Restrictions on the Emission of a Digital Currency in a Central Reserve Bank for Minor Transactions

Lisbeth Amelia Callo Solis1*

Yasmir Ivette Figueroa Zamudio2

Aracely Pilar Espinoza Huamani3

Nivardo Alonzo Santillán Zapata4

Pedro Bernabe Venegas Rodriguez5

Albert Farith Chavarri Balladare6

1,2,3,4,5Faculty of Business Sciences, Continental University, Peru. |

AbstractThe objective of this study was to identify the challenges that the Central Reserve Bank of Peru has faced with the issuance of a digital currency that can be used as a substitute for cash in retail transactions. The study was carried out by using the hypothetical-deductive method with a basic descriptive approach rather than an experimental one. To estimate the probability of creating the Digital Currency of the Central Bank and the economic variables that explain its challenges and cross-sectional information obtained from the 2020 National Household Survey with the discrete choice model (Logit). According to the research results, i) the possibility of using a digital currency increases by 46.83% if you have a formal job compared to an informal job. ii) If the individual has an internet connection, the probability of using digital currency is 8.54%. iii) If he lives in a rural area, the probability of using digital currency is 1.79. iv) The educational level influences the probability of the use of digital currency by 1.47% if they have secondary education 16.34% have no higher education and 26.44% having university education. v) Individual’s age is important for the use of a digital currency. Older people are less likely to adapt to technology than people between the age of 18 and 24 with 8.74% use of digital currency. vi) People considered poor will have a probability of reduction of 2.26% by the use of digital currency. These findings allow the researcher to conclude that public policies should be undertaken to increase financial inclusion, close connectivity gaps and create alliances with private investment to enhance people's digital skills and the adoption of digital means of payment. |

Licensed: |

|

Keywords: JEL Classification |

|

Received: 22 July 2022 |

Funding: This study received no specific financial support. |

Competing Interests:The authors declare that they have no competing interests |

1. Introduction

Technological advancement brought about globalization had impact on the economic, political, social and cultural repercussions. In order to integrate in the digital system and benefits from what it has to offer, it is necessary to constantly adapt to the use of information technologies. Technology is used in the field of economics to make transactions easier between economic agents and to introduce new payment systems with benefits of using physical money. Fantacci and Gobbi (2021) indicate that the use of a digital currency has the advantages of conventional bank money in relation to its stability. In addition, they include the benefits of a cryptocurrency related to privacy and potentially lower transaction costs.

According to Khiaonarong and Humphrey (2019) the use of paper money (bills) has been replaced by substitutes through debit and credit cards, electronic wallets, transfers, among others which makes the demand for digital currency less relevant. As long as there is a high use of cash, the demand for digital currency will be significant due to the lack of a substitute. However, the use of cash free payments methods has increased recently with the emergence of cryptocurriencies. Due to this reason , the Central Reserve Bank of Peru (CRBP) has considered the possibility of issuing a Central Bank Digital Currency in order to create a digital payment alternative to those already available in the market. At the same time its issuance contributes to the achievement of macroeconomic stabilization goals. In the era of digitalization considering the role of the Central Bank in the future. Likewise, the impact that the progressive use of a Central Bank Digital Currency will have on the financial system must be considered (Bordo, 2021).

Tan and Xue (2021) found that COVID- 19’s quick stimulation which favors the effect of monetary policy enhances the financial system’s vulnerability and challenges the regulatory framework which has a favorable impact on the growth of digital currencies and cyber security. Peters, Green, and Yang (2020) argued that the digital Yuan system is capable of digitizing the entire monetary base. It has the ability to alter the Chinese monetary system. Later, it will be able to change the international monetary system and compete with the US dollar as the world's main reserve currency but it will need improvements. According to Tong and Jiayou (2021) China has raised the digital currency as a national strategy, a systematic and an international project with the purpose of influencing policy and prevention of potential risks.

According to Lee, Yan, and Wang (2021) Central Bank Digital Currency will serve as the main tool in the future digital economy and countries familiar with the technology will have a competitive advantage considering its implementation and current regulation. Zams et al. (2020) found that the optimal central bank digital currency implementation model for Indonesia should be similar to cash, a central bank digital currency for retail transactions should have the same characteristics as traditional paper money in the sense of being universal, anonymous and being a medium of exchange and not a medium of performance similar to the models implemented by the People's Bank of China which uses a technology similar to that of Indonesia.

Fernandez (2021) highlighted that the European Central Bank approved the issuance of a digital euro in a response to the rising interest in digital currencies and to take into consideration a new economic management and control mechanism. Arauz and Garratt (2021) argued that electronic money was a mobile payment system developed by the Central Bank of Ecuador to transfer balances in dollars via cell phones, with the goal of increasing increase financial inclusion and reducing the Central Bank’s retention and distribution of physical currency. However, this system was suspended due to its failure.

Kochergina and Yangirovab (2019) studied that the main incentives for the introduction of a digital currency is that it must be substitute and universally accessible legal payment to ensure transparent and cheaper national and international payments. The influence of the digital currency will depend on the scenario of your monetary and credit system. Janisch and Stapleton (2021) found that the circular currency in Austria has a higher potential for widespread acceptance than the acceptance of a digital currency. Government and local economic support had no impact on a digital currency.

