The Effects of International Financial Reporting Standards Implementation on the Financial Performance and Position of Businesses in Developing Countries: Evidence from Kosovo

Edona PERJUCI1

Arber HOTI2*

1Faculty of Economics, University of Prishtina ‘Hasan Prishtina’, Prishtina, Kosovo. |

AbstractThe International Financial Reporting Standards (IFRS), which are now used in many countries around the world, are an important step in the international development of financial reporting and auditing as they create international harmonization and a common language of financial reporting and accounting between companies and countries. Given Kosovo's recent adoption of IFRS, the purpose of this study is to undertake an empirical examination of the implementation of IFRS for enterprises that are legally obliged to comply with these standards. The research quantifies the impact of these standards on the actual performance and financial position ratios of the businesses examined by comparing periods before and after the implementation of IFRS. Research findings suggest that the adoption and implementation of IFRS did not affect the profitability and returns of businesses. In the contrary, long-term solvency and stability of businesses in Kosovo was affected by the implementation of IFRS. Additionally, there was an influence on the short-term solvency and liquidity of firms in Kosovo during the pre- and post-adoption periods of IFRS. |

Licensed: |

|

Keywords: JEL Classification: |

|

Received: 17 March 2022 |

|

| (* Corresponding Author) |

Funding: This study received no specific financial support |

Competing Interests:The authors declare that they have no competing interests. |

1. Introduction

Financial crises have emphasized the significance of enhancing financial reporting and auditing regimes, including the audit profession's oversight, in order to prevent such crises in the future and distribute and mitigate their risks and impacts. Numerous nations promote the adoption of IFRS because they may enhance the quality and comparability of financial reporting, hence creating a standardized financial reporting language and avoiding any negative effects. These objectives, however, cannot be met without the oversight of regulators who support the rigorous and uniform use of IFRS.

The economies of the former Yugoslavia have comparable integration challenges with the European Union's economic and financial system owing to the former Yugoslav system's distinctive standard characteristics. Parallel to the region's transition and economic reforms, global financial reporting and auditing systems have evolved toward convergence with International Financial Reporting Standards and International Accounting Standards, as well as a renewed emphasis on audit quality and external oversight mechanisms to facilitate this convergence. While Kosovo is not the only nation in the area confronting the changes necessary to properly integrate its economy into the European Union system, this research emphasizes both the potential and the challenges specific to Kosovo while making suitable suggestions for the reforms at hand.

Since January 1, 2005, all publicly traded firms in the European Union have been obliged to produce financial statements in line with International Financial Reporting Standards. This process of accounting harmonization has been actively encouraged in order to increase comparability, minimize information asymmetry, and affect risk assessment (European Community Regulation No. 1606/2002).

Kosovo, which is pursuing EU accession, has built a regulatory framework to meet the aforementioned objectives. Kosovo's law on Accounting, Financial Reporting, and Auditing compels large and medium-sized firms to use full IFRS. This provision was enacted in 2012 by Law No 04/L-017 on Accounting, Financial Reporting, and Auditing, and was repealed in 2018 by Law No 06-L-032 on Accounting, Financial Reporting, and Auditing. Because the subject of IFRS adoption and implementation has been extensively explored and continues to be a critical and priority issue in accounting and financial reporting, we felt it was critical to examine it in our study as this subject is under-researched regarding Kosovo’s market.

Our research focuses on the implications of IFRS adoption in Kosovo. The influence of these standards on the major performance and financial position ratios of the firms subject to the study is quantified by comparing the period previous to IFRS adoption (2010–2012) and after the adoption of IFRS (2013–2021).

The following research questions are:

- What effect does the adoption of International Financial Reporting Standards have on the performance and financial position of businesses in Kosovo?

- Is there an improvement or deterioration in profitability and return coefficients as a consequence of the implementation of IFRS?

- Is there an increase in liquidity as a consequence of the implementation of IFRS?

- Are Kosovo's businesses financially sound before and after the implementation of International Financial Reporting Standards (IFRS)?

- How have the International Financial Reporting Standards influenced assets and short-term liability turnover ratios?

This research contributes to the growing body of knowledge about the necessity and consequences of adopting and implementing IFRS. However, the evidence in this area is inconsistent. Christensen, Lee, and Walker (2007) discovered that mandating the use of IFRS has a variable influence on the cost of capital depending on a firm's characteristics.

