Influence of Corporate Social Responsibility on Firm Performance among Companies Listed on the Nairobi Securities Exchange

Sisimonda Kinya Mwanja1*

Zablon Evusa2

Antony Wahome Ndirangu3

1,2,3South Eastern Kenya University, Kenya. |

AbstractNumerous studies and literature with varied results have been conducted in the subject of CSR. Several questions about CSR still remain, for example there is no evident answer if CSR activities affect the financial performance, why companies engage in CSR and how they apply to it. There are several different definition of CSR and companies choose to apply it in different ways therefore it is a rather complex subject. A peculiar paradox of Kenyan economic history is that the large firms listed at the NSE have been the symbol of economic progress and yet a clear relation between the progress and involvement in community outreach programs has never been clear. This study therefore sought to investigate the relationship between CSR and performance of firms listed in the Nairobi Securities Exchange. The study specifically sought to examine the relationship between ethical CSR, environmental CSR and philanthropic CSR on the performance of firms listed in the NSE. The study focused on the CSR activities done and documented by the firms listed in the NSE. Moreover, the study focused on the CSR activities for the five year period 2010-2014 because the trading at the NSE before then was affected by the post-election violence that occurred in 2007 in Kenya. The study was anchored on the open systems theory. The nature of this study was document analysis. The population for the purpose of this study was the NSE listed firms in Nairobi County. The total population of firms listed in the NSE stands at 61. The study was a census because of the small population size. The study adopted a data collection form to gather data which was analysed using both content analysis and SPSS. Frequency tables, percentages and means were used to present the findings. Out of the sixty one (61) firms targeted with the data collection forms, only fifty four (54) data forms were fully filled with relevant information that could be entered and analysed. The result reveals that ethical CSR, environmental CSR and philanthropic CSR can be held responsible for the fluctuations in EBIT of firms listed at the NSE, Kenya. From the findings, it can be concluded that ethical CSR, philanthropic CSR and environmental CSR indeed affect the performance (EBIT) of firms listed at the NSE. Environmental CSR had the major influence on performance of firms listed at the NSE while philanthropic CSR had the least influence on performance of firms listed at the NSE. Moreover, the study findings show that ethical CSR has a positive relationship with performance; environmental CSR has a positive effect on performance and philanthropic CSR has a positive influence on performance of firms listed at the NSE. The study recommends that the firms listed at the NSE should come up with strategies to strengthen and align their CSR activities to fast track and build the CSR programs so as to improve performance. |

Licensed: |

|

Keywords: | |

| (* Corresponding Author) |

Funding: This study received no specific financial support. |

Competing Interests: The authors declare that they have no competing interests. |

1. Introduction

1.1. Background of the Study

Corporate Social Responsibility is an increasingly important part of the business environment. The past twenty years have seen a radical change in the relationship between business and society (Omboto, 2014) . Key drivers of this change have been the globalization of trade, the increased size and influence of companies, the repositioning of government and the rise in strategic importance of stakeholder relationships, knowledge and brand reputation (Turker, 2008) . The relationship between companies and civil society organizations has moved on from paternalistic philanthropy to a re-examination of the roles, rights and responsibilities of business in society (Omboto, 2014) . Corporate Social Responsibility (CSR)is a management concept whereby companies integrate ethical and environmental concerns in their business operations and interactions with their stakeholders (Omboto, 2014) .

Corporate Social Responsibility (CSR), defined in terms of the responsiveness of businesses to stakeholders’ legal, ethical, social and environmental expectations, is one outcome of these developments (Omboto, 2014) . Corporate social responsibility (CSR) is an essential topic that is receiving increasing attention from organizations. One of the reasons is that, according to corporate governance principles issued by OECD (Udayasankar, 2008) CSR is highly associated with good corporate governance. In addition, if properly used, CSR projects have a positive influence on consumer’s behaviour (Mohr, 2001) . Besides performance and earnings performance, stakeholders have recently developed interests in CSR projects that organizations engage in. In other words, organizations are also measured by their concerns about the society in which they operate (Quintin, 2004) .

