Financial Development and Economic Growth in Asian Countries: A Panel Empirical Investigation

Cher Chen1

GholamReza Zandi Pour2*

Edwin R. de los Reyes3

1George Mason University, USA. |

AbstractThis study aimed to evaluate the association of financial development and economic growth by considering the case of 10 Asian countries. The study used quantitative research design where the preliminary testing was conducted using descriptive statistics and unit root testing. The sample size comprised of 10 emerging Asian countries (India, China, Malaysia, Philippines, Pakistan, Thailand, Singapore, Bhutan, Vietnam, and Bangladesh) and the time-frame for the study was 1990 to 2018. The main techniques of analysis were Pedroni cointegration, dynamic panel least squares (DOLS) and Granger Causality. This study concluded that long-run equilibrium existed between financial development and economic growth. The research was limited to the case of Asian countries, therefore, in future, the evaluation of European countries can be conducted or African region can also be undertaken into consideration. |

Licensed: |

|

Keywords: JEL Classification |

|

Accepted: 5 June 2020 |

|

| (* Corresponding Author) |

Funding:This study received no specific financial support. |

Competing Interests: The authors declare that they have no competing interests. |

1. Introduction

With the advancement of technology and rapid globalisation, it was determined from the existing studies that economic growth and financial development are associated with each other. Financial development is an important indicator which helps to measure the economic growth of a country. For instance, some of the researchers have argued that financial development has strong and significant impact on total productivity which leads towards economic growth. Some of the researchers have laid emphasis on significant role of financial variables that influence the growth of economy (Lerohim, Affandi, & W Mahmood, 2014). The role of financial development is emphasized by researchers because they help to understand how allocation of resources and growth inducing sectors can be beneficial for the economy. However, during period of financial crisis, the country has to undergo financial instability due to which firms are not able to generate adequate amount of revenue.

Financial development is associated with the process of enhancing quality measures, quantity and financial intermediary services. However, the current study is focused on examining the impact of financial development on economic growth particularly in Asian countries. The current scenario and economic conditions of Asian countries show fluctuating trends and policies. The economists believe that institutions and activities are aligned with each other that influence the economic growth of countries. However, many studies (Abosedra, Shahbaz, & Sbia, 2015; Alom, 2018; Estrada, Park, & Ramayandi, 2010; Hasan & Barua, 2015; Shahbaz, 2015) have also argued that financial development occurs due to many reasons and any factors cannot be held responsible for it. The positive relationship between both the factors was found in previously published literature but the current literature has revealed some ambiguous results (Sepehrdoust, 2018). Financial development is basically a macroeconomic variable which is positively associated with economic growth of a country. For instance, stock market liquidity and the banking sector has overall positive correlation with economic growth in many countries.

It was also found from the existing studies that financial systems that are developing in Asia are still below the industry and country standards and lack in various domains. Financial development is different in developing and developed countries (Komal & Abbas, 2015). This is so because in most of the underdeveloped regions such as Asia, the financial development activities are associated with more infrastructural developments, building more banks and developing the stock markets. It was also found from the existing studies that developing Asian regions have made great progress in building financial systems (Valickova, Havranek, & Horvath, 2015). However, several studies that are conducted in similar domain have shed light on the fact that economic growth of a country can only be increased through encouraging more foreign investments which leads towards enhanced growth. The demand and supply situation needs to be maintained so that, financial development is not hindered through any excessive dependence on other markets. According to Samargandi, Fidrmuc, and Ghosh (2015) despite of the fact that developing and emerging economies have been focusing heftily on financial development in the domestic markets, the true fruits are ripped when the foreign direct investment is received.

In general terms, the financial development can be noted as the development of financial institutions within the country that not only support the central banks in stabilising the economic conditions in a country but also tend to facilitate the customer with the major aim of reducing poverty (Ductor & Grechyna, 2015). Secondly, the financial development is a major contributor to stimulation of economic growth since countries having well-established and controlled financial sector tends to enjoy exponential economic growth and stability with not only Multinational Corporation flourishing but also the development of small and medium enterprises (SMEs).

