Informal Sector and Tax Compliance: The Role of Associational Membership in South West, Nigeria

AKEJU, Kemi Funlayo1

1Department of Economics, Faculty of the Social Sciences, Ekiti State University. Ado-Ekiti, Nigeria. |

AbstractThis paper identifies the viability of trade unions and associations in informal sector as agents for state tax collection and their labour absorptive capacity using a field survey of 600 artisans selected from three states (Ekiti, Ondo and Oyo) in the South West region of Nigeria. It reveals that although the informal sector is marginalized with a weak voice in centralized policy making, it has allowed a large proportion of the population to escape extreme poverty through its economic activities. Using logit regression, the result indicated that associational members in informal sectors are strong and showcase a positively significant relationship towards ensuring tax compliance among tax payers. The paper recommends the integration of informal sectors into the formal economic mainstream of Nigeria with the usage of trade associations as agent of tax collection and further recommends the functioning of effective public service delivery by government in a transparent and accountable government towards ensuring tax compliance among taxpayers. |

Licensed: |

|

Keywords: |

1. Introduction

International Labour Office (2002) estimated that the informal sector represents 51% of non-agricultural employment in Latin America, 65% in Asia, 48% in North Africa, and 72% in Sub-Saharan Africa (SSA). Chen (2001) estimated that in the 1990s the informal sector created up to 93% of new jobs in sub-Saharan Africa. African’s share of the informal sector across the world is the highest and this is enhanced by its limited labour absorption capacity into formal job amidst high population rate and urbanization. The domination of Sub Saharan Africa’s economies by Small Medium Enterprises (SMEs) in the informal sector was also attested to by Fjose, Grunfeld, and Green (2010).

The informal sector is dominated by economic activities which operate outside government regulations, registration and laws. It has allowed a large proportion of the population to escape extreme poverty through its economic activities and has also contributed to rapid urbanisation of some semi-urban areas. Transactions within the sector involve mostly cash with low record keeping attitude on their daily profits and losses which has made it difficult for government to tax the personal income and profit of these categories of businessmen and women, even though their income contributes to the nation’s gross domestic product. In Nigeria, the National Bureau of Statics (NBS) recorded that the contribution of informal sector to the nation’s GDP in 2015 was 41.43% with the sector serving as source of livelihood for families and households. Most operators in the sector includes; artisans, petty traders, supermarkets operators, road side mechanics, marketers, transporters, welders, hairdresser, fashion designers, etc who majorly depends on public services delivered by government. These government services in terms of merit goods, infrastructures and adequate health care have been lacking. Inequality gap has continued to widen and of recent it is difficult for common man to access basic needs. Social contact between the populace and government is lacking with poor governance and corrupt practices among government leaders. Most labourers in the informal sector have becomes marginalized and cut off from governance, a situation which has turned many against government activities as they struggle for survival.

The National Bureau of Statistics (NBS) and the Nigerian Joint Tax Board recorded that 0.43% tax/GDP ratio in 2010 rose to 2.96% in 2011 and was 4.06% in 2013 while the Central Intelligence Agency (2016) recorded 2.9% tax/GDP ratio estimates in 2015 for Nigeria. Although variations exist in these figures yet it is an indication that though taxation has been a major fiscal policy for revenue generation over the years in Nigeria, it’s ratio to gross domestic product is very low. Plausible cause can be attributed to low contributions of the workforce in the informal sector on the nation’s internally generated revenue despite its huge population to the Nigerian workforce because tax revenue has mainly come through direct taxation involving personal income tax and royalties in Nigeria over the years.

Of recent, economic recession, unemployment and the drastic reduction in oil price has compelled nations to look inwards on other ways of generating revenue. Shah (2014) noted that it is becoming difficult for developing countries to source for financial aids from abroad and there is increased need to generate revenue through taxation. The fact that most taxable persons are outside the tax net constitutes challenge towards increasing tax revenue in developing countries. Ensuring tax compliance is a tasks faced with many hurdles due to the nature of the informal sector just as reduction in federal allocations to states due to fall in oil price has made most states in Nigeria failed in their delivery of the dividends of democracy and public service to the citizens. Only Lagos states have been able to significantly raise their internally generated revenue over time. Their IGR of N15 billion in 1999 rose to N237 billion in 2013 and also increased to N268 billion in 2015 (National Bureau of Statistics/Joint Tax Board, 2016).

