Central Bank Independence, Economic Growth and Inflation: Theories and Empirical Validations

Adel BOGARI

Assistant Professor- College of Business Administration, Al-Baha University, KSA. |

AbstractEconomics theory’s assumption is that a central bank's independence from political power entails a split between political and monetary power. Such a split is unavoidable in order to control price instability without harming other macroeconomic variables such as growth or unemployment. The theory calling for central bank autonomy, started as early as the 1970s and still gaining ground, assumes the role of central banks as an arrangement sin qua non for tying the hands of government and consequently reducing inflationary bias, or even eliminating this scourge. Moreover, such a debate is mostly relevant for monetary policy, because of its inherent incredibility. Then, our aim in this study is to test the relevance of an anti-inflationary policy, reflected in freeing the central bank from the grip of political power, to combat inflation. To this end, we examine samples of developed countries (20 countries) and developing countries (37 countries) observed over the two study periods 1997-2006 and 2007-2016. We found that high-inflation countries and atypical countries biased our results, for both inflation rates and variability. This finding remains valid even after the introduction of a set of political and economic variables likely to affect inflation. |

Licensed: |

|

Keywords: JEL Classification |

|

Accepted: 24 March 2020 |

Funding: This study received no specific financial support. |

Competing Interests: The authors declare that they have no competing interests. |

1. Introduction

Central bank independence (CBI), as an institutional arrangement to reduce inflationary bias, had had an unprecedented resonance and surge during the second half of the 1980s, particularly reflected in founding the European Central Bank, probably the most independent central bank in the world.

The debate on central bank independence revolves, essentially, around the ability of monetary authorities to ensure price stability. Much of the debate is rooted in the fear that governments may use their influence over their central banks to massively finance budget deficit or try to stimulate output by implementing a more expansionary policy than anticipated (Arnone & Romelli, 2013; Chu, Cozzi, Furukawa, & Liao, 2017).

In the standard model, introduced in the pioneering work (Barro & Gordon, 1983) the main problem is the credibility of monetary policy. In other words, the optimal policy may prove impractical when it is not credible, i.e., when rational economic entities consider that it will be in the interest of monetary authorities to go back on their commitment to the initial monetary policy. According to its devout supporters, central bank independence, by neutralizing the effects of political pressures on decision making, is thus presented as a radical solution that is able to eliminate the problem of temporal inconsistency and the inherent lack of credibility thereof. In short, central banks should achieve independence, which is a prerequisite for the acquisition of true credibility in monetary policies and a guarantee of an unwavering commitment to the pursuit and maintenance of price stability, (Casinhas Luís Miguel Clemente, 2019).

Although the issue of credibility is important, it hardly exhausts the debate on independence, since consideration of the microeconomic function of the central bank reinforces the interest of the orthodox thesis. Indeed, autonomy of the issuing institution is often presented as a remedy for the conflict that may arise with the government (Ferguson, 2006; Gharleghi, 2019).

Under a certain thesis, Rogoff (1985) shows that the appointment of a conservative central banker eliminates inflationary bias, whereas when the economy is subject to random shocks, the single objective of price stability assigned to the central bank is not the best monetary policy, since it increases employment variability.

Some economists have called for limiting the power of central bankers over the economy and for reassessing the role of tax authorities, since the central bank's underlying thesis suffers from major shortcomings of its basic assumptions: the coherence of the entire economic policy program, exogenous autonomy and credibility of the monetary policy, Kokoszczyński and Mackiewicz‐Łyziak (2020).

This paper discusses the three-sided relationship between central bank independence, economic growth and inflation. It examines the extent to which central bank independence, once confirmed, may stimulate economic growth and control inflationary pressures.

The rest of the article is organized as follows: Section tow reviews briefly the theoretical background. Section three displays the methodology, the sample and the period. Section four presents the empirical findings. Finally, section five concludes.

2. Background to the Study

The literature seems to confirm the link between the following three concepts: independence, credibility and macroeconomic performance, i.e. a greater central bank autonomy benefits the monetary authority's credibility with the public, which translates into a remarkable improvement in macroeconomic performance, i.e. inflation, growth, budget deficit, etc.

Testing the relevance of this assumption has been done in the literature through two different perspectives: The first perspective has been interested in studying, directly, the independence-efficiency correlation without focusing on the intermediate stage of credibility gain, Bažantová (2017). Given that credibility is difficult to empirically apprehend, this approach has been favored. The second approach, on the other hand, considered the intermediate stage of credibility gain (Kokoszczyński & Mackiewicz‐Łyziak, 2020).