The association of financial development and economic growth has been vastly studied by many studies previously such as (Durusu-Ciftci, Ispir, & Yetkiner, 2017). However, this study is specifically focusing on Asian economies among which, many countries over the last 2 decades have emerged as economic giants. Apart from Japan being the developed country for many years, China is becoming a global economic power winning the race from America (Shahbaz, Van Hoang, Mahalik, & Roubaud, 2017). Similarly, India is also among the BRIC countries having been the fastest growing economies in the world. Pakistan and Bangladesh are also listed in the N11 list which is the list of next fastest growing economies (Pradhan, Arvin, & Norman, 2015). With this into consideration, all of these countries need to have stable and well-controlled financial sector so that the countries can augment their status and become developed nations from Asia. Hence, the research aims to identify the panel investigation and examine whether in Asian economies, the financial development and economic growth are inter-linked.

2. Literature Review

The financial markets are termed as the drivers of strong economic outlook and growth as they are responsible for supplying and managing the funds to customers that are public for productive uses that can contribute to the economy (Caporale, Rault, Sova, & Sova, 2015). Financial development tends to promote the business opportunities in a country which creates jobs in the market employing people and increasing their household income ultimately lifting their lifestyle. All of this is termed as the economic cycle which is repeated numerous times over the course of years when the countries are on the verge of becoming economically strong states (Asteriou & Spanos, 2019). However, the concept of financial development is very broad and is sometimes independent of economic growth thus, a clear link has been missing (Eren, Taspinar, & Gokmenoglu, 2019). In the past, there have been many researches that have talked about the topic but the uniformity is the main concern in this regard. Although most of the researchers are of the view that financial development is statistically positive and significant towards economic growth, the results vary according to middle-income countries and the long-time periods taken into account.

It has been stated by Saud, Chen, and Haseeb (2019) that the view towards economic growth has been completely changed since the induction of endogenous growth theory. Furthermore, Wang et al. (2019) opine that financial development of institutions is not a unidimensional aspect but has many ways to it. Although the primary role of financial institutions is to allocate the funds and resources among the customers in a cycle which starts from the central bank printing the money which is accessed by customers through financial institutions, commonly the commercial banks (Yang, 2019). However, with the passage of time, their role has evolved into being a smart manager of firms. These institutions also provide advisory services to customers in terms of diversification of portfolio, reduction of risk and hence, more wealth generation which is a direct contributor and indicator of economic growth.

The development of financial sector is a critical yet integral component in an open economic system which is in interaction with the outer world. The corruption in institutions also hinders the economic growth but with the development of financial sector, intermediaries and agents are eliminated from in-between and hence, a stable economic cycle is generated that helps in fostering the economy (Madsen, Islam, & Doucouliagos, 2018). The financial institution’s role has also enhanced to become more specialized for businesses that are encouraged to adopt new technologies. Not only the businesses, but financial institutions themselves have evolved to such extent that technology with regards to FinTech has been introduced making the financial operations hassle-free and easy (Batuo, Mlambo, & Asongu, 2018). This also tends to make the allocation of resources efficient which is the want of any government to utilize all the factors of production at their maximum capacity and as efficiently as possible to making a perfect economy.

The role of financial institution in an economy is to make the access and availability of the basic financial services easy and available. However, the very opposite has been seen in the real-world scenario from the last century where, the complex and ambiguous financial development policies have led to the stock markets and banks being crashed leading the world economic into economic turmoil and chaos like the Great Depression of 1930s (Ahmed, 2018). This has been seen numerous times where the most recent financial crisis occurred in 2008 fuelled by the collateralized debt obligations leading to subprime mortgage crisis (Pradhan, Arvin, & Bahmani, 2018). Hence the financial development, although appears to be a positive contributor to the economy but has been argued as also the very thing that might destroy or halt and economy in the form of financial crisis.

Conversely, authors have also critiqued the association of financial development and economic growth being the other way around. Bist (2018) profess that economic growth is actually an independent variable that triggers the development of financial sector and that financial development is independent of the economic growth. Hence to work in the association, governments and policy makers need to work on economic growth if the financial development is anticipated in an economy.

With regards to empirical investigation carried out by Sehrawat and Giri (2015) they presented a model of using private credit, total credit, money supply and market capitalisation to be important indicators of financial development whereas per capita GDP and real GDP growth to be proxies for economic growth. The results revealed that financial development and economic growth are cointegrated in the long-run. Similarly, Ibrahim and Alagidede (2018) have investigated the Sub-Saharan African countries for financial expansion and economic progress where credit to private sector was an alternative measure to financial development and real GDP growth rate was considered for the latter. Although the study implied a positive interlinkage between the variables mentioned above, the major contribution is dependent on real-estate and financial service sector to outperform other sectors for a strong financial development.

