Monetary Policy Effectiveness and Financial Inclusion in Nigeria: FinTech, ‘the Disrupter’ or ‘Enabler’

Tonuchi E. Joseph1*

Nwolisa U. Chinyere2

Obikaonu C. Pauline3

Alase, A. Gbenga4

1Department of Statistics, Central Bank of Nigeria, Abuja; Department of Economics, University of Nigeria, Nsukka, Nigeria. |

AbstractThe extent monetary policy is effective in achieving financial inclusion has been scarcely investigated in the literature. Hence, this study examined the extent monetary policy is effective in achieving financial inclusion in Nigeria and whether FinTech improves or impedes this relationship. Quarterly time series data spanning from 2009 to 2019 from the Central Bank of Nigeria were used for estimations. Johansen’s cointegration test and fully modified OLS were used to carry out the analysis. The result shows that measures of monetary policy effectiveness, such as inflation rate and lending rate all had a significant effect on financial inclusion in the country. It was also discovered that accounting for FinTech in the model improves the effectiveness of the monetary policy on financial inclusion in Nigeria, contrary to popular assertion that Fintech impedes monetary policy effectiveness. The study concludes by emphasizing the role of monetary policy in achieving financial inclusion in Nigeria. |

Licensed: |

|

Keywords: JEL Classification: |

|

Received: 2 December 2020 |

|

| (* Corresponding Author) |

Funding: This study received no specific financial support. |

Competing Interests: The authors declare that they have no competing interests. |

1. Introduction

Monetary policy has generally been referred to as central banks’ actions to influence the availability and cost of credit in the economy with the intent of influencing aggregate demand. However, for its effect to be felt in the economy, it usually follows a transmission channel. Bondt (1999) states that the transmission of monetary policy conventionally is theorized to be through two main channels; direct monetary transmission and the interest rate channels. The direct monetary transmission channel deals with the use of expansionary or contractionary monetary policy to influence money supply directly, which alters the aggregate spending rate in the economy, hence affecting economic growth. The second channel of monetary policy transmission is the interest rate mechanism. Here, when the prevailing interest rate in the economy is altered, the money market’s lending and borrowing rates also become altered (Peters, Yaaba, Adetoba, Tomologu-Okunomo, & Tonuchi, 2020). In economic theory, when the interest rates in the economy are reduced, the level of consumption in the economy is likely to rise because of a reduction in the cost of capital and the propensity to save. However, an increase in the interest rate is likely to reduce the rate of investment and consumption in the economy, hence affecting aggregate demand negatively (Peters et al., 2020).

Monetary policy is said to be effective when policies by the central banks tend to stabilize the economy, especially the components of the financial aspect such as the price level, investment, and bank lending rates (Peters et al., 2020; Tahir, 2012). A significant component of the financial aspect of the economy that exerts a great influence on the overall state of the economy is the price level. Hence, price stabilization has become a significant focus of monetary authorities, with the use of inflation as a means of checking the effectiveness of the monetary policy is prevalent in the literature (Rasche & Williams, 2007; Tahir, 2012). However, its effectiveness is not to be in the short-run because of numerous shocks that might influence the price level that originates from numerous sources, both monetary and nonmonetary. While monetary authorities might not be held responsible for price fluctuations in the short-run, they are held accountable for sustained inflation in the long-run (Chileshe & Olusegun, 2017). Hence, the long-term inflation rate has been used to establish the effectiveness of monetary policy with inflation targeting as the major tool (Rasche & Williams, 2007). Anarfo, Abor, Osei, and Gyeke-Dako (2019) suggested that the effectiveness of monetary policy in achieving the objective of influencing aggregate demand depends on the rate of financial inclusion in an economy. The extent to which financial inclusion can be achieved also depends on the effectiveness of the monetary policy, which suggest a two-way causation between both.

In Nigeria, despite recent success in the rate of financial inclusion in line with global trends, a considerable section of the Nigerian Population is financially excluded. Approximately 36.8 percent of the adult population in the country are currently financially excluded in Nigeria (Central Bank of Nigeria, 2018). There are also demographic and regional disparities in the rate of financial inclusion in Nigeria. For instance, the CBN National Financial Inclusion Strategy 2018 report revealed that women account for 55.1 percent of the financially excluded individuals in Nigeria. Similarly, Northwest and Northeast constitute the most financially excluded region in the country, where approximately 45 and 38 percent of those financially excluded were from these two zones, respectively.