2.1. Central Bank Independence and Economic Growth

Most studies in the literature support a null relationship between independence and growth, while the independence-growth variability relationship remains, still, ambiguous. Theoretical models argue that the CBI allows the inflationary trend to be curbed without suffering a loss in growth. Indeed, it can be admitted that independence can affect growth in two contradictory ways which can compensate each other: (1) The positive effect; low uncertainty about inflation and therefore monetary stability, a corollary of the CBI, may favor economic growth because of a premium on the interest rate. (2) The negative effect ; the disinflationary process takes place via a restrictive monetary policy involving a high real interest rate, which is likely to curb investment (Tobin’s effect). Thus, most studies conducted on industrialized countries fail to conclude to a correlation between CBI and long-term growth. Indeed, Grilli, Masciandaro, and Tabellini (1991) and Alesina and Summers (1993) examined the issue over a sample of developed countries. More recently, studies (e.g. (Chu et al., 2017; De Haan & Kooi, 1997)) have only corroborated the above correlation in line with the expectations of "conventional" theory and the general trend of the relevant empirical studies. However, correcting growth for the influence of initial GDP, in line with catch-up theory, De Long, Summers, and Abel (1992) even show a positive relationship between CBI and growth, assuming that CBI is a factor of prosperity. Cukierman.., Kalaitzidakis, Summers, and Webb (1993) extend their scope of analysis and included 16 industrialized countries and 24 developing countries observed from 1960 to 1988. They manage to show that the legal independence index does not affect average growth in any way whatsoever. On the other hand, the real independence index has a significant negative effect on Developing Countries (DCs). While this effect is totally nil for all industrialized countries, "The negative coefficient obtained for developing countries may stem from the existence of simultaneity. Growth would have a negative impact on political instability and therefore on turnover, and causality would in fact be reversed" (Iwasaki & Uegaki, 2017; Kokoszczyński & Mackiewicz‐Łyziak, 2020). In sum, expectations of the "conventional" theory on growth level seem to be confirmed in industrialized countries. However, empirical validation is more delicate in developing countries. (He & Zou, 2016).

2.2. Central Bank Independence and Inflation

Several studies seem to confirm this relationship in line with the expectations of conventional theory, namely that degree of central bank autonomy negatively correlates with inflation rates. Indeed, Bade and Parkin (1982) found a negative correlation between degree of central banks’ policy independence and average inflation rate over the [1972-1986] period in 12 industrialized countries. However, no correlation is found between the financial independence index and inflation. The study of Alesina and Summers (1993) "provides a result that is a priori compatible with the theory of the dual relationship autonomy/inflation and autonomy/inflation variability"(Casinhas Luís Miguel Clemente, 2019). These results are stable and unambiguous when the studies focus on very long periods that are assumed to be homogeneous [1955-1972] and [1973-1988]. However, as soon as the analyses become more refined in terms of the division of periods and the choice of autonomy indicators, more "original" results appear. Grilli et al. (1991) whose empirical study covered the period [1950-1989] in eighteen Organization for Economic Co-operation and Development (OECD) countries, subdivided their observation period into four decades. The authors conclude that the expected negative relationship with inflation rates over all sub-periods is negative. Nevertheless, the political independence index is significant only during the 1970s, while the other partial independence index and the economic independence index, are consistent with the expectations of the theory except during the 1950s and 1960s. Similarly, the test conducted by Cukierman, Web, and Neyapti (1992) confirmed, as expected, the negative relationship between average inflation and legal independence in developed countries. It is, moreover, statistically significant at an error risk of 5%.

A review of the research and empirical studies carried out since then shows how far researchers have come towards integrating other independence indicators, diversifying observation periods and, in particular, introducing economic and political control variables (political instability, openness degree, institutional structure of the labor market, etc.). Economists aim, above all, to examine closely the statistical association "autonomy/inflation" under these new circumstances. Subscribing to these ideas, Fuhrer (1997) shows that the significance rate of the results of Alesina and Summers (1993) tends to be lower if their index is replaced by that of Cukierman (1992) or Cukierman et al. (1992) while keeping the same sample of countries. In fact, the negative relationship between independence, on the one hand, and inflation, on the other, is hecked. Nevertheless, it is less significant. Eijffinger and Schaling (1993) focused on the sensitivity of this relationship to several independence indices and observation periods. Thus, using the indices of Alesina (1988); Grilli et al. (1991); Cukierman (1992) and Ferguson (2006) examine the impact of autonomy on macroeconomic performance in twenty countries. The period under study, [1972-1992], has been subdivided into two sub-periods [1972-1982] and [1983-1992] to represent the cut-point period of membership to the European Monetary System (EMS). An inverse relationship between inflation and CBI level is found for all the above-mentioned indices, (Arnone, Laurens, Segalotto, & Sommer, 2007). However, it turns out that this correlation is much more significant in the first sub-period than in the second, probably because of the endogeneity of the choice of monetary policy following exchange rate fixture in EMS member countries. Indeed, the empirical estimation elaborated by and Jonsson (1995) corroborates this analytical guideline, which advocates that "autonomy/inflation" correlation is less obvious in the case of exchange rate fixture. Thus, Jonsson, examining 18 OECD countries over the [1961-1989] period, reaches the following conclusion: the effect of CBI in dampening inflation is much greater under a floating exchange rate regime. Focusing on developed countries, it is necessary to highlight the atypical nature of the Japanese case, often highlighted by empirical work, since it is characterized simultaneously by its low CBI level as well as its average inflation rate. To explain this paradox, Walsh (1995) refers to two economic variables, namely equilibrium unemployment rate and public deficit. In fact, the low coefficients of these variables lend credibility to the government's position with the public, who believe that the government does not resort to voluntary policies. From this point of view, the Japanese situation could be explained using a Barro-Gordon model rather than a Rogoff model: the Japanese government's rate of preference for the present would be low enough to check the non-diversion condition and thus make the delegation of monetary power to a more independent body useful.