Cash is still used extensively in Peru’s emerging economy and the implementation of a digital currency would increase financial inclusion (Boar & Wehrli, 2021). In this way, the Central Bank would make it a priority to reach all economic agents to have a greater scope and include everyone within the financial system. The primary purpose of the digital currency is to replace cash in order to take benefit from a Central Bank Digital Currency offers.

With theoretical considerations and information sharing with other Central Banks, the Central Bank began its investigation into the potential issuing of a virtual currency. However, the proposal has not yet reached the experimental stage or the development of a pilot plan because in the country the main means of payment is still paper money (bills) among citizens included in the financial system as among those that are not. Since agents avoid government regulations by avoiding the financial system the high level of informality in the economy is one of the cause.

Similarly, technological barriers such as poor internet access and the low digital knowledge of the population especially among those excluded from the financial system. Generational problems and difficulty in adapting to new technologies which is prevalent in all economies. It is necessary and highly relevant to identify the gaps that hinder the process of implementing a retail digital currency to prioritize them when mitigating or solving them if possible.

In addition, the issuance of a Central Bank Digital Currency by central banks must also consider not only consumer preferences for privacy and possible efficiency gains (in terms of payments, clearing and settlement) but also take into account risks that may be involved for the financial system and the economy as a whole as well as any implications for monetary policy as mentioned by Bordo and Levin (2017).

In this context, the purpose of this study is to identify the obstacles faced by the Central Reserve Bank for the issuance of a digital currency considering that the phase in which this proposal is still not implemented at the pilot level.

2. Literature Review

2.1. Requirements for the Implementation of a Central Bank Digital Currency and Its Adaptation to the Functions of Money

According to George (2018) the issuance of a Central Bank Digital Currency requires a properly developed technological infrastructure such as electrical coverage, a telecommunications network and appropriate internet coverage. According to the development of the telecommunications infrastructure and the progress in its implementation within their territory, the countries could choose a combination between submarine fiber optic cables, fixed lines and satellite connections. Investments in cables and satellites can be undertaken in urban areas or large cities due to the need for more bandwidth and it can be supported by investing in satellites in rural areas or locations remote from large cities to prevent interruptions.

Taylor, Wilson, Holttinen, and Morozova (2020) highlighted that issuing a Central Bank Digital Currency is a complex national project that will involve multiple stakeholders in addition to the Central Bank’s conventional counterpart and the Ministry of Economy and Finance in the Peruvian case. The current system must be changed to accommodate the use of a Central Bank Digital Currency because the Central Bank Digital Currency has significant value and implications. (Changes in the regulation by the Central Bank and the regulator of the financial system identified the adequacy for the use of the Central Bank Digital Currency through the financial system, adequacy of the framework accounting and information to adapt its use in the financial and private system). These legal framework changes would affect the operation of the state apparatus in a transversal way including ministries, subnational governments, supervisors, financial intelligence units, statistical agencies, consumer protection agencies among others. The central bank could incorporate a committee to work with government entities, the financial system and the private sector to facilitate communication as a solution in the transition process to the adoption of the use of the Central Bank Digital currency in retail transactions.

On the other hand, Rodríguez (2020) argues that the Germans used the word Geld (money) which meaning is to have validity so the term money refer to the means that exists to pay. The fact that some goods are converted into money enables us to understand the importance of the custom of money’s origin. In this sense, money is a commodity that represents a measure of exchange value or price also conceived as a set of financial assets that fulfill the functions of means of payment, a reserve of value and unit of account. In this case, money is an acceptable means of payment or exchange that is widely used to acquire products whose main characteristic is to facilitate the exchange or trade of said products. Therefore, money can adopt different presentations including a digital version, without harming its value or its main functions.

Auer and Böhme (2021) mentioned that Central Bank Digital Currencies should be able to offer central banks to provide a common means of payment in the digital age. Such currencies must safeguard consumer privacy and maintain the two-tier financial system. Its economic design needs to emphasize the use of Central Bank Digital Currencies as a medium of exchange but needs to limit its attractiveness as a savings vehicle. They also mention that central banks must develop substantial technological expertise.

Similarly, Jiménez and Zubiate (2021) identified a series of risks and challenges following the implementation of a Central Bank Digital Currency, regulatory and technological which has largely neglected by the State including Internet access, cybersecurity, the State’s digital architecture and inclusion of vulnerable populations.

Similarly, Yermán Martínez (2020) indicates that the process of money handling between the Central Bank and commercial banks are already digital which promotes and facilitates the digitization of the money issued by the Central Bank to the population. The main motivations range from considering the digital currency as another option for the payment system managed by private individuals to being an agent for promoting financial inclusion. For Ordóñez (2020) technological change and the digital explosion explain the emergence of the idea of creating a digital currency which requires enormous human resources to implement. In additionally, new technologies make it easier for the issuing entity (Central Bank) to issue public digital money in the same way as in the past the physical money was issued.

