Non-Performing Loans in Banking Sector of Bangladesh: An Evaluation

Dhanonjoy Kumar1*

Md. Zakir Hossain2

Md. Saiful Islam3

1Associate Professor, Department of Management, Islamic University, Kushtia, Bangladesh. JEL Classification |

AbstractNon-performing loan is a loan that is in default or close to being in default. Non-performing loans (NPLs) badly affects the health of banking sector and also economy of the nations. The main aim of this paper is to analyze the recent trend of NPLs in banking sector with reference to Bangladesh. The present study is based on the secondary data which have been collected from the report of Bangladesh Bank and websites of the scheduled banks o f Bangladesh from the year 2003 to 2018. The study revealed that NPLs are the burning problems of the banking sector in Bangladesh for last few decades. The international standard of NPL is 2 percent or below but in our country it is much higher. The NPL percentages in Bangladesh are 5 to 6 times higher than the standard which is alarming for the sector. According to the reports of Bangladesh Bank (central bank of Bangladesh) Non Performing Loans ratio stood at 10.30 % in December 2018, 9.31 percent in December 2017, 9.23 percent in December 2016 and 8.79 percent in December 2015. It is observed that the NPL ratio is growing successively with the passage of time. So, as a credit controlling authority Bangladesh Bank should give more emphasize on the NPLs of commercial banks. |

Licensed: |

|

Keywords: |

|

Accepted:27 March 2020 |

|

| (* Corresponding Author) |

Funding: This study received no specific financial support. |

Competing Interests:The authors declare that they have no competing interests. |

1. Introduction

The banking system of Bangladesh has been departing through an uninterrupted process of development since the 1990s. Around 59 scheduled banks in Bangladesh who function under full control and direction of Bangladesh Bank which is empowered to do so through Bangladesh Bank Order, 1972 and Bank Company Act, 1991 (Bangladesh Bank, 2019). Last ten years there has been quick growth in the banking sector with many new banks functioning in the country for the first time. Ever since Bangladesh became a signatory to the Millennium Development Goals (MDGs) of the United Nations, the economic policies of the Bangladesh Government have been focused on two things: economic growth or more precisely the growth of the GDP and further integration into the international financial system (Akter & Roy, 2017). The funds can be largely explained as owned capital and loan capital. Owned capital is basically the own fund in the business which is a very small amount of the total investment. The rest is termed as loan capital. The banking sector is the main source of loan capital in the business. In the development of the country’s economic growth, the banking system is an essential consideration (Ozili, 2015). Bankers are the custodian and distributors of the liquid cash and capital in a country like Bangladesh. Since independence, the Bangladesh banking sectors are trying to retrieve the economy from the trap of the underdevelopment and use some anti-poverty vaccine to reduce poor from society (Ovi, 2018). The heart of a bank is truncated into two segments namely deposits and loans. The principal objective of a bank is to collect deposit from the surplus portion (i.e from depositors) and supply the collected fund to the deficit portion (i.e to the loanee). Non-performing loan (NPL) is that portion of loan which has already become the default or close to being a default. When the bank fails to gather the interest payments or the main amount of a loan then that loan is consider as NPL. The Central Bank of Bangladesh has defined eight stages of the loan in terms of classification which includes superior, good, acceptable, marginal/watch list, Special Mentioned Account (SMA), Sub Standard (SS), Doubtful (DF) and Bad & Loss (BL). As per classification guideline of Bangladesh Bank, Sub Standard (SS), Doubtful (DF) and Bad & Loss (BL) are considered as a non-performing loan (NPL). Bank has been set up with the aims of lending loans and mobilizes the fund in society. The goal of this study is to analyze the situation of non-performing loans in the banking sector of Bangladesh (Chowdhury, 2018).

2. Literature Review

Non-performing loans are an important and debated issue in many academic kinds of literature in the world. A good number of researchers have been enlightened about the issue of NPLs. The immediate consequence of a large amount of NPLs in the banking system is bank failure as well as an economic slowdown. The causes of NPLs are usually attributed to the lack of effective monitoring and supervision on the part of banks, lack of effective lenders’ recourse, weaknesses of legal infrastructure, and the short of efficient debt recovery strategies (Adhikari, 2007).

