Effect of Social and Environmental Disclosure on the Performance of Listed Consumer Goods Producing Companies in Nigeria

Emuebie, EMEKE1

Samuel Adebayo OLAOYE2

Grace Oyeyemi OGUNDAJO3*

1,2,3Department of Accounting, Babcock University, Nigeria. |

AbstractInformation is power; its presentation, processes and utilization can make or mare circumstances. One of the strategies of bridging information asymmetry is to disclose relevant information required by stakeholders in taking crucial decision. The impact of social and environmental disclosure on the performance of Nigeria consumer goods’ producing companies was examined in this paper, using multiple regression analysis while the sample constitute 16 out of 20 companies listed as consumer goods sector. The study found that social and environmental disclosure had significant effect on return on assets while firm size and age had no significant control in the effect of social and environmental disclosure on ROA. Also, social and environmental disclosure had insignificant effect on earnings per share (EPS) but firm size and age had significant control in the effect of social and environmental disclosure on EPS. The study concluded that social and environmental disclosure has significant impact on the performance of manufacturing companies in Nigeria. It was opined that managers should ensure that information about their social practices is well communicated in an understandable manner to the stakeholders, and thus the stakeholders would be able to comprehend, value and process it in taking meaningful decision about the firm, and that disclosure should be country-specific; every country should design the benchmark, rules and guidelines befitting their environment for such to be impactful. |

Licensed: |

|

Keywords: JEL Classification |

|

Received: 23 August 2021 |

|

| (* Corresponding Author) |

Funding: This study received no specific financial support. |

Competing Interests:The authors declare that they have no competing interests. |

1. Introduction

Accounting provides a system through which costs and revenue can be established. This system is developed and employed by businesses in order to examine the financial and operational performance of its affairs. Corporate entities prepare reports and communicate same to users and these reports capture costs and revenue items used in determining the financial position of an entity. However, improving the financial performance of an entity can be hampered by external factors operating within the business environment. Consequently, corporate entities have continued to identify these external factors that could affect its financial performance and position (Eruemegbe, 2015).

The manufacturing sector recorded retarded performance reflecting its growth rate in the first quarter of 2020 being 0.43%, compared to 0.81% growth rate reported in the first quarter of 2019 (Ojeyinka & Adegboye, 2017). Many businesses are particularly involved in capturing environmental discourse and other social related benefits at various national levels. This trend has reawakened corporate attention to the strategic and competitive importance of corporate environmental responsibility to survival. The perception within the developed nations is differs widely due to robust policies and the presence of organized advocacy groups and customer knowledge that influence corporate behaviour (Zelazna, Bojar, & Bojar, 2020).

In developing countries, many companies give little or inadequate attention to its environment. They believe that, corporate goals can be accomplished without necessarily being socially responsible (Adeyanju, 2012). However, the increase in global environmental awareness and the campaign for sustainable economic development has led to re-orientation and sensitivity of corporate entities about the environment (Worae, Ngwakwe, & Ambe, 2018). In Nigeria, there are National Environmental Standards and Regulations Enforcement Agency (Establishment) Act 2007, National-Environmental Standards and Regulations Enforcement Agency (Establishment) Act 2008, Environmental Impact Assessment Act 2004, Harmful Waste (Special Criminal Provision) Act 2004, Nuclear Safety and Radiation Protection Act 2007 which centred on review of regulations on air and water quality, discharge of effluents and other harmful substances as well as control of other forms of environmental pollution. Multinational corporations have continued to show keen interest in business environment and sustainability of its operations. This has led to the development of principles by regulatory agencies given the human interaction with the environment. Such principles have encouraged companies to recognize their strategic role in the society as it has the power to influence its operations and performance (Oti, Effiong, & Tapang, 2012).

It is predicted that non-financial reporting will soon become a required business practice and companies will need to focus on how best to integrate their financial and non-financial information (KPMG, 2015). Already integrated reports are required by regulation and/or law in South Africa and India. Although only 11% of companies surveyed by KPMG (2020) have integrated reports, over 50% included CSR information in annual report, with many moving toward convergence of CSR and annual reports.

It has been observed that the rate at which most manufacturing companies are experiencing dwindling earnings in recent times is so alarming. The fluctuating and decline in the reported earnings is an indication of poor financial performance. An entity cannot grow in isolation, the developments of any firm is a function of its stakeholders and their belief in the firm. Information is power, as it enlightens the stakeholders on the performances and the operations of the firm. In a bid to provide balanced reporting that provides both quantitative and qualitative information to users, corporate entities are encouraged to sustain its contribution to its immediate communities as corporate social responsibility carried out by corporations would help minimise the negative impact of corporate activities on the environment. Business organisations must ensure it continues to earn profit in order to sustain these social activities. Most recently, the world has been challenged by the corona virus diseases (COVID-19). This pandemic is on a daily basis threatening not only human existence but corporate existence also. Corporate organisations have been making huge donations and contributions to nations and states towards fighting the pandemic. This is evident that corporate entities are not only interested in profit making but also interested in maintaining good corporate relationship with other stakeholders.

Beyond making donations and contributions towards addressing environmental and social issues, corporate entities should provide proper accounting and disclosure that could be used to assess its future performance and its ability to satisfy its shareholders. The arguments among researchers on social and environmental accounting has been ongoing for years. While the agency theory supports the argument that, managers of corporate entities acting in trust must act in the best interest of the shareholders, the stakeholder theory contradicts this by emphasising that other stakeholders such as customers, suppliers, creditors and the general public are equally important and should be considered as businesses cannot operate in isolation. Despite the increasing level of interest in corporate social environmental disclosure, there is a contention on whether the performance of corporate entities reacts to the level of awareness being created to the stakeholders through the extent of information disclosed on the operations of the firm, both financial and non-financial nature. Based on this premise, this study examined the effect of social and environmental disclosure on performance of manufacturing companies listed on the Nigerian stock exchange.

The remainder of the paper was presented in sections; section two covered the review of literature, the methods and material adopted was discussed in section three, section four captured the results and discussion of findings, while the summary and the conclusion was explained in section five.

2. Review of Literature

This sub-section captured the review of the key concept of the study, the theoretical underlying and the review of related empirical studies.

2.1. Conceptual Review

Performance is the measurement of the achievement of entities goal, depicting the financial strength of firms, represented by earnings (Galant & Cadez, 2017). Financial performance is a measure of how much a company has the ability to create profit or revenue (Fatihudin, Jusni, & Mochklas, 2018). It also measures the extent to which a company financial health over a period of time (Naz, Ijaz, & Naqvi, 2016). Several ratios have been used in literature to measure performance (Asuquo, Dada, & Onyeogaziri, 2018) for example, return on asset (Adjound & Amar, 2015; Gelb, 2017; Kowaleski, 2014; Menike, 2020) net asset per share (Brockman, 2015; Nahiba, 2017; Omaliko, Nweze, & Nwadialor, 2020) return on equity (Erhinyoja & Marcella, 2019; Polycarp, 2019) earnings per share (Agbiogwu, Ihendinihu, & Okafor, 2016; Ahmed, Zakaree, & Kolawale, 2016; Nwabueze, 2015; Polycarp, 2019). However, return on asset and earnings per share were constructs used for performance in this study.

