Federal Funds Rate Spillover to ECB Interest Rate: Are Macroeconomic Fundamentals Important?

Nahid Kalbasi Anaraki

Fort Hays State University, USA. |

AbstractThis paper explores fertility preference and its associated factors among older Nigerian women within the reproductive ages 40 to 49. It considers the impact of proximate factors of place, wealth, education, use of contraceptives, and other associated factors on fertility preference. Using Nigeria Demographic and Health Survey (NDHS 2018) data, responses of 1357women of ages 40-49 years in the couples recode file were considered. Fertility preference is measured by “the desire for another child”. We use descriptive statistics and logistic regression to identify the associating factors and impacts of identified explanatory variables on the desire for another child. Result revealed up to 25% of women within ages 40-49 desire to have another child while 35% uses contraceptives. The desire by older women to have another child is higher in the rural areas than in urban areas while more than 50% with desire for another child have no education and are found practising Islam. Logistic regression result indicates that older women not using contraceptive have higher odd ratio with the desire for another child, those in urban areas have lower odd ratio while women in the Northeast and the Northwest have more than 2.5 chance of desiring for another child than those in the Southwest. This study concludes that the desire for pregnancy at later end of reproductive years must be controlled through women's education and community-based sensitization programs. |

Licensed: |

|

Keywords: JEL Classification |

|

Received: 4 January 2021 |

Funding: This study received no specific financial support. |

Competing Interests:The author declares that there are no conflicts of interests regarding the publication of this paper. |

Author acknowledge the comments she received from her colleagues at Fort Hays State University to enrich this paper. |

1. Introduction

The integration of financial markets in the past decades has enormously fostered the coordination among monetary policy institutions and central banks around the globe. As Mishkin has emphasized, monetary policy affects the economy through a number of transmission channels including interest rate, asset prices, exchange rates, real estate prices, credit channel, and balance sheet channel (Mishkin, 1996). The focus of the Federal Reserve on Federal Funds Rate (FFR) has induced several central banks to envisage a reaction function in conducting their monetary policy, as the world economy has become increasingly integrated. Though a huge amount of studies has examined the relationship between the FFR and emerging and advanced economies interest rates including (Ahmad, Aziz, & Rummun, 2013; Ehrmann & Fratzscher, 2004; Friedman & Shachmurove, 2017; Giovanni, Kalemli-Ozcan, Ulu, & Baskaya, 2019; Ullrich, 2003) the results are contradictory.

The goal of this study is trifold. First, it examines the relationship between the FFR and the European Central Bank interest rate to find out whether there is any relationship between the two interest rates; second, it tests whether the causality runs from FFR to ECB interest rate or the other way around. Third, the study examines whether the European Central Bank interest rate is more responsive to US or EU macroeconomic fundamentals. The findings of this study are of great importance to monetary authorities because the European Central Bank interest rate is a benchmark for several European countries and can affect the level of investment and capital flows to these countries significantly. An increase in FFR, which leads to appreciation of dollar, reduces the competitiveness of US products and exports and stimulates imports; therefore, the result would be a reduction in US aggregate demand that can have positive effects on EU exports; however, this result depends on the reaction function of ECB to a FFR shock. If the foreign interest rate moves quickly in tandem with the domestic interest rate, then this foreign transmission channel will be trivial. Therefore, the existence of a strong relationship between FFR and ECB interest rate can help us understand the outcome of foreign exchange rate channel.

To respond to the above questions, following Lee and Werner (2018) this paper employs a regression model to examine the relationship between FFR and ECB interest rate. The paper also implements a Granger Causality test to find out the causality direction between FFR and the ECB interest rate.

The remainder of the paper is organized as follows. Section II reviews the literature on monetary transmission and importance of Fed’s policy for the rest of the world. Section III presents the data, and methodology. Section IV represents the estimated results of the regression model and Granger Causality test. Finally, Section V concludes and offers policy recommendations.

2. Literature Review

Monetary policy affects the economy through a variety of monetary transmission channels; however, the FFR has attained more attention in the past decades because it is the main monetary policy tool that Fed implements. Due to the existence of controversial results on the relationship between FFR and domestic interest rates in advanced and emerging markets, this section briefly reviews some of orthodox studies in the literature.