Akter and Roy (2017) in their study to find out the time-series scenario of non-performing loans (NPLs), its growth, provisions and relation with banks profitability by using some ratios and a linear regression model of econometric technique. The experimental result signify that non-performing loan (NPL) as a percentage of total loans on listed banks in Dhaka Stock Exchange (DSE) is very high and they holds more than 50 % of total non-performing loans (NPLs) of the listed 30 banks in Dhaka Stock Exchange (DSE) for the year 2008 to 2013. The study revealed that it is one of the major factors of influencing banks profitability and it has a statistically significant negative impact on net profit margin (NPM) of listed banks for the study periods.

In an analytical study, Lata (2015) investigates the significant linkage between Non- Performing Loans (NPLs) and profitability of the SCBs in Bangladesh. She also suggested that it is time to formulate proper rules on lending policy, credit policy, interest rate adjustment, risk management strategy etc. on all scheduled banks operating in our country. Some other relevant, as well as emergency precautions, can be initiated by the authority as soon as possible to ensure a sound environment in the banking industry of Bangladesh.

There are several reasons for the non-performing loan. But recently fund diversion, political instability, aggressive banking, fall in real estate business, weak monitoring, lack of coordination among related parties are aggravating non-performing loan. Strong and regular monitoring, collaboration among connected parties and strict enforcement of active laws help to reduce NPLs. Bangladesh Bank must play a very important role in these issues. Commercial banks should ensure transparency in credit granting and Bangladesh Bank should ensure that the application of credit sanctioning guidelines is being followed to issue a new loan. To decrease NPLs, appropriate steps should be taken for debt recovery and new investment must be safe and sound. An otherwise large amount of NPLs reduce banks‟ profitability and may erode capital also. That may bring human-created disaster in the banking industry, Alam, Haq, and Kader (2015).

Hossain (2018) Stated that Non-performing loan in Bangladesh has become apparent in the last few years. Structural weakness, political will and lack of good governance are main factors for the bank industry depressed. There may also be a reason for the small economy to move more to the bank. In order to overcome this situation, the family tradition in banking will be reduced in the bank sector in the country, at the same time, the capacity of the country's central bank to increase immediately.

Laveena and Kumar (2016) made a comparative study of management of non-performing assets of the public and private sector banks of India. The study was based on the secondary data for the period 2001 to 2010. It was found from the study that the profitability of the banks gets affected by the non-performing assets. Public sector banks are more affected by the poor management of NPA than the private sector banks. It was also found from the study that the level of NPA is higher in public sector banks than private sector banks. The researcher suggested that the credit evaluation policy of the banks should be improved to reduce the level of NPA in the banks.

Bashir, Yu, Hussain, Wang, and Ali (2017) conducted empirical testing of the determinants of NPLs in the Chinese banking system. The researchers found that high banking system transparency reduces NPLs but not in the case of government-owned banks, whereas, high competition in the banking market increases NPLs. Macroeconomic determinants have a significant effect on NPLs, especially inflation, real interest rate and real GDP. Finally, bank-specific determinants, such as bank profitability, and size has a significant effect on NPLs.

2.1. Objectives of the Study

The present study has been concentrated to achieve the following objectives:

- To know and measure the present as well as future trends of NPLs in Bangladesh.

- To find out the effects of NPLs in Bangladesh’s economy.

- To compare the management and also various policies to reduce NPLs in Bangladesh.

2.2. Research Methodology

The study followed a quantitative approach to achieve the objectives of this study, which was descriptive in nature. The main aim of this study is to find out the facts and figures that are associated with NPLs in the banking sector of Bangladesh. To ascertain the above-mentioned objectives as well as to draw the major findings and to put the appropriate recommendations researchers have used both primary and secondary data. Secondary data are cheaper and more obtainable than the primary data. The secondary data have been collected from published reports of newspaper, annual report of Bangladesh central bank (Bangladesh Bank) annual report of related scheduled banks annual reports, related books, journals, articles, seminar paper, publications from national and international research institutions, report of different financial institutions, public records and statistics, different research reports etc. Some simple statistical tools and graphical presentation used in this study. Primary data were collected from the employees of the banks as per the following ways:

| Nature of Banks | Name of Banks | Selected Bankers |

| Foreign Commercial Banks | Standard Chartered Bank | 2 |

| HSBC | 2 |

|

| State Owned Commercial Banks | Sonali Bank Limited | 2 |

| Janata Bank Limited | 2 |

|

| Private Commercial Banks (Islamic Sariaha Based) | Islami bank Bangladesh Limited | 2 |

| Al Arafah Islami Bank Limited | 2 |

|

| Private Commercial Banks (General) | Dutch Bangla Bank Limited | 2 |

| Prime Bank Limited | 2 |

|

| Specialized Banks | Bangladesh Krishi Bank | 2 |

| BDBL | 2 |

|

| Total | 20 |

|

Here the banks were selected randomly which have been covered all the four broad categories of banks. From each type of individual banks, one branch manager and one loan officer were selected for interview purpose.