Organizations have a large, positive or negative, direct or indirect influence on every party in society (Kitchen, 2010) . In general, in the literature, any action taken for society as a whole or for a particular party within society is considered as CSR (Comfort, Hiller, & Jones, 2007) . The need for CSR projects has increased in accordance with the changing understanding of organizations on each party affected by an organization's actions. Organizations are socially responsible to each party related with the organization (Turker, 2008) . However, this responsibility does not necessarily mean that organizations’ main goal is to satisfy all parties they contract with. The benefits expected by each party from an organization vary (O’Riordan & Fairbrass, 2008) . For an organization, the aim is to create economic and social value to their organization, for a shareholder, it might be to increase wealth, or for the government to decrease unemployment and increase Gross Domestic Product by high volume production of organization (Ocran, 2011) . Thus, the role of organizations in balancing the interacting benefits or expectations of each party is crucial for both society and the business environment.

Firm performance relates to business practices that do not diminish the prospects of future persons to enjoy levels of consumption, wealth, utility, or welfare comparable to those enjoyed in the present (Jerkee, 2008) . This means companies' operational practices reduce environmental damage and resource depletion. Efforts to influence business practices toward economic sustainability include pricing mechanisms, such as carbon taxes, that pass on the cost of environmental impact to the users of those resources (Jerkee, 2008) . Tracking sustainability measures can be performed using sustainability accounting, in which a corporation discloses its performance with respect to activities that have a direct impact on the societal, environmental, and economic performance of an organization (Owiti, 2013) .

According to common definitions, sustainability has three key dimensions: environmental, social, and economic. Companies are for example starting to take more concern to the environmental, ethical and philanthropic issues (Jenkins, 2014) . However, other companies have resisted spending in CSR as they believe that it contradicts their aim to maximize firm performance or profits (Jenkins, 2014; McWilliams & Siegel, 2000) . Idowu and Papasolomou (2007) states that there are five key drivers influencing the increasing focus on CSR which are, greater stakeholder awareness of corporate ethical, philanthropic and environmental behaviour, direct stakeholder pressures, investor pressures, peer pressures as well as an increased sense of social responsibility.

1.2. Specific Objectives

The study was guided by the following objectives:

- To examine the relationship between ethical CSR and performance of firms listed in Nairobi Securities Exchange.

- To find out the effect of environmental CSR on performance of firms listed in Nairobi Securities Exchange.

- To investigate the influence philanthropic CSR has on performance of firms listed in Nairobi Securities Exchange.

2. Theoretical Review

The signalling theory asserts that the most profitable companies signal their competitive strength by communicating more and better information to the market than their competitors who are less profitable (Bini, Dainella, & Giunta, 2011). This theory was founded at the beginning of the 1970 and was originally founded for the labour market. But according to Clark and Master (2012) signalling is a general phenomenon and therefore applicable in any market with information asymmetry. It is used for describing behaviour when two parties (individuals or organizations) have access to different information (Connelly, 2011).

The legitimacy theory by Deegan (2002) states that organizations continually seek to ensure that they are operating within the bounds and norms of their respective societies. In other words, they attempt to ensure that their activities are perceived by outside parties as being legitimate’ (Deegan & Unerman, 2011). According to Deegan (2002) entities assumed to be influenced by, and in turn to have influence upon, the society in which it operates. Society, politics and economics are inseparable and economic issues cannot meaningfully be investigated in the absence of considerations about the political, social and institutional framework in which the economic activity takes place (Deegan, 2002). However, during the years the bounds and norms of this framework can change and thereby organizations need to be responsive to the ethical environment in which they operate. It is a relative concept within a socially system of norms, values, beliefs and definition within a specific time and place (Deegan & Unerman, 2011).