Another study by Omri, Daly, Rault, and Chaibi (2015) have examined financial development and economic growth with trade and environmental quality for a clearer picture. CO2 emissions were considered for environmental quality while domestic credit to private sector was taken as proxy for financial development and trade openness was used to measure trade. The economic growth was measured through real output which showed a unidirectional relationship between all four variables. A study in Nigeria was conducted by Iheanacho (2016) by following the autoregressive distributed lag (ARDL) approach. The variables used were credit to private sector, GDP per capita, liquid liabilities, bank deposits and deposit money bank assets. The results, astonishingly, reveal that there is a negative relationship between financial development and economic growth in Nigeria for both short-run and long-run. Although Nigeria is the fastest developing country in African continent, this study points to the fact that differences in geographies not only tend to hinder the relationships but other crucial factors are also present which need to be considered. Hence, this study undertakes the assessment of Asian countries due to non-uniformity of results as discussed above. Considering the review of literature, the study has formed the following hypothesis for the study:

H1: There is a significant impact of financial development on economic growth in Asian countries.

The theoretical foundations of financial development and economic development have long been examined concepts by various authors. Schumpeter (1911) laid the foundation of financial development advocating banks as crucial for economic development due to being allocators of resource, funding providers and innovation encouragement. This work was further developed by Schumpeter. and Redvers (1934) who professed that banks with complex structure and regulations will create obstacles in the way of economic growth. Financial development has since evolved as a concept and now, the banks have become the central component of an economic system of a country which fosters the economic growth in countries or regions around the globe.

On the other hand, the economic growth has been a concept that was coined by Adam Smith in his book wealth of nations but since, many authors and economists have provided a number of theories to support Adam’s idea and take it forward. In this context, the first theory that could be discussed in this context is classical growth theory. Since it is a basic economics concept that resources are scarce, this theory states that economic growth will decrease with increase in population and a temporary rise could be seen (Borrero & Garza, 2019). However, this is negated to the topic since many researchers have observed that financial development leads to prosperity of people not depleting but augmenting the resources which eventually enhances the economic growth. Secondly, the endogenous growth theory is another popular economic theory (Dosi, Roventini, & Russo, 2019). This theory states that economic growth is not the result of external drives or forces but the reason for economic growth comes from within the economy in terms of knowledge, human capital and innovation hence, countries are required to invest in these three elements to foster economic growth. The following study also supports the endogenous theory of growth because financial development is also an element that is based on skills, knowledge, innovation and investment in human capital therefore; this theory seems to be directly related with the topic of this paper.

Considering both the theoretical aspects of this paper, the endogenous growth theory and financial development are taken as the cornerstone of this study. Based upon this, the following section describes the data and method selected for this study along with suitable analysis techniques to be applied for reaching a feasible and valid conclusion. The method section is important to include since it paves the way for the researcher to conduct the study by selecting the most appropriate and suitable methods to reach a conclusion and test the hypotheses of the study.3. Method

The main focus of the is to examine the association between the financial development and economic growth among the Asian countries (India, China, Malaysia, Philippines, Pakistan, Thailand, Singapore, Bhutan, Vietnam, and Bangladesh) where the study attempts to provide proof regarding short and long-run association between financial development and growth of the economy. Thus, the research uses the panel data annually which is extracted from 1990 till 2018. The variables that are identified in the study consist of GDP growth, broad money, gross fixed capital (GFC), inflation, and long term interest rate. The source from which it is collected is from World Bank which has been accessed for obtaining the data. With this respect, the paper is emphasized in analysing the link between the development of financial and growth of economy, the procedures that are used in the study consist of the unit root test for determining if the data contains the unit root. The second tool adopted is the panel cointegration in which Pedrone panel cointegration is applied for evaluating the cointegration association. Finally, the short cointegration between development of financial and growth of economy is measured through the panel Granger causality test and Pedroni cointegration respectively.

