The Effect of Macroeconomic Indicators on Non-Performing Loans: The Case of Balkan Countries

Agnesa Krasniqi-Pervetica1

Skender Ahmeti2*

1,2University of Prishtina “Hasan Prishtina,” Faculty of Economy, Republic of Kosova. |

AbstractThis paper investigates the impact of macroeconomic indicators on non-performing loans at commercial banks in the Balkans. In this research, we calculated how the macroeconomic indicators mentioned below affect non-performing loans and how strong this relationship is. The study of this problem is crucial because the Balkan countries experience economic trends reflected in macroeconomic indicators. In this study, the OLS model was used to examine the relationship between macroeconomic factors and non-performing loans in the study period from 2006 to 2020. We used correlation, regression, and co-integration methods. Non-performing loans (NPLs) were the dependent variable, and the independent variables were gross domestic product (GDP), government debt to GDP ratio, unemployment, and inflation. According to the linear regression model, GDP and inflation negatively impacted non-performing loans, while government debt to GDP ratio and unemployment had a positive effect. |

Licensed: |

|

Keywords: JEL Classification |

|

Received: 16 June 2022 |

Funding: This study received no specific financial support. |

Competing Interests:The authors declare that they have no competing interests. |

1. Introduction

According to the Basle Committee (2016) and the IMF (2005), a non-performing exposure is an exposure that defaults, is impaired, or is more than 90 days in arrears. The number of non-performing loans (NPLs) is used as an indicator of the soundness of institutions or the financial system in general. When a client defaults on their loan, a bank will have less money to offer new loans, as banks mainly make money from the interest that clients pay on their loans. NPLs can result from a lack of sound lending policies and a lack of proper credit judgment by management when approving loans. NPLs can include loans issued to new businesses, loans for speculative purchases of goods, loans covered by collateral without an adequate insurance margin, loans issued to borrowers with bad credit reputations, and others. In addition to the bank’s internal factors, the macroeconomic indicators of a country can also have an impact on the NPL rate. The NPL rate is mainly affected by three macroeconomic factors: GDP, unemployment, and inflation.

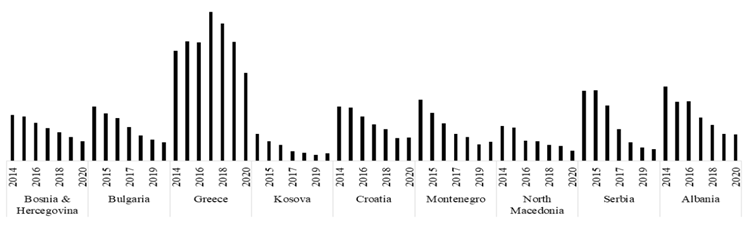

As can be seen in Figure 1, during 2014–2020, Kosovo had the lowest NPL rate of the Balkan countries. Greece had the highest percentage of NPLs due to the recent crisis of 2007–2008. Greece reached its highest level in 2017, when nearly approximately half of all loans issued, 45%, were non-performing. Kosovo’s level dropped from 2014, when the percentage of NPLs was 8.31%, to 2.47% in 2020. In Albania, the NPL rate decreased by over 50% from 2014, when it was 22%, to 8.11% in 2020. A large decline is also observed in Serbia, where it fell from 21% in 2014 to 3.70% in 2020.

Figure 1. Graphic presentation of NPL rates in Balkan countries 2014-2020. Source: World Bank Database. |

2. Literature Review

There is no single accepted definition of non-performing loans. NPL definitions vary from state to state, and it is accepted that a definition that is appropriate in one country may not be so in another. However, there is a convergence of opinions on this issue (IMF, 2005). A loan is considered non-performing when interest and/or principal payments are 90 days or more past due (IMF, 2005). After a loan has been classified as non-performing, it must remain classified as such until either written off or payments of interest and/or principal are received (IMF, 2005).

In the last decade, countries worldwide have begun to pay more attention to NPL because of the risk that those loans would grow uncontrollably and cause a possible failure of the banking system as a whole.