In the last decades, legitimacy theory has been subject to numerous empirical studies. One of the more recent studies is that by Haji and Ghazali (2012). They examined whether the 2007/08financial crisis had impact on corporate voluntary disclosure of 85 Malaysian companies listed on Bursa Malaysia. The study showed, in line with legitimacy theory, that the sample companies significantly increased their corporate voluntary disclosure in the annual reports following the global financial crisis. Moreover, the companies increased their involvement in corporate sustainability programs to reduce the possibility of a legitimacy gap. However, according to structural functions systems theory by Gonzalez-Herrero and Pratt (1995) (as cited in Iqbal, Ahmad, Basheer, and Nadeem (2013) communication plays a pivotal role in management of CSR programs.

Correct flow of information across all hierarchies is essential. Management must effectively communicate with employees and provide them the necessary information for any CSR program to be carried out. Leaders must take charge and ask the employees to give their best. Providing information to an organization in a time of CSR planning is also critical to effectively manage CSR programs. Structural-functional systems theory addresses the intricacies of information networks and levels of command making up successful organizational CSR. The structural-functional theory identifies information flow in organizations as "networks" made up of members and "links". Information in organizations flow in patterns called networks (Iqbal et al., 2013). Structural approach is based on modelling the underlying dynamics and firm characteristics that can lead to a default CSR event. However, a clear disadvantage of this approach is its limited applicability to public firms because it requires specific information (Iqbal et al., 2013).

The theory of multi-dimensional performance by Branco and Rodrigues (2007) distinguishes between task and contextual performance. Task performance refers to an individual’s proficiency with which he or she performs activities which contribute to the organization’s ‘technical core’.

2.1. Empirical Literature

Sarbutts (2013) established that there are various arguments about the relationship between a company’s CSR engagement and their financial performance. Sarbutts (2013) argues that if CSR affect a company’s reputation it is also very likely that this will affect the company’s financial performance. A company's first responsibility is its economic responsibility -- that is to say, a company needs to be primarily concerned with turning a profit (Jerkee, 2008). This is for the simple fact that if a company does not make money, it won't last, employees will lose jobs and the company won't even be able to think about taking care of its social responsibilities (Owiti, 2013). The three pillars; also known as the "triple bottom line" have served as a common ground for numerous sustainability standards and certification systems in recent years, though a universally accepted definition of sustainability remains elusive (Jerkee, 2008).

Simpson and Kohers (2002) have on the basis of previous research been able to sort the relationship between CSR usage and financial performance into three main viewpoints. In the first viewpoint, it is argued that CSR investments put these companies into an economic disadvantage compared to less responsible companies. The second viewpoint is that explicit CSR investment costs are minimal and that companies investing in CSR actually gain benefits from this in terms of employee morale and productivity (Simpson & Kohers, 2002). In the third viewpoint, costs from CSR investments are significant; they are however offset by the reduction in other company costs. It is also suggested that companies should satisfy all stakeholders not just the shareholders of a company. Branco and Rodrigues (2007) states that those who distinguished a negative correlation, between CSR and financial performance, argue that this is due to the high investment costs of CSR. However, Carroll (1999) also points out that the added costs that CSR investments bring might place a company in an economic disadvantage compared to companies that have not made these CSR investments. Sarbutts (2013) also points out that, CSR activities that address human issues such as employment or equal opportunities are more likely to increase financial performance compared to more abstract concerns, such as philanthropic activities. Previous research regarding the correlation between CSR and financial performance has as seen above, resulted in mixed views.3. Target Population

A population refers to an entire group of individuals, events or objects that have a common observable characteristic (Orodho, 2003). A population describes the parameters whose characteristics the research will attempt to describe. The population for the purpose of this study was the NSE listed firms in Nairobi County. The total population of firms listed in the NSE stands at 61(Nairobi Securities Exchange, 2014).

