The Effect of Omni-channel Value Perception and Customer Engagement on Customer Commitment, Mediated by Customer Trust

Yohanes Ferry Cahaya1*

Tirta Nugraha Mursitama2

Mohammad Hamsal3

Viany Utami Tjhin4

1,2,3,4Management Department, BINUS Business School Doctor of Research in Management, Bina Nusantara University, Jakarta, Indonesia. |

AbstractThis research aimed to analyse and reveal the influence of omni-channel perceived value and consumer engagement on customer trust and the implications thereof on customer commitment at BUKU IV banks in Jabodetabek, which are commercial banks based on business activities. The research employed a quantitative descriptive approach and a causal technique to a sample of 245 respondents. Structural equation modelling using the Lisrel Program was utilized as the method of data analysis. According to the research results, the omni-channel perceived value and basic consumer engagement partially or cooperatively impacted customer trust at BUKU IV banks in Jabodetabek with a coefficient of determination (R2) of 82%. Likewise, omni-channel perceived value, consumer engagement and customer trust partially and jointly affected customer commitment at BUKU IV banks in Jabodetabek, in a way that was both positive and significant, with a coefficient of determination (R2) of 95%. This research thus proved that to increase customer commitment, it is necessary to increase omni-channel perceived value, consumer engagement and customer trust. |

Licensed: |

|

Keywords: |

|

Received: 12 July 2022 |

Funding: This study received no specific financial support. |

Competing Interests:The authors declare that they have no competing interests. |

1. Introduction

The Indonesian banking industry is developing rapidly, particularly since the Pakto 88 (October 1988 Package), a banking liberalization policy that eased the requirements for establishing a bank, making it easier for anyone to set up a bank and become a banker. One of the fundamental provisions in Pakto 88 stipulated that the establishment of a national private bank would be made easier by only requiring a paid-up capital of 10 billion rupiahs, the only necessity to establish a commercial bank. Indeed, it allowed a bank to be established with a paid-up capital of 1 billion rupiahs, and the establishment of a people’s credit bank required only a minimum paid-up capital of 50 million rupiahs. Pakto 88 was thus a banking liberalization policy that eliminated regulations that make it difficult to establish a bank and represents the most liberal regulation in the history of Indonesian banking.

The main goal of a company is to gain maximum profits; this also applies to the Indonesian banking industry. Banks compete with each other to reach as many customers as possible so this maximum profit can be achieved while still focusing on the main interests of banking activities. The decreasing number of banks and bank offices in Indonesia will have a huge impact on banks’ ability to gain customers. On the other hand, however, financial technology institutions, or fintech, are on the rise and have grown since 2016 to a total of 170 in 2021. In recent years, the rapid growth of fintech has captivated the attention of all areas of society (Sheng, 2021).

According to the Core Capital and based on the Regulation of Financial Services Authority of the Republic of Indonesia Number 12/POJK.03/2021, Indonesian banks are divided into 4 (four) BUKUs. The category BUKU IV, in turn, comprises 4 commercial banks, namely Bank Mandiri, Bank Rakyat Indonesia, Bank Central Asia, and Bank Negara Indonesia. The banking service companies listed in the BUKU IV category are currently faced with very sharp competition and a rapidly changing business environment; therefore, they must take special measures to retain customer loyalty. Customer loyalty is the main driving factor of banks’ marketing activities (Akoto, Nkrumah, Benjamin, & Adjei, 2019; Marshal, 2017; Prasetyo & Ariawan, 2021; Watson, Beck, Henderson, & Palmatier, 2015; Wiharso, Prasetyo, Prakoso, & Fabrianto, 2022), making it a necessary focus for them to survive the current business competition. Customer loyalty is reflected in the continued increase in third-party funds deposited in banks.

The Indonesian banking industry has adopted various strategies to retain customers. One method banks can pursue is increasing customer commitment. Customers with a high level of sustainable commitment will continue to be customers because their financial transaction needs can be met. Commitment also involves customers’ long-term relationships (Parihar & Dawra, 2020). Customer commitment is an individual’s desire to maintain a valuable connection (Lee, Jeong, & Choi, 2014). High customer commitment to the bank is expected to keep customers loyal, with hopes those customers will recommend their experience with the bank to their families or others.