Hence, the main objective of this study is to investigate the extent monetary policy is effective in achieving financial inclusion in Nigeria and whether FinTech improves or impedes this relationship. We hypothesize that monetary policy is effective in driving financial inclusion and that growth in financial technologies not only has a significant positive effect on financial inclusion but also enhances the nexus between monetary and financial inclusion in Nigeria. Although few studies, such as Mbutor and Uba (2013) have established the relationship (impact of) financial inclusion on the effectiveness of monetary policy in Nigeria, to the best of the researcher’s knowledge, no study has investigated the extent monetary policy is effective in driving financial inclusion in the country. Also, no study has tried to investigate whether growth in financial technologies has improved the effectiveness of monetary policy in driving financial inclusion.

Accounting for financial technology is paramount, giving the upsurge of disruptive financial technologies disrupting the traditional financial value chain. Tonuchi (2020) noted that FinTech provides opportunities for reaching the unbanked population quickly, especially using mobile money and other financial technology. FinTech provides a platform for a wide range of innovative services that ensures the simplicity and convenience of all financial procedures, such as turning investments into crowdfunding, making microcredit available to the informal economy participants (Elmirzaev, 2019; Tonuchi, 2020). The rest of the paper is grouped into literature reviews, methodology, analysis, and conclusion.

2. Literature Review

2.1. Financial Inclusion in Nigeria: What we know

First, financial technology thereafter referred to as FinTech, is the application and integration of technology to improve the provision of financial services and products (Jerene & Sharma, 2020; Thakor, 2020). It includes those financial services and products delivered through electronic-based platforms like mobile banking, mobile money, internet banking, debit, and credit banking, among others (Thakor, 2020). In the value chain of FinTech, Jerene and Sharma (2020) noted that FinTech covers areas such as, (i) credit, deposits, and capital raising services; (ii) investment management services; (iii) payment, settlement, and clearing services; (iv) recently insurance.

Globally, FinTech has generated more than $US100billion funds (EFInA, 2018) and within the space of five (5) years; 2014-2019, Nigeria FinTech has generated over $US600million, attracting $US122million of the $US491.6 million start-up investment raised by African FinTech companies in 2019. This means that Nigeria attracted 25 percent of the FinTech funding in Africa behind Kenya, which raised $US149million (Kola-Oyeneyin, Kuyoro, & Olanrewaju, 2020). Total FinTech funding increased to $US460million in 2019 from $US306million raised by FinTech startup in 2018 (Green, 2020; Kola-Oyeneyin et al., 2020). As of 2019, 80 percent of Nigeria’s FinTech market comprised of 36 percent digital retail payment, 25 percent lending, 19 percent payment infrastructure (EFInA, 2018).

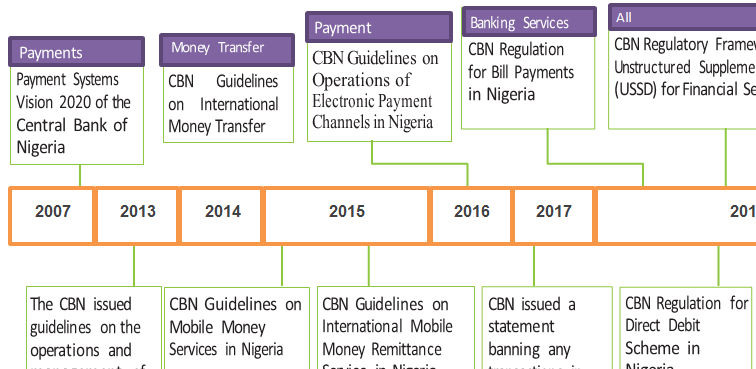

While the industry has performed very well in the last four years, data revealed that the industry accounted for only 1.25 percent of retail banking revenue in 2019, indicating a huge potential for FinTech in the banking industry. The low penetration in retail banking revenue indicates that the industry is still challenged by some constraints. Top among them includes low access to funding, information inadequacy, corporate governance issues, intellectual property right, strategic partnership, and appropriate regulation (EFInA, 2018). Other constraints identified include infrastructural deficiency, security concerns, cost of services, poor stakeholder management, lack of public awareness, poor complaint resolution, overwhelming interphase, and funding (Jerene & Sharma, 2020; Tonuchi, 2020). On the regulation issues, several efforts have been made by regulatory bodiestodevelop a suite of regulations to project the industry. Among the top regulation is as presented in Figure 1.

Figure-1. FinTech Regulatory Framework from 2007 to date.

