The Effect of COVID-19 on the Value Relevance of European Firms’ Financial Statements

Nicholas D. Belesis1

Christos G. Kampouris2*

Alkiviadis Th. Karagiorgos3

1Department of Business Administration, University of Piraeus, Piraeus, Greece |

AbstractThe main topic of this study was the value relevance of accounting information. It employed a sample of 1,645 companies listed on the stock exchanges of the top six European Economies (in terms of GDP) – France, Germany, Italy, the Netherlands, Spain and the United Kingdom – for the period 2010-2020. The study’s analysis was based on the Ohlson model and used linear regression. The paper examines the difference between these countries in terms of value relevance. In addition, the paper examines the effects that the Covid-19 pandemic outbreak had on the value relevance of financial statements. The purpose is to examine how investors have been affected by the pandemic and the influence it has had on the importance of financial statements and specific accounting variables. Furthermore, we compare the importance of the two most significant accounting variables, earnings and book value (equity) before and after the pandemic. The results suggest that the explanatory power of financial statements is almost the same for all countries, except Germany, where it is significantly higher. The explanatory power of financial statements decreased in all countries after the start of the pandemic. Moreover, in most countries, earnings seem to have lost value relevance compared with book value due to the financial crisis. |

Licensed: |

|

Keywords: |

|

Received: 8 July 2022 |

Funding: This study received no specific financial support. |

Competing Interests:The authors declare that they have no competing interests. |

1. Introduction

This paper compares the value relevance of companies’ financial statements in the top six European countries (as measured by Gross Domestic Product (GDP)) for the period 2010–2020. We also attempt to determine the impact of the Covid-19 outbreak on the value relevance of the financial statements of the companies in these countries. Our purpose is to examine a) how investors have been affected by the outbreak of the pandemic, and b) the influence of the pandemic on the importance of financial statements and specific accounting variables.

Several accounting research groups have explored the value relevance of accounting information to the subject matter of accounting (Ahmadi & Bouri, 2018; Ali & Hwang, 2000; Black & White, 2003; Glezakos, Mylonakis, & Kafouros, 2012; Oppong & Bruce-Amartey, 2022; Tsalavoutas, André, & Evans, 2012). According to empirical studies conducted in both developed and developing nations, accounting information is regarded as the most critical driver in measuring firm worth, and these variables are highly related to firm stock prices. To put it another way, these studies have shown that accounting data is useful.

The main purpose of a company's financial statements is to give prospective users, particularly external users, accurate and valuable information that they can use to make informed decisions about the company when investing and conducting business. Investors, creditors, clients, and other external users of financial reporting judge a company's financial status, future prospects, and value from the information in financial statements.

When the accounting information included in financial statements is useful and significant for users’ decisions, firms’ market value can be considered value relevant. In other words, using statistical terms, when financial information included in financial statements is a significant estimator of firms’ market value, this information is value relevant.

On the contrary, when the information in a company’s financial statements is irrelevant to its market value, the firm’s accounting information is not considered value-relevant accounting.

In order for the financial statement to be value relevant, it must fully disclose all facts relating to the firm's operations throughout the present and subsequent reporting periods. To achieve this, financial statements must be prepared according to a tight financial reporting framework such as the IFRS (International Financial Reporting Standards) or US GAAP (Generally Accepted Accounting Principles), without violating the standards of these frameworks. Previous research by Paglietti (2010); Anagnostopoulou and Tsekrekos (2017); Antonakakis, Gupta, and Tiwari (2017); Robinson, Glean, and Moore (2018) and Ahmadi, Garraoui, and Bouri (2018) has shown that accounting data is valuable when it can adequately represent a company's current state and is visible, intelligible, and available to all market participants.

In recent years, a large number of value relevance research studies, focusing on various countries, have been conducted to compare the value relevance of accounting information of domestic companies. These studies have revealed some discrepancies in the value relevance of accounting information provided by the companies. Arce and Mora (2002); Black and White (2003); Pervana and Bartulović (2014); Joliet and Muller (2016); Houcine (2017); Wang (2017) and Wang (2018) have all indicated that the value relevance is differentiated according to different institutional and legal frameworks.

Regarding the Covid-19 pandemic, the outbreak of the novel coronavirus (Covid-19) is undoubtedly the most significant event of the 21st century so far and has affected the entire world. The first case of the virus was recorded in the Chinese city of Wuhan in December 2019, after which it spread around the entire world. The World Health Organization (WHO) issued its first global alert about Covid-19 on 30th January 2020 and proclaimed Covid-19 a pandemic on 11th March 2020. Under the influence of this pandemic, the world economy, financial markets, employment and all economic sectors in every country have been severely impacted. Like the 2007–2009 global financial crisis, the key question for stockholders and stakeholders is the impact that the Covid-19 pandemic will have on companies’ profitability, financial position and market value.