3.1. Panel Unit Root Test

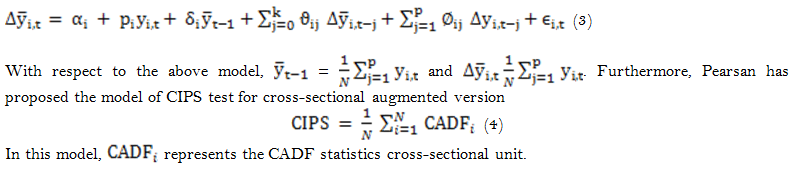

Evaluating the unit root of the data is imperative for identifying as if the variable consist of unit root. The traditional univariate method for conducting the unit root test is through the Dickey and Fuller which has problem of lower power that becomes challenges in rejecting the null hypothesis in which the unit root is present. Due to weakness of this particular unit root test, the Im, Pesaran and Shin (IPS) is applicable. IPS is considered to be more powerful and less limited while comparing with the ADF. The basic equation for conducting the panel unit root test is following:

In the model, ![]() represents the variables that are considered,

represents the variables that are considered, ![]() reflects on the fixed effects,

reflects on the fixed effects, ![]() is reflected to develop uncorrelated residuals. On the basis of the model, the nully hypothesis is that all the panels consist of unit root whereas the alternative hypothesis is that one panel is stationary. Furthermore, IPS test is based on averaging ADF statistics in which the standardized statistics is denoted as:

is reflected to develop uncorrelated residuals. On the basis of the model, the nully hypothesis is that all the panels consist of unit root whereas the alternative hypothesis is that one panel is stationary. Furthermore, IPS test is based on averaging ADF statistics in which the standardized statistics is denoted as:

With respect to the model, ti,T is identified as ADF t-statistics for industry and i represents the sector. The limitations of IPS is it is cross-sectional dependent; thus a well-recognized test to address the cross-sectional dependence is augmented Dickey-Fuller regression that is applied and its model is provided below

3.2. Panel Co-Integration Test

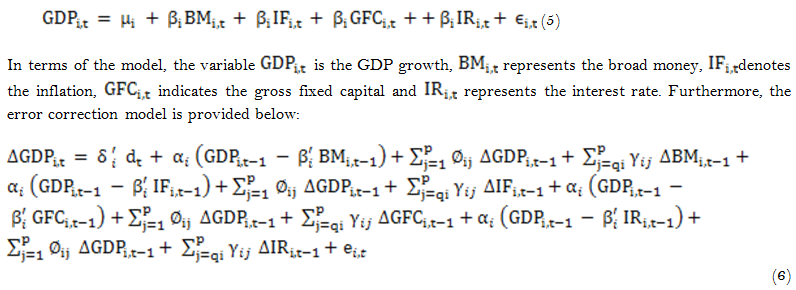

The long-run association among the variables has been measured through the panel cointegration test along with the causality test. The cointegration association among financial development and economic growth is measured through the following:

From the model above, it can be indicated that ![]() = (1, t)’ whereas the parameter

= (1, t)’ whereas the parameter ![]() highlights the speed of error-correlation with respect to long-run equilibrium. However, δ and α are parameter estimates.

highlights the speed of error-correlation with respect to long-run equilibrium. However, δ and α are parameter estimates.

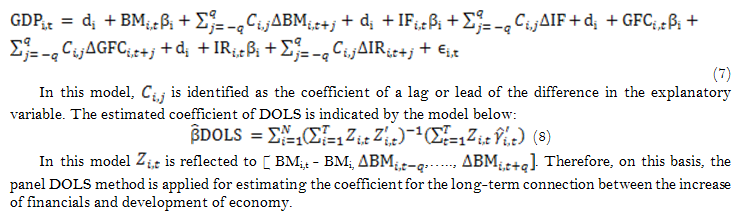

3.3. Dynamic Ordinary Least Square

The DOLS method widely used method for estimating and testing the hypothesis regarding the cointegration vector regarding the panel data. The DOLS method is accessed through the following equation

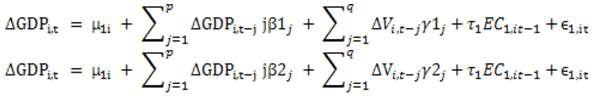

3.4. Panel Granger Causality Test

Once cointegration is evaluated, and the granger causality test is applied to understand the short- term association of variables. The granger causality model for testing short-term association is provided below:

In the above equation, EC stands for error correction term while V is vector denoting all the independent variables considered in the study.