Morricone, Oriani, and Sobrero (2010) did not find any overall increase in the relationship between accounting information and capital market values following the application of IFRS. On the other hand, some studies reported beneficial effects in terms of increasing the importance of IFRS for mandatory adopters, thus reducing the cost of capital, increasing market liquidity, and expanding cross-border investments (Daske, Hail, Leuz, & Verdi, 2008; DeFond, Hu, Hung, & Li, 2011; Kim & Siqi, 2010; Morais & Curto, 2009) .

Some studies show that the economic consequences of IFRS can be explained and justified by changes in the financial reporting and auditing environments, the level of enforcement of laws and regulations, the level of capacity-building for the implementation of IFRS, and the adoption and implementation of auditing standards ( Hail, Christian, & Peter, 2010) .

Regulators and standard setters expect that high-quality and transparent financial information resulting from the application of IFRS will increase the well-being of market participants, boost market liquidity, create new opportunities for risk diversification, and, ultimately, reduce the cost of capital.

Recommendations and findings from this study could also be used by regulators and oversight bodies in Kosovo, as increasing the quality of financial reporting would provide policymakers with more reliable financial information, thus influencing the factors of economic growth.

This paper contributes to the literature on the consequences of applying IFRS on the performance and financial position of companies that have adopted and implemented these standards in Kosovo. This paper also provides a basis and recommendations for further research in this area.

2. The Review of Literature

The empirical results so far in the academic literature are mixed regarding the implementation of IFRS. The existing literature highlights a considerable heterogeneity in the economic consequences of the implementation and adoption of IFRS.

On the one hand, some studies found a positive correlation between stock market reactions and the adoption of IFRS by European firms, characterized by the low or high level of information quality before applying IFRS. At the same time, researchers have also found negative market reactions for firms in law-based countries. The benefits of the capital market appear to be greater in countries where firms have higher incentives to be transparent and in those countries where legal systems protect investors effectively (Ball, Robin, & Wu, 2003; Christensen, Lee, Walker, & Zeng, 2015; Daske et al., 2008; Dubois & Silvius, 2020) . On the other hand, countries characterized by weak investor rights, high concentration of ownership, and poor quality of disclosures have not had a significant reduction in the cost of capital following the adoption of IFRS (Lee, Walker, & Christensen, 2008).

Whittington (2005) showed that the primary motivator for adopting IFRS is the need for an international accounting language and the need for the internationalization of capital markets. Frey and Chandler (2007) noted that IFRS enable the comparison of financial statements between firms in the same industry, even if they operate in different markets.

Extensive literature has focused on the effects of IFRS on information asymmetry and, more broadly, on the information environment. Consistent with this goal, several previous studies have documented the differential effects of IFRS on capital markets and the information environment across countries.

For example, Daske et al. (2008) found that capital market benefits from IFRS exist only in countries with strong enforcement. Byard, Li, and Yu (2011) found that the adoption of IFRS only improves the information environment of analysts in countries with both, i.e., strong enforceability regimes and internal accounting standards, that differ significantly from IFRS. Landsman, Maydew, and Thornock (2012) found that the improvement in financial information content following the adoption of IFRS is more significant in countries with strong legal enforcement.

The stated purpose of the IFRS and the International Accounting Standards (IAS) is to produce high quality financial statements that reflect the economic substance of transactions, reflecting profits and losses in a more appropriate way and by providing details that are informative for the users of those financial statements (Ball, 2006).

Consistent with this objective, Barth, Landsman, and Lang (2008) found that companies that apply IAS and IFRS have a higher quality of accounting and financial reporting, evidenced and documented by less profit management, timely recognition of losses or impairment of items in the financial statements and, consequently, accounting numbers, which have more value.

Landsman et al. (2012) found that the information regarding profits increased after the mandatory adoption of IFRS due to increased financial analysis and increased foreign investment. In general, these studies, show that companies provide additional disclosures in financial statements after the adoption of IFRS.

On the other hand, although the harmonization of accounting and financial reporting standards will present benefits, many elements need to be included when harmonizing these standards, such as culture, and economic and political systems that are different not only between developed and developing countries but also between countries that may have similar characteristics. These elements can then be considered as barriers to the adoption and implementation of the harmonization system.

In addition to creating high-quality financial statements, a significant feature of IFRS is "fair value" or "market valuation" in accounting (Ball, 2006). Fair value orientation of IFRS is more pronounced by the rules of measurement and recognition of assets and liabilities, which were often missing in the financial statements of companies in countries, including Kosovo, before the adoption of IFRS.

