An Empirical Analysis of the Factors Affecting the Profitability of China’s Agricultural Listed Companies under the Background of Agricultural Modernization

Zhen Ying Bugu1

He Yucheng2

1,2College of Economics and Management,Huazhong Agricultural University,Wuhan 400370,China. |

AbstractThe profitability of agricultural listed companies is an important aspect to measure the development level of agricultural modernization in China. Based on the relevant data of agricultural listed companies from 2011 to 2016, this paper empirically analyzes the relationship among the profitability of agricultural listed companies in China, the level of assets and liabilities, the degree of equity concentration , the level of primary business operation, tax subsidy intensity, income subsidy intensity and high-level agricultural modernization by using the method of multiple regression. Besides, high-level agricultural modernization listed company is the important trend of agricultural listed company development, which is also a focal point of this paper. The results show that the profitability of agricultural listed companies in China is negatively correlated with the level of assets and liabilities, and is positively correlated with the degree of equity concentration, the intensity of tax subsidies, and the high-level of agricultural modernization listed companies. However, the operating level of primary business and the intensity of income subsidy have no significant influence on the profitability of listed companies. According to the above conclusions, this paper puts forward the corresponding suggestions and countermeasures for the further improvement of the profitability of agricultural listed companies. |

Licensed: |

|

Keywords: |

|

| (* Corresponding Author) |

1. Introduction

In recent years, the role of agricultural modernization has been increasingly enhanced in the process of agricultural development in China. The No. 1 Central Document released by the CPC Central Committee has also highlighted the need to constantly accelerate the pace of agricultural modernization and promote the transformation and upgrading of agriculture. As a representative of agricultural modernization, the development of agricultural listed companies plays a crucial role in determining the future development trend of agriculture. As profitability is a key index to measure the development of agricultural listed companies, it is fairly vital to probe into the influencing factors of agricultural listed companies’ profitability in depth.

2. Literature Review

In terms of the profitability of listed companies in China, relevant scholars have done a lot of research from different perspectives. Wang and Zhang (2015) and Yang and Yi (2012) studied the influencing factors of profitability from the perspective of capital structure. The former two scholars take real estate listed companies as an example while the latter two scholars take listed companies in Hunan province as an example. Eventually, they drew the same conclusion that the debt ratio is negatively correlated with profitability. Leng and Wang (2006) studied the impacts of ownership concentration of agricultural listed companies on profitability from the perspective of ownership structure and finally found that the shareholding percentage of the largest shareholder had a significant influence on profitability. From the same perspective, Gu (2015) conducted relevant research and also came to a consistent conclusion through selecting 83 domestic securities companies. Apart form the above research perspectives, some scholars also studied the profitability of listed companies from the perspective of primary business. Huang (2008) carried out an empirical analysis of 35 agricultural listed companies and concluded that the specialization degree of agriculture as the primary business has a significant effect on profitability. Similarly, Du and Marable (2015) adopted the data of partial listed companies in 2004 and 2005 from Shanghai and Shenzhen stock markets and conducted the study by using both the univariate and multivariate analysis methods. The results showed that when the growth rate of the primary business increased, the profitability of enterprises would significantly enhance. The above studies primarily investigated the relevant factors of profitability from the perspective of internal management whereas the industry characteristics of the company’s were attached less consideration. Therefore, some scholars also carried out corresponding researches on the characteristics of traditional industries enjoying higher financial subsidies including the agriculture, machinery and equipment industry. Leng and Wang (2006) analyzed the data of agricultural listed companies from 2002 to 2005 through panel data model and found that tax subsidies had a significant impact on the profitability of agricultural listed companies while the income subsidy is right the opposite. He and Liu (2016) focused on the government subsidies, and they conducted relevant empirical tests on some listed companies concerning the machinery, equipment and instrument industries in China and ultimately reached the conclusion that there was a significant negative correlation between the intensity of government subsidies and the profitability of agricultural listed companies.

As the agricultural modernization is continuously advanced, the contribution of high-level agricultural modernization listed companies to the development of agricultural listed companies has become more and more significant. In addition, since agricultural listed companies embody the characteristics of both common listed companies and traditional industries, the paper probes into the profitability of agricultural listed companies from the following 6 aspects, namely,the level of assets and liabilities, the degree of equity concentration, the operating level of primary business, the intensity of tax subsidies, the intensity of income subsidies and the high-level agricultural modernization listed companies.