4. Results

4.1. Descriptive Statistics

The following section of the study pertains to the analysis of the descriptive statistics. Results in Table 1 asserts average growth of Asian countries for GDP in the last 29 years is recorded to be 5.975%. However, the averages of broad money to GDP, inflation, GFC to GDP and interest rate are computed to be 82.81%, 5.110%, 29.52% and 4.69% respectively. The results in Table 1 also depict minimum and maximum values along with standard deviation. The deviation is apparently higher in broad money to GDP ratio which is computed 40.956% whilst in the case of inflation, GFC to GDP and interest rate, the values are computed to be 4.29%, 10.681% and 3.78% respectively.

GDP Growth (%) |

Broad Money to GDP (%) |

Inflation (%) |

GFC to GDP (%) |

Interest Rate (%) |

|

| Mean | 5.975 |

82.811 |

5.110 |

29.520 |

4.692 |

| Maximum | 18.361 |

209.451 |

24.257 |

69.673 |

17.333 |

| Minimum | -7.634 |

19.566 |

-18.109 |

12.521 |

-7.977 |

| Std. Dev. | 3.079 |

40.956 |

4.291 |

10.681 |

3.784 |

4.2. Unit Root Testing

For the evaluation of stationarity of the data, ADF, IPS and Levin Lin-Chu’s testing has been conducted on each variable that has been undertaken in this research. The findings of Table 2 are implying that GDP growth, broad money to GDP, inflation, and interest rates are stationary in nature because the statistics is negating the null hypothesis depicting presence of unit root. The assertion has been made on the basis of p-values which are lower than 5% and 1% as well. However, the only variable which has exhibited some presence of unit root is GFC to GDP in terms of ADF statistics; however, the Levin Lin-Chu’s statistics is stating otherwise (p-value< 0.05). In terms of IPS, all are found to be stationary except for broad money to GDP ratio.

ADF-Statistics |

Levin Lin-Chu statistics |

IPS |

|

| GDP Growth (%) | 69.368*** |

-4.761*** |

-7.43*** |

| Broad Money to GDP (%) | 34.167** |

-2.136** |

0.037 |

| Inflation (%) | 90.969*** |

-6.235*** |

-7.40*** |

| GFC to GDP (%) | 26.56 |

-2.194** |

-1.57* |

| Interest Rate (%) | 82.073*** |

-5.273*** |

-5.66*** |

| Note: ***: significant at 1%; **: significant at 5%; *: significant at 10%. |

4.3. Pedroni Panel Cointegration Analysis

The approach that has been used to test the cointegration relationships in the panel data is Pedroni cointegration as mentioned in the methodology as well. It has helped in the evaluation of long-run association or equilibrium amongst the variables. The results present in Table 3 and Table 4 have been accumulated from E-Views and it consists of 11 different statistics with a combination of within-dimension and between-dimension statistics. Out of 11 statistics, it has been found that 8 are significant because the p-values are seen to be below thir thresholds as depicted in Table 3. Therefore, the numbers asserts that there is a long-run equilibrium between the financial development and economic growth in the case of Asian countries specifically from 1990 to 2018.

