Microfinance Banks Dynamics Effect on Small-Scale Enterprise Development in Nigeria

Adesola, Wasiu Adebisi1

Ewa, Uket Eko2*

Arikpo, Oka Felix3

1,2Department of Accountancy, Faculty of Management Sciences, Cross River University of Technology, Nigeria. |

AbstractThis study examined the effect of Microfinance Banks on the development of Small and Medium Scale Enterprises in Nigeria. This study was specifically meant to assess the extent to which microfinance banks loans and advances, investments and deposit mobilization affect the productivity of SMEs in Nigeria. The study employed the ex-pose facto research design. Time series data were collected from the CBN statistical Bulletin and SMEDAN annual publications using the desk survey method. The data were analysed using the Vector Error Correction Mechanism. Result from the analyses revealed that Microfinance banks loans and advances and investments do not have any significant effect on SMEs’ productivity in Nigeria both in the long run and short run period. The study further reveals that microfinance banks’ deposit mobilization does not have any significant effect on SMEs’ productivity in Nigeria in the long run, however, within the short run period microfinance banks deposits mobilization has a significant effect on SMEs’ productivity. Based on these findings, it was recommended that MFBs should lighten the condition for lending and increase the duration of lending to their customers, spreading the repayment over a long period of time to assist SMEs meet their funding needs. Also, the Government and its institutions, including the Central Bank, should work in concert to promote the sector, as a means of mobilizing domestic savings, widening the financial system, promoting enterprises, creating employment and income and reducing poverty. |

Licensed: |

|

Keywords: JEL Classification |

|

Accepted: 3 June 2020 |

|

| (* Corresponding Author) |

Funding: This study received no specific financial support. |

Competing Interests: The authors declare that they have no competing interests. |

1. Introduction

Lack of access to credit has been identified as the reason behind the growing level of poverty in many developing countries. This further emphasizes the crucial role microfinance institutions play in economic growth and development, especially in their service for those not served or underserved markets to help meet development objectives which include to reduce poverty (considered as the most important), create employment, help existing businesses to grow and or diversify their activities, empower women and other disadvantaged groups, and even encourage the growth of new businesses (Khandker, 2003). Microfinance as a development strategy has been deemed successful by many studies (Ledgerwood, 1999; Ukeje, 2005) but, its impact on socio-economic welfare on its target population relies largely on intensive financial and outreach performance.

In 2009, the Consultative Group to Assist the Poor (CGAP), whose main objective is to accelerate financial inclusion for all, observed microfinance contributed to achieving the following development objectives of poverty eradication and hunger, universal primary education, promotion of gender equality and empowerment of women, reduction in child mortality, and improvement in maternal health.

Microfinance operation is not a new concept in Nigeria as it has been in existence through such phenomenon such as ‘Esusu or Itutu or Adashi’ – a rotating contribution savings scheme mostly seen among market traders. What is new however is the measure taken by policymakers to ensure financial inclusion for all, whether be rich or poor, living in urban or rural areas (God’stime & Uchechi, 2014). In 2005, the Central Bank of Nigeria (CBN) formulated a new policy framework to enhance the access of financial services to micro entrepreneurs and low-income households who require such facilities to expand and modernize their operations and then contribute to rapid economic growth in Nigeria.

The objective is in line with the institution’s policy on ensuring financial inclusionfor allsuch that, financial services reach the poor whether in rural or urban communities, as this would help improve their productivity levels and also help contribute to the nation’s gross domestic product (God’stime & Uchechi, 2014). The growth of microfinance institutions has been largely due to the inability of the formal financial institutions to provide financial services to both the urban and rural poor. In view of the need for financial inclusion, both the government and non-governmental agencies have over the year’s implemented series of microfinance programs and institutions as well as government agencies providing policy strategies needed to improve the sub-sector. This study is intended therefore to investigate the effect of microfinance on the performance of SMEs in Nigeria.

1.1 Statement of the Problem

It is often said that micro finance banks provide diversified, affordable and dependable financial services to the active poor; mobilize savings for intermediation; create employment opportunities and increase the productivity of the active poor in the country. Also enhance organized, systematic and focused participation of the poor in the socio-economic development and resource allocation process and provide veritable avenues for the administration of the micro credit programs of government and high net worth individuals on the non-recourse case basis.

Considering these vital financial and non-financial services provided to the active poor, one expects that microfinance institution would receive the due attention and support it deserves. Ironically, many literatures have shown that despite its importance, microfinance institution have not received the due attention and support it deserves, rather emphasis and importance have overtime been placed more on the mainstream financial institutions like the commercial banks at the expense of microfinance banks that cater for more than half of Nigeria economically active population.

These results in the micro finance institution not being able to adequately mobilized deposits to fund the financial needs of SMEs’, invest and insulate productive activities in Nigeria. Many scholars who attempted a study in this area seemed not to have a consensus about the nature and extent of relationship between microfinance banks and SMEs performance. This is why this study seeks to examine the contribution of microfinance banks on SMEs performance in Nigeria.

1.2. Objective of the Study

The major objective of this study is to examine the impact of micro finance banks on SMEs development in Nigeria. The specific objectives include:

- To assess the effect of Microfinance Banks loans and advances on SMEs output growth in Nigeria.

- To determine the impact of Microfinance Banks long term investments on the output growth of SMEs in Nigeria.

- To ascertain the effect of Microfinance Banks’ deposits on the output growth of SMEs in Nigeria.

1.3. Research Hypotheses

The following research hypotheses were formulated for this study.

HO1: Microfinance Banks loans and advances do not have any significant effect on SMEs output growth in Nigeria.

HO2: Microfinance Banks long term investments do not have any significant impact on the output growth of SMEs in Nigeria.

HO3: Microfinance Banks deposits do not have any significant effect on SMEs output growth in Nigeria.

