Impact of Changes in Exchange Rate on Stock Market: An Empirical Evidence from Indonesia

Armida Amado1*

Looi Mun Choon2

1University of Indonesia, Indonesia. |

AbstractThis paper explores fertility preference and its associated factors among older Nigerian women within the reproductive ages 40 to 49. It considers the impact of proximate factors of place, wealth, education, use of contraceptives, and other associated factors on fertility preference. Using Nigeria Demographic and Health Survey (NDHS 2018) data, responses of 1357women of ages 40-49 years in the couples recode file were considered. Fertility preference is measured by “the desire for another child”. We use descriptive statistics and logistic regression to identify the associating factors and impacts of identified explanatory variables on the desire for another child. Result revealed up to 25% of women within ages 40-49 desire to have another child while 35% uses contraceptives. The desire by older women to have another child is higher in the rural areas than in urban areas while more than 50% with desire for another child have no education and are found practising Islam. Logistic regression result indicates that older women not using contraceptive have higher odd ratio with the desire for another child, those in urban areas have lower odd ratio while women in the Northeast and the Northwest have more than 2.5 chance of desiring for another child than those in the Southwest. This study concludes that the desire for pregnancy at later end of reproductive years must be controlled through women's education and community-based sensitization programs. |

Licensed: |

|

Keywords: |

|

Accepted:15 June 2020 |

|

| (* Corresponding Author) |

Funding: This study received no specific financial support. |

Competing Interests:The authors declare that they have no competing interests. |

1. Introduction

The rate of exchange is basically a currency rate of one country with respect to another country’s currency rate, while, the share market refers the value’s measurement of the section of the stock. There is profound effect on the nation’s economy plus life of the people by share market. In order to expound the market, and to compare specific investment’s return, it is considered an imperative tool that is used by the investors and financial managers (Jain & Biswal, 2016). It has been observed that there are many aspects utilised by various analysts to explore the possible bond or combination among the stock price and convertibility rate. There are various critical components of economy through which the convertibility rate can be affected (Zarei, Ariff, & Bhatti, 2019).

Share market and convertibility rate significantly affect countries, their economies and consequently has impact on economists and investors. The effectiveness of firm greatly depends upon the future prices and movements of convertibility rate. As compare to the economy of developed markets, the economy of growing country is considered much unstable (Jacob & Kattookaran, 2017; Mikhaylov, 2018). It has been observed that towards the growing economy the investors are likely to expand their investment in order elude the risk of loss.

The stock are influenced by various forces, and among them, convertibility rate fluctuation have considerable significance. However, when it comes to the share market and convertibility rate’s relationship, despite of having been discussed widely there is no consensus on their relationship can be seen (Jain & Biswal, 2016; Zarei et al., 2019). The financial theory explains that the convertibility rates and interest should affect the position of the organization. The stock prices of the firm are determined by the upward and downward movements of convertibility rate (Khatri, Kashif, & Shaikh, 2017; Suriani, Kumar, Jamil, & Muneer, 2015). In Indonesia, for the stock prices, the FDI is considered a crucial aspect. Besides, the trend of FDI can considerably be influenced because of changes in convertibility rate. Likewise, due the movement in share price, the convertibility rates are affected.

The interest rate is forced to become higher by the rise in domestic currency’s demand, and due to this, the foreign investors will be attracted eventually to invest and gain maximum advantage (Delgado, Delgado, & Saucedo, 2018; Mikhaylov, 2018). Therefore, against that of foreign currency, the domestic currency’s the convertibility rate encourages, and negative relation is shown by it as suggested Portfolio Balance approach. While, it is advocated by the traditional approach, the market of exchange and the market of stock have positive relationship, and from convertibility rate to share market the causality runs (Bagh, Azad, Razzaq, Liaqat, & Khan, 2017). It has been inferred that there is optimist relation between the convertibility rates and share market when the competitiveness of domestic form increases and domestic currency depreciates. Resultantly, there is great increase in stock prices.