| Alternative hypothesis: common AR coefs. (within-dimension) | Statistic |

Prob. |

Weighted Statistic |

Prob. |

| Panel v-Statistic | -0.609 |

0.729 |

-1.206 |

0.886 |

| Panel rho-Statistic | -2.030** |

0.021 |

-1.523* |

0.064 |

| Panel PP-Statistic | -9.626*** |

0.000 |

-7.995*** |

0.000 |

| Panel ADF-Statistic | -8.926*** |

0.000 |

-8.200*** |

0.000 |

| Note: ***: significant at 1%; **: significant at 5%; *: significant at 10%. |

| Alternative hypothesis: individual AR coefs. (between-dimension) | Statistic |

Prob. |

| Group rho-Statistic | -0.176 |

0.430 |

| Group PP-Statistic | -10.534*** |

0.000 |

| Group ADF-Statistic | -8.509*** |

0.000 |

| Note: ***: significant at 1%; **: significant at 5%; *: significant at 10%. |

4.4. Dynamic Ordinary Least Squares for Panel Data

Since its been observed that long-run association between financial development and economic growth is present. Therefore, Dynamic Ordinary Least Squares (DLOS) has been conducted. It has further validated the results of cointegration by evaluating the long-run equilibrium. DOLS has further helped to curb the issue of endogeneity between the cross-sections and other biases as well. In accordance with the results in Table 5, Broad money to GDP and GFC to GDP have found to be adequet in affecting the economic developement of Asian countries with B= -0.023 (p-value= 0.025< 0.05) and B= 0.156 (p-value= 0.00< 0.01) respectively. This implies that high money supply would be drastic for Asian countries where 1% positive change in broad money to GDP would lead to 0.023% decline in economic growth. Conversely, increment in GFC to GDP by 1% would improve the economic growth by 0.156%. In addition, inflation and interest rates are found to have insignificant long-run effect. The results in Table 5 also implies that the variance in broad money to GDP, inflation, and interest rates explain 78.62% variance in the economic progress of Asian countries which following the adjustment, the value is reduced to 56.05%.

| Variables | Coefficient |

t-Statistic |

Prob. |

| Broad Money to GDP (%) | -0.023** |

-2.269 |

0.025 |

| GFC to GDP (%) | 0.156*** |

4.252 |

0.000 |

| Inflation (%) | 0.049 |

0.564 |

0.574 |

| Interest Rate (%) | 0.056 |

0.536 |

0.593 |

| R-squared | 78.62% |

||

| Adjusted R-squared | 56.05% |

||

| Note: ***: significant at 1%; **: significant at 5%; *: significant at 10%. |

4.5. Panel Granger Causality

As the long-run equilibrium is evaluated, the short-run assessment has been conducted using Granger Causality proposed by Pedroni. The results pertaining to this study have been presented in Table 6. In terms of money supply and GDP, a bi-directional causality in found (p-values < 0.05). Therefore, a short-run association is found between them. Pertaining to inflation’s impact economic development, a significant short run effect is computed (p-value= 0.015< 0.05). However, in terms of GFC, the effect of GDP’s growth rate is computed to be significant (p-value= 0.001< 0.01).

| Null Hypothesis | F-Statistic |

Prob. |

| Broad Money to GDP does not Granger Cause GDP Growth | 2.510** |

0.043 |

| GDP Growth does not Granger Cause Broad Money to GDP | 3.930*** |

0.004 |

| Inflation does not Granger Cause GDP Growth | 3.165** |

0.015 |

| GDP Growth does not Granger Cause Inflation | 1.040 |

0.387 |

| GFC to GDP does not Granger Cause GDP Growth | 0.743 |

0.564 |

| GDP Growth does not Granger Cause GFC to GDP | 4.602*** |

0.001 |

| Interest Rate does not Granger Cause GDP Growth | 0.934 |

0.445 |

| GDP Growth does not Granger Cause Interest Rate | 1.320 |

0.263 |

| Note: ***: significant at 1%; **: significant at 5%; *: significant at 10%. |

4.6. Assessment Summary of Hypotheses

The primary hypothesis under consideration was the significant effect of financial development of the Asian region of economic growth which on the basis of sufficient evidence is accepted.

5. Discussion

The research underpinned the evaluation of economic growth and the financial development of the Asian region. The outcomes supported the long-run association whilst evidence on the short-run association is also found.

The findings, in this case, are similar to the study of Pradhan et al. (2015) who asserted that Pakistan and Bangladesh are emerging economies in the Asian region and their financial growth and economic progress are interlinked. In this manner, the paper has contributed to the body of knowledge by highlighting the most significant factors.

The results also implied that Asian countries need to limit the money supply in order to growth prosperously. Therefore, the analysis of the paper is similar to the study conducted by Galadima and Ngada (2017) on Nigeria. This implies that the dynamism of Asian region is similar to Nigerian economy to some extent as well.

6. Conclusion

Conclusively, regarding Asian countries (India, China, Malaysia, Philippines, Pakistan, Thailand, Singapore, Bhutan, Vietnam, and Bangladesh), there is a long-run equilibrium present between economic progress and financial growth. Besides, in the short-run, it was found that inflation controls the relationship in short-run while effect of supply of money was negative of economic growth.

Therefore, it has been implied that increment in the money supply especially broad money, the progress of Asian countries would be affected negatively. However, increment in the GFC is found to have a positive influence on the Asian regions’ economy. Consequently, more investment in the Asian region is recommended considering the untapped potential.