The reduction in federal revenue has led to the drastic reduction in allocation to states. States are in dire need to boost their internally generated revenue sourced within their area of jurisdiction through various means such as tenement rates, licences, rents on government/individual properties, taxes and all other levies available to the state. Kiabel and Nwokah (2009) identified that the need for state to generate adequate revenue is important. This generated revenue at all levels of government is necessary for the provision of basic infrastructural facilities for all and sundry. Due to the nature of small and medium scale businesses in Nigeria, the proportion of people outside the tax net needed to be incorporated are enormous. The inability of the government to generate revenue from this sector can be attributed to the neglect of this sector coupled with the over concentration on the formal sector via personal income tax since independence in Nigeria. Although the concept of the informal sector has always been a topic for discussion in Africa in the early 1970s many policy makers, labour advocates and researchers see its large share in the global workforce as a veritable component for sourcing internally generated revenue because it provides full time, stable and protected employment for reasonable percentage of the employment population yet the modality for their inclusion in the tax net have generated various degrees of argument.

This study extended and complements existing literature on modalities for strengthening internally generated revenue in South West, Nigeria with an insight into formalisation of informal sector into tax net through various trade associations. The paper uses primary survey to show the strength of trade associations in ensuring tax compliance among traders in the informal sector and how they can be formalised into tax net using artisans in Ekiti, Oyo and Ondo states of Nigeria as population sample.

2. Literature and Theoretical Approach to Taxation in Nigeria

2.1. Stylized Facts on the Growth of Informal Sectors in Nigeria

Studies have shown that the informal sector in developing countries is large and borne out of the need for survival (Gerxhani, 2004; Williams & Youssef, 2015). Nigerian informal sector is a factor to be reckoned with as job creation lies heavily in the sector than in the formal sector. Even in the face of high unemployment rate, most Nigerians cannot afford to be totally unemployed thereby venturing their productive capacity to low income tasks for survival. Schneider, Buehn, and Montenegro (2010) in their policy research paper prepared for the World Bank affirmed that the size of Nigeria’s informal sector as a percentage of GDP averaged about 56.2% from 1999-2006, placing Nigeria the fifth largest informal economy out of the 98 developing countries examined in their study. The Nigerian Bureau of Statistics (NBS) in 2016 estimates that the contribution of the informal sector to GDP (at current basic prices) for 2015 is about 42%.

In Nigeria, key factors which led to the rapid growth of the informal sector are weak institutional framework, corrupt leaders, poor governance, unemployment, illiteracy, limited training opportunities and the failure of government to accommodate the nation’s growing population into formal jobs. These factors are similar to those identified by the Swedish International Development Cooperation Agency as key drivers to the growth of informal sector in developing countries. Nigeria rapid population growth has contributed immensely to the difficulty of the economy in creating enough formal jobs to lift large number of people out of poverty. The need for household survival and its sustainability has gingered the growth of informal sectors which comprises of people in agricultural practices, artisans, shop owners, small scale business men/women, entrepreneurs, hawkers, road side traders, road transporters and various marketing activities. Various activities operating in the informal sector has not only served as avenue for the poor to earn a living but has also contributed to Nigeria GDP over time.