There is another approach exists, which is known as Asset Market approach, and it is proposed by this approach which states, there are no interactions between the convertibility rates and share market or a very weak association (Gong & Dai, 2017; Jamil & Ullah, 2013). The reason is that there are different factors that drive both the variables (Bala Sani & Hassan, 2018). The attention of many scholars has been captured by the share market and convertibility rate’s relationship, and due to the increasing importance of financial system, these scholars are propelled to study it.

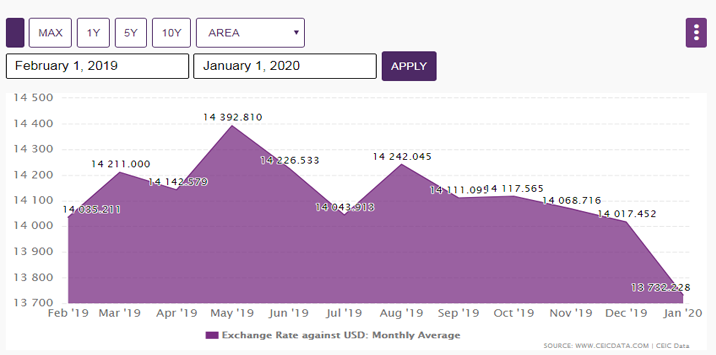

The stock exchange in Indonesia was founded in 2007. In the recent times, there are 656 companies listed in this stock exchange. In the year of 2017, there were 628,346 domestic investors based on single identification number. While, in the year of 2019, there has been an increase of 30 percent in the number of total stock investors, and they are in number 1.1 million (Tempo.Co, 2020; Tribunbisnis, 2020). However, since the beginning of 2020, there is 12.49% decrease in the share market (Trading Economics, 2020).

Figure-1. Performance of Indonesia stock exchange in the year of 2020.

Source: Trading Economics (2020).

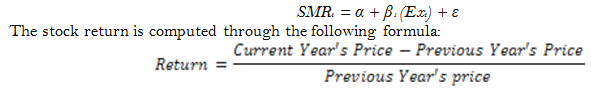

The main intent of this study is to furthermore investigate the convertibility rate and stock price’s relationship within the context of Indonesia share market. In the present research, by employing the most recent available data, the current scenario is tired to be analysed. Furthermore, the following research is aimed towards assessing the changes influence in the convertibility rate on market of stock considering the evidence from Indonesia. In the contemporary business world, there is major role in the international businesses globally played by the convertibility rate and share market. Country’s currency rate refers the convertibility rate which differs with another country (Azizan & Sorooshian, 2014; Wong, 2013). Moreover, the stock prices and the face value of the organizations can be influenced by various factors among which ups and downs in the convertibility rate is the significant factor. Currently, the Indonesian rupiah fell to the weakest level against the dollars for more than 20 years which prompts the Central bank of the country to intervene. The current exchange rate of the country is expressed as,

The precautionary measure will able be taken before the crisis spreads as this research will provide the awareness to understand the association of exchange or convertibility rate and share market. The related paper is reviewed in the section 2, whereas in chapter 3, methodology and data is discussed. In the section 4 of this paper, findings and results are analysed, while the last section is based on summary and conclusion.

The research question of the study is designed as,

Q. What is the association between fluctuations in exchange rate and stock market in Indonesia?

2. Literature Review

When it comes to the literature pertaining to the exchange rate’s impact on the share market, there are considerable amount of studies can be found. There are various factors that has substantial importance, such as variables of macroeconomics; corporate action and the measurement of risk in predicting the return of share market (Khan, 2019; Khatri et al., 2017). It is analysed that the return of share market to a greater extent can be stabilised by the investors through finding the predictable components (Kwofie & Ansah, 2018; Tang & Yao, 2018). However, in various existing researches and forecasting models, certain critiques exist.