2. Literature Review and Theoretical Framework

2.1. Theoretical Framework

The theoretical foundation to which this study was based on is the classical microfinance theory. Supporting this theory is neoclassical growth models. A brief review of these theories is presented below.

2.2. The Classic Microfinance Theory of Change

This study is anchored on the classic theory of change propounded by Godwin (2014). This theory is built on three key assumptions: a poor person must take a loan from (or save with) a micro finance institution (or similar institutions); must invest the money in a viable business and must manage the business to yield major return on the investment. The theory holds that a poor person takes a loan (or saves) to start or expand a microenterprise which yields enough net revenue to repay the loan with major interest and still have sufficient profit to increase personal or household income enough to raise the standard of living and contribute to the growth of the economy.

2.3. Neoclassical Growth Model

The neoclassical growth model, developed by Robert Solow and Trevor Swan in the 1950s, was the first attempt to model long-run growth analytically. Essentially, the model assumes efficient utilization of available resources in the economy, and that there are diminishing returns to capital and labour. Based on these, the model predicts that increasing capital relative to labour creates economic growth. Poor countries with less capital per person will grow faster because each investment in capital will produce a higher return than rich countries with ample capital. Thus because of diminishing returns to capital, economies will eventually reach a point at which any increase in capital will no longer create economic growth. This point is called a 'steady state' (Audretsch & Keilbach, 2005).

The model also posits that economies can grow beyond the steady state by inventing new technology. The process by which countries continue to grow despite the diminishing returns is ‘exogenous’ and represents the creation of new technology that allows production with fewer resources. This aspect is typically expected to rest on the SMEs alongside the large enterprises. This theory is relevant to this study as SMEs play a key role in capital accumulation and growth inducement. Ojong, Arikpo, and Anthony (2015) state that SMEs are very vital for the indigenization of the industrial sector, creation of employment opportunities, utilization of local raw materials and development of local technology and manpower needed to feed large scale enterprises

2.4. Conceptual Framework

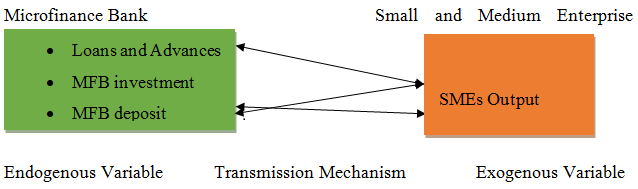

The conceptual framework is as shown in Figure 1. The Microfinance bank (measured by microfinance loans and advances, microfinance investment and microfinance deposit mobilization) are the independent variables, while SMEs output will measure the dependent variable. The provision of loans and advances to SMEs operators by MFBs is used to fund the expansion of SMEs operations. This results in the expansion of output of SMEs. When MFBs invest its excess funds in earnings yielding investment vehicle, it results in more funds for on-lending to SMEs, which in turn enhances SMEs productive capacity and output. Also the more the deposit mobilization capacity of the MFB, the more the loanable funds available to it and the more the output of SMEs.

Figure-1. Conceptual framework.

3. Empirical Literature

There abound several empirical literatures on the effect of MFBs on the development of SMEs in Nigeria. Many studies found evidences of a positive relationship, others showed that MFIs are not significant in promoting SMEs performances, yet others had evidences of a no relationship. Most of these studies, their methodologies and findings are reviewed in this section.

Olutunla and Marshal (2008) examined the socio-economic factors influencing the capacity of SMEs to alleviate poverty in the South-Western part of Nigeria. Primary data were used for this study. The target population was all small and medium scale enterprises in three states (Lagos, Ogun and Oyo) in the South-Western region of Nigeria. The choice of these three states was based on size and concentration of SMEs. Data were collected using questionnaire from a sample of 700 SMEs using systematic random sampling procedure. The data collected were analysed using appropriate descriptive statistics and inferential techniques. The results showed that majority (75percent) of surveyed SMEs operating in the southwest were microenterprises employing less than 10 workers while only (19 per cent) and (6percent) of the respondents engaged in small scale and medium scale enterprises, employing between 10 and 50 workers respectively. The results also showed that there was substantial increase (133percent) in number of SMEs owners that have grown in terms of employment generation from microenterprises to small scale and medium firms over the span of five years. The study concluded that business registration, business size, nature of business, sources of capital were the major factors determining both income and employment generation potentials of SMEs.

Ojo (2009) investigated the relationship between profitability, bank loans, age of business and the size of small and medium enterprises in Nigeria. Using fixed-effects regression model, the paper was based on a balanced panel data of 115 SMEs of existing firms that have taken loans or currently have active loans, randomly selected in Ondo State, Nigeria. The equation specified profitability as dependent variable and loans, sales, age of business, size of business and interest rate as independent variables. All the data except interest rate have been derived from the primary source/field survey. The results demonstrated that there is interdependence between the SMEs profitability and bank loans, and a significant relationship between profitability and the size of business. For high profitability, increased loans and growth in size of business remained important. The paper recommended that the government should formulate policies that will compel commercial banks to relax their restrictive regulations and operations which discourage borrowing, and offer more credit facilities for SMEs.

Mba and Cletus (2014) examine the effect of Small and Medium Enterprises financing on the economic growth of Nigeria. In doing this, the Ordinary Least Squares Method (OLS), Error Correction and Parsimonious models are used to analyze quarterly data between 1994 and 2008. The result of the analysis shows that MFIs loans to SMEs and other variables such as MFI investment and deposit mobilization except money supply and deficit financing exert a positive impact on GDP growth. The study recommended Government to find ways in encouraging financial institutions to lend to SMEs by providing guarantees, interest rate subsidies and other incentives. Also ensuring proper capitalization of specialized agencies set up for SMEs financing and ensuring such agencies are self-sustaining by raising funds from the financial market and participating in the equity of SMEs.