Legal, Blanco, and Ortiz Ibarrola (2022) suggest that the Central Bank Digital Currency design should be aligned with the public policy objectives pursued by the Central Bank and the risks of financial stability and monetary policy stressing the inflation target. According to their analysis, a non-interest-bearing retail Central Bank Digital Currency with limitations on its use could achieve many policy objectives without risking the financial system or monetary policy. However, an unrestricted Central Bank Digital Currency with an interest rate yield would be considered the most disruptive option for the financial system and monetary policy since it poses greater complexities in its implementation.

Sanz (2021) suggests that a Central Bank Digital Currency should have its own regulatory framework which help to complete current instant payment systems and enables businesses and individuals to transact with each other instantly without being constrained by weekend or business time. The biggest challenge facing banking and monetary regulators is for the Central Bank Digital Currency to be stable, managed and to provide confidence as a means of payment with the ability to gradually replace physical cash. The Central Bank Digital Currency represents a more technologically advanced means of payment and the different regulatory approaches that would have implications for the monetary policy of the Central Bank and its objective of ensuring financial stability. The Central Bank Digital Currencies would neutralize the rise of cryptocurriencies whose usefulness is only as a store of value and not as a means of payment.

Finally, Auer, Cornelli, and Frost (2020) state that the demand for cash from consumers increased in past crises as it is a means of payment and a stable reserve of value; However, there has been a noticeable increase in the use of mobile, card and online payments in recent months due to ongoing crises and these will probably continue to increase in the medium and long term in order to avoid physical contact with paper money (bills). In this regard, technological inclusion for these type of contactless transactions must be taken into account along with the search for easily accessible platforms and interfaces for the entire population. The protection of individuals' data, cybersecurity and the operational continuity of the technological systems necessary for the real-time operation of digital currency transactions must also be considered.

2.2. Benefits of Implementing a Central Bank Digital Currency in Emerging Economies and Pending Challenges for Monetary Policy, its Instruments and the Financial System

Tobias and Mancini-Griffoli (2021) found that digital forms of money could be a boon to low-income and emerging market economies if the transition is well managed and regulated. Digital money has a lot of potential to transform the financial system. The vast system of technological and telephone access could advantageous to everyone who are still excluded from the financial system. That’s why they do not have any type of traditional bank account. This system facilitate commercial transactions and market integration. However, having this type of currency entails risks that would exclude those who are unable to bridge the digital divide as well as leaving room for fragmentation, currency substitution and loss of policy effectiveness. Therefore, the transition must be managed, coordinated and very well regulated.

Gouveia, Dos Santos, De Lis, Neut, and Sebastián (2017) suggested a phased Central Bank Digital Currency implementation strategy which would reduce the risk of disruption and high costs to the current financial structure and credit markets. However, it would bring benefits such as reduced brokerage costs, expanded feasible policies and reduced informality of illicit activities and reduced taxes.

A Central Bank Digital Currency involves two possible designs: (a) an account-based Central Bank Digital Currency and (b) a token-based (or value-based) Central Bank Digital Currency. These designs correspond to the two existing types of central bank money and their corresponding payment systems (Gadou, 2022; Kahn & Roberds, 2009) central bank reserves (in an account-based system) and banknotes (in a token-based system). A payment is made if a monetary asset is transferred from a payer to a payee. In an account-based system, a transfer occurs by charging the payer’s account and transferring the credit to the payee’s account. In a token-based system, the transfer occurs by transferring the value itself or the token that is, an object representing the monetary asset (Butola, Dube, & Jain, 2022; Chaum, Grothoff, & Moser, 2021).

According to Carrascosa and Montalvo (2021) Central Bank Digital Currencies have a strong impact on the banking business. In the pandemic, there was a cyber-print in the design of the Central Bank Digital Currency that Central Banks faced with the galloping introduction of cryptocurrencies and declining cash usage. It should be kept in mind that a Central Bank Digital Currency can be used as an instrument for payment, savings and for the objectives and functions of the Central Banks so its implementation should be progressive.

Latimer and Duffy (2019) concluded that the main practical advantage of a digital currency is the lower cost, specifically in international transfers. Similarly, the lack of regulation and anonymity are closely related to its greatest social disadvantage that of financing illegal activities, a part that includes a risk to the holders for not having a link with real assets that is the only value is as a medium of exchange.

Ruiz (2020) argues that each country that wishes to implement a digital currency must rigorously evaluate in advance the benefits and risks of introducing this type of financial innovation since its implications are structural especially in the banking system and monetary policy. In addition, he states that in the existing literature, there is a preference for the use of digital currencies as long as they coexist with physical money that it only partially covers the demand for cash.

According to Belke and Beretta (2020) the coexistence of physical and virtual currency can have a disciplinary effect on Central Banks. However, there are still high risks that digital currency should not be considered as a perfect substitute for physical currency. Li and Jing (2020) identify prominent privacy and security issues that seek to strengthen the soundness of the legal digital currency system and build a harmonious credit society, including security and privacy protection measures.