3. Methodology

In what follows, we propose to test the relevance of monetary policy autonomy as an institutional arrangement to control inflationary bias. To this end, a sample of 20 developed and 37 developing countries will be examined. In order to account for a possible relationship between central bank independence and a multitude of economic variables that can absorb its direct impact, namely growth, growth variability, inflation and inflation variability, we will draw on the work of Cukierman et al. (1992). Thus, we will use the two independence indicators as conceived by the above-mentioned authors, namely the legal independence index based on the analysis of banks' statutes and the current independence index, which measures the frequency of managerial replacement.

Since the observation period extends over the [1997-2016] period, we will use the updated legal independence and turnover indices as developed by Cukierman et al. (1992) and updated by ourselves over the [1997-2006] decade. By way of comparison, during the same period, the updated turnover rates as reformulated by De Haan and Kooi (2000) will be used for developing countries. While for the [2007-2016] decade, only the turnover rate is taken into account as a proxy for the autonomy of the issuing institution, given the enormous difficulty of collecting the information required to construct the legal independence indices for a sample of 57 countries.

Turnover ratios (TOR) are developed as follows: for developed countries, the websites of the considered central banks are consulted to compile a list of the names of the governors of these issuing institutions in these countries. Once this list is compiled, calculating a turnover ratio that reflects the average length of time the central bank’s governor has held office is an easy task. For developing countries, the rates based on the calculation of Sturm and De Haan (2001) were updated and used. To test the correlation between independence and the various macroeconomic variables, series of ordinary least squares regressions are used. In a second step, we will follow Casinhas Luís Miguel Clemente (2019) and introduce, in addition to the independence indices, a set of control variables which may influence inflation. To check that the ordinary least squares assumptions are satisfied, tests of error normality were conducted beforehand. In order to complete this study, a set of sources of statistical information was consulted. It should be noted that a country is only considered in the sample if data are available for at least eight out of ten consecutive observation periods.

4. Main Results and Interpretation

4.1. The Independence - Growth Link

The dependent variable, growth level (GR), will be operationalized by average annual growth rates recorded over the GR decade, i.e. the geometric mean:

Over the [1997-2006] decade and as previously developed, the regression will be carried out with two exogenous variables:

The results are reported in Table 1:

| Independent Variables | Entire sample |

Developed countries |

Developing countries |

|

1 |

2 |

3 |

4 |

|

0.028 (3.323)*** |

0.020 (3.097)*** |

0.043 (3.040)*** |

0.039 (2.819)*** |

|

CBI |

-0.009 (-0.471) |

0.0016 (0.013) |

-0.018 (-0.541) |

-0.0086 (-0.261) |

| CWN TOR |

0.062 (3.949)*** |

0.038 (1.652) |

0.042 (2.011)* |

|

| De Haan/ Kooi TOR | 0.044 (2.335)*** |

|||

| R2 | 0.26 |

0.14 |

0.14 |

0.20 |

0.23 |

0.04 |

0.07 |

0.13 |

|

| N | 49 |

20 |

29 |

26 |

| DW | 2.29 |

2.02 |

2.79 |

2.81 |

| F | 8.20 |

1.43 |

2.20 |

2.89 |

| Note: The first value shows the coefficient of each variable. The second value in parentheses, denotes t-student statistic. *, **, ***Denote degree of significance10,5 and 1 percent levels, respectively. |

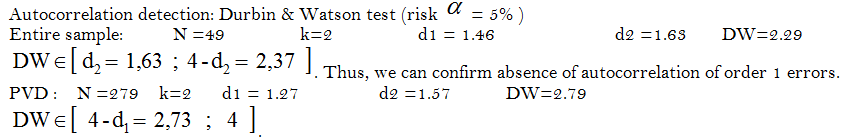

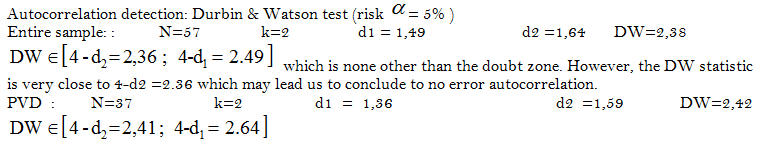

Therefore, the null hypothesis of autocorrelation is rejected. In this table, which plots the entire sample1 of 57 countries, including 20 developed countries and 37 developing countries, only the coefficient of effective independence is statistically significant at an error risk of 1%. In other words, the turnover rate index shows a significant negative effect while the legal independence index does not affect average growth in any way whatsoever. For developed countries, we notice that no independence index is statistically significant. As a result, even the legal independence effect is totally zero for industrialized countries. This result is in line with the theoretical models that argue that CBI may curb the inflationary trend without suffering a loss in growth. Indeed, most studies of this group of countries corroborate this assumption (e.g., Grilli et al. (1991); Alesina and Summers (1993); De Haan and Kooi (1997); Badea (2018)). Nevertheless, error risk is clearly lower when the frequency of replacement of the governor is taken into account. For developing countries, it is easy to see, as in the entire sample, that only the turnover ratio coefficient has a positive sign and is therefore statistically significant, thus highlighting a negative relationship between autonomy of the issuing institution and growth. This suggests that this institutional layout represents a real barrier to development. The same result was highlighted by Cukierman et al. (1993) during the [1960-1988] period. Gharleghi (2019) tried to explain this empirical finding. The author suggests that the negative coefficient for developing countries may result from simultaneity. Growth would have a negative impact on political instability and thus on turnover, and causality would in fact be reversed.