Previous studies have documented improvements in the quality of mandatory reporting after the adoption of IFRS, evidenced by lower manipulation in profits and sales, and timely and relevant information (Barth et al., 2008). Therefore, given the evidence that IFRS improve profitability verification, the supplementary views suggest that the mandatory adoption of IFRS will increase management forecasts.

Silva and Couto (2007) empirically measured the impact of the application of IFRS by companies in Portugal, concluding that number of adjustments in the financial statements during the transition from national to international standards have undergone significant changes. These findings are in line with the findings of our study.

In line with the findings mentioned above in the literature, we can say that while the mandatory implementation of IFRS is a part of the regulation at the national level that aims to increase the quality of information available to the public to protect the public interest, voluntary implementation of IFRS can be seen as a strategic commitment of an individual company to provide better financial reporting strategies and a higher level of financial information disclosure (Covrig, Defond, & Hung, 2007; Leuz & Verrecchia, 2000).

Opponents of IFRS, on the other hand, question their superiority and point out that the mere fact of enforcing the use of IFRS alone cannot make the financial reporting process more informative. First, forced accounting choices may limit the presentation of the economic core of companies, and principle-based standards may delay earnings management (Barth et al., 2008).

Second, some studies suggest a limited role of accounting and financial reporting standards in determining the quality of financial reporting, and instead they highlight the importance of companies’ own incentives to report fair and true views of their financial position and performance (Ball et al., 2003; Barth et al., 2008; Daske et al., 2008).

Therefore, these authors conclude that if IFRS are not applied consistently and companies do not have an incentive to improve financial reporting, it is debatable whether IFRS impact financial reporting quality.

These findings from the literature review have important implications, suggesting that effective harmonization of accounting and financial reporting is unlikely to be achieved by accounting and financial reporting standards alone. In this regard, this paper will take into account these different authors who support and oppose international financial reporting standards.

3. Research Methodology

In order to test the research hypotheses, quantitative research strategies are used regarding the collection of data on several variables from the financial statements. The quantitative method was chosen because the sample of 250 preparers of the financial statements is large, and it is not possible to do face-to-face interviews with this many people. Therefore, it is more effective to use the data from the financial statements as quantitative data, and quantitative indicators are necessary to make this type of analysis. Also, the correlation of conclusions and findings through quantitative research demonstrate the validity of the results of this study.

The data collected in this study started from secondary sources, based on which the theoretical framework was built. Initially, it started with reading written literature. It was found that there a lot of interest in the subject, and from this, the main objectives of the study were formed. These data include financial statements submitted to the KCFR, International Financial Reporting Standards, academic and professional literature, and analysis of the legal framework and its implementation.

By analyzing the sampling selection techniques from the above, as well as according to the literature research which has been used in similar works, non-probabilistic sampling techniques were used in this study.

Our research uses 100 financial statements to calculate key performance and financial position ratios of large commercial, manufacturing, service, and public enterprises over ten years (2010–2020) from a total population of 250 businesses that are legally obliged to report according to IFRS, thus making a total of 1000 observations. Therefore, the sample is 40% of the population, which in statistics is considered to be a large sample with over 30 observations.

After calculating all the coefficients for all years separately, the averages were found for the years before the adoption of IFRS and the years after the adoption of IFRS.

Therefore, 2012 is considered to be a comparative year, when the adoption of IFRS began according to the legal requirements in Kosovo, as the performance and financial position for the years before IFRS and after IFRS were analyzed.

The data were analyzed with a multiple regression analysis, using performance measurement factors and financial position as research variables.

3.1. The Independent Variables

The coefficients of performance and financial position represented by K are profitability and return, long-term solvency and stability, short-term solvency and liquidity, and efficiency (turnover coefficients).

The independent variables are:

Δ A: Change in Assets before and after IFRS implementation.

ΔL: Change in Liabilities before and after IFRS implementation.

Δ E: Change in Equity / Equity before and after IFRS implementation.

Δ P: Change in net profit before and after IFRS implementation.

Βi: Coefficient of regression, i = 0,1,2,3,4.

3.2. Dependent Variables

1) Profitability and return are measured by calculating the average of the coefficients as follows:

1.1 Return on capital employed (ROCE) is the most important measurement of return, which emphasizes profit as a percentage of the capital employed.