2.2. Financial Inclusion in Nigeria: What we Know

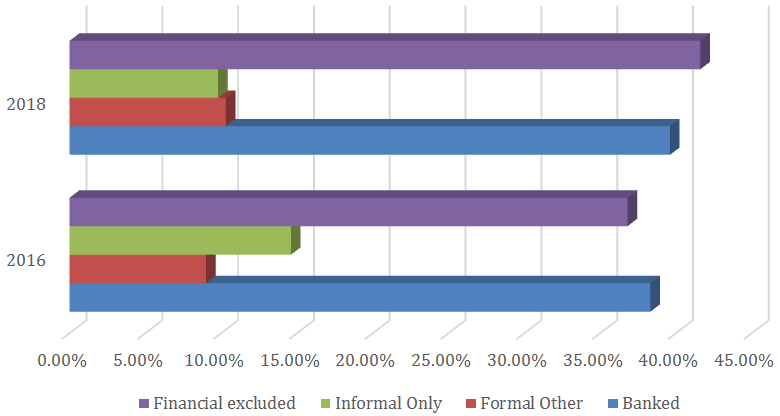

One of the driving forces behind FinTech emergence is the challenge of financial inclusion facing developing countries, particularly Nigeria (Jerene & Sharma, 2020; Tonuchi, 2020). Data from the Central Bank of Nigeria (2018) revealed that financial inclusion is at 63.2 percent increasing 58.4 percent in 2016, which means that financial exclusion rate in Nigeria is about 36.8 percent (Central Bank of Nigeria, 2018). The data further revealed that North West and North East are the regions with the most financially excluded individuals at 38 and 45 percent, respectively. The current financial exclusion rate of 36.8 percent in the country is an indication that progress has been made significantly in that regard, from 53 percent in 2008 to 46.3 percent in 2010 down to the current 36.8 percent (Central Bank of Nigeria, 2018). Figure 2 below presents the financial inclusion state of Nigeria.

Figure-2. Financial inclusion in Nigeria 2016 to 2018 data.

According to Central Bank of Nigeria (2018) report, Nigeria target to achieve 80 percent financial inclusion rate by the end of 2020 from the baseline target of 46.3 percent in 2010. While other target set by the institution is as presented in Table 1.

| Targets | 2010 |

2015 |

2020 |

|

| % of Total Adult | Payment | 21.6% |

53% |

70% |

| Population | Savings | 24% |

42% |

60% |

| Credit | 2% |

26% |

40% |

|

| Insurance | 1% |

21% |

40% |

|

| Pension | 5% |

22% |

40% |

|

| Units per 100,000 | Bank Branches | 6.8 |

7.5 |

7.6 |

| Adults | MFB branches | 2.9 |

4.5 |

5.0 |

| ATMs | 11.8 |

88.5 |

203.6 |

|

| POS | 13.3 |

442.6 |

850.0 |

|

| Mobile Money/Bann Agents | 0 |

31 |

476 |

|

| % of Population | KYC ID | 18% |

59% |

100% |

| Source: Central Bank of Nigeria (2018) |

Given that high financial inclusion has been linked to sustainable economic development and growth in developed countries (Barajas, Beck, Belhaj, & Ben Naceur, 2020), the IMF and World Bank have over the year, advocated the need for high financial inclusion as a strategy for sustainable economic development. Nigeria has made several policies through Central Bank of Nigeria, targeting the minimal reduction of financial exclusion in the country.

The first effort made to increase financial inclusion in Nigeria was the introduction of rural banking in 1977 aimed at establishing at least one bank branch in each of the local government areas. In 1989, the peoples’ bank of Nigeria was established to increase the mobilization of rural savings and deposits. This was followed by the establishment of community banks and microfinance banks. While these measures indirectly aimed at increasing financial inclusion by taking the banks closer to the rural dwellers, it was not until 2005 that there was a clear policy framework to guide the country towards the achievement of financial inclusion in the country (Abiola, Adedoyin, Umoren, & Areghan, 2019).

It was in 2005 that financial inclusion was incorporated as one cardinal objective of Financial System Strategy 2020 (FSS 2020). Abiola et al. (2019) noted that of the six initiatives adopted by FSS 2020 to strengthen the domestic market, four directly is aimed at financial inclusion. These include enhancement of the payment system, development of the credit system, encouragement of saving culture, development of different financial products. Other policies like FinTech regulation are not explicitly designed for financial inclusion, but the policymaker views FinTech emergence, particularly mobile money, as a driver of financial inclusion in the country.

It is clear from the discussion so far that despite several efforts made to increase financial inclusion in the country, about 36.6 million Nigerians are still financially excluded from the financial sector, whether formal or informal financial markets. Among the top challenges identified hindering financial inclusion strategies include macroeconomic and structural issues like double-digit inflation, growing unemployment, poverty, exchange rate depreciation. Others include low or poor saving habits that can be linked to the structural issues, lack of adequate infrastructural facilities to encourage rural banking, low level of education, perception of the rural dwellers, among others (Abiola et al., 2019).

2.3. Monetary Policy and Financial Inclusion

While it has been established that conventional strategies, as discussed earlier, play a significant role in driving financial inclusion in Nigeria and elsewhere, efforts have also been made to examine the relationship between financial inclusion and monetary policy effectiveness empirically. The bulk of literature on the nexus between financial inclusion and monetary policy has focused on the extent financial inclusion improves the effectiveness of monetary policy (Anarfo et al., 2019; Mbutor & Uba, 2013). Though, literature like Evans (2016), Anarfo et al. (2019) particularly made a further effort to investigate whether monetary policy effectiveness granger causes financial inclusion or financial inclusion granger causes monetary policy.