3.1 Sampling Frame

The population of firms listed at the NSE is 61; due to the small population size of the listed firms, sampling was not done but a complete census was carried out.

3.2. Data Processing and Analysis

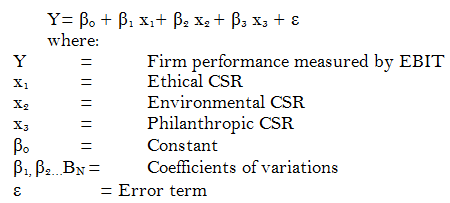

Secondary data was analysed using content analysis. The data obtained using data collection form was checked for any errors and omissions. Some of the data obtained using data collection form was tabulated, coded and processed by use of a computer Statistical Package for Social Science (SPSS) program. Frequency tables, percentages and means were used to present the findings. The relationship between the independent variables and the dependent variable was tested using multiple linear regression model of the form:

4. Empirical Findings

This section presents the findings and discussions in line with the study objectives which were to investigate the relationship between ethical CSR and performance of firms listed at the Nairobi Securities Exchange; the effect of environmental CSR on performance of firms listed in Nairobi Securities Exchange; and influence of philanthropic CSR on performance of firms listed in Nairobi Securities Exchange.

4.1. Ethical CSR and Firm Performance

Table 4.1 displays the feedback from the content analysis of data collection forms regarding how ethical CSR affects performance of firms listed at the NSE.

| Year | 2010 |

2011 |

2012 |

2013 |

2014 |

| EBIT(Ksh-BILLIONS) | 41.19 |

58.32 |

78.44 |

89.45 |

101.51 |

| EXPENDITURE-Ethical CSR | 1.82 |

2.22 |

3.15 |

5.17 |

7.21 |

| ETHICAL CSR POLICY | 41/54 |

50/54 |

51/54 |

53/54 |

54/54 |

The results indicate a consistent increase in the expenditure in ethical CSR activities as the years go by from 2010 to 2014. Moreover, the findings indicate a steady increase in performance (EBIT) with the year 2014 recording the highest performance. The findings further indicate that in 2010 only forty one out of the fifty four firms had ethical CSR policies; but the number of firms having the policy kept on increasing each year such that in 2014 all the firms had the ethical CSR policy in place.

To critically assess the relationship between ethical CSR and Performance of firms listed at the NSE, expenditure on ethical CSR was regressed against EBIT (performance). The findings are presented in table

4.2. The Following Table Displays the Regression Model Summary.

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

1 |

0.615(a) |

0.378 |

0.279 |

11.858 |

From the findings, the value of R was 0.615 and R square was 0.279 (27.9%).The adjusted R square, also called the coefficient of multiple determinations, is the per cent of the variance in the dependent variable (performance)explained uniquely by the independent variable (ethical CSR). This basically means that 27.9% of the changes in the EBIT (performance) could be attributed to the effect of ethical CSR.

The following table presents the ANOVA results.

Model |

Sum of Squares |

Df |

Mean Square |

F |

Sig. |

|

1 |

Regression | 42.759 |

11 |

10.69 |

32.501 |

0.001 |

| Residual | 13.164 |

156 |

0.169 |

|||

| Total | 55.923 |

167 |

The probability value of 0.001 indicates that the regression model was highly significant in predicting how ethical CSR influenced firm performance. The F calculated at 5% level of significance was 32.501 since F calculated is greater than the F critical (value = 2.5252), this shows that the overall model was significant. The following table displays the results from the regression analysis.

