Financial Literacy and its Impact on Funding Source’s Decision-Making

Mirza Hedismarlina Yuneline1*

Usdi Suryana2

1Management Study Program, Sekolah Tinggi Ilmu Ekonomi (STIE) Ekuitas, Indonesia. |

AbstractSmall and Medium Enterprises (SMEs) plays a significant role for the economic development of a country. Specifically, the existence of SMEs is to contribute in poverty alleviation through job creation. However, not many SMEs can survive and grow their business due to limited access to obtain resources such as financial, technological, and human resources. One of the factors that inhibit the development of MSMEs in Indonesia is the lack of knowledge and management of personal finance. In addition, the participation rate of SMEs to financial institutions is still very low, with only 30% able to access financing. This study aims to analyse the level of financial literacy, the factors that affect the level of financial literacy, and the correlation between the level of financial literacy (proxied by general knowledge, risk management, savings and credits, and investment) with funding decision. The data used are primary data and secondary data, with data collection methods conducted in this study are literature studies, interviews and questionnaires with SMEs in Bandung, Indonesia, with a sample used as many as 97 respondents. The respondents’ financial literacy in low level on general financial knowledge, savings & credits, and investment. But they have medium financial literacy level on insurance. The data processed using discriminant analysis, shows that the average financial literacy level which is in low level and has no effect on funding decision-making. |

Licensed: |

|

Keywords: JEL Classification |

|

Accepted: 6 February 2020 |

|

| (* Corresponding Author) |

Funding: This study received no specific financial support |

Competing Interests:The authors declare that they have no competing interests. |

1. Background

Based on Indonesian Central Statistics Agency (Badan Pusat Statistik, BPS), Indonesian economy in the second quarter of 2017 grew by 5.01% and the amount of Gross Domestic Product (GDP) reached Rp. 3,366.8 trillion (https://www.bps.go.id/pressrelease/2017/08/07/1365/pertumbuhan-ekonomi-indonesia-triwulan-ii-2017.html). The level of public consumption such as Domestic Investment and the level of investment such as Foreign Investment were still the two main engines of economic growth. According to the data from the Ministry of Cooperatives and Small Medium Enterprises (SMEs), the contribution of Micro, Small and Medium Enterprises (MSMEs) to GDP reached 61% of which 30.3% consisted of micro enterprises; 12.8% of small enterprises; 14.5% of medium enterprises; and the rest is the contribution of cooperatives.

MSMEs have long been understood to have a significant role for a country's economic development

(Audretsch, Van der Horst, Kwaak, & Thurik, 2009; Carter & Jones-Evans, 2006). Specifically, the existence of MSMEs is believed to contribute to the efforts of poverty alleviation through job creation (Carree & Klomp, 1996). But with a relatively large number and promising business potential, MSMEs have not been able to contribute significantly to the economy. Aside from issues of efficiency, effectiveness, and business ability, the MSME sector is also constrained by capital problems. Therefore, MSMEs need stimulus in the form of access to capital so that they can bankable and raise their capital to improve Indonesia's economy.

One of the factors that inhibit the development of MSMEs in Indonesia is the lack of knowledge and management of personal finance. In addition, the level of participation of MSME in financial institutions is very low, within only 30% being able to access financing. That was influenced by the lack of understanding of MSME towards the financial sector.

Based on the Global Financial Inclusion Index (Global FIndex) in Suryana and Yuneline (2017) only 19.6% of Indonesia's population are adults who have access to formal financial institution services. This figure shows that Indonesia is still far behind compared to other Southeast Asian countries, such as Thailand (77.7%), Malaysia (66.7%), Philippines (26.5%) and Vietnam (21.4%). This shows that the financial system in Indonesia has not been running optimally and there is still room for improvement in order to increase public access to financial institution services.

Furthermore, based on the Global Findex above, of the 19.6% of Indonesia's population who have access to formal financial services, only 52% are served by formal financial institutions. Of the 52% served by financial institutions, 21% consist of low-income households.

In 2013, the Financial Services Authority (Otoritas Jasa Keuangan-OJK) explained in the Regulation No. 76 / POJK.07 / 2016 for consumers and community regarding the Financial Literacy and Inclusion Improvement Program with the target of the program being households/women, business people, students, employees and pensions. The program aims to encourage a financial system that is easily accessible to all levels of society so that it is expected to increase growth and overcome poverty. Thus, the program is expected to influence the understanding of public finance for all forms of financial services.

Based on national survey on financial literacy (OJK, 2013) showed that the index of utility of financial products and services in Indonesia is 59.74%. The data showed that the Indonesian people are still at a low literacy level compared to other countries.