Social and environmental disclosures are disclosures related to company's policies, attitudes or actions toward environmental impact, emissions, pollution, cleaning, planting, or energy efficiency. It is a disclosure is generated by environment accounting system which is part of overall environmental information that is disclosed by company (Worae et al., 2018). Dyllick and Hockerts (2016); Guthrie, Cuganesan, and Ward (2016); Amran and Siti-Nabiha (2017) described social and environmental disclosures as corporate social responsibility reports, eco-reports, and corporate accountability reports. However, disclosure of social and environmental activities of corporate entities may be either mandatory or voluntary; where the nature and extent of information needs to be disclosed is governed by the stipulated regulations and standards or showcasing the contributions of the corporate entities’ contribution to its environment. In the aspect of mandatory disclosure practices, regulations have been established in different countries, resulting in a predictable increase in disclosure levels in the affected countries (Eze, Nweze, & Enekwe, 2016).

The studies of Yusuf (2016) and Kanwal, Khanam, Nasreen, and Hameed (2013) among others measured social and environmental disclosures (SED) using Corporate Social Responsibility Disclosure (CSRD) while Adjound and Amar (2015); Brockman (2015) measured social and environmental disclosures (SED) using environmental disclosures; also, Omaliko et al. (2020) used Corporate Social Responsibility Disclosure (CSRD) and Environmental disclosure (ED) indexes in their study. In line with GRI performance indicators, (Olayinka and Oluwamayowa (2014) measured corporate environmental disclosure using environmental pollution and control policy (EPC), energy policy (ENP), impact on biodiversity (BIO), waste management Cost (WSM), award received for installing environmental management system (AWR), environmental research and development cost (ERD) and cost of compliance with environmental laws (CEL). However, this study adopted social disclosure scores (SD) as well as environmental disclosure scores (ED) using the GRI (2020) 28 indexes (See Appendix).

Firm size is the quantum of resources in the possession of the organisation in running their operations while age is the length of time during which a being or thing has existed. In disclosure related studies, empirics have shown that the Bigger and older firms tend to disclose more information showcasing their experiences and achievements over the years of existence (Souissi & Khlif, 2012). Withisuphakorn and Jiraporn (2016); Pistoni, Songini, and Perrone (2016); Trencansky and Tsaparlidis (2014) believed that the older the firm, the more it is conscious of its operating environment; contribution to the growth and protection of the environment.

2.2. Underpinning theory (Stakeholders’ Theory )

Stakeholder theory was first described by Freeman (1983) a professor at the University of Virginia, in his landmark book, “Strategic Management: A Stakeholder Approach.” It suggests that shareholders are merely one of many stakeholders in a company. The theory argues that a firm should create value for all stakeholders, not just shareholders. In Freeman (1984) originally detailed the Stakeholder Theory of organizational management and business ethics that addresses morals and values in managing an organization. Asher, Mahoney, and Mahoney (2005); Letza, Sun, and Kirkbride (2004); Lawal and Oluwatoyin (2011) pointed out that contrary to agency theory’s view organizations of as a system of relationship between shareholders and management, stakeholders’ theory view organizations as a system that accommodates not only the interest of the owners but also the interests of other groups within the environment which the organization operates. The theory argued that since organizations cannot operate and exist in isolation without relating to its immediate environment then the interest of other stakeholders like employees, customers, suppliers and local community might be considered in the process of strategic

decision making. Therefore, the main argument of the theory, as pointed by Lawal and Oluwatoyin (2011) is that organizations should not only maximize the returns of shareholders alone, but also

the expectations of stakeholders should be considered. Finally, the theory argued that for a

firm to achieve effective performance in the market, cordial relationship must exist

between the firm and the stakeholders and the firm board should be large and diversified

enough to accommodate the interest of other stakeholders.

Simsek and Ozturk (2021) examined the impact of environmental accounting on performance of businesses in Istanbul Province. The study used primary data through the administration of structured questionnaire while multiple regression analysis was adopted to test the hypothesis. It was obtained that environmental accounting measured as Planning and Costing, responsibility and Image, environmental sustainability, certification and qualification and environmental consciousness significantly impacted on business performance. Contrarily, Nkwoji (2021) conducted a study on the impact of environmental accounting on profitability of oil and gas companies in Nigeria using secondary source of data, obtained from annual report and accounts of the selected companies; the result of the regression analysis carried out revealed an insignificant relationship between environmental cost and net profit of oil and gas companies listed on the Nigerian Stock Exchange

Menike (2020) investigated how environmental disclosure impacted the return on asset using secondary data obtained from annual reports of twenty-six (26) food, tobacco and beverages producing firms quoted on the Colombo Stock Exchange. The result of the regression analysis conducted revealed that return on asset was positive and significantly impacted by environmental accounting disclosure and firm size; but insignificantly influenced by liquidity.

Omaliko et al. (2020) empirically examined the impact of social and environmental disclosures on performance of non-financial firms in Nigeria, the study adopted ex post facto design and made use of data obtained from the NSE Factbook and published annual financial reports of the entire 112 non-financial firms quoted on NSE with data spanning from 2011-2018. The study found that social and environmental disclosures have significant positive impact on net-asset per share (firms’ performance) over the years. The study opined that firms should have positive disposition towards social and environmentally friendly practices.

Kowaleski (2014) examined effect of non-financial information on shareholders’ investment decision making explored the statistical test tool of OLS, using the variable of ROA and environmental disclosures as index for non-financial information and found that the level of firms’ environmental disclosures influences its performance, and suggested corporate bodies should increase the volume of disclosures in their reports for investors’ consumption. Also, Gelb (2017) discovered a significant positive between the level of environmental disclosure of firms and performance measured by ROA in his study on environmental disclosures and corporate performance in Japan.

Adjound and Amar (2015) on effect of non-financial information disclosures on performance of manufacturing firms in France explored the test tool of simple regression emphasizing on the environmental aspect of non-financial reporting and found that environmental disclosures impacted return on asset positively and significantly. Similarly, Brockman (2015) used OLS estimation technique and found significant positive association between environmental disclosure and firms’ performance measured by Net Assets Per Share of the selected listed manufacturing firms in Italy. Contrarily, Lang (2016) reported that social and environmental disclosures negatively related with firm’s performance of firms.

The study of Nahiba (2017) on non-financial disclosures and performance of manufacturing firms in India used the variable of environmental disclosures, corporate governance disclosure and firms Net Assets Per Share. The result of the regression model adopted revealed that firms’ performance is positively and significantly affected by non-financial disclosures. Also, Yusuf (2016) used dummy variables and explored the test tool of regression model and found significant positive effect between corporate social responsibility disclosure (CSRD) and firms’ performance. In contrast, the report of Malarvizhi and Ranjani (2016) revealed insignificant impact of the level of environmental disclosure on firm performance of selected companies listed in Bombay Stock Exchange (BSE), India

Guthrie et al. (2016) in their study on social and environmental reporting and its effect on performance of food and beverage firms in Australia note that quality social and environmental disclosure influences firm’s performance. The study explored the use of dummy variable and applied the test tool of OLS and recommended that shareholders should look beyond the quantitative information in the companies report and its footnote. Much emphasis should also be placed also on qualitative information provided in the companies report for investment decision making. This is contrary to the studies of Amran and Siti-Nabiha (2017) in their study on corporate social reporting in Malaysia established simple regression model and found significant negative relationship between corporate social reporting and firms’ performance. The study recommended on the relevance of quantitative information sufficed in the companies report.