7. Limitations and Future Research Directions

The research was limited to the case of Asian countries, therefore, in future, the evaluation of European countries can be conducted or African region can also be undertaken into consideration.

For financial development, limited indicators have been considered, therefore, other metrics, for instance, bank deposits can be considered in future researches.

In furtherance, limited sample of years has been considered in this study due to limited availability of the data on publicly available sources. Therefore, the enhancement in future studies can be conducted by incorporating dta of more years or changing the frequency of the data to quarterly or monthly. Hence, this research can be improved considerably.References

Abosedra, S., Shahbaz, M., & Sbia, R. (2015). The links between energy consumption, financial development, and economic growth in Lebanon: Evidence from cointegration with unknown structural breaks. Journal of Energy, 2015, 1-15.Available at: https://doi.org/10.1155/2015/965825.

Ahmed, A. A. (2018). Bank-based financial development and economic growth: Time-varying causality analysis for Egypt. International Journal of Economics and Finance, 10(4), 123-135.Available at: https://doi.org/10.5539/ijef.v10n4p123.

Alom, K. (2018). Financial development and economic growth dynamics in South Asian region. The Journal of Developing Areas, 52(4), 47-66.Available at: https://doi.org/10.1353/jda.2018.0051.

Asteriou, D., & Spanos, K. (2019). The relationship between financial development and economic growth during the recent crisis: Evidence from the EU. Finance Research Letters, 28, 238-245.Available at: https://doi.org/10.1016/j.frl.2018.05.011.

Batuo, M., Mlambo, K., & Asongu, S. (2018). Linkages between financial development, financial instability, financial liberalisation and economic growth in Africa. Research in International Business and Finance, 45, 168-179.Available at: https://doi.org/10.1016/j.ribaf.2017.07.148.

Bist, J. P. (2018). Financial development and economic growth: Evidence from a panel of 16 African and non-African low-income countries. Cogent Economics & Finance, 6(1), 1449780.Available at: https://doi.org/10.1080/23322039.2018.1449780.

Borrero, H., & Garza, N. (2019). Growth and distribution endogenously determined: A theoretical model and empirical evidence. Brazilian Journal of Political Economy, 39(2), 344-361.Available at: https://doi.org/10.1590/0101-31572019-2880.

Caporale, G. M., Rault, C., Sova, A. D., & Sova, R. (2015). Financial development and economic growth: Evidence from 10 new European Union members. International Journal of Finance & Economics, 20(1), 48-60.Available at: https://doi.org/10.1002/ijfe.1498.

Dosi, G., Roventini, A., & Russo, E. (2019). Endogenous growth and global divergence in a multi-country agent-based model. Journal of Economic Dynamics and Control, 101, 101-129.Available at: https://doi.org/10.1016/j.jedc.2019.02.005.

Ductor, L., & Grechyna, D. (2015). Financial development, real sector, and economic growth. International Review of Economics & Finance, 37, 393-405.Available at: https://doi.org/10.1016/j.iref.2015.01.001.

Durusu-Ciftci, D., Ispir, M. S., & Yetkiner, H. (2017). Financial development and economic growth: Some theory and more evidence. Journal of Policy Modeling, 39(2), 290-306.Available at: https://doi.org/10.1016/j.jpolmod.2016.08.001.

Eren, B. M., Taspinar, N., & Gokmenoglu, K. K. (2019). The impact of financial development and economic growth on renewable energy consumption: Empirical analysis of India. Science of the Total Environment, 663, 189-197.Available at: https://doi.org/10.1016/j.scitotenv.2019.01.323.

Estrada, G. B., Park, D., & Ramayandi, A. (2010). Financial development and economic growth in developing Asia. Asian Development Bank Economics Working Paper, No. 233.

Galadima, M. D., & Ngada, M. H. (2017). Impact of money supply on economic growth in Nigeria (1981–2015). Dutse Journal of Economics and Development Studies, 3(1), 133-144.

Hasan, R., & Barua, S. (2015). Financial development and economic growth: Evidence from a panel study on South Asian countries. Asian Economic and Financial Review, 5(10), 1159-1173.

Ibrahim, M., & Alagidede, P. (2018). Nonlinearities in financial development–economic growth nexus: Evidence from sub-Saharan Africa. Research in International Business and Finance, 46, 95-104.Available at: https://doi.org/10.1016/j.ribaf.2017.11.001.