MSMEs are one of the targets in the Financial Literacy and Inclusion Improvement Program because its level of financial literacy is still low. Based on OJK (2013) this can be seen from the low credit channelling to the MSME sector from the total credit in Indonesia. MSME’s credit is only 18% of the total credit. Therefore, increasing financial literacy and financial strategies for MSMEs in Indonesia is very important to be improved.

MSMEs really need financial literacy in order to increase their competitiveness. In addition to being able to manage their own finances, financial literacy can lead to financial inclusion and MSMEs can choose their own funding sources and choose investments as allocation of funds, so that financial management capabilities can have a positive impact on business continuity.

Bosma and Harding (2007) stated that poor financial literacy harmed the entrepreneurial activity. Furthermore (Drexler, Fischer, & Schoar, 2014) argued that micro-entrepreneurs often suffered for the complex financial decisions due to their lack of financial literacy level. Wise (2013) found that the increasing in financial literacy led to the production of financial statement frequently which also can produce higher probability on entrepreneur to pay off their debt. Adomako, Danso, and Ofori (2015) showed that financial literacy is a major enhancer for MSME to have access on finance and improve their growth. But Eresia-Eke and Raath (2013) failed to link the financial literacy of MSME’s owner to improve their business growth.

Bandung city is one of the regions with a large number of MSMEs. Based on the Bandung’s Central Statistics Agency (https://www.bps.go.id/pressrelease/2017/08/07/1365/pertumbuhan-ekonomi-indonesia-triwulan-ii-2017.html) the number of MSMEs in 2015 spread across the city of Bandung reached 12,266 business units and absorbed as many as 43,321 workers. Based on data from Bank Indonesia (http://www.bi.go.id/id/umkm/kredit/data/Documents/Perkembangan%20Kredit%20UMKM%20dan%20MKM%20Apr%202017_BD.pdf) MSME lending in April amounted to 908 trillion, of which around 46% of MSME loans were medium business loans, 30% were small business loans, and the rest were micro-business loans. Based on the type of usage, 74% of the credit is used as working capital, and the remainder is used as investment. The study aims to analyse financial literacy level of MSME’s owner (proxied by general knowledge, risk management, savings and credits, and investment) and examine whether it has contribution on funding decision-making (from financial institution or non financial institution).

2. Literature Review

2.1. Micro, Small, and Medium Enterprise (MSME)

Referring to Sijabat (2011) the empowerment of MSMEs is the best solution for optimizing the national resource potential, but to make MSMEs as a basis for regional development and supporting the success of national development, it is faced many problems such as the low productivity of MSMEs, limited access to productive resources, and in conducive business climate that faced by MSMEs. Furthermore, Syarif (2007) stated that most MSMEs carry out business not because they have the ability in a business activity, but only because they are pressured by scarcity of employment.

Furthermore, the Law No. 20 of 2008 article (4) stated the Principles of MSMEs Empowerment as follows:

- The independence, togetherness and entrepreneurship of MSMEs growth to work with their own initiatives.

- The realization of public policies that are transparent, accountable and fair.

- Regional potential and market-oriented business development in accordance with MSME competencies.

- Increasing the competitiveness of MSMEs.

- Implementation of integrated planning, implementation and control.

The principle of MSMEs Empowerment itself has included three aspects in good corporate governance, namely transparency, accountability and fairness. So that good corporate governance should be applied in MSMEs to create a resilience and competitiveness of the company towards a dynamic business climate, and not just carry out business activities as followers or just see the business benefits of others.

2.2. Financial Literacy

Financial literacy is related to one's competence on managing finances. Definition of financial literacy according to Vitt et al. in Huston (2010) is the ability to read, analyse, manage, and communicate personal financial conditions that affect material well-being. Included in, it is the ability to understand investment choices, discuss financial issues without feeling uncomfortable, plan finances for the future, and respond competently to events in life that affect financial decision making.

Financial literacy occurs when an individual has a set of skills and abilities that enable the person to utilize the available resources to achieve the goal. Huston (2010) states that financial knowledge is a dimension that is inseparable from financial literacy, but only financial knowledge itself cannot describe the financial literacy.

Referring to Remund (2010) there were four most common things in financial literacy such as budgeting, savings, loans, and investment. Mandell (2009) argued that financial knowledge consisted of knowledge in income; money management; savings and investment; and loans or credit. We developed 15 financial literacy indicators that were adapted to conditions in Indonesia, such as; 1) Choices in a career; 2) Understand the factors that influence net salary; 3) Know the sources of income; 4) Explain how to achieve prosperity and fulfil financial goals; 5) Understand the savings budget; 6) Understand the insurance; 7) Analyse the risk, returns and liquidity; 8) Evaluate investment alternatives; 9) Analyse the influence of taxes and inflation on investment returns; 10) Analyse the gains and losses of having debt; 11) Explain the purpose of the credit track record and recognize the rights of the debtor; 12) Describe ways to avoid or correct debt problems; 13) Know the basic laws of consumer protection in credit and debt; 14) Able to make financial records; and 15) Understand the balance sheet, profit and loss, and cash flow.