Ahmed et al. (2016) investigated environmental accounting and firm profitability in Nigeria using ordinary least square regression (OLS). With a sample of 50 listed companies and a cross-sectional research design, data were obtained from annual reports and accounts of the sampled firms. The research evidence showed that a significant relationship exist between environmental accounting and firm’s profitability. However, the study revealed a negative relationship when moderated by firm size.

Okafor (2018) evaluated the link between environmental costs accounting and reporting of firm financial performance of listed oil and gas firms in Nigeria. Proxied by cost of environmental remediation and pollution control, cost of environmental laws compliance and penalty, donations and charitable contributions. It was established that environmental performance influence business value positively. Data obtained from five (5) sampled oil and gas firms was analysed using multiple regression with a panel data model. The study also revealed that, environmental accounting provides organisation’s an opportunity to reduce environmental and social costs and improve their performance. In a similar vein, Etale and Otuya (2018); Onyekwelu and Uche (2014); Nze, Okoh, and Ojeogwu (2016) discovered that positive relationship exist between performance and environmental responsibility reporting in the oil and gas sector of Nigeria. Likewise, Erhinyoja and Marcella (2019) measured performance as return on asset and return on equity and the result of their regression analysis showed that the commitment of the Nigeria listed oil and gas companies to social and environmental sustainability significantly impact their financial performance.

In the same vein, Agbiogwu et al. (2016) examined the impact of environmental and social costs on performance of Nigerian manufacturing companies. Results showed that environmental and social cost significantly affect earnings per share of manufacturing companies. However, Adediran and Alade (2013) reported a contrary finding in the same environment, that is insignificant negative relationship exist between environmental accounting and earnings per share of Nigeria listed companies. While, Sergio and Carmen Pilar (2017) established that environmental practices positively and significantly influence financial performance in developed countries.

Polycarp (2019) conducted a research on environmental accounting and financial performance of oil and gas companies in Nigeria from 2016-2017; measured performance as return on equity, earnings per share and net profit margin. The result of the multiple regression carried out showed that environmental disclosure has no relationship with financial performance. On the contrary, Nwabueze (2015) examined environmental costs and performance using exploratory research design and multiple regression as techniques of analysis; and found negative and insignificant influence of social and environmental disclosure on EPS; Ahmed et al. (2016) in their study on the impact of social and environmental disclosure on financial performance of listed manufacturing firms in Nigeria proved that environmental disclosure has significant positive impact on earnings per share, and hence profitability of companies.

According to Yahaya (2018) disclosing information regarding a firm’s environmental practices may be beneficial to the firm’s reputation and by extension help improve firm’s financial performance. Nyirenda, Ngwakwe, and Ambe (2013) are of the view that disclosing environmental information has no significant effect on financial performance of firms. According to Magara, Aming, and Momanyi (2015) environmental accounting disclosure is significantly and positively related to financial performance of firms; while Ezejiofor, John-Akamelu, and Chigbo (2016) reported contrary findings using the same environment.

Rakiv, Islam, and Rahman (2016) examined the relationship of financial performance and extent of environmental accounting reporting disclosure in the annual reports. The research disclosed that there is a significant positive relationship between company profitability and environmental accounting reporting. Onyinyechi and Ihendinihu (2016) examined the impact of environmental disclosure and corporate social responsibility accounting on organizational financial performance of firms in Nigeria. The result showed no significant impact between environmental accounting disclosure and financial performance. Gatimbu and Wabwire (2016) assessed the effect of Environmental Disclosure on financial performance of listed firms at the Nairobi Securities Exchange, Kenya. Findings revealed that environmental disclosure has a positive significant effect on financial performance.

Utile, Tarbo, and Ikya (2017) discovered that environmental accounting disclosure has significant effect on the performance of Nigeria listed firms. Olayinka and Oluwamayowa (2014) in a study conducted, concluded that the disclosure of the environment information resulted in an improvement in the organization financial performance. Caesaria and Basuki (2017) concluded that environmental accounting disclosure leads to an improvement in the organization’s financial performance by improving the confidence of potential investors and creditors, thereby enhancing the image of the organization. Also, Festus and Akinselure (2017) suggested that oil and gas producing companies should give preference to their environment so as to improve their future performance and profitability of their operations.

2.4. Hypotheses Development

The relationship between social and environmental issues and corporate performance have been examined by scholars using different variables, models and approach. The findings of these studies cut across nearly all the sectors; oil and gas, consumer goods, industrial goods, telecommunication, technology, financial services and services, as listed on the Nigerian stock exchange (NSE) with diverse measures adopted as proxy for social and environmental disclosure. Although (Asuquo et al., 2018; Iheduru & Chukwuma, 2019; Nwabueze, 2015; Solomon & Ayodeji, 2019) investigated the manufacturing sector however, the samples as well as scope were insufficient. Eze et al. (2016) examined the effect of environmental accounting on a developing nation such as Nigeria. They established that, increased environmental accounting could improve the performance and operating system of oil and gas firms. Etale and Otuya (2018) further established the existence of positive relationship between environmental responsibility reporting and financial performance. Other studies on the subject were: (Beredugo, 2014; Makori & Jagongo, 2013) .

Several other studies conducted such as Asuquo et al. (2018) ; Erhinyoja and Marcella (2019) ; Etale and Otuya (2018) ; Eze et al. (2016) ; Yusuf (2011) have established relationship between corporate social responsibility and performance. Etale and Otuya (2018) establish the existence of a significantly positive relationship between corporate financial performance and environmental responsibility reporting. Similarly, Asuquo et al. (2018) ; Yusuf (2011) in an attempt to establish the relationship between environmental, social responsibilities of quoted oil and gas firms found that economic performance disclosure by oil and gas firms in Nigeria influences social performance of the sampled firms. However, most studies (Esira, Ikechukwu, & Ikechukwu, 2014; Etale & Otuya, 2018; Eze et al., 2016; Festus & Akinselure, 2017; Hassan, 2012; Ifurueze, Lydon, & Bingilar, 2013; Nwaiwu & Oluka, 2018; Okafor, 2018) conducted in Nigeria focuses on listed oil and gas firms. The studies reported mixed findings as to the impact of environmental accounting on financial performance of quoted oil and gas firms.

Similarly, studies of Adediran and Alade (2013) ; Agbiogwu et al. (2016) ; Nwabueze (2015) ; Erhinyoja and Marcella (2019) ; Iheduru and Chukwuma (2019) ; Makori and Jagongo (2013) ; Solomon and Ayodeji (2019) measured environmental costs, as the total amount of monies spent by listed firms on environmental and social activities. This approach did not classify the environmental costs into its various components as revealed by Hassan (2012) ; Okafor (2018) and Oti et al. (2012) in their studies. This resulted in matching total environmental costs with different performance measures. More so, Agbiogwu et al. (2016) ; Nwabueze (2015) ; Makori and Jagongo (2013) ; Solomon and Ayodeji (2019) despite focusing on the manufacturing sector, were studies conducted over five years ago.

Iheduru and Chukwuma (2019) ; Jones (2018) ; Okafor, Okaro, and Egbunike (2013) ; Oti et al. (2012) examined various environmental cost components and its effect on performance of listed manufacturing firms in Nigeria. These studies were conducted using different approaches which resulted in different findings and conclusions by the researchers. While Nwabueze (2015) established a negative association between environmental costs and financial performance of listed manufacturing firms, Oti et al. (2012) found a positive relationship between environmental costs and financial performance of manufacturing firms in Nigeria. This further establishes the existence of inconclusive findings as researched and reported by previous researchers.