During the [2007-2016] decade, the regression is as follows:

The results are reported in Table 2 below:

| Independent Variables | Entire sample |

Developed countries |

Developing countries |

0.028 (6.142)*** |

0.032 (3.738)*** |

0.037 (6.260)*** |

|

TOR |

0.033 (1.999)* |

-0.03 (-0.767) |

0.029 (1.601) |

| R2 | 0.08 |

0.03 |

0.09 |

0.06 |

0.022 |

0.05 |

|

| N | 46 |

20 |

26 |

| Note: The first value shows the coefficient of each variable. The second value in parentheses, denotes t-student statistic. *, **, ***Denote degree of significance10,5 and 1 percent levels, respectively. |

Thus, even for developing countries, a reliable and stable relationship between CBI and growth level cannot be concluded to, which corroborates the expectations of conventional theory in this area, namely that CBI reduces inflationary bias without affecting growth. However, for the entire sample, the turnover ratio coefficient is positive and significant, suggesting a negative relationship between central bank independence and growth level.

4.2. The Independence - Growth Variability Link

Over the [1997-2006] decade, the model to be estimated is as follows:

With:

GRV: Growth variability is captured by the standard deviation of growth.

The results are as follows:

| Independent Variables | Entire sample |

Developed countries |

Developing countries |

|

1 |

2 |

3 |

4 |

|

0.024 (3.689)*** |

0.015 (3.406)*** |

0.042 (4.445)*** |

0.040 (3.947) |

|

| CBI | -0.009 (-0.632) |

0.005 (0.644) |

0.026 (1.166) |

-0.016 (-0.675) |

| CWN TOR |

0.040 (3.342)*** |

0.008 (0.559) |

0.020 (1.419) |

|

| De Haan/ Kooi TOR | 0.015 (1.102) |

|||

| R2 | 0.20 |

0.03 |

0.11 |

0.07 |

0.17 |

0.007 |

0.05 |

0.004 |

|

| N | 49 |

20 |

29 |

26 |

| DW | 1.39 |

1.31 |

1.92 |

2.18 |

| F | 6.08 |

0.29 |

1.74 |

0.94 |

| Note: The first value shows the coefficient of each variable. The second value in parentheses, denotes t-student statistic. *, **, ***Denote degree of significance10,5 and 1 percent levels, respectively. |

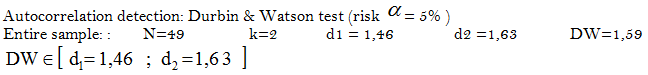

which is none other than the doubt zone. However, the DW statistic is very close to d2 = 1.63, which may lead us to conclude to no error autocorrelation.

The results reported in Table 3 above automatically point to a number of observations. In contrast to Rogoff (1985) who argues for a trade-off between credibility and flexibility, thus laying the groundwork for a positive correlation between independence and inflation variability, and like (Cukierman et al., 1993) and Badea (2018) we found no correlation between the legal independence index and output variability. On the other hand, it seems that, for the entire sample, a higher turnover rate only accentuates fluctuation of economic activity. Examining this impact separately for each type of country (developed and developing countries), it seems that the coefficient of the turnover rate ceases to be significant. As a result, the expected effect dissipates and no relationship is found. Cukierman et al. (1993) found exactly the same result. In this regard, they claim that this variable (Turnover) captures, rather, institutional differences between groups.

Over the [2007-2016] decade, the regression is the following:

The Table 4 below summarizes all our regressions:

| Independent Variables | Entire sample |

Developed countries |

Developing countries |

0.019 (5.237)*** |

0.21 (3.194)*** |

0.025 (5.207)*** |

|

| TOR | 0.030 (2.324)** |

-0.012 (-0.410) |

0.027 (1.830) |

| R2 | 0.10 |

0.09 |

0.12 |

0.08 |

0.045 |

0.08 |

|

| N | 46 |

20 |

26 |

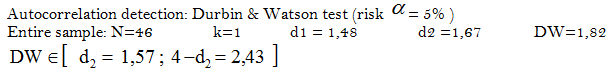

| DW | 1.82 |

2.86 |

2.11 |

| F | 5.40 |

0.16 |

3.35 |

| Note: The first value shows the coefficient of each variable. The second value in parentheses, denotes t-student statistic. *, **, ***Denote degree of significance10,5 and 1 percent levels, respectively. |

which is none other than the doubt zone. However, the DW statistic is very close to d2 = 1.63, which may lead us to conclude to no error autocorrelation. Like in the [1997-2006] decade, it seems that, for the entire sample, the coefficient of the turnover rate is statistically significant, whereas it is not for each type of country taken separately.