To examine the relative value relevance to companies’ earnings per share and book value, this paper employs a panel regression model with stock market value as the dependent variable, and earnings and book value as the independent variables. The methodology for evaluating the value relevance of earnings per share and book value is based on partial and simultaneous regression analysis.

2. Literature Review

Many papers have been written about the value relevance of accounting information. According to Barth, Beaver, and Landsman (2001) value relevance research provides useful information to standard setters for two primary reasons derived from the FASB’s (Financial Accounting Standards Board 2010) conceptual framework. First, the basic purpose of financial statements is to provide information to users (capital providers, equity investors) upon which they can base their investment decisions, and share prices reflect those decisions. Second, value relevance tests are joint tests of items’ relevance and their faithful representation, which are the two fundamental qualitative characteristics of useful and reliable financial information.

Collins, Maydew, and Weiss (1997) focused on US firms and concluded that the explanatory power of book value and earnings, as expressed by value relevance, had marginally increased over time. Specifically, the researchers found that the value relevance of earnings had decreased, but the value relevance of book value increased to a larger degree. Also, Francis and Schipper (1999) came to the same conclusions on the value relevance of earnings and book value, using a different methodology.

However, other researchers arrived at different conclusions on the joint value relevance of earnings and book value. According to the findings of Lev and Zarowin (1999), there was a decline in combined value relevance from the late 1970s to the early 2000s. The researchers believed that this decrease occurred because the business world underwent numerous substantial changes, but accounting did not keep up with these changes. Similarly, Lev and Gu (2016) claimed that from 1950 to 2013, there was a fall in the value significance of earnings, equity book value, and a separate set of four categories: assets, revenue, COGS (cost of goods sold), and SGA (selling, general and administrative expenses). They declared the "end of accounting". However, if additional accounting factors that the literature regards as value relevant are considered, the results of this research may change (Barth et al., 2001; Holthausen & Watts, 2001).

Amir and Lev (1996) concluded that financial statements are of limited interest to investors in high-tech and service companies because the value of these businesses, which depends on expectations of future development and profits, is substantially connected to intangible fixed assets. For investors to be interested in these businesses, these assets are important. In financial statements, the assets are usually not included in the most appropriate way, which gives investors inaccurate information. Therefore, it negatively affects the value relevance of the financial statements.

Basu (1997) found that firms act conservatively and are more willing to report losses in their financial statements than gains. As a result, gains have a greater impact on stock values than losses. He argues that earnings will have weak value relevance if the link between stock prices and losses is not studied independently of the correlation between stock prices and gains. In their study of US companies from 1989 to 1997, Agnes and Yang (2003) concluded that markets place greater faith in averages than in extreme estimates of profitability and cash flows. The researchers also discovered that only typical earnings and cash flows had a significant incremental value relevance over the others.

Ng, Gul, and Mensah (2007) investigated how the implementation of the Sarbanes-Oxley (SOX) Act of 2002 and corporate managerial entrenchment traits affected the value relevance of earnings. The researchers discovered that anti-managerial entrenchment strategies only have a positive influence on the value relevance of earnings during the Enron scandal (SCA) period, which they used as a gauge of strong corporate governance. Additionally, the favorable effect only applies to businesses that manage their revenues by reducing their income in the previous year. The researchers concluded that, from the perspective of investors, there could be a substitution effect between severe regulatory environments and effective firm-specific corporate governance processes.

Other researchers have found that when a corporation experiences losses or is in financial trouble, the value relevance of book value increases compared to that of earnings (Barth, Beaver, & Landsman, 1996; Collins, Pincus, & Xie, 1999; Jan & Ou, 1995). This result supports the hypothesis that investors prioritize the abandonment value over all other factors when a company is struggling financially.