3.Methodology

3.1. Research Hypotheses

As a key indicator to measure the company’s overall state of operation, the level of assets and liabilities will directly affect the company’s profitability. According to the MM theorem, under certain conditions, as the total value of the company market is not affected by debt financing and equity financing, when the debt ratio (ie, debt-to-asset ratio) rises, the financial risk of the business also increases, resulting in the decline of its profitability. Thus, Hypothesis 1 is proposed in this paper.

H1: The profitability of agricultural listed companies in China is positively correlated with the level of assets and liabilities

Liu, Sun, and Liu (2003) found that the profitability of an enterprise will be affected by the degree of ownership concentration, on the basis of which Leng and Wang (2006) further studied the relationship between the two factors in agricultural listed companies and drew the conclusion that the degree of ownership concentration would positively affect the profitability. Accordingly, Hypothesis 2 is put forward in this paper.

H2: The profitability of agricultural listed companies in China is positively correlated with the degree of ownership concentration

The primary business of an enterprise is the main source of corporate profits, so the level of its primary business has a great impact on its profitability. Du and Marable (2015) and Huang (2008) researched the listed companies in China and the agricultural listed companies in China respectively, and concluded that the primary business operations have a significant impact on the profitability. Hence, the hypothesis 3 is raised in this paper.

H3: The profitability of agricultural listed companies in China is positively correlated with the business operation of primary businesses

Agriculture is a traditional industry in China, and when its development lags behind, the government often renders certain subsidies including tax subsidies and income subsidies. eng and Wang (2006) held the opinion that tax subsidies had a significant effect on the profitability of agricultural listed companies, while income subsidies were exactly the opposite. Gao and Peng (2018) took the A-share new energy automobile listed companies as the research object and came to the same conclusion. Both the automotive industry and the agricultural sector are industries with high subsidies, from which we assume Hypothesis 4 and Hypothesis 5.

H4: The profitability of China’s agricultural listed companies and tax subsidies are positively correlated

H5: The profitability of China’s agricultural listed companies is not related to income subsidies

Currently, there is no clear definition for high-level agricultural modernization listed companies in academia. However, some financial websites (including www.southmoney.com and www.10jqka.com) mention many agricultural listed companies with the features of agricultural modernization (Southmoney Website, 2004) and deem that modern agricultural listed companies are agricultural listed companies with some agricultural modernization characteristics. Based on this, this paper asserts that agricultural modernization listed companies should possess the following features by referring to the index system of agricultural modernization raised by Tan, Li, and Xie (2011) the State Council’s Notice on Issuance of the National Agricultural Modernization Plan (2016) and the relevant evaluation of the green development model and process for the Northern Wilderness agricultural modernization conducted by Wu, Wang, and Ma (2017) that is, modern machinery and equipment, modern advanced technology, multiple financing channels, diversified management mode, high quality employees as well as the concept of green production. Also, this paper defines the agricultural modernization listed companies embodying three or more above characteristics as the high-level agricultural modernization listed companies. In the course of the agricultural listed company’s development, the high-level agricultural modernization listed companies better adapt to the trend of agricultural modernization, make full use of the means of modern agriculture, improve its operational efficiency and production capacity, reduce production costs, and thereby make its profitability increase. Accordingly, Hypothesis 6 is proposed in this paper.

H6: The profitability of agricultural listed companies in China is positively correlated with the modernization level of agricultural listed companies3.2. Data Sources

Based on the industry classification standards of listed companies released by CITIC Securities, this paper selects the panel data of A-share agricultural listed companies from 2011 to 2016 in the research. Considering the validity of the selected data and the results of the analysis, this paper excludes the listed companies with ST-type and incomplete data from the sample. Sample company’s relevant data and information are obtained from Wind Database and Shanghai and Shenzhen Stock Exchange websites

3.3. Variables and Empirical Model

Based on the above hypotheses, the relevant variables are selected as follows:

| Variable Type | Variable Name | Variable Abbreviation | Variable Definition |

| Dependent Variable | Profitability | ROA | Total assets net interest rate |

| Independent Variable | The level of assets and liabilities | DA | Asset-liability ratio |

| The degree of equity concentration | OC | Shares held by the top ten shareholders | |

| The operating level of primary business | AI | Primary business income / total assets | |

| The intensity of tax subsidies | TS | Income tax revenue support = profit before tax * (25% - income tax expense / profit before tax) | |

| The intensity of income subsidies | IS | Government subsidies included in current profit and loss | |

| The high-level agricultural modernization listed companies | AM | If it is high-level agricultural modernization listed company or not | |

| Control Variable | The scales of enterprises | PN | The total number of employees |