For Carstens (2019) the introduction of Central Bank Digital Currency could affect the transmission of monetary policy. For example, a Central Bank Digital Currency would change the base money demand and its composition in unpredictable ways and could also change the sensitivity of money demand to changes in interest rates. Along these lines, Armelius, Boel, Claussen, and Nessén (2018) mention that the exchange rate transmission channel may be altered by the introduction of Central Bank Digital Currency because it would facilitate greater foreign exchange management activity that could lead to stronger exchange rate movements, faster for given changes in market rates.

In addition, Belke and Beretta (2020) concluded that technological progress must consider some fundamental monetary principles such as the physicality and tangibility of the currency. These remain irreplaceable especially in difficult economic times so these should not be neglected without expecting negative consequences on financial stability. Nevertheless, Mancini-Griffoli et al. (2018) argue that such impacts are unlikely to be significant under plausible Central Bank Digital Currency designs. In fact, monetary policy transmission could be strengthened if the Central Bank Digital Currency increases financial inclusion and thus exposes more households and businesses to interest rate instruments.

Finally, Sanchez de la Pena (2022) argued that the Central Bank Digital Currency faces various challenges such as replacing cash and making transactions , without internet access and without disrupting the economic flow.3. Research Methodology

According to the objective stated in paper, it is a non-experimental descriptive basic research seeks to identify and describe the restrictions for the issuance of a digital currency for retail transactions by the Central Reserve Bank of Peru.

In the same way, a hypothetical deductive investigation develops new hypotheses by observing reality and is transversal in its temporal scope as it compares the characteristics of various individuals at a specific moment. Similarly, the technique used for data collection was documentary analysis and secondary data sources. The instruments are the econometric model and the bibliographic compilation obtained from various sources of information.

The variable considered in this document is represented by:

Y: Probability of using a Central Bank Digital Currency for retail payments

X: Restrictions for the issuance of a retail Central Bank Digital Currency by the Central Reserve Bank of Peru.

The main restrictions for the Central Reserve Bank of Peru to issue a digital currency for retail transactions are:

Hypothesis 1 (H1). The high level of labor informality in the country's economy.

Transactions in the formal labor sector are taxed without any inconvenience for tax purposes. However, in the informal labor market the payment of taxes is completely evaded. Therefore, the use of a digital currency issued by the Central Bank would be ruled out in this sector.

Hypothesis 2 (H2). Internet connectivity problems.

If you do not have an internet connection, mobile devices cannot be used for economic transactions instead a network other electronic devices must be integrated.

Hypothesis 3 (H3). The geographical area of residence.

The place of residence constitutes a gap for the use of a digital currency. The urban area usually greater access to electronic devices, instruction for their use and ease of connection which does not happen in rural areas.

Hypothesis 4 (H4). The educational level.

The level of educational instruction will influence the learning capacity to facilitate the use of new technologies. Therefore, at a higher educational level, the use of a digital currency will be more common.

Hypothesis 5 (H5). Generational problems that make it difficult to adapt to new technologies.

According to the age, sex and activities carried out, there is a greater possibility that young people and adults make use of a digital currency for their economic transactions even more so if they are female. This age group is adapted to the use of technology and the variations that it continually offers while for older adults it is more complicated to use electronic devices and learn new procedures.

Hypothesis 6 (H6). The monetary condition of the individual.

If the individual is considered poor due to the low income they receive, it is difficult for them to have electronic devices and internet service to carry out economic transactions as well as the knowledge to make use of these devices. Such situation does not occur in the same way with people from the middle class or considered non-poor. Since the economic transactions with digital currency that they carry out will be more feasible due to access to technology, connectivity, knowledge and the monetary income received with better conditions.

Likewise, the technique used for data collection was documentary analysis and secondary data sources. The instruments are the econometric model and the bibliographic compilation obtained from various sources of information.

To estimate the probability of using a Central Bank Digital Currency and the variables that explain its restrictions. We use a discrete choice model (Logit) with cross-sectional information from the National Household Survey 2020. The dependent variable to be explained is the probability of using a Central Bank Digital Currency for retail transactions. For this we use the number of individuals included. It will take the value of 1 in the affirmative case and 0 if they do not have access to any financial service. The independent variables are: employment status (Value 1 represents informal employment and 2 formal employment), Internet connectivity (Value 0 represents no Internet access and 1 represents Internet connection), area of residence (The value 1 represents the urban area and 2 the rural area), education (The value 1 represents that the individual has up to the Primary level, 2 if they have a Secondary level, 3 if the education is Superior, not university, and 4 if it is University superior), age (The value 1 indicates if the subject belongs to the age range of 18 to 24 years, 2 if his age ranges between 25 to 44 years and 3 if he is more than 45 years old), sex (The value 1 represents a if the subject is a man and 2 if a woman), monetary condition (The value 0 represents the characteristic of not poor and 1 represents poor).