In view of the gaps identified above, this study attempt to examine the effect of social and environmental disclosure on performance of manufacturing companies listed on the Nigerian Stock Exchange. Unlike previous studies, this study measured social and environmental disclosure based on the global reporting initiative (GRI) framework. In GRI (2020) standards, 27 out of the 40 standards are categorized as social and environmental standards; 19 out of the 27 are social-based while the remaining 8 are on environmental issues (See Appendix). In addition, this study viewed performance from two perspectives, namely, the financial measures view and market measures view; thus, four measures of performance were used in this study, which are return on assets, and earnings per share. The study also introduced firm size and age as control variables as adopted from the studies of Okpala and Iredele (2018) . Thus, this study hypothesized that:

Ho1: Social and environmental disclosure have no significant effect on return on assets of Nigerian listed manufacturing firms.

Ho2: Firm size and age have no significant control in the effect of social and environmental disclosure on return on assets of manufacturing companies listed on the Nigerian Stock Exchange.

Ho3: Earnings per share of manufacturing companies listed on the Nigerian Stock Exchange is not significantly affected by Social and environmental disclosure.

Ho4: Firm size and age have no significant control in the effect of social and environmental disclosure on earnings per share of manufacturing companies listed on the Nigerian Stock Exchange.

3. Materials and Methods

This study examined the impact of social and environmental disclosure on performance of consumer goods producing firms, listed on the NSE. The time frame for the study was ten (10) years (2010 – 2019). As at December 31, 2019, twenty companies listed as consumer goods producing companies out of which DN TYRE & RUBBER PLC had stopped its operations in Nigeria since 2015. The study made use of sixteen (16) of these companies as sample subjects constituting 84.21 per cent of the population of the study using convenient sampling techniques and based on data availability within the period of conducting this study.

Both correlation and regression analytical techniques were employed in testing the formulated hypotheses. Correlation analysis was conducted to ensure that no unhealthy association exist among the explanatory variables while multiple linear regression analysis was carried for determining the predictive nature of the models. Hausman test was conducted to determine the most appropriate estimation technique to be adopted between fixed effect, random effect and Pooled ordinary least square regression. In addition, Testparm or Breusch-pagan Langrangian Multiplier test was carried for the confirmation of Hausman results.

Appropriate diagnostic tests were carried out to ensure the fitness of the models. Breusch-Pagan/Cook-Weisberg Test for heteroskedasticity was conducted to test the constancy of the residuals of the models; the existence of associations among the coefficients of the model and its residuals was tested using Wooldridge test for serial correlation was carried out to know if there is serial correlation problem in the model; also, the possibility of the existence of cross-sectional dependence in the models was examined using Pesaran cross-sectional dependence test.

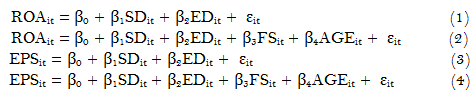

The regression model employed for this study was adopted from the study of Menike (2020) as:

Where, β0 = value of the intercept. β1, β2, β3 = Coefficient of the explanatory variables, ROA = Return on Assets, EADI = Environmental Accounting Disclosure Index,

Menike (2020) studied the impact of environmental accounting disclosure on return on assets, with the inclusion of firm size and liquidity as control variables. However, in order to suit the purpose of this current study, the adopted model was modified and the models for the study were developed as:

Where: ROA = Return on assets; EPS = Earnings per share, SD = Social Disclosure; ED = Environmental Disclosure; FS = Firm size and AGE = Age of firm; β1 – β4 = Coefficient of explanatory variables; β 0 = Constant or Intercept; ɛ = error term; i is the number of the sampled firms and t is the time frame of the study.

Equation 1 and 3 denote the regression models of the effect of social and environmental disclosures on firm performance, where performance was measured as Return on Assets (ROA) in Equation 1 and earnings per share (EPS) in Equation 3 ; while SD represents Social Disclosure and ED stands for Environmental Disclosure.

With the inclusion of firm size (FS) and firm age (AGE) as control variables; the Equation 1 and 3 were restated as Equation 3 and 4 , examining how firm size and age influences the effect of social and environmental disclosures on performance (measured as Return on Assets (ROA) in Equation 3 and earnings per share (EPS) in Equation 4 .

4. Results and Discussions

This study tested the series in the distribution for multicolinearity problem, and the regression analysis was conducted to test the formulated hypotheses. The results, interpretations and discussions are presented in Table 1 and 2 respectively.

| Variable | SD |

ED |

FS |

AGE |

VIF |

1/VIF |

| SD | 1.00 |

2.55 |

0.39 |

|||

| ED | 0.72 |

1.00 |

2.12 |

0.47 |

||

| FS | 0.52 |

0.44 |

1.00 |

1.39 |

0.72 |

|

| AGE | 0.51 |

0.42 |

0.33 |

1.00 |

1.38 |

0.73 |

Mean = 1.86 |

||||||

4.1. Interpretation

Using correlation matrix to examine the existence of multicolinearity among the explanatory variables, the results with the least value of 0.33 and the highest value of 0.72 which are less than the benchmark of 0.8 (Baltagi, 2021) revealed that multicolinearity problem does not exists amidst the explanatory variables. Also, the VIF (Variance Inflation Factor) results supported that of the correlation matrix, as VIF showed a mean of 1.86 which is relatively lower than the threshold of 5 or 10 (James, Witten, Hastie, & Tibshirani, 2017); therefore, this study concluded that multicolinearity problem does not exist among the explanatory variables.

4.2. Regression Analysis

Model One |

Model Two |

|||||||

Pooled OLS with Cluster Std. Err |

RE GLS regression with AR(1) |

|||||||

| Variable | Coeff |

Std. Err |

T-Stat |

Prob |

Coeff |

Std. Err |

T-Stat |

Prob |

| Constant | 19.24 |

5.61 |

3.43 |

0.001 |

-5.00 |

12.96 |

-0.39 |

0.700 |

| SD | 13.04 |

8.93 |

1.46 |

0.146 |

2.63 |

8.35 |

0.32 |

0.752 |

| ED | -28.35 |

8.76 |

-3.24 |

0.001 |

-16.24 |

8.54 |

-1.90 |

0.057 |

| FS | 3.28 |

1.92 |

1.71 |

0.088 |

||||

| AGE | -0.06 |

0.12 |

-0.49 |

0.622 |

||||

| Adj. R2 | 0.06 |

0.175 |

||||||

| F-Stat/Wald Stat | 6.04 |

6.02 |

||||||

| Probability of F-Stat | 0.00 |

0.30 |

||||||

| Hausman Test | chi2(3) = 38.39 (0.000) |

chi2(4) = 9.35 (0.053) |

||||||

| Testparm Test/LM Test |

F(9, 122) = 1.18 (0.31) |

chi2(1) = 15.30 (0.00) |

||||||

| Heteroskedasticity Test |

chi2(1) = 4.46 (0.03) |

chi2(1) = 0.19 (0.66) |

||||||

| Serial Correlation Test | F(1, 7) = 20.89 (0.00) |

F(1, 15) = 18.32 (0.00) |

||||||

| Cross-sectional Indep. | 1.265 (0.21) |

|||||||

4.3. Interpretation

4.3.1. Diagnostic Tests

The results of the Hausman tests for Model One showed significant result with ρ-value of 0.000 which is less than the chosen significant level of 5 per cent level negates the null hypothesis of Hausman test which states that “there is no fixed effect” thus, fixed effect is the appropriate techniques. However, the Testparm result with ρ-value of 0.31, being higher than the 5 per cent level, negate the results of the Hausman test, thus this study failed to reject the null that the coefficients for all years are jointly equal to zero, therefore no time fixed effects are needed in this case; therefore, Pooled OLS is considered the appropriate estimation for the analysis of both model one. Contrarily, the Hausman result for Model two was insignificant (ρ-value of 0.053), indicating the appropriateness of random effect, likewise, the Breusch-Pagan LM test result (ρ-value of 0.00) supported the appropriateness of Random model for Model Two.