Iheanacho, E. (2016). The impact of financial development on economic growth in Nigeria: An ARDL analysis. Economies, 4(4), 26.Available at: https://doi.org/10.3390/economies4040026.

Komal, R., & Abbas, F. (2015). Linking financial development, economic growth and energy consumption in Pakistan. Renewable and Sustainable Energy Reviews, 44, 211-220.Available at: https://doi.org/10.1016/j.rser.2014.12.015.

Lerohim, S. N. F., Affandi, S., & W Mahmood, W. M. (2014). Financial development and economic growth in ASEAN: Evidence from panel data.

Madsen, J. B., Islam, M. R., & Doucouliagos, H. (2018). Inequality, financial development and economic growth in the OECD, 1870–2011. European Economic Review, 101, 605-624.Available at: https://doi.org/10.1016/j.euroecorev.2017.11.004.

Omri, A., Daly, S., Rault, C., & Chaibi, A. (2015). Financial development, environmental quality, trade and economic growth: What causes what in MENA countries. Energy Economics, 48, 242-252.Available at: https://doi.org/10.1016/j.eneco.2015.01.008.

Pradhan, R. P., Arvin, M. B., & Bahmani, S. (2018). Are innovation and financial development causative factors in economic growth? Evidence from a panel granger causality test. Technological Forecasting and Social Change, 132, 130-142.Available at: https://doi.org/10.1016/j.techfore.2018.01.024.

Pradhan, R. P., Arvin, M. B., & Norman, N. R. (2015). The dynamics of information and communications technologies infrastructure, economic growth, and financial development: Evidence from Asian countries. Technology in Society, 42, 135-149.Available at: https://doi.org/10.1016/j.techsoc.2015.04.002.

Samargandi, N., Fidrmuc, J., & Ghosh, S. (2015). Is the relationship between financial development and economic growth monotonic? Evidence from a sample of middle-income countries. World Development, 68, 66-81.Available at: https://doi.org/10.1016/j.worlddev.2014.11.010.

Saud, S., Chen, S., & Haseeb, A. (2019). Impact of financial development and economic growth on environmental quality: An empirical analysis from Belt and Road Initiative (BRI) countries. Environmental Science and Pollution Research, 26(3), 2253-2269.Available at: https://doi.org/10.1007/s11356-018-3688-1.

Schumpeter, J. (1911). The theory of economic development. Harvard Economic Studies (Vol. XLVI): Harvard Economic Studies.

Schumpeter., J. A., & Redvers, O. P. I. E. (1934). Theorie der wirtschaftlichen Entwicklung. the theory of economic development. An Inquiry into Profits, Capital, Credit, Interest, and the Business Cycle... Translated... by Redvers Opie.

Sehrawat, M., & Giri, A. (2015). Financial development and economic growth: Empirical evidence from India. Studies in Economics and Finance.

Sepehrdoust, H. (2018). Impact of information and communication technology and financial development on economic growth of OPEC developing economies. Kasetsart Journal of Social Sciences.

Shahbaz, M. (2015). Electricity consumption, financial development and economic growth nexus in Pakistan: A visit. Bulletin of Energy Economics (BEE), 3(2), 48-65.

Shahbaz, M., Van Hoang, T. H., Mahalik, M. K., & Roubaud, D. (2017). Energy consumption, financial development and economic growth in India: New evidence from a nonlinear and asymmetric analysis. Energy Economics, 63, 199-212.Available at: https://doi.org/10.1016/j.eneco.2017.01.023.

Valickova, P., Havranek, T., & Horvath, R. (2015). Financial development and economic growth: A meta-analysis. Journal of Economic Surveys, 29(3), 506-526.Available at: https://doi.org/10.1111/joes.12068.

Wang, C., Zhang, X., Ghadimi, P., Liu, Q., Lim, M. K., & Stanley, H. E. (2019). The impact of regional financial development on economic growth in Beijing–Tianjin–Hebei region: A spatial econometric analysis. Physica A: Statistical Mechanics and its Applications, 521, 635-648.Available at: https://doi.org/10.1016/j.physa.2019.01.103.

Yang, F. (2019). The impact of financial development on economic growth in middle-income countries. Journal of International Financial Markets, Institutions and Money, 59, 74-89.