In the Logit model, the following function is used:

4. Results

Table 1 shows the results of the regressions to explain whether an individual can use a Central Bank Digital Currency for retail transaction. It is obtained from the estimation of the Logit model and it is observed that the value of the pseudo R2 amounts to 0.2323 and the p-value for all the dependent variables less than 5%, which confirms that the variables are significant. It should be noted that for variables that have more than two categories, one category is used as the base. For example, in the case of education, the categories of secondary, higher non-university and university levels are evaluated with respect to the primary level, being this last level considered as base category. In the same way as in the case of age, the age range between 25 - 44 years and over 45 years is evaluated based on the base category, which is comprised of the range of 18 - 24 years. In this sense, the signs of the explanatory variables shown are positive except for the poverty condition which shows a reduction in the probability of using a Central Bank Digital Currency if the individual is in the poverty category.

Hypothesis 1 (H1). The high level of labor informality in the country's economy.

The probability of using a digital currency increases by 46.83% if you have a formal job compared to if your job is informal.

Hypothesis 2 (H2). Internet connectivity problems.

The probability of using a digital currency increases by 8.54% if the individual has an internet connection compared to individuals who do not have an internet connection.

Hypothesis 3 (H3). The geographical area of residence.

The probability of using a digital currency increases by 1.79% if you live in a rural area compared to if the individual lives in an urban area.

Hypothesis 4 (H4). The educational level.

The probability of using a digital currency increases by 1.47% if you have only a secondary education with respect to only having primary studies (base category), 16.34% if the education is higher than a non-university with respect to the base category and 26.44% if you have a higher university education with respect to the base category.

Hypothesis 5 (H5). Generational problems that make it difficult to adapt to new technologies.

The probability of using a digital currency increases by 6.26% if the individual's gender is female compared to male and 8.74% increased probability of using a digital currency if they are between 25 and 44 years old compared to a person who is between 18-24 years old (base category), 4.46% if the age is between 45 years and over with respect to the base category.

Hypothesis 6 (H6). The monetary condition of the individual.

On the other hand, the probability of using a digital currency for retail transactions is reduced by 2.26% if the individual is in a poor condition compared to if the individual is not considered poor.

| Number of obs = | 53,377 |

|||||

| LR chi2(10) = | 16993.26 |

|||||

| Prob > chi2 | 0.0000 |

|||||

| Log likelihood= | -28083.53 |

|||||

| Pseudo R2= | 0.2323 |

|||||

| Central Bank Digital Currency | Coef. |

Std. Err |

z |

P>|z| |

[95% Conf. Interval] |

|

| Gender | ||||||

| Woman | 0.3565 |

0.0211 |

16.9 |

0.0000 |

0.3151 |

0.3978 |

| Area | ||||||

| Rural | 0.1029 |

0.0243 |

4.24 |

0.0000 |

0.0553 |

0.1505 |

| Age | ||||||

| 25-44 | 0.5077 |

0.0349 |

14.56 |

0.0000 |

0.4393 |

0.5760 |

| 45 and + | 0.2665 |

0.0364 |

7.32 |

0.0000 |

0.1952 |

0.3378 |

| Education | ||||||

| High school | 0.0809 |

0.0268 |

3.02 |

0.0030 |

0.0283 |

0.1334 |

| Non-university | 0.8343 |

0.0378 |

22.07 |

0.0000 |

0.7602 |

0.9085 |

| University | 1.3291 |

0.0416 |

31.95 |

0.0000 |

1.2476 |

1.4106 |

| Working condition | ||||||

| Formal employment | 2.3111 |

0.0341 |

67.82 |

0.0000 |

2.2443 |

2.3779 |

| Monetary condition | ||||||

| Poor | -0.1509 |

0.0253 |

-5.96 |

0.0000 |

-0.2006 |

-0.1013 |

| Internet Access | ||||||

| Has internet connection | 0.4620 |

0.0253 |

18.29 |

0.0000 |

0.4125 |

0.5115 |

| Constant | -1.6942 |

0.0456 |

-37.15 |

0.0000 |

-1.7836 |

-1.6048 |

For its part, Table 2 estimates the average marginal effects where the proposed hypotheses are corroborated:

| Logit - Average marginal effect | Delta-method | z | P>|z| | [95% Conf. Interval] | ||

