Covid-19 Pandemic and Internally Generated Revenues in Local Governments: Nigeria Experience

ADEKOYA, A. Augustine1*

AGBETUNDE, L. Ayodele2

AKINRINOLA, O. Oladipo3

1Department of Accounting, Babcock University, Ilisan-Remo, Ogun State, Nigeria. |

AbstractThe impact of COVID-19 pandemic on individuals, businesses, economy and governments has become a focus of attention in recent times by scholars, administrators and policy makers. Many researches have been conducted on COVID-19 with less focus on its impact on Internally Generated Revenues (IGR) in Local Governments (LGs). COVID-19 pandemic has impaired the economies and activities of the informal sector (IS) which form the nucleus of rate/taxpayers in LGs. This affects LGs finances in meeting the infrastructural and social-economics needs of the people at the grassroots level. Therefore, the study examined COVID-19 and its impact on LGs IGR in Nigeria, and how to enhance future IS tax compliance and LGs IGR. The study employed exploratory research design with focus on literatures in the area of LG administration and COVID-19 pandemic, public sector accounting and finance, and Nigeria constitution. Secondary data on IGR of LGs in Lagos state were collected while descriptive statistics was adopted for data analysis. The study concluded that COVID-19 pandemic affects many lives, business, and governments. It impacted negatively on the revenues and finances of LGs. However, Public trust, accountability and transparency are key to realization of revenues, therefore, policy makers at the LGs needs to recognize the importance and role of IS on economic development and IGR potentials by extending palliatives measures. LGs should also computerize their revenues register while economic recovery team should be set up on revenue assurance, and how to tackle post COVID-19 financial capability and tax evasion.s |

Licensed: |

|

Keywords: JEL Classification: |

|

Received: 23 December 2020 |

|

| (* Corresponding Author) |

Funding: This study received no specific financial support. |

Competing Interests:The authors declare that they have no competing interests. |

1. Introduction

Revenue in Local government is a generic terms that involves tax and non-tax sources of revenues. According to Agya, Ibrahim, and Emmanuel (2015) revenue is all form of monetary receipts from both taxes and non-taxes sources. A tax revenue is a compulsory payment on income, profit and property while non-tax revenue are collectables that are subjects to usage or activities, these are fees, fines, rates, tolls, licences, permits and other miscellaneous revenues. According to Federal Ministry of Finance (2012) the National Tax Policy (NTP) defined revenue as income received from all activities engaged in by the receiving entity. It is the entire amount received by the government from all sources within and outside the government entity. Revenues generation is vital to local government because local governments are established to provide for the immediate needs of the people at the grassroots level. Local governments are created to enhance the process of democratization, provision of goods and services and to facilitate citizens’ participation in decision making at the grassroots level (Adekoya, 2020). The creation of local governments are subjected to political, social and cultural structure of self-governance and this makes the local governments to become unique in terms of economic, social-cultural, political and physical characteristics. Despite these, most citizens has lost trust in local governments as an institution because of their failure and inefficiency in prompt service delivery (Adeyemi, 2013).

All over the world, local governments play a vital role in the provision of essential goods and services at the grassroots level. The challenges of urbanization growth, limited financial resources and constant demand for public goods and services has deterred local government administration for efficient service delivery. The recent global outbreak of COVID-19 pandemic has also added to the problems of local government administration due to its spread and impact, which slow down economic activities and governance in different parts of the world. According to Ozili (2020) the COVID-19 pandemic has resulted into economic loss to business activities and governance. Mostly affected at the local government level are the operators in the informal sector and daily income earners who formed the bulk of taxpayers to local government. At the central government level, the advent of COVID-19 pandemic has led to huge external debt for most countries (McKibbin & Fernando, 2020). Anjorin (2020) opined that the virus has the potential to crush the health sector and the economy of any country. This assertion was also agreed to by Okhuese (2020) based on the current situation where an effective vaccine has not been discovered to tackle and curtail the spread of the pandemic and minimise its effects. Oruonye and Ahmed (2020) reported that this COVID-19 pandemic has led to shutdowns of cities and states in countries and this has worsens the rate of unemployment, poverty level, sales decline and revenues loss to the government. Local governments are blessed with small and medium scale enterprises operators, these operators had been the major tax and rate payers to the local government, however, any dwindling in their income and business as a result of any crises will probably have impact on the level of revenues to be generated by the local government.

In Nigeria, the first COVID-19 pandemic case was announced on February 27, 2020 in Lagos. The government took action immediately to curtail the spread of the pandemic across the country. The measures adopted includes instant lockdown, restriction on individual movements, travel ban and suspension of visa on arrival, instant public enlightenment and monitoring, contact tracing as well as other health sensitisation. The total lockdown of city of Lagos, Ogun and Abuja was announced on March 30, 2020 in order to curtail the spread and enable health officials to carry out instant contact tracing. COVID-19 pandemic has serious impact on the economies and activities of the informal sector which form the nucleus of rate/taxpayers to local government. In most rural areas which form the nucleus of local government, the livelihoods of the self-employed and informal sector operators are at risks and vulnerability because the daily business activities had been disrupted as a result of the government pronouncement of total lockdowns, movement restriction and social distances. The government policy and steps to curtail the spread of the virus has seriously affected revenue generation at all level of governments and this has probably impacted negatively on the implementation of year 2020 annual budget. In the past, internally generated revenue in local government are characterised with series of revenues generation problems which has become a clog to good administration and provision of infrastructural development. Some of these problems as highlighted by previous researchers are corruption and dishonesty on the part of revenue officers, manpower shortage, technological lapses, political interference, lack of tools and machineries, all these problems has leads to high level of revenue gap and tax evasion. The outbreak of COVID-19 pandemic is an added problem to revenues generation at local governments with its impact on businesses and income of informal sector and other firms’ operators.

According to ILO (2018) informal employment in Africa act as main sources of employment and this accounts for 85.8 percent of all employment in activities where most men and women engaged themselves. In addition, 72.3 percent of the informal sector employee in Nigeria are poor and this is around 58 percent of the entire population of Nigeria, of an estimated figure of 200 million people. The informal economy in Nigeria comprises of workers in the agricultural sector (53%), service industry (39.4%), and other industries (6.9%) (ILO, 2018). Informal labour activities involved farming and herding, small scale trading, small enterprises, home based enterprises, micro and small scale manufacturing. These group of people or operators form the major target by local government for revenues generation but most of these operators have lost sales, businesses and incomes due to COVID-19 pandemic, government policy of instant lock down, restriction on individual movements and social distances. This in turn has disrupted revenues collection by local governments.