Model |

Unstandardized Coefficients |

Standardized Coefficients |

||||

B |

Std. Error |

Beta |

t |

Sig. |

||

1 |

(Constant) | 4.714 |

0.371 |

9.28 |

.068 |

|

| Ethical CSR | 0.581 |

0.193 |

0.154 |

3.01 |

.046 |

|

The beta coefficients give the rate of standard deviations change on the dependent variable (firm performance) that was produced by a change on the independent variables (ethical CSR). Here, ethical CSR causes a 0.154 deviation on firm performance. The researcher thus concluded that ethical CSR indeed affects performance of firms listed at NSE. Therefore, the findings reveal that existence of ethical CSR relate to EBIT of firms listed at the NSE. The study sought to answer the research question: what is the relationship between ethical CSR and performance of firms listed at the NSE? Since the deviation caused by ethical CSR is not negative, it can therefore be concluded that ethical CSR indeed has a positive relation to performance of firms listed at the NSE.

The study findings are similar to those of Wiegel (2013) who found a relationship between ethical CSR and performance of companies while studying the relationship between CSR reporting and financial performance of companies in America. Wiegel (2013) concluded that ethical CSR was the most influential type of CSR affecting company performance. However, another study by Jiao and Xie (2013) contradicts the above findings. Jiao and Xie (2013) focused on firm performance in relation to CSR programs and the CSR-profitability relationship in a case study of Sandvik Engineering Company in the United Kingdom (UK) and found no relationship between ethical CSR and financial performance of Sandvik Engineering Company. Nevertheless, the study took financial performance to a broader range of financial perspectives such as working capital, leverage, earnings, operating and free cash flow, asset backing, capital expenditure and turnover.4.3. Environmental CSR and Firm Performance

| Year | 2010 |

2011 |

2012 |

2013 |

2014 |

| EBIT(Ksh-BILLIONS) | 41.19 |

58.32 |

78.44 |

89.45 |

101.51 |

| EXPENDITURE-Environmental CSR | 1.54 |

1.77 |

2.79 |

4.32 |

8.11 |

| Environmental CSR Policy | 50/54 |

50/54 |

53/54 |

54/54 |

54/54 |

The results indicate a consistent increase in the expenditure in environmental CSR activities as the years go by from 2010 to 2014. Moreover, the findings indicate a steady increase in performance with the year 2014 recording the highest performance. The findings further indicate that in 2010 only fifty out of the fifty four firms had ethical CSR policies; but the number of firms having the policy kept on increasing each year such that in 2014 all the firms had the environmental CSR policy in place.

To critically assess the effect of environmental CSR on performance of firms listed at the NSE, expenditure on environmental CSR was regressed against EBIT (performance). The findings are presented in the Table 4.3.1.

The following table displays the regression model summary.Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

1 |

0.772(a) |

0.597 |

0.572 |

0.1858 |

From the findings, the value of R was 0.772 and R square was 0.572 (57.2%).The adjusted R square, also called the coefficient of multiple determinations, is the per cent of the variance in the dependent variable explained uniquely by the independent variables. This basically means that 57.2% of the changes in firm performance could be attributed to the effect of environmental CSR.

Model |

Sum of Squares |

Df |

Mean Square |

F |

Sig. |

|

1 |

Regression | 45.944 |

11 |

11.47 |

26.304 |

0.003 |

| Residual | 11.872 |

156 |

0.235 |

|||

| Total | 57.816 |

167 |

The probability value of 0.003 indicates that the regression model was highly significant in predicting how environmental CSR influenced performance of firms listed at the NSE. The F calculated at 5% level of significance was 26.304 since F calculated is greater than the F critical (value = 2.5252), this shows that the overall model was significant.

The following table displays the results from the regression analysis.

Model |

Unstandardized Coefficients |

Standardized Coefficients |

||||

B |

Std. Error |

Beta |

t |

Sig. |

||

1 |

(Constant) | 4.469 |

0.534 |

9.28 |

.043 |

|

| Environmental CSR | 0.628 |

0.231 |

0.241 |

2.719 |

.037 |

|

The beta coefficients give the rate of standard deviations change on the dependent variable (firm performance) that was produced by a change on the independent variable (environmental CSR). Here, environmental CSR causes a 0.241 deviation on firm performance. The researcher thus concluded that environmental CSR indeed affects performance of firms listed at the NSE. Therefore, the findings reveal that environmental CSR affects EBIT of firms listed at the NSE. The study sought to answer the research question: what is the effect of environmental CSR on performance of firms listed at the NSE? Since environmental CSR does not cause a negative deviation on firm performance, it can be concluded that environmental CSR positively affects performance of firms listed at the NSE.