In this study, customer commitment may be affected by customer trust. When customer trust is created, the customer will tend to continue to buy the products offered, even though there are many similar products on the market that offer lower prices and greater benefits. In fact, trust in the brand makes the product a “part” of the customer’s identity that is connected to their memory. When this phase is reached, the customer will tend to buy any product issued by the brand, even at an irrational price, and will also tend to buy products that they do not really need.

Customer trust and customer commitment may also be affected by omni-channel perceived value, customer engagement and interaction quality. Omni-channel marketing is defined as a coherent and coordinated strategy, especially for interacting with customers and potential customers, on how to give customers the best service through the right channels, at the right moment, and under the right conditions (Sugesti, Kusniawati, & Prabowo, 2019). All banks’ offline and online services should be integrated to provide the best service to customers. Thus, customers no longer need to worry about customer banking services, even though they do not visit the bank directly.

In addition to omni-channel perceived value, consumer engagement is also thought to have an impact on customer trust and commitment, given the emergence of various global service activities involving the concept of consumer engagement as a key success factor for companies (Kumar, Rajan, Gupta, & Pozza, 2019; Vivek, Beatty, & Morgan, 2012). Customer engagement leads to a level of contribution and relations in which information is shared through interactions between companies and their customers, such that a deep bond is created that leads to customer loyalty. Customers, or those who are engaged with and have an emotional attachment to the bank of their choice, feel satisfied and proud to be called a customer of that bank. Thus, it is important that banks in category BUKU IV adopt this method to create trust and commitment among their customers.

Several studies have shown that customer trust has a significant effect on customer commitment (Al‐Hawari, 2011; Tabrani, Amin, & Nizam, 2018), although the research of Sumaedi, Juniarti, and Bakti (2015) found that customer trust had no effect on commitment. On the other hand, Giovanis (2016); Rather (2018) and Tran Le Na and Hien (2021) found that omni-channel perceived value played a significant role in increasing customer trust and customer commitment. Furthermore, Auh (2005); Kusumasondjaja, Shanka, and Marchegiani (2012) and Lee et al. (2014) found that customer trust and customer commitment could be increased through consumer engagement.

Previous research on this phenomenon still shows gaps and variation in the research results that make it advisable for more scholars to conduct research along similar lines. This study has focused on the Indonesian banking industry; this was selected as the object of the research because, as of 2020, Indonesia was the 4th most populous country in the world, with 325,728,934 savings accounts. In this research, the authors examined the effect of omni-channel perceived value and consumer engagement in the banking industry on customer commitment, with customer trust playing a mediating role. The influence of omni-channel perceived value on customer commitment has not previously been widely studied by other researchers; therefore, the omni-channel perceived value variable is a novel aspect of this research, which is expected to increase customer commitment and thus lead to increased customer loyalty in BUKU IV banks.

2. Literature Review

2.1 Omni-Channel Perceived Value (OPV)Omni-channel is an advanced multi-channel strategy that makes it easy for customers to search for product information and facilitates interactions between entrepreneurs and their customers. Omni-channel refers to the integration of online and offline channels with direct marketing channels, which makes it easier for customers and companies to interact with each other and thereby increases customer value (Neslin et al., 2006; Verhoef, Kannan, & Inman, 2015). The implementation of omni-channel banking is expected to provide improved services to customers by making it more convenient to carry out finance-related activities. The omni-channel interaction model allows banks to simultaneously achieve several main goals in the effort to increase the efficiency of the customer’s business, which is expected to increase the customer’s perception of the value of banking (Vasiliev & Serov, 2019). Perceived value is the consumer’s assessment of a product’s utility (Zeithaml, Bitner, & Gremler, 2006). The customer’s perception of value can be used as an evaluation method for customers to measure the benefits provided and as a way for companies to increase profits because customers will perceive this value during the buying process (Butler, Gordon, Roggeveen, Waitt, & Cooper, 2016; Prasetyo, Prakoso, Wiharso, & Fabrianto, 2021). An omni-channel strategy allows customers to access various banking services seamlessly, so that the perceived value, which represents the benefits that customers seek, expect or experience, can be developed in the long term (Tran Le Na & Hien, 2021).