Dominguez (1996) examines international independence and coordination of monetary and exchange rate policy between the United States, Germany, and Japan since 1970. The study implements a VAR model to estimate dynamic relationship between interest rates and monetary policy in G-3 countries without imposing structural assumptions. The study implements monthly data for the period 1977-1993 and finds that an expansionary monetary policy shock in the United States is followed by a statistically significant expansion in Germany and Japan. The maximum impact of US shock occurs after about seven months in Germany and after one year in Japan. An expansionary monetary policy shock in Germany also leads to expansions in the United States and Japan, although the influence on US monetary policy is marginally significant and short lived. However, an expansionary monetary policy shock in Japan does not significantly influence US or German monetary policy over the full period.

Mojon (2000) examines the pass through effects of money market rates (MMR) to various bank retail rates. It covers retail bankers of six largest countries in the Euro zone including Belgium, Germany, Spain, Italy, France, and Netherlands. Using Error Correction Model with panel data for the periods1979-1982, 1982-1988, 1988-1992, and 1992-1998 he finds that the degree of pass-through effect depends on financial structure. The higher the volatility of MMR, the lower the pass through effect will be. He also finds that the higher the competition from other financial resources increases the pass-through effect from MMR to bank interest rates.

Jorda and Bergin (2004) measure the degree of monetary policy interdependence between major advanced economies for OECD countries. Their results indicate that there is a significant policy interdependence among these countries during 1980-1998. While a number of countries appeared to respond to Germany monetary policy, others appeared to respond to the US monetary policy shocks.

De Bondt (2002) investigate the pass-through from money market rate to retail banking rates by implementing Error Correction model and marginal cost pricing with asymmetric information model, using monthly data for 1996-2001. He finds the proportion of market interest rate, which is passed through within one month, is around 50% at its highest. However, the pass through effect is higher in the longer term and notably close to 100%. He also finds the pass-through effect has been reinforced since the introduction of euro.

Sarno and Thornton (2002) investigate the dynamic relationship between two key US money market interest rates, the Federal Funds Rate and the three-month Treasury bill rate. Using daily data for the period 1974-1999 they find a strong long-run relationship between these two rates that is stable across monetary policy regimes.

Atesoglu (2003) analyzes the monetary transmission channel from the federal funds rate to the prime rate and finds a strong pass-through effect from FFR to prime and long-term interest rates. Employing a Vector Error Correction model, he finds most of adjustment toward long-run equilibrium occurs through the Federal Funds Rate.

Ehrmann and Fratzscher (2004) investigate the changing nature of EU monetary policy interdependence with United States and find that Euro area and US monetary policy have become interdependent over time. They find that Euro area markets react strongly to news in the US than vice versa. They find strong evidence that US macroeconomic news have become good leading indicators for economic development in the Euro area. Overall, their results indicate that the US and EU money markets have become significantly interdependent due to real integration of the two economies.

Mizen and Hoffmann (2004) use monthly data for thirteen deposit interest rates and mortgage products offered by the UK financial institutions. The methodology they use allows for asymmetries and non-linearity adjustments. Their results indicate that the speed of adjustment in retail rates depends on whether the perceived gap between retail and base rate is widening or narrowing during the time.

Atesoglu (2005) explores the relationship between the FFR and long-term interest rates including the yields on both AAA corporate bond and the 30-year Treasury bonds. He finds a cointegrated relationship between the FFR and long-term interest rate. He draws a division between the effects of the long-term interest rates in the short-term versus long-term, and indicates that in the short run the FFR does not have much effect on long-term interest rates.

Sander and Kleimeier (2006) investigate interest rate pass-through effects for eight Central and Eastern European Countries (CEECs). They find evidence of convergence across CEECs. They also find that higher inflation leads to higher speed of pass-through effect process, while lower market volatility has a positive impact on the size and speed of pass-through effect.