4.3. Independence - Inflation Level

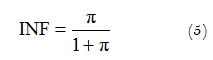

Inflation is captured by the annual growth rate of the implicit GDP deflator. To reduce error heteroscedasticity and improve estimation efficiency, Cukierman et al. (1992) suggest using a transformed inflation rate with the following form :

Thus, if inflation is 100%, INF = 0.5, and of course if the inflation rate is positive, the rate varies over the interval [0.1]. Therefore, to obtain average inflation of country i, it is enough to first calculate INF for each year and then calculate the arithmetic mean of the annual values of INF. In what follows, like many studies, we will empirically try to confirm the relationship consistent with the expectations of the conventional theory, i.e., a negative relationship between the legal independence index and the level or variability of inflation and a positive relationship between the replacement frequency of managers and the level of variability of inflation.

Over the [1997-2006] period, the regression takes the following simple form:

With:

INF: The transformed inflation rate.

TOR: The central bank's turnover rate.

ε: error term.

The results obtained over the [1997-2006] period are reported in Table 5.

which is namely the indeterminate zone. Also, it is easy to see that the DW statistic is very close to 4-d2 =2.41 and therefore the assumption of no error autocorrelation is very presumptive.

| Independent Variables | Entire sample |

Developed countries |

Developing countries |

|

1() |

2() |

3 |

4() |

|

0.02 (0.46) |

0.07 (3.21)*** |

0.03 (0.39) |

0.02 (0.32) |

|

| CBI | -0.007 (-0.05) |

-0.05 (-1.23) |

0.05 (0.23) |

0.10 (0.47) |

| CWN TOR |

0.45 (5.10)*** |

0.04 (0.49) |

0.42 (3.48)*** |

|

| De haan- Kooi TOR | 0.39 (3.46)*** |

|||

| R2 | 0.32 |

0.11 |

0.26 |

0.26 |

0.30 |

0.008 |

0.22 |

0.22 |

|

| N | 57 |

20 |

37 |

37 |

| DW | 2.38 |

1.90 |

2.42 |

2.41 |

| F | 13.03 |

1.082 |

6.190 |

6.11 |

| Note: The first value shows the coefficient of each variable. The second value in parentheses, denotes t-student statistic. *, **, ***Denote degree of significance10,5 and 1 percent levels, respectively. |

Thus, bearing on the above results, we formulate the following observations. For the entire sample, coefficients of legal independence or the frequency of replacement of managers have the expected sign when the dependent variable is inflation level. However, only the turnover index is statistically significant. Moreover, this result is consistent with that of Cukierman et al. (1992) over the 1950-1989 period. For developed countries, it should be noted that the sign of legal independence is negative, which is in line with the theory postulated by the dominant thesis. However, it turns out that this coefficient is far from being statistically significant. The statistical insignificance of the legal independence index in industrialized countries undeniably contradicts, for illustrative purposes, the results of Alesina and Summers (1993) whose empirical work was conducted on 16 developed countries during the [1955-1988] period. On the other hand, it should always be borne in mind that our observation period is relatively short. In this regard, Kokoszczyński and Mackiewicz‐Łyziak (2020) state that these results are stable and unambiguous when the studies remain focused on very long periods assumed to be homogeneous. Nevertheless, as soon as the analyses become more refined in terms of the division of periods and the choice of autonomy indicators, more original results appear.

For developing countries, the positive sign expected by conventional theory between inflation level and the turnover rate is confirmed. Moreover, this positive correlation is statistically significant in support of a stable and reliable relationship between the average length of time the issuing institution has been in charge and inflation level, irrespective of the used effective independence index Cukierman et al. (1992) or De Haan and Kooi (2000)).

In what follows, we will examine the extent of correlation between these indices and the presence of a few high-inflation cases in the studied sample. To this end, we will exclude, like De Haan and Kooi (2000) countries with an average inflation rate above 100% (INF > 0.5). Taking this measure into account will exclude three Latin American countries from the sample under consideration, namely Argentina, Brazil and Peru. It should be noted that no industrialized country recorded hyperinflation. The following table summarizes the new regressions that have been estimated.

Thus, the earlier conclusion, that there was a significant correlation between the effective independence index and inflation level, both for the entire sample and for developing countries, seems to be called into question following the exclusion of high-inflation countries ( ≥100%). Indeed, it is clear that the turnover rate indices cease to be statistically significant. Moreover, this finding is similar to that of De Haan and Kooi (2000) and Gharleghi (2019)

Contrary to what has been shown previously, the regression will be estimated with a single exogenous variable:

| Independent Variables | Entire sample |

Developing countries | |

1 |

1 |

2 |

|

0.074 (1.670) |

0.085 (1.196) |

0.090 (1.236) |

|

| LCBI | 0.005 (0.056) |

0.119 (0.645) |

0.131 (0.715) |

| CWN TOR |

0.168 (1.855) |

0.066 (0.511) |

|

| De Haan- Kooi TOR |

0.034 (0.274) |

||

| R2 | 0.062 |

0.025 |

0.019 |

0.025 |

0.003 |

0.004 |

|

| N | 54 |

34 |

34 |

| Note: The first value shows the coefficient of each variable. The second value in parentheses, denotes t-student statistic. *, **, ***Denote degree of significance10,5 and 1 percent levels, respectively. |