The results of the heteroskedasticity tests conducted on both models (One and Two) using Breusch-Pagan/Cook-Weisberg Test with ρ-values of 0.03 and 0.66 indicated that while Model One is heteroskedastic, Model Two is homoscedastic; that’s no residuals of the model One varies over time while that of Model Two is stable. The existence of associations among the coefficients of the model and its residuals were tested using Wooldridge test for serial correlation was carried out to know if there is serial correlation problem in the model and the results with ρ-values of 0.00 and 0.00 imply that both models have serial correlation problem. The result of the cross-sectional dependence test for Model Two (ρ-value of 0.21) revealed that Model Two has no cross-sectional problem

Based on the results of the Hausman tests, Testparm, heteroskedasticity test, and autocorrelation tests conducted out, Model One is estimated using Pooled Ordinary Least Square with Cluster Standard Errors. While summary of the results of the diagnostic tests conducted on Model Two (Hausman tests, LM test, heteroskedasticity test, autocorrelation, and cross-sectional dependence) concluded that Model Two is estimated using RE GLS regression with AR(1) disturbances.

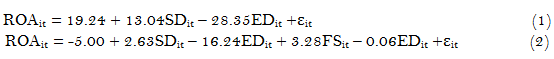

4.4. Interpretation

As depicted in Table 2 (Hypothesis One), the probability values of the t-test revealed that social disclosure (p=0.146) has insignificant effect on Return on Asset (ROA), while environmental disclosure significantly affect ROA (p=0.001). Considering the coefficients of the explanatory variables; SD (α = 13.04); and ED (α = -28.35); means that social disclosure positively impact on ROA, while environmental disclosure exerted a negative effect. The magnitude of the effect is expressed in the actual value of the coefficients; thus, an additional information about environment disclosed will result to 28.35 per cent decrease in the return on asset. The explanatory powers of the independent variables reflect that the joint variations in the independent variables yield 6% variation in the ROA, while the remaining 94% changes in ROA is caused by other factors outside the scope of this model. Also, the result depicts the value of the probability of F-test as 0.00; which implied that social and environmental disclosures significantly affects Return on Asset of manufacturing companies listed in Nigeria.

Model Three |

Model Four |

|||||||

RE GLS Regression with Cluster Error |

RE GLS Regression with Driscoll-Kraay standard errors |

|||||||

| Variable | Coeff |

Std. Err, |

T-stat |

Prob |

Coeff |

Std. Err, |

T-stat |

Prob |

| Constant | 3.28 |

3.98 |

0.82 |

0.410 |

-7.36 |

3.04 |

-2.42 |

0.038 |

| SD | -4.48 |

5.17 |

-0.87 |

0.386 |

-9.52 |

6.77 |

-1.41 |

0.193 |

| ED | 4.51 |

4.44 |

1.02 |

0.310 |

0.43 |

5.66 |

0.08 |

0.941 |

| FS | 1.80 |

0.64 |

2.80 |

0.021 |

||||

| AGE | 0.16 |

0.06 |

2.78 |

0.022 |

||||

| R2 | 0.0086 |

0.0689 |

||||||

| Wald-Stat | 1.11 |

94.71 |

||||||

| Probability | 0.5747 |

0.00 |

||||||

| Hausman Test | chi2(2) = 2.65 (0.27) |

chi2(2) = 5.94 (0.20) |

||||||

| LM Test | chi2(1) = 389.06 (0.00) |

chi2(1) = 58.20 (0.00) |

||||||

| Heteroskedasticity Test | chi2(1) = 31.20 (0.00) |

chi2(1) = 39.37 (0.00) |

||||||

| Serial Correlation Test | F(1, 15) = 3112.08 (0.00) |

F(1, 15) = 835.852 (0.00) |

||||||

| Cross-sectional Dep. | 1.087 (0.28) |

4.345 (0.00) |

||||||

With the introduction of firm size and age into the model; the probability values of the t-statistics revealed that social disclosure (ρ=0.752), environmental disclosure(ρ=0.057), firm size(ρ=0.088) and age (ρ=0.622) have insignificant effect on return on asset (ROA); while social disclosure and firm size positively impacted on ROA, environmental disclosure and age affect ROA negatively. Also, the probability of the F-test (ρ-values of 0.30) implied that social and environmental disclosure with the control of firm size (FS) and age (AGE) jointly but insignificantly affects return on asset of manufacturing companies listed in Nigeria.

4.5. Interpretation

The insignificant results of the Hausman tests for Models three and four, (ρ-values of 0.27, and 0.20; supported its null hypothesis which states that “there is no fixed effect” thus, random effect is the appropriate techniques. In addition, the confirmatory test carried out using the LM results for both models with ρ-values of 0.00, and 0.00 which are less than the 5 per cent level, confirmed the results of the Hausman test, thus Random-Effect is adjudged appropriate for estimating models Three and Four.

The results of Breusch-Pagan/Cook-Weisberg Test (heteroskedasticity test) carried on models three and four, yielding ρ-values of 0.00 and 0.00 indicated that both models possessed heteroskedasticity problem. This is an indication that the residuals of the model are variant over time. The probability values of the Wooldridge test conducted to know if the models have autocorrelation problem, with ρ-values of 0.00 and 0.00 implied that there is serial correlation problem in both models. Also, cross-sectional dependence test was conducted and the results revealed that model four has cross-sectional dependence problem while model three has no cross-sectional dependence issue.

Based on the results of the Hausman tests, LM test, heteroskedasticity test, and autocorrelation and cross-sectional dependence tests carried out; Model Three is estimated using Random-Effect GLS regression with Cluster Errors while Model Four is estimated using Random-Effect GLS regression with Driscoll-Kraay standard errors.

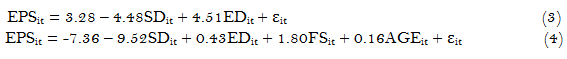

4.6. Interpretation

As presented in Table 3 (Hypothesis Three), the probability values of the t-test revealed that social disclosure (p=0.386) and environmental disclosure (p=0.310) have insignificant effect on earnings per share (EPS), the sign and the magnitude of the effect is explained by the value of the coefficients of the explanatory variables: SD (α = -4.48); and ED (α = 4.51); means that social disclosure has negative effect on EPS, while environmental disclosure positively influence EPS. Also, the probability of the Wald-test (ρ-values of 0.5747) mean that social and environmental disclosures have insignificant effect on earnings (EPS) of Nigerian listed manufacturing companies.