1.2 Return on equity (ROE) as a coefficient gives more limited capital views than the ROCE, but it is based on the same principles. ROE is calculated as the ratio of net profit to equity. ROCE and ROE are indicators of managerial effectiveness. A high ratio indicates high capability and is therefore an indicator of better performance. ROCE is often further analyzed because two factors contribute to the return on capital employed, both of which relate to sales revenue.

1.3 Net profit margin and return on assets: Return on assets is a measure of how well a business's assets are used to generate sales. Profit margin and return on assets together explain the ROCE, and the ROCE is the primary rate of return; the other two are secondary coefficients.

2) Second aggregates: Long-term solvency and stability are measured by calculating the average debt ratios. Debt ratios deal with how much a company owes in relation to its size, whether it is entering into larger debts or if it is improving the situation, and whether its debt burden seems heavy or light.

2.1 The debt ratio is the ratio of the total debts of the company to its total assets.

2.2 The debt/leverage ratio deals with the long-term capital structure of a company. The debt-to-equity ratio is a measure of the proportion of a company's borrowed capital. It is measured as the ratio of long-term liabilities to capital employed, which is equity plus long-term liabilities.

2.3 The equity to assets ratio is measured as the ratio of equity to capital employed.

2.4 Interest coverage: The interest rate ratio indicates whether a company is making enough profit before interest and tax to pay its interest costs easily, or if its interest costs are high relative to the size of its profits so that a decline in earnings before interest and taxes (EBIT) would have a significant impact on the profits available to ordinary shareholders. This ratio is calculated as the ratio of profit before interest and tax on interest expenses.

3) Third aggregates: Short-term solvency and liquidity. Liquidity ratios and working capital return ratios are used to test a company's liquidity, money cycle length, and working capital investment.

3.1 The 'standard' liquidity test is the turnover ratio, which is calculated as the ratio of short-term assets to short-term liabilities.

3.2 The acid test calculates the ratio of current assets minus inventories to current liabilities.

4) Fourth aggregate: Efficiency (turnover coefficients). This indicates what period short-term assets are collected and when short-term liabilities related to the sale and purchase of goods for resale are paid during an operating business cycle. Key ratios consist of the period of receivables collection and the period of turnover of goods/stocks.

4.1 Accounts receivable collection period is calculated as the ratio of accounts receivable to sales multiplied by 365 days.

4.2 The period of inventory turnover is calculated as the ratio of stocks to the cost of sales multiplied by 365 days.

Based on the research questions proposed in this study, the following hypotheses will be empirically evaluated:

H1: There are no effects in the pre- or post-adoption periods of IFRS on the profitability of businesses in Kosovo.

H2: There are no effects in the pre- or post-adoption periods of IFRS on the long-term solvency and stability of businesses in Kosovo.

H3: There are no effects in the pre- or post-adoption periods of IFRS in the short-term solvency and liquidity of businesses in Kosovo.

H4: There are no effects in the pre- or post-adoption periods of IFRS on the efficiency of businesses in Kosovo.

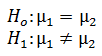

Through these null hypotheses, it is assumed that the financial performance ratios and financial position of the period before IFRS are equal to those after IFRS and are expressed as follows:

Alternative hypotheses will be verified in this study to show that IFRS implementation has had a substantial impact on the change in performance and financial position of businesses in Kosovo.

4. Hypothesis Testing and Research Results

We have analyzed the financial position and performance of 100 commercial, manufacturing, service, and public companies as a research sample, comparing the financial performance and position before and after the adoption of IFRS. Therefore, 2012 was taken as a comparative year, when the adoption of IFRS began according to the legal requirement in Kosovo.

Table 1 presents a summary of the results from the regression analysis. The first part of Table 1 presents the whole model and regression coefficients for all dependent variables and the significance level for each. For the return on capital employed (ROCE) coefficient, the regression coefficient is r = 0.4195 with a significance level of p = 0.0000 (p ≤ 1%).