For the classification of agricultural modernization listed companies, this paper adopts the method of content analysis (Qiu & Zou, 2004) to read the brief introduction to the company and business summary sentence by sentence of a total of 25 listed companies in agriculture-related companies and then picks and scores the statements correspondent with characteristics of the modern agricultural listed companies. The specific scoring rules are as follows: if the annual report discloses the relevant statement of a certain characteristic of the agricultural modernization listed company, 1 point is recorded, otherwise 0 point is recorded. In the meantime, in the process of reading information, in order to reduce the error caused by subjective consciousness, this paper has done the following in data collection process: (1) For a multiple perspective on the characteristics of a listed company in agriculture modernization; (2) The contents about the features of agricultural modernization listed company disclosed in the annual report can not simply display the features of the agricultural modernization listed company, so there must be the relevant text supporting explanation or the corresponding data. The related scoring results are shown in Table 2:

| Corporation | Modern Machinery and Equipment |

Modern Advanced Technology |

Multiple Financing Channels |

Diversified Management Mode |

High Quality Employees |

Concept of Green Production |

Total |

| Fengle Seed | 0 |

1 |

1 |

1 |

1 |

0 |

4 |

| Donlink | 1 |

0 |

1 |

0 |

0 |

0 |

2 |

| Nanning Sugar Industry | 0 |

1 |

0 |

1 |

1 |

0 |

3 |

| COFCO Biochemical | 0 |

1 |

0 |

0 |

0 |

0 |

1 |

| Longping High-tech | 1 |

1 |

0 |

1 |

1 |

1 |

5 |

| Denghai | 0 |

1 |

0 |

1 |

0 |

0 |

2 |

| Baolingbao Biology | 0 |

1 |

1 |

0 |

0 |

1 |

3 |

| Longlive | 0 |

1 |

1 |

0 |

0 |

1 |

3 |

| Win-all High-tech Seed | 0 |

1 |

0 |

1 |

1 |

0 |

3 |

| Quantum High-tech | 0 |

1 |

0 |

1 |

0 |

1 |

3 |

| Lontrue | 0 |

0 |

0 |

1 |

0 |

0 |

1 |

| Shenong Gene | 0 |

1 |

0 |

1 |

0 |

0 |

2 |

| Yasheng Group | 1 |

1 |

1 |

1 |

1 |

1 |

6 |

| Jinjian Cereals | 0 |

1 |

0 |

1 |

0 |

0 |

2 |

| Huazi Industry | 0 |

0 |

1 |

0 |

0 |

0 |

1 |

| Guannong Group | 0 |

1 |

1 |

0 |

0 |

1 |

3 |

| Zhongnongfa Seed | 0 |

1 |

0 |

1 |

0 |

0 |

2 |

| Dunhuang Seed | 0 |

1 |

0 |

0 |

0 |

0 |

1 |

| Xinjiang Talimu Agriculture Development | 0 |

0 |

0 |

1 |

0 |

0 |

1 |

| Wanxiang Doneed | 0 |

1 |

0 |

1 |

1 |

0 |

3 |

| Xinjiang Korla Pear Corporation | 0 |

0 |

0 |

1 |

0 |

1 |

2 |

| Beidahuang | 1 |

1 |

1 |

1 |

1 |

1 |

6 |

| COFCO Sugar | 1 |

0 |

0 |

1 |

0 |

0 |

2 |

| SDIC Zhonglu | 0 |

1 |

0 |

0 |

0 |

0 |

1 |

| Hainan Rubber Group | 0 |

0 |

1 |

0 |

0 |

1 |

2 |

| Source: Wind Database & Shanghai and Shenzhen Stock Exchange websites . |

Among them, 11 agricultural listed companies scoring more than 3 points including Fengle Seed Industry Co., Ltd. are regarded as high-level agricultural modernization listed companies. Nonetheless, when we determine whether the company is a high-level agricultural modernization listed company, there are merely two results -- it is or it is not. Therefore, this paper uses the dummy variables to measure the results. More specifically, 1 is marked if it is a high-level agricultural modernization listed company, otherwise 0 is marked.