There are various studies conducted to show the association between fluctuations in convertibility rate and share market, and hence, there are many different views in this regard. Najaf and Najaf (2016) suggests in his research that in convertibility rate and share market, there are no considerable interactions. Furthermore, Bhattacharya and Mukherjee (2003) opines in their study that there are zero interactions between the financial sector of currency exchange and the market of stock. In contrast to these aforementioned studies, Jain and Biswal (2016) explains in their study that the stock prices and stock rate has association by using nonlinear least square method, but this relation was found very weak. While, in the study of Kalra and Gupta (2019) there is significantly pessimist association found among the convertibility rate and stock prices.

Furthermore, the above mentioned information, there is a study conducted by Saleem and Alifiah (2017) and in the study it was found that there were significant differences determined across industries by considering exchange rate’s impact on multinational firm. Furthermore, it has been suggested that the developing countries and emerging countries are experiencing more exchange rate movements’ exposure as compare to the developed countries (Khan, 2019). Furthermore, it has been observed that between the two variables, there is a bidirectional relationship exists, and there is little or more impact on each other from both the variables.

There are various studies in which the association among the dollar’s convertibility rate and change in indices in share prices has been focused on. It has been observed that the flow-oriented convertibility rate model and oriented convertibility rate model are two types of model in which the convertibility rate and stock index’s relationship is presented (Bagh et al., 2017; Mitra, 2017; Sarrafi & Mehregan, 2018). This is indubitable that share market is the market that fluctuates on continuous basis. The role of country’s economic and political conditions have substantial value in the fall and rise of the share market, but to measure political changes or occurrences is a formidable task. There are variables, such as economic and financial those have been focused by most of the previous studies.

The country’s economy is reflected by the share market. The significance of share market has been increased from the last few decades, and the gap for research in the development of growth of economy and share market is created by it. It has been found that on the basis of macro-economic factors, the rate of interest, consumer index prices and the level of inflation is gauged along with the stock indexes and exchange rates (Hai & Thuy, 2018; Huang, An, Gao, Wen, & Hao, 2017). It is believed by most of the investors that the economic events influence the share market prices. However, it has been analysed that the investors’ decision towards investment is impacted by the macro-economic factors (Jacob & Kattookaran, 2017). The reason is that fluctuation in convertibility rates greatly depends upon the macroeconomic factors.

There are various studies in which it has been opined that there is a great exposure of convertibility rate can be seen in small open economies. However, there is less impact of variations in the share market of developed countries. There is variation in the relation among the exchange and share market (Market, 2018). The factors, such as the relations with the domestic conditions and international world, economic condition, geographical arena and others are all considered the determinants of the relationship between both of them. Furthermore, the trade volume, economic relations, equity, assessment of risk, etc. could be the most important reasons behind the results’ inconsistencies between the different countries (Aimer, 2019). The both variables could be either unidirectional, bidirectional or multidirectional, the impact of them may not be estimated.

In various studies convertibility rate and share market have unidirectional association and from the changes of prices level to the changes in convertibility rate such relation runs (Bagh et al., 2017; Jamil & Ullah, 2013; Suriani et al., 2015). While, in some studies the connection regarding the stock prices and convertibility rate is found to be as dual and bidirectional in the short run (Jain & Biswal, 2016; Khan, 2019; Khatri et al., 2017). In addition to this, there are also some studies where this relation is found as significantly strong (Anjum, Ghumro, & Husain, 2017; Kumar, 2019). Kemal, Haider, and Khalid (2004) in his research suggested that due to the change in prices, rate of interest, trade balances and foreign reserves, the movement of exchange rate takes place. It has been found in his research that between the executive prices and nominal exchange rate, there is no significant correlation exists, and correlation between the changes in real exchange rate and the convertibility rate that is nominal, there is high correlation.

Thus, the fact that there are great variations and the diversity of opinions about the exchange rates and share market relationship can be corroborated by the above mentioned information. Consistent with the view, it would not be inappropriate to opine that the how share market is influenced by rate of exchange cannot be determined easily.