Financial literacy involves not only knowledge and ability to deal with financial problems, but also non-cognitive attributes (PISA, 2010). Attitude is an important element in financial literacy. Financial attitudes are defined as a person's psychological characteristics related to personal financial problems (Gutter, Wang, & Way, 2008). Financial attitudes such as being open to information, assessing the importance of managing finance, not impulsive in consumption, future orientation, and responsibility.

Janor, Yakob, Hashim, Zanariah, and Wei (2016) argued that demographic, social, economic, and psychological factor are the main determinants that effect the financial literacy level on financial decision. Futhermore (Hilgert, Hogarth, & Beverly, 2003) stated that financial literacy includes the changing in financial skills and behavior. Altman (2012) argued that the increase in financial literacy should lead to more informed and effective financial decision. According to Kotzé and Smit (2008) the financial illiteracy can lead to consumptive behavior, lack of investment planning, lack of record keeping, and inefficient financial decision.

Abdeldayem (2016) argued that financial literacy is the set of financial knowledge and skills that allow people to determine their rationale decision by using their financial resources. Abdeldayem (2016) found that high financial literacy group have higher level of financial products awareness.

2.3. Financial Inclusion

Referring to Irmawati, Damelia, and Puspita (2013) the financial inclusion is a model of efforts to encourage the formal financial system to be accessible to all levels of society, so it encouraged the quality economic growth while alleviating poverty. The financial inclusion aims to eliminate all forms of obstacles to people's access to financial services by supporting existing infrastructure.

Thus, Shankar (2013) stated that the importance of financial inclusion comes from various factors, namely the inability to access financial services that can lead to the exclusion of financial entities in obtaining capital; lack of access to safe and formal savings can reduce the urge to save funds; the lack of a credit product means the inability to invest and an effort to increase the profitability of the business; the lack of remittance products makes money transfers difficult and high risk; and lack of insurance products, which means a lack of opportunities for risk management and welfare levelling.

Financial inclusion promotes retrenchment; develop a culture of saving; and increasing credit access for both business/productive and consumptive loans; and also enables efficient payment mechanisms so as to strengthen the resource base of financial institutions capable of providing economic benefits as a resource and the availability of efficient and effective payment mechanisms.

The concept of financial inclusion was launched by Bank Indonesia through the National Strategy for Financial Inclusion program in 2010 as an effort to expand public access to financial services. About 32% of Indonesia's population do not yet know formal financial institutions. In addition, around 70% of MSMEs do not have access to banking. Even though almost 53 million poor people work in the MSME sector have enormous potential to reduce unemployment and poverty alleviation.

The implementation of this financial inclusion in Indonesia has been carried out in various ways, such as Kredit Usaha Rakyat (KUR). KUR is a business credit scheme for MSMEs and Cooperatives that have business feasibility but do not have collateral in accordance with banking requirements.

Abdeldayem (2016) argued that financial literacy and financial inclusion can be examined as twin stilts. Financial inclusion, as the supply side, is providing the financial market that people need, while financial literacy, as the demand side, encourages people to acquainted with the rationale decision on their financial resources.

2.4. Positioning Research Problems

As explained above, MSME in Indonesia have the potential to increase the economic growth and also alleviate poverty through jobs creation. But MSME have their own problems such as being able to survive in the midst of competition in globalization era. Wattanapruttipaisan (2003) stated MSME’s long-term growth and competitiveness often constraints on their access to formal-sector finance to strengthen their capital. Other problem faced by MSME is corporate governance where Randøy and Goel (2003) stated that there are differences in the performance of SMEs in different ownership structures. Positioning of this research is focused on the problems faced by these MSMEs as showed in Table 1:

No |

Problem faced by MSME | Source |

1 |

Competitiveness | Wattanapruttipaisan (2003) |

2 |

Capital | Irmawati et al. (2013) |

3 |

Low Financial Literacy | Aribawa (2016); Ratnawati, Rohmasari, and Lokajaya (2017) |