Finally, numerous academics have contrasted the importance of accounting information in various nations. Many studies have focused on the relative value relevance of accounting information in a large group of countries (for example, see Rodríguez, Alejandro, Sáenz, and Sánchez (2017) regarding Latin America or Devalle, Onali, and Magarini (2010) and André, Dionysiou, and Tsalavoutas (2018) regarding Europe), with comparability problems that are due to the differences in local accounting standards. For instance, King and Langli (1998) studied compared Germany, Norway, and the United Kingdom and found that earnings and book value are more important to value in Germany and less important in the United Kingdom. Also, Indrayono (2019), studying the value relevance of accounting information in some European countries for the period 2013–2015, concluded that accounting information is value relevant and that book value and earnings partially and simultaneously affect firms' stock prices. Other studies, with a more limited scope, have investigated single countries (e.g., Cormier and Magnan (2016) regarding France, Bartov, Goldberg, and Kim (2005) regarding Germany, Chalmers, Clinch, and Godfrey (2011) regarding Australia, Tsalavoutas et al. (2012) regarding Greece, Callao, Jarne, and Laínez (2007) regarding Spain).

3. Data and Methodology

Our sample comprises the listed companies of the six European countries with the highest GDP in 2020 as per Worldbank.1 These are France, Germany, Italy, the Netherlands, Spain and the United Kingdom. We collected data for these businesses from the Thomson Reuters DataStream for the period 2010–2020. Basic information on the accounting variables we examined is provided in Table 1 and Table 2. Table 1 displays each country’s correlation coefficients for the variables share price, book value and operating income (e.g., for France the correlation coefficient between book value and share price is 0.572).

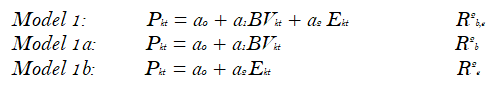

The Ohlson (1995) model served as the basis for the model we utilized in our study. This model states that a firm's value can be described as a function of earnings (E) and book value (BV) as follows:

P kt = a0 + a1 BVkt + a2 Ekt

where for each firm k:

Pkt: Share price as of 31/3/t.

BVkt: Book value per share as of 31/12/t.

Ekt: Earnings per share for period t.

We compared the value relevance of companies’ financial statements in the aforementioned countries for the years 2010 through 2020 using this approach.

Also, to examine how the value relevance of financial statements changed due to the pandemic, we focused on two sub-periods of our sample: a) 2019, before the start of the pandemic, and b) 2020, after the start of the pandemic.

We compared the value relevance of financial statements across periods using the model mentioned above. Additionally, for each country and each of the time periods (2010–2020, 2019 and 2020), we assessed how earnings and book value each affected share prices to determine which variable was more related to value.

For each country, after minorizing the data at the 1% level, we ran the following regressions for each period:

To calculate the incremental explanatory power of each variable, we used the following formulas (differences in coefficients of determinations - R²), as suggested by Theil (1971):

- The incremental explanatory power of Book Value (R2b/e) is equal to the total explanatory power of book value and earnings (R2b,e) minus the explanatory power of earnings (R2e), as follows:

R2b/e = R2b,e - R2e

- The incremental explanatory power of Earnings (R2e/b) is equal to the overall explanatory power of book value and earnings (R2b,e) minus the explanatory power of book value (R2b), as follows:

R2e/b = R2b,e - R2b

- The incremental explanatory power Common to Book Value and Earnings (R2 com) is equal to the overall explanatory power of book value and earnings (R2b,e) minus the incremental explanatory power of book value (R2b/e) minus the incremental explanatory power of earnings (R2e/b), as follows: R2 com = R2b,e - R2b/e - R2e/b

In the next section, we report the results of the computation of the above variables to see whether the incremental explanatory power of book value and earnings differs significantly. Table 2 presents the findings concerning the descriptive statistics of the variables (price, book value and earnings).