Return on equity (KNE) has a regression coefficient of r = 0.5042 at a significance level of p = 0.0002 (p ≤ 1%), the return on assets (ROA) has a regression coefficient of r = 0.3659 with a significance level of p = 0.0096 (p ≤ 1%), the equity coefficient has a regression coefficient of r = 0.0602 with a significance level of p = 0.01600 (p ≤ 5%), the net profit margin has a regression coefficient of r = 0.2771 with a significance level of p = 0.0000 (p ≤ 1%). Debt ratio has a regression coefficient of r = 0.0602 with a significance level of p = 0.01600 (p ≤ 5%), the leverage/gearing ratio has a regression coefficient of r = 0.2780 with a significance level of p = 0.0031 (p ≤ 1%), interest cover has a regression coefficient of r = 0.2309 with a significance level of p = 0.0000 (p ≤ 1%), the current ratio coefficient has a regression coefficient of r = 0.3420 with a significance level of p = 0.3900 (p > 5%), the acid test coefficient has a regression coefficient of r = 0.3195 with a significance level of p = 0.0000 (p ≤ 1%), the accounts receivable collection period has a regression coefficient of r = 0.4709 with a significance level of p = 0.006 (p ≤ 1%), and the inventory turnover period has a regression coefficient of r = 0.5208 with a significance level of p = 0.389 (p > 5%).

The second part of Table 1 shows the impact of each independent variable in the model on the dependent variable, from which it can be seen that the change in assets in the ROCE variable has a negative impact but with a significance of p = 0.0054 (p ≤ 1%), the change on liabilities has a non-significant negative impact with a significance level of p = 0.0940 (p > 5%), the change in equity has a positive non-significant impact with a significance level of p = 0.5596 (p > 5%), and the change in net profit has a significant negative impact with a significance level of p = 0.000 (p ≤ 1%).

The change in assets in the ROE variable has a significant negative impact with a significance level of p = 0.0001 (p ≤ 1%), the change in liabilities has a significant negative impact on the ROE variable with a significance level of p = 0.0333 (p ≤ 1%), change in equity has a significant positive impact with a significance level of p = 0.0015 (p ≤ 1%), and the change in net profit has a significant positive impact with a significance level of p = 0.0007 (p ≤ 1%).