2.3. Research Questions

To achieve the objectives of the study two research questions are given below:

- What is the ratio of present NPLs in Bangladesh?

- What are the effects of NPLs in the economy of Bangladesh?

2.4. Non-performing Loan in Bangladesh

The topic of NPLs in Bangladesh is not a new event. The seeds of NPLs were cultured during the early stage of the liberation age (1972-1981), by the government’s “expansion of credit” policies on the one hand and a feeble and infirm banking infrastructure combined with an unskilled workforce on the other. The growth of credit policy through the early stage of liberation, which was heading for to disbursement of credit on relatively easier terms, did actually expand credit in the economy in nominal terms (Lata, 2015). The government nationalized commercial banks to lend to losing state-owned enterprises, imperfect policy strategy regarding “loan classification and provisioning” and the use of accrual policies of accounting for recording interest income of Non-Performing Loans resulted in alignments of the credit discipline of the country till the end of 1989 (Mujeri, 2018). In the 1990s a broad-based monetary measure was undertaken in the name of FSRP, enlisting the help of World Bank to re-establish financial discipline to the country. Unexpectedly, even after so many methods, the banking system of Bangladesh is yet to free itself from the hold of the NPL disaster. Now the study has determined on the above issue largely with a view to supplementary policymakers to invent concrete measures concerning sound management of NPLs in Bangladesh (Mallick, 2018).

3. Analysis and Discussion

3.1. Non-performing Loans in Bangladesh: By Ratio (2003-2018) From Bangladesh Bank

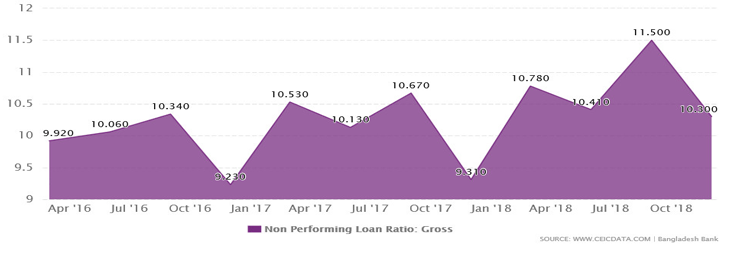

Non-performing Loans in Bangladesh: By Ratio (2003-2018) From Bangladesh Bank. NPLs are defined as the sum of inferior, suspicious and Bad/Loss Loans. Bangladesh's Non-Performing Loans Ratio stood at 10.3 % in Dec 2018, compared with the ratio of 11.5 % in the previous quarter. Bangladesh's Non-Performing Loans Ratio data is updated quarterly, available from March 2003 to Dec 2018. Data reached an all-time high of 28.0 % in March 2003 and an evidence low of 6.1 % in December 2011.

Figure-1. Non-performing Loans in Bangladesh: By Ratio (2003-2018).

3.2. Non-Performing Loan Ratio: Gross Foreign Commercial Banks

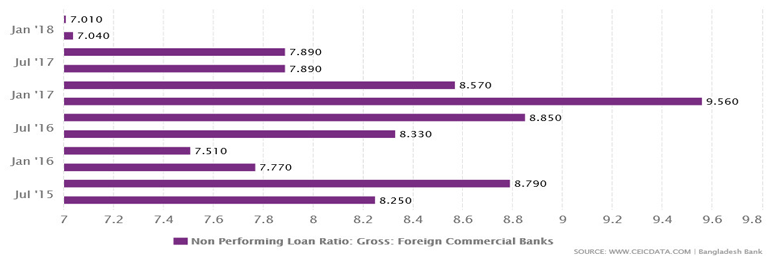

Bangladesh’s Non-Performing Loan Ratio: Gross: Foreign Commercial Banks data was reported at 7.010 % in Mar 2018. This records a decrease from the previous number of 7.040 % for Dec 2017. Bangladesh’s Non-Performing Loan Ratio: Gross: Foreign Commercial Banks data is updated quarterly by Bangladesh Bank, averaging 2.680 % from Mar 2003 to Mar 2018, with 61 observations. The data reached an all-time high of 9.560 % in Dec 2016 and a record low of 0.670 % in Jun 2006.

Figure-2. Bangladesh’s Non-Performing Loan Ratio: Gross: Foreign Commercial Banks.