2.2. Consumer Engagement (CE)

Consumer engagement is a psychological process that models the mechanism that underlies the creation of customer loyalty for new customers, as well as the mechanism by which loyalty can be maintained for repeat purchase customers (Khan, Hollebeek, Fatma, Islam, & Rahman, 2020). Consumer engagement focuses on the cognitive, emotional and behavioural dimensions that play a central role in repeat purchases (Brodie, Ilic, Juric, & Hollebeek, 2013; Khan et al., 2020). Considering customer engagement in the long term, it has an impact on the customer’s voluntary contribution to the bank beyond the transaction process itself (Jaakkola & Alexander, 2014). Banking services that put a customer engagement program in place to handle all customer complaints enable banks to maintain long-term relationships with customers so that strong bonds are created between customers and products, and customers are engaged in 2-way communication and cooperative interactions (Cook, 2017).

2.3. Customer Trust (CT)

Customer trust is defined as the feeling of security that customers have in their interactions for the interests and welfare of the customer themselves (Wen, Qin, & Liu, 2019). Customer trust is an important factor in customer interactions and business connections, and represents the extent to which consumers believe that the functions required by customers can be performed well (Kwon, Jung, Choi, & Kim, 2020). Trust is considered a major antecedent of customer commitment, satisfaction and retention (Høgevold, Svensson, & Roberts-Lombard, 2020). According to Delgado-Ballester and Munuera-Alemán (2005), trust is a key variable in developing consumer desire for durable products and maintaining a long-term relationship with a company’s brand. High customer trust in a bank results in the customer feeling a sense of pleasure or pride and feeling satisfied with the bank’s services; in the end, it will therefore affect the customer’s commitment to the bank.

2.4. Customer Commitment(CC)

Commitment is a customer’s long-term desire to maintain a valuable relationship, which allows the customer to take actions that have a positive impact on the company (Moorman, Zaltman, & Deshpande, 1992; Riyanto & Prasetyo, 2021). Customer commitment is a psychological force that incorporates customers into the business organization in which they do business (Fullerton, 2019). In marketing, customer commitment can be divided into 3 (three) categories, namely affective commitment, behavioural commitment and continuance commitment (Lee et al., 2014). Affective commitment relates to a person's feelings, which are relatively short-lived, behavioural commitment relates to taking action, promising and sacrificing to demonstrate commitment, and continuance commitment relates to a long-term relationship (Lee et al., 2014). Continuance commitment has been used frequently in the field of marketing, where it is connected to switching costs, regulation and lack of options (Lee et al., 2014; Parihar & Dawra, 2020). To create a sustainable commitment, the company must maximally support the various business sectors in which it is involved because a sustainable commitment will result in a higher level of loyalty (Jones, Fox, Taylor, & Fabrigar, 2010; Riyanto, Janiah, & Prasetyo, 2021).

2.5. Conceptual Framework

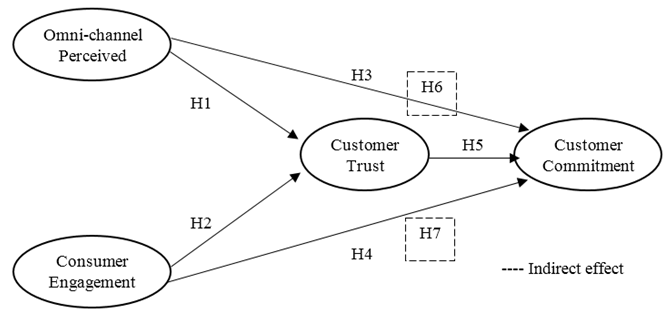

This conceptual framework is based on the theory and previous research, as well as the problems and research objectives that have been stated above.

Figure 1 illustrates the conceptual framework.

Figure 1. The conceptual framework.

3. Research Methods

The research method used was a quantitative descriptive approach with a causal technique, which provides a real picture of a phenomenon in the research context and answers questions related to the research problems. The unit of analysis used in this research refers to customers of BUKU IV category banks in Jabodetabek. This research used a cross-sectional study to answer the research questions (Sekaran & Bougie, 2016), while the data collection technique consisted of a field survey using a questionnaire.