4 |

Corporate Governance | Randøy and Goel (2003); Abor and Adjasi (2007) |

One of the most basic problems of MSMEs is related to capital, the following are some of the results of previous studies as showed in Table 2 below where financial literacy and financial inclusion play an important role in increasing the productivity of MSMEs:

| Country | Financial Literacy and Financial Inclusion Implementation | Source |

| Indonesia | Financial Inclusion Model for Village Based MSMEs | Irmawati et al. (2013) |

| Uganda | Influence between Financial Literacy and Financial Access from Formal Financial Institution | Nkundabanyanga, Kasozi, Nalukenge, and Tauringana (2014) |

| Uganda | The relationship between access to finance and growth of SMEs in developing economies – Financial literacy as moderator | Bongomin, Ntayi, Munene, and Malinga (2017) |

| Ghana | Financial Literacy Increase Financial Access for Corporate Growth | Adomako et al. (2015) |

| Culture, financial literacy, and SME performance in Ghana | Agyei and Nsiah (2018) | |

| India | Branchless Banking for Increasing Financial Inclusion | Singh et al. (2014) |

| Canada | The Impact of Financial Literacy on New Venture Survival | Wise (2013) |

| South Africa | SMME Owner’s Financial Literacy and Business Growth | Eresia-Eke and Raath (2013) |

| Croatia | Is there a Relationship between financial literacy, Capital Structure and Competitiveness of SMEs? | Delić, Peterka, and Kurtovic (2016) |

| Business Owner and Managers Attitudes towards Financial Decision-Making and Strategic Planning: Evidence from Croatian SMEs | Čalopa (2017) | |

| Bahrain | Is there a Relationship between Financial Literacy and Investment Decision in the Kingdom of Bahrain | Abdeldayem (2016) |

| Malaysia | Financial Literacy and Investment Decision in Malaysia and United Kingdom: A Comparative Analysis | Janor et al. (2016) |

Bongomin et al. (2017) revealed that there was positive significant effect of financial literacy as moderating in the relationship between access to finance and SMEs’ growth in Uganda. Delić et al. (2016) also stated that financial literacy as an important factor to SMEs on making decision about capital structure. It supported by Njoroge and Gathungu (2013) argued that the better financial literacy level of individuals tend to make better financial decision. The research is in line with Bosma and Harding (2007); Drexler et al. (2014); Wise (2013) and Adomako et al. (2015).

In the contrary, Eresia-Eke and Raath (2013) failed to link the financial literacy of MSME’s owner to improve their business growth. It is supported by Agyei and Nsiah (2018) that argued that cultural beliefs also have implications on financial decision. In Ghana, individuals with Protestant beliefs tend to seek the resource of alternative funding. Čalopa (2017) also stated that the most important on financial decision making is the organizing function of management.

3. Research Methodology

Based on the purpose of this research classified into quantitative descriptive research. Referring to Sugiyono (2013) this research deals with one or more variables independently. In this research, we intended to find out the level of financial literacy, factors that influence the level of financial literacy, and the correlation between the level of financial literacy and funding decision making.

In this research, the data used consisted of primary and secondary data. The data collection methods carried out in this research were literature studies, interviews and questionnaires with MSME in Bandung as respondents. The respondent population are 12,266 respondents with the sample used as many as 97 respondents with Slovin calculations. The sampling method used is non-probability sampling by using convenience sampling which is a simple sampling and population technique that is anyone who accidentally meets and is considered in accordance with the research objectives as a source of data (Sujarweni, 2015).

This research used two analytical methods, such as descriptive and quantitative analysis. In this research, the descriptive analysis explained how the characteristics of respondents, the current level of financial literacy of MSME in Bandung and demographic factors on financial literacy.

Referring to Janor et al. (2016) demographic, social, economic, and psychological factor are the main determinants of financial literacy level. This study started to examine the financial literacy level referring to the respondent’s characteristics, such as gender, age, type of business, income per month, and funding source. The interview with the respondents also conducted to get the main reason of their funding decision.

The level of financial literacy conducted by examining the knowledge of the respondents regarding the basic financial knowledge, saving and credits, insurance, and investments. The responses from each participant were used to calculate the average percentage value with the correct answers for each question, section, and throughout the survey. Consistent with existing literature (Danes & Hira, 1987) the average percentage value with the correct answers is grouped into (1) more than 80%, (2) 60% for 79%, and (3) below 60%. The first category is a relatively high level of financial literacy. The second category shows the middle level of financial literacy. The third category is a relatively low level of financial literacy.

In order to determine the impact of financial literacy the respondents were asked to make decisions on related financial problems. As in the logistic regression analysis, the sample was divided into two groups of MSMEs with relatively more knowledge and those who were relatively less knowledgeable. Because of the problems associated with each part of the survey, the average percentage portion of the correct answer is used to classify the sample. Cross tabulation and Chi-square test were used to determine whether the two groups' differences of opinion and decisions were statistically significant.