Nishiyama (2007) investigates whether long-term market rates Granger cause policy controlled rates. The study provides empirical evidence that causality relationship is in reverse. In addition, he finds causality relationship between long-term bond yields and the federal funds rate; the results are consistent with accommodative position under the assumption of expectation theory.

Payne (2007) employs Johansen cointegration and Vector Error Correction (VEC) model to investigate the relationship between FFR and various domestic interest rates. He finds that fixed mortgage interest rate is cointegrated with FFR, with incomplete pass-through and asymmetric adjustments. His estimated results suggest that the causality runs from FFR to fixed mortgage interest rate.

Payne and Waters (2008) examine the long-run interest rate pass-through of the FFR to the prime rate. They find the adjustments of prime rates to changes in FFR appears asymmetric with upward rigidity.

Ullrich (2003) estimate Taylor reaction function of the Federal Reserve and the European Central Bank with monthly data from 1995:1 to 1998:12 and from 1999:1 to 2002:8 to track the behavior of the two central banks. He uses a Taylor reaction function, which explains the interest rate behavior using inflation rate and output gap as the main explanatory variables. The results suggest that the Fed’s interest rate policy has a significant impact on Eurozone, especially after 1999. However, for the period before 1999, he finds it difficult to track the behavior of Fed with a Taylor reaction function.

Fuertes and Heffernan (2009) implement Error Correction model for 662 monthly retail rates for the period 1993:01- 2004:09 and find that long-run pass-through effect is higher for unsecured personal loans and credit cards than for mortgage rates. They find the long-run pass through effect for saving rates is significantly faster than that of the mortgage rate. They conclude that long-run pass through effect tends to be more complete, the higher the deposit level and the maturity.

Fratzcher, Lo Duca, and Straub (2013) analyze the spillover of the Federal Reserve unconventional monetary policy. They find that Fed measures in early phase of crisis were highly effective in lowering sovereign yield in the US compared to other countries. In addition, they find no evidence that foreign exchange or capital account policies helped countries shield themselves from the US policy spillover, but rather response to Fed’s policies are related to country risk. They also show that Fed’s policy have led to portfolio reallocation in global financial markets.

Ahmad et al. (2013) study the relationship between LIBOR and four other UK retail interest rates. Implementing data for the period 1999:01-2009:06, they examine how four retail interest rates react to LIBOR interest rate. They find evidence that UK banking system retail interest rate adjustment in response to changes in LIBOR is complete in the long-run, but not in the short run.

Bruno and Shin (2015) investigate global factors associated with capital flows. Using panel data for 46 countries, they find that bank leverage cycles act as determinants of transmission of financial conditions across borders through banking sector capital flow. They find that local currency appreciation is associated with higher leverage of the banking sector.

Bruno and Shin (2015) find evidence of monetary policy spillovers on cross-border capital flows. They find that a contractionary shock to the US monetary policy leads to a decrease in cross-border capital flow and a decline in the leverage of international banks.

Santacreu (2015) investigates whether news about monetary policy in advanced economies may create volatility for emerging markets. He finds that when central banks in US, EU, and UK, enacted expansionary monetary policy after the financial crisis in 2007 capital flew into emerging markets in search of higher yields.

Ahmed, Coulibaly, and Zlate (2015) assess the importance of economic fundamentals in the transmission of international shocks to financial markets in emerging market economies. Cross-country regression results for the taper tantrum episode suggest that economies with better economic fundamentals suffer less deterioration in financial markets. Controlling for economic fundamentals, they show that during the taper tantrum financial conditions deteriorated more in emerging markets that had experienced larger capital inflow and exchange rate appreciation.

Bremus and Fratzscher (2015) analyze the effects of changes in monetary policy on cross border bank lending since global financial crisis. They use data on bilateral bank claims for 46 countries during 2005-2012. Their results suggest that expansionary monetary policy in the source countries as measured by changes in reserves held at the central banks has encouraged cross-border lending both in euro area and non-euro area countries. They also find that regulatory policy, and increase in financial supervisory power have encouraged credit outflows from source countries. The prospect of Federal Reserve ending its quantitative easing in 2015 sent capital flow out of emerging markets, causing volatility in these markets. He finds that countries with weaker economic fundamentals were intensively affected.