4.4. Philanthropic CSR and Firm Performance

| Year | 2010 |

2011 |

2012 |

2013 |

2014 |

| EBIT(Billions) | 41.19 |

58.32 |

78.44 |

89.45 |

101.51 |

| EXPENDITURE- Philanthropic CSR | 5.47 |

7.65 |

8.81 |

11.15 |

21.03 |

| Philanthropic CSR Policy | 41/54 |

45/54 |

47/54 |

50/54 |

51/54 |

The results indicate a consistent increase in the expenditure in philanthropic CSR activities as the years go by from 2010 to 2014. Moreover, the findings indicate a steady increase in performance with the year 2014 recording the highest performance. The findings further indicate that in 2010 only forty one out of the fifty four firms had ethical CSR policies; but the number of firms having the policy kept on increasing each year such that in 2014, fifty one out of fifty four firms had the philanthropic CSR policy in place.

4.5. Influence of CSR on Performance of Firms listed at the NSE.

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

1 |

.587(a) |

.346 |

.379 |

1.858 |

The value of R was 0.587 and R square was 0.379 (37.9%) as shown in Table 4.5. The adjusted R square, also called the coefficient of multiple determinations, and is the per cent of the variance in the dependent variable explained uniquely by the independent variables. This basically means that 37.9% of the changes in the EBIT (performance) could be attributed to the effect of the independent variables.

5. Summary of Findings

The study sought to answer the research question: what is the relationship between ethical CSR and performance of firms listed at the NSE? Since expenditure in ethical CSR and existence of ethical CSR policy are elements of ethical CSR, it can be concluded that ethical CSR indeed has a relation to performance of firms listed at the NSE. The study sought to answer the research question: what is the effect of environmental CSR on performance of firms listed at the NSE? The study also sought to answer the research question: what is the influence of philanthropic CSR on performance of firms listed at the NSE? From the findings, all the deviations on the dependent variable (firm performance) caused by the independent variables (ethical CSR, environmental CSR and philanthropic CSR) were not negative. Therefore, it can be concluded that environmental CSR has a positive effect on performance of firms listed at the NSE; philanthropic CSR has a positive influence on performance of firms listed at the NSE; and ethical CSR has a positive relationship with performance of firms listed at the NSE.

From the findings, environmental CSR took a lead with 0.587 deviations on firm performance, ethical CSR had 0.293 deviations on firm performance while philanthropic CSR had 0.251 deviations on firm performance. Therefore, environmental CSR had the major influence on performance of firms listed at the NSE while philanthropic CSR had the least influence on performance of firms listed at the NSE. This was proof that a relationship exists between CSR (ethical, environmental and philanthropic) and performance of firms listed at the NSE.

References

Bini, L., Dainella, F., & Giunta, F. (2011). Signalling theory and voluntary disclosure to the financial market: evidence from the profitability indicators published in the annual Report. School of Economics, University of Florence, Britain.

Branco, M. C., & Rodrigues, L. L. (2007). Positioning stakeholder theory within the debate on corporate social responsibility. Electronic Journal of Business Ethics and Organization Studies, 12(1), 1-11.

Carroll, A. B. (1999). Corporate social responsibility: Evolution of a definitional construct. Business and Society Review, 38(3), 268–296.

Clark, L., & Master, D. (2012). Corporate ESG / sustainability / responsibility reporting – does it matter? An analysis of S&P 500 companies. UK. Governance & Accountability Institute.