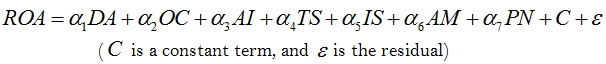

According to the above elaboration, this paper constructs the following multiple regression model:

4. Results and Discussion

4.1. Descriptive Statistical Analysis

As can be seen from the descriptive statistics in Table 3, the average debt-to-asset ratio is 0.402, showing that the overall debt level of agricultural listed companies is relatively high. The average shareholding ratio of the top ten shareholders exceeds 0.500, indicating that the equity of agricultural listed companies is relatively concentrated. The minimum degree of specialization is 0.005, while the maximum is 1.758 and the standard deviation is 0.378, which indicates that the primary business operations of agricultural listed companies vary widely. The average income tax support is 69.2 million yuan, which is closer to the maximum 186.7 million yuan, while the average of government subsidies included in the current profit and loss is 19.9 million yuan, closer to the minimum of zero. Hence, we can observe that the subsidies of agricultural listed companies come more from tax subsidies.

| Variable Name | N |

Min |

Max |

Average |

Standard Deviation |

| ROA | 150 |

-0.240 |

0.190 |

0.023 |

0.057 |

| DA | 150 |

0.030 |

0.950 |

0.402 |

0.224 |

| OC | 150 |

0.200 |

0.820 |

0.516 |

0.145 |

| AI | 150 |

0.005 |

1.758 |

0.518 |

0.378 |

| TS | 150 |

-3.894 |

1.867 |

0.692 |

0.656 |

| IS | 150 |

0.000 |

2.146 |

0.199 |

0.292 |

| AM | 150 |

0.000 |

1.000 |

0.440 |

0.498 |

| PN | 150 |

0.0048 |

7.617 |

0.573 |

1.387 |

| Valid N (list status) | 150 |

| Source: Computer analysis using SPSS 18.0. |

4.2. Correlation Analysis

Table 4 is the correlation analysis of variables using Pearson product-moment correlation coefficient test. The results reveal that the net asset-liability ratio may be significantly correlated with the total assets, the asset-liability ratio, the total of the top ten shareholders’ equity, the degree of agriculture as the primary business, the income tax support and agricultural modernization and may not be relevant to government subsidies included in current profits and losses.

| Variable Name | ROA |

DA |

OC |

AI |

TS |

IS |

AM |

PN |

| ROA | 1 |

|||||||

| DA | -0.399*** |

1 |

||||||

| OC | 0.288*** |

-0.134 |

1 |

|||||

| AI | -0.179** |

0.243*** |

-0.036 |

1 |

||||

| TS | 0.818*** |

-0.372*** |

0.171** |

-0.153* |

1 |

|||

| IS | -0.124 |

0.271*** |

0.019 |

0.246*** |

-0.070 |

1 |

||

| AM | 0.260*** |

-0.066 |

0.000 |

-0.200*** |

0.230*** |

0.114 |

1 |

|

| PN | -0.055 |

-0.021 |

0.376*** |

0.113 |

0.087 |

0.485*** |

-0.057 |

1 |

| Note: The two variables of each row and each column correspond to the related analysis results of two variables. *** means that it is significant at 1% level; ** means that it is significant at 5% level; and * means that it is significant at 10% level. |

4.3. Multiple Regression Analysis

To further verify the correlation between the profitability of agricultural listed companies and the various influencing factors, this paper adopts the method of multiple regression analysis to standardize the initial data, and the results are shown in Table 5. The results reveal that the asset -liability ratio, the total shareholding ratio of the top ten shareholders, the income tax support and whether the company is an agricultural modernization listed company is verified by the significant test while the specialization degree of agriculture as the primary business and government grants included in current gains and losses failed to pass the test. The analysis results of this model are as follows: R2 = 0.747, Adjusted R2 = 0.734, Durbin-Waston = 1.829, and F = 59.795, indicating that the fitting of this model is well and there is no multiple collinearity among variables, and there is no significant correlation between residuals. From the regression results in Table 5, we can see that:

Firstly, the profitability of agricultural listed companies in China is significantly and negatively correlated with the level of assets and liabilities (![]() = -0.111), so H1 is verified. This shows that the development of agricultural listed companies is relatively stable when compared to non-listed companies. At this time if the debt ratio continues to be increased, it will make the risk increase and the corporate profitability decrease.

= -0.111), so H1 is verified. This shows that the development of agricultural listed companies is relatively stable when compared to non-listed companies. At this time if the debt ratio continues to be increased, it will make the risk increase and the corporate profitability decrease.