| a. Correlation matrix France. | |||

| Correlation | Share Price |

Book Value |

Operating Income |

| Share Price | 1.000 |

||

| Book Value | 0.572 |

1.000 |

|

| Operating Income | 0.601 |

0.723 |

1.000 |

b. Correlation matrix Germany. |

| Correlation | Share Price |

Book Value |

Operating Income |

| Share Price | 1.000 |

||

| Book Value | 0.735 |

1.000 |

|

| Operating Income | 0.771 |

0.751 |

1.000 |

c. Correlation matrix Italy. |

| Correlation | Share Price |

Book Value |

Operating Income |

| Share Price | 1.000 |

||

| Book Value | 0.481 |

1.000 |

|

| Operating Income | 0.552 |

0.458 |

1.000 |

d. Correlation matrix Netherlands. |

| Correlation | Share Price |

Book Value |

Operating Income |

| Share Price | 1.000 |

||

| Book Value | 0.566 |

1.000 |

|

| Operating Income | 0.548 |

0.453 |

1.000 |

e. Correlation matrix Spain. |

| Correlation | Share Price |

Book Value |

Operating Income |

| Share Price | 1.000 |

||

| Book Value | 0.097 |

1.000 |

|

| Operating Income | 0.579 |

0.240 |

1.000 |

f. Correlation matrix UK. |

| Correlation | Share Price |

Book Value |

Operating Income |

| Share Price | 1.000 |

||

| Book Value | 0.416 |

1.000 |

|

| Operating Income | 0.558 |

0.544 |

1.000 |

| France | Germany | Italy | ||||||||||

| Statistics | P |

BV |

E |

Statistics |

P |

BV |

E |

Statistics |

P |

BV |

E |

|

| Mean | 60.61 |

21.62 |

4.09 |

Mean |

54.78 |

24.12 |

3.79 |

Mean |

8.57 |

1.50 |

0.38 |

|

| Median | 17.19 |

2.89 |

0.68 |

Median |

17.55 |

4.30 |

0.76 |

Median |

3.67 |

0.50 |

0.16 |

|

| Maximum | 1,183.90 |

532.00 |

98.02 |

Maximum |

882.52 |

722.11 |

93.98 |

Maximum |

73.13 |

26.33 |

4.26 |

|

| Minimum | 0.00 |

-52.98 |

-9.08 |

Minimum |

0.01 |

-43.35 |

-6.80 |

Minimum |

0.01 |

-9.03 |

-2.05 |

|

| Std. Dev. | 154.51 |

75.14 |

13.44 |

Std. Dev. |

128.74 |

95.01 |

12.47 |

Std. Dev. |

12.78 |

4.87 |

0.95 |

|

| Skewness | 5.51 |

5.21 |

5.40 |

Skewness |

4.79 |

6.31 |

5.73 |

Skewness |

3.03 |

2.50 |

1.45 |

|

| Kurtosis | 36.54 |

32.45 |

35.21 |

Kurtosis |

27.76 |

44.44 |

38.98 |

Kurtosis |

13.61 |

13.30 |

7.90 |

|

| Observations | 3,390 |

3,390 |

3390 |

Observations |

2,970 |

2,970 |

2,970 |

Observations |

1,639 |

1,639 |

1,639 |

|

| Netherlands | Spain |

UK |

||||||||||

| Statistics | P |

BV |

E |

Statistics |

P |

BV |

E |

Statistics |

P |

BV |

E |

|

| Mean | 29.65 |

6.80 |

1.37 |

Mean |

12.84 |

2.28 |

0.71 |

Mean |

698.37 |

1.41 |

0.25 |

|

| Median | 17.75 |

4.31 |

0.50 |

Median |

6.28 |

0.49 |

0.16 |

Median |

151.65 |

0.28 |

0.00 |

|

| Maximum | 172.28 |

43.64 |

12.97 |

Maximum |

85.91 |

115.08 |

9.89 |

Maximum |

9,730.50 |

20.77 |

4.09 |

|

| Minimum | 0.03 |

-21.99 |

-6.57 |

Minimum |

0.00 |

-56.68 |

-3.72 |

Minimum |

0.10 |

-5.41 |

-1.35 |

|

| Std. Dev. | 35.29 |

11.80 |

3.07 |

Std. Dev. |

17.67 |

18.07 |

1.88 |

Std. Dev. |

1,544.11 |

3.60 |

0.78 |

|

| Skewness | 2.01 |

0.98 |

1.24 |

Skewness |

2.48 |

3.32 |

2.22 |

Skewness |

3.99 |

3.36 |

2.85 |

|

| Kurtosis | 7.39 |

4.57 |

6.63 |

Kurtosis |

9.35 |

24.97 |

11.51 |

Kurtosis |

20.68 |

16.53 |

12.93 |

|

| Observations | 751 |

751 |

751 |

Observations |

1,184 |

1,184 |

1,184 |

Observations |

3,514 |

3,514 |

3,514 |

|

| Value Relevance Results (Adj R^2) | |||||||||||||||||||

| 2011-2020 | |||||||||||||||||||

| Country | Explanatory Power |

Incremental Explanatory Power (IEP) |

|||||||||||||||||

EP Common |

EP of BV |

EP of E |

IEP of BV |

IEP of E |

IEP Common |