Finance is the bedrock of any administration at both private and public sector, but most local government as an arms of public sector in developing countries faces financial problem due to low level of internally generated revenues to complement funds from the central or state government in achieving their primary objectives and constitutional or statutory responsibilities of their creation. Previous researchers, Abegunde (2019); Alao, Osakede, and Owolabi (2015); Coker, Eteng, Agishi, and Adie (2015); Dada, Adebayo, and Adeduro (2017); Eteng and Agbor (2018); Oduola, Sawaneh, Ogunbela, and Babarinde (2019) and Olusola (2011) revealed that most local government in Nigeria depends on federally allocated revenues for servicing both recurrent and capital expenditures with less focus on internally generated revenues potentials. The dwindle allocation in recent time and increase in recurrent expenditures because of the outbreak of COVID-19 pandemic has necessitated the need to re-engineered the revenue drives of the local government for future prospect and development, especially, at post pandemic era. Various researchers had conducted research on the impact of COVID -19 on various areas such as informal economy (Khambule, 2020; Nnabuife, Okoli, & Anugwu, 2020); Government response to socioeconomic (Awofeso & Irabor, 2020); Agriculture (Otekunrin, Otekunrin , Fashina, Omotayo, & Akran, 2020; Singh, Sharma, & Sharma, 2020); Stock market indices (Adekoya. & Nti, 2020); Medical tourism (Sharma, Vishray, Ahlawat, Mittal, & Mittal, 2020); Churches and pastoral ministry (Afolaranmi, 2020); Small and medium scale business (Imache, Tian, Tasinda, & Salisu, 2020); Supply chain (Babatunde, 2020) and Aviation (Siyan, Adegoriola, & Agunbiade, 2020) with less emphasis or focus on the impact on local government internally generated revenues and its administration. The objective of the study is to look at the impact of COVID-19 on revenues generation at local governments’ level in Nigeria. The paper looked at the relationship between COVID-19 and revenue generation at local governments by taking into consideration the taxpayers ability to pay theory. The paper attempts to answer the question: Does COVID-19 impacts on revenues generation capacity of local governments in Nigeria?

2. Review of Extant Literature

2.1. Conceptual Review

2.1.1. COVID-19 Pandemic

Coronavirus tag COVID-19 according to Ozili. and Arun (2020) is a novel strain from Severe Acute Respiratory Syndrome (SARS) species. COVID-19 pandemic was first detected in Wuham, the capital of Hubei, China in December 2019. It was pronounced as pandemic by World Health Organisation (WHO) on March 11, 2020. (McKibbin & Fernando, 2020) opined that COVID-19 is caused by SARS-COV-2 virus and this starts with a symptoms of high fever, dry coughing, sore throat or diarrhoea and shortness of breath. The pandemic has become a global phenomenon which started spreading from countries to countries as an invisible enemies, it work against the economy, social and psychological behaviour of citizens in a nation. It affects all aspect of human life ranging from religious, social, cultural, sporting, career and educational activities. In February 27, 2020, the first case of the pandemic was reported in Lagos, Nigeria, through an Italian citizen who was confirmed as carrier of the virus (NCDC, 2020). This Italian citizen travelled to the country from Milan, Italy on 24th February 2020 via Muritala Muhammed International Airport, Lagos. He then proceeded to Ogun state on 25th February, 2020 for an assignment, while in the state, he was discovered with high index suspicious on 26th February, 2020. On 27th February, 2020 he was confirmed at Infectious Diseases Hospital (IDH) Yaba, Lagos as COVID-19 carrier and as the first to be identified as importer of the virus into the country.

COVID-19 has disrupted millions of people ways of life and sources of income, especially the informal sector business operators and family households’ income at local government level. As soon as the pandemic was reported in Nigeria and its spread continue, the government switched into action to curtail the spread by closing down the economy, enforce restriction on individual movement, carried out instant publicity and public enlightenment, quick contact tracing and enforcement of social distancing. The new government policy and directives on the citizens’ ways of life as a result of the COVID-19 pandemic outbreak has impacted negatively on the nation’s economy and business activities, it bite high on the individuals and firms that operate in the informal sectors mostly, those business activities that are based on human face to face business transactions. The pandemic has impacted on the level of unemployment and business activities, disrupt labour markets, slow down governance and drive down economic growth in all areas of the country. These had resulted into 58,848 confirmed cases; 50,358 discharge cases and 1,112 death cases as at 30th September, 2020. Lagos state is the epicentre of the pandemic in Nigeria while Kogi state has the least figure with 19461 and 5 confirmed cases respectively as at 30th September, 2020. The numbers still continue to increase on daily basis. The pandemic has created much impact on the economy at the local government level because of the weak institution and lack of social welfare programmes for the indigent, informal sector operators and vulnerable citizens who are really being affected by the outbreak with a multiplier effects on the local government internally generated revenues. The continuous impact of this pandemic on local government internally generated revenues depends on many unknown factors such as the period of times the pandemic will take, numbers of days government policy on individual social distancing and restriction policy will takes, and the breakthrough on vaccine. The situation report as at 30th September, 2020 are as follows:

| States | Confirmed cases |

Discharges cases |

Deaths |

Total active cases |

| Lagos | 19461 |

15249 |

204 |

4008 |

| FCT | 5709 |

4977 |

79 |

653 |

| Plateau | 3450 |

2597 |

33 |

820 |

| Oyo | 3261 |

2337 |

40 |

884 |

| Edo | 2626 |

2495 |

107 |

24 |

| Rivers | 2432 |

2244 |

59 |

129 |

| Kaduna | 2419 |

2324 |

39 |

56 |

| Others (30States) | 19490 |

18135 |

551 |

804 |

| Total | 58848 |

50358 |

1112 |

7378 |

| Sources: NCDC COVID-19 Situation Report 215. |

2.1.2. Local Government

Local government is unique to economic growth and development of a nation. According to Adedokun (2004) local government is responsible for the control, administration and governance of at least 70 percent of Nigeria population, therefore, local government act as the closest government that quickly responds to the immediate needs of the people within the locality by putting in place the necessary strategies for the provision of goods and services, and better well-being of the local citizens. The philosophy of local government administration is the effective involvement of grassroots citizens in administration and leadership, by providing solution to immediate challenges at the local level through the formulation and implementation of policies for the well-being of the citizens (Abegunde, 2019). The present form of local government system in Nigeria metamorphosed from the native authority system introduced by the British colonial administration in 1921. This native authority system was in operation in Nigeria until 1950’s when the legislative system form of participatory governance commenced. Although, the native authority systems which was based on cultural value operates in the Northern part (Hausa/Fulani tribe) and Western part (Yoruba tribe) of the country, but it was a failure in the eastern part (Igbos tribe) of the country and it was abolished because the Igbos culture (the citizens of the eastern part) does not have a culture of kingship which is based on supremacy rather, each village is regarded as autonomous and authority dispersed (Hassan, 2011). The native authority system in the northern part of the country leads to the introduction of indirect rule system in 1900 by Lord Lugard. In 1953, the western region’s local government law of Macpherson constitution backed native and local administration.