Secondly, the profitability of agricultural listed companies in China is significantly and positively correlated with the ownership concentration (![]() = 0.237), so that H2 is verified. It can be seen from Table 5 that the P value is 0.000 and the result is very significant, showing that the ownership concentration is the main factor affecting its profitability. When the concentration of ownership is greater, the ability of major shareholders to supervise the company agents will be greater, and thus reducing the agency costs, improving the operating performance, and enhancing the company’s profitability.

= 0.237), so that H2 is verified. It can be seen from Table 5 that the P value is 0.000 and the result is very significant, showing that the ownership concentration is the main factor affecting its profitability. When the concentration of ownership is greater, the ability of major shareholders to supervise the company agents will be greater, and thus reducing the agency costs, improving the operating performance, and enhancing the company’s profitability.

Thirdly, the profitability of agricultural listed companies in China is not related to the level of primary business (![]() = 0.864), in which case, H3 is not verified. This shows that in agricultural listed companies, the primary business fails to play a role in enhancing profitability, and the reason may be that some agricultural companies make profits through non-primary business, and may even be that some non-agricultural enterprises are listed under the disguise of agricultural enterprises.

= 0.864), in which case, H3 is not verified. This shows that in agricultural listed companies, the primary business fails to play a role in enhancing profitability, and the reason may be that some agricultural companies make profits through non-primary business, and may even be that some non-agricultural enterprises are listed under the disguise of agricultural enterprises.

Fourthly, the profitability of agricultural listed companies in China is significantly and positively correlated with the intensity of tax subsidies (![]() = 0.745), and thus H4 is verified. Also, as can be seen from Table 5 that the P value is 0.000 and the correlation coefficient is as high as 0.745, we can see that, compared with other variables, the intensity of tax subsidies is the most important factor affecting the profitability of agricultural listed companies.

= 0.745), and thus H4 is verified. Also, as can be seen from Table 5 that the P value is 0.000 and the correlation coefficient is as high as 0.745, we can see that, compared with other variables, the intensity of tax subsidies is the most important factor affecting the profitability of agricultural listed companies.

| Model | Nonstandard Coefficient |

Standard Coefficient |

T Value |

P Value |

Collinear statistics |

||

B |

Standard Error |

Trial Version |

Allowance |

VIF |

|||

| C | 0.000 |

0.042 |

0.000 |

1.000 |

|||

| DA | -0.111** |

0.048 |

-0.111 |

-2.292 |

0.023 |

0.762 |

1.312 |

| OC | 0.237*** |

0.047 |

0.237 |

5.040 |

0.000 |

0.808 |

1.237 |

| AI | -0.008 |

0.045 |

-0.008 |

-0.172 |

0.864 |

0.876 |

1.142 |

| TS | 0.745*** |

0.047 |

0.745 |

15.782 |

0.000 |

0.800 |

1.251 |

| IS | 0.084 |

0.052 |

0.084 |

1.605 |

0.111 |

0.649 |

1.541 |

| AM | 0.076* |

0.044 |

0.076 |

1.706 |

0.090 |

0.909 |

1.100 |

| PN | -0.247 |

0.054 |

-0.247 |

-4.597 |

0.000 |

0.617 |

1.621 |

| Note: *** indicates that it is significant at 1% level; ** indicates that it is significant at 5% level; * indicates that it is significant at 10% level. |

Fifthly, the profitability of agricultural listed companies in China is irrelevant to the intensity of income subsidies (![]() = 0.111), so H5 is not verified. This reveals that the government subsidies for agricultural listed companies in terms of income are not conducive to the enhancement of the profitability, which illustrates that the subsidized income for agricultural listed companies mainly comes from the tax subsidies.

= 0.111), so H5 is not verified. This reveals that the government subsidies for agricultural listed companies in terms of income are not conducive to the enhancement of the profitability, which illustrates that the subsidized income for agricultural listed companies mainly comes from the tax subsidies.

Sixthly, the profitability of agricultural listed companies in China is positively correlated with the level of modernization of agricultural listed companies (![]() = 0.076), in which case, H6 is verified. This indicates that high-level agricultural modernization of listed companies can better integrate with the background of agricultural modernization and take advantage of modern agricultural means rationally and efficiently, so that when compared to other agricultural listed companies, they possess stronger profitability.

= 0.076), in which case, H6 is verified. This indicates that high-level agricultural modernization of listed companies can better integrate with the background of agricultural modernization and take advantage of modern agricultural means rationally and efficiently, so that when compared to other agricultural listed companies, they possess stronger profitability.

5. Conclusion and Recommendation

Based on the relevant data