The results obtained over the 2007-2016 period, thus conducted, are as follows:

| Independent Variables | Entire sample |

Developed countries |

Developing countries |

0.076 (2.961)*** |

0.0165 (1.632) |

0.125 (4.097)*** |

|

| TOR | 0.1180 (1.229) |

0.041 (0.875) |

0.085 (0.841) |

| R2 | 0.029 |

0.040 |

0.023 |

0.009 |

0.012 |

0.009 |

|

| N | 52 |

20 |

32 |

| Note: The first value shows the coefficient of each variable. The second value in parentheses, denotes t-student statistic. *, **, ***Denote degree of significance10,5 and 1 percent levels, respectively. |

Looking at these results closely, the following observations are of an order. The coefficients of the replacement frequency of managers have the expected sign when the dependent variable is inflation level. However, no coefficient is statistically significant. Thus, the presence of an inverse relationship between degree of central bank autonomy and inflation level, even for underdeveloped countries, is far from being the case. This result is very striking since it runs counter to the results found over the previous decade, namely that for developing countries, the effective independence index is far from failing. Consequently, a decrease in turnover rate is likely to ease the inflationary trend in the economy. It should, however, be noted that this conclusion is, in part, linked to the presence of a few "atypical" cases in the studied sample. Thus, Colombia, Nigeria, Peru, Venezuela and Zimbabwe appear to be "atypical" countries since they combine low turnover rates (only one governor during the whole decade) with relatively high inflation rates. In the same line of thinking, Japan appears to be an "atypical" case since it combines low inflation and a central bank considered as dependent according to our index. The exclusion of all these countries alters quite significantly the results reported in the table presenting the relationship between central bank independence and inflation level during the [2007-2016] decade. The results of the new estimates are presented as follows:

| Independent Variables | Entire sample |

Developed sample |

Developing countries |

0.023 (0.869) |

0.009 (1.038) |

0.073 (1.917) |

|

| TOR | 0.282 (2.961)*** |

0.081 (1.774) |

0.236 (2.021)* |

| R2 | 0.16 |

0.15 |

0.14 |

0.14 |

0.10 |

0.10 |

|

| N | 46 |

19 |

27 |

| DW | 1.73 |

1.39 |

2.03 |

| F | 8.77 |

3.14 |

4.08 |

| Note: The first value shows the coefficient of each variable. The second value in parentheses, denotes t-student statistic. *, **, ***Denote degree of significance10,5 and 1 percent levels, respectively. |

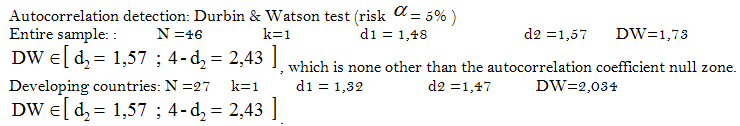

Therefore, the hypothesis of first-order error autocorrelation is rejected.

Thus, both for the entire sample and for developing countries, and like in Alesina and Summers (1993) who set aside a few cases in their study of the first experiments with independence after the inflationary periods of the interwar period in Europe, the exclusion of countries likely to be considered as "atypical" cases has improved the results obtained in the regressions on inflation level, given the static significance of these two coefficients, unlike in Cukierman et al. (1992) and Condrey and Neaves (2018).

4.4. Independence - Inflation Variability

The regression is as follows:

![]()

With:

VINF: Variable that refers to the standard deviation of inflation. For the 1997-2006 period, the results are as follows:

| Independent Variables | Entire sample |

Developed countries |

Developing countries |

|

1 |

2 |

3 |

4 |

|

-0.950 (-1.474) |

0.034 (3.865)*** |

-1.166 (-1.074) |

0.120 (0.112) |

|

| CBI | 0.846 (0.549) |

-0.031 (-1.458) |

1.141 (0.408) |

-2.612 (-0.917) |

| CWN TOR |

4.464 (4.296)*** |

-0.007 (-0.201) |

4.833 (3.284)*** |

|

| De Haan/ Kooi TOR |

0.35 |

5.026 (3.771)*** |

||

| R2 | 0.25 |

0.11 |

0.24 |

0.42 |

0.23 |

0.007 |

0.20 |

0.36 |

|

| N | 57 |

20 |

27 |

22 |

| DW | 2.10 |

1.91 |

1.88 |

1.46 |

| F | 9.31 |

1.07 |

5.59 |

7.12 |

| Note: The first value shows the coefficient of each variable. The second value in parentheses, denotes t-student statistic. *, **, ***Denote degree of significance10,5 and 1 percent levels, respectively. |

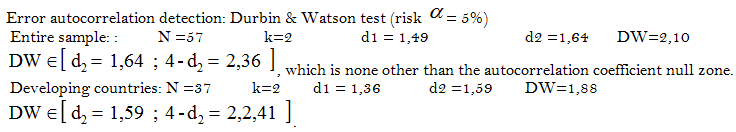

Therefore, the hypothesis of first-order error autocorrelation is rejected.