In Nigeria context, businesses in the informal sector ranges from small/medium scale whose activities are not monitored or regulated by the government to petty trading found in almost every corner or street in almost all the localities whose mode of operations exist outside official and fiscal system. Such businesses involves rendering of services learnt through skills from craft and apprenticeship while most rural dweller activities are in subsistence farming and trading. The diverse nature of the informal sector is attributed to its free mode of entry and registration unlike the hurdles and barriers associated with establishment of formal sector.Smaller scale firms exhibits greater incentive to operate in an invisible economy where their operations are neither guided nor regulated by any formal institution. Excessive cost of registration is a constraint to formal regulation of firms in Nigeria, The informal sector on the other hand offers a lot of flexibility to entrepreneurs, artisans, petty traders, apprentices, road transport workers and manual workers e.t.c. because they are usually not regulated and as a result, these category of workers enjoy free entry into any sphere of business more easily.

Other determining factors for the size of the informal sector are: weak and flexible system, corruption, high rate of tax evasion, fees and high taxes, high levels of unemployment and the need to survive, low literacy levels (it is typical for the least educated/skilled entrepreneurs in Nigeria to operate in the informal sector because entry into the formal sector requires a lot of documentation and disclosures which may be difficult for them to comprehend).

2.2. Tax System and Administration in Nigeria

Nigeria tax reform introduced the National Tax Policy (2016) articulated for optimizing revenue generation at all levels of government in the country which was reviewed and upgraded in 2016 to enhance the culture of tax compliance and to correct loopholes for tax evasion among taxpayers. The updated National Tax Policy (2016) provides basic guidelines to clarify the roles of stakeholders in the Nigeria tax system towards achieving its overall objectives. The policy identified tax which is a compulsory payment levied on income of people as a component of revenue generated by government while other sources of internally generated revenue in Nigeria comes from different fees such as development fees, fines, rates on properties such as tenement rates, charges paid on services and infrastructure provided by government. It also provides medium of avoiding multiple taxation by the different levels of government (local, state and federal) with the introduction of a central monitoring database. The fundamental principles of the National tax policy is based on the basic canon of taxation which identifies simplicity, certainty, fairness, flexibility, low compliance cost to taxpayers, sustainability and low administration cost.

Taxable Groups in Nigeria are taxed under Two Main Forms:

Direct Tax: This is done through direct taxing of individuals and corporate bodies’ income. Personal income of individuals working in all registered jobs (private and public) is taxed through Pay As You Earn (PAYE) system and the payment of development levies (usually flat rate) is imposed on every taxable person within the state. Corporate bodies and companies are taxed based on the annual profit declared by such institutions and there is also petroleum tax, telecommunication services providers, banks and insurance firms.

Indirect Tax: This method is based on taxing assets/goods. Property taxes are imposed on duly registered landed properties, factories and tenement rates are paid as levies. Taxes on transaction through the value added tax on net sales value of non- exempt goods while capital gains tax such as stamp duties, excise duties, import and export duties are also imposed.

In 2016, the revised National Tax Policy (NTP) identifies that compliance with tax system by the small and medium enterprises has constituted great challenges due to the large size of the informal and therefore recommends the use of Presumptive Income Tax Assessment (PITAS) for broadening the tax base by including businesses in the informal sector and ensuring effectiveness in combating tax avoidance and evasion through the introduction of tax identification number (TIN). This revised national tax policy initiated by the Federal Inland Revenue Service (FIRS) to improve revenue from taxation has recently been approved by the Federal Executive Council in 2017 placing more focus on indirect taxation.

The Presumptive Income Tax is a simplified option for informal sector for ensuring tax compliance without requiring full financial transparency and to suppress the burden of Value Added tax (VAT) on entrepreneurs, small and medium enterprises (SME’s). Presumptive taxation is based on presumed profits of those individuals whose record of income cannot ascertain due to the nature of the business. The scheme provides forum for dialogue between government and private stakeholders in the business while its effectiveness depends on the mutual understanding between the taxpayers and bodies involved in its administration.