Fernández, Schmitt-Grohé, and Uribe (2017) use econometric technique for 138 poor emerging and rich economies, with quarterly data for the period 1960 to 2015. The panel includes observation on three commodity prices (agriculture, fuel and metals), a proxy for the world interest rate and four macroeconomic variables (output, consumption, investment, and trade balance). The main finding of their study is that global shocks explain a sizable fraction of business cycles around the world. They find that more than one third of variances of output, consumption, investment, and trade balance are accounted by world disturbances, and shocks to interest rates. Using post 2000 data, the importance of world shocks in accounting for domestic business cycles doubles.

Lane and Milesi-Ferretti (2017) investigate the evolution of financial integration post financial crisis covering 210 economies for the period 1970-2015. They show that growth in cross-border position in relation to world GDP has come to a halt, which reflects much weaker capital flows from the advanced economies, while cross-border FDI position have continued to expand, unlike to portfolio positions.

Lee and Werner (2018) investigate the relationship between monetary policy and real GDP growth among four advanced countries including, US, UK, Germany, and Japan. They find that interest rates are positively correlated with GDP growth.

Iacoviello and Navarro (2018) analyze the spillover of US interest rates on economic activity in a panel of 50 advanced and emerging economies for 1965:01-2016:2. They measure the foreign GDP response to monetary shocks in the US, and find that a shock to FFR by 1 percentage point induces a decline in US GDP by 0.7 percent after two years. The dynamic response of GDP in advanced economies follow a similar pattern to the US but smaller and more delayed with GDP dropping by 0.5 percent, three years after the shock. They find the GDP response of emerging economies is as delayed as of advanced economies but falls as large as the US, by 0.7 percent, four years after the shock.

Brauning and Ivashina (2018) use a wide range of data for the period 1990:1-2016:3 for a group of emerging economies and estimate the spillover effects of FFR at international level. They estimate that over a typical US monetary easing cycle emerging market economies experience a 32-percentage point increase in the volume of loans issued by foreign banks. On the flip side, a US contractionary monetary policy would pull out bank flows from emerging markets and leads to a strong contraction in foreign credit in emerging markets. Finally, they show that spillover effect is stronger for riskier emerging economies.

Hartmann and Smets (2018) emphasize that ECB worked in tandem with Federal Reserve to cut the interest rate post financial crisis in 2007-09, while at the same time it implemented a number of nonstandard measures to satisfy demand for high liquidity. They show that ECB adjusts its rate according to changes in FFR, particularly post financial crisis.

Miranda-Agripinno and Rey (2019) study the transmission of global financial cycles to domestic credit market in Turkey over the period 2003-2013. Using econometric techniques and regression model, they find that easing global financial conditions leads to lower borrowing costs and more lending in Turkey.

Alper, Altounk, Capacioglu, and Ongena (2019) analyze the impacts of quantitative easing (QE) by the Federal Reserve, European Central Bank, and Bank of England on cross border capital flows. They use time series data for 2008:10-2014:12 for the borrowing of Turkish banks from international banks originating from 157 countries. They find that Fed quantitative easing boost the cross-border credit granted to Turkish banks, while effects of ECB and Bank of England QE work moderately.

Kalmeli-Ozcan (2019) use data for the period 1996-2018 for emerging and advanced economies and show that a 10 percentage point increase in policy rate differential implies 2.8% point increase in capital flow to GDP in emerging markets and 6.3% points increase in advanced economies. The relation between capital flow and policy rate differential remains negative after controlling for changes in global risk perceptions. He finds that monetary policy spillover from the US to the rest of the world operates through changes in risk premia. The risk channel implies larger effects on emerging markets than advanced economies.

Giovanni et al. (2019) study the transmission channel of global financial cycles to domestic market conditions in Turkey over 2003-2013. Using regression model they indicate that lower borrowing costs can drive a credit boom in Turkey despite collateral constraint. Their estimated results indicate that shocks affect risk premia and real variables. Indeed, easing the global financial conditions leads to lower borrowing costs and an increase in local lending. Banks that are exposed to international capital markets transmit the global financial cycles locally.