Analyzing the available literature and the studies conducted by various authors has given us a better overview of the state of research in this field. The existing literature mainly analyzes macroeconomic indicators and their impact on NPLs. Several studies have highlighted NPLs from a macroeconomic perspective. Louzis, Vouldis, and Metaxas (2012) examined the impact of macroeconomic and bank-specific determinants on NPLs. The authors used panel data of the nine largest banks operating in Greece in the period 2003-2009 and analyzed the determinants of loan non-performance separately for each loan category (consumer loans, business loans, and mortgages). They concluded that macroeconomic factors such as unemployment, real GDP growth, and lending rate affect the NPL level. At the same time, bank-specific variables such as risk management practices and performance and quality management were also found to be responsible for the reporting level of NPLs.

On the other hand, Bofondi and Ropele (2011), by applying linear regression to aggregated data of the Italian banking system from 1990 to 2012, showed that actual GDP growth rates and house prices have a negative impact on households’ NPLs, while the unemployment rate and nominal interest rate have a positive effect. An increase in unemployment and key interest rates leads to an increase in NPLs. In contrast, NPLs decrease with an increase in sustainable consumption. Nkusu (2011) examined the determiners of NPLs in 26 developed countries during the period 1998 to 2009 and found that if macroeconomic conditions (economic growth and unemployment) worsen, the NPL rate increases. In his study on the impact of macroeconomic indicators in Albania, Shingjergji (2013) concluded that GDP growth led to NPL growth, in contrast to the relationship that is generally accepted worldwide. He also found that inflation was negatively related to NPLs, and interest rates were positively related to NPLs. Shingjergji recommended that the government take these relationships into account when formulating monetary policy. One of the study’s most important findings, according to the author, was the positive correlation between the Euro/ALL exchange rate and NPL; this is because more than 50% of loans in this country are in the Euro currency. Clichici and Colesnicova (2014) researched the Moldovan banking system and concluded that NPLs increase when GDP, exports, and remittances decrease and unemployment increases. Beck, Jakubik, and Piloiu (2015) analyzed the macroeconomic determinants of NPLs in 91 countries. They found that NPLs are significantly affected by real GDP growth, stock prices, the exchange rate, and the loan interest rate. Kjosevski, Petkovski, and Naumovska (2019) examined the impact of bank-specific determinants and macroeconomic indicators. They concluded that there is a negative correlation between economic growth and the increase in NPLs, while the real exchange rate has a significant impact on corporate loans. Inflation alone, however, was not statistically significant using the long-term dynamics model. Kjosevski et al. (2019) found that the variation in the unemployment rate had the greatest impact because of the connection between it and the financial solvency of the population. They concluded that regulatory authorities should focus on developing the real economy and creating new jobs to prevent possible disruptions in the functioning of the banking sector.

3. Research Methodology

Sound lending policies and credit management at the origination stage can help a bank reduce the number of NPLs. However, in addition to bank-specific factors, NPLs can also affect a country's macroeconomic environment and vice versa. The macroeconomic environment includes GDP, unemployment, inflation, and other factors. The main objective of this study was to examine the impact of macroeconomic factors (GDP, unemployment, and inflation) on the rate of non-performing loans (NPLs) using panel data for Bosnia and Herzegovina, Bulgaria, Greece, Albania, Kosovo, Croatia, Montenegro, Serbia, and Northern Macedonia for the period 2006–2020 (see Table 1 for variables, definitions, and sources). This research was based on a descriptive methodology as it involved collecting data to test hypotheses regarding the impact of macroeconomic indicators on NPL. According to Salaria (2012), the descriptive methodology is of great importance because it pays attention not only to the characteristics of a sample but also to the entire population. It also provides information on local issues.

Data to calculate the impact of macroeconomic indicators on the NPL rate were derived from the World Bank database. GDP and inflation were expected to have a negative impact on NPL; on the other hand, unemployment was expected to have a positive impact on NPL. Based on these expectations, four hypotheses were devised for the study:

H1: GDP growth rate has a negative impact on non-performing loans in the Balkan countries.

H2: Debt-to-GDP ratio has a positive impact on non-performing loans in the Balkan countries.

H3: Unemployment positively impacts non-performing loans in Balkan countries. H4: Inflation has a negative impact on non-performing loans in Balkan countries.