||||||||||||||

R²b,e |

R²b |

R² e |

R²b/e = R²b,e - R²e |

R²e/b = R²b,e - R²b |

R²com = R²b,e - R²b/e - R²e/b |

||||||||||||||

| FRANCE | 0.400 |

0.326 |

0.353 |

0.047 |

0.074 |

0.279 |

|||||||||||||

| GERMANY | 0.651 |

0.540 |

0.595 |

0.056 |

0.111 |

0.485 |

|||||||||||||

| ITALY | 0.371 |

0.231 |

0.306 |

0.065 |

0.140 |

0.166 |

|||||||||||||

| NETHERLANDS | 0.454 |

0.337 |

0.321 |

0.133 |

0.117 |

0.204 |

|||||||||||||

| SPAIN | 0.336 |

0.009 |

0.335 |

0.001 |

0.328 |

0.007 |

|||||||||||||

| UK | 0.329 |

0.173 |

0.311 |

0.018 |

0.156 |

0.155 |

|||||||||||||

| Value Relevance Results (Adj R^2) | |||||||||||||||||||

| 2019 | |||||||||||||||||||

| Country | Explanatory Power |

Incremental Explanatory Power (IEP) |

|||||||||||||||||

EP Common |

EP of BV |

EP of E |

IEP of BV |

IEP of E |

IEP Common |

||||||||||||||

R²b,e |

R²b |

R²e |

R²b/e = R²b,e - R²e |

R²e/b = R²b,e - R²b |

R²com = R²b,e - R²b/e - R²e/b |

||||||||||||||

| FRANCE | 0.596 |

0.382 |

0.596 |

0.001 |

0.214 |

0.382 |

|||||||||||||

| GERMANY | 0.606 |

0.478 |

0.565 |

0.042 |

0.129 |

0.436 |

|||||||||||||

| ITALY | 0.585 |

0.207 |

0.562 |

0.023 |

0.378 |

0.183 |

|||||||||||||

| NETHERLANDS | 0.512 |

0.406 |

0.329 |

0.183 |

0.107 |

0.223 |

|||||||||||||

| SPAIN | 0.542 |

0.004 |

0.538 |

0.004 |

0.538 |

-0.001 |

|||||||||||||

| UK | 0.501 |

0.239 |

0.497 |

0.004 |

0.262 |

0.234 |

|||||||||||||

| Value Relevance Results (Adj R^2) | |||||||||||||||||||

| 2020 | |||||||||||||||||||

| Country | Explanatory Power |

Incremental Explanatory Power (IEP) |

|||||||||||||||||

EP Common |

EP of BV |

EP of E |

IEP of BV |

IEP of E |

IEP Common |

||||||||||||||

R²b,e |

R²b |

R²e |

R²b/e = R²b,e - R²e |

R²e/b = R²b,e - R²b |

R²com = R²b,e - R²b/e - R²e/b |

||||||||||||||

| FRANCE | 0.606 |

0.449 |

0.521 |

0.084 |

0.157 |

0.365 |

|||||||||||||

| GERMANY | 0.529 |

0.479 |

0.393 |

0.136 |

0.050 |

0.343 |

|||||||||||||

| ITALY | 0.351 |

0.156 |

0.282 |

0.069 |

0.195 |

0.088 |

|||||||||||||

| NETHERLANDS | 0.430 |

0.387 |

0.206 |

0.224 |

0.043 |

0.163 |

|||||||||||||

| SPAIN | 0.268 |

0.031 |

0.270 |

-0.002 |

0.237 |

0.033 |

|||||||||||||

| UK | 0.433 |

0.274 |

0.381 |

0.051 |

0.159 |

0.223 |

|||||||||||||

| Value Relevance Change 2020 VS 2019 | |||||||||||||||||||

| Differences (Adj R^2 OF 2020) - (Adj R^2 OF 2019) | |||||||||||||||||||

| Country | Explanatory Power |

Incremental Explanatory Power (IEP) |

|||||||||||||||||

EP Common |

EP of BV |

EP of E |

IEP of BV |

IEP of E |

IEP Common |

||||||||||||||

R²b,e |

R²b |

R²e |

R²b/e = R²b,e - R²e |

R²e/b = R²b,e - R²b |

R²com = R²b,e - R²b/e - R²e/b |

||||||||||||||

| FRANCE | 0.001 |

0.067 |

-0.074 |

0.083 |

-0.057 |

-0.017 |

|||||||||||||

| GERMANY | -0.077 |

0.002 |

-0.172 |

0.095 |

-0.079 |

-0.093 |

|||||||||||||

| ITALY | -0.234 |

-0.050 |

-0.280 |

0.046 |

-0.184 |

-0.096 |

|||||||||||||

| NETHERLANDS | -0.082 |

-0.019 |

-0.123 |

0.041 |

-0.064 |

-0.060 |

|||||||||||||

| SPAIN | -0.275 |

0.027 |

-0.268 |

-0.007 |

-0.302 |

0.034 |

|||||||||||||

| UK | -0.069 |

0.035 |

-0.116 |

0.047 |

-0.104 |

-0.012 |

|||||||||||||

Note: R²b,e (overall explanatory power of book value and earnings), R²b (explanatory power of book value), R²e (explanatory power of earnings), R²b/e (incremental explanatory power of book value) = R²b,e-R²e, R²e/b (incremental explanatory power of earnings) = R²b,e-R²b, R2 com (incremental explanatory power common to book value and earnings) = R2b,e - R2b/e - R2e/b. |