| dy/dx | Std. Err | |||||

| Gender | ||||||

| Woman | 0.0626 |

0.0037 |

16.95 |

0.0000 |

0.0553 |

0.0698 |

| Area | ||||||

| Rural | 0.0179 |

0.0042 |

4.27 |

0.0000 |

0.0097 |

0.0261 |

| Age | ||||||

| 25-44 | 0.0874 |

0.0058 |

15.16 |

0.0000 |

0.0761 |

0.0987 |

| 45 and + | 0.0446 |

0.0060 |

7.49 |

0.0000 |

0.0329 |

0.0562 |

| Education | ||||||

| High school | 0.0147 |

0.0049 |

3.01 |

0.0030 |

0.0051 |

0.0243 |

| Non-university | 0.1634 |

0.0077 |

21.28 |

0.0000 |

0.1483 |

0.1785 |

| University | 0.2644 |

0.0084 |

31.58 |

0.0000 |

0.2479 |

0.2808 |

| Working condition | ||||||

| Formal employment | 0.4683 |

0.0055 |

85.92 |

0.0000 |

0.4576 |

0.4790 |

| Monetary condition | ||||||

| Poor | -0.0264 |

0.0044 |

-5.97 |

0.0000 |

-0.0350 |

-0.0177 |

| Internet Access | ||||||

| Has internet connection | 0.0854 |

0.0049 |

17.53 |

0.0000 |

0.0758 |

0.0950 |

Note: dy/dx for factor levels is the discrete change from the base level. |

Table 3 shows the correct predicted percentage of the Logit model is 75.03%

| Classified | TRUE |

Total |

|

D |

~D |

||

| + | 13150 |

3124 |

16274 |

| - | 10203 |

26900 |

37103 |

| Total | 23353 |

30024 |

53377 |

| Classified + if predicted Pr(D) >= 0.5 | |||

| True D defined as Central Bank Digital Currency != 0 | |||

| Sensitivity | Pr( +| D) | 56.31% |

|

| Specificity | Pr( -|~D) | 89.59% |

|

| Positive predictive value | Pr( D| +) | 80.80% |

|

| Negative predictive value | Pr(~D| -) | 72.50% |

|

| False + rate for true ~D | Pr( +|~D) | 10.41% |

|

| False - rate for true D | Pr( -| D) | 43.69% |

|

| False + rate for classified + | Pr(~D| +) | 19.20% |

|

| False - rate for classified - | Pr( D| -) | 27.50% |

|

| Correctly classified | 75.03% |

||

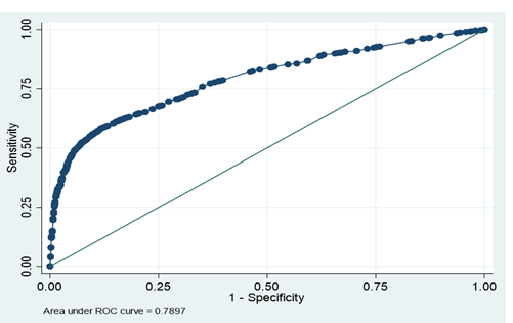

Figure 1. Area down curve.

Figure 1 illustrates the AUC (Area under the Curve) value of 0.79 which gives us an idea that the logit model is able to distinguish between positive and negative results. The AUC can range from 0 to 1. The higher the AUC, the better the model will be at correctly classifying the results evidence that it adequately classifies the results.

5. Discussion

Our findings are concur with the findings of Aurazo and Vega (2020) who mentioned that individuals between 25-40 years old are more likely to use digital payments in purchases of all product categories, compared to a person who is between 18-24 years old (base category), while older people (56 years and older) are less likely to pay digitally than younger people. In relation to the type of employment, the fact that a person has an informal job significantly reduces the probability that they use digital payments in all product categories on the contrary, if they had a formal job. Regarding the educational level, the higher the level of education a person has, the greater the probability of paying digitally.

On the other hand, it is considered that the implementation of a digital currency is a way of presenting money and as a means of payment for retail transactions it should not affect the main functions of money. It can adopt different presentations according to the characteristics of the individual and the environment in which it operates as mentioned by Rodríguez (2020).

6. Conclusions

The results showed the main restrictions faced by the Central Reserve Bank of Peru to issue a Central Bank Digital Currency for use in retail transactions are: (i) The labor condition, there is an increase in the probability of using a Central Bank Digital Currency of 46.83% if the individual has a formal job. (ii) Having an internet connection increases the probability of using a Central Bank Digital Currency as a means of payment by 8.54%. (iii) The geographical area where the individuals reside, there is a greater probability of its use in 1.79 % if their place of residence is the rural sector. (iv) The educational level increases the probability of using a Central Bank Digital Currency according to the level at which it is, if there is a secondary school it increases by 1.47%, with a non-university higher level it is increases by 16.34% and 26.44% if you have a university education. (v) Age of the individuals, older individuals are less likely to use a Central Bank Digital Currency due to less adaptation to the technologies used in digital means of payment, in the case of individuals whose ages are between 25-44 years old, the probability of using a digital currency increases by 8.74% compared to individuals aged 18-24 while in those over 45 years of age, the probability increases by only 4.46%. Finally, (vi) Individuals living in poverty reduce the probability of using a Central Bank Digital Currency by 2.26%.

In their opinion, Tobias and Mancini-Griffoli (2021) mentioned that broad technological and telephone access could benefit all the people who are still excluded from the financial system, however, for this transition to be successful, the technological gaps must be closed. On the other hand, it is argued that the adoption of a digital currency for payments of retail transactions must initially coexist with physical money, partially covering the demand for cash as Ruiz (2020) considers, likewise, as mentioned by Cámara et al. (2018) the adoption of the Central Bank Digital Currency in Latin American countries would imply improvements in the levels of financial inclusion and reduction of the costs of transportation and management of cash, but it could generate an increase in informality.

In this context, it is suggested that some public policy guidelines focus on the progressive reduction of the limitations to the implementation of a Central Bank Digital Currency such as advancing in the process of financial inclusion, closing internet connection gaps and in alliance with companies related to the financial, technological and communications system, the capacities of individuals in the use of digital means of payment must be strengthened.