The variables in this research included independent variables, such as omni-channel perceived value and consumer engagement, and dependent variables, which were customer trust and customer commitment. Each variable was measured on a 1–5 Likert scale (Hair, Black, Babin, & Anderson, 2018). The sampling technique used in this research was cluster random sampling. The sample was taken based on bank customers who had used at least 3 banking channels. In this study, the sample size was adjusted for the analytical model employed, namely structural equation modelling (SEM), through a maximum likelihood estimation model of 100–200 samples (Ghozali, 2014). In accordance with Hair et al. (2018), the minimum sample size was determined as 5 observations for each measured parameter, thus the number of samples was set at 5 x 49 indicators = 245 respondents. To analyse and prove the influence of omni-channel perceived value and consumer engagement on customer commitment, mediated by customer trust, among customers of BUKU IV banks in Greater Jakarta, the SEM Lisrel analysis was supplemented by a model feasibility test, a goodness of fit evaluation and a hypothesis test.

4. Results and Discussion

4.1. Results

In examining the validity of all research indicators, which totalled 49 items, the standardized loading factor value was > 0.5, and the reliability test showed a construct reliability (CR) value of > 0.7 and a variance extracted (VE) of > 0.5, meaning that all indicators and research variables were declared valid and reliable.

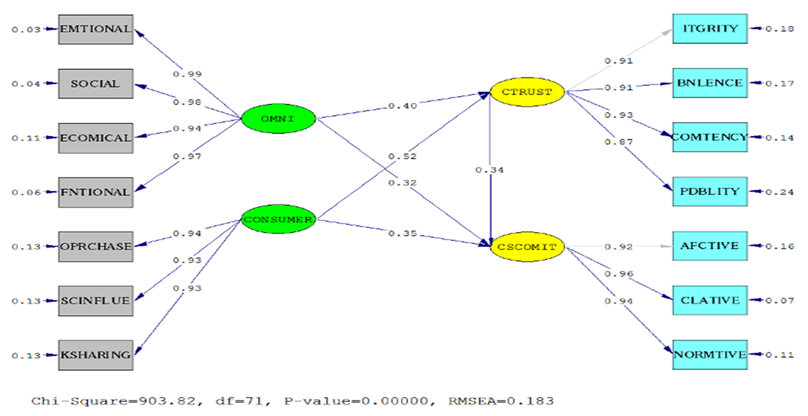

Figure 2 illustrates the full model of the path diagram.

Figure 2. Full model of path diagram.

In the goodness of fit (GoF) test, all estimates of the goodness of fit value from the structural model had good values, although some were marginal, such as the Chi-Square and GFI (Goodness of Fit Index). Nevertheless, the estimated structural model was acceptable overall; therefore, it can be said that the correlations among the various constructs of these variables were structural. This can be justified by the opinion of Hair et al. (2018), who stated that the application of 4 to 5 GoF criteria was sufficient to measure the feasibility of a model, provided that the GoF criteria included absolute fit indices, incremental fit indices and parsimony fit indices.

Table 1 presents the goodness of fit test results.

No |

GoF Size | Fit Rate |

Result |

Conclusion |

1 |

Chi-Square (c2) P > 0.05 |

Expect lower than P |

903.82 P = 0.005 |

Marginal |

2 |

RMSEA Root Mean Square Error Approximation |

£ 0.08 |

0.18 |

Marginal |

3 |

NFI Normed Fit Index | 0.94 |

Fit |

|

4 |

PNFI Parsimony Normed Fit Index | Expect higher than |

0.73 |

Fit |

5 |

CFI Comparative Fit Index | 0.95 |

Fit |

|

6 |

RFI Relative Fit Index | 0.95 |

Fit |

|

7 |

RMR Root Mean Square Residual | 0.030 |

Fit |

|

8 |

GFI | 0.73 |

Marginal |

The results of testing hypotheses 1 to 5 proved that they could all be accepted (T-Value > 1.97). The overall results of the hypothesis tests for the direct effects are summarized in Table 2.