3. Data and Method

In order to carry out this research, the researcher has focused on quantitative research design based on secondary available information. The main sources of the data will be Federal Reserve economic data, World Bank and trading-economics. The data for the variables will be collected from 1995 to 2018 on the variables described below. Here it becomes important to mention that monthly data for the aforementioned variables of duration1995 to 2018 was collected with from the perspective of Indonesia. Further, the exchange rate was collected as real effective exchange rate whereas; the returns from the share market were collected for the specific tenure.

The empirical equation is modelled as follows:

ARDL, ADF, and Granger Causality will be applied.

As discussed, the researcher has intended to execute the listed test for the purpose of processing the time series. In realisation of this, the description for each test or applied method has been presented as follows:

3.1. Unit Root Test: Augmented Dickey-Fuller (ADF)

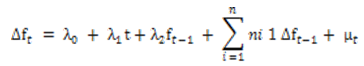

As discussed, the current study deals with analysing the impacts of variations in exchange rates on the share market with respect to the case of Indonesia. In order to comprehend the current research phenomenon, the researcher has gathered time series for the variables share market and exchange rates. However, while proceeding to econometric models and time series, different assumptions are required to be fulfilled. Among which, one of the assumptions is also considered consistency of time series. With reference to the findings of Li, Zhang, He, and Wang (2017) the consistency of time series is usually evaluated through the Augmented Dickey-Fuller test (ADF), ADF is considered to be an effective technique which through the supposition of null hypothesis suggests that time-series entails unit-roots. With this supposition or acceptance/rejection of the null hypothesis, it is distinguished which time series is stationary or which is non-stationary. The mathematical model on which the ADF techniques relies is presented as followed:

The expression above entails ![]() which can be defined as the difference operator. Furthermore, the equation also highlights

which can be defined as the difference operator. Furthermore, the equation also highlights ![]() which can be described as random error of stationary. Further,

which can be described as random error of stationary. Further, ![]() in the equation above reflects the non-stationary series.

in the equation above reflects the non-stationary series.

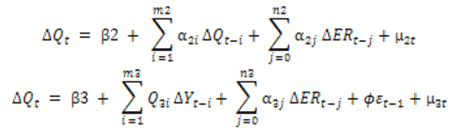

3.2. Autoregressive Distributed Lag (ARDL)

The study is concerned with determining the changes that exhibit on the share market due to the changes occur in exchange rates. In this regard, the long terms association between the variables is required to be determined. And, the Autoregressive Distributive Lag (ARDL) is considered to be an essential statistical model that forms the basis with the iterative maximising to predict the one-time series from that of the other. In this concern, the standard log-linear function has also been presented below:

The expression above entails ![]() which can be described as the log of the share market. Further,

which can be described as the log of the share market. Further,![]() indicates usual error terms while

indicates usual error terms while ![]() is the parameter estimate.

is the parameter estimate.

In light of the findings of Nkoro and Uko (2016) the presence of the long term association is usually determined through autoregressive distributed lag (ARDL). The preference given to the ARDL approach in the context of the current research is justified for different reasons. For instance, the ARDL approach is preferably utilised for its robustness and in determining the long term association. As discussed, the technique is distinct because of its iterative approach and lead and lag concept, in this context, the ARDL has been utilised in the current research to facilitate the researcher in determining both the short term and long term association.

Furthermore, the cointegration association between ![]() and the independent variable of the study i.e. share market has also been represented. Further, the long term and short term dynamics have also been presented through the two mathematical models respectively:

and the independent variable of the study i.e. share market has also been represented. Further, the long term and short term dynamics have also been presented through the two mathematical models respectively:

Here ![]() directs as the statistically significant coefficient error.

directs as the statistically significant coefficient error.