The model chosen to study the impact of the selected macroeconomic factors as independent variables on the NPL rate was the multiple regression model, presented in the form of a linear relation:

Where:

Y - dependent variable.

β0 - constant, indicating the expected value of the dependent variable if all independent variables take the value equal to zero.

β1i, β2i, and βpi - are the parameters, or coefficients, that determine the effect the independent variables have on the dependent variable.

ε - residual error estimation variable in period i.

This model is used in our study as follows:

Table 1 shows the variables that were used, along with their definitions and sources.

| Variables | Definition | Source | |

| Dependent | |||

| NPL | Non-performing loans to total loans | World Bank Database | |

| Independent | |||

| Gross domestic product growth rate | The change in a nation’s GDP from one year to the next. | World Bank Database | |

| Unemployment | Unemployment is the ratio between the labor force and the educated force looking for work, who can work but do not. | World Bank Database | |

| Inflation | The consumer price index measures inflation as the annual percentage change in the cost to the average consumer of acquiring a basket of goods and services that may be fixed or changed at specified intervals, such as yearly. | World Bank Database | |

| Public Debt to GDP | Public debt to GDP is the ratio between the public debt of a country and its GDP. | International Monetary Fund (IMF) | |

4. Empirical Findings

The empirical results of this study include descriptive, linear regression, co-integration, and correlation analyses. We used descriptive analysis to summarize and describe the dataset for each country. Regression analysis was used to examine the movements of the dependent variable, non-performing loans (NPLs), and the independent or explanatory variables of the regression model (GDP growth rate, debt-to-GDP ratio, unemployment, and inflation). Next, correlation analysis was used to determine whether the variables were correlated and, if so, whether the correlation was positive or negative. Co-integration analysis was used to determine if there was co-integration between the variables. The software program SPSS was used for the descriptive, regression, and correlation analyses, while the Johansen test for co-integration was carried out in E-Views. All empirical results are described in detail below.

| Variables | N |

Minimum |

Maximum |

Mean |

Std. Deviation |

| NPL | 135 |

1.90 |

45.57 |

11.9341 |

8.281 |

| PD_to_GDP | 135 |

5.27 |

225.54 |

56.079 |

45.334 |

| GDP_Gr | 135 |

-15.31 |

8.57 |

1.872 |

3.899 |

| UnpR | 135 |

4.23 |

47.50 |

19.306 |

9.105 |

| INF | 135 |

-2.83 |

16.04 |

2.627 |

3.039 |

| Valid N (listwise) | 135 |

Descriptive analysis serves to summarize and describe a dataset in a way that makes it more understandable to the reader. Table 2 presents the descriptive analysis of the variables in the Balkan countries over a period of fifteen years. This analysis revealed that the minimum ratio of debt to GDP was 5.27% in Kosovo, while the maximum was 225.54% in Greece. The average ratio was 56.07%. Based on the descriptive statistics, the minimum NPL in these countries between 2006 and 2020 was 1.9%, which was in Kosovo in 2019, while the maximum NPL was 45.57% in Greece in 2017 due to events triggered by the 2007–2008 financial crisis. The average NPL was 11.93%. The minimum GDP growth rate was -15.31%, while the maximum was 8.57%; both the minimum and maximum values were recorded in Montenegro. The average GDP over fifteen years in the studied Balkan countries was 1.87%. According to the descriptive analysis, the lowest rate of unemployment was 4.23% in Croatia, while the highest rate was 47.50% in Kosovo. The average unemployment ratio was 19.30%. On the other hand, during the observation period, the lowest recorded inflation was -2.83%, which is the deflation that occurred in Kosovo in 2009, while the highest was 16.04%, in Montenegro in 2007. Over the fifteen-year study period, the average inflation was 2.62%.