For instance, Anarfo et al. (2019) using panel VAR to investigate the nexus between monetary policy and financial inclusion in Sub-Saharan Africa, finds the existence of a bi causal relationship between financial inclusion and monetary policy (proxied by monetary policy rate). Additionally, Evans (2016) used a panel Vector Error Correction Model (VECM) to investigate the nexus between monetary policy and financial inclusion using data from fifteen African countries. To achieve their objectives, monetary policy effectiveness was proxied by inflation, while the number of depositors with commercial banks (per 1,000 adults) was used as a measure of financial inclusion. The estimations showed evidence of a long-run relationship between inflation and financial inclusion. However, the reaction of monetary policy effectiveness to the positive financial inclusion shock was not significant. Instead, variations in monetary policy effectiveness were explained by interest rate shocks. Furthermore, Granger causality estimates revealed that monetary policy effectiveness caused financial inclusion without reverse causality. As seen above, while Anarfo et al. (2019) discovered a bi causal relationship, Evans (2016) found a uni-causal relationship from monetary policy effectiveness to financial inclusion.

The findings from Evans (2016) upheld the earlier assertion from Lapukeni (2015), who carried out a study on the impact of financial inclusion in Malawi on monetary policy effectiveness. The author discovered an inverse relationship between monetary policy and financial inclusion in the country using quarterly data from 2001 to 2013. It further reveals a unidirectional relationship between monetary policy effectiveness and financial inclusion, where the causality flows from monetary policy effectiveness to financial inclusion, though, a negative relationship was discovered. Giorgio and Rotondi (2011) investigated the nexus between monetary policy and financial stability. It was discovered that the practice of smoothing interest rate backward does not alleviate the problem of equilibrium indeterminacy. A similar stance that was shared by Mbutor and Uba (2013) the authors appear to be the first to investigate how financial inclusion enhances monetary policy effectiveness in Nigeria. Specifically, the authors employed time series data spanning from 1980 to 2012. It was discovered that financial inclusion improves the effectiveness of monetary policy (inflation rate) in the country. They argue that this relationship should be expected, especially if the new loans and advances (measures of financial inclusion) are put to the purposes of investment.

Other studies have examined the determinants of financial (Abel, Mutandwa, & Le Roux, 2018) carried out a study on the determinants of financial inclusion in Zimbabwe using data drawn from the Fin Scope Consumer Survey 2014. Estimations were performed using the logistic regression technique to ascertain the likelihood of an individual being financially included. The estimations show that age, education, distance to the nearest access point, financial literacy, income, documentation required to open bank accounts, and internet connectivity all had significant effects on financial inclusion in the country. This was similar findings from Uddin, Chowdhury, and Islam (2017) who studied the determinants of financial inclusion using the generalized method of moments (GMM), and data from 2005–2014 in Bangladesh. The results show that bank size, efficiency, interest rates, literacy rate, and age dependency ratio were all factors associated with financial inclusion. Similarly, Akileng, Lawino, and Nzibonera (2018) using a cross-sectional design comprising the adult population in both rural and urban settings, evaluated the determinants of financial inclusion in Uganda. The results from the regression analysis showed that financial literacy and financial innovation were all determinants of financial inclusion among households in the study area.

Nwafor (2018) studied the relationship between the penetration of the internet and financial inclusion in Nigeria using the OLS for estimation. The result shows a significant and inverse relationship between internet penetration and financial inclusion in the country. They state that this relationship is tenable, possibly due to the underutilization of internet services with regard to financial services. Similarly, Adetunji (2017) studied the drivers of financial inclusion in Nigeria using panel data sourced from the Enhancing Financial Innovation & Access’ (EFInA) to financial services in a Nigeria survey conducted in 2008, 2010, 2012, 2014, and 2016. The percentage of the banked Population of adults in a state or adults having access to formal financial services was used to reflect financial inclusion. Regressions were performed using pooled ordinary least squares (POLS), fixed effect, and random effect techniques. The results showed that income, education levels, being a woman, being a youth, and living in a rural area were significant determinants of the likelihood of owning a bank account or from any other formal financial service provider.

In summary, it has been established that financial inclusion facilitates monetary policy effectiveness in Nigeria and elsewhere, but the reverse has not been established in Nigeria particularly the role of FinTech in this nexus.