Alasan and Yakubu (2011) examined the contribution of MFI activities on SMEs productivity in Nigeria between 1981 and 2013 using an ARDL approach. Results from the empirical analysis showed that investment in SMEs has a significant positive impact on SMEs growth. Thus, given that Nigeria is economically undeveloped, the integration of majority of the people who live in rural areas into the process of economic development is essential through entrepreneurship in small business.

Pagano and Fabiano (2001) examined the contributions and relevance of MFIs to SMEs contribution to economic growth in Nigeria. The study employed a time series research design and descriptive method of analysis to investigate the relevance of the manufacturing SMEs in growth of the Nigerian economy. Data were extracted from relevant publications of the Central Bank of Nigeria (CBN) and National Bureau of Statistics (NBS). Graphs were used to enhance descriptive analysis of data values over time. Results showed that the MFIs have significant effect on SMEs contributions to the sustained increases in gross domestic product,

Gbandi and Amissah (2014) conducted a descriptive study on the financing options for SMEs in Nigeria. The study examined debt financing by considering the role commercial, microfinance banks, co-operatives and other finance institutions play in the financing of SMEs in Nigeria. The study revealed that the informal financial sector provides more than 70percent of funds to SMEs in Nigeria and concluded that funding of SMEs in Nigeria is very critical if SMEs are to perform their role of growth and development of the nation’s economy.

Emmanuel and Daniya (2012) used the deductive approach to investigate the role of government and other financial institution in the development of SMEs. The study discovered that financial institutions provide the necessary financial lubricant that facilitate the development of Small and Medium Scale Enterprises, but, a lot still needed to be done by the government in terms of policy formulation in order to complement the efforts of financial institutions.The study also unfolded that poor implementation of government policies, erratic financing of schemes initiated by government and other administrative bottlenecks have hindered the economic potentials of SMEs in Nigeria from being fully harnessed.

Egbetunde (2012) examined the relationship between commercial bank credits indicators and rural economic growth in Nigeria. Using a double-log equation within the context of Ordinary Least Square (OLS) framework and co-integration test, the study revealed that rural economic growth is co-integrated with banks credits indicators in Nigeria. The study also revealed a positive relationship between rural economic growth and commercial banks rural loans as well as commercial banks loans to agricultural and rural economic growth.

Safiyyah and Garba (2013) investigated the contribution of commercial banks to the growth of SMEs in Nigeria. Applying the descriptive method ratio and trend analysis, it was discovered that commercial banks contributed to financing small and medium scale enterprises but their contribution has declined as the government through CBN directives abolished the mandatory bank’s credit allocations.

Godwin (2014) examined the impact of microfinance banks on rural transformation in Nigeria. The methodology used by the researcher was descriptive research. The findings of the study show that micro-finance banks have impacted positively on the rural poor by providing loans and advances for agriculture, investment opportunities, savings mobilization and credit delivery; asset financing and community development financing. Despite the achievements of microfinance banks in transforming the rural areas they have been met with stiff difficulties like loans repayment problems, illiteracy among the poor and inadequate or non-monitoring of micro and small enterprises by the micro financial institutions. The following recommendations were made by the author to address the issues: To match products to customer needs, examination of cash flows and repayment cycles, broaden the range of products and services to the poor and regulatory authorities looking closely at the activities of the microfinance banks.Yahaya, Osemene, and Abdulraheem (2011) studied the impact of Microfinance banks on standard of living of hairdressers in Oshodi, Nigeria as a poverty eradication strategy among the society. The objectives of the study examined how Microfinance banks in Oshodi have impacted on the businesses of hairdressers in the local Government and to also examine the impact of Microfinance banks on asset acquisition and savings of hairdressers in that LGA. A total of 120 hairdressers who registered with Oshodi-Isolo LGA were used as study sample. However, primary data of questionnaire analysis was adopted and Spearman’s rank correlation coefficient analysis was used as the estimation techniques. More so, the hypotheses of the research were tested at 5% level of significance and the result revealed that there is a significant relationship between Microfinance banks’ efforts and standard of living of hairdressers in the, and the implication of this is that due to the existence and help of Microfinance banks, poverty has reduced a little bit among the hairdressers. In conclusion, the study recommends that governments at all levels through the Central bank of Nigeria should ensure that Microfinance banks loans are easily obtainable and repayment should include a grace period with reasonable schedule instead of weekly payment period that is commonly found among the microfinance banks in Nigeria.

Zacheus and Omoseni (2014) in his study examined the impact of the role played by micro finance banks MFBs in promoting the growth of SMEs in Nigeria. An empirical study was carried out using Garu Micro Finance bank in Bauchi, Bauchi State being one of the most successful Micro Finance Banks in North East sub regions to determine impact of the role of MFBs in promoting small and medium enterprises growth. Out of the total number of employees in the bank, 15 members of staff who constitute the middle and management staff were used as respondents. Questionnaire was developed and distributed to them which they all filled and returned. The study revealed that MFBs have contributed to the promotion of small and medium enterprises growth in Nigeria. It was recommended that government should further encourage the activities of Micro Finance Banks (MFBs) by creating enabling environment so that they can further support SMEs growth.

Yahaya et al. (2011) examined the effectiveness of microfinance banks in alleviation of poverty in Kwara State, Nigeria. The data collected were analyzed through the use of t-test and Analysis of Variance (ANOVA). From the research findings, results revealed that microfinance banks have significant role to play in the economy, as it helps reduce poverty by providing financial services to the active poor, helps in generating employment and also provide small loans to grow small businesses. Therefore, microfinance policy should further be publicized so that members of low-income groups will be aware of what microfinance institutions have to offer them and how they can obtain financial services to grow their small businesses.