4.1. Correlation Analysis

To identify whether there was any correlation between the variables, we used the Pearson and Spearman Correlation tests.

| Variables | NPL |

PD_to_ GDP |

GDP_ Gr |

UnpR |

INF |

|

| NPL | Pearson Correlation | 1 |

0.693** |

-0.227** |

0.002 |

-0.344** |

| Sig. (2-tailed) | 0.000 |

0.008 |

0.984 |

0.000 |

||

| PD_to_ GDP |

Pearson Correlation | 0.693** |

1 |

-0.455** |

-0.214* |

-0.344** |

| Sig. (2-tailed) | 0.000 |

0.000 |

0.013 |

0.000 |

||

| GDP_Gr | Pearson Correlation | -0.227** |

-0.455** |

1 |

0.174* |

0.382** |

| Sig. (2-tailed) | 0.008 |

0.000 |

0.043 |

0.000 |

||

| UnpR | Pearson Correlation | 0.002 |

-0.214* |

0.174* |

1 |

-0.237** |

| Sig. (2-tailed) | 0.984 |

0.013 |

0.043 |

0.006 |

||

| INF | Pearson Correlation | -0.344** |

-0.344** |

0.382** |

-0.237** |

1 |

| Sig. (2-tailed) | 0.000 |

0.000 |

0.000 |

0.006 |

||

Note: ** Correlation is significant at the 0.01 level (2-tailed). |

To clarify the results, Pearson’s correlation coefficient was used to discover the degree of the linear relationship between each pair of continuous variables. The possible value for a correlation coefficient lies between 0.00 (no correlation) and 1.00 (perfect correlation). Table 3 shows that according to this coefficient, the independent variable NPL has the strongest correlation with the ratio of government debt to GDP, with a result of 0.693. The debt-to-GDP ratio is positively correlated with NPL, which means that an increase in the debt-to-GDP ratio leads to an increase in NPL and vice versa. NPL is also positively correlated with unemployment, though not significantly, while GDP growth rate and inflation are negatively correlated.

We also used Spearman’s rho, a nonparametric measure of the strength and direction of an association between two variables, to further analyze the data. From the correlation matrix shown in Table 4, we can conclude that there is a strong, positive, and significant correlation between NPL and the debt-to-GDP ratio, as well as a strong, negative, and significant correlation between NPL and GDP growth rate and NPL and inflation. On the other hand, the link between NPL and unemployment is weak and insignificant.

A negative correlation with the GDP growth rate and a positive correlation with unemployment echoes the findings of other authors such as (Akinlo & Emmanuel, 2014; Cotugno, Stefanelli, & Torluccio, 2010; De Lis, Pagés, & Saurina, 2001; Fiordelisi, Marques-Ibanez, & Molyneux, 2011; Kjosevski et al., 2019; Louzis et al., 2012; Nkusu, 2011) . In contrast, (Anjom & Karim, 2016; Mboka, 2013; Murumba, 2013; Pradhan, Shyam, & Pandey, 2016) concluded that the GDP growth rate was positively correlated with NPL.

| Variables | NPL |

PD_to_GDP |

GDP_ Gr |

UnpR |

INF |

|

| NPL | Correlation Coefficient | 1.000 |

0.512** |

-0.412** |

0.032 |

-0.345** |

| Sig. (2-tailed) | 0.000 |

0.000 |

0.000 |

0.710 |

0.000 |

|

| PD_to_GDP | Correlation Coefficient | 0.512** |

1.000 |

-0.430** |

-0.332** |

-0.334** |

| Sig. (2-tailed) | 0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

|

| GDP_Gr | Correlation Coefficient | -0.412** |

-0.430** |

1.000 |

0.130 |

0.425** |

| Sig. (2-tailed) | 0.000 |

0.000 |

0.000 |

0.133 |

0.000 |

|

| UnpR | Correlation Coefficient | 0.032 |

-0.332** |

0.130 |

1.000 |

-0.207* |

| Sig. (2-tailed) | 0.710 |

0.000 |

0.133 |

0.000 |

0.016 |

|

| INF | Correlation Coefficient | -0.345** |

-0.334** |

0.425** |

-0.207* |

1.000 |

| Sig. (2-tailed) | 0.000 |

0.000 |

0.000 |

0.016 |

0.000 |

|

Note: ** Correlation is significant at the 0.01 level (2-tailed). |

Cointegration tests identify scenarios in which two or more non-stationary time series are integrated so that they cannot deviate from equilibrium in the long run. The tests are used to determine how sensitive two variables are to the same average price over a specified period. In this paper, we used the Johansen Co-integration test to determine whether three or more time series were cointegrated. This test evaluates the validity of a cointegrating relationship using a maximum likelihood estimates approach.