Comfort, D., Hiller, D., & Jones, P. (2007). What's in store? Retail marketing and corporate social responsibility. Marketing Intelligence & Planning Journal, 25(1), 17-30.

Connelly, P. (2011). An examination of corporate sustainability disclosure level and its impact on financial performance. The Middlesex University, Multimedia.

Deegan, C. (2002). Introduction: The legitimizing effect of social and environmental disclosures – a theoretical foundation. Accounting. Auditing & Accountability Journal, 15(3), 282-311.

Deegan, C., & Unerman, J. (2011). Financial accounting theory. European Edn. Berkshire: McGraw-Hill Higher Education.

Haji, A. A., & Ghazali, N. A. M. (2012). The influence of the financial crisis on corporate voluntary disclosure: Some Malaysian evidence. International Islamic University Malaysia (pp. 101-125). Kuala Lumpur.

Idowu, S. O., & Papasolomou, I. I. (2007). Are the corporate social responsibility matters based on good intentions or false pretences? An Empirical Study of the Motivations behind the Issuing of CSR Reports by UK Companies, 7(2), 136-147.

Iqbal, N., Ahmad, N., Basheer, N. A., & Nadeem, M. (2013). Impact of corporate social responsibility on financial performance of corporations: evidence from Pakistan. International Journal of Learning & Development, 2(6), 107-118.

Jenkins, R. (2014). Globalization, corporate social responsibility and poverty. Baltic Journal of Management, 6(1), 12-32.

Jerkee, J. T. (2008). Building trust in project-stakeholder relationships. Baltic Journal of Management, 3(1), 7-22.

Jiao, Y., & Xie, W. (2013). CSR and its influence on firm profitability: A case of Sandvik company Unpublished MBA Thesis. Hogskolan University.

Kitchen, H. T. (2010). Corporate social management: A systems approach to planning, scheduling and controlling. New York, USA: John Wiley & Sons Inc.

McWilliams, J., & Siegel, T. (2000). Corporate social responsibility and firm financial performance. Academy of Management Journal, 31(4), 854-872.

Mohr, L. (2001). What do we mean by corporate social responsibility? Corporate Governance Journal, 1(2), 16-22.

Nairobi Securities Exchange. (2014). Report on firms listed in 2013. Nairobi: Author.

O’Riordan, L., & Fairbrass, J. (2008). Corporate social responsibility (CSR): Models and theories in stakeholder dialogue. Journal of Business Ethics, 83(4), 745-758.

Ocran, E. (2011). The effect of corporate social responsibility (CSR) on performance of multinational companies. Kwame Nkrumah University, A case study of Nestle Ghana Limited. MBA Thesis.

Omboto, P. (2014). Adoption of blue ocean strategy in csr by commercial bank of Africa Unpublished MBA Thesis. University of Nairobi, Kenya.

Orodho, A. J. (2003). Research methods. Nairobi, Kenya: Masola Publishers.

Owiti, W. B. (2013). Effects of corporate social responsibility on company image Unpublished MBA Project. University of Nairobi.

Quintin, O. (2004). Worshop report on activities of the european commission on corporate social responsibility. Tokyo, Japan.

Sarbutts, N. (2013). Can SMEs ‘do’ CSR? A practitioner’s view of the ways small- and medium sized enterprises are able to manage reputation through corporate social responsibility. Journal of Communication Management, 7(4), 340–347.

Simpson, W. G., & Kohers, T. (2002). The link between corporate social and financial performance: Evidence from the banking industry. Journal of Business Ethics, 35(2), 97–109.

Turker, D. (2008). Measuring corporate social responsibility: A scale development study. Journal of Business Ethics, 85(4), 411-427.

Udayasankar, K. (2008). Corporate social responsibility and firm size. Journal of Business Ethics, 83(2), 167-175.

Wiegel, K. (2013). The relationship between CSR reporting and financial performance in Rotterdam Unpublished MBA Thesis. Erasmus University, Rotterdam.