4. Research Methodology

4.1. Research Design

The exploratory design was applied to collect the data on the study’s variables, analyze and test them. Annual time series data from 1992-2018 was collected to determine the effect of microfinance banks on SMEs in Nigeria. The endogenous variable is Small and Medium Enterprise productivity SMEP while the exogenous variables were Microfinance loans and advances (MLA), Microfinance investment (MLI) and Microfinance deposit (MD). Data was obtained from the CBN (2017) Central Bank of Nigeria Stability Reports, Small and Medium Enterprise Development Agency of Nigeria Reports and various other publications.

4.2. Methods of Data Collection

Annual time series data were collected for the period 1992 to 2018 on Microfinance loans and advances, investment, deposit, Small and medium enterprise productivity. The desk survey method was used to extract the data on the variables from the data sources bearing in mind the study objectives and hypotheses. These variables were transformed into their natural log to ensure that their elasticity is duly captured and to control the robustness of the time series.

Model Specification: The functional relationship of this study can be expressed functionally thus:

SMEP = f (MFBF) (1)

Equation 1 is the functional model of the study,

Where:

SMEP = Small and Medium Enterprises Productivity

MFBF = Microfinance Bank Funding

And where,

Small and Medium Enterprises productivity (SMEP) represented the endogenous variable while,

Microfinance Banks loans and advances (MLA), Microfinance Banks investment (MLI) and Microfinance Banks deposit (MD) measures the exogenous variables thus using the ordinary least squared model:

Equation 2 is the functional model depicting all the proxies used to capture Microfinance banks finances (MFBF).

Equation 3 is the econometric specification of the functional model of equation 2.

Where

SMEP = Small and Medium Enterprise productivity.

MLA = Microfinance Loans and Advances.

MLI = Microfinance Investments.

MD = Microfinance Deposit.

The a priori expectation about the signs of the parameters of the independent variables is stated thus: b1, b2 and b3 > 0

5. Results and Discussions

5.1. Descriptive Analysis

LSMEP |

LMLA |

LMLI |

LMD |

|

| Mean | 5.871161 |

9.188443 |

7.384752 |

9.765278 |

| Median | 6.072860 |

9.334662 |

7.868139 |

9.971515 |

| Maximum | 7.153529 |

12.14024 |

10.85274 |

11.92983 |

| Minimum | 3.920785 |

4.911183 |

4.774069 |

6.460843 |

| Std. Dev. | 0.972335 |

1.975349 |

1.551221 |

1.647929 |

| Skewness | -0.572906 |

-0.265034 |

0.132390 |

-0.228408 |

| Kurtosis | 2.166632 |

2.007759 |

2.132286 |

1.716640 |

| Jarque-Bera | 2.091027 |

1.318243 |

0.857330 |

1.933014 |

| Probability | 0.351511 |

0.517306 |

0.651378 |

0.380409 |

| Sum | 146.7790 |

229.7111 |

184.6188 |

244.1319 |

| Sum Sq. Dev. | 22.69043 |

93.64804 |

57.75085 |

65.17605 |

| Observations | 25 |

25 |

25 |

25 |

The result in Table 1 shows that Small and Medium Scale Enterprises productivity, hereafter called SMEP has an average value of 5.871161 with a standard deviation of 0.72335 ranging from 3.920785 as minimum to 7.153529 as maximum values. Microfinance Banks’ loans and advances, hereafter referred to as MLA has its mean value as 9.188443, a standard deviation of 1.975349 with a range from 4.911183 as minimum to 12.14024 as maximum. Microfinance Banks’ investment, hereafter called MLI has a mean value of 7.384752. Its minimum value is 4.774069 and maximum is 10.85274 with a standard deviation of 1.551221. Micro finance banks’ deposit mobilization, hereafter referred to as MD showed a mean value of 9.765278, a standard deviation of 1.647929 and ranges between a minimum value of 6.460843 and a maximum value of 11.92983.

Again, analysis of the descriptive statistics revealed that, the SMEP, MLA and MD were negatively skewed, meaning that their means are also peaked to the left. The mean of MLI however is peaked to the right of the distribution as it is skewed to the right (positively skewed). The coefficient of the kurtosis of the variables indicates that all the variables were platykurtic (below 3.000000) relative to the normal, meaning that the distribution produces fewer and less extreme outliers than does the normal distribution. The Jarque-Bera values of 2.091027, 1.318243, 0.857330, and 1.933014 for SMEP, MLA, MLI, and MD respectively with their respective p-values of 35.15 percent, 51.73 percent, 65.149 percent and 38.04 percent means that they are normally distributed.

5.2. Unit Root Test

| Variables | ADF Test Statistics |

Order of integration |

|

Level |

1st Difference |

||

| LSMEP | -1.987300 |

-5.736733 |

I(1) |

| LMLA | -1.755092 |

-6.261765 |

I(1) |

| LMLI | -0.530084 |

-3.896812 |

I(1) |

| LMD | -0.844011 |

-7.020527 |

I(1) |

| Note: Test critical values at level: 1% = -3.769597, 5% = -2.991878, 10% = -2.635542. Test critical values at 1st Diff: 1% = -3.769597, 5% = -3.004861, 10% = -2.642242. |

Table 2 showed that SMEP, MLA, MLI and MD had unit root at levels but after differencing one time they became stationary. This is so, as their test statistics at levels, taking their absolute values were less than their critical values at 5 percent. However, after differencing one time, the test statistics, taking their absolute values became greater than their critical values at 5 percent level. In verifying the validity of this result, the coefficient of the ADF test equation was checked. Because of their negativity; the ADF test result is valid.

Since the series are integrated of order I(1), the study proceeds determine the optimal lag size in order to estimate the Johansen cointegration test.

