J. (2008). The causal effect of mortgage refinancing on interest rate volatility: Empirical evidence and theoretical implications. Review of Financial Studies, 21(4), 1689–1731. Available at: https://doi.org/10.1093/rfs/hhm062.

Fang, V. A. S. M., Sohel, A. J. A. B., & Chien-Ting, L. (2012). Business cycles and the impact of macroeconomic surprises on interest rate swap spreads: Australian evidence. In Contemporary Studies in Economic and Financial Analysis, edited by Jonathan A. Batten and Niklas Wagner, Emerald Group Publishing Limited, 94, 379–398. Available at: https://doi.org/10.1108/s1569-3759(2012)0000094018.

Fornari, F., Carlo, M., Marcello, P., & Massimo, T. (2002). The impact of news on the exchange rate of the lira and long-term interest rates. Economic Modelling, 19(4), 611-639. Available at: https://doi.org/10.1016/s0264-9993(00)00073-0.

Hainz, C., Roman, H., & Michal, H. (2014). The interest rate spreads in the Czech Republic: Different loans, different determinants? Economic Systems, 38(1), 43–54. Available at: https://doi.org/10.1016/j.ecosys.2013.10.002.

Haughton, A. Y., & Emma, M. I. (2012). Interest rate volatility, asymmetric interest rate pass through and the monetary transmission mechanism in the Caribbean compared to US and Asia. Economic Modelling, 29(6), 2071–2089. Available at: https://doi.org/10.1016/j.econmod.2012.06.034.

Huang, R., & Lev, R. (2011). The dark side of bank wholesale funding. Journal of Financial Intermediation, 20(2), 248–263. Available at: https://doi.org/10.1016/j.jfi.2010.06.003.

Kim, S.-J., & Jeffrey, S. (2000). International linkages and macroeconomic news effects on interest rate volatility — Australia and the US. Pacific-Basin Finance Journal, 8(1), 85–113. Available at: https://doi.org/10.1016/s0927-538x(99)00027-x.

Kiptui, M. C. (2014). Determinants of interest rate spread: Some empirical evidence from Kenya’s banking sector. International Business Research, 7(11), 94-107.

Obeng, S. K., & Daniel, S. (2017). Macroeconomic determinants of interest rate spreads in Ghana. African Journal of Economic and Management Studies, 8(1), 76-88. Available at: https://doi.org/10.1108/ajems-12-2015-0143.

Ozdemir, N., & Cuneyt, A. (2012). Determinants of interest rate pass-through for emerging market economies: The role of financial market structure. International Advances in Economic Research, 18(4), 397–407. Available at: https://doi.org/10.1007/s11294-012-9377-9.

Saunders, A., & Liliana, S. (2000). The determinants of bank interest rate margins: An international study. Journal of International Money and Finance, 19(6), 813–832. Available at: https://doi.org/10.1016/s0261-5606(00)00033-4.

Sensoy, A., & Cihat, S. (2014). Effects of volatility shocks on the dynamic linkages between exchange rate, interest rate and the stock market: The case of Turkey. Economic Modelling, 43(12), 448–457. Available at: https://doi.org/10.1016/j.econmod.2014.09.005.

Smales, L. A. (2013). Impact of macroeconomic announcements on interest rate futures: High-frequency evidence from Australia. Journal of Financial Research, 36(3), 371–388. Available at: 10.1111/j.1475-6803.2013.12015.x.

Tennant, D., & Abiodun, F. (2009). Macroeconomic and market determinants of interest rate spreads in low- and middle-income countries. Applied Financial Economics, 19(6), 489–507.

Toyoshima, Y. (2012). Determinants of interest rate swap spreads in the US: Bounds testing approach to cointegration. Applied Financial Economics, 22(4), 331–338.

Tumwine, S., Samuel, S., Edward, B., & Nixon, K. (2018). Determinants of interest rate in emerging markets: A study of banking financial institutions in Uganda. World Journal of Entrepreneurship, Management and Sustainable Development, 14(3), 267–290.

Ying, H., Carl, R. C., & Maximo, C. (2008). Determinants of Japanese yen interest rate swap spreads: Evidence from a smooth transition vector autoregressive model. Journal of Futures Markets, 28(1), 82–107. Available at: https://doi.org/10.1002/fut.20281.