4. Results and Discussion

4.1. Respondents Characteristics

The population of MSMEs in Bandung is 12,266. MSMEs in Bandung are engaged in various fields such as the creative industry, trade and services. Based on the results of questionnaires distribution on 97 respondents obtained characterization consisting of gender, age, type of business, income. The following are the details of the processed results related to the characteristics of the respondents.

Based on Table 3, it was found that the dominating characteristics of respondents were 44% of men and 56% of women. In the age column there are 18% of respondents in the age between 23-30 years, 15% at the age of 31 - 39 years, 32% at the age of less than 22 years and the rest are aged over 40 years. The type of business that is in demand is trade as much as 55%, followed by culinary as much as 20%, manufacture sector 14%, and the rest in service. Based on their income per month, the data showed that 63% have revenues between Rp. 1 to 5 million, 25% with revenues less than Rp. 1 million, 8% have revenues between Rp. 5 to 10 million and the remaining above 10 million. So that it can be concluded that the majority of respondents have a type of micro business. As many as 56% of respondents tend to choose Bank funding sources and the remaining 44% choose non-bank funding sources.No |

Demographic Factors | Information | Amount |

1 |

Gender | Male | 43 |

| Female | 54 |

||

2 |

Age | < 22 year-old | 31 |

| 23 – 30 year old | 17 |

||

| 31 – 39 year old | 14 |

||

| > 40 year old | 34 |

||

3 |

Type of Business | Culinary | 19 |

| Trade | 53 |

||

| Service | 11 |

||

| Manufacture | 14 |

||

4 |

Income per Month | Less than Rp. 1 million | 24 |

| Rp. 1 – 5 million | 61 |

||

| Rp. 5 – 10 million | 8 |

||

| More than Rp. 10 million | 4 |

||

5 |

Funding Source | Bank | 54 |

| Non Bank | 43 |

4.2. The Survey Result on Financial Literacy Level of MSME in Bandung

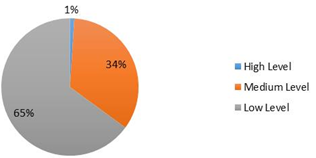

Based on the results of data processing, it was found that the level of financial literacy of MSMEs in Bandung, which had a low level of 65%, medium literacy category level of 34%, and high category level of 1%. While the results of data processing related to the financial level of MSME in Bandung amounted to 52.80%. That is, based on Danes and Hira (1987) MSME players in the city of Bandung are in the low literacy category which is below 60%. The details of the value based on financial literacy aspects can be seen as follows:| Financial Literacy Aspects | Financial Literacy Levels (%) |

||

Low (<60%) |

Middle (61% - 79%) |

High (>80%) |

|

| General Financial Knowledge | |||

| 1. Personal Financial Literacy | 72.16% |

||

| 2. Personal Financial Planning | 50.52% |

||

| 3. Asset Liquidity | 71.65% |

||

| 4. Net worth | 51.55% |

||

| 5. Non-wasteful behavior | 35.05% |

||

| 6. General knowledge affects | 65.63% |

||

| Financial management | |||

| The average of the financial literacy level based on general financial knowledge | 57.75% |

||

| Savings and Credits | |||

| 1. Savings | 39.18% |

||

| 2. Interest | 16.49% |

||

| 3. Credit Card Usage | 42.27% |

||

| 4. Overdraft Checking Accounts | 41.24% |

||

| 5. Creditworthiness | 81.44% |

||

| 6. Consquences of Loan Signing | 45.53% |

||

| The average of financial literacy level based on savings and credit | 42.27% |

||

| Insurance | |||

| 1. Insurance premiums | 57.73% |

||

| 2. Benefits of Insurance | 79.38% |

||

| 3. Insurance Characteristics | 55.67% |

||

| 4. Insurance Conflict Resolution | 70.62% |

||

| 5. Unit Link Characteristics | 44.33% |

||

| The average of financial literacy level based on insurance | 61.55% |

||

| Investment | |||

| 1. Comparison of interest rates and bond price | 58.76% |

||

| 2. Risk and Return | 30.93% |

||

| 3. Mutual Funds | 43.30% |

||

| 4. Return of Mutual Funds | 52.58% |

||

| The average of financial literacy level based on investment | 46.39% |

||

| The average of financial literacy level of MSMEs in Bandung | 52.80% |

||

From the Table 4, it is showed that the respondents had higher understanding in the creditworthiness. They understand the requirements to get the loan from the bank. The survey also showed that the respondents had medium understanding about the personal financial literacy, asset liquidity, general knowledge that affects the financial management, the benefit of insurance, and how to get the resolution of insurance conflict. But the other knowledge especially investment knowledge, the survey showed the respondents have low financial literacy level. This mean that MSMEs in Bandung already do not have the knowledge and trust in financial service institutions as well as their products and services, including features, benefits and risks, and the rights and responsibilities associated with financial products and services.