2.3. Arguments for the Inclusion of Informal Sector in Taxation

Much of the debate on taxing the informal sector has centred on the revenue capability and potentials of the sector which is seen as a sector too large to be ignored. Proponents of this school of thought posit that a sector that contributes largely to a country’s GDP without a measurable means of taxation should be co-opted into the tax net through a formal set-up so as to improve the internally generated revenue of the same economy. However, some scholars argued that the inclusion of this sector would attract more cost particularly in developing countries. Cheesema and Griffith (2005) indicated that in Kenya, taxing the informal sector involves investing heavily on the technical tax expertise which the country is constrained with. Keen (2012) opined that the benefit in form of gains from taxation of the informal sector to the government will be lower than its cost of administration thereby opposing the fundamental principles of taxation policy.

Taxation should not only focus on the cost and benefits to be derived but emphasis must be placed on ensuring equity, fairness and sense of belonging among all productive workers in a country and this call for the inclusion of the informal sector. Mpapale (2014) pointed out that in an efficient tax regime the inclusion of the informal sector in taxation dwells on how to broaden the tax net and not hampering the growth and development of the sector. Considering the large size of the informal sector, the benefits of applying taxation on their profit could yield revenue to the government and also help promote the sense of participation and recognition of the associational authorities. Prichard (2010) reported that in Ethiopia, the inclusion of small firms in taxation promoted public engagement and prompted the government to include other businesses in the presumptive tax regime which foster fairness and equity.At present, the informal sectors in Nigeria are marginalized in political power participation as their voices are not heard. Sometimes notable associations such as NURTW, RTEAN (drivers union) and other artisans are used as political thugs during elections and compensated for that purpose alone. They fail to recognize the role and duties of government to its citizens hence could not agitate for their rights from government who make them feel they are being privileged to be recognized. While taxation help inform them about their rights and duties to government, it also help them recognise the need for government to be accountable to taxes paid by the people through provision of infrastructure, aids, grants, loans and favourable policies that could enhance their effective operations. Joshi and Ayee (2008) attested that payment of taxes by informal sector to government have the potential of promoting good governance, social and economic understanding between the government and the tax payers.

Formalisation of informal firms through associational registration helps in building tax culture and also proffers access to opportunities such as access to credit facilities, trainings, workshops and seminars to enhance smooth running of business operation and the development of key business strategic plans relative to specific trades and businesses. Prichard (2009) identified that Joshi and Ayee (2008) indicated that taxing informal sector in Ghana by the government brought out a positive response which linked associations in the sector with the government. Thus, in terms of political participation, good governance and local participation, taxation of the informal sector can help align the populace in the sector into power through power decentralisation and their inclusion in governance.

Across the states in Nigeria, people in the informal sector tend to be passive political participants not only because of their failure to pay tax but also because of their level of literacy and access to information thereby losing to a large extent benefits from the government. Their inclusion into the tax base through associational taxation can help educate them towards building a culture of tax compliance, create awareness towards government programmes targeted at strengthening their business, participate in decision making of policies that affect them and their existence and also provide assurance that the government has a responsibility in enhancing the growth of their businesses.

Schomerus and Titeca (2012) noted that though the act of formalisation served as protective measures to some firms yet it could also lead firms to vulnerability of unequal treatment by government officials. The argument that, considering the low personal income made as profits by these categories of people, the cost of taxing an individual profit might be higher than its derived benefit is intuitive. However, this can be overridden over time with the inclusion of associational authorities of each cohort group or trade as tax administrators and collectors with selected government officials overseeing each group/cohort periodically.

2.4. Contributions of Associations to Internally Generated Revenue in Nigeria

Every associations and trade union existing in Nigeria is guided by principles, rules and regulations enforced by their authorities. Government enforce payment of development levies on its citizens. Although such levies are not taxable on personal incomes but represent certain flat sum to be paid annually yet it has become part of IGR to states and local government authorities. The collections of these levies have been enhanced by trade association leaders who in their meetings often make the payment of such levies sacrosanct, non-negotiable and inevitable for members maybe because of the way government has tied the collection of such levies round the neck of their leaders. Trade association leaders help to build up tax morale and encouragement among members even though sometimes some cases of evasion of such levies are recorded. The executives engage in persistent call for such levies throughout the year