4. Results

This section presents the results from our models' regression analyses. Table 3 displays the findings concerning the explanatory power of our models, as well as the incremental explanatory power of book value and earnings.

Regarding the entire 2011–2020 period, we observe that the explanatory power of financial statements, as expressed by the Adj R2, was almost the same for all countries, as the Adj R²’ values are in a narrow range of 32% to 40%, except for Germany where Adj R2 is 65%, significantly greater than all the other counties’ Adj R2 values. Financial statements in Germany seem to be more value relevant and thus more useful to their users. A possible explanation for this may be that the German economy is in a better position than those of other countries. Because of this, German firms may be in better financial positions and therefore make fewer efforts to manipulate their financial statements than firms in weaker economies. Furthermore, there is a general climate of trust in Germany, so the users of financial statements find them more reliable.

Regarding the explanatory power of earnings and book value, we see that for all countries except the Netherlands – where the value relevance of book value and earnings are almost identical – earnings appear to have a higher value relevance than book value. Also, their contribution to the total value relevance of financial statements is greater than the contribution of book value. In all countries, the users of financial statements seem to rely more on earnings than on book value for their investment decisions. This is in contrast to previous studies, where book value was more value relevant than earnings. A possible explanation may be that investors in European markets are focused on short-term investments and feel insecure regarding the future. They prefer earnings, which usually lead to dividends, to higher book value.

From the comparison of the results in 2019 and 2020, we observe that the explanatory power of financial statements in all countries, as expressed by the Adj R2, decreased after the outbreak of the pandemic. The only exception is France, where there was no change. This result indicates that the epidemic decreased the value relevance of financial statements. It is possible that the users of financial statements, after the pandemic lockdowns and the global economic downturn, became more concerned about companies’ financial position and future prospects. Because of that, they gather information beyond financial statements to inform their investment decisions, meaning that in the total mixture of information, the financial statements lose significance in favor of other, non-accounting information.

Focusing on the separate accounting variables, we observe that in all countries, earnings affected the market value of firms less after the outbreak of the pandemic than before. In other words, the pandemic caused earnings to lose value relevance. In contrast, book value seems to have slightly gained value relevance, except in Italy and the Netherlands, where it lost value relevance. However, this was not enough to reverse the value relevance decrease of earnings. We also see that the incremental explanatory power of book value increased after the outbreak. Possibly, the more concerned investors turned to book value over earnings as it is less susceptible to manipulation.

5. Conclusions

The above results show that the explanatory power of our models decreased after the outbreak of the pandemic. This indicates that the impact of the pandemic reduced the value relevance of financial statements. It seems that financial statements affect market prices less than before the pandemic, meaning that investors trust statements less and rely less on accounting information when making investment decisions.

We also observe that the crisis caused book value to gain value relevance and earnings to lose value relevance, as the incremental explanatory power of the book value increased, and the incremental explanatory power of earnings decreased. It seems that after the outbreak of the pandemic, investor anxiety about the financial position of firms increased, and they turned to the accounting variable book value to inform their decisions, as it is less susceptible to manipulation than earnings and a better indicator of future prospects.References

Agnes, C. C., & Yang, S. S. (2003). The incremental information content of earnings and cash flows from operations affected by their extremity. Journal of Business Finance & Accounting, 30(1-2), 73-116.Available at: https://doi.org/10.1111/1468-5957.00484. <

Ahmadi, A., & Bouri, A. (2018). The accounting value relevance of earnings and book value: Tunisian banks and financial institutions. International Journal of Law and Management, 60(2), 342-354.Available at: https://doi.org/10.1108/ijlma-11-2016-0131.

Ahmadi, A., Garraoui, M., & Bouri, B. (2018). The value relevance of book value, earnings per share and cash flow: Evidence of Tunisian banks and financial institutions. International Academic Journal of Accounting and Financial Management, 5(1), 47-56.Available at: https://doi.org/10.9756/iajafm/v5i1/1810006.