ROCE |

ROE |

ROA |

Equity coefficient |

Net profit margin |

Debt ratio |

Gearing or leverage |

Interest cover |

Current ratio |

Quick ratio (Acid test) |

Accounts receivable collection period |

Inventory turnover period |

||

| R2 | 0.4195 |

0.5042 |

0.3659 |

0.0602 |

0.2771 |

0.0602 |

0.2780 |

0.2309 |

0.3420 |

0.3195 |

0.4709 |

0.5208 |

|

| R2 Adjusted | 0.3951 |

0.4859 |

0.3467 |

0.0410 |

0.2622 |

0.0410 |

0.2590 |

0.2151 |

0.30166 |

0.2951 |

0.3519 |

0.5007 |

|

| Statistics-F | 17.168 |

5.6754 |

3.4406 |

3.12 |

18.688 |

3.128 |

4.1245 |

14.636 |

1.041 |

17.16 |

3.725 |

1.036 |

|

| Significance | 0.0000** |

0.0002** |

0.0096** |

0.01600* |

0.0000** |

0.01600* |

0.0031** |

0.0000** |

0.3900 |

0.0000** |

0.006** |

0.389 |

|

| ∆ Assets before and after IFRS | R Sig |

5.95e-7

0.0054** |

-1.13e-8

0.0001** |

-1.26 e-7

0.0006** |

2.58 e-9

0.0737 |

-2.54 e-8

0.0000** |

-2.58 e-9

0.0737 |

-5.42 e-9

0.0004** |

-1.33 e-6

0.0235* |

-1.65 e-8

0.828 |

5.95 e-7

0.0054** |

2.91 e-6

0.0003** |

1.89 e-6

0.0484* |

| ∆ Liabilities before and after IFRS | R Sig |

-9.32e-7

0.0940 |

-7.77e-9

0.0333* |

1.13 e-7

0.0479* |

-9.02 e-9

0.0039** |

-1.12 e-10

0.9906 |

9.02 e-9

0.0039** |

1.03 e-8

0.0018** |

-7.04 e-7

0.5733 |

3.72 e-8

0.0606 |

-6.32 e-7

0.0940 |

-4.23 e-6

0.0132* |

-2.55 e-6

0.2135 |

| ∆ Equity before and after IFRS | R Sig |

3.96 e-8

0.5596 |

4.94e-9

0.0015** |

-7.31 e-10

0.0204* |

-4.25 e-10

0.1447 |

3.09 e-9

0.0007** |

4.25 e-10

0.1447 |

1.98 e-10

0.5163 |

7.49 e-7

0.0000** |

1.40 e-8

0.0462* |

3.96 e-8

0.5596 |

-1.73 e-7

0.2780 |

-1.32 e-7

0.0943 |

| ∆ Net profit before and after IFRS |

R Sig |

-2.61e-5

0.000** |

1.39 e-7

0.0007** |

2.63 e-7

0.0748 |

1.26 e-8

0.1032 |

1.85 e-8

0.0000** |

-1.26 e-8

0.1032 |

7.98 e-9

0.3229 |

1.27 e-5

0.0001** |

-6.86 e-8

0.0551 |

-2.61 e-5

0.000** |

-3.14 e-6

0.0564 |

-3.32 e-6

0.0146* |

Note: * Significant at the < 0.05 level; ** Significant at the < 0.01 level. |

A change in assets in the ROA variable has a significant negative impact with a significance level of p = 0.0006 (p ≤ 1%), a change in liabilities has a significant positive impact on the ROA variable with a significance level of p = 0.0479 (p ≤ 5%), change in equity has a significant negative impact with a significance level of p = 0.0204 (p ≤ 5%), and a change in net profit has a positive non-significant impact with a significance level of p = 0.0748 (p > 5%).

A change in assets in the equity coefficient variable has a positive non-significant impact with a significance level of p = 0.0737 (p > 5%), a change in liabilities has a significant negative impact on the equity coefficient variable with a significance level of p = 0.0039 (p ≤ 1% ), a change in equity has a non-significant negative impact with a significance level of p = 0.1447 (p > 5%), and a change in net profit has a positive non-significant impact with a significance level of p = 0.1032 (p > 5%).

A change in assets in the net profit margin variable has a significant negative impact with a significance level of p = 0.0000 (p ≤ 1%), a change in liabilities has a negative non-significant impact on the net profit margin variable with a significance level of p = 0.9906 (p > 5%), a change in equity has a significant positive impact with a significance level of p = 0.0007 (p ≤ 1%), and a change in net profit has a significant positive impact with a significance level of p = 0.0000 (p ≤ 1%).

A change in assets in the debt ratio variable has a non-significant negative impact with a significance level of p = 0.0737 (p > 5%), a change in liabilities has a significant positive impact with a significance level of p = 0.0039 (p ≤ 1% ), a change in equity has a non-significant positive impact with a significance level of p = 0.1447 (p > 5%), and a change in net profit has a non-significant negative impact with a significance level of p = 0.1032 (p > 5%).

A change in assets in the leverage/gearing ratio variable has a significant negative impact with a significance level of p = 0.0004 (p ≤ 1%), a change in liabilities has a significant positive impact with a significance level of p = 0.0018 (p ≤ 1%), a change in equity has a non-significant positive impact with a significance level of p = 0.5163 (p > 5%), and a change in net profit has a non-significant positive impact with a significance level of p = 0.3229 (p > 5%).

A change in assets in the interest cover variable has a significant negative impact with a significance level of p = 0.0235 (p ≤ 5%), a change in liabilities has a non-significant negative impact with a significance level of p = 0.5733 (p > 5%), a change in equity has a significant positive impact with a significance level of p = 0.000 (p ≤ 1%), and a change in net profit has a significant positive impact with a significance level of p = 0.0001 (p ≤ 1%).

A change in assets in the current ratio variable has a non-significant negative impact with a significance level of p = 0.828 (p > 5%), a change in liabilities has a non-significant positive impact with a significance level of p = 0.0606 (p > 5 %), a change in equity has a significant positive impact with a significance level of p = 0.0462 (p ≤ 5%), and a change in net profit has a non-significant negative impact with a significance level of p = 0.0551 (p > 5%).

A change in assets in the acid test variable has a significant positive impact with a significance level of p = 0.0054 (p ≤1%), a change in liabilities has a non-significant negative impact with a significance level of p = 0.0940 (p > 5%), a change in equity has a non-significant positive impact with a significance level of p = 0.5596 (p > 5%), and a change in net profit has a significant positive impact with a significance level of p = 0.000 (p ≤ 1%).

A change in assets in the accounts receivable collection period variable has a significant positive impact with a significance level of p = 0.0003 (p ≤ 1%), a change in liabilities has a significant negative impact with a significance level of p = 0.0132 (p ≤ 5%), a change in equity has a non-significant negative impact with a significance level of p = 0.2780 (p > 5%), and a change in net profit has a non-significant negative impact with a significance level of p = 0.0564 (p > 5%).