This study differs from previous studies, as it examines the responsiveness of ECB interest rate to Federal Funds Rate and US macroeconomic fundamentals. First, it investigates the pass-through effects of US expansionary and contractionary monetary policy on the responsiveness of ECB. Second, it uses a dummy variable for the periods of high inflation in the US economy to find out whether the ECB reacts differently during the high inflation versus low inflation. Finally, it uses a Granger causality test to see the causality runs from FFR to ECB interest rate or vice versa.

3. Data and Methodology

3.1. Data

The quarterly data for FFR, US GDP, money supply, exchange rate, and CPI inflation for the period 1999:01-2019:01 were obtained from the Federal Reserve Bank of St. Louis Economic Data website (FRED). The data for EU interest rate, EU GDP, money supply, and CPI inflation were retrieved from European Central Bank website (Statistical Data Warehouse).

3.2. Econometric Specification

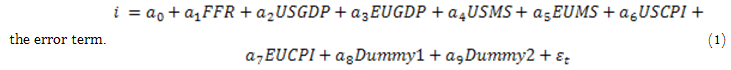

Following Lee and Werner (2018) this paper investigates the relationship between the FFR and ECB interest (i) using macroeconomic fundamentals in both regions. In this context, the interest rate is a function of FFR, and macroeconomic fundamentals such as GDP, Money Supply and CPI in both regions, and ![]() is the

is the

3.3. List of Variables

The list of variables in the regression model is presented in Table 1.

| Name | Description |

| FFR | Federal Funds Rate |

| i | European Central Bank Interest Rate |

| USGDP | US Gross Domestic Production |

| EUGDP | EU Gross Domestic Production |

| USMS | US Money Supply (M2) |

| USMG | US Money Supply Growth |

| EUMS | EU Money Supply |

| USCPI | US Consumer Price Level Inflation |

| EUCPI | EU Consumer Price Level Inflation |

| Dummy1 | Dummy for Contractionary Monetary Policy in US |

| Dummy2 | Dummy for high inflation rate in the US Economy |

3.4. Unit Root Tests

Table 2 for the Augmented Dickey-Fuller (ADF) tests suggest that there is no unit root for those macroeconomic fundamentals. In other words variables are integrated of degree zero I(0) and if used in the level, the econometric results are not spurious.

Estimated value |

Critical Value 1% |

Critical value 5% |

|

| FFR | 1.23(3.78)** |

2.24 |

3.56 |

| i | 0.87(4.23)** |

3.15 |

4.12 |

| USGDP | 1.47(2.56)** |

1.95 |

3.78 |

| EUGDP | 1.35(2.98)** |

2.18 |

2.46 |

| USMS | 1.95(4.78)** |

3.17 |

3.56 |

| EUMS | 4.15(3.96)** |

3.47 |

3.94 |

| USCPI | 3.86(4.21)** |

3.84 |

3.96 |

| EUCPI | 2.17(4.56)** |

3.94 |

4.27 |

To find out whether there is a long-term relationship between variables the Johansen’s cointegration technique has been implemented and the results in Table 3 suggest that there is a long-run relationship between ECB interest rate and macroeconomic fundamentals in the US and Euro zone.

Ho |

Eigenvalue |

Likelihood ratio |

5% Critical value |

1% Critical value |

r=0 |

0.13 |

39.17** |

32.15 |

38.56 |

r<1 |

0.21 |

48.14** |

39.27 |

46.18 |

r<2 |

0.19 |

33.76* |

31.14 |

35.94 |

r<3 |

0.16 |

45.27** |

37.17 |

39.24 |

r<4 |

0.18 |

30.17* |

22.56 |

34.18 |

r<5 |

0.14 |

34.15* |

23.74 |

35.17 |

r<6 |

0.21 |

38.17** |

27.85 |

37.24 |

r<7 |

0.17 |

39.26** |

29.56 |

38.36 |

| Note: Rejection of unit root test at five and one percent of confidence level is indicated with * and ** respectively. |