| Hypothesis | Path | Path Coefficient/R2 |

T-Value |

Information |

| H1 | OPV |

0.40 |

4.46 |

Accepted |

| H2 | CE |

0.52 |

5.90 |

Accepted |

| H3 | OPV |

0.32 |

5.66 |

Accepted |

| H4 | CE |

0.35 |

5.33 |

Accepted |

| H5 | CT |

0.34 |

7.16 |

Accepted |

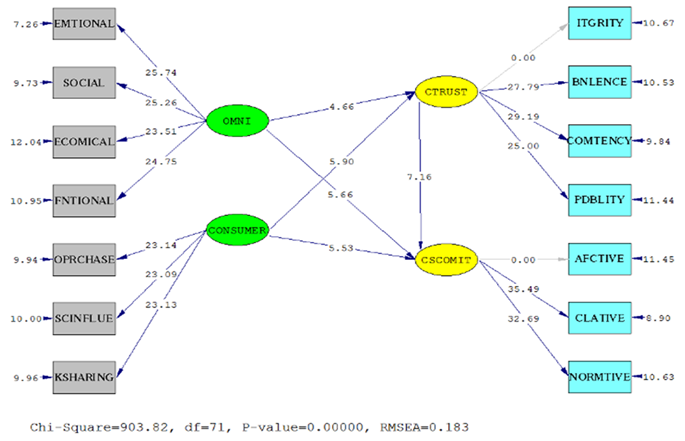

Figure 3. Full model (t-value) path diagram.

Figure 3 illustrates the full model (t-value) path diagram.

Aside from the direct effect tests that were carried out, the study also investigated indirect effects, in other words, the mediating role of customer trust on the relationship between omni-channel perceived value and customer commitment and between consumer engagement and customer commitment, as customer commitment could be increased if customers have high trust in BUKU IV banks in Jabodetabek. Table 3 presents the summary of the hypothesis test results for the indirect effects.

Hypothesis |

Path |

Direct Effect |

Indirect Effect |

Conclusion |

H6 |

OPV |

0.322 = (0.10) |

0.40 x 0.34 = 0.14 |

Direct Effect < Indirect Effect (Full mediation) |

H7 |

CE |

0.352 = (0.12) |

0.52 x 0.34 = 0.18 |

Direct Effect < Indirect Effect (Full mediation) |

The structural equivalence of this research can be presented as follows:

CT = 0.40*OPV + 0.52*CE, Errorvar.= 0.18 , R² = 0.82.............. (1)

CC = 0.34*CT + 0.32*OPV + 0.35*CE, Errorvar.= 0.046 , R² = 0.95 (2)

The results of structural Equation 1 show that the contribution of the two independent variables (omni-channel perceived value and consumer engagement) to customer trust was 82%, so these two independent variables were a very strong antecedent in increasing customer trust. Structural Equation 2 reveals that the contribution of the two independent variables (omni-channel perceived value and consumer engagement), together with customer trust, to customer commitment was 95%; therefore, these three variables were a very strong antecedent for increasing customer commitment.

4.2. Discussion

According to the test results, omni-channel perceived value has a significant positive impact on customer trust. The results of this research support the findings of Giovanis (2016); Rather (2018) and Tran Le Na and Hien (2021), who found that omni-channel perceived value could directly increase customer trust. The dimension that contributes most to omni-channel perceived value is the dimension of economic value. This indicates that economic value or a reasonable price of use are very necessary to omni-channel perceived value. Respondents who feel that the price is reasonable when using omni-channels show increased customer trust. Omni-channel marketing is a persistent and coordinated strategy for interacting with customers and potential customers that includes how to provide customers with the best service, through the right channels, at the right moment, and under the right conditions (Sugesti et al., 2019). Bank management must consider how to provide their customers with omni-channel perceived value. All banks’ offline and online services should be integrated to offer customers the best possible service. In that way, customers no longer need to worry about banking services, even though they do not visit the bank in person. According to these findings, if customers’ omni-channel perceived value increases, it could improve customer trust.

Also, based on the test results, consumer engagement has a significant positive effect on customer trust. This finding supports those of Auh (2005); Kusumasondjaja et al. (2012) and Lee et al. (2014) who found that customer engagement has the effect of increasing customer trust in a company. The dimension that most reflects on customer engagement is knowledge sharing. This indicates that knowledge sharing by means of bank feedback is very necessary. Respondents who feel engaged will respond well to feedback provided by the bank, which will increase customer trust. Customer engagement is a psychological process that underlies the development of customer loyalty in new customers as well as the mechanism by which loyalty can be maintained for repeat customers (Khan et al., 2020). Customer engagement is more concerned with the emotional bonds between the company and the customer, particularly the interaction between the two parties when sharing information. This communication can generate profits for the company through customer loyalty (Vivek et al., 2012). Customers who have a high level of engagement with banking companies will voluntarily make a positive contribution to the company. Consumers or customers who have an emotional attachment to the bank they choose feel happy and proud to be a customer of that bank.