A change in assets in the inventory turnover period variable has a significant positive impact with a significance level of p = 0.0484 (p ≤ 5%), a change in liabilities has a non-significant negative impact with a significance level of p = 0.2135 (p > 5%), a change in equity has a negative non-significant impact with a significance level of p = 0.0943 (p > 5%), and a change in net profit has a negative impact significant with a significance level of p = 0.0146 (p ≤ 5%).

In all coefficients except the current ratio and the inventory turnover period, we see that IFRS have a significant impact for some at the level of p ≤ 1% and others at the level of p ≤ 5%. Therefore, the greatest impacts are on profitability and return, long-term solvency and stability, and short-term solvency and liquidity, and the least significant impact is on efficiency because two of the ratios did not have significant changes before or after IFRS. In this regard, we have proven alternative hypotheses:

- H1: The implementation of IFRS does affect the profitability and returns of businesses in Kosovo.

- H2: Long-term solvency and stability of businesses in Kosovo are affected by the implementation of IFRS.

- H3: There is an effect in the pre- and post-adoption periods of IFRS in the short-term solvency and liquidity of businesses in Kosovo.

And regarding efficiency coefficients, we have proven the following null hypothesis:

- H0: Efficiency (turnover coefficient) is not affected by the implementation of IFRS.

5. Conclusions

While developing countries are part of a globalized world in which developed countries' capital markets and regulatory systems predominate, some of the risks associated with globalization are evident for developing countries, and the need to reform globalization is becoming increasingly apparent. Additionally, nations such as Kosovo, who lack national accounting standards, would benefit from the facilitation and quick improvement of their accounting and financial reporting systems, allowing them to access global funding.

We conclude from our research that IFRS have had a significant impact on the performance and financial position of companies in Kosovo, with the greatest impact on the coefficients of performance and financial position (ROCE, ROW, ROA, Net Profit Margin, Debt Ratio, Interest Cover, Quick ratio (Acid Test), and accounts receivable collection period), which have a significance level of p <0.01, and the other coefficients (Equity Ratio, and Leverage/Gearing) had a significance level of p <0.05, while the non-significant level was for current ratio and inventory turnover period.

Given that just two of the 12 major performance and financial position ratios have not been significantly impacted by IFRS, it is determined that IFRS adoption has impacted the performance and financial condition of businesses in Kosovo. These results support those of Stent, Bradbury, and Hooks (2010) and Biancone (2006); however, they contradict those of Iatridis (2010).

Taking into account the current situation, it can be said that the Kosovar corporate financial reporting system isn't yet complete or in line with European Union rules. A report from the World Bank called ROSC gives an independent view of how financial reporting is going in Kosovo right now, and it doesn't like what it sees. According to this report, there are a lot of things that need to be improved and developed. The report gives advice on how to make more changes, and hard work is needed to make them happen.

It can also be said that the adoption of IFRS as part of a legal framework is easier than the full implementation of IFRS because standards haven't been developed for unique countries, and especially for countries that are still in the process of developing.

The future scope and subject of study may involve a bigger sample size of Kosovo firms and an examination of the additional advantages associated with IFRS implementation in Kosovo. Additionally, potential study suggestions include comparing Kosovo's economy to those of other Southeast European nations, stressing the contrasts and similarities, as well as the obstacles and possibilities associated with IFRS implementation in these countries.

References

Ball, R., Robin, A., & Wu, J. S. (2003). Incentives versus standards: Properties of accounting income in four East Asian countries. Journal of Accounting and Economics, 36(1-3), 235-270.Available at: https://doi.org/10.1016/j.jacceco.2003.10.003.

Ball, R. (2006). International financial reporting standards (IFRS): Pros and cons for investors. Accounting and Business Research, 36(sup1), 5-27.Available at: https://doi.org/10.1080/00014788.2006.9730040.

Barth, M. E., Landsman, W. R., & Lang, M. H. (2008). International accounting standards and accounting quality. Journal of Accounting Research, 46(3), 467-498.Available at: https://doi.org/10.1111/j.1475-679x.2008.00287.x.

Biancone, P. P. (2006). Intangible assets, goodwill and impairment in the financial statements. International accounting standards (IAS / IFRS) and US GAAP (pp. 171, 181-182, 215, 270-271): Giuffrè Publisher.