4.3. Logistic Regression Analysis Result

The following is the result of logistic regression analysis:

B |

S.E |

Wald |

df |

Sig. |

Exp(B) |

||

| Step 1a | GenKnow | -1.166 |

1.355 |

.741 |

1 |

.389 |

.312 |

| SavCred | .266 |

1.059 |

.063 |

1 |

.801 |

1.305 |

|

| Insurance | .837 |

.877 |

.913 |

1 |

.339 |

2.310 |

|

| Investment | .403 |

.900 |

.201 |

1 |

.654 |

1.497 |

|

| Constant | .082 |

.882 |

.009 |

1 |

.926 |

1.085 |

| Note: a Varieble(s) entered on step 1: GenKnow, SavCred, Insurance, Investment. |

Based on the results of the logistic regression analysis test, referring to Table 5 the function equation can be written as follows:

Through the model it can be seen the trend of choosing funding sources in each indicator. If an indicator has a positive value, it indicates that the respondent chooses the bank as a funding source. Whereas if an indicator has a negative means the respondent has a tendency to choose non-bank funding sources.

The first indicator is general financial knowledge that has negative value of 1.166. This means that the higher value of financial knowledge indicating that the respondents tend to choose non-bank funding as a source of funding.

The second indicator is savings and credits showed positive value of 0.266 that indicating the higher management of savings and credits of respondents, they tend to choose bank as a source of funding. The third indicator is insurance that had positive value of 0.837. It indicated that the better knowledge related to insurance management, the respondent tends to choose bank as source of funding. And the last indicator is investment that had positive value of 0.403 that indicated the better of investment management, the respondents tend to choose bank as a source of funding.

Chi-square |

df |

Sig |

||

| Step | Step | 2.167 |

4 |

.705 |

| Block | 2.167 |

4 |

.705 |

|

| Model | 2.167 |

4 |

.705 |

In Table 6 it can be seen that the chi-square value is 2.167 < from X2 table is 9.4877 or the significance value in the current study is equal to 0.705 > than 0.05. This shows that the four financial literacy indicators cannot be used to classify the selection of funding sources by MSME in Bandung.

4.4. Discriminant Classification Analysis

The following is the discriminant classification analysis result:

| Observed | Predicted |

||||

Decision |

Percentage Correct |

||||

.00 |

1.00 |

||||

| Step 1 | Decision | .00 |

10 |

33 |

23.3 |

1.00 |

9 |

45 |

83.3 |

||

| Overall Percentage | 56.7 |

||||

Through Table 7, decision ‘0’ means the respondents choose non-bank as source of funding and decision ‘1’ means that the respondents choose bank as source of funding. It is shown that from 43 respondents choose the non-bank category, there were 10 respondents who entered the non-bank category. And there was a misclassification of 76.7% respondents entered the bank category.

In the Bank category, from 54 respondents there were 9 respondents with a percentage level of 16.7% experienced misclassification. And there were 45 respondents with a percentage level of 83.3% entering the Bank category.

4.5. Discussion

From the analysis result above, it is statistically stated that financial literacy does not significantly influence the decision on funding sources. As showed in figure-1, from 97 respondents, there were 65% respondents in low level of financial literacy, 34% in medium level of financial literacy and only 1% respondents in high level of financial literacy.

Figure-1. Financial literacy level of MSME in Bandung.

All the respondents in high level of financial literacy tend to choose non-bank as source of funding. And 36.36% of respondents in medium level of financial literacy also tend to choose non-bank as source of funding. From all the respondents that choose non-bank as source of funding, there were 44.19% of respondents committed to have funding from their own equities, 25.58% of respondents preferred to have loan from family and closest friends, and the rest preferred from other source of funding, such as peer-to-peer loan, cooperatives, pawn shop, and fund from social gathering (arisan). Based on interview to some respondents, there are many reasons such as high interest and accessibility for micro business to get credit from bank, so that many respondents thought that by getting credit from bank will take the business into the higher risk.

This research results different with most of the previous research that there is positive significant effect between financial literacy and financial-decision making where business owner’s that have low financial literacy level tend to choose bank as their alternative funding but in the contrary whose with high financial literacy level tend to choose personal financing. This is in line with Eresia-Eke and Raath (2013) research and may have support the Agyei and Nsiah (2018) research that cultural beliefs also have implications on funding decision-making. Most of Indonesian citizen is Moslem and they beliefs that funding from bank has riba (interest) that not suitable with their beliefs.