With the inclusion of firm size and age in Model three; model four was developed and with results presented in Table 3, the probability values of the t-statistics revealed that social disclosure (ρ=0.193), and environmental disclosure(ρ=0.941), have insignificant effect on net profit margin (NPM); while firm size(ρ=0.021) and age (ρ=0.022) have significant effect on earnings per share. while social disclosure negatively affects EPS; environmental disclosure, firm size and age affect EPS negatively. The magnitude of the effect represented by the coefficients shows that as the asset of the firm increase by a change, EPS will also increase by 0.43 naira while a year added to the age of the firm will give rise to 0.17 naira increase inn EPS. Also, the probability of the F-test (ρ-values of 0.00) implied that social disclosure and environmental disclosure with the control of firm size (FS) and age (AGE) jointly and significantly affect earnings per share of listed manufacturing firms. The coefficient of multiple determination of 0.0689 means that 6.89% changes in EPS is as a result of joint variations in the social disclosure, environmental disclosure, firm size and age; while the remaining changes of 93.11% is caused by other factors not captured in the model four.

5. Discussion

The findings of this study supported the report of Polycarp (2019) in his research on environmental accounting and financial performance (Return on equity, earnings per share and net profit margin) of oil and gas companies in Nigeria reported that environmental disclosure has no relationship with financial performance. Contrarily, the findings negate the reports of Omaliko et al. (2020) which reported that social and environmental disclosure have significant positive effect on performance (net asset per share) of non-financial firms in Nigeria.

This study obtained significant effect of social and environmental disclosure on return on assets; this findings supported the reports of Menike (2020) using food, tobacco and beverages producing firms quoted on the Colombo Stock Exchange as sample subjects; Adjound and Amar (2015) in their study on effect of non-financial information disclosures on performance of manufacturing firms in France; also, consistent with the report of the study conducted on Nigeria oil and gas sector by Erhinyoja and Marcella (2019). However, the findings negate the discoveries of Lang (2016) who reported that social and environmental disclosures negatively related with firms performance of firms; and Malarvizhi and Ranjani (2016) which revealed insignificant impact of the level of environmental disclosure on firm performance of selected Indianan companies. Likewise, the result corroborate with the reports of Agbiogwu et al. (2016) which found that environmental and social cost significantly affect return on equity of manufacturing companies in Nigeria. Also aligned with the report of Adediran and Alade (2013) who obtained significant negative relationship between environmental accounting and return on equity of listed firms in Nigeria.

The positive but insignificant effect of social and environmental disclosure on earnings per share obtained in this study negates the findings of Agbiogwu et al. (2016) and Ahmed et al. (2016) reported that social and environmental disclosure has significant positive effect on earnings per share of listed manufacturing firms in Nigeria; while, Adediran and Alade (2013) obtained significant negative relationship between environmental accounting earnings per share.

6. Conclusion and Recommendations

From the findings, it is glaring that social and environmental disclosures have insignificantly impacted the performance of the manufacturing companies listed on the NSE. This could be as a result of the level of awareness of the stakeholders about the disclosures of social and environmental information as well as the visibility of these information in the annual reports and accounts of companies. Information is meaningless except it is well-processed and applied in taking decision by the stakeholders involved. The significant positive impact of firm size and age on earnings per share is a reflection of goodwill, the long existence of the sampled companies had granted them the competitive advantage, improved earnings and yielded high market share. It is opined that:

- Managers should ensure that information about their social practices is well communicated in an understandable manner to the stakeholders, and thus the stakeholders would be able to comprehend, value and process it in taking meaningful decision about the firm; as only understandable and processed information can trigger action in the market and show as signal of good performance of the entities.

- Although, the nature of information on social and environment practices by firms has been outlined in accordance to global practices, but not all of these indexes, tailored rules and guidelines fit into every community. The educational status and level of exposure of the citizens who happened to be the stakeholders determine the effectiveness of the use of that information by them in making crucial decision about the reporting entity. Therefore, disclosure should be country-specific; every country should design the benchmark, rules and guidelines befitting their environment for such to be impactful.

- There should be sensitization on the part of the stakeholders on the usefulness of non-financial information reported in the annual reports and accounts of companies.

- There should be a segment in the annual report and accounts for reporting vital non-financial information to make it more visible unlike the current style of reporting it as part of general statements in Chairman’s reports and under corporate governance reports.

- Also, directors should find means of reporting their social and environmental practice in a quantifiable form as only donations are commonly reported in values by manufacturing companies in their annual reports and accounts.

Agencies regulating the issuance of guidelines and information disclosure should ensure that only relevant information which will result to increase in performance should be set as checklists.

References

Adediran, S., & Alade, S. O. (2013). The impact of environmental accounting on corporate performance in Nigeria. European Journal of Business and Management, 5(23), 141–152.

Adeyanju, O. D. (2012). An assessment of the impact of corporate social responsibility on Nigerian society: The examples of banking and communication industries. Universal Journal of Marketing and Business Research, 1(1), 17-43.

Adjound, L., & Amar, T. (2015). Effect of non-financial information disclosure on performance of manufacturing companies' in France. International Journal of Management Business Research, 6(3), 93-101.

Agbiogwu, A., Ihendinihu, J., & Okafor, M. (2016). Impact of environmental and social costs on performance of Nigerian manufacturing companies. International Journal of Economics and Finance, 8(9), 173-180. Available at: https://doi.org/10.5539/ijef.v8n9p173 .

Ahmed, M. A., Zakaree, S., & Kolawale, O. O. (2016). Corporate social responsibility disclosure and financial performance of listed manufacturing firms in Nigeria. Research Journal of Finance and Accounting, 7(4), 47-58.

Amran, A., & Siti-Nabiha, A. (2017). Corporate social reporting in Malaysia: A case of mimicking the west or succumbing to local pressure. Social Responsibility Journal, 5(3), 358–375. Available at: https://doi.org/10.1108/17471110910977285 .

Asher, C. C., Mahoney, J. M., & Mahoney, J. T. (2005). Towards a property rights foundation for a stakeholder theory of the firm. Journal of Management & Governance, 9(1), 5-32. Available at: https://doi.org/10.1007/s10997-005-1570-2 .

Asuquo, A. I., Dada, E., & Onyeogaziri, U. (2018). The effect of sustainability reporting on corporate performance of selected quoted brewery firms in Nigeria. International Journal of Business & Law Research, 6(3), 1-10.

Baltagi, B. H. (2021). Econometric analysis of panel data (6th ed.). Switzerland: Springer Nature.

Beredugo, S. B. (2014). Environmental accounting and social responsibility disclosure on the earning capacity of Nigerian manufacturing firms. Journal of Economics and Sustainable Development, 5(14), 66-73.

Brockman, T. (2015). Corporate disclosure and companies performance, evidence from list manufacturing companies’ in Italy. Journal of Science, 4(9), 45-52.

Caesaria, A. F., & Basuki, B. (2017). The study of sustainability report disclosure aspects and their impact on the companies’ performances. Paper presented at the 17th Annual Conference of the Asian Academic Accounting Association (2016 FourA Conference), SHS Web of Conferences 34, 08001.

Dyllick, M., & Hockerts, T. (2016). Environmental and social disclosure; theoretical review. International Journal of Scientific Management, 4(2), 64-70.

Erhinyoja, E. F., & Marcella, E. C. (2019). Corporate social sustainability reporting and financial performance of oil and gas industry in Nigeria. International Journal of Accounting, Finance and Risk Management, 4(2), 44–60. Available at: https://doi.org/10.11648/j.ijafrm.20190402.12 .