5.3. VAR Lag Order Selection Criteria

Endogenous Variables: LSMEP LMLA LMLI LMD |

||||||

Lag |

LogL |

LR |

FPE |

AIC |

SC |

HQ |

0 |

-11.09538 |

NA |

2.49e-06 |

1.287631 |

1.531406 |

1.355244 |

1 |

112.7168 |

188.1946* |

9.65e-10 |

-6.617346 |

-5.154695* |

-6.211669 |

2 |

137.4455 |

27.69609 |

1.30e-09* |

-6.595638* |

-3.914111 |

-5.851897* |

3 |

187.3852 |

35.95660 |

4.17e-10 |

-8.590817 |

-4.690414 |

-7.509011 |

| Note: * indicates lag order selected by the criterion. LR: sequential modified LR test statistic (each test at 5% level). FPE: Final prediction error. AIC: Akaike information criterion. SC: Schwarz information criterion. HQ: Hannan-Quinn information criterion. |

To select the optimum lag length for this study as depicted in Table 3, the VAR lag order selection criteria was applied. The result is presented in Table 4 below. From the table, majority of the criteria shows that lag two is most suitable lag length for the study.

5.4. Johansen Cointegration Test

The test for long run association among the variables of the study was conducted using the Johansen cointegration. The test criterial is that there should be at least one cointegrating equation for both trace and eigen value test. Table 4 presents extract of the result.

| Hypothesized | Trace |

0.05 |

||

| No. of CE(s) | Eigenvalue |

Statistic |

Critical Value |

Prob.** |

| None * | 0.943000 |

94.60244 |

47.85613 |

0.0000 |

| At most 1 | 0.619011 |

29.79707 |

34.44368 |

0.0836 |

| At most 2 | 0.354862 |

14.17900 |

15.49471 |

0.0782 |

| At most 3 | 0.210929 |

3.841466 |

4.974873 |

0.0557 |

| Trace test indicates 1 cointegrating eqn(s) at the 0.05 level * denotes rejection of the hypothesis at the 0.05 level **MacKinnon-Haug-Michelis (1999) p-values Unrestricted Cointegration Rank Test (Maximum Eigenvalue) |

||||

| Hypothesized | Max-Eigen |

0.05 |

||

| No. of CE(s) | Eigenvalue |

Statistic |

Critical Value |

Prob.** |

| None * | 0.943000 |

60.15876 |

27.58434 |

0.0000 |

| At most 1 | 0.619011 |

20.26468 |

21.13162 |

0.0658 |

| At most 2 | 0.354862 |

9.204126 |

14.26460 |

0.2696 |

| At most 3 | 0.210929 |

3.841466 |

4.974873 |

0.0557 |

| Note: Max-eigenvalue test indicates 1 cointegrating eqn(s) at the 0.05 level. * denotes rejection of the hypothesis at the 0.05 level. **MacKinnon-Haug-Michelis (1999) p-values. |

The co-integration test results as presented in Table 5 indicates that there is one co-integrating equations both in the trace test and maximum eigenvalue test of the model. The values of the test statistics in the co-integration equations for both trace test and maximum eigenvalues are found to be greater than their critical values at 5 percent significance level. Also, the p-values of the co-integrating equations are less than 5 percent, meaning that the variables share a common stochastic trend and will grow proportionally. In other words, they move together in the long run meaning that they have long run association.

5.5. Vector Error Correction

In view of the proven long run association among the variables in the study, a vector error correction analyses of the variables was conducted. The result of the test is as presented in Table 5 below.

| Vector Error Correction Estimates Standard errors in ( ) & t-statistics in [ ] |