Byard, D., Li, Y., & Yu, Y. (2011). The effect of mandatory IFRS adoption on financial analysts information environment. Journal of Accounting Research, 49(1), 69-96.Available at: https://doi.org/10.1111/j.1475-679x.2010.00390.x.

Christensen, H. B., Lee, E., & Walker, M. (2007). Cross-sectional variation in the economic consequences of international accounting harmonization: The case of mandatory IFRS adoption in the UK. The International Journal of Accounting, 42(4), 341-379.Available at: https://doi.org/10.1016/j.intacc.2007.09.007.

Christensen, H. B., Lee, E., Walker, M., & Zeng, C. (2015). Incentives or standards: What determines accounting quality changes around IFRS adoption? European Accounting Review, 24(1), 31-61.Available at: https://doi.org/10.1080/09638180.2015.1009144.

Covrig, V. M., Defond, M. L., & Hung, M. (2007). Home bias, foreign mutual fund holdings, and the voluntary adoption of international accounting standards. Journal of Accounting Research, 45(1), 41-70.Available at: https://doi.org/10.1111/j.1475-679x.2007.00226.x.

Daske, H., Hail, L., Leuz, C., & Verdi, R. (2008). Mandatory IFRS reporting around the world: Early evidence on the economic consequences. Journal of Accounting Research, 46(5), 1085-1142.Available at: https://doi.org/10.2469/dig.v39.n2.42.

DeFond, M., Hu, X., Hung, M., & Li, S. (2011). The impact of mandatory IFRS adoption on foreign mutual fund ownership: The role of comparability. Journal of Accounting and Economics, 51(3), 240-258.Available at: https://doi.org/10.1016/j.jacceco.2011.02.001.

Dubois, O., & Silvius, G. (2020). The relation between sustainable project management and project success. International Journal of Management and Sustainability, 9(4), 218–238.Available at: https://doi.org/10.18488/journal.11.2020.94.218.238.

Frey, N., & Chandler, R. (2007). Acceptance of international accounting standardsetting: Emerging economies versus developed countries. Research in Accounting in Emerging Economies, 7, 147-162.Available at: https://doi.org/10.1016/s1479-3563(06)07007-1.

Hail, L., Christian, L., & Peter, W. (2010). Global accounting convergence and the potential adoption of IFRS by the US (Part I): Conceptual underpinnings and economic analysis. Accounting Horizons, 24(3), 355-394.

Iatridis, G. (2010). International Financial Reporting Standards and the quality of financial statement information. International Review of Financial Analysis, 19(3), 193-204.Available at: https://doi.org/10.1016/j.irfa.2010.02.004.

Kim, Y., & Siqi, L. (2010). Mandatory IFRS adoption and intra-industry information transfers. Document de travail, Leavey School of Business, Santa Clara University. Retrieved from: https://sa.sufe.edu.cn.

Landsman, W. R., Maydew, E. L., & Thornock, J. R. (2012). The information content of annual earnings announcements and mandatory adoption of IFRS. Journal of Accounting and Economics, 53(1-2), 34-54.Available at: https://doi.org/10.1016/j.jacceco.2011.04.002.

Lee, E., Walker, M., & Christensen, H. B. (2008). The impact of mandatory IFRS adoption by the EU on the cost of equity capital. Working Paper, University of Manchester.

Leuz, C., & Verrecchia, R. E. (2000). The economic consequences of increased disclosure. Journal of Accounting Research, 38, 91-91.

Morais, A. I., & Curto, J. D. (2009). Mandatory adoption of IASB standards: Value relevance and country-specific factors. Australian Accounting Review, 19(2), 128-143.Available at: https://doi.org/10.1111/j.1835-2561.2009.00051.x.

Morricone, S., Oriani, R., & Sobrero, M. (2010). The value relevance of intangible assets and the mandatory adoption of IFRS. Paper presented at the 2010 American Accounting Association Meeting.

Silva, F. J., & Couto, G. (2007). Measuring the impact of international financial reporting standards (ifrs) in firm reporting: The case of Portugal. CEEAplA-A-Working Paper Series, No. 1-22.

Stent, W., Bradbury, M., & Hooks, J. (2010). IFRS in New Zealand: Effects on financial statements and ratios. Pacific Accounting Review, 22(2), 92-107.Available at: https://doi.org/10.1108/01140581011074494.

Whittington, G. (2005). The adoption of international accounting standards in the European Union. European Accounting Review, 14(1), 127-153.Available at: https://doi.org/10.1080/0963818042000338022.