4. Results

4.1. Descriptive Statistics

The table below Table 1 highlights some of the important statistical figures that can help in comprehending the data involved in a time series. The table below highlights mean, maximum, minimum and standard deviation for the concerned time series. The mean for exchange rate fluctuation has been computed as 0.050%. Further, the maximum value and the minimum values have been computed as 13.343% and -17.556% respectively. In addition to this, the standard deviation of 2.251% has also been computed. On the basis of this obtained computed results, it can be inferred that the value within its time series deviates significantly from its mean value. It is mainly because of the significant difference between the maximum and minimum values for exchange rate fluctuations.

For share market, the mean has appeared as -0.281%. In addition, the maximum value has been computed as 24.744% while the minimum value has been obtained as 43.217%. As far as standard deviation is a concern, the deviation of 8.123% has also been computed. Since there is a considerable difference between the maximum and minimum value. Meanwhile, the standard deviation of 8.123% is also high enough. From this perspective, it can be stated that values within the time series of stock returns deviate significantly from its mean.

Exchange Rate Fluctuations |

Stock Returns |

|

| Mean | 0.050% |

-0.281% |

| Maximum | 13.343% |

24.744% |

| Minimum | -17.556% |

-43.217% |

| Std. Dev. | 2.251% |

8.123% |

4.2. Unit Root Testing

As already discussed, ADF is considered to be an essential statistical technique which by identifying the unit-roots helps in claiming evaluating the consistency in the time series. It has also been discussed that the ADF technique supposes that the null hypothesis entails unit-roots. On the basis of the obtained p-values Table 2 for the time series exchange rate fluctuations (0.000), it can be stated that time series does not entail roots. It has been because of the reason that p-value has been obtained lesser than the threshold of 0.05 thereby suggesting to not accept the null hypothesis which emphasis that time series entails unit-roots. As time-series does not entail unit-roots therefore, it is claimed that data within the time series is stationary.

Upon further investigation for the time series stock returns, the p-value has also appeared as 0.000 Table 2. Since the obtained p-value has also been appeared as lesser than the threshold of 0.05 therefore, the null hypothesis suggesting time series entails unit is rejected. As the time series for the share market does not contain unit-roots thus, it can be advocated that data time series possess stationarity.

| Unit Root testing | T-statistics |

p-Value |

| Exchange Rate Fluctuations | -13.902*** |

0.000 |

| Stock Returns | -16.426*** |

0.000 |

| Note: ***: showing significance at 1%; **: showing significance at 5%; *: showing significance at 10% |

4.3. Auto-Regressive Distributed Lag Model

As already discussed, ARDL is considered an essential statistical model that significantly helps in determining whether and how the regressand is predicted by regressors along with the lagged value of dependent variable. In this regard, the table below elucidates the developed ARDL model which has mainly been developed for the purpose of determining long term association among convertibility rate fluctuations and share market.

Based on the below results Table 3 it is inferred that the convertibility rate has a long term effect on the share market. It has been because of the p-value which has been appeared adequate at the threshold level of 5%. Upon assessing the developed model, the value of R-square, adjusted R-square and its F-statistic are also required to be considered as these parameters help in evaluating the extent the developed model is significant. On the basis of the obtained R-square of 3.14 %, it can be suggested that fluctuations of convertibility rates bring 3.14 % variances in the share market. In addition, with the adjustment of errors, the variance further reduced to 2.16 %. However, on the basis of the obtained f-statistics 3.20 [0.02], it can be suggested that there is a big effect of the convertibility rate’s fluctuations on the share market of Indonesia. Nonetheless, it has also been found that the coefficient value for the convertibility rate appeared in the negative (-0.001). Moreover, the inclusion of trend is also found to have a significant influence (p-value < 0.05). This implies that there is a good but negative long term effect of convertibility rate fluctuation on the share market of Indonesia.