Furthermore, test results indicate that omni-channel perceived value has a significant positive impact on customer commitment. This result supports the research of Giovanis (2016); Rather and Parray (2018) and Tran Le Na and Hien (2021) who found that omni-channel perceived value has a close and positive correlation with customer commitment. This shows that the application of omni-channel banking was expected to provide excellent service to all customers, allowing them to access various banking services so that the perceived value expected by customers could develop into increased customer commitment in the long term.

According to the test results, it was further revealed that customer engagement has a significant positive effect on customer commitment. This is in line with the research of Rather (2018) and Rather and Parray (2018) who found that consumer engagement increases customer commitment on an ongoing basis. By considering customer engagement in long-term connections, it has an impact on the customer’s voluntary contribution to the bank because consumer engagement affects the customer behaviours of committing to and making repeat purchases.

Finally, the test results showed that customer trust has a significant positive effect on customer commitment. This research result is in line with the findings of Al‐Hawari (2011) and Tabrani et al. (2018), who found that customer trust can increase customer commitment. Customer trust is an important factor in consumer interactions and business relationships and represents the extent to which consumers believe that the functions specified by customers can be performed well (Kwon et al., 2020). This indicates that high customer trust in a bank where they are a customer results in a sense of pleasure, pride, and satisfaction with the bank’s services, ultimately resulting in high customer commitment to the bank itself.

5. Conclusion

The research results outlined above can be interpreted to suggest that omni-channel perceived value and customer engagement directly increase customer trust and customer commitment at BUKU IV category banks in Jabodetabek. Customer trust also perfectly mediates the relationships between omni-channel perceived value and customer commitment and between consumer engagement and customer commitment.

Based on these results, it is recommended that the management teams of BUKU IV category banks in Jabodetabek recognize the factors that can affect customer trust and customer commitment, such as omni-channel perceived value and customer engagement.

References

Akoto, L. S., Nkrumah, E. N. K., Benjamin, K., & Adjei, A. A. (2019). The influence of credit risk on equity performance: An empirical assessment of banks listed on the Ghana stock exchange. American Journal of Social Sciences and Humanities, 5(1), 33–46.Available at: https://doi.org/10.20448/801.51.33.46.

Al‐Hawari, M. A. (2011). Automated service quality as a predictor of customers' commitment: A practical study within the UAE retail banking context. Asia Pacific Journal of Marketing and Logistics, 23(3), 346–366.Available at: https://doi.org/10.1108/13555851111143259.

Auh, S. (2005). The effects of soft and hard service attributes on loyalty: The mediating role of trust. Journal of Services Marketing, 19(2), 81–92.Available at: https://doi.org/10.1108/08876040510591394.

Brodie, R. J., Ilic, A., Juric, B., & Hollebeek, L. (2013). Consumer engagement in a virtual brand community: An exploratory analysis. Journal of Business Research, 66(1), 105–114.Available at: https://doi.org/10.1016/j.jbusres.2011.07.029.

Butler, K., Gordon, R., Roggeveen, K., Waitt, G., & Cooper, P. (2016). Social marketing and value in behaviour? Perceived value of using energy efficiently among low income older citizens. Journal of Social Marketing, 6(2), 144–168.Available at: https://doi.org/10.1108/JSOCM-07-2015-0045.

Cook, S. (2017). Measuring customer service effectiveness. New York: Routledge.

Delgado-Ballester, E., & Munuera-Alemán, J. L. (2005). Does brand trust matter to brand equity? Journal of Product and Brand Management, 14(3), 187–196.Available at: https://doi.org/10.1108/10610420510601058.

Fullerton, G. (2019). Using latent commitment profile analysis to segment bank customers. International Journal of Bank Marketing, 38(3), 627–641.Available at: https://doi.org/10.1108/IJBM-04-2019-0135.