| Unrestricted Co-Integration Rank Test (Trace) | ||||

| Hypothesized No. of CE (s) | Eigenvalue |

Trace Statistic |

0.05 (Critical Value) |

Prob.** |

| None* | 0.272 |

266.639 |

125.615 |

0.000 |

| At most 1* | 0.214 |

192.078 |

98.753 |

0.000 |

| At most 2* | 0.184 |

135.352 |

69.818 |

0.000 |

| At most 3* | 0.164 |

87.628 |

47.856 |

0.000 |

| At most 4* | 0.158 |

45.543 |

29.797 |

0.000 |

| At most 5 | 0.021 |

5.196 |

15.494 |

0.788 |

| At most 6 | 0.001 |

0.236 |

3.842 |

0.627 |

Note: The trace test indicates 5 cointegrating eqn(s) at the 0.05 level. |

| Unrestricted Co-integration Rank Test (Maximum Eigenvalue) | |||||

| Hypothesized No. of CE (s) | Eigenvalue |

Max-Eigen Statistic |

0.05 (Critical Value) |

Prob.** |

|

| None* | 0.272 |

266.639 |

125.615 |

0.000 |

|

| At most 1* | 0.214 |

192.079 |

98.753 |

0.000 |

|

| At most 2* | 0.184 |

135.353 |

69.818 |

0.000 |

|

| At most 3* | 0.165 |

87.629 |

47.856 |

0.000 |

|

| At most 4* | 0.158 |

45.544 |

29.797 |

0.000 |

|

| At most 5 | 0.022 |

5.196 |

15.494 |

0.788 |

|

| At most 6 | 0.001 |

0.236 |

3.842 |

0.627 |

|

Note: The max-eigenvalue test indicates 5 cointegrating eqn(s) at the 0.05 level. |

The results of the co-integration tests using trace and maximum eigenvalue are shown in Tables 5 and 6. Based on these two values, there are five co-integration equations, indicating that there is co-integration between the variables used in the study. This means that non-performing loans are linked to macroeconomic indicators in the long run. This finding aligns with those of the majority of authors who used this method to test for co-integration (Badar, Javid, & Zulfiquar, 2013; Islamoğlu, 2015; Sheefeni, 2015; Vatansever & Hepsen, 2013).

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

1 |

0.721a |

0.519 |

0.505 |

5.828 |

Note: a. Predictors: (Constant), INFLATION, UNEMPLOYMENT, DEBT_TO_GDP, GDP_GROWTH. |

4.3. Regression Analysis

The R-squared for the regression model was 0.519 (as shown in Table 7). Therefore, the model explains 51.9% of the change in NPL using four independent variables. This finding indicates that the four selected independent variables (GDP, unemployment, inflation, and debt-to-GDP ratio) explain 51.9% of the difference in the number of banks’ non-performing loans in Western Balkan countries. The indicator Std. Error of the Estimate points to the precision of the model, and its value is 5,5879.

| Model | Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

Collinearity Statistics |

|||

B |

Std. Error |

Beta |

Tolerance |

VIF |

||||

| 1 | (Constant) | 2.874 |

1.884 |

0 |

1.526 |

0.130 |

0 |

0 |

| PD_to_GDP | 0.134 |

0.013 |

0.736 |

10.231 |

0.000 |

0.715 |

1.399 |

|

| GDP_Gr | -0.285 |

0.154 |

0.134 |

1.856 |

0.006 |

0.707 |

1.415 |

|

| UnpR | 0.095 |

0.061 |

0.104 |

1.547 |

0.022 |

0.812 |

1.232 |

|

| INF | -0.320 |

0.198 |

-0.118 |

-1.620 |

0.011 |

0.701 |

1.427 |

|

Note: Dependent variable: NPL. |

If there is multicollinearity in a regression analysis, meaning that two or more variables are highly correlated with each other, then these are not the best variables to provide unique or independent information in the regression model (Jensen & Ramirez, 2013). In SPSS, multicollinearity is calculated using the variance inflation factor (VIF) coefficient. To interpret this factor, the following rules are use: VIF = 1 (Not correlated), 1 < VIF < 5 (Moderately correlated), and VIF > 5 (Highly correlated). In our research, this factor has values between 1 and 5, so we can say that our variables are moderately correlated and that the regression model information is sufficiently independent. For the regression analysis, the following regression equation was constructed:

The regression analysis, shown in Table 8, revealed that all three independent variables have a strong negative correlation with NPL, with a coefficient R greater than 70%. Based on the beta coefficient, inflation is the variable that explains the most variation in the NPL and UnpR explains the least variation in the NPL. The beta ratio also displayed the number of units, indicating how much the dependent variable would change if the independent variable changed by one unit of standard deviation.

Based on the P-value (Sig.), which requires a value of less than 0.05 for the impact of the independent variable to be considered significant, we conclude that the GDP growth rate has a large impact on NPL, as this coefficient was less than 0.05. From these results, we can conclude that the GDP growth rate has a negative impact on the NPL rate, and the first hypothesis is confirmed. This significant negative impact on the GDP growth rate has been found in many studies of different countries. Similar results were found by Ersoy (2022), concerning commercial banks in Turkey, Khan, Ahmad, Khan, and Ilyas (2018) regarding commercial banks in Pakistan, Klein (2013) regarding commercial banks in CESEE countries, and Jesus and Gabriel (2006) concerning Spanish banks. On the other hand, the debt-to-GDP ratio has a positive and significant impact on NPL. This result confirms the findings of previous authors (Ghosh, 2015; Louzis et al., 2012; Makri, Tsagkanos, & Bellas, 2014). This finding also allows us to confirm the second hypothesis.

For unemployment, the P-value was also less than 0.05, indicating that unemployment has a significant positive impact. Our findings confirm the research on the impact of unemployment on NPLs in Western Balkan and OECD countries conducted by Komonia, Grima, Ercan, and Mazreku (2022), who also concluded that unemployment has a strong positive correlation with NPLs in all statistical tests they performed, all of which produced results that were significant at the 1% level, demonstrating that NPLs rise as unemployment rises. Given that unemployment has a positive impact on the NPL rate, we can confirm the third hypothesis.

The above results also show that inflation has a negative impact on NPL. This negative impact is highly significant as the p-value is only 0.02. Similar results were obtained in Haxhihyseni’s (2016) thesis, which studied the impact of macroeconomic factors on NPL in Western Balkan countries. On the other hand, Komonia et al. (2022), in their study on the impact of unemployment on NPL in the Western Balkans and OECD countries, concluded that the effect of inflation on NPL was not significant in Western Balkan countries and only significant for OECD countries. Nevertheless, from the results shown in the table below, we can conclude that inflation has a negative impact, and we thus confirm the fourth hypothesis.

Another method to test the reliability of regression parameters is the confidence interval method, the results of which are shown in Table 9, where the intervals are presented with confidence coefficients of 90% and 95%. From the results in the table, it can be seen that with a confidence coefficient of 90%, NPL increases between 49.61% and 62.54% when the government debt-to-GDP ratio is increased by one percent, while with a confidence coefficient of 95%, there is an increase between 48.36% and 63.79%.

| Variables | Coefficient |

90% CI |

95% CI |

||

Low |

High |

Low |

High |

||

| PD_to_GDP | 56.079 |

49.617 |

62.542 |

48.363 |

63.797 |

| GDP_Gr | 1.871 |

1.315 |

2.428 |

1.208 |

2.536 |

| UnpR | 19.306 |

18.001 |

20.604 |

17.756 |

20.856 |

| INF | 2.627 |

2.194 |

3.060 |

2.109 |

3.144 |

5. Conclusion

This paper has identified several macroeconomic factors affecting non-performing loans in the Balkan banking system. In general, the results are comparable to those of other regions. In this study, we used an econometric model to identify the factors affecting the NPL rate in the Balkans. We discovered strong relationships between the NPL rate and various macroeconomic factors. Our results are generally consistent with the literature because, from a macroeconomic perspective, GDP growth, government debt-to-GDP ratio, unemployment rate, and inflation rate seem to be the four most important factors affecting the NPL rate, showing that the economic situation of Balkan countries affects the quality of the loan portfolio. In addition, non-performing loans in the Balkan countries may result from a lack of sound lending policies and bad credit judgment by management when approving loans.