According to Gboyega cited in Adeola (2008) local government system in Nigeria revolved round four milestone of colonial rule, this are traditional administrative system (1903-1950), the liberal and participatory method (1950), the intervention of military rule of military centralization and unity of command, and local government reform of 1976 with liberal participatory approach. Federal Government of Nigeria (FGN) in 1976, introduced a major reform of local government administration in which local government was recognized as a third tier of government. The reform was to ensure the creation of local government with an estimated population 150,000 to 800,000 peoples; entrench democratically elected leadership at the local government level; ensure that each state have an independent local government service commission saddled with the responsibilities of staff recruitment, training, deployment, promotion and discipline; and furthermore, local governments are assigned with specific functions, roles and responsibilities that is distinct from other tiers of government.

The framework of local government as a third tier of government in Nigeria according to 1976 reform was further entrenched in 1979, 1989, 1999 constitution and 2011 (as amended). According to Adekoya (2020) local governments as an institution are created to entrenched grassroots democracy and ensure social and economic wellbeing of the citizens in the areas of security, infrastructural developments, and provision of goods and services. Therefore, the creation of local government is to ensure and promote grassroots development and local participation in governance. It is also to facilitate democratic self-government at the grassroots level; act as a channel of communication between the local government and the other tier of government; ensure infrastructural, socio-economic development activities; gives the local citizens the opportunity to conduct their own affairs in their own way; provides the ground for art of learning governance and administration of justice; and to ensure the involvement of traditional rulers in effective leadership, decision making and entrenchment of better administration. The local governments in Nigeria has grown from 190 prior to 1976 reforms to 301 in 1976, 449 in 1989 and 774 as at today, as enlisted in the fourth schedule part 1 of the Nigeria 1999 constitution.

In line with 2006 population census, the population and average population per local government in the 36 states and Federal Capital Territory (FCT), Abuja is as highlighted in Table 1. The average population per local government in Nigeria based on 2006 population census is 180,883 while Lagos state has the largest population per local government with 450,677 average populations.

Taking the present day Nigeria population figures of over 200 million into consideration, the average population per local government will possibly double or triple the figures as reported in Table 2. The increase in the population of citizens within the local governments has created a serious implication for social, economic and infrastructural development. This increase has necessitated some states in Nigeria to create more Local Council Development Areas (LCDAs). As at 2003, Lagos states created 37 LCDAs in addition to 20 local governments entrenched in the Nigeria 1999 constitution. The creation of 37 LCDAs was in line with the provision of section 8(3) of the 1999 constitution, this was backed up by the Lagos State House of Assembly (LSHA) creation of Local Council Development Areas (LCDAs) (amendment) law 2004. Besides, Section 8 (5 & 6) of Nigeria 1999 constitution provides that each State House of Assembly shall after the creation of more LCDAs make adequate returns to the National Assembly in order for National Assembly to makes consequential provisions with respect to names and headquarter of state and local government areas. The twenty 20 LGs and 37 LCDAs created by Lagos state government are as highlighted in Table 3.

| States | Population |

No. of LGAs. |

Average Population per LGAs |

Ranking |

| Lagos | 9,013,534 |

20 |

450,677 |

1st |

| FCT | 1,405,201 |

05 |

281,040 |

2nd |

| Kaduna | 6,066,562 |

23 |

263,764 |

3rd |

| Bauchi | 4,676,465 |

20 |

233,823 |

4th |

| Zamfara | 3,259,846 |

14 |

232,846 |

5th |

| Rivers | 5,185,400 |

23 |

225,452 |

6th |

| Bayelsa | 1,793,358 |

8 |

224,170 |

7th |

| Gombe | 2,353,879 |

11 |

213,989 |

8th |

| Kano | 9,383,682 |

44 |

213,266 |

9th |

| Anambra | 4,182,032 |

21 |

199,144 |

10th |

| Enugu | 3,257,298 |

17 |

191,606 |

11th |

| Ondo | 3,441,024 |

18 |

191,168 |

12th |

| Plateau | 3,178,712 |

17 |

186,983 |

13th |

| Ogun | 3,728,098 |

20 |

186,405 |

14th |

| Benue | 4,219,244 |

23 |

183,445 |

15th |

| Edo | 3,218,332 |

18 |

178,796 |

16th |

| Kastina | 5,792,578 |

34 |

170,370 |

17th |

| Oyo | 5,591,589 |

33 |

169,442 |

18th |

| Ebonyi | 2,173,501 |

13 |

167,192 |

19th |

| Abia | 2,833,999 |

17 |

166,706 |

20th |

| Delta | 4,098,391 |

25 |

163,936 |

21st |

| Jigawa | 4,384,649 |

27 |

162,394 |

22nd |

| Sokoto | 3,696,999 |

23 |

160,739 |

23rd |

| Cross-Rivers | 2,888,966 |

18 |

160,498 |

24th |

| Niger | 3,950,249 |

25 |

158,010 |

25th |

| Kogi | 3,278,487 |

21 |

156,158 |

26th |

| Kebbi | 3,238,628 |

21 |

154,220 |

27th |

| Borno | 4,151,193 |

27 |

153,748 |

28th |

| Adamawa | 3,168,101 |

21 |

150,862 |

29th |

| Ekiti | 2,384,212 |

16 |

149,013 |

30th |

| Kwara | 2,371,089 |

16 |

148,193 |

31st |

| Imo | 3,934,899 |

27 |

145,737 |

32nd |

| Taraba | 2,300,736 |

16 |

143,796 |

33rd |

| Nasarawa | 1,863,275 |

13 |

143,329 |

34th |

| Yobe | 2,321,591 |

17 |

136,564 |

35th |

| Akwa-Ibom | 3,920,208 |

31 |

126,458 |

36th |

| Osun | 3,423,535 |

30 |

114,118 |

37th |

| Nigeria | 140,003,542 |

774 |

180,883 |

| Source: National Population Commission, 2012. |

These LCDAs were created purposely to add value to the quality of lives and standard of living of the numerous citizens at the grassroots and urban centres. The essence of these LCDAs are to bring about administrative convenience in managing the local entity for the provision of goods and services that are of immediate needs to the populace rather than waiting for the state or central government.