Finally, we run the Granger Causality test introduced by Engle and Granger (1987) to find out whether the causality runs from the FFR to ECB interest rate or the other way around. We divide the data into two sub-periods of pre and post financial crisis 2007. The results summarized in Table 4 suggest that causality runs from FFR to ECB interest rate for pre financial crisis, while for the post financial crisis the causality is bi-directional. The results support the idea that both central banks react to other central bank shocks for conducting their monetary policy and a shock in one country has significant spillover effects on the other country.

| Null Hypothesis (Whole period) | Statistics |

Probability |

Causality direction |

| FFR doesn’t cause i | 1.98 |

0.01 |

FFR |

| i doesn’t cause FFR | 1.14 |

0.34 |

No causality |

| Null Hypothesis (Post 2007 period) | Statistics |

Probability |

Causality direction |

| FFR doesn’t cause i | 2.14 |

0.01 |

FFR |

| i doesn’t cause FFR | 2.56 |

0.01 |

ECBI |

4. Estimated Econometric Results

The estimated results for Equation 1 with quarterly data for the period 1999:01-2019:01 presented in Table 5 for three sub-periods: pre financial crisis, post financial crisis, and post Taper Tantrum in 2013, suggest that in all sub-periods the macroeconomic fundamentals are able to explain more than 80 percent of changes in ECB interest rate movements. There correlation between FFR and the ECB interest rate is equal to 0.88 for pre financial crisis 2007, while it jumps up to 0.94 for post financial crisis, highlighting a stronger relationship during the second period. The results for post Taper Tantrum suggest that the correlation between the two variables jumps up to 0.97, underlining more integration between the two economies during recent years. The results of this study support those of Ehrmann and Fratzscher (2004) and Hartmann and Smets (2018) who find that Euro area markets react strongly to changes in the US markets than vice versa. Indeed, the estimated results suggest that the US and EU money markets have become significantly interdependent due to real integration of the two economies; however, the ECB interest rate is more responsive to US monetary policy and FFR shocks, than European fundamentals. In addition, the coefficient on the dummy variable for the US monetary stance suggests that European Central Bank reacts more aggressively when the US monetary policy is contractionary than when it is expansionary, to reverse the capital flow to the United States due higher interest rates created by the contractionary monetary policy.

The coefficient on the dummy variable for the US inflation rate suggests that the level of inflation rate in the US economy matters for the reaction of the ECB interest rate.

Pre Financial Crisis |

Post Crisis (2007) |

Post Taper Tantrum period in 2013 |

|

FFR |

0.88 (3.15)** |

0.94 (4.67)** |

0.97 (4.89)** |

USGDP |

0.23 (3.4)* |

0.25 (3.76)** |

0.34 (6.78)** |

EUGDP |

0.17 (1.45) |

0.21 (1.75) |

0.23 (2.18)* |

USMS |

-0.05 (1.78)* |

-0.02 (1.98)* |

-0.04 (2.56)** |

EUMS |

0.04 (1.49) |

0.03 (1.37) |

0.03 (1.18) |

USCPI |

0.21 (4.78)** |

0.26 (5.64)** |

0.23 (4.15)** |

EUCPI |

-0.27 (5.16)** |

-0.24 (2.89)** |

-0.21 (3.98)** |

Dummy1 |

0.17 (4.17)** |

0.13 (2.65)** |

0.16 (3.45)** |

Dummy2 |

0.12 (5.26)** |

0.11 (4.17)** |

0.14 (4.79)** |

R-Squared |

0.84 |

0.83 |

0.87 |

Adjusted R-Squared |

0.81 |

0.81 |

0.83 |

F Statistics |

112.65 |

126.34 |

143.15 |

Durbin Watson |

1.78 |

1.89 |

1.95 |

5. Conclusion and Policy Recommendation

This paper extends the research of Lee and Werner (2018) by examining the relationship between FFR and the ECB interest rate using macroeconomic fundamentals. First, Johanson co-integration results suggest that there is a long-run relationship between ECB interest rate and FFR and US macroeconomic fundamentals. Second, the Granger causality test results suggest that causality runs from FFR shocks to ECB interest rate for pre-financial crisis 2007, while for post financial crisis the causality is bi-directional.