Eruemegbe, G. O. (2015). Impact of business environment on organizational performance in Nigeria-A study of union Bank of Nigeria. Abstract of Economic, Finance and Management Outlook, 4, 1-5.

Esira, A. F., Ikechukwu, E. C., & Ikechukwu, E. M. (2014). Environmental cost management and profitability of oil sector in Nigeria (2004-2013). Journal of Good Governance and Sustainable Development in Africa, 2(2), 181-192.

Etale, L., & Otuya, S. (2018). Environmental responsibility reporting and financial performance of quoted oil and gas companies in Nigeria. European Journal of Business and Innovation Research, 6(6), 23-34.

Eze, J. C., Nweze, A., & Enekwe, C. (2016). The effects of environmental accounting on a developing nation: Nigerian experience. European Journal of Accounting, Auditing and Finance Research, 4(1), 17-27.

Ezejiofor, R. A., John-Akamelu, C. R., & Chigbo, B. E. (2016). Effect of sustainability environmental cost accounting on financial performance of Nigerian corporate organizations. International Journal of Scientific Research and Management, 4(8), 4536-4549.

Fatihudin, D., Jusni, W., & Mochklas, M. (2018). How measuring financial performance. International Journal of Civil Engineering and Technology, 9(6), 553-557.

Festus, O. S., & Akinselure, O. P. (2017). Impact of environmental accounting on financial performance of selected quoted companies. International Research Journal of Management and Commerce, 4(11), 337–348.

Freeman, H. (1983). Stakeholders theory: Theoretical perspective. New York: Harper and Row Inc.

Freeman, R. E. (1984). Strategic management: A stakeholder approach. Boston: Pitman.

Galant, A., & Cadez, S. (2017). Corporate social responsibility and financial performance relationship: A review of measurement approaches. Economic Research, 30(1), 676-693. Available at: https://doi.org/10.1080/1331677x.2017.1313122 .

Gatimbu, K. K., & Wabwire, J. M. (2016). Effect of corporate environmental disclosure on financial performance of firms listed at the Nairobi Stock Exchange, Kenya. International Journal of Sustainability Management and Information Technology, 2(1), 1-6. Available at: https://doi.org/10.11648/j.ijsmit.20160201.11 .

Gelb, B. (2017). Environmental disclosures and corporate performance in Japan. Social and Basic Sciences Research Review, 1(4), 49-56.

GRI. (2020). GRI. Retrieved from: https://www.globalreporting.org/how-to-use-the-gri-standards/gri-standards-english-language/ . [Accessed May 23, 2020].

Guthrie, M., Cuganesan, S., & Ward, L. (2016). Environmental and social reporting and its effect on performance of food and beverage companies. Journal of Financial Economics, 3(4), 1-40.

Hassan, S. U. (2012). Environmental costs and firm performance: Evidence from quoted oil companies in Nigeria. Zaria: Ahmadu Bello University.

Ifurueze, M., Lydon, M., & Bingilar, P. (2013). The impact of environmental cost on corporate performance: A study of oil companies in Niger Delta States of Nigeria. Journal of Business and Management, 2(2), 1-10. Available at: https://doi.org/10.12735/jbm.v2i2p01 .

Iheduru, N. G., & Chukwuma, I. R. (2019). Effect of environmental and social cost on performance of manufacturing companies in Nigeria. International Journal of Accounting & Finance Review, 4(2), 5-12. Available at: https://doi.org/10.46281/ijafr.v4i2.378 .

James, G., Witten, D., Hastie, T., & Tibshirani, R. (2017). An introduction to statistical learning: With applications in R (7th ed.). New York, London: Springer.

Jones, E. (2018). Effect of sustainability costs accounting on net-worth of listed firms on Nigeria stock exchange. International Journal of Economics and Business Management, 4(7), 59–76.

Kanwal, M., Khanam, F., Nasreen, S., & Hameed, S. (2013). Impact of corporate social responsibility on the firm's financial performance. IOSR Journal of Business and Management, 14(5), 67-74.

Kowaleski, M. (2014). Effect of waste management disclosures on dividend policies of manufacturing companies. Journal of Empirical Literature, 3(5), 4-11.

KPMG. (2015). Currents of change. The KPMG survey of sustainability reporting 2015. Retrieved from: https://assets.kpmg/content/dam/kpmg/pdf/2016/02/kpmg-international-survey-of-corporate-responsibility-reporting-2015.pdf. [Accessed August 19, 2020].

KPMG. (2020). The time has come: The KPMG survey of sustainability reporting 2020. Retrieved from: https://assets.kpmg/content/dam/kpmg/uk/pdf/2020/12/the-time-has-come-kpmg-survey-of-sustainability-reporting-2020.pdf. [Accessed August 19, 2020].

Lang, L. (2016). Effect of environmental and social disclosures on performance of listed manufacturing companies in France. European Journal of Business and Management, 2(4), 14-22.

Lawal, T., & Oluwatoyin, A. (2011). National development in Nigeria: Issues, challenges and prospects. Journal of Public Administration and Policy Research, 3(9), 237-241.

Letza, S., Sun, X., & Kirkbride, J. (2004). Shareholding versus stakeholding: A critical review of corporate governance. Corporate Governance: An International Review, 12(3), 242-262. Available at: https://doi.org/10.1111/j.1467-8683.2004.00367.x.

Magara, R., Aming, N., & Momanyi, E. (2015). Effect of environmental accounting on company financial performance in Kisii County. Journal of Economics, Management and Trade, 10(1), 1-11. Available at: https://doi.org/10.9734/bjemt/2015/19909 .

Makori, D. M., & Jagongo, A. (2013). Environmental accounting and firm profitability: An empirical analysis of selected firms listed in Bombay Stock Exchange, India. International Journal of Humanities and Social Science, 3(18), 248-256.

Malarvizhi, P., & Ranjani, M. (2016). Link between corporate environmental disclosure and firm performance. Perception or Reality? Review of Integrated Business & Economic Research, 5(3), 01-12.

Menike, L. M. C. S. (2020). Impact of environmental disclosure on firm performance: An empirical analysis of food, beverage and tobacco sector companies listed in Colombo Stock Exchange, Sri Lanka. International Journal of Academic Research in Business and Social Sciences, 10(10), 518-536. Available at: http://dx.doi.org/10.6007/IJARBSS/v10-i10/7977 .

Nahiba, M. (2017). Non financial disclosures and performance of manufacturing firms in India. Journal of Empirical Literature, 7(9), 21-29.

Naz, F., Ijaz, F., & Naqvi, F. (2016). Financial performance of firms: Evidence from Pakistan cement industry. Journal of Teaching and Education, 5(01), 81-94.

Nkwoji, N. (2021). Environmental accounting and profitability of selected quoted oil and gas companies in Nigeria (2012-2017). Journal of Accounting and Financial Management, 7(3), 22-39.

Nwabueze, C. R. (2015). Influence of environmental costs on the performance of some selected quoted manufacturing companies in Nigeria. Enugu Campus: University of Nigeria.

Nwaiwu, N. J., & Oluka, N. O. (2018). Environmental cost disclosure and financial performance of oil and gas in Nigeria. International Journal of Advanced Academic Research, 4(2), 1–23.