2.1.3. Internally Generated Revenues

Internally Generated Revenues (IGRs) are the type of revenues that are generated within the conferment of the local government council which at time peculiar and distinct. The fourth schedule of Nigeria 1999 constitution highlighted the various functions of local government and also implicitly mentioned the various sources of revenues available to local government. These are classified into externally and internally generated revenues. The externally generated revenues are statutory allocation from central and state government, grants and loans while the IGR in local government are taxes; rates; tolls, local licences, fees and fines; earnings from commercial undertakings; permits; charges; rent on local government property; and miscellaneous revenues. Finance is the fuel of any administration as it constitutes lubricants for the wheel of good administration (Adekoya, 2020). Therefore, IGR as a sources of finance is vital for the socio-economic growth and sustainability of local government. IGR is the totality of revenues on rates/taxes imposed by the local government on the incomes, products or activities undertaken by individual or firm within the conferment of the local government.

S/N |

20 Local Governments | 57 Local Council Development Areas |

1 |

Agege | Orile-Agege |

2 |

Ajeromi-Ifelodun | Ifelodun |

|

3 |

Alimosho | Agbado-Okeodo |

| Ayobo-Ipaja | ||

| Egbe-Idimu | ||

| Igando-Ikotun | ||

| Mosan-Okunola | ||

4 |

Amuwo Odofin | Oriade |

5 |

Apapa | Apapa-Iganmu |

6 |

Badagry | Badagry West |

| Olorunda | ||

7 |

Epe | Eredo |

| Ikosi-Ejirin | ||

8 |

Eti Osa | Eti-Osa East |

| Iru-Victoria Island | ||

| Ikoyi-Obalende | ||

9 |

Ibeju-Lekki | Lekki |

10 |

Ifako-Ijaiye | Ojokoro |

11 |

Ikeja | Ojodu |

| Onigbongbo | ||

|

12 |

Ikorodu | Ikorodu-North |

| Ikorodu-West | ||

| Imota | ||

| Ijede | ||

| Igbogbo-Baiyeku | ||

13 |

Kosofe | Ikosi-Isheri |

| Agboyi-Ketu | ||

14 |

Lagos Island | Lagos Island East |

15 |

Lagos Mainland | Yaba |

16 |

Mushin | Odiolowo |

17 |

Ojo | Oto-Awori |

| Iba | ||

18 |

Shomolu | Bariga |

19 |

Oshodi-Isolo | Ejigbo |

| Isolo | ||

20 |

Surulere | Coker-Aguda |

| Itire-Ikate |

| Source: LSHA creation of LCDAs (amendment) Law 2004. |

The relevant tax/revenue authority saddled with the responsibility to administer, control and collect revenues in local government is Local Government Revenue Committee (LGRC). Section 162 (10) of Nigeria constitution defined revenue as any income or returns accruing to or derived by government from any sources such as receipts arising from operation of the law, receipt from property held by government and any form of returns such as interest from loan or dividend from shares in any company or statutory body. In local government, revenue sources are classified into:

1. Tenement rates/ Property rating- Property/tenement rates is a direct tax levied on the owner or occupier of a building or an underdeveloped or developed piece of land. It is a form of tax imposed on owner or user of property at a rate based on the fixed percentage of the current value of the chargeable property. According to Hassan (2011) tenement rate is potentially a large source of local government revenues, such that, if properly tapped, less emphasis will be placed on statutory allocation from the central or state government.

2. Local Licences, Fines and Fees- This comprises of various forms of revenues under one roof of activities that qualify for local government regulation and monitoring with the issuance of licences in line with the provision of the law as stipulated in the Fourth Schedule of the Nigeria 1999 constitution. These are forms of revenues which its future incomes generation cannot be accurately predicted. The annual revenues collection performance of this type of revenue is based on the total efforts put in by the local government officials on an annual basis. This efforts or performance level is based on provision of required logistics, machineries and tools, and attitudinal behaviour of revenue officers.

3. Earnings from Commercial Undertakings and Rent on Local Government property – These are incomes derived from business ventures being undertaking by local government for profit motives. These are revenues derivable from motor parks, shop and shopping centre, markets, abattoirs, transportation, agricultural proceeds, and other forms.

4. Interest and Dividend payments- These are incomes receivable from funds deposited with banks and dividend from investment in shares of companies and statutory bodies.

5. Miscellaneous Revenues- These are revenues receivable from other sources apart from those classification previously highlighted. These are revenues receivable from other sources such as letter of identification, health services, hearse and cemetery and other forms.

2.1.4. Challenges of IGR in Nigeria Local Governments

The ability to meet the yearning expectations of the citizens within the locality depends on the financial resources available to the local government at all times. Most local governments in Nigeria depends on statutory allocation or grant from the central or state government, at times, these are either controlled, diverted or string attached by the state governor. The over dependency on allocation for financial survival has scuttle the financial autonomy of local governments. According to Adeyemi (2013) this has turned the local government to a stooge rather than partners in progress with other tiers of government, on governance, the provision of goods and service, and infrastructural development. In addition, Adeyemi. (2019) opined that Nigeria local governments are characterized with series of interventions and interferences by the state government, in areas of financial matters and these had led to series of calls for constitutional review in order to make local governments fully autonomy in terms of fiscal power, function, finance, revenue control, and constitutional responsibilities. Some of the challenges facing revenues generation in local government in Nigeria are lack of financial autonomy, Citizens level of indigent and poverty, leadership problems, lack of budget and budgetary control, security inadequacy, corruption, political interference, staff inefficiency, inter-governmental intervention, lack of revenue court for adjudication, lack of bye-laws, lack of will for enforcement, lack of tools and machineries for revenues drive, inappropriate contracting of revenues, ineffective electioneering process, juicy revenues taking over by the state government, increase in tax evasion through party stalwarts and paramount rulers, rich lords and wealthy personnel within the local government, while presently, the issue of COVID-19 pandemic.