| Optimal Lag Order of the Model: ARDL (1, 0) | ||||

| Variable | Coefficient |

Std. Error |

t-Statistic |

Prob.* |

| Stock Return (-1) | 0.029 |

0.058 |

0.508 |

0.612 |

| Exchange Rate Fluctuation | -0.001** |

0.001 |

-2.430 |

0.016 |

| C | 0.101** |

0.049 |

2.060 |

0.040 |

| @TREND | 0.000** |

0.000 |

2.507 |

0.013 |

| R-squared | 3.14% |

F-statistic |

3.20 |

|

| Adjusted R-squared | 2.16% |

Prob (F-statistic) |

0.02 |

|

| Note: ***: showing significance at 1%; **: showing significance at 5%; *: showing significance at 10% |

5. Discussion

The study deals with determining the association between exchange rates and the share market. Drawing on literature, it can be inferred that prior researchers have made considerable attempts in determining the causality between the concerned variables. In the current research, the researcher by realising the importance of the two variables has intended to determine the association from the perspective of Indonesia. The study findings have been constructed on the basis of the supposition that a huge impact of fluctuations on the share market of Indonesia. From this perspective, the study found that there is a long-run link between the variables. Although, it has also been found that the convertibility rate is significant at its level. This, therefore, has inferred that the convertibility rate has a long term association with the share market. Nonetheless, it has also been found the long term association between the convertibility rate and share market is negative.

In the literature section above, the findings of Bhattacharya and Mukherjee (2003) have also been highlighted where it has been inferred that there is no substantial interaction among stock price and the financial sector or currency exchange. However, the findings of the current research also suggest that there is a long term association among changes in convertibility rates and share market. In this perceptive, the findings of Bhattacharya and Mukherjee (2003) can contradict with the current findings that have been undertaken in the context of Indonesia.

However, the literature also highlights one of the findings which provides a similar viewpoint from the aforementioned findings. The findings of Jain and Biswal (2016) resulted that the relationship among share prices and stock rate exists. Their findings were based on non-linear least square method meanwhile, the weak link among the variables was confirmed by their findings. Similarly, the findings of the current research also suggest that there a long term association between the fluctuations in convertibility rates and the share market. In addition, the findings of the aforementioned research also found that there is a thin but negative connection between the variables. Likewise, the current research findings, it has also been found that the substantial but negative association exists between the convertibility rate and the share market in the context of Indonesia. From this perspective, it can be concluded that the findings of the current research are well aligned with the prior findings despite they were constructed in different contexts and geographical locations.

6. Conclusion

The study that is the effects of fluctuations in the convertibility rate on the share market has proceeded in the context of Indonesia. The researcher adopted the quantitative research design where the time series from1995 to 2020 were collected for the variable exchange rate (real effective exchange) and share market (return). The study developed the ARDL method to determine the long term and among the variables. The findings of the current research suggest that there is long-run association between the exchange rate’s fluctuations and share market of Indonesia. The study has found that when share market was dependent on its lag, exchange rate fluctuations has a long-run association with the share market. The findings of the current research are based on the context of Indonesia. However, there are also several other prior studies that have intended to comprehend the same research phenomenon. The findings of the current research are also well aligned with the prior findings where the researchers have also intended to determine the causal connection of exchange rate fluctuations with the share market.

7. Limitations and Future Research Directions

The current study has been undertaken in the context of Indonesia. The outcomes of the current study can be applied with full confidence to the context of Indonesia only. However, while applying the current research to a different context and geographical location, there are some definite limitations. It has been due to the reason that the time series for the share market and real effective convertibility rate were collected mainly from the perspective of Indonesia. In this regard, while applying the current findings of different research contexts, the differences and dissimilarities do exist. Additionally, in the current research, time series from the years 1995 to 2018 have been gathered. However, there is an opportunity for future researchers to further enhance or exceed the number of observations in order to provide a more comprehensive viewpoint regarding the research contexts. As discussed, the current study has mainly been executed in the context of Indonesia. However, there is also an opportunity for future researchers to also execute a comparative study in order to acquire more comprehensive and in-depth views regarding the research context.References

Aimer, N. M. (2019). The impact of exchange rate volatility on stock prices: A case study of Middle East countries. Asian Development Policy Review, 7(2), 98-110.Available at: https://doi.org/10.18488/journal.107.2019.72.98.110.