3. Methodology

3.1. The Model and Data

The main objective of this study is to determine the extent monetary policy is effective in driving financial inclusion in Nigeria and to determine whether FinTech upsurge contributes to the nexus. To achieve this, we fit an empirical model following Anarfo et al. (2019) to model financial inclusion as a function of monetary policy effectiveness. When measuring financial inclusion, the World Bank recommends three indicators: access indicators, usage indicators, and quality indicators. In this study, we will use both a usage indicator (outstanding deposits with commercial banks (% of GDP)) and an access indicator (ratio of credit to the private sector (% of GDP)) to measure financial inclusion. Lapukeni (2015) and Mbutor and Uba (2013) have all used outstanding deposits with commercial banks (% of GDP) as measures of financial inclusion in their respective studies. The following models are fitted:![]()

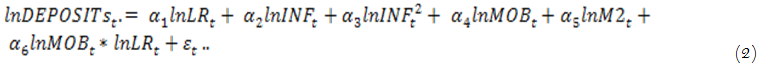

where the dependent variable is outstanding deposits with commercial banks (% of GDP), monetary policy effectiveness is proxied by inflation (INF), lending rate (LR), and XB is vector of other independent variables. Theoretically, a rise in the lending rate will spur the household to increase deposits, thereby increasing financial inclusion. Similarly, a rise in inflation will reduce consumer purchasing power, thereby reducing the commercial bank deposit. However, we include a squared term of inflation since, as previously discussed, monetary authorities may not be held accountable as to the rate of inflation in the short run. They can be held accountable for “sustained inflation,” which typically focuses on the “medium term. Hence, this squared term investigates the relationship of inflation with financial inclusion in the longer term where prices would be sticky, which we hypothetically expect that the squared term would have reduced significantly or become ineffective. Sarel (1996) shows the possibility of inflation having a nonlinear effect, but he focused on economic growth. Equation 1 can be modified to account for the upsurge of FinTech. As such, Equation 1 can then be modified as Equation 2;

Where M2 is broad money supply, mobile money (MOB) transaction is used to proxy for FinTech upsurge, while MOB*LR is the interaction between monetary policy and FinTech. We hypothesize that the rise in FinTech will increase financial inclusion to greater penetration while interacting FinTech with the monetary policy will improve the effectiveness of the monetary policy in the country. As a double-check, we further proxy financial inclusion with access indicators.

Where Findev as in Equation 3 is a financial deepening variable that is, the percentage ratio of the credit to the private sector to GDP, and equation 3 serves primarily as a form of robustness check. The other variables remain as previously discussed, while it is a vector of other independent variables credit to private sector, volume of mobile money transactions. Quarterly data from 2009 to 2019 were sourced from the central bank of Nigeria (CBN) bulletin.

3.2. Estimation Technique and Procedures

To investigate our study objective, we use the Fully Modified Ordinary Least Squares (FMOLS). The FMOLS method was originally developed by and traced to Phillips and Hansen (1990) for the estimation of a single cointegrating relationship that has a combination of I(1). We choose this technique especially for its advantage over the simple OLS and other common estimation techniques. For instance, the FMOLS tends to perform better than the OLS in terms of consistency, especially in the presence of large sample bias. Furthermore, the estimates of the OLS may suffer problems of heteroscedasticity and serial correlation due to the possibility of omitted dynamics captured in the residual influencing the model performance and likely affecting the true state of the standard errors. However, the FMOLS and its counterpart, the Dynamic OLS (DOLS), can solve this problem and provide accurate results by adding leads and lags that account for this likely problem of endogeneity and serial correlation. Rukhsana and Shahbaz (2008) state that the FMOLS is important for achieving asymptotic efficiency due to its ability to modify the ordinary least squares to account for the effects of serial correlation in the regressors that result from the existence of cointegrating relationships.

The first step in our analysis is the conduct of the stationarity tests for the variables used in the study. After establishing the order of stationarity for the variables using the ADF unit root test, we further conducted a test to ascertain if cointegration exists among the variables using Johansen’s cointegration. Then, we estimate the model using FMOLS. Furthermore, we first conduct an analysis to check whether monetary policy (monetary lending rate) affects the lending rate and inflation rates, which are proxies for monetary policy effectiveness. However, we do not report this, but the results can be made available on request.

4. Results and Discussion

4.1. Stationarity Test

This section will present and discuss the findings of the study.

| Variable | Stationarity |

| Deposits (% of GDP) | I(1) |

| Inflation Rate | I(1) |

| Inflation Rate Squared | I(1) |

| Money Supply | I(1) |

| Lending rate | I(1) |

| Volume of Findev | I(1) |

| Value of Mobile money | I(1) |

The results of the unit root test show that all the variables, Deposits (% of GDP), inflation rate, lending rate, and value of mobile money were all stationary at first difference. This validates our choice of the FMOLS approach for establishing the relationship between our variables in the model. Since the long-run information of the series is often lost during the process of differencing, the study tried to establish the existence of long-run relationships among the series by conducting a cointegration test.