5. Conclusions

This study showed that most of financial literacy level of MSME in Bandung is at a low literacy level. The respondents have low financial literacy level average in general financial knowledge, savings & credits, and investment. But they have medium financial literacy level on insurance. Even though their knowledge on savings and credits, their understanding on creditworthiness are high. It means that they actually understand the requirement to get loan, and it impact to their funding decision.

The results of logistic regression analysis showed that the four financial literacy indicators such as general financial knowledge, credits and savings knowledge, insurance knowledge, and investment knowledge did not significantly influence the decision making of funding sources. The study showed that high financial literacy group tend to choose non-bank as source of funding. Their main reasons are high risk due to high interest rate and accessibility to get credit from bank for micro business. The cultural beliefs also have implication on funding decision. Most of Indonesian citizen is Moslem and they beliefs that funding from bank has riba (interest) that not suitable with their beliefs.

The main recommendations of this research are for the regulators that are advised to educate financial knowledge such as insurance, investment, financial management, and financial records so as to improve financial literacy. The MSME are suggested to elevate their financial literacy level, so it is expected that MSME players can increase their financial knowledge, especially investment and funding in the capital market.

This study also has many limitations. The study has limitation on sample size. For further research, it is recommended to have larger number of sample size and because of cultural beliefs also have the strong point, it is also recommended to add variables on cultural beliefs related to alternative funding decision-making. The alternative of funding decision also can be wider to capital market, since the Indonesia Stock Exchange also create opportunities for SME to conduct an Initial Public Offering (IPO)References

Abdeldayem, M. M. (2016). Is there a relationship between financial literacy and investment decision in the Kingdom of Bahrain? Uct Journal of Management and Accounting Studies, 4(2), 68-78.

Abor, J., & Adjasi, C. K. D. (2007). Corporate governance and the small and medium enterprises sector: Theory and implications. Corporate Governance, 7(2), 111-122. Available at: https://doi.org/10.1108/14720700710739769.

Adomako, S., Danso, A., & Ofori, D. J. (2015). The moderating influence of financial literacy on the relationship between access to finance and firm growth in Ghana. Venture Capital, 18(1), 43-61.

Agyei, S., & Nsiah, C. (2018). Culture, financial literacy, and SME performance in Ghana. Cogent Economics & Finance, 6(1), 1-16. Available at: https://doi.org/10.1080/23322039.2018.1463813.

Altman, M. (2012). Implications of behavioural economics for financial literacy and public policy. The Journal of Socio-Economics, 41(5), 677-690. Available at: https://doi.org/10.1016/j.socec.2012.06.002.

Aribawa, D. (2016). The effect of financial literacy on the performance and sustainability of MSMEs in Central Java. Journal of Business Strategy, 20(1), 1-13.

Audretsch, D., Van der Horst, R., Kwaak, T., & Thurik, R. (2009). First section of the annual report on EU small and medium-sized enterprises. EIM Business & Policy Research. Avaiable at: http://www.ggb.gr/sites/default/files/basic-page-files/2008_annual-report_en.pdf .

Bongomin, G., Ntayi, J., Munene, J., & Malinga, C. (2017). The relationship between access to finance and growth of SMEs in developing economies. Review of International Business and Strategy, 27(4), 520-538. Available at: https://doi.org/10.1108/ribs-04-2017-0037.

Bosma, N., & Harding, R. (2007). Global entrepreneurship monitor. Retrieved from: http://entreprenorskapsforum.se/wp-content/uploads/2010/02/GEM-Global-Report_2007.pdf .

Čalopa, M. K. (2017). Business owner and managers attitudes towards financial decision-making and strategic planning: Evidence from Croatian SMEs. Management, 22(1), 103-116. Available at: https://doi.org/10.30924/mjcmi/2017.22.1.103.

Carree, M., & Klomp, L. (1996). Small business and job creation: A comment. Small Business Economics, 8(4), 317-322. Available at: https://doi.org/10.1007/bf00393279.

Carter, S., & Jones-Evans, D. (2006). Enterprise and small business. Harlow: FT Prentice-Hall.

Danes, S. M., & Hira, T. K. (1987). Money management knowledge of college students. Journal of Student Financial Aid, 17(1), 4-16.

Delić, A., Peterka, S. O., & Kurtovic, I. (2016). Is there a relationship between financial literacy, capital structure and competitiveness of SMEs? Economic Bulletin Econviews-Review of Contemporary Business, Entrepreneurship and Economic Issues, 29(1), 37-50.

Drexler, A., Fischer, G., & Schoar, A. (2014). Keeping it simple: Financial literacy and rules of thumb. American Economic Journal: Applied Economics, 6(2), 1-31. Available at: https://doi.org/10.1257/app.6.2.1.