Ali, A., & Hwang, L.-S. (2000). Country-specific factors related to financial reporting and the value relevance of accounting data. Journal of Accounting Research, 38(1), 1-21.Available at: https://doi.org/10.2307/2672920.

Amir, E., & Lev, B. (1996). Value-relevance of nonfinancial information: The wireless communications industry. Journal of Accounting and Economics, 22(1-3), 3-30.Available at: https://doi.org/10.1016/s0165-4101(96)00430-2.

Anagnostopoulou, S. C., & Tsekrekos, A. E. (2017). Accounting quality, information risk and the term structure of implied volatility around earnings announcements. Research in International Business and Finance, 41, 445-460.Available at: https://doi.org/10.1016/j.ribaf.2017.04.046.

André, P., Dionysiou, D., & Tsalavoutas, I. (2018). Mandated disclosures under IAS 36 impairment of assets and IAS 38 intangible assets: Value relevance and impact on analysts’ forecasts. Applied Economics, 50(7), 707-725.Available at: https://doi.org/10.1080/00036846.2017.1340570.

Antonakakis, N., Gupta, R., & Tiwari, A. K. (2017). Has the correlation of inflation and stock prices changed in the United States over the last two centuries? Research in International Business and Finance, 42, 1-8.Available at: https://doi.org/10.1016/j.ribaf.2017.04.005.

Arce, M., & Mora, A. (2002). Empirical evidence of the effect of European accounting differences on the stock market valuation of earnings and book value. European Accounting Review, 11(3), 573-599.Available at: https://doi.org/10.1080/09638180220125616.

Barth, M. E., Beaver, W. H., & Landsman, W. R. (2001). The relevance of the value relevance literature for financial accounting standard setting: Another view. Journal of Accounting and Economics, 31(1-3), 77-104.Available at: https://doi.org/10.1016/s0165-4101(01)00019-2.

Barth, M., Beaver, W., & Landsman, W. (1996). Valuation characteristics of equity book value and net income: Tests of the abandonment option hypothesis. Research Paper. Stanford Univertsity. Graduate School of Business. No 1404.

Bartov, E., Goldberg, S. R., & Kim, M. (2005). Comparative value relevance among German, US, and international accounting standards: A German stock market perspective. Journal of Accounting, Auditing & Finance, 20(2), 95-119.Available at: https://doi.org/10.1177/0148558x0502000201.

Basu, S. (1997). The conservatism principle and the asymmetric timeliness of earnings1. Journal of Accounting and Economics, 24(1), 3-37.Available at: https://doi.org/10.1016/s0165-4101(97)00014-1.

Black, E. L., & White, J. J. (2003). An international comparison of income statement and balance sheet information: Germany, Japan and the US. European Accounting Review, 12(1), 29-46.Available at: https://doi.org/10.1080/0963818022000001127.

Callao, S., Jarne, J. I., & Laínez, J. A. (2007). Adoption of IFRS in Spain: Effect on the comparability and relevance of financial reporting. Journal of International Accounting, Auditing and Taxation, 16(2), 148-178.Available at: https://doi.org/10.1016/j.intaccaudtax.2007.06.002.

Chalmers, K., Clinch, G., & Godfrey, J. M. (2011). Changes in value relevance of accounting information upon IFRS adoption: Evidence from Australia. Australian Journal of Management, 36(2), 151-173.Available at: https://doi.org/10.1177/0312896211404571.

Collins, D. W., Maydew, E. L., & Weiss, I. S. (1997). Changes in the value-relevance of earnings and book values over the past forty years. Journal of Accounting and Economics, 24(1), 39-67.Available at: https://doi.org/10.1016/s0165-4101(97)00015-3.

Collins, D. W., Pincus, M., & Xie, H. (1999). Equity valuation and negative earnings: The role of book value of equity. The Accounting Review, 74(1), 29-61.Available at: https://doi.org/10.2308/accr.1999.74.1.29.

Cormier, D., & Magnan, M. L. (2016). The advent of IFRS in Canada: Incidence on value relevance. Journal of International Accounting Research, 15(3), 113-130.Available at: https://doi.org/10.2308/jiar-51404.

Devalle, A., Onali, E., & Magarini, R. (2010). Assessing the value relevance of accounting data after the introduction of IFRS in Europe. Journal of International Financial Management & Accounting, 21(2), 85-119.Available at: https://doi.org/10.1111/j.1467-646x.2010.01037.x.

Francis, J., & Schipper, K. (1999). Have financial statements lost their relevance? Journal of Accounting Research, 37(2), 319-352.Available at: https://doi.org/10.2307/2491412.