4.2. Cointegration Test

| Unrestricted Cointegration Rank Test (Trace) | ||||

| Hypothesized | Trace |

0.05 |

||

| No. of CE(s) | Eigenvalue |

Statistic |

Critical Value |

Prob.** |

| None * | 0.906550 |

220.6364 |

125.6154 |

0.0000 |

| At most 1 * | 0.881619 |

147.1564 |

95.75366 |

0.0000 |

| At most 2 * | 0.711689 |

81.00721 |

69.81889 |

0.0049 |

| At most 3 | 0.532236 |

42.45204 |

47.85613 |

0.1465 |

| At most 4 | 0.315924 |

18.89850 |

29.79707 |

0.5003 |

| Note: The trace test indicates 3 cointegrating eqn(s) at the 0.05 level. * denotes rejection of the hypothesis at the 0.05 level; **MacKinnon, Haug, and Michelis (1999) p-values. |

As revealed in Table 3, there exist a three cointegrating series validating a long-run relationship among the variables under estimation since the trace statistics is greater than the 5% critical values in three equation. Having validated the existence of a long-run relationship, the study proceeds to estimate the models using FMOLS. Since the variables are all differenced before being stationary, the researchers used the difference version of FMOLS to estimate each of the models.

| Variable | Deposit 1 |

Deposit 2 |

Findev 1 |

Findev 2 |

| Log(LR) | 0.089 (2.132)** |

1.266 (4.483)*** |

-0.001 (2.269)** |

-0.001 (-7.854)*** |

| Log(INF) | -2.628 (4.808)*** |

-1.165 (-2.292)** |

-0.011 (-2.79)*** |

-0.021 (4.805)*** |

| Log(INF)2 | 0.522 (4.629)*** |

0.243 (2.316)** |

-0.002 (-2.656)** |

0.001 (2.20)** |

| Log(M2) | -0.293 (8.759)*** |

-0.391 (-10.396)*** |

0.033 (151.1)*** |

0.034 (156.9)*** |

| Log(MOB) | - |

0.197 (4.627)*** |

- |

-0.002 (-6.198)*** |

| Log (MOB*LR) | - |

0.073 (4.261)*** |

- |

0.001 (4.947)*** |

| C | 8.874 (10.994)*** |

4.793 (4.496)*** |

0.026 (4.477) |

0.082 (8.77)*** |

| R2 | 0.8420 |

0.9011 |

0.9686 |

0.9695 |

| Note: Significance is indicated as follows: ***, ** and * for 1%, 5% and 10% respectively, T-calculated in parenthesis. Interaction of lending rate with FinTech proxy =(MOB*r); t-calculated is reported in the bracket (). |

From the findings in Table 4 above, both lending rate and inflation rate, which are measures of monetary policy effectiveness, have a significant impact on financial inclusion when commercial bank deposit as a percent of GDP were used as a measure of financial inclusion. Specifically, it was revealed that one (1) percent increase in lending rate would increase the level of financial inclusion in Nigeria by 8.9 percent. Similarly, a rise in inflation by one (1) percent is likely to reduce the level of financial inclusion by 262 percent. This is consistent with the findings of Anarfo et al. (2019) that inflation granger causes financial inclusion. However, it appears that in the long run, the inverse relationship between inflation and financial inclusion would likely turn positive or becomes insignificant as the squared inflation term turns positive in our case.

When monetary policy effectiveness measures interacted with the upsurge of financial technologies (FinTech), it was discovered that it improved the nexus between monetary policy and financial inclusion in Nigeria. For instance, the introduction of FinTech (MOB) and its interaction with the lending rate, it immediately increases the percentage effect of lending rate on financial inclusion by 117 percent. In comparison, that of inflation was reduced by 146 percent. Again, it was discovered that FinTech has a significant positive impact on financial inclusion as expected since the t-calculated (4.261) is greater than the t-tabulated (1.96). This is in-line with the argument that FinTech improves financial inclusion by providing a platform where the excluded populace can be included. It enables the operators of informal economies to easily transfer and make payments using their mobile wallets without necessarily owning a formal bank account. Tonuchi (2020) noted that FinTech is revolutionizing the banking industry by providing platforms where the informal sector operators can quickly secure a microloan without owing a formal bank account, thereby increasing financial inclusion in the country.

The interactive variable also reveals that FinTech drives the nexus between the lending rate and financial inclusion positively as expected. Unfortunately, money supply both in model (1) and (2) turns negative contrary to the expected positive sign. One possible explanation is the fact that rise in money supply might be trapped in the informal economy that often exhibits high liquidity, thereby driving inflation upward and distorting the ability of many Nigerians from saving (Peters et al., 2020).