Nyirenda, G., Ngwakwe, C. C., & Ambe, C. M. (2013). Environmental management practices and firm performance in a South African mining firm. Managing Global Transitions, 11(3), 243–260.

Nze, D. O., Okoh, J., & Ojeogwu, I. C. (2016). Effect of corporate social responsibility on earnings of quoted firms in Nigeria. ESUT Journal of Accountancy, 1(1), 260-267.

Ojeyinka, T. A., & Adegboye, A. A. (2017). Trade liberalization and economic performance in Nigeria: Evidence from agricultural and manufacturing sectors. African Journal of Economic Review, 5(3), 1-14.

Okafor, G. O., Okaro, S. C., & Egbunike, F. (2013). Environmental cost accounting and cost allocation (A study of selected manufacturing companies in Nigeria). European Journal of Business and Management, 5(18), 68-75.

Okafor, T. G. (2018). Environmental costs accounting and reporting on firm financial performance: A survey of quoted Nigerian oil companies. International Journal of Finance and Accounting, 7(1), 1-6.

Okpala, O. P., & Iredele, O. O. (2018). Corporate social and environmental disclosures and market value of listed firms in Nigeria. Copernican Journal of Finance & Accounting, 7(3), 9-28. Available at: https://doi.org/10.12775/cjfa.2018.013 .

Olayinka, A. O., & Oluwamayowa, I. O. (2014). Corporate environmental disclosures and market value of quoted companies in Nigeria. The Business & Management Review, 5(3), 171-184.

Omaliko, E. L., Nweze, A. U., & Nwadialor, E. O. (2020). Effect of social and environmental disclosures on performance of non-financial firms in Nigeria. Journal of Accounting and Financial Management, 6(1), 67-84.

Onyekwelu, U. L., & Uche, U. (2014). Corporate social accounting and the enhancement of information disclosure among firms in Nigeria: A case of some selected firms in Nigeria. Journal of Economics and Sustainable Development, 5(6), 35-44.

Onyinyechi, O. C., & Ihendinihu, J. (2016). Impact of environmental and corporate social responsibility accounting on organizational financial performance: Evidence from selected listed firms in Nigeria stock exchange. Journal of Emerging Trends in Economics and Management Sciences, 7(5), 291-306.

Oti, P. A., Effiong, S. A., & Tapang, A. T. (2012). Environmental costs and Its implication on the returns on investment: An evaluation of selected manufacturing companies in Nigeria. Global Journal of Management and Business Research, 12(7), 17-20.

Pistoni, A., Songini, L., & Perrone, O. (2016). The how and why of a firm’s approach to CSR and sustainability: A case study of a large European company. Journal of Management & Governance, 20(3), 655-685. Available at: https://doi.org/10.1007/s10997-015-9316-2 .

Polycarp, S. U. (2019). Environmental accounting and financial performance of oil and gas companies in Nigeria. Research Journal of Finance and Accounting, 10(10), 192-202.

Rakiv, M., Islam, F., & Rahman, R. (2016). Environmental accounting reporting disclosure and company profitability: A case study on listed manufacturing companies of Bangladesh. International Journal of Ethics in Social Sciences, 4(2), 21-30.

Sergio, M., & Carmen Pilar, M. (2017). Analyzing the effect of corporate environmental performance on corporate financial performance in developed and developing countries. Sustainability, 9(1957), 1-30.

Simsek, H., & Ozturk, G. (2021). Evaluation of the relationship between environmental accounting and business performance: The case of Istanbul province. Green Financ, 3(1), 46-58. Available at: https://doi.org/10.3934/gf.2021004 .

Solomon, A. O., & Ayodeji, O. C. (2019). Environmental cost and financial performance: Analysis of cement companies in Nigeria. International Journal of Academic and Applied Research, 3(8), 60–65.

Souissi, M., & Khlif, H. (2012). Meta-analytic review of disclosure level and cost of equity capital. International Journal of Accounting & Information Management, 20(1), 49-62. Available at: https://doi.org/10.1108/18347641211201072 .

Trencansky, D., & Tsaparlidis, D. (2014). The effects of company’s age, size and type of industry on the level of csr. the development of a new scale for measurement of the level of CSR. Master’s Thesis, Umeå School of Business and Economics, Umeå, Sweden.

Utile, B. J., Tarbo, D. I., & Ikya, E. A. (2017). Corporate environmental reporting and the financial performance of listed manufacturing firms in Nigeria. International Journal of Advanced Academic Research Social and Management Sciences, 3(8), 15 – 25.

Withisuphakorn, P., & Jiraporn, P. (2016). The effect of firm maturity on corporate social responsibility (CSR): Do older firms invest more in CSR? Applied Economics Letters, 23(4), 298-301. Available at: https://doi.org/10.1080/13504851.2015.1071464 .

Worae, T. A., Ngwakwe, C. C., & Ambe, C. M. (2018). Effects of environmental pro-activeness on financial performance in South Africa: Short panel vector autoregressions analysis. International Journal of Sustainable Economy, 10(3), 249-262. Available at: https://doi.org/10.1504/ijse.2018.10012165 .

Yahaya, O. A. (2018). Environmental reporting practices and financial performance of listed environmentally-sensitive firms in Nigeria. Savanna A Journal of the Environmental & Social Sciences, 24(2), 403-412.

Yusuf, I. (2016). Effect of non financial disclosure on profitability of firms listed on industrial goods sector of NSE. Journal of Empirical Literature, 3(3), 78-83.

Yusuf, A. (2011). Environmental responsibility and performance of quoted oil companies in Nigeria. Zaria: Ahmadu Bello University.

Zelazna, A., Bojar, M., & Bojar, E. (2020). Corporate social responsibility towards the environment in Lublin Region, Poland: A comparative study of 2009 and 2019. Sustainability, 12(11), 1-13. Available at: https://doi.org/10.3390/su12114463.

Appendix: Gri Standards – Social and Environmental.

Number Title

GRI 301 MATERIALS

GRI 302 ENERGY

GRI 303 WATER AND EFFLUENTS

GRI 304 BIODIVERSITY

GRI 305 EMISSIONS

GRI 306 WASTE

GRI 307 ENVIRONMENTAL COMPLIANCE

GRI 308 SUPPLIER ENVIRONMENTAL ASSESSMENT

GRI 401 EMPLOYMENT

GRI 402 LABOUR MANAGEMENT RELATIONS

GRI 403 OCCUPATIONAL HEALTH AND SAFETY

GRI 404 TRAINING AND EDUCATION

GRI 405 DIVERSITY AND EQUAL OPPORTUNITY

GRI 406 NON-DISCRIMATION

GRI 407 FREEDOM OF ASSOCIATION AND COLLECTIVE BARGAINING

GRI 408 CHILD LABOUR

GRI 409 FORCED OR COMPULSORY LABOUR

GRI 410 SECURITY PRACTICES

GRI 411 RIGHTS OF INDIGENOUS PEOPLES

GRI 412 HUMAN RIGHTS ASSESSMENT

GRI 413 LOCAL COMMUNITIES

GRI 414 SUPPLIER SOCIAL ASSESSMENT

GRI 415 PUBLIC POLICY

GRI 416 CUSTOMER HEALTH AND SAFETY

GRI 417 MARKETING AND LABELLING

GRI 418 CUSTOMER PRIVACY

GRI 419 SOCIO-ECONOMIC COMPLIANCE

Source: Extracted from GRI 2020 Standards.