The estimated results for the regression model for three sub-periods indicate that European Central Bank interest rate has a high correlation with FFR; particularly for the post-Taper Tantrum period is close to 1. The results of this study support the findings of De Bondt (2002); Ehrmann and Fratzscher (2004) and Hartmann and Smets (2018) who conjecture that Euro area interest rate react more strongly to US monetary policy and FFR shocks than vice versa and the responsiveness has increased during the past decade since introduction of Euro.

In addition, the estimated results for regression models suggest that the ECB reacts more aggressively when the monetary policy stance is contractionary in the US, than when it is expansionary. Finally, the dummy variable for high inflation indicates that the reaction of ECB interest rate depends on the level of inflation in the US economy. The higher the inflation rate, the more aggressively ECB will react to changes in FFR. Amazingly, the ECB interest rate is more responsive to US macroeconomic fundamentals than EU fundamentals. Indeed, the conduct of monetary policy in the Euro area has become more dependent on the United States monetary policy stance and inflation. The findings of this study support those of Hartmann and Smets (2018) who find that Fed’s interest rate policy and monetary policy variables have important repercussions on the Eurozone monetary policy and its interest rate policy.

The study can be extended in different directions. First, it may use a Vector Error Correction (VEC) model as suggested by Ahmad et al. (2013) to quantify both the degree and speed of adjustment of one interest rate to changes in other policy rate. Second, it may use other macroeconomic fundamentals such as non-borrowed reserve, exchange rate volatility, and expected inflation to see whether there is a significant change in the correlation between the two policy rates.References

Ahmad, A. H., Aziz, N., & Rummun, S. (2013). Interest rate pass-through in the UK: Has the transmission mechanism changed during the financial crisis. Economic Issues, 18(1), 17-38.

Ahmed, S., Coulibaly, B., & Zlate, A. (2015). International financial spillover to emerging market economies: How important are economic fundamentals? Board of governors of federal reserve system. International Finance Discussion Paper No. 1135.

Alper, K., Altounk, F., Capacioglu, T., & Ongena, S. (2019). The effects of unconventional monetary policy on cross border bank loans: Evidence from an emerging market. Swiss Finance Institute, Research Paper No. 19-38.

Atesoglu, H. S. (2003). Monetary transmission--federal funds rate and prime rate. Journal of Post Keynesian Economics, 26(2), 357-362.

Atesoglu, H. (2005). Monetary policy and long-term interest rates. Journal of Post Keynesian Economics, 27, 533-539.Available at: 10.1080/01603477.2005.11051451.

Brauning, F., & Ivashina, V. (2018). US monetary policy and emerging market credit cycles. NBER Working Paper No. 25185.

Bremus, F., & Fratzscher, M. (2015). Drivers of structural change in cross-border banking since the global financial crisis. Journal of International Money and Finance, 52(C), 32-59.

Bruno, V., & Shin, H. S. (2015). Capital flows and the risk-taking channel of monetary policy. Journal of Monetary Economics, 71, 119-132.Available at: https://doi.org/10.1016/j.jmoneco.2014.11.011.

De Bondt, G. (2002). Retail bank interest rate pass through: New evidence at the euro area level. European Central Bank, Working Paper No.136.

Dominguez, K. M. E. (1996). Monetary interdependence and coordination. University of Michigan, Discussion Paper No. 408.

Ehrmann, M., & Fratzscher, M. (2004). Equal size, equal role? Interest rate interdependence between euro area and United States. European Central Bank, Working Paper No. 342.

Engle, R. F., & Granger, C. W. J. (1987). Cointegration and error correction: Representation, estimation and testing. Econometrica, 55(2), 251-276.Available at: 10.2307/1913236.

Fernández, A., Schmitt-Grohé, S., & Uribe, M. (2017). World shocks, world prices, and business cycles: An empirical investigation. Journal of International Economics, 108, S2-S14.

Fratzcher, M., Lo Duca, M., & Straub, R. (2013). On the international spillovers of US quantitative easing. European Central Bank, Working Paper No. 1557.