As a robust check, the financial deepening was also employed to capture financial inclusion in the country. It was discovered that when FinTech was not accounted for, all the explanatory variables have a significant negative impact on financial inclusion except for the money supply as expected. The implication is that the higher the inflation rate, the lower level of financial inclusion in the country. So, the inflation rate has a significant negative impact on financial inclusion both in the short-run and long-run. In order words, countries with low and stable inflation rates tend to enjoy a higher degree of financial inclusion. When FinTech was accounted for in the fourth model, FinTech, though, has a significant impact on financial inclusion but is negatively signed.

5. Conclusion

Our result reveals that monetary policy influences financial inclusion positively in Nigeria. For instance, through the lending rate channel, an increase in the lending rate increases the deposits at banks because as the lending rate rises, individuals and SMEs are unlikely to seek loans or financial facilities from financial institutions. Additionally, individuals are likely to save than to borrow because of the high interest rate, hence increasing financial inclusion. Furthermore, through the inflation rate channel, as the rate of inflation rises, that is, an increase in the general price level, individuals are likely not to patronize financial institutions due to reasons such as increased consumption expenditure and reduction in savings. This is because the general price level has risen without a corresponding increase in income, thereby causing deposits with commercial banks to fall. However, as seen in the analysis, inflation rate effects on financial inclusion reduce in the long term because of the stickiness of prices.

Similarly, the upsurge of FinTech driving the likes of mobile money showed positive and significant effects on financial inclusion. This shows the possible benefits of financial technologies to financial development in the country. This is possible through the revolution of the conventional credit channels. For instance, the emergence of mobile and online platforms allows individuals and businesses to conduct financial transactions through new technology-driven payment processes and alternative processing networks, fostering a more manageable payments system. Disintermediation (especially face-to-face contact) has often been stated to be FinTech’s most powerful weapon in influencing the financial sector.

The study, therefore, concludes that monetary policy is effective in driving financial inclusion in Nigeria and that FinTech has further revolutionized the banking industry providing the economic opportunities to reach the unreached through technology. We further conclude that contrary to some assumptions in the literature, FinTech propels positive nexus between monetary policy and financial inclusion instead of impeding the process. FinTech provides a platform for better regulation by providing the necessary transparency in the flow of transactions, makes monitoring and compliance much easier, and ultimately reduces the incidence of corruption in the financial system.

The policy implication is that the central bank policy of financial inclusion can be facilitated through a friendly and strategic regulation of the FinTech industry in Nigeria. First, by ensuring the availability of policies that protect the resources of the informal economy participants mostly targeted by FinTech. Secondly, more strategic partnerships can be encouraged between the FinTech companies and the network providers to guarantee a more stable network, thereby increasing public trust in mobile money and mobile banking transaction. Thirdly, the central bank policy of encouraging mobile financial transactions and transfer should be intensified as critical pathways to achieving increased access to financial services and hence, a developed financial sector in Nigeria. Lastly, the holistic development of plans to integrate, monitor, and evaluate the various technology-driven payment system within the ecosystem of financial system.

References

Abel, S., Mutandwa, L., & Le Roux, P. (2018). A review of determinants of financial inclusion. International Journal of Economics and Financial Issues, 8(3), 1-8.

Abiola, B., Adedoyin, L., Umoren, G., & Areghan, I. (2019). Financial inclusion in Nigeria: Prospect, issues and challenges. Paper presented at the In Proceedings of the 33rd International Business Information Management Association Conference, IBIMA 2019: Education Excellence and Innovation Management Through Vision 202.

Adetunji, O. (2017). The drivers of financial inclusion in Nigeria. The International Journal Of Business & Management, 5(7), 273-279.

Akileng, G., Lawino, G. M., & Nzibonera, E. (2018). Evaluation of determinants of financial inclusion in Uganda. Journal of Applied Finance & Banking, 8(4), 47-66.

Anarfo, E. B., Abor, J. Y., Osei, K. A., & Gyeke-Dako, A. (2019). Monetary policy and financial inclusion in Sub Sahara Africa: A Panel VAR Approach. Journal of African Business, 20(4), 549-572.

Barajas, A., Beck, T., Belhaj, M., & Ben Naceur, S. (2020). Financial inclusion: What have we learned so far? What do we have to learn? In IMF Working Paper. WP/20/157. Retrieved from: https://www.imf.org/en/Publications/WP/Issues/2020/08/07/Financial-Inclusion-What-Have-We-Learned-So-Far-What-Do-We-Have-to-Learn-49660 .

Bondt, G. J. (1999). Banks and monetary transmission in Europe: Empirical evidence. BNL Quarterly Review, 52(9), 149-168.

Central Bank of Nigeria. (2018). National financial inclusion strategy (Revised). In Central Bank of Nigera, Abuja. Retrieved from: https://www.cbn.gov.ng/out/2019/ccd/national%20financial%20inclusion%20strategy.pdf .