Sanchez de la Pena (2022) assumes that the Central Bank Digital Currency has additional difficulties such as replacing cash and the ability to conduct the transactions without disrupting the economy.

In addition, Chaum et al. (2021) indicates that a Central Bank Digital Currency involves two possible designs: (a) an account-based Central Bank Digital Currency and (b) a token-based (or value-based) Central Bank Digital Currency. Corresponds to the two existing types of central bank money and respective payment systems: central bank reserves (in an account-based system) and banknotes (in a token-based system). A payment is made if a monetary asset is transferred from a payer to a payee. In an account-based system, a transfer occurs by charging the payer’s account and transferring the credit to the payee’s account. In a token-based system, the transfer occurs by transferring the value itself or the token, that is, an object representing the monetary asset.

However, within the limitations of the research we must noted that we incorporated economic and social variables from 2020 National Household Survey into the logit model. But it would be beneficial for future studies to broaden to a data panel that takes into account times before and after the COVID -19 health crisis in order to determine whether there were changes in the use of digital payment methods as well as incorporating some variables that collect the tastes and preferences of the agents for the use of a digital payment method, the size of the informal economy, an indicator that reflects the degree of financial inclusion among others. Finally, it is suggested that the following questions be addressed in future research: Is the process of implementing a digital currency for retail purchases only possible in cities with higher levels of financial inclusion? Can a digital currency be used for retail purchase in rural areas?

References

Arauz, A., & Garratt, R. (2021). Dinero Electrónico: The rise and fall of Ecuador's central bank digital currency. Latin American Journal of Central Banking, 2(2), 100030.Available at: https://doi.org/10.1016/j.latcb.2021.100030.

Armelius, H., Boel, P., Claussen, C. A., & Nessén, M. (2018). The e-krona and the macroeconomy. Sweden's Riksbank Economic Review(3), 43-65.

Auer, R. A., Cornelli, G., & Frost, J. (2020). Rise of the central bank digital currencies: Drivers, approaches and technologies. CESifo Working Paper No. 8655.

Auer, R., & Böhme, R. (2021). Central bank digital currency: The quest for minimally invasive technology. Bank for International Settlements No. 948.

Aurazo, J., & Vega, M. (2020). Why do people use digital payments?: Evidence from microdata from Peru. Central Reserve Bank of Peru (No. 2020-016).

Belke, A., & Beretta, E. (2020). From cash to private and public digital currencies. The risk of financial instability and “modern monetary Middle ages”. Economics and Business Letters, 9(3), 189-196.

Belke, A., & Beretta, E. (2020). From cash to central bank digital currencies and cryptocurrencies: A balancing act between modernity and monetary stability. Journal of Economic Studies, 47(4), 911-938.Available at: https://doi.org/10.1108/jes-07-2019-0311.

Boar, C., & Wehrli, A. (2021). Ready, steady, go?-Results of the third BIS survey on central bank digital currency. BIS Papers, 114, 7-8.

Bordo, M. D., & Levin, A. T. (2017). Central bank digital currency and the future of mone-tary policy. National Bureau of Economic Research (No. w23711).

Bordo, M. D. (2021). Central bank digital currency in historical perspective: Another cross-road in monetary history. National Bureau of Economic Research (No. w29171).

Butola, P., Dube, P., & Jain, V. K. (2022). A study on impact of credit risk management on the profitability of Indian banks. International Journal of Management and Sustainability, 11(3), 103–114.Available at: https://doi.org/10.18488/11.v11i3.3068.

Cámara, N., Dos Santos, E., Grippa, F., Sebastian, J., Soto, F., & Varela, C. (2018). Central bank digital currencies: An assessment of their adoption in Latin America (No. 18/13).

Carrascosa, A., & Montalvo, J. G. (2021). Digital currencies: What should be the role of cen-tral banks? Valencian Institute of Economic Research. Spanish Economy Papers, 170, 43-61.

Carstens, A. (2019). The future of money and payments. Speech at the Central Bank of Ire-land. Retrieved from: https://www.bis.org/speeches/sp190322.pdf.

Chaum, D., Grothoff, C., & Moser, T. (2021). How to issue a central bank digital currency. SNB Working Papers 2021-03, 1 -29.

Fantacci, L., & Gobbi, L. (2021). Stablecoins, central bank digital currencies and US dollar hegemony. Accounting, Economics, and Law: A Convivium, 1-28.

Fernandez, F. H. (2021). Towards a European digital currency. Euro 2.0. Journal of European Community Law, 25(70), 1006-1033.

Gadou, L. M. A. (2022). Banking risk in selected MENA countries. International Journal of Innovative Research and Scientific Studies, 5(4), 306–331.Available at: https://doi.org/10.53894/ijirss.v5i4.743.

George, A. (2018). How satellite internet could provide disaster-proof coverage. Popular Me-chanics (March). Retrieved from: https://www.popularmechanics.com/technology/infrastructure/a15895600/disaster-proof-internet.