||||

| Cointegrating Eq: | CointEq1 |

|||

| LSMEP(-1) | 1.000000 |

|||

| LMLA(-1) | -1.402199 |

|||

(0.14904) |

||||

[-9.40797] |

||||

| LMLI(-1) | -0.116167 |

|||

(0.06842) |

||||

[-1.69792] |

||||

| LMD(-1) | 1.203271 |

|||

(0.19296) |

||||

[ 6.23577] |

||||

| C | -3.902959 |

|||

| Error Correction: | D(LSMEP) |

D(LMLA) |

D(LMLI) |

D(LMD) |

| CointEq1 | -0.795430 |

1.396522 |

1.222484 |

1.568825 |

(0.52279) |

(0.76253) |

(0.86697) |

(0.60026) |

|

[-1.52151] |

[ 1.83144] |

[ 1.41006] |

[ 2.61355] |

|

| D(LSMEP(-1)) | 0.419815 |

-0.874378 |

-1.034614 |

-0.983209 |

(0.41815) |

(0.60990) |

(0.69344) |

(0.48012) |

|

[ 1.00399] |

[-1.43364] |

[-1.49200] |

[-2.04785] |

|

| D(LSMEP(-2)) | -0.060188 |

-1.084313 |

-0.068875 |

-0.942956 |

(0.39005) |

(0.56892) |

(0.64685) |

(0.44786) |

|

[-0.15431] |

[-1.90591] |

[-0.10648] |

[-2.10548] |

|

| D(LMLA(-1)) | -1.022068 |

2.232144 |

2.959294 |

2.679463 |

(0.89600) |

(1.30688) |

(1.48588) |

(1.02878) |

|

[-1.14070] |

[ 1.70799] |

[ 1.99161] |

[ 2.60450] |

|

| D(LMLA(-2)) | -1.194358 |

1.956098 |

-1.036482 |

2.295089 |

(1.02155) |

(1.49001) |

(1.69410) |

(1.17294) |

|

[-1.16916] |

[ 1.31281] |

[-0.61182] |

[ 1.95669] |

|

| D(LMLI(-1)) | 0.093561 |

0.014848 |

-0.570082 |

-0.086508 |

(0.20631) |

(0.30092) |

(0.34214) |

(0.23689) |

|

[ 0.45349] |

[ 0.04934] |

[-1.66622] |

[-0.36518] |

|

| D(LMLI(-2)) | 0.106278 |

-0.176807 |

-0.015045 |

-0.404096 |

(0.20602) |

(0.30050) |

(0.34166) |

(0.23655) |

|

[ 0.51586] |

[-0.58838] |

[-0.04403] |

[-1.70826] |

|

| D(LMD(-1)) | 0.748360 |

-3.038034 |

-2.727136 |

-3.306546 |

(0.93973) |

(1.37067) |

(1.55841) |

(1.07900) |

|

[ 0.79636] |

[-2.21646] |

[-1.74995] |

[-3.06446] |

|

| D(LMD(-2)) | 1.097912 |

-2.113617 |

1.057554 |

-2.278763 |

(1.04295) |

(1.52122) |

(1.72958) |

(1.19751) |

|

[ 1.05270] |

[-1.38942] |

[ 0.61145] |

[-1.90291] |

|

| C | 0.237290 |

0.495966 |

0.264214 |

0.373030 |

(0.09487) |

(0.13838) |

(0.15733) |

(0.10893) |

|

[ 2.50111] |

[ 3.58408] |

[ 1.67932] |

[ 3.42438] |

|

| R-squared | 0.560048 |

0.567941 |

0.718576 |

0.632178 |

| Adj. R-squared | 0.230084 |

0.243896 |

0.507508 |

0.356311 |

| Sum sq. resids | 0.985061 |

2.095659 |

2.709062 |

1.298663 |

| S.E. equation | 0.286511 |

0.417897 |

0.475137 |

0.328971 |

| F-statistic | 1.697299 |

1.752663 |

3.404474 |

2.291605 |

| Log likelihood | 2.950384 |

-5.353731 |

-8.177808 |

-0.089868 |

| Akaike AIC | 0.640874 |

1.395794 |

1.652528 |

0.917261 |

| Schwarz SC | 1.136803 |

1.891722 |

2.148456 |

1.413189 |

| Mean dependent | 0.126971 |

0.228779 |

0.211613 |

0.175169 |

| S.D. dependent | 0.326527 |

0.480595 |

0.677048 |

0.410034 |

| Determinant resid covariance (dof adj.) | 2.52E-05 |

|||

| Determinant resid covariance | 2.23E-06 |

|||

| Log likelihood | 18.27189 |

|||

| Akaike information criterion | 2.338919 |

|||

| Schwarz criterion | 4.521004 |

|||

Table 5 is the result of the VECM estimate with four equations. However, of interest is the SMEP equation (which is the first equation). In view of the presence in the table standard deviation and t-statistics in these equations, but without their p-values, system equations to obtain the probability of the estimates for effective analyses of the equation of interest were generated.

| Dependent Variable: D(LSMEP) | ||||

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

| C(1) | -0.795430 |

0.522789 |

-1.521512 |

0.1540 |

| C(2) | 0.419815 |

0.418149 |

1.003985 |

0.3352 |

| C(3) | -0.060188 |

0.390053 |

-0.154307 |

0.8799 |

| C(4) | -1.022068 |

0.895998 |

-1.140703 |

0.2762 |

| C(5) | -1.194358 |

1.021551 |

-1.169161 |

0.2650 |

| C(6) | 0.093561 |

0.206314 |

0.453491 |

0.6583 |

| C(7) | 0.106278 |

0.206022 |

0.515859 |

0.6153 |

| C(8) | 0.748360 |

0.939731 |

0.796355 |

0.4413 |

| C(9) | 1.097912 |

1.042950 |

1.052699 |

0.3132 |

| C(10) | 0.237290 |

0.094874 |

2.501113 |

0.0279 |

| R-squared | 0.560048 |

|||

| Adjusted R-squared | 0.230084 |

|||

| F-statistic | 1.697299 |

Durbin-Watson stat |

2.353456 |

|

| Prob.(F-statistic) | 0.193794 |

|||

From Table 6, C (1) is the error correction term which measures the speed of adjustment of SMEP toward long run equilibrium. The expectation about C (1) is that it must be negative and significant at 5 percent level. From the result above, C (1) is negative but not significant at 5 percent level. This means therefore that there is no long run causality of MLA, MLI and MD to SMEP; meaning that microfinance banks’ operations do not have a significant influence on Small and Medium Enterprises’ operations in Nigeria in the long run. In other words, there is no long run causality running of Microfinance Banks’ activities to Small and Medium Enterprises productivity in Nigeria.

Furthermore, the R2 value 0.560048 or 56 percent shows that about 56 percent of the observed changes in Small and Medium Enterprises production have been explained by the variations in Microfinance Banks’ activities such as Microfinance Banks loans and advances, investments and deposits mobilization. The F-statistics value of 16.973 with its corresponding probability of 0.00379 percent shows that the Small and Medium Enterprise productivity model is statistically robust at 5 percent level.

5.6. Analyses of Long Run Dynamics

From the results of the system equations, the error correction term of the equation of interest was extracted and used for the analysis of the existence of long run causality of Microfinance banks’ loans and advances, investments and deposits mobilization to SMEs productivity. The result is presented in Table 7.