2.1.5. How to Improve Revenues Generation

1. Use of modern technology to drive revenues.

2. Palliatives measure to taxpayers.

3. Adequate staff motivation.

4. Good revenues management.

5. Instant provision of socio-cultural and infrastructural development.

6. Enhancing the loyalty of taxpayers.

7. Attitudinal changes among revenue officials.

2.2. Theoretical Review

Ability to pay theory- The study anchored on the ability to pay theory. The theory stipulates that citizens’ contribution towards government financial need for provision of goods and services, infrastructural developments and administrative purposes depends on individual’s or firm’s sacrifice on which tax payment is rest upon and ability to pay. Ability to pay is derived from the economic condition of the firm, enterprise or individual taxpayers based on the principle of affordability to pay taxes. It is an extension of the canon of equity as proposed by Adam Smith. According to Batt (2012) ability to pay theory means taxpayer ability to pay taxes to the government based income or profit derived. This is a form of tax payment that is based on the proportion of income or profit derived from economic activities and also based on proportion of individual or firms abilities. The theory distinguishes between vertical and horizontal equalities as highlighted in principle of taxation. A vertical equalities means tax or rate payers bear burden in proportion of their income or economic wellbeing while horizontal equalities means tax payment equality among individuals or firms in the same circumstances. The theory is based on equity, fairness and justice in taxation and this necessitate a wealthy individual to pay more taxes to the government when compared to indigent or poor individual in the society. According to Kendrick (1939) ability to pay is good with honest sound, therefore, in the public domain or government, revenue required for provision of goods and services should come from those that have rather than those that cannot afford. The essence of ability to pay theory is to ensure that the poor or indigent people are not overstrain in tax payment but rather being given relief or low tax payment for purpose of fairness and justice. Zhou and Madhikani (2013) opined that ability to pay theory treat taxes based on taxpayer’s current economic condition, income, wealth and power to pay. As the theory focus on taxpayer’s affordability to pay taxes, therefore at local government level and with the present case of COVID-19 pandemic in the country and the world at large, revenues payment to local government will be a function of taxpayer’s capability to pay.

2.3. Empirical Review

Okoye (2016) and Uhunmwuangho and Aibieyi (2013) studied revenues generation problems and management by local government administration in Nigeria. The studies revealed various factors and challenges that are responsible for low revenue generation, some of these are tax evasion, dishonesty, misappropriation and overdependence on federally allocated funds. The studies recommends the establishment of proper internal control system for checkmating revenue loss, stiff punishments for revenue embezzlement, stop the use political agents for revenue drives while qualified staff should be hired, trained and motivated. In addition, Agbe, Terzungwe, and Igbabee (2017) studied internal revenue generation and economic development in Local government areas in Nigeria. The study revealed that local governments in Nigeria are submissive to aggressive revenue generation. The study concluded that poor revenue generation has impact on the level of infrastructural development in local governments, therefore recommended that revenue bye-laws should be reviewed to meet the modern day application. Dada et al. (2017) also studied an assessment of revenue mobilization in Nigeria local government. The study concluded that human and infrastructural development, rate of financial misappropriation determines the revenue base of Nigeria local governments. The study recommends an adequate human and infrastructural development in local government with appropriate means of reward for revenue performances and stiff punishment for any form of financial misappropriations.

Obinna (2017) studied the effect of tax contractors in revenue generation of local governments in Enugu state, Nigeria, between 2010 and 2015. The study revealed that the use of tax contractors in revenue collections does not lead to an increase in local governments’ revenue. It was reported that corruption, political interference and poor revenue enforcement are factors militating against the success of revenue contractors. The study recommends that a conducive atmosphere for tax contractors in order to achieve good success and revenue increase. In the same vain, Eteng and Agbor (2018) studied the challenges of internal revenue generation and inclusive development of local government areas in Cross-River state, Nigeria. The study revealed that overbearing control of juicy revenue point in local government by state government, corruption, mismanagement and lack of accountability leads to tax evasion and poor revenue collection. The study recommends that state should hands-off local government revenue, while local government management should ensure accountability and judicious utilization of revenue resources. Besides, Coker et al. (2015) studied the challenges of expanding internally generated revenues in local government council areas in Nigeria. The study revealed that apart from fiscal federalism which seems hostile to local government, local governments are faced with little internal revenues to argument the federally allocated funds in order to achieves its responsibilities. Furthermore, Oduola et al. (2019) also studied revenue generation in Lagelu Local government area of Oyo state, Nigeria based on a correlate of tax mobilization and utilization. The study revealed that council’s tax mobilization were not optimally explored because most viable revenues of the council were not in most cases mobilized. The study recommends transparent in revenue generation and adequate training for revenue collectors in order to achieve good result in revenue generation.

3. Methodology

The study employed exploratory research design with the reviewed of relevant books, journals and other literatures on public sector accounting and finance, local government administration and COVID 19 pandemic, and the Nigeria constitution. Secondary data on local government internally generated revenues from January to September of each year, 2015-2020 were collected while descriptive statistical method of data analysis was adopted, and this involved the use of trend analysis, percentage, bar chart, and tabulation. A purposeful sample technique was adopted to select the study state of Lagos state, the selection of the study state was based on the following characteristics:

1. It has the highest internally generated revenue in the country for the past 10 years (NBS, 2020).

2. It has the highest percentage of 29.9% (₦398.73 billion) to the total states internally generated revenues in 2019 (NBS, 2020).

3. It has a contributions of 77% to the total revenues available for the state in 2019 (NBS, 2020).

4. It has the highest noticeable average population per local of 450, 677 (NPC, 2012).

5. The state is the epicentre for COVID-19 in Nigeria with confirmed case of 19461 as at 30th, September, 2020 (NCDC, 2020).

6. It is the commercial hub of the country, Nigeria.

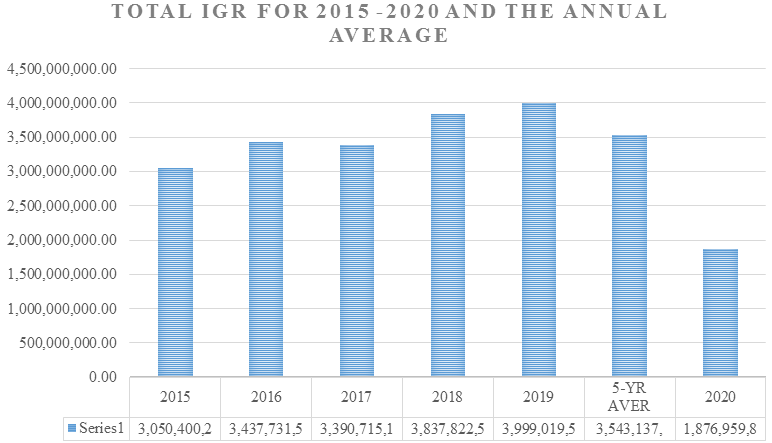

The trend analysis of the Internally Generated Revenues (IGR) performance as presented in Figure 1 revealed that collectively, the LGAs/LCDAs generated a steadily growing IGR over the past five years preceding year 2020, the COVID-19 pandemic year. The consolidated IGR for 20 LGAs was ₦3.05 billion in 2015, this was increased to ₦3.438 billion in 2016, but slightly fell by 1.4% to ₦3.391 billion in 2017. Thereafter, the revenues generated increased to ₦3.838 billion and N3.999 billion in 2018 and 2019 respectively. In 2020, the LGAs revenues generated dropped drastically by 53.06% to ₦1.877 billion which is the period of COVID-19 pandemic. This shows that the pandemic seriously affects the IGR of local governments. The impact is 53% of the annual average figure of ₦3.543 billion.