Ghozali, I. (2014). Structural equation modeling: Theory, concept and application with the program Lisrel 9.10 (4th ed.). Semarang: Diponegoro University Publishing Agency.

Giovanis, A. (2016). Consumer-brand relationships’ development in the mobile internet market: Evidence from an extended relationship commitment paradigm. Journal of Product & Brand Management, 25(6), 568–585.Available at: https://doi.org/10.1108/JPBM-05-2015-0884.

Hair, J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2018). Multivariate data analysis (8th ed.). Hampshire: Cengage Learning.

Høgevold, N., Svensson, G., & Roberts-Lombard, M. (2020). Antecedents and postcedents of satisfaction in seller-business relationships: Positive and negative alter egos. European Business Review, 33(4), 537–565.Available at: https://doi.org/10.1108/EBR-04-2020-0108.

Jaakkola, E., & Alexander, M. (2014). The role of customer engagement behavior in value co-creation: A service system perspective. Journal of Service Research, 17(3), 247–261.Available at: https://doi.org/10.1177/1094670514529187.

Jones, T., Fox, G. L., Taylor, S. F., & Fabrigar, L. R. (2010). Service customer commitment and response. Journal of Services Marketing, 24(1), 16–28.Available at: https://doi.org/10.1108/08876041011017862.

Khan, I., Hollebeek, L. D., Fatma, M., Islam, J. U., & Rahman, Z. (2020). Brand engagement and experience in online services. Journal of Services Marketing, 34(2), 163–175.Available at: https://doi.org/10.1108/JSM-03-2019-0106.

Kumar, V., Rajan, B., Gupta, S., & Pozza, I. D. (2019). Customer engagement in service. Journal of the Academy of Marketing Science, 47(1), 138-160.Available at: https://doi.org/10.1007/S11747-017-0565-2.

Kusumasondjaja, S., Shanka, T., & Marchegiani, C. (2012). Credibility of online reviews and initial trust: The roles of reviewer’s identity and review valence. Journal of Vacation Marketing, 18(3), 185-195.Available at: https://doi.org/10.1177/1356766712449365.

Kwon, J. H., Jung, S. H., Choi, H. J., & Kim, J. (2020). Antecedent factors that affect restaurant brand trust and brand loyalty: Focusing on US and Korean consumers. Journal of Product and Brand Management, 30(7), 990–1015.Available at: https://doi.org/10.1108/JPBM-02-2020-2763.

Lee, Y.-K., Jeong, Y.-K., & Choi, J. (2014). Service quality, relationship outcomes, and membership types in the hotel industry: A survey in Korea. Asia Pacific Journal of Tourism Research, 19(3), 300-324.Available at: https://doi.org/10.1080/10941665.2012.749930.

Marshal, I. (2017). Product brand and customer loyalty: A survey of the Nigeria banking industry. Journal of Accounting, Business and Finance Research, 1(1), 7–18.Available at: https://doi.org/10.20448/2002.11.7.18.

Moorman, C., Zaltman, G., & Deshpande, R. (1992). Relationships between providers and users of market research: The dynamics of trust within and between organizations. Journal of Marketing Research, 29(3), 314-328.Available at: https://doi.org/10.2307/3172742.

Neslin, S. A., Grewal, D., Leghorn, R., Shankar, V., Teerling, M. L., Thomas, J. S., & Verhoef, P. C. (2006). Challenges and opportunities in multichannel customer management. Journal of Service Research 9(2), 95–112.Available at: https://doi.org/10.1177/1094670506293559.

Parihar, P., & Dawra, J. (2020). The role of customer engagement in travel services. Journal of Product and Brand Management, 29(7), 899–911.Available at: https://doi.org/10.1108/JPBM-11-2018-2097.

Prasetyo, J. H., & Ariawan, J. (2021). Exact strategies to increase indonesian’s Millenial customer loyalty towards digital banking product. Enrichment: Journal of Management, 12(2), 1558-1565.

Prasetyo, J. H., Prakoso, B. S., Wiharso, G., & Fabrianto, L. (2021). E-commerce: The importance role of customer perceived value in increasing online repurchase intention. Dinasti International Journal of Digital Business Management, 2(6), 955-962.Available at: https://doi.org/10.31933/DIJDBM.V2I6.954.