Also the results of the system equations, the short run dynamics of each of the independent variable is appraised using the Wald test. Extract of the result is presented below.

| Variables Tested | Null Hypothesis |

F-statistics |

Prob. |

Remark |

| LMLA | C (5) =C (6) = 0 |

0.707279 |

0.5124 |

Accepted |

| LMLI | C (7 = C (8) = 0 |

0.330615 |

0.7248 |

Accepted |

| LMD | C (9)=C (10)= 0 |

6.373547* |

0.0130 |

Rejected |

| Note: * Represents Rejection of Null hypothesis @ 5 % level |

Table 7 shows that the null hypotheses for all the variables were accepted except for Microfinance Banks deposits mobilization, meaning that there is a short run causality running of Microfinance Banks’ deposit mobilization to SMEs’ productivity. The result shows that Microfinance Banks’ deposit mobilization has a significant effect on SMEs’ productivity in Nigeria while Microfinance Banks’ loans, advances and investments do not have any significant effect on SMEs’ productivity in Nigeria.

| F-Statistic | 0.603427 |

Prob. F(2,10) | 0.5657 |

| Obs*R-squared | 2.369158 |

Prob. Chi-Square(2) | 0.3059 |

In Table 8 checking the observed R2 value of 2.369158 with its corresponding prob. Chi-square (2) of 30.59 percent, we conclude that the model is free from serial correlation.

| F-Statistic | 0.651263 |

Prob. F(12,9) | 0.7598 |

| Obs*R-squared | 10.22491 |

Prob. Chi-Square(12) | 0.5962 |

| Scaled explained SS | 3.385164 |

Prob. Chi-Square(12) | 0.9922 |

From Table 9 the observed R2 value of 10.22491 with its corresponding prob. Chi-square value of 59.62 percent, more than five per cent, implies that the model is free from heteroskedasticity.

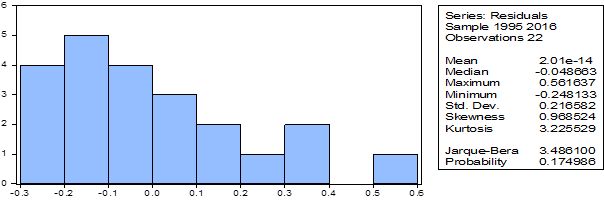

Figure-2. Histogram normality test of the model.

The Jarque Bera statistics of 3.486 with its corresponding probability of 17.50 per cent in Figure 2 is more than 5 per cent which means that the residual of the model is normally distributed.

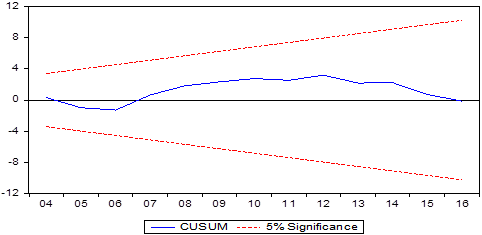

Figure-3 . Stability test of the model.

From the CUSUM Test result in Figure 3, it could be seen that the blue line lies in between the two red lines. This means that the estimates of the model and are stable and reliable.

5.7. Test of Hypothesis

5.7.1. Hypothesis One

H01: Microfinance Banks’ loans and advances do not have any significant effect on SMEs productivity growth in Nigeria.

H11: Microfinance Banks’ loans and advances have a significant effect on SMEs productivity growth in Nigeria.

5.8. Decision Rule

Accept H0: if calculated f-statistics value < table f-statistics value.'

Reject H0: if calculated f-statistics value > table f-statistics value.

From the regression result,

Calculated f-statistics value = 0.707

Table f-statistics value = 2.82

Since the calculated f-statistics value of 0.707 is less than the table f-statistics value of 2.82 at 5 per cent level of significance, we accept the null hypothesis and reject the alternative hypothesis. It therefore implies that Microfinance Banks’ loans and advances do not have any significant effect on SMEs productivity in Nigeria

5.9. Test of Hypothesis Two

H02: Microfinance Banks’ long term investments do not have any significant impact on the productivity growth of SMEs in Nigeria.

.H12: Microfinance Banks’ long term investments do have any significant impact on the productivity growth of SMEs in Nigeria.

5.10. Decision Rule

Accept H0: if calculated f-statistics value < table f-statistics value.'

Reject H0: if calculated f-statistics value > table f-statistics value.

From the regression result,

Calculated F-statistics value = 0.331

Table F-statistics value = 2.82

Since the calculated f-statistics value of 0.331 is less than the table f-statistics value of 2.82 at 5 per cent level of significance, we accept the null hypothesis and reject the alternative hypothesis. It therefore implies that Microfinance Banks’ long term investments do not have any significant effect on SMEs productivity growth in Nigeria

5.11. Test of Hypothesis Three

H03: Microfinance Banks’ deposits mobilization does not have any significant effect on SMEs productivity growth in Nigeria.

H13: Microfinance Banks’ deposits mobilizations have significant effect on SMEs productivity growth in Nigeria.

5.12. Decision Rule

Accept H0: if calculated f-statistics value < table f-statistics value.'

Reject H0: if calculated f-statistics value > table f-statistics value.

From the regression result,

Calculated F-statistics value = 6.374

Table F-statistics value = 2.82

Since the calculated t-statistics value of 6.374 is greater than the table t-statistics value of 2.82 at 5 per cent level of significance, we reject the null hypothesis and accept the alternative hypothesis. It therefore implies that Microfinance Banks’ deposits mobilization do not have any significant effect on SMEs growth in Nigeria.

6. Discussion of Findings

Findings arising from hypothesis one showed that microfinance banks loans and advances have an insignificant impact on the performance of SMEs in Nigeria. This means that both in the short run and long run periods, Microfinance Banks effect have actually not yielded the expected significant result in improving SMEs. This finding may be attributed to the non-application of loan funds for business operations as most funds made available to SMEs operators are always mismanaged. This finding is in tandem (Egbetunde, 2012) who examined the relationship between microcredits and SMEs productivity in Nigeria and found an insignificant relationship between microfinance bank loans and the contribution of SMEs to GDP.