Eresia-Eke, C., & Raath, C. (2013). SMME owners’ financial literacy and business growth. Mediterranean Journal of Social Sciences, 4(13), 397-397. Available at: https://doi.org/10.5901/mjss.2013.v4n13p397.

Gutter, M. S., Wang, L., & Way, W. (2008). Financial management practices of college student from states with varying financial education mandates.

Hilgert, M. A., Hogarth, J. M., & Beverly, S. G. (2003). Household financial management: The connection between knowledge and behavior. Federal Reserve Bulletin, 89, 309.

Huston, S. J. (2010). Measuring financial literacy. Journal of Consumer Affairs, 44(2), 296-316.

Irmawati, S., Damelia, D., & Puspita, D. W. (2013). Financial inclusion models in rural-based MSMEs. Journal of Economics and Policy, 6(2), 103-213.

Janor, H., Yakob, R., Hashim, N. A., Zanariah, & Wei, C. A. C. (2016). Financial literacy and invesment decisions in Malaysia and United Kingdom; A comparative analysis. Malaysian Journal of Society and Space, 12(2), 106 - 118.

Kotzé, L., & Smit, A. (2008). Personal financial literacy and personal debt management: The potential relationship with new venture creation. The Southern African Journal of Entrepreneurship and Small Business Management, 1(1), 35-50. Available at: https://doi.org/10.4102/sajesbm.v1i1.11.

Mandell, L. (2009). The financial literacy of young American adult: Result of the 2008 national jump$tart coalition survey of high school senior and college student. Washington, D.C: Jump$tart Coalition.

Njoroge, C. W., & Gathungu, J. M. (2013). The effect of entrepreneurial education and training on development of small and medium size enterprises in Githunguri District-Kenya. International Journal of Education and research, 1(8), 1-22.

Nkundabanyanga, S. K., Kasozi, D., Nalukenge, I., & Tauringana, V. (2014). Lending terms, financial literacy and formal credit accessibility. International Journal of Social Economics, 41(5), 342-361. Available at: https://doi.org/10.1108/ijse-03-2013-0075.

OJK. (2013). Regulation No. 76 / POJK.07 / 2016 concerning literacy and financial inclusion improvement program (SLNIK).

PISA. (2010). Financial literacy framework. Australia: PISA.

Randøy, T., & Goel, S. (2003). Ownership structure, founder leadership, and performance in Norwegian SMEs: implications for financing entrepreneurial opportunities. Journal of Business Venturing, 18(5), 619-637. Available at: https://doi.org/10.1016/s0883-9026(03)00013-2.

Ratnawati, T., Rohmasari, F., & Lokajaya, I. N. (2017). Detection of financial literacy and financial inclusion to improve the welfare of small industries in the tourism regions of Gresik regency, East Java. Archives of Business Researrch, 5(9), 151-163.

Remund, D. L. (2010). Financial literacy explicated: The case for a clearer definition in an increasingly complex economy. Journal of Consumer Affairs, 44(2), 276-295. Available at: https://doi.org/10.1111/j.1745-6606.2010.01169.x.

Shankar, S. (2013). Financial inclusion in India: Do microfinance institutions address access barriers. ACRN Journal of Entrepreneurship Perspectives, 2(1), 60-74.

Sijabat, S. (2011). Impact of the application of law Number 20 Year 2008 concerning MSMEs on the development of entrepreneurship for MSMEs. Infokop, 19, 86 - 103.

Singh, C., Mittal, A., Garg, R., Goenka, A., Goud, R., Ram, K., & Suresh, R. (2014). Financial inclusion in India: Select issues. IIM Bangalore Research Paper No. 474. Retrieved from SSRN: https://ssrn.com/abstract=2532876 or http://dx.doi.org/10.2139/ssrn.2532876 .

Sugiyono. (2013). Research methods - quantitative, qualitative, and R&D. Bandung: Alfabeta.CV.

Sujarweni, V. W. (2015). Research methods - business and economics. Yogyakarta: PT. New Library.

Suryana, U., & Yuneline, M. H. (2017). Measurement of financial literacy levels among S1 students at STIE equity.

Syarif, T. (2007). Successful UMKM profile study. Deputy of UKMK resource study. Ministry of cooperatives and SMEs.

Wattanapruttipaisan, T. (2003). Four proposals for improved financing of SME development in ASEAN. Asian Development Review, 20(2), 66-104.

Wise, S. (2013). The impact of financial literacy on new venture survival. International Journal of Business and Management, 8(23), 30-39. Available at: https://doi.org/10.5539/ijbm.v8n23p30.