Rather, R. A., & Parray, S. H. (2018). Customer engagement in increasing affective commitment within hospitality sector. JOHAR, 13(1), 73-91.

Rather, R. A. (2018). Consequences of consumer engagement in service marketing: An empirical exploration. Journal of Global Marketing, 32(2), 116-135.Available at: https://doi.org/10.1080/08911762.2018.1454995.

Riyanto, S., Janiah, S., & Prasetyo, J. H. (2021). A strategy to strengthen the organizational citizenship behaviour of steel industry’s employee in indonesia. Academy of Strategic Management Journal, 20(3), 1-14.

Riyanto, S., & Prasetyo, J. H. (2021). Factors affecting civil servant performance in indonesia. International Journal of Entrepreneurship, 25(5), 1-15.

Sekaran, U., & Bougie, R. (2016). Research methods for business: A skill building approach (7th ed.). Chichester: John Wiley & Sons.

Sheng, T. (2021). The effect of fintech on banks’ credit provision to SMEs: Evidence from China. Finance Research Letters, 39, 101558.Available at: https://doi.org/10.1016/J.FRL.2020.101558.

Sugesti, N. L., Kusniawati, A., & Prabowo, F. H. E. (2019). Pengaruh omni-channel marketing terhadap minat beli konsumen (Studi kasus pada produk tabungan emas PT. Pegadaian Syariah cabang Padayungan). Business Management and Entrepreneurship Journal, 1(4), 92-101.

Sumaedi, S., Juniarti, R. P., & Bakti, I. G. M. Y. (2015). Understanding trust & commitment of individual saving customers in Islamic banking: The role of ego involvement. Journal of Islamic Marketing, 6(3), 406–428.Available at: https://doi.org/10.1108/JIMA-06-2013-0045.

Tabrani, M., Amin, M., & Nizam, A. (2018). Trust, commitment, customer intimacy and customer loyalty in Islamic banking relationships. International Journal of Bank Marketing, 36(5), 823–848.Available at: https://doi.org/10.1108/IJBM-03-2017-0054.

Tran Le Na, N., & Hien, N. N. (2021). A study of user’s m-wallet usage behavior: The role of long-term orientation and perceived value. Cogent Business & Management, 8(1), 1899468.Available at: https://doi.org/10.1080/23311975.2021.1899468.

Vasiliev, S. A., & Serov, E. R. (2019). Omnichannel banking economy. Risks, 7(4), 1–11.Available at: https://doi.org/10.3390/RISKS7040115.

Verhoef, P. C., Kannan, P. K., & Inman, J. J. (2015). From multi-channel retailing to omni-channel retailing: Introduction to the special issue on multi-channel retailing. Journal of Retailing, 91(2), 174-181.Available at: https://doi.org/10.1016/J.JRETAI.2015.02.005.

Vivek, S. D., Beatty, S. E., & Morgan, R. M. (2012). Customer engagement: Exploring customer relationships beyond purchase. Journal of Marketing Theory and Practice, 20(2), 122-146.Available at: https://doi.org/10.2753/MTP1069-6679200201.

Watson, G. F., Beck, J. T., Henderson, C. M., & Palmatier, R. W. (2015). Building, measuring, and profiting from customer loyalty. Journal of the Academy of Marketing Science, 43(6), 790-825.Available at: https://doi.org/10.1007/s11747-015-0439-4.

Wen, T., Qin, T., & Liu, R. R. (2019). The impact of nostalgic emotion on brand trust and brand attachment: An empirical study from China. Asia Pacific Journal of Marketing and Logistics, 31(4), 1118–1137.Available at: https://doi.org/10.1108/APJML-09-2018-0390.

Wiharso, G., Prasetyo, J. H., Prakoso, B. S., & Fabrianto, L. (2022). The effect of mobile banking product quality on customer satisfaction of Indonesian Sharia Bank Jakarta wolter monginsidi branch. Matriks: Jurnal Sosial dan Sains, 3(2), 80-88.

Zeithaml, V. A., Bitner, M. J., & Gremler, D. D. (2006). Services marketing: Integrating customer focus across the firm (7th ed.). Boston: McGraw-Hill.