3.3. Non-Performing Loan Ratio: Gross Nationalized Commercial Banks

Bangladesh’s Non-Performing Loan Ratio: Gross: Nationalized Commercial Banks data was reported at 28.240 % in Jun 2018. This records a decrease from the previous number of 29.840 % for Mar 2018. Bangladesh’s Non-Performing Loan Ratio: Gross: Nationalized Commercial Banks data is updated quarterly by Bangladesh Bank, averaging 25.045 % from Mar 2003 to Jun 2018, with 62 observations. The data reached an all-time high of 37.820 % in Jun 2003 and a record low of 11.270 % in Dec 2011.

Figure-3. Bangladesh’s Non-Performing Loan Ratio: Gross: Nationalized Commercial Banks.

3.4. Non-Performing Loan Ratio: Gross Private Commercial Banks

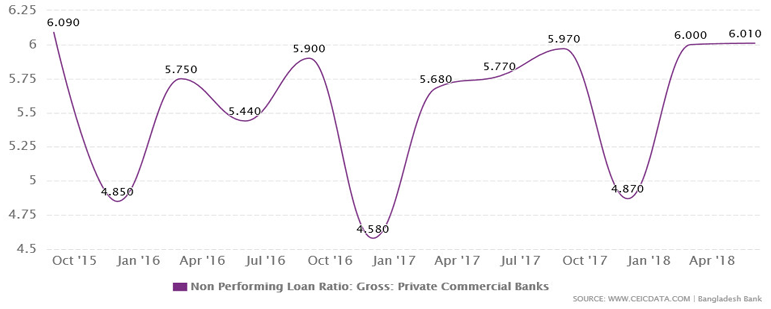

Bangladesh’s Non-Performing Loan Ratio: Gross: Private Commercial Banks data was reported at 6.010 % in Jun 2018. This records an increase from the previous number of 6.000 % for Mar 2018. Bangladesh’s Non-Performing Loan Ratio: Gross: Private Commercial Banks data is updated quarterly by Bangladesh Bank, averaging 5.675 % from Mar 2003 to Jun 2018, with 62 observations. The data reached an all-time high of 17.440 % in Mar 2003 and a record low of 2.950 % in Dec 2011.

Figure-4. Bangladesh’s Non-Performing Loan Ratio: Gross: Private Commercial Banks.

3.5. Non-Performing Loan Ratio: Gross Specialized Banks

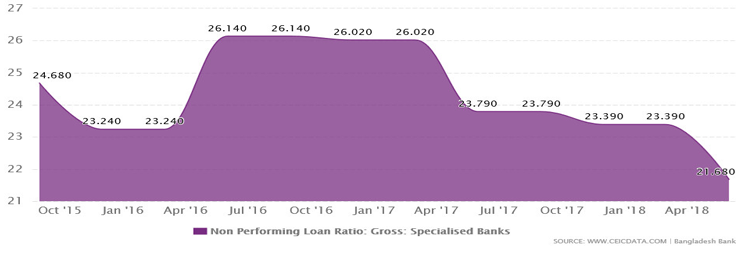

Bangladesh’s Non-Performing Loan Ratio: Gross: Specialized Banks data was reported at 21.680 % in Jun 2018. This records a decrease from the previous number of 23.390 % for Mar 2018. Bangladesh’s non-performing loan ratio: gross: specialized banks data is updated quarterly by Bangladesh Bank, averaging 26.270 % from Mar 2003 to Jun 2018, with 62 observations. The data reached an all-time high of 55.620 % in Mar 2003 and a record low of 21.64 % in Sept. 2011.

Figure-5. Bangladesh’s Non-Performing Loan Ratio: Gross: Specialized Banks.

Year |

In Crore taka |

2011 |

22,644 |

2012 |

42,725 |

2013 |

40,583 |

2014 |

50,155 |

2015 |

51,371 |

2016 |

62,172 |

2017 |

74,303 |

2018 |

93,911 |

2019 (March) |

1,10,873 |

Non-payment loans at Bangladeshi banks go up by a huge 26.38 per cent or Tk 19,608 crore in last year; it is the maximum rise in seven years, exposing the precarious condition of the banking sector. The total of non-performing loan stood at Tk 93,911 crore at the finish of 2018, up from Tk 74,303 crore a year ago, according to data from the central bank. The NPLs now accounted for 10.30 per cent of the banking sector's total loans, up from 9.31 per cent in 2017.