Similarly, findings from hypothesis two revealed that Microfinance Banks’ long term investments in SMEs have no significant effect on SMEs productivity growth in Nigeria. The study showed long term investments by Microfinance banks do not contribute to SMEs productivity growth. The study revealed the more long-term investments made by Microfinance Banks, the less proportional the growth of SMEs. This is in line with the studies by Ojong et al. (2015) that held that SMEs seek short term self-liquidating loans from Microfinance Institutions. These loans according to the authors often serve the working capital requirements of SMEs

However, the result of hypothesis three showed that there is a significant effect of Microfinance Banks’ deposit mobilization on SMEs productivity growth in Nigeria. By this finding, an increase in the Microfinance Banks’ deposit mobilization results in a more than proportional increase in the productivity growth of SMEs in Nigeria. Accordingly, an increase in the Microfinance Banks’ deposit mobilization increases the loanable funds of the institution, this reduces the cost of borrowing by SMEs for productive activities which further increases effective loans demand and enhance productivity by SMEs in Nigeria. This finding is in agreement with Nwankwo, Olukotu, and Abah (2013) who found a significant relationship between deposit mobilization, investment and SMEs growth in Nigeria.

7. Summary of Findings

Based on the study, it is evident that Microfinance Banks loans and advances, as well as investments do not have any significant effect on SMEs’ productivity growth both in the long run and short run periods. However, MFBs deposit mobilizations do have significant effect on SMEs’ productivity growth both in the long run and short run periods.8. Recommendations

Arising from the study, it is recommended that the CBN in collaboration with MFBs should relax the conditions for credit lending and increase the duration of credit facilities by spreading the repayments over a long period of time to assist SMEs meet their funding needs.

The government and the Central Bank on Nigeria should work in concert to provide special purpose funds through the MFBs for SMEs. Also, the Government should initiate programs that will promote the MFB sector that will ginger mobilization of domestic savings, widening the financial system.

The CBN should formulate policies aimed at regulating the investments of Microfinance Banks to ensure that they invest in only viable outlets that promises short to medium term earnings towards contributing to SMEs productivity.References

Alasan, S. L., & Yakubu, A. L. (2011). An empirical study of small scale financing in Nigeria. Journal of Unilorin Business School, 1(1), 87-96.

Audretsch, D. B., & Keilbach, M. (2005). Entrepreneurship capital and regional growth. The Annals of Regional Science, 39(3), 457-469.Available at: https://doi.org/10.1007/s00168-005-0246-9.

CBN. (2017). Statistical bulletine, Central bank of Nigeria. 28.

Egbetunde, T. (2012). Bank credits and rural development in Nigeria (1982-2009). International Journal of Finance and Accounting, 1(3), 45-52.Available at: https://doi.org/10.5923/j.ijfa.20120103.04.

Emmanuel, O. O., & Daniya, A. A. (2012). Development of small and medium scale enterprises (SMEs): The role of government and other financial institutions. Arabian Journal of Business and Management Review, 1(7), 6-29.Available at: https://doi.org/10.12816/0002132.

Gbandi, E., & Amissah, G. (2014). Financing options for small and medium enterprises (SMEs) in Nigeria. European Scientific Journal, 10(1), 327-340.Available at: org/10.19044/esj.2014.v10n1p%p.

God’stime, O. E., & Uchechi, S. A. (2014). Human capital development and economic growth: The Nigerian experience. International Journal of Academic Research in Business and Social Sciences, 4(4), 25-35.

Godwin, M. (2014). Micro Finance repayment in Bangladesh: How to improve the allocation of loan by MFI. Journal of World Development, 32(11), 1909 – 1926.Available at: https://doi.org/10.1016/j.worlddev.2004.05.011.

Khandker, S. R. (2003). Microfinance and poverty: Evidence using panel data from Bangladesh (pp. 1-31). World Bank Policy Research Working Paper Series No. 2945.

Ledgerwood, H. (1999). Microfinance Handbook: An institutional and financial perspective. Washington: D:C: World Bank.

Mba, O. A., & Cletus, I. E. (2014). Issues, challenges and prospect of small and medium enterprises in Port-Harcourt city Nigeria. European Journal of Sustainable Development, 3(1), 101-114.Available at: https://doi.org/10.14207/ejsd.2014.v3n1p101.

Nwankwo, O., Olukotu, G., & Abah, E. (2013). Impact of microfinance on rural transformation in Nigeria. International Journal of Business and Management, 8(19), 99.Available at: https://doi.org/10.5539/ijbm.v8n19p99.

Ojo, O. (2009). Impact of microfinance on entrepreneurial development: The case of Nigeria. Paper presented at the International Conference on Administration and Business.

Ojong, C. M., Arikpo, O. F., & Anthony, O. (2015). The role of deposit money banks on the growth of smes in Yakurr local government area, cross river state, Nigeria. Journal of Social Science Research, 6(2), 1047-1054.Available at: https://doi.org/10.24297/jssr.v6i2.3486.

Olutunla, G. T., & Marshal, O. T. (2008). An empirical analysis of factors associated with the profitability of small and medium enterprises in Nigeria. African Journal of Business Management, 12(10), 195 - 200.

Pagano, P., & Fabiano, S. (2001). Firm size distribution and growth. Bancad’ Italia Working Paper No. 394.

Safiyyah, M. A., & Garba, B. B. (2013). An assessment of the contribution of commercial banks on the growth of SMEs in Nigeria. International Journal of Research in Social Science, 2(4), 47-55.

Ukeje, E. (2005). Poverty reduction through microfinancing: The case of Uganda. CBN Bullion, 30(3), 30-42.

Yahaya, K. A., Osemene, O. F., & Abdulraheem, A. (2011). Effectiveness of microfinance banks in alleviating poverty in Kwara State Nigeria. Global Journal of Management and Business Research, 11(4), 12-21.

Zacheus, O. O., & Omoseni, O. A. (2014). The impact of small and medium scale enterprises on economic development of Ekiti State, Nigeria. Journal of Economic and Sustainable Development, 5(16), 115-122.