Glezakos, M., Mylonakis, J., & Kafouros, C. (2012). The impact of accounting information on stock prices: Evidence from the Athens stock exchange. International Journal of Economics and Finance, 4(2), 56-68.Available at: https://doi.org/10.5539/ijef.v4n2p56.

Holthausen, R. W., & Watts, R. L. (2001). The relevance of the value-relevance literature for financial accounting standard setting. Journal of Accounting and Economics, 31(1-3), 3-75.Available at: https://doi.org/10.1016/s0165-4101(01)00029-5.

Houcine, A. (2017). The effect of financial reporting quality on corporate investment efficiency: Evidence from the Tunisian stock market. Research in International Business and Finance, 42, 321-337.Available at: https://doi.org/10.1016/j.ribaf.2017.07.066.

Indrayono, Y. (2019). Value relevance of accounting information: An empirical investigation in certain European stock exchanges. International Journal of Economics and Finance, 11(9), 75-80.Available at: https://doi.org/10.5539/ijef.v11n9p75.

Jan, C., & Ou, J. (1995). The role of negative earnings in the evaluation of equity stocks. Working paper. New York: New York University.

Joliet, R., & Muller, A. (2016). Are foreign earnings disclosures value-relevant?: Disaggregation solves the puzzle. Research in International Business and Finance, 37, 170-183.Available at: https://doi.org/10.1016/j.ribaf.2015.09.009.

King, R. D., & Langli, J. C. (1998). Accounting diversity and firm valuation. The International Journal of Accounting, 33(5), 529-567.Available at: https://doi.org/10.1016/s0020-7063(98)90012-7.

Lev, B., & Zarowin, P. (1999). The boundaries of financial reporting and how to extend them. Journal of Accounting Research, 37(2), 353-385.Available at: https://doi.org/10.2307/2491413.

Lev, B., & Gu, F. (2016). The end of accounting and the path forward for investors and managers. Hoboken, NJ, USA: John Wiley & Sons, Inc.

Ng, A. C., Gul, F. A., & Mensah, Y. M. (2007). Managerial entrenchment and value-relevance of earnings during the pre-and post-Sarbanes Oxley periods. Available at SSRN 1012746.Available at: https://doi.org/10.2139/ssrn.1012746.

Ohlson, J. A. (1995). Earnings, book values, and dividends in equity valuation. Contemporary Accounting Research, 11(2), 661-687.Available at: https://doi.org/10.1111/j.1911-3846.1995.tb00461.x.

Oppong, C., & Bruce-Amartey, A. (2022). International financial reporting standards, board governance and accounting quality: Preliminary Ghanaian evidence. Journal of Accounting, Business and Finance Research, 15(2), 27–40.Available at: https://doi.org/10.55217/102.v15i2.528.

Paglietti, P. (2010). Earnings management, timely loss recognition and value relevance in Europe following the IFRS mandatory adoption: Evidence from Italian listed companies. Online Business Administration, 1(4), 97-117.

Pervana, I., & Bartulović, M. (2014). Value relevance of accounting information: Evidence from South Eastern European countries. Economic Research, 27(1), 181-190.Available at: https://doi.org/10.1080/1331677x.2014.947132.

Robinson, J., Glean, A., & Moore, W. (2018). How does news impact on the stock prices of green firms in emerging markets? Research in International Business and Finance, 45, 446-453.Available at: https://doi.org/10.1016/j.ribaf.2017.07.176.

Rodríguez, G. M. D. P., Alejandro, K. A. C., Sáenz, A. B. M., & Sánchez, H. H. G. (2017). Does an IFRS adoption increase value relevance and earnings timeliness in Latin America? Emerging Markets Review, 30, 155-168.Available at: https://doi.org/10.1016/j.ememar.2016.11.001.

Theil, H. (1971). Principles of econometrics. New York: Wiley.

Tsalavoutas, I., André, P., & Evans, L. (2012). The transition to IFRS and the value relevance of financial statements in Greece. The British Accounting Review, 44(4), 262-277.Available at: https://doi.org/10.1016/j.bar.2012.09.004.

Wang, L.-H. (2017). Accounting quality and information asymmetry of foreign direct investment firms. Research in International Business and Finance, 42, 950-958.Available at: https://doi.org/10.1016/j.ribaf.2017.07.125.

Wang, B. (2018). Ownership, institutions and firm value: Cross-provincial evidence from China. Research in International Business and Finance, 44, 547-565.Available at: https://doi.org/10.1016/j.ribaf.2017.07.125.