Classified loans at the state-run lenders stood at 57 per cent of the NPLs in the banking sector. The eight state-owned banks' non-payment loans totalled Tk 53,484 crore last year, up 25.10 per cent year-on-year. “But non-payment loans go up again in the January to March quarter. In the October-December quarter, the NPLs were down 5.49 per cent compared to the preceding quarter when it was Tk 99,371 crore. The non-payment loans at private commercial banks rose 30 per cent year-on-year to Tk 38,140 crore last years. Foreign banks too saw a boost of 6.19 per cent to Tk 2,288 crore.

3.6. Non-Performing Loans at State-Owned Commercial Banks

Non-Performing Loans at State-owned Commercial Banks such as Sonali Bank Limited, Janata Bank Limited, Agrani Bank Limited, Rupali Bank Limited, BASIC Bank Limited and BDBL (Bangladesh Development Bank Limited) are given below.

| Banks | NPLs by end of December 2017 |

NPLs by end of December 2018 |

Increase of NPLs |

| Agrani bank Limited | 5,115.78 |

5,750 |

634.22 |

| BDBL | 771.15 |

886.66 |

115.51 |

| Basic bank Limited | 7,598.97 |

8,631.85 |

1.033.85 |

| Janata Bank Limited | 5,818.60 |

17,224.90 |

11,406.30 |

| Rupali Bank Limited | 4,250.79 |

4,140.89 |

109.90 |

| Sonali Bank Limited | 13,770.80 |

12,061.03 |

-1,709.77 |

| Total | 37,326.09 |

48,695.78 |

11,369.69 |

Six state-owned commercial banks accounted for 52% of the banking sector's total non-payment loans of Tk. 93, 911.40 crore, at the finish of December 2018, according to the latest Bangladesh Central Bank data. The total amount of these six state-owned banks' non-performing loans stood at Tk. 48, 695.87 crore, which was Tk. 37,326.09 crore in December 2017.

Non-payment loans of six state-owned banks amounted to 29.96% to their total outstanding loans, with Janata Bank having the highest amount of default loans worth Tk.17,224.9 crore (35.72% of Total outstanding loans), followed by Sonali Bank at Tk. 12,061.03 crores (30.06% of its total outstanding loans).

Agrani Bank’s non-payment loans stood at Tk. 5,750.54 crore (16.65% of its total outstanding loans), Bangladesh Development Bank’s default loans stood at Tk. 886.66 crore (56.54% of its outstanding loans), Basic Bank’s at Tk. 8,631.85 crore (57.55% of total outstanding loans), and Rupali Bank’s at Tk4,140.89 crore (17.95% of total outstanding loans). In the last one year, Janata Bank's non-payment loans rose by Tk.11,406 crore to Tk. 17,224.90 crore. Sonali Bank's non-payment loans decreased in the last one year by Tk. 1, 709.77crore to Tk. 12,061.03 crore, the bank still holds the second-largest share of Non-Performing Loans in the sector.

4. Findings of the Study

Following findings are drawn on the basis of data analysis and the discussion with the selected bankers:

- The most frequent cause of NPL is due to choosing the wrong customer at the time of loan sanction. Behind many reasons banks fail to recognize the correct client and take incorrect decision in customer selection.

- The small customers become defaulter without having any bad intention of loan default. They do not have adequate financial literacy for taking and servicing of loan and interest payable thereon.

- Banks enhance facilities of overload loan to existing customers or exceed the limit approved to the new customers to increase business volume. The customer invests their excess amount outside the designated business.

- Aggressive, unscrupulous and target-oriented banking indirectly increases NPL. The bankers do not scrutinize and fine-tune the loan file due to the pressure of achieving target. Political pressure influences to authorize loans that are not entitled.

- The NPL has an adverse effect on the bank on its day to day operation and profitability. Banks have to keep excess provision against the defaulted loan which directly affects the net profit.

- A bank becomes weak and highly non-profitable due to excessive NPL portfolio. Huge NPL portfolio erodes the ability of banks to make a profit. NPL also affects economic growth. A rise in NPL is a feature of the financial crisis of a country.

- The NPL amount of a bank is blocked till recovery of the loan. Earning of interest income from NPL is also ceased which results in a reduction in income generation.

- Smooth, efficient and safe investments are prerequisites for the development of economic factors of a country. Presently our banking sector is heavily burdened with a high percentage of NPL.

- Default loans increase the cost of credit as the banks have to keep provisioning against it, which cast shadows on new investments and new entrepreneurs, pushing the cost of doing business.

- The default loans have a definite adverse impact on the business environment of a country since there is no better alternative to secure local fund.