Four hypotheses were proposed to analyze the research problem, i.e., the impact of macroeconomic indicators on the NPL rate. The ratio of public debt to GDP, GDP growth, unemployment, and the inflation rate were each tested statistically. The macroeconomic factors of GDP growth and inflation were negatively related to non-performing loans, while the government debt-to-GDP ratio and the unemployment rate were positively correlated.

Our research has certain policy implications. Since our study has shown that macroeconomic indicators affect NPLs and that NPLs can harm a country's economy, policymakers should adopt a protective stance to help banks deal with potentially defaulting loans. Apart from this, a country's government should work to stabilize the economy by reducing unemployment, increasing productivity, and providing interest rate subsidies to banks. Since macroeconomic indicators significantly impact NPLs, banks should keep a close eye on them to avoid an economic collapse caused by increased NPLs.

Like any research, our study has some limitations. The most important limitation is the time series of the data. If we could have extracted the data for each quarter, the impact calculation would have been more accurate.

Based on our results, we recommend that governments maintain a GDP growth trend, a decline in unemployment, and an optimal inflation rate through their economic, especially monetary and fiscal, policies in order to avoid an increase in NPLs, which would be unsustainable for commercial banks and lead to a collapse of the financial sector.

References

Akinlo, O., & Emmanuel, M. (2014). Determinants of non-performing loans in Nigeria. Accounting & Taxation, 6(2), 21-28.

Anjom, W., & Karim, A. M. (2016). Relationship between non-performing loans and macroeconomic factors with bank specific factors: A case study on loan portfolios–SAARC countries perspective. ELK Asia Pacific Journal of Finance and Risk Management, 7(2), 1-29.

Badar, M., Javid, A. Y., & Zulfiquar, S. (2013). Impact of macroeconomic forces on nonperforming loans: An empirical study of commercial banks in Pakistan. wseas Transactions on Business and Economics, 10(1), 40-48.

Basle Committee. (2016). Prudential treatment of problem assets–definitions of non-performing exposures and forbearance. Basel, Switzerland: Bank for International Settlements.

Beck, R., Jakubik, P., & Piloiu, A. (2015). Key determinants of non-performing loans: New evidence from a global sample. Open Economies Review, 26(3), 525-550.Available at: https://doi.org/10.1007/s11079-015-9358-8 .

Bofondi, M., & Ropele, T. (2011). Macroeconomic determinants of bad loans: Evidence from Italian banks. Bank of Italy Occasional Paper No. 89.

Clichici, D., & Colesnicova, T. (2014). The impact of macroeconomic factors on non-performing loans in the Republic of Moldova.

Cotugno, M., Stefanelli, V., & Torluccio, G. (2010). Bank intermediation models and portfolio default rates: What’s the relation? Paper presented at the At 23rd Australasian Finance and Banking Conference.

De Lis, F. S., Pagés, J. M., & Saurina, J. (2001). Credit growth, problem loans, and credit risk provisioning in Spain. BIS Papers, 1, 331-353.

Ersoy, E. (2022). The determinants of the non-performing loans: The case of Turkish banking sector. International Journal of Insurance and Finance, 1(2), 1-11.

Fiordelisi, F., Marques-Ibanez, D., & Molyneux, P. (2011). Efficiency and risk in European banking. Journal of Banking & Finance, 35(5), 1315-1326.Available at: https://doi.org/10.1016/j.jbankfin.2010.10.005 .

Ghosh, A. (2015). Banking-industry specific and regional economic determinants of non-performing loans: Evidence from US states. Journal of Financial Stability, 20, 93-104.Available at: https://doi.org/10.1016/j.jfs.2015.08.004 .

Haxhihyseni, A. (2016). Macroeconomic indicators affecting non-performing loans in Western Balkan Countries: A panel regression. Doctoral Dissertation, Epoka University.