A close examination of the results summarized in the table above leads to the following conclusions when the dependent variable is inflation variability. For the entire sample, the assumed direction of the relationship is not observed only for the current independence index (the coefficient of the legal independence index is positive whereas the theory predicts that it is negative). On the other hand, the effective independence index is statistically significant. As for developed countries, it can be observed that no independence index is statistically significant. Thus, for this group of countries, we cannot conclude to a stable and reliable correlation between the central bank and price variability. Moreover, this finding is consistent with that of Jácome and Vázquez (2008); Klomp and De Haan (2010) and Posso and Tawadros (2013). All developing countries record the assumed direction of the relationship for the frequency of replacement of governors (the coefficient of effective independence is positive). Moreover, this index is statistically significant. The observations thus presented are in line with the following statement by Cukierman et al. (1992): "the turnover rate contributes significantly to explaining the variability of (INF), both for the entire sample and for underdeveloped countries. However, the legal independence variable is not". However, it is not really possible to conclude to a link between independence and inflation variability in the entire sample and developing countries following the exclusion of countries with high inflation (INF > 0.5). The following table summarizes the results:

| Independent Variables | Entire sample |

Developing countries |

|

1 |

2 |

3 |

|

0.029 (0.382) |

0.038 (0.295) |

0.034 (0.492) |

|

| CBI | 0.085 (0.467) |

0.283 (0.847) |

0.159 (0.931) |

| CWN TOR |

0.176 (1.106) |

0.017 (0.007) |

|

| De Haan/ Kooi TOR | 0.086 (0.752) |

||

| R2 | 0.027 |

0.023 |

0.05 |

0.01 |

0.019 |

0.01 |

|

| N | 54 |

34 |

30 |

| Note: The first value shows the coefficient of each variable. The second value in parentheses, denotes t-student statistic. *, **, ***Denote degree of significance10,5 and 1 percent levels, respectively. |

As in De Haan and Kooi (2000) the governor replacement frequency index ceases to be statistically significant following the exclusion of countries with excessively high inflation rates, namely Argentina, Brazil and Peru, which supports the conclusion that "central bank independence only becomes more important if high inflation countries are included in the sample".

5. Conclusion

The purpose of this paper is threefold: first, to outline attempts to measure the operational margin index of central banks when using their instruments and implementing their objectives. Thus, the so-called first-generation research focused on the statutory provisions of central banks, while second generation research, mainly that of Cukierman and his team, addressed the issue well beyond the de jure independence criteria alone by introducing, in addition to the questionnaire, the governor replacement frequency index or the effective independence index. This latter reflects the average effective office term of a governor. It is clear that a series of difficulties faced by economists, in particular the selection of the criteria for the index in question, the interpretation of the statutory provisions and the way in which assessments are aggregated within an overall index, have not, to date, found a unanimously agreed solution. In a second stage, our aim is to study the link between autonomy and macroeconomic performance, namely growth and inflation.

Moreover, we set ourselves the task of testing the relevance of the assumption stipulating that an anti-inflationary policy guaranteed by freeing the central bank from political power is likely to combat inflation. Within the studied sample, it was found that high-inflation countries and atypical countries played a decisive role in biasing the results of the conducted tests, not only for inflation level but also for inflation variability, growth level and variability. This empirical finding remains valid even after the introduction of a set of political and economic variables likely to affect inflation.

As for our last objective, the unreliability of estimators that try to quantify monetary authority autonomy only casts doubt on the countless empirical studies that support the conventional thesis which assumes that this institutional arrangement provides a "free lunch," which tempers the enthusiasm of proponents of central bank independence.References

Alesina, A., & Summers, L. H. (1993). Central bank independence and macroeconomic performance: some comparative evidence. Journal of Money, credit and Banking, 25(2), 151-162.Available at: https://doi.org/10.2307/2077833.

Alesina., A. (1988). Macroeconomics and politics. In S. Fischer, NBER macroeconomics annual (pp. 17- 52). Cambridge: MIT Press.

Arnone, M., Laurens, B., Segalotto, J., & Sommer, M. (2007). Central Bank Autonomy: Lessons from global trends. IMF Working PaperNo 07/88.

Arnone, M., & Romelli, D. (2013). Dynamic central bank independence indices and inflation rate: A new empirical exploration. Journal of Financial Stability, 9(3), 385-398.Available at: https://doi.org/10.1016/j.jfs.2013.03.002.

Bade, R., & Parkin, M. (1982). Central bank laws and monetary policy.

Badea, I.-R. (2018). Central bank independence and its impact on the macroeconomic performance. Evidence from Romania before and after crisis, Kursat Cross, 1(1), 46-65.

Barro, R. J., & Gordon, D. B. (1983). Rules, discretion and reputation in a model of monetary policy. Journal of Monetary Economics, 12(1), 101-121.Available at: https://doi.org/10.1016/0304-3932(83)90052-1.

Bažantová, I. (2017). Legal analysis of the independence of the Czech Central Bank. Paper presented at the International Multidisciplinary Scientific Conference on Social Sciences & Arts SGEM, SGEM2017 Conference Proceedings.

Casinhas Luís Miguel Clemente. (2019). Central bank independence and economic growth, MSc Dissertation, ISCTE Business School, Economics Department, Retrieved from; https://repositorio.iscte-iul.pt/bitstream/10071/18974/1/Master_Luis%20_Clemente_Casinhas.pdf.