5. Recommendations of the Study

On the basis of the findings and the discussion with the selected bankers researchers recommends the following in order to mitigate causes of non-performing loans:

1. Bank should have adequate and reliable information about clients, good credit policy, conduct appropriate credit appraisal, and train their customers on business, management, financial, entrepreneurships and book keeping skills.

2. In order to reduce non-performing loans customers should be trained on different business skills like the general business management skills, financial services skills, and accounting and book keeping skills.

3. To takes some action plan for potential NPLs. Banks should take some steps to collect the Non-Performing Loans.

4. Classification of extremely risk responsive borrowers in the credit portfolio. Banks should take reliable information about the clients and about business before giving the loans.

5. In order to reduce the defaulted loan in Bangladesh, good governance in the banking sector is very much needed for instance banking must stop the family business and there should be strict monitoring cell to observe loan recovery system.

6. There should be proper rules for an appointment and removal of the directors of banks. In this case the government and the Bangladesh Bank must have the authority to observe this issue.

7. There should be proper policies and surveillance in the evaluation of the performance of the Fourth Generation Banking.

6. Conclusion

In a nutshell, researchers can conclude that the escalation of NPLs in the banking sector of Bangladesh is dramatically upward rising. The trends of NPLs are found to be unstable during the study period. It is also revealed in the study that the non-performing loans have an adverse impact on the profitability for all types of banks in Bangladesh and its create additional serious trouble in public sector bank somewhat than the private sector banks.

Thus, overall fact is that the profitability of the bank gets upward trends if there is downward movement of the non-performing loans in the bank and vice versa. Therefore, the management of the banking sector more specifically public banks, should take some preventive and recovery strategy to minimize and control non-performing assets to sustain and there is a need to modify the client assessment procedure. So it is suggested that the management of the banking sector should be focused on the nature of the client rather than the signature to maximize profitability.References

Adhikari, B. K. (2007). Non-performing loans in the banking sector of Bangladesh: Realities and challenges. BIBM, 75-95.

Akter, R., & Roy, J. K. (2017). The impacts of non-performing loan on profitability: An empirical study on banking sector of Dhaka stock exchange. International Journal of Economics and Finance, 9(3), 126-132.Available at: https://doi.org/10.5539/ijef.v9n3p126 .

Alam, S., Haq, M. M., & Kader, A. (2015). Non-performing loan and banking sustainability: Bangladesh perspective. International Journal of Advanced Research, 3(8), 1197 – 1210.

Bangladesh Bank. (2019). Annual Report (2018-2019), Bangladesh-Bank.org. Dhaka, Bangladesh. Retrieved from: https://www.bb.org.bd/pub/publictn.php .

Bashir, U., Yu, Y., Hussain, M., Wang, X., & Ali, A. (2017). Do banking system transparency and competition affect nonperforming loans in the Chinese banking sector? Applied Economics Letters, 24(21), 1519-1525.Available at: https://doi.org/10.1080/13504851.2017.1305082 .

Chowdhury, M. (2018). Causes of non-performing loan and effects on banking sector, The Daily Sun, Dhaka, Bangladesh. Retrieved from: https://www.daily-sun.com/post/311639/2018/05/27/ .

Hossain, M. T. (2018). The trend of default loans in Bangladesh: Way forward and challenges. International Journal of Research in Business Studies and Management, 5(6), 24-30.

Lata, R. S. (2015). Non-performing loan and profitability: The case of state owned commercial banks in Bangladesh. World Review of Business Research, 5(3), 171-182.

Laveena, & Kumar, H. (2016). Management of non-performing assets on profitability of public and private sectors banks. International Journal of Research in Management & Technology, 6(2), 86-93.

Mallick, S. (2018). Default loan rises by Tk. 12,000 Crore, Dhaka Tribune, Dhaka, Bangladesh. Retrieved from https://www.dhakatribune.com .

Mujeri, K. M. (2018). Rising non-performing loans is special-purpose AMC an option? The Daily Star, Dhaka, Bangladesh. Retrieved from https://www.thedailystar.net .

Ovi, I. H. (2018). DCCI: NPLs threaten banking sector stability, Dhaka Tribune, Dhaka, Bangladesh. Retrieved from https://www.dhakatribune.com .

Ozili, P. K. (2015). How bank managers anticipate non-performing loans evidence from Europe, US, Asia and Africa. Applied Finance and Accounting, 1(2), 73-80.Available at: https://doi.org/10.11114/afa.v1i2.880.