The National Bureau of Statistics/Joint Tax Boards of Internal Revenue in Nigeria reported that internally generated revenue at states level in 2015 stood at 682 billion with Lagos state holding 268 billion of it followed by Rivers state (82 billion), Delta (40 billion), Ogun (34 billion) with all other states having revenue lower than 16 billion, Ekiti is among the least with figure lower than 4 billion. These revenue collected is grouped under; Pay As You Earn (PAYE), direct assessment, road taxes and other revenue with “PAYE” (tax on personal income of formal sector) having large volume of the revenue followed by “Other Revenue”. Components of the “Other Revenue” includes levies from tenement rate, development levy, shop/kiosk approval, market women fees and all other levies payable by informal sectors.

The Lagos state government introduced an indigenous tax scheme involving informal businesses. These scheme has helped in generating revenue from the so called “hard to be taxed” group every month. The effectiveness of these has been the involvement of associational leaders and the market women leaders who helped in gathering of the money on behalf of the state government and ensure its payment into the government account with tax clearance identity card being issued to all payers to represent its receipt. These leaders also provide up-to-date register of all their members in each cohort group /line of business.

Taxing the informal sectors can be done through negotiation between the government and the various associations. It entails the formalisation of individuals, groups and unregistered firms into the tax base. Associational authorities at local levels have the potentials to negotiate tax deals for their members and act as tax administrators for government in terms of collection, educating members and ensuring tax compliance. The role of associational authorities also ensures proper accountability and flexibility of tax payment by the government. At the local level, this policy showcases building social contract between government and taxpayers and ensuring public service awareness which is essential for the development of a country.

2.5. Theoretical Approach of Optimal Taxation

Normative approach to taxation for decades placed focus on the theory of optimal taxation. With the belief that the central aspect of economic policy entails the design of a good tax system, optimal taxation captures the design of tax structure towards reducing inefficiency. The theory identified the structuring of tax towards ensuring maximization of social welfare.The theory identified that a good tax must be proportionate to incomes and ability to pay, it must be certain, cheap to administer and convenient to the tax payers. Modern approach to optimal taxation based on Mirrlees (1971) opined that optimal tax system is such that ensures raising revenue and resources redistribution without generating any form of distortion. It identify the usage of vertical equity (tax burden distribution where the rich pays higher that the poor) to balance the efficiency and equity trade off. This paper considered optimal taxation approach towards ensuring effectiveness in the formulation of tax policy in informal sectors.

3. Research Method

3.1 Research Design and Method of Data Collection

The research design for the study is a survey field study which studied the responses and behaviour of individuals at micro level. This study uses a descriptive survey of 600 artisans belonging to the informal sector in Ekiti, Ondo and Oyo states of Nigeria. These groups of people are skilled craft workers who render their skills as services to people in their environs for monetary reward. Ten forms of such business activities were selected and considered for the survey based on their popularity within the state.

3.2. Population and Sampling Technique

The population of this study is the south west region of Nigeria. Specifically three states; Ekiti, Oyo and Ondo states were chosen to represent the region. The three states are classified among states with many rural dwellers with record of low IGR. The sample size is drawn from six major towns with two taken from each state: Ado and Ikole Ekiti in Ekiti state, Ibadan and Iwo in Oyo state, Akure and Ikare in Ondo state. The towns were selected based on specific factors of; large commercial/economic activities, market proximity, urbanization and population size. In total, 600 respondents were selected with the sample size selection of 200 people from each state.3.3. Method of Data Analysis/ Techniques

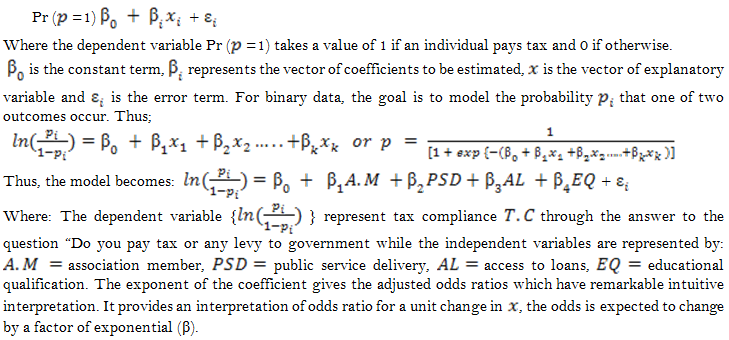

This study involves both descriptive and statistical method of analysis. Collated data were statistically analyzed using logit regression. The logit distribution constraint the estimated probability to lie between 0 and 1 and the model is built such that:

4. Discussion of Findings

4.1. Socio – Demographic Descriptive Analysis of RespondentsTable 4.1 presented in the appendix revealed the number of people surveyed in their different categories of business. Restaurants/catering services, transporters, tailoring/fashion designing and hair dressing salon were found at virtually every corner of the street in the towns surveyed. These services were seen to be needed daily. Most of the respondents were married. Male constitutes 270(45%) and women 330(55%). This finding support evidences that women are mostly involved in informal businesses in a bid to cater for their homes and children. Respondents within ages less than 25 were 25(4.2%), 26-35were 135(22.5%) 36-45 years were 305(50.8%) while those above 46 years were 135(22.5%) an indication that most of the people in informal sectors are in the reproductive age and are capable of increasing their family size. In term of educational qualification; 105(17.5%) attained tertiary education while 445(74.2%) possess basic secondary school leaving certificates, thus signifying that most have basic secondary level of education.

| Sex :Male Female |

270 330 |

45% 55% |

| Marital status: Single Married Divorced/widow |

100 360 140 |

16.7% 60.0% 23.3% |

| Age: < 25 years 26 – 35 years 36- 45years 46years and above |

25 135 305 135 |

4.2% 22.5% 50.8% 22.5% |

| Educational qualification Primary school Secondary school NCE/OND/HND/B.sc |

50 445 105 |

8.3% 74.2% 17.5% |

| Source:Authors Computation (2018). |

4.1.1. Responses from Questionnaire and Interview

The major focus of this study is to have an insight into the role of trade associations in informal sectors towards strengthening of internally generated revenue.

4.2. Business Size and Income Generation.

The result in Table 4.2 revealed that the job/business has provided employment for the artisans for a reasonable period of time. Majority of the business is also performed in small scale with an average business starting capital of N31, 000 – N50, 000 (37.5%). This indicates that the cost of starting such business (renting of shop, acquisition of tools) is not very high thus signifying the easy mode of entry into business in informal sectors. (25.8%) indicated that their monthly income/profits from their business activities ranges between N20,000 – N40,000 while those with N41,000 – N60,000 captures (41.7%).

| 1-3years 4-7 years 8+ years |

65 255 280 |

10.8% 42.5% 46.7% |

| Size of business Small scale medium scale Large scale |

375 225 0 |

62.5% 37.5% 0% |

| starting capital < N30,000 N31,000 – N50,000 N51,000 – N70,000 N71,000 – N100,000 N101,000 and above |

90 225 150 100 35 |

15.0% 37.5% 25.0% 16.7% 5.8% |

| Income < N20,000 N20,000 – N40,000 N41,000 – N60,000 N61,000 and above |

45 155 250 150 |

7.5% 25.8% 41.7% 25.0% |

| Source:Authors Computation (2018). |

4.3. Rationale behind Tax Payment and Tax Evasion/Avoidance

As reported in Table 4.3 only 4.2% of tax payers indicated that government does tax them monthly. 193 (32.2%) of the respondents are not involved in payment of any levies to the government while 407 (67.8%) indicated that they do pay government levies/tax on their business. This they indicated was made payable with the help of their associational leaders who often compel all registered members of their association to pay and avoid embarrassment/harassment from tax collectors and officials. Evasion of fees to be paid to tax officials in the local government is possible by non members of any association.