Anjum, N., Ghumro, N. H., & Husain, B. (2017). Asymmetric impact of exchange rate changes on stock prices: Empirical evidence from Germany. International Journal of Economics and Financial Research, 3(11), 240-245.

Azizan, N. A., & Sorooshian, S. (2014). Stock Market performance and modern portfolio theory: Case on Malaysian stock market and Asian indices. WSEAS Transactions on Business and Economics, 11(303), 2224-2899.

Bagh, T., Azad, T., Razzaq, S., Liaqat, I., & Khan, M. A. (2017). The impact of exchange rate volatility on stock index: Evidence from Pakistan stock exchange (PSX). International Journal of Academic Research in Accounting, Finance and Management Sciences, 7(3), 70-86.Available at: https://doi.org/10.6007/ijarafms/v7-i3/3150.

Bala Sani, A., & Hassan, A. (2018). Exchange rate and stock market interactions: Evidence from Nigeria. Arabian Journal of Business and Management Review, 8(1), 334.

Bhattacharya, B., & Mukherjee, J. (2003). Causal relationship between stock market and exchange rate, foreign exchange reserves and value of trade balance: A case study for India. Paper presented at the Fifth Annual Conference on Money and finance in the Indian Economy.

CEIC. (2020). Indonesia exchange rate against USD [1967 - 2020] [Data & Charts]. [online] Ceicdata.com. Retrieved from: https://www.ceicdata.com/en/indicator/indonesia/exchange-rate-against-usd . [Accessed 4 Mar. 2020].

Delgado, N. A. B., Delgado, E. B., & Saucedo, E. (2018). The relationship between oil prices, the stock market and the exchange rate: Evidence from Mexico. The North American Journal of Economics and Finance, 45, 266-275.Available at: https://doi.org/10.1016/j.najef.2018.03.006.

Gong, P., & Dai, J. (2017). Monetary policy, exchange rate fluctuation, and herding behavior in the stock market. Journal of Business Research, 76, 34-43.Available at: https://doi.org/10.1016/j.jbusres.2017.02.018.

Hai, N. T. T., & Thuy, D. T. T. (2018). Analysis of the impact of exchange rate and interest rate on stock return in Vietnam stock market. Hong Duc University Journal of Science(4).

Huang, S., An, H., Gao, X., Wen, S., & Hao, X. (2017). The multiscale impact of exchange rates on the oil-stock nexus: Evidence from China and Russia. Applied Energy, 194, 667-678.Available at: https://doi.org/10.1016/j.apenergy.2016.09.052.

Jacob, T., & Kattookaran, T. P. (2017). Dynamic relationship between exchange rate and stock returns: Empirical evidence from Indian stock exchange. Anvesha, 10(4), 23-31.

Jain, A., & Biswal, P. (2016). Dynamic linkages among oil price, gold price, exchange rate, and stock market in India. Resources Policy, 49, 179-185.Available at: https://doi.org/10.1016/j.resourpol.2016.06.001.

Jamil, M., & Ullah, N. (2013). Impact of foreign exchange rate on stock prices. Journal of Business and Management, 7(3), 45-51.Available at: https://doi.org/10.9790/487x-0734551.

Kalra, M., & Gupta, S. (2019). Casual relationship between exchange rate and stock index prices. Doctoral Dissertation.

Kemal, M. A., Haider, R. M., & Khalid, A. M. (2004). Exchange rate behaviour after recent float: The experience of Pakistan [with Comments]. The Pakistan Development Review, 43(4II), 829-852.Available at: https://doi.org/10.30541/v43i4iipp.829-852.

Khan, M. K. (2019). Impact of exchange rate on stock returns in Shenzhen stock exchange: Analysis through ARDL approach. International Journal of Economics and Management, 1(2), 15-26.