Gouveia, O. C., Dos Santos, E., De Lis, S. F., Neut, A., & Sebastián, J. (2017). Digital curren-cies issued by central banks: Adoption and repercussions. Work docu-ment. Retrieved from: https://www.bbvaresearch.com/wp-content/uploads/2017/09/1705_WP_CBDC_mod.pdf.

Janisch, F., & Stapleton, L. (2021). Digital currencies and community empowerment in aus-tria: Gesell’s concept of effective demand as a basis for local digital currencies. IFAC-Papers On Line, 54(13), 698-703.Available at: https://doi.org/10.1016/j.ifacol.2021.10.533.

Jiménez, N. J. P., & Zubiate, N. G. D. C. (2021). Challenges in the implementation of a sovereign digital currency in Peru. Retrieved from: https://repositorio.esan.edu.pe/handle/20.500.12640/2741.

Kahn, C. M., & Roberds, W. (2009). Why pay? An introduction to payments economics. Journal of Financial Intermediation, 18(1), 1-23.

Khiaonarong, T., & Humphrey, D. (2019). Cash use across countries and the demand for central bank digital currency. Journal of Payments Strategy & Systems, 13(1), 32-46.

Kochergina, D. A., & Yangirovab, A. I. (2019). Central bank digital currencies: Key character-istics and directions of influence on monetary and credit and payment systems. Finance: Theory and Practice, 23(4), 80-98.Available at: https://doi.org/10.26794/2587-5671-2019-23-4-80-98.

Latimer, P., & Duffy, M. (2019). Deconstructing digital currency and its risks: Why ASIC must rise to the regulatory challenge. Federal Law Review, 47(1), 121-150.Available at: https://doi.org/10.1177/0067205x18816237.

Lee, D. K. C., Yan, L., & Wang, Y. (2021). A global perspective on central bank digital currency. China Economic Journal, 14(1), 52-66.

Legal, D., Blanco, C., & Ortiz Ibarrola, G. (2022). Central bank digital currency: Implications for financial stability and monetary policy in Paraguay. Central Bank of Paraguay Working Documents, 27, 1 -35.

Li, S., & Jing, X. (2020). Intelligent digital currency and dynamic coding service system based on internet of things technology. Complexity, 2020, 1-16.

Mancini-Griffoli, T., Peria, M. S. M., Agur, I., Ari, A., Kiff, J., Popescu, A., & Rochon, C. (2018). Casting light on central bank digital currency. IMF Staff Discussion Note, 8(18), 1-39.

Ordóñez, M. F. (2020). Goodbye to the banks: A different vision of money and banking. Taurus. Retrieved from: https://books.google.com.pe/books?hl=es&lr=&id=cWHGDwAAQBAJ&oi=fnd&pg=PT3&dq=Ord%C3%B3%C3%B1ez,+M.+F.+(2020).+Adi%C3%B3s+a+los+bancos:+una+visi%C3%B3n+distinta+del+dinero+y+la+banca.+Taurus.&ots=Ly2QnluMPl&sig=e8z1LKRiveGed05Dqmx0fkUAlgo&redir_esc=y#v=onepage&q&f=false.

Peters, M. A., Green, B., & Yang, H. (2020). Cryptocurrencies, China's sovereign digital cur-rency (DCEP) and the US dollar system. Educational Philosophy and Theory, 1-7.

Rodríguez, C. V. (2020). Constitutional currency regime and stability of the general level of prices in Peru. Law PUCP Papers, 85, 277-320.

Ruiz, L. (2020). Advances in the introduction of central banking digital currencies. Central Bank Reserve of Peru. Currency Magazine 184, 8-14.

Sanchez de la Pena, S. (2022). The change in international trade with CBDCs. Retrieved from: https://titula.universidadeuropea.com/handle/20.500.12880/1287.

Sanz, B. P. (2021). Regulatory and financial challenges of the future Digital Euro. Retrieved from: https://repositorio.comillas.edu/xmlui/handle/11531/57200.

Tan, L., & Xue, L. (2021). Research on the development of digital currencies under the COVID-19 Epidemic. Procedia Computer Science, 187, 89-96.

Taylor, M. C. R., Wilson, C., Holttinen, E., & Morozova, A. (2020). Institutional arrangements for Fintech regulation and supervision: International monetary fund. Fintech Note 19/02, 1 – 7.

Tobias, A., & Mancini-Griffoli, T. (2021). A new era of digital money. Finance & develop-ment. Retrieved from: https://www.imf.org/external/pubs/ft/fandd/2021/06/online/digital-money-new-era-adrian-mancini-griffoli.htm.

Tong, W., & Jiayou, C. (2021). A study of the economic impact of central bank digital cur-rency under global competition. China Economic Journal, 14(1), 78-101.

Yermán Martínez, G. (2020). Central bank digital currencies. Master's Thesis University of the Republic (Uruguay), Faculty of Engineering.

Zams, B. M., Indrastuti, R., Pangersa, A. G., Hasniawati, N. A., Zahra, F. A., & Fauziah, I. A. (2020). Designing a central bank digital currency for Indonesia: The delphi–analytic network process. Bulletin of Monetary Economics and Banking, 23(3), 413-440.