Chileshe, M. P., & Olusegun, A. A. (2017). The Impact of informal economy on the interest rate pass-through: Evidence from an ARDL approach. African Journal of Economic Review, 5(2), 130-148.

EFInA. (2018). Overview and lessons learnt from global fintech landscape and Nigerian FinTech Landscape. In EFInA FinTech Report (Issue December). Retrieved from: https://www.efina.org.ng/wp-content/uploads/2019/04/EFInA-FinTech-Report-Global-and-Nigeria-Landscape.pdf .

Elmirzaev, S. (2019). The importance and challenges of FinTech In Uzbekistan. International Journal of Economics, Commerce and Management, 7(7), 559-565.

Evans, O. (2016). The effectiveness of monetary policy in Africa: Modeling the impact of financial inclusion. Iranian Economic Review, 20(3), 327-337.Available at: http://dx.doi.org/10.22059/ier.2016.58961 .

Giorgio, D. G., & Rotondi, Z. (2011). Financial stability, interest-rate smoothing and equilibrium determinacy. Journal of Financial Stability, 7(1), 1–9.Available at: https://doi.org/10.1016/j.jfs.2009.05.004.

Green, A. (2020). State of play: Fintech in Nigeria. In The Economist Intelligence Unit, Abuja Nigeria. Retrieved from: eiu-mastercard-mtn_fintech_in_nigeria_22nd_march_2020_1.pdf (nairametrics.com).

Jerene, W., & Sharma, D. (2020). The adoption of financial technology in Ethiopia: A study of bank customers perspective. Journal of Banking and Financial Technology, 0123456789.

Kola-Oyeneyin, E., Kuyoro, M., & Olanrewaju, T. (2020). Harnessing Nigeria ’ s fintech potential. Abuja Nigeria: In McKinsey & Company (Issue September).

Lapukeni, A. F. (2015). The impact of financial inclusion on monetary policy effectiveness: The case of Malawi. International Journal of Monetary Economics and Finance, 8(4), 360-384.

MacKinnon, J. G., Haug, A. A., & Michelis, L. (1999). Numerical distribution functions of likelihood ratio tests for cointegration. Journal of Applied Econometrics, 14(5), 563-577.Available at: https://doi.org/10.1002/(sici)1099-1255(199909/10)14:5<563::aid-jae530>3.0.co;2-r.

Mbutor, M. O., & Uba, I. A. (2013). The impact of financial inclusion on monetary policy in Nigeria. Journal of Economics and International Finance, 5(8), 318-326.Available at: https://doi.org/10.5897/jeif2013.0541.

Nwafor, M. C. (2018). Nexus between internet penetration and financial inclusion in Nigeria. International Journal of Research and Innovation in Social Science, 2(10), 220-226.

Peters, I., Yaaba, B., Adetoba, O., Tomologu-Okunomo, A., & Tonuchi, E. J. (2020). How effective is monetary policy in the presence of high informality in Nigeria. Journal of Accounting, Business and Finance Research, 10(2), 84-93.Available at: 10.20448/2002.102.84.93.

Phillips, P. C., & Hansen, B. E. (1990). Statistical inference in instrumental variables regression with I (1) processes. The Review of Economic Studies, 57(1), 99-125.Available at: https://doi.org/10.2307/2297545.

Rasche, R. H., & Williams, M. M. (2007). The effectiveness of monetary policy. Federal Reserve Bank of St. Louis Review 89(5), 447-489.

Rukhsana, K., & Shahbaz, M. (2008). Remittances and poverty nexus: Evidence from Pakistan. Paper presented at the Oxford Business & Economics Conference Program.

Sarel, M. (1996). Nonlinear effects of inflation on economic growth. IMF Staff Papers, 43, 43(1), 199-205.

Tahir, M. N. (2012). Relative importance of monetary transmission channels: A structural investigation; A case of Brazil, Chile, and Korea: University of Lyon Working Paper Series, F-69003, France. Retrieved from: https://www.researchgate.net/publication/289220212_Relative_Importance_of_Monetary_Transmission_Channels_A_Structural_Investigation_Case_of_Brazil_Chile_and_Korea .

Thakor, A. V. (2020). Fintech and banking: What do we know? Journal of Financial Intermediation, 20(30), 1-13.

Tonuchi, T. E. (2020). How to improve mobile money service usage and adoption by Nigerians in the Era of Covid-19. International Journal of Finance, Insurance and Risk Management, 10(3), 31–52.

Uddin, A., Chowdhury, M., & Islam, N. (2017). Determinants of financial inclusion in Bangladesh: Dynamic GMM and quantile regression approach. Journal of Developing Areas, 51(2), 221-237.