It was also discovered that 5.2% of the 193 people that evaded government levies reported they are unaware of the need for tax payment, 7.3% also indicated that they deliberately avoided payment due to poor service delivery by the government while 33.7% indicated that it is easier for them to evade payment since they failed to register under any trade association. 14.5% was of the opinion that no punishment is on defaulters while 39.4% is of the opinion that levies paid were not always remitted to government account by tax officials.| Tax/ Levy payer Non payer |

407 193 |

67.8% 32.2% |

| Reasons for evading government levy Non awareness/inadequate information by government Deliberate effort to avoid payment/ poor service delivery No disturbance by any association/not member of any association No force/ punishment on it Non remittance by tax collectors |

10 14 65 28 76 |

5.2% 7.3% 33.7% 14.5% 39.4% |

| Time range of payment Weekly Monthly Quarterly annually |

0 17 324 66 |

0% 4.2% 79.6% 16.2% |

| Source:Authors Computation (2018). |

4.4. Trade Association: Membership, Role and Strength of Association

Table 4.4 reported that 415 (69.2%) indicated that they belong to a trade association which they indicated have strength and strong hold on their members. Majority also indicated that payment of associational dues was made compulsory by their leaders through different enforcement, disciplinary actions and strategies. 96.9% of the 415 that belong to associational groups identify that they pay their dues regularly as defaulters are dealt with based on their associational regulations. Mutual understanding and easy dissemination of information was also identified among associational members.

| Associational operations | Size |

% |

| member of trade association | 415 |

69.2% |

| payers of associational dues regularly | 402 |

96.9% |

| Association leaders disseminate levies | 395 |

95.2% |

| Participation in monetary contributions (thrifts, savings) | 387 |

93.3% |

| Source:Authors Computation (2018). |

4.5. Result of Logistic Estimation

Considering the result of the logit model presented in Table 4.5 association members (AM) exhibits a positive and significant relationship with tax compliance. The odd ratio is high with 60.91982. This implies that artisans that belong to trade associations have more than 60 times likelihood of complying with tax payment greater than those that fails to belong to any association. Other variables; access to loans (AL), public service delivery (PSD), educational qualification( EQ) exhibited negative relationship with tax compliance and their odd ratio is less than 1, an indication that their contribution towards ensuring tax compliance is very low. People with no access to loans and does not benefit from good service delivery have negative response to government tax/levy payment. The McFadden R-squared (0.48) implies that 48% of changes in being tax compliance are captured by the identified independent variables. The probability statistics is significant (0.0000) while the LR statistics (88.08) is large enough.

| Logistic TC c A.M AL PSD EQ | |||||||

| Number of observation = | 600 |

||||||

| LR chi2(4) = | 88.09 |

||||||

| Probability > chi2 = | 0.0000 |

||||||

| Pseudo R2 = | 0.4764 |

||||||

| Observation with Dependent variable(0) = | 193 |

||||||

| Observation with Dependent variable(1) = = | 407 |

||||||

| Variables | Coefficient |

Odd ratio |

Std. Err. |

z |

P>|z| |

||

| AM | 4.109544 |

60.91892 |

65.95418 |

3.80 |

0.000 |

||

| AL | -4.357634 |

.0128087 |

.0141926 |

-3.93 |

0.000 |

||

| PSD | -0.2670971 |

.7655987 |

.4581624 |

-0.45 |

0.655 |

||

| EQ | -2.2.54533 |

.1049225 |

.1295892 |

-1.83 |

0.068 |

||

| cons | -.0009302 |

0.99907 |

1.607648 |

-0.00 |

1.000 |

||

| Source:Authors Computation (2018). |

4.6. A Plausible Solution: Formalisation of Trade Association

The results discussed identified the role played by association in ensuring tax compliance by members in the informal sectors. For effective tax compliance which is essential for adequate public service delivery, the contribution of informal sector is important in Nigeria. A formal way of integrating them into the tax net is to ensure all business activities are registered under their associated associations which must act as effective tax administrators through the incorporation of their associational leaders who have the potential of influencing their member decisions. Proper sensitization and inclusion as tax administrator will help erase biasness and negative feelings on tax payment. It will also help eradicate tax evasion and its avoidance among taxpayers in the informal sectors. Considering the social interaction effect; social groups and association can help ensure mutual understanding, follow up of actions and ability to copy attitudes which can help in adjusting to fiscal policies and mechanism over time.