Friedman, J., & Shachmurove, Y. (2017). Monetary transmission: The federal funds rate (FFR) and the London interbank offered rate (LIBOR). Journal of Finance and Economics, 5(1), 1-8.Available at: 10.12735/JFE.V5N1P01.

Fuertes, A., & Heffernan, S. A. (2009). Interest rate transmission in the UK: A comparative analysis across financial firms and products. International Journal of Finance and Economics, 14(1), 45-63.Available at: 10.2139/ssrn.903348

Giovanni, J., Kalemli-Ozcan, S., Ulu, M. F., & Baskaya, Y. S. (2019). International spillovers, and local credit cycles. NBER, Working Paper No. 23149.

Hartmann, P., & Smets, F. (2018). The European central bank’s monetary policy during its first 20 years, brookings paper on economic activity. Retrieved from https://www.brookings.edu/wp-content/uploads/2018/09/Hartmann-Smets_Text.pdf .

Iacoviello, M., & Navarro, G. (2018). Foreign effects of higher US interest rates, board of governors of federal reserve system. International Finance Discussion Papers, No 1227.

Jorda, O., & Bergin, P. (2004). Measuring monetary policy interdependence. Journal of International Money and Finance, 23(5), 761-783.Available at: https://doi.org/10.1016/j.jimonfin.2004.03.004.

Kalmeli-Ozcan, S. (2019). US monetary policy and international risk spillovers. Paper presented at the Jackson Hall Conference Proceeding, Federal Reserve Bank of Kansas City.

Lane, P. R., & Milesi-Ferretti, G. M. (2017). International financial integration in the aftermath of global financial crisis. IMF Working Paper, No. 17/115.

Lee, K. S., & Werner, R. A. (2018). Reconsidering monetary policy: An empirical examination of relationship between interest rates and nominal GDP growth in the U.S., U.K., Germany, and Japan. Ecological Economics, 146, 26-34.Available at: https://doi.org/10.1016/j.ecolecon.2017.08.013.

Miranda-Agripinno, S., & Rey, H. (2019). US monetary policy and the global financial cycle (pp. 1-56). NBER, Working Paper 21722.

Mishkin, F. (1996). The channels of monetary transmission: Lessons for monetary policy. NBER Working Paper No. 5464.

Mizen, P., & Hoffmann, B. (2004). Interest rate pass through and monetary transmission: Evidence from individual financial institutions’ retail rates. Economica, 71(281), 99-123.Available at: https://doi.org/10.1111/j.0013-0427.2004.00359.x.

Mojon, B. (2000). Financial structure and interest rate channel of the ECB monetary policy. European Central Bank, Working Paper No. 40.

Nishiyama, Y. (2007). Monetary transmission: Federal funds rate and CD rates. Journal of Post Keynesian Economics, 29(3), 409-426.Available at: 10.2753/PKE0160-3477290303.

Payne, J. (2007). More on the monetary transmission mechanism: Mortgage rates and the federal funds rate. Journal of Post Keynesian Economics, 29(2), 247-257.Available at: 10.2753/PKE0160-3477290204.

Payne, J., & Waters, G. A. (2008). Interest rate pass through and asymmetric adjustment: Evidence from the federal funds rate operating target period. Applied Economics, 40, 1355-1362.Available at: 10.1080/00036840600806233.

Sander, H., & Kleimeier, S. (2006). Convergence of interest rate pass-through in a wider eurozone? Economic Systems, 30(4), 405-423.Available at: https://doi.org/10.1016/j.ecosys.2006.07.007.

Santacreu, A. M. (2015). The economic fundamentals of emerging market volatility. Federal Reserve Bank of St. Louis. Economic Synopses, No.2.

Sarno, L., & Thornton, D. (2002). The dynamic relationship between the federal funds rate and the treasury bill rate: An empirical investigation. The Federal Reserve Bank of St. Louis, Working Paper No. 2000-032C.

Ullrich, K. (2003). A comparison between the fed and the European central bank: Taylor rules. Center for European Economic Research, ZEW Discussion Paper No. 03-19.