IMF. (2005). The treatment of nonperforming loans. Paper presented at the Eighteenth Meeting of the IMF Committee on Balance of Payments Statistics.

Islamoğlu, M. (2015). The effect of macroeconomic variables on non-performing loan ratio of publicly traded banks in Turkey. Transactions on Business and Economics, 12, 10-20.

Jensen, D., & Ramirez, D. (2013). Revision: Variance inflation in regression. Advances in Decision Sciences, 1-15.Available at: https://doi.org/10.1155/2013/671204 .

Jesus, S., & Gabriel, J. (2006). Credit cycles, credit risk, and prudential regulation (pp. 65-98): Bank of Spain.

Khan, I., Ahmad, A., Khan, M. T., & Ilyas, M. (2018). The impact of GDP, inflation, exchange rate, unemployment and tax rate on the non performing loans of banks: Evidence from Pakistani commercial banks. Journal of Social Sciences and Humanities, 26(1), 141-164.

Kjosevski, J., Petkovski, M., & Naumovska, E. (2019). Bank-specific and macroeconomic determinants of non-performing loans in the Republic of Macedonia: Comparative analysis of enterprise and household NPLs. Economic Research, 32(1), 1185-1203.Available at: https://doi.org/10.1080/1331677x.2019.1627894 .

Klein, N. (2013). Non-performing loans in CESEE: Determinants and impact on macroeconomic performance. International Monetary Fund.WP/13/72.

Komonia, A. F., Grima, S., Ercan, Ö. Z., & Mazreku, I. (2022). A comparative analysis between Western Balkan countries and selected OECD countries (2010-2019) of the effect of unemployment on non-performing loans. Journal of Mehmet Akif Ersoy University Faculty of Economics and Administrative Sciences, 9(1), 656-678.

Louzis, D. P., Vouldis, A. T., & Metaxas, V. L. (2012). Macroeconomic and bank-specific determinants of non-performing loans in Greece: A comparative study of mortgage, business and consumer loan portfolios. Journal of Banking & Finance, 36(4), 1012-1027.Available at: https://doi.org/10.1016/j.jbankfin.2011.10.012 .

MacKinnon, J. G., Haug, A. A., & Michelis, L. (1999). Numerical distribution functions of likelihood ratio tests for cointegration. Journal of Applied Econometrics, 14(5), 563-577.

Makri, V., Tsagkanos, A., & Bellas, A. (2014). Determinants of non-performing loans: The case of Eurozone. Panoeconomicus, 61(2), 193-206.Available at: https://doi.org/10.2298/pan1402193m .

Mboka, T. M. (2013). Effects of macro-economic variables on nonperforming loans of commercial banks in Kenya. Doctoral Dissertation, University of Nairobi.

Murumba, I. (2013). The relationship between real GDP and non-performing loans: Evidence from Nigeria (1995–2009). International Journal of Capacity Building in Education and Management, 2(1), 1-7.

Nkusu, M. (2011). Nonperforming loans and macro-financial vulnerabilities in advanced economies. International Monetary Fund.WP/11/161.

Pradhan, P., Shyam, R., & Pandey, A. (2016). Bank specific and macroeconomic variables affecting non-performing loans of Nepalese commercial banks. Nepalese Journal of Finance, 3, 1-12.

Salaria, N. (2012). Meaning of the term descriptive survey research method. International Journal of Transformations in Business Management, 1(6), 1-7.

Sheefeni, J. P. S. (2015). The impact of macroeconomic determinants on non-performing loans in Namibia. International Review of Research in Emerging Markets and the Global Economy (IRREM), 1(4), 612-632.

Shingjergji, A. (2013). The impact of macroeconomic variables on the non performing loans in the Albanian Banking System During 2005-2012. Academic Journal of Interdisciplinary Studies, 2(9), 335.Available at: https://doi.org/10.5901/ajis.2013.v2n9p335 .

Vatansever, M., & Hepsen, A. (2013). Determining impacts on non-performing loan ratio in Turkey. Journal of Finance and Investment Analysis, 2(4), 119-129.