5. Recommendation

The paper makes insightful policy recommendation on the necessary administrative reforms to enhance the collection of taxes from informal sectors in South West, Nigeria. These are:

- Establishment of effective data collection unit for all businesses in informal sector:These should be done with government grouping businesses under different associations and enforcing all business associations to register all members with adequate information of their size and mode of operations.

- At local levels tax administrators should maintain partnership with the trade association representative to access adequate information from them.

- Grassroots development must be encouraged to foster the spirit of tax compliance among tax payers because an understanding of the benefits of tax payment remove doubts and mistrust in governance.

- The functioning of effective public service delivery should be provided by the government towards informing individuals to be tax compliance.

References

Central Intelligence Agency. (2016). Nigeria. The World Fact Book. 2016.

Cheesema, N., & Griffith, R. (2005). Increasing tax revenue in Sub- Saharan Africa; the case of Kenya. OCGG Economy Analysis.

Chen, M. A. (2001). Women in the Informal Sector: A Global Picture, the Global Movement, SAIS Review, Winter-Spring 2001.

Fjose, S., Grunfeld, L., & Green, C. (2010). SMEs and growth in Sub Saharan Africa (SSA): Identifying SMEs roles and obstacles to SMEs growth. MENON Business Economics Publication, No. 14.

Gerxhani, K. (2004). The informal sector in developed and less developed countries: A literature survey. Public Choice, 120(3-4), 267-300.

International Labour Office. (2002). ILO compendium of official statistics on employment in the informal sector. STAT Working Paper, 2002 –(1).

Joshi, A., & Ayee, J. (2008). Associational taxation: A pathway into the informal sector? In Brautigam, D., Fjeldstad, O.-H. & Moore, M. (Eds.). Taxation and state building in developing countries (pp. 183–211). Cambridge: Cambridge University Press.

Keen, M. (2012). Taxation and development; again. IMF Working Papers 12/220, International Monetary Fund.

Kiabel, D. B., & Nwokah, G. N. (2009). Boosting revenue generation by states governments in Nigeria. The tax consultant option revisted. European Journal of Social Sciences, 8(4), 532-539.

Mirrlees, J. A. (1971). An exploration in the theory of taxation. Review of Economic Studies, 38(2), 175-208.

Mpapale, C. (2014). Broadening the tax base in Kenya; the case of the informal sector. (A diagnosis of the current practice & a prognosis of reform options). The East Africa Tax and Governance Network (EATGN), Nairobi.

National Bureau of Statistics/Joint Tax Board. (2016). Internally generated revenue at state level. Q1- Q3. NBS 2017.

National Tax Policy. (2016). National tax policy: Ministry of finance 2016.

Prichard, W. (2009). The politics of taxation and implications for accountability in Ghana 1981-2008.IDS Working Paper 330. Brighton: Institute of Development Studies.

Prichard, W. (2010). Taxation and state building: Towards governance focused tax reform agenda. IDS Working Paper 4. Brighton: Institute of Development Studies.

Schneider, F., Buehn, A., & Montenegro, C. (2010). Shadow economies all over the world: New estimates for 162countries from1999 to 2007. World Bank Policy Research Working Paper No. 5356. Washington, DC.

Schomerus, M., & Titeca, K. (2012). Deals and dealings: Inconclusive peace and treacherous trade along the South Sudan Uganda border. Africa Spectrum, 47(2-3), 5-31.

Shah, A. (2014). Foreign aid for development assistance. Global issues news article. Retrieved from http://www.globalissues.org/article/35/foreign-aid-development-assistance .

Williams, C., & Youssef, Y. (2015). Theorising entrepreneurship in the informal sector in urban Brazil: A product of exit or exclusion? Journal of Entrepreneurship, 24(2), 148-168.