Khatri, S. N., Kashif, M., & Shaikh, A. S. (2017). The exchange rate as significant predictor of movement in stock market indices in South Asian Countries: An econometric analysis. Journal of Business Strategies, 11(2), 107-123.

Kumar, S. (2019). Asymmetric impact of oil prices on exchange rate and stock prices. The Quarterly Review of Economics and Finance, 72, 41-51.Available at: https://doi.org/10.1016/j.qref.2018.12.009.

Kwofie, C., & Ansah, R. K. (2018). A study of the effect of inflation and exchange rate on stock market returns in Ghana. International Journal of Mathematics and Mathematical Sciences.

Li, B., Zhang, J., He, Y., & Wang, Y. (2017). Short-term load-forecasting method based on wavelet decomposition with second-order gray neural network model combined with ADF test. IEEE Access, 5, 16324-16331.Available at: https://doi.org/10.1109/access.2017.2738029.

Market, F. O. S. (2018). Impact of exchange rate fluctuation on stock market volatility-a study to predict the economic Scenario In India. International Journal of Pure and Applied Mathematics, 118(18), 4309-4316.

Mikhaylov, A. (2018). Volatility spillover effect between stock and exchange rate in oil exporting countries. International Journal of Energy Economics and Policy, 8(3), 321-326.

Mitra, R. (2017). Stock market and foreign exchange market integration in South Africa. World Development Perspectives, 6, 32-34.Available at: https://doi.org/10.1016/j.wdp.2017.05.001.

Najaf, R., & Najaf, K. (2016). A study of exchange rates movement and stock market volatility. Asian Journal of Management, Engineering & Computer Sciences, 1(1), 32-38.

Nkoro, E., & Uko, A. K. (2016). Autoregressive Distributed Lag (ARDL) cointegration technique: Application and interpretation. Journal of Statistical and Econometric Methods, 5(4), 63-91.

Saleem, F., & Alifiah, M. N. (2017). Causal relationship between macroeconomic variables and stock prices in Pakistan. Journal of Humanity, 15(1).

Sarrafi, Z. M., & Mehregan, N. (2018). Asymmetric effect of exchange rate risk on the stock index of export-oriented industries using the NARDL model. Journal of Economic Modeling Research, 9(33), 89-116.Available at: https://doi.org/10.29252/jemr.9.33.89.

Suriani, S., Kumar, M. D., Jamil, F., & Muneer, S. (2015). Impact of exchange rate on stock market. International Journal of Economics and Financial Issues, 5(1S), 385-388.

Tang, X., & Yao, X. (2018). Do financial structures affect exchange rate and stock price interaction? Evidence from emerging markets. Emerging Markets Review, 34, 64-76.Available at: https://doi.org/10.1016/j.ememar.2017.10.004.

Tempo.Co. (2020). IDX: Stock investors in domestic capital market reaches 500,037. Retrieved from https://en.tempo.co/read/805204/idx-stock-investors-in-domestic-capital-market-reaches-500037.

Trading Economics. (2020). Indonesia stock market (JCI). Retrieved from https://tradingeconomics.com/indonesia/stock-market.

Tribunbisnis. (2020). The stock exchange said investor shares reached 1.1 Million, transaction average of Rp 9.1 Trillion / Day. Retrieved from https://www.tribunnews.com/bisnis/2019/12/30/bursa-efek-sebut-investor-saham-capai-11-juta-rata-rata-transaksi-rp-91-triliunhari . [Accessed 6 March 2020]

Wong, H. T. (2013). Real exchange rate misalignment and economic growth in Malaysia. Journal of Economic Studies, 40(3), 298-313.Available at: https://doi.org/10.1108/01443581311283934.

Zarei, A., Ariff, M., & Bhatti, M. I. (2019). The impact of exchange rates on stock market returns: new evidence from seven free-floating currencies. The European Journal of Finance, 25(14), 1277-1288.Available at: https://doi.org/10.1080/1351847x.2019.1589550.