4. Discussions and Analysis

Figure-1. Total IGR by all LGAs in Lagos State for 2015 – 2020.

| Local Governments | Covid-19 Period |

5-YearPre Covid-19 Average |

IGR Achieved/ Average |

Ranking of Effect |

=N= |

=N= |

% |

||

| Apapa | 22,388,573.00 |

152,190,721.95 |

0.15 |

1 |

| Shomolu | 24,630,663.56 |

77,447,629.33 |

0.32 |

2 |

| Alimosho | 93,943,666.30 |

289,711,388.15 |

0.32 |

3 |

| Surulere | 71,892,922.62 |

220,889,778.05 |

0.33 |

4 |

| Kosofe | 93,960,280.70 |

209,478,229.28 |

0.45 |

5 |

| Badagry | 40,611,966.84 |

89,642,071.24 |

0.45 |

6 |

| Ibeju-Lekki | 14,472,343.90 |

30,504,937.27 |

0.47 |

7 |

| Lagos Mainland | 59,207,206.92 |

122,361,240.61 |

0.48 |

8 |

| Ojo | 69,949,143.92 |

142,259,823.55 |

0.49 |

9 |

| Ikeja | 151,814,558.21 |

307,195,201.40 |

0.49 |

10 |

| Ikorodu | 97,842,262.13 |

194,842,272.02 |

0.50 |

11 |

| Oshodi Isolo | 94,855,474.18 |

179,006,128.53 |

0.53 |

12 |

| Epe | 25,966,925.53 |

46,383,580.22 |

0.56 |

13 |

| Agege | 53,476,222.32 |

90,473,026.18 |

0.59 |

14 |

| Amuwo Odofin | 76,779,595.93 |

129,698,333.34 |

0.59 |

15 |

| Eti-Osa | 368,270,242.65 |

587,347,074.08 |

0.63 |

16 |

| Ifako-Ijaiye | 64,149,804.51 |

94,828,432.99 |

0.68 |

17 |

| Lagos Island | 215,112,483.22 |

286,171,428.99 |

0.75 |

18 |

| Mushin | 139,096,538.08 |

172,141,947.37 |

0.81 |

19 |

| Ajeromi Ifelodun | 98,539,004.40 |

120,564,553.88 |

0.82 |

20 |

| Total | 1,876,959,878.92 |

3,543,137,798.44 |

0.53 |

Table 4 shows that the total IGR generated by all the 20 LGAs in Lagos was negatively affected. The IGR dropped by 47% from ₦3.543 billion of five years average to ₦1.877 billion in year 2020. The study revealed that none of the LGAs was able to generate revenues in year 2020 up to the five years annual IGR average of the years proceeding year 2020, which is the year of COVID–19 pandemic. Specifically, out of the 20 LGs in the state, 10 LGs were unable to individually generate up to 50% of the five years IGR annual average prior to the year of pandemic. These LGs are Apapa, Shomolu, Alimosho, Surulere, Kosofe, Badagry, Ibeju-lekki, Lagos Mainland, Ojo and Ikeja. Apapa LGA was the most affected of all the LGAs followed by Shomolu and Alimosho.

Furthermore, Ajeromi–Ifelodun, Mushin, Lagos Island, Ifako-Ijaiye and Eti-Osa LGs performed better with 82%, 81%, 75%, 68% and 63% achievement respectively during the COVID-19 pandemic period. In general, all the 20 LGAs in the state collectively achieved 53% IGR performance during the COVID-19 pandemic (₦1.877 billion of the expected ₦3.543 billion). This is considered to be encouraging compared to the fear envisaged by the World Health Organisation (2020), World Bank (2020) and other bodies that opined that developing countries would be grossly affected by the COVID-19 pandemic.

5-years Average |

2020 |

% Achieved |

Ranking |

|

| Rural | 90,343,215.19 |

44,723,374.60 |

49.50 |

1st |

| Semi-urban | 150,560,949.26 |

80,938,039.39 |

53.76 |

3rd |

| Urban | 279,359,240.85 |

148,114,331.10 |

53.02 |

2nd |

| State Average | 177,156,889.92 |

93,847,993.95 |

52.97 |

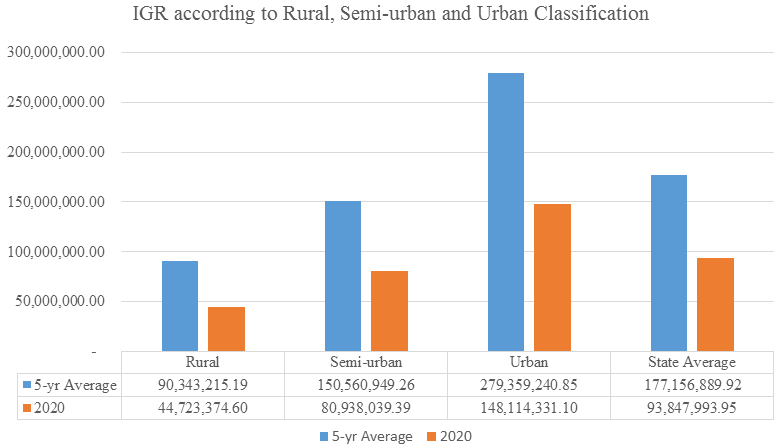

Figure-2. IGR according to Rural, Semi-urban and Urban Classification.

Local government areas in Lagos can be classified into Urban, Semi-Urban and Rural areas. Six LGAs were classified as urban, these are Surulere, Lagos Mainland, Lagos Island, Ikeja, Eti-Osa and Apapa while ten LGAs were classified as semi-urban, these are Oshodi-Isolo, Shomolu, Ojo, Kosofe, Ifako-Ijaiye, Amuwo-Odofin, Alimosho, Ajeromi-Ifelodun, Agege and Mushin. The remaining four LGAs were classified as rural, these are Ikorodu, Epe, Badagry and Ibeju-Lekki. Based on this classification and according to Table 5 analysis and Figure 2 bar chart comparison, those LGAs that are classified as rural LGAs were collectively the most affected by COVID-19 pandemic in terms of IGR. The rural LGAs were collectively able to achieve 49.5% of the five years IGR average (₦44.723 billion out of ₦90.343 billion expected annual average). The IGR performance improved in semi-urban areas whereby the semi-urban LGAs collectively achieved 53.76% of their average annual IGR (₦80.938 billion out of ₦150.561 billion expected) while the urban LGAs were able to collectively generates 53.02% of their average annual IGR (₦148.114 billion out of ₦279.359 billion expected).