Chu, A. C., Cozzi, G., Furukawa, Y., & Liao, C.-H. (2017). Inflation and economic growth in a schumpeterian model with endogenous entry of heterogeneous firms. European Economic Review, 98, 392-409.Available at: https://doi.org/10.1016/j.euroecorev.2017.07.006.

Condrey, S. E., & Neaves, T. (2018). Central bank independence and deflation. Public Administration Review, 78(5), 803-808.

Cukierman, A., Web, S. B., & Neyapti, B. (1992). Measuring the independence of central banks and its effect on policy outcomes. The World Bank Economic Review, 6(3), 353-398.Available at: https://doi.org/10.1093/wber/6.3.353.

Cukierman., A. (1992). Central bank strategy, credibility, and independence: Theory and evidence. Cambridge: MIT Press.

Cukierman, A., Kalaitzidakis, P., Summers, L., & Webb, S. (1993). Central Bank Independence, growth, investment and real rates. Paper presented at the Carnegie-Rochester Conference Series on Public Policy, Autumn.

De Haan, J., & Kooi, W. (1997). What really matters: conservativeness or independence? National Bank of Labor Quarterly Review, 50(200), 23-38.

De Haan, J., & Kooi, W. J. (2000). Does central bank independence really matter?: New evidence for developing countries using a new indicator. Journal of Banking & Finance, 24(4), 643-664.Available at: https://doi.org/10.1016/s0378-4266(99)00084-9.

De Long, J. B., Summers, L. H., & Abel, A. B. (1992). Equipment investment and economic growth: How strong is the nexus? Brookings Papers on Economic Activity, 1992(2), 157-211.Available at: https://doi.org/10.2307/2534583.

Eijffinger, S. C. W., & Schaling, E. (1993). Central bank independence in twelve Industrialized Countries. Banca Nazionale del Lavoro Quarterly Review, No. 184, 1- 44.

Ferguson, R. (2006). Monetary credibility, inflation and economic growth. Cato Journal, 26(2), 223-230.

Fuhrer, J. (1997). Shifts in the beveridge curve, job matching, and labor market dynamics. New England Economic Review(sep), 3-19.

Gharleghi, B. (2019). Central bank independence, inflation, and economic growth, chapter in book: Macroeconomic Policies in Countries of the Global South, Publisher. New York: NOVA Science Publishers.

Grilli, V., Masciandaro, D., & Tabellini, G. (1991). Political and monetary institutions and public financial policies in the industrial countries. Economic Policy, 6(13), 341-392.Available at: https://doi.org/10.2307/1344630.

He, Q., & Zou, H.-f. (2016). Does inflation cause growth in the reform-era China? Theory and evidence. International Review of Economics & Finance, 45, 470-484.Available at: https://doi.org/10.1016/j.iref.2016.07.012.

Iwasaki, I., & Uegaki, A. (2017). Central bank independence and inflation in transition economies: A comparative meta-analysis with developed and developing economies. Eastern European Economics, 55(3), 197-235.Available at: https://doi.org/10.1080/00128775.2017.1287548.

Jácome, L. I., & Vázquez, F. (2008). Is there any link between legal central bank independence and inflation? Evidence from Latin America and the Caribbean. European Journal of Political Economy, 24(4), 788-801.

Jonsson, G. (1995). Institutions and incentives in monetary and fiscal policy. Ph.D. dissertation, Institute for International Economic Studies, Stockholm University, Monograph Series No. 28.

Klomp, J., & De Haan, J. (2010). Inflation and central bank independence: A meta regression analysis. Journal of Economic Surveys, 24(4), 593-621.Available at: https://doi.org/10.1111/j.1467-6419.2009.00597.x.

Kokoszczyński, R., & Mackiewicz‐Łyziak, J. (2020). Central bank independence and inflation—Old story told anew. International Journal of Finance & Economics, 25(1), 72-89.

Posso, A., & Tawadros, G. B. (2013). Does greater central bank independence really lead to lower inflation? Evidence from panel data. Economic Modelling, 33, 244-247.Available at: https://doi.org/10.1016/j.econmod.2013.04.005.

Rogoff, K. (1985). The optimal degree of commitment to an intermediate monetary target. The quarterly journal of economics, 100(4), 1169-1189.Available at: https://doi.org/10.2307/1885679.

Sturm, J.-E., & De Haan, J. (2001). How robust is the relationship between economic freedom and economic growth? Applied Economics, 33(7), 839-844.Available at: https://doi.org/10.1080/00036840121977.

Walsh, C. E. (1995). Optimal contracts for central bankers. The American Economic Review, 85(1), 150-167.

Footnote:

1.AUS,AUT,BEL,CAN,DNK,FIN,FRA,DEU,IRL,ITA,JPN,NLD,NZL,NOR,PRT,ESP,SWE,CHE,GBR,USA,ARG,BHS,BRB, BOL ,BWA,BRA,CHL,CHN,COL,ZAR,CRI,EGY,GHA,HND,HUN,IND,ISR,KEN,KOR,MEX,MLT,MYS,MAR,NPL,NGA,PAK,PAN,PER,PHL,SGP,ZAF,THA,TUR,VRY,VEN,ZMB,ZWE.