These findings are in line with the forecasts of the Organization for Economic Cooperation and Development (OECD) which envisaged a projected decline in the global economic growth across the world (OECD, 2020). The study outcome also align with the empirical finding of the World Trade Organisation (2020) that COVID-19 pandemic will made an unprecedented disruption to the economy, finance and trade across the globe. Furthermore, it also affirm the outcome of African Union, that reported a drastic drop in growth coupled with declined in employment and investments which was caused by COVID-19 pandemic from the study five top African economies of Nigeria, South Africa, Algeria, Egypt and Morocco (AU, 2020). Although, in all it is however noted that the result showed that the various condition was not as critical as speculated by the World Bank (2020) which forecasted economic recession.

5. Conclusion and Recommendations

Conclusion is drawn along with appropriate recommendations for enhancing the frontiers of knowledge.

5.1. Conclusion

COVID-19 pandemic affects many lives, businesses and governments all over the world. It has also impacted negatively on the revenues and finances of the local government. Besides, findings from the analyses showed that the IGR achieved by each of the 20 LGAs in Lagos state steadily improved on yearly basis until the year 2020, when the whole world experienced COVID-19 pandemic and lockdown. The revenue generation performance fell by almost have of the annual average figure in the year, with the rural area as the most affected area. Meanwhile, despite the effect of the pandemic, three of the LGAs were able to individually generate up to 75% of its expected annual average IGR. In all, the LGAs were able to perform better than envisaged by international bodies like WTO, African Union and the Word Bank/IMF.

Public trust is key to realization of revenue, therefore, policy makers at the local government needs to recognize the importance and role of informal sector on economic development and revenue generation at the local government level. The revenue authority or committee require measures to support individual taxpayer and business who are faced with challenges of financial burden and hardship caused by the advent of the pandemic. This can be achieved by given additional period for revenue payment while revenue audit and enforcement should temporarily be suspended in order to give taxpayers enough time to make payment. On the other hand, at the local government level, there should be quick update to have a comprehensive revenue register and quality revenue data through the form of computerization and digitalization. Local governments should follow the principle of revenue assurance by ensuring that all revenues are collected accurately and timely, this is to minimize revenue loss, reduce fraudulent practices and all form of misappropriation. In this pandemic period, for local government to achieve its objectives, it require the adoption of measures that will ensure effective and efficient revenues generation, this is to eliminate leakages and abuses in order to enhance financial capability for provision of goods and services, curtail the spread of the pandemic and enhance economic growth and development at the grassroots.

Furthermore, the application of technology for revenue drives through the use of computer and digital channels of banks for revenues collection, along with good governance will instil trust in the heart of the citizens and enhance IGR. Local governments should add voices to the fight against the impact of the pandemic on the life and business of the citizens and the economy in general. Local government management should design a policy that will enhance the operation of the informal sector and taxpayers during and after COVID-19 period. An economic recovery team should be set up to fashioned out the procedures for reviving revenue generation at post COVID-19 period in order to enhance the financial capability of local government in achieving its constitutional responsibilities towards the citizens and the communities at large. Also necessary assistance can be stretch to taxpayers in the form of rebates on tax or rate payments, appropriate palliatives relief can also be extended to grassroots dwellers to complement and reduce their financial burden and enhance their well-being. Small amount of loan and other form of empowerment can be extended to the operators in the informal sectors, this will have multiplier future benefit that will boost their business activities, create more jobs and open more revenue for the local government.

5.2. Recommendations

1. Local governments should invest in technology for revenue drive in the form of digitalization and computerization of revenue data base.

2. All form of revenue leakages under the guise of COVID-19 should be properly blocked with stiff punishment for erring revenue officer.

3. Adequate public enlightens through media, road show and community square on the importance of revenue to local government along with health talks on how to curb the spread of the COVID-19 pandemic should explored.

4. Local government should ensure adequate infrastructural development, instant social service especially basic health assistance and free health relief, and provision of goods and services according to the yearning of the citizens

5. Bye-law on all revenues collectable at local governments should be made available to all citizens in order to enhance revenues collection.

6. Adequate monitoring on revenues collection should be put in place to avoid and reduce fraudulent practices and embezzlement under the disguise of COVID-19 pandemic.

7. Exhibiting public accountability and transparency on all revenues collection and its usage will encourage citizens to comply with future revenue payment.

References

Abegunde, O. (2019). Local government administration and service delivery in Nigeria: Prospects and challenges. International Journal of Research and Innovation in Social Sciences, 3(4), 211-217.

Adedokun, A. (2004). The development of local government in Nigeria since pre-colonial era to 1999 Constitution. Polycom Journal, 2(2), 115-120.

Adekoya, A. A. (2020). Financial management in local governments: The challenges and prospects of the 21st century. Journal of Economics, Commerce and Management, 8(8), 339-357.

Adekoya., A. F., & Nti, I. K. (2020). The COVID-19 outbreak and effects on major stock market indices across the globe: A machine learning approach. Indian Journal of Science and Technology, 13(35), 3695-3706.

Adeola, G. L. (2008). From nature authority to local government in Nigeria. Implication for flexibility and dynanism in local governance. Journal of Constitutional Development, 8(3), 1-10.

Adeyemi, O. (2013). Local government and the challenges of service delivery: The Nigeria experience. Journal of Sustainable Development in Africa, 15(7), 84-98. doi: https://doi.org/10.4102/apsdpr.v1i3.37

Adeyemi., O. O. (2019). Local government administration in Nigeria: A historical perspective. Journal of Public Administration and Governance, 9(2), 161-179. doi: https://doi.org/10.5296/jpag.v9i2.14813

Afolaranmi, A. O. (2020). Effects of CVID-19 pandemic lockdown of churches in Nigeria on pastoral ministry: Matter arising. EPRA International Journal on Multidisciplinary Research, 6(6), 164-171.

Agbe, I. E., Terzungwe, A. S., & Igbabee, U. S. (2017). Internal revenue generation and economic development in local government areas in Nigeria. Imperial Journal of Interdisciplinary Research, 3(5), 782-786.

Agya, A. A., Ibrahim, Y. M., & Emmanuel, E. (2015). Internal revenue generation in Taraba state, Nigeria: Problems and prospects. International Journal of Economics, Commerce and Management, 3(2), 1-13.

Alao, D. O., Osakede, K. O., & Owolabi, T. Y. (2015). Challenges of local government administration in Nigeria: Lessons from comparative analysis. International Journal of Development and Economic Sustainability, 3(4), 61-79.

Anjorin, A. (2020). More preparedness on coronavirus disease-2019 (covid-19) in Nigeria, Anjorin Pan African J. Life Sciences, 4(1), 200-203.

Awofeso, O., & Irabor, P. A. (2020). Assessment of government response to socioeconomic impact of COVID-19 pandemic in Nigeria. Journal of Social and Political Sciences, 3(3), 677-686. doi: https://doi.org/10.31014/aior.1991.03.03.201

Babatunde, A. I. (2020). Impacts of COVID-19 on supply chain operation in Nigeria. International Journal of Business and Management Invention, 9(4), 43-52.

Batt, H. (2012). Tax regimes that don’t invite corruption. International Journal of Transdisciplinary Research, 6(1), 65-82.

Coker, M. A., Eteng, F. O., Agishi, T. V., & Adie, H. I. (2015). Challenges of expanding internally generated revenue in local government council areas in Nigeria. Journal of Sustainable Development, 8(9), 79-88. doi: https://doi.org/10.5539/jsd.v8n9p79

Dada, R. A., Adebayo, I. A., & Adeduro, O. A. (2017). An assessment of revenue mobilisation in Nigeria local government: Problems and prospects. Archives of Business Research, 5(9), 119-127.

Eteng, F. O., & Agbor, U. (2018). The challenges of internal revenue generation and inclusive development of local government areas in Cross-River state, Nigeria. International Journal of Public Administration and Management Research (IJPAMR), 4(4), 1-9.

Federal Ministry of Finance. (2012). National tax policy. FCT Abuja, Nigeria: Federal Ministry of Finance.

Hassan, M. M. (2011). Financial management in Nigeria local governments. Ibadan, Nigeria: University Press Plc.

ILO. (2018). Women and men in the informal economy. A statistical picture. Geneva: ILO.

Imache, S. A., Tian, Z., Tasinda, O. T., & Salisu, G. D. (2020). Efeect of COVID -19 pandemic on small and medium scale business in Nigeria. International Journal of Research Publication, 56(1), 2708-3578.

Kendrick, M. S. (1939). The ability to pay theory of taxation. The American Economic Review, 29(1), 92-101.

Khambule, I. (2020). The effects of COVID-19 on the South African informal economy: limits and pitfalls of government’s response. Loyola Journal of Social Sciences, 34(1), 95-109.

McKibbin, W., & Fernando, R. (2020). The global macroeconomic impacts of COVID-19: Seven scenarios. Asian Economic Papers, 00 ja, 1-55.

NBS. (2020). Internally generated revenue at state level. Abuja, Nigeria: Nagerian National Bureau of Statistics.

NCDC. (2020). Coronavirus disease (COVID-19) pandemic. Lagos, Nigeria: NCDC Publication.

Nnabuife, E. K., Okoli, I. E., N., & Anugwu, C. C. (2020). Informal sector and Nigerian economic prospects: The COVID-19 experience. European Journal of Business and Management Research, 5(4), 1-5.

NPC. (2012). National population census figure. Abuja, Nigeria: Nagerian National Population Commission.

Obinna, C. O. (2017). Revenue generation in Enugu state local government, Nigeria: An assessment of tax contractors. International Journal of Social Science and Humanities Research, 5(1), 236-247.

Oduola, S. O., Sawaneh, B., Ogunbela, G. K., & Babarinde, L. B. (2019). Revenue generation in Lagelu local government area of Oyo state: A correlate of tax mobilisation and utilisation. Canadian Social Science, 15(1), 15-21.

OECD. (2020). OECD economic outlook. Paris, France: OECD Publishing.

Okhuese, V. A. (2020). Mathematical predictions for COVID 19 as a global pandemic. MedRxiv Preprint. Available at: https://doi.org/10.1101/2020.03.19.20038794 .

Okoye, G. O. (2016). Generation and management of revenues by local government in Nigeria. International Journal of Social Sciences and Humanities Reviews, 6(2), 113-122.

Olusola, O. (2011). Boosting internally generated revenue of local government in Ogun state (A study of selected local government in Ogun state). European Journal of Humanities and Social Sciences, 8(1), 336-348.

Oruonye, E. D., & Ahmed, Y. M. (2020). An appraisal of the potential impacts of COVID-19 on tourism in Nigeria. Journal of Economics and Technology Research, 1(1), 32-41.

Otekunrin, O. A., Otekunrin , O. A., Fashina, F. O., Omotayo, A. O., & Akran, A. (2020). Assessing the zero hunger target readiness in Africa in the face of COVID-19 pandemic. Caraka Tani Journal of Sustainable Agriculture, 35(2), 213-227.

Ozili, P. (2020). COVID-19 pandemic and economic crisis: The Nigeria experience and structural causes. Retrieved from: https://mpra.ub.unimuenchen.de/103131/MPRA Paper No. 103131, posted 28 Sep 2020.

Ozili., P., & Arun, T. (2020). Spillover of COVID-19: Impact on the global economy. MPRA Paper No 99850.

Sharma, A., Vishray, B., Ahlawat, J., Mittal, T., & Mittal, M. (2020). Impact of COVID-19 outbreak over medical tourism. IOSR Journal of Dental and Medical Sciences, 19(5), 56-58.

Singh, N., Sharma, D. P., & Sharma, D. D. (2020). Effect of COVID-19 pandemic on India agriculture. Krishi Science eMagazine for Agriculture Science, 1(1), 1-4.

Siyan, P., Adegoriola, A., & Agunbiade, O. (2020). Impact of COVID-19 on the Aviation industry in Nigeria. International Journal of Trend in Scientific Research and Development, 4(5), 2456-2470.

Uhunmwuangho, S. O., & Aibieyi, S. (2013). Problems of revenue generation in local government administration in Nigeria. International Journal of Arts and Humanities, Bashier Dar, Ethiopia, 2(3), 192- 209.

World Bank. (2020). Global economics prospects. Washington DC, United States of America: World Bank Group.

World Health Organisation. (2020). COVID-19 public health emergencies of international concern (PHEIC),global research and inovation forum. Geneva, Switzerland: World Health Organisation.

World Trade Organisation. (2020). COVID-19 and world trade. Geneva, Switzerland: World Trade Organisation.

Zhou, G., & Madhikani, A. (2013). Systems, processess and challenges of public revenue collection in Zimbabwe. American International Journal of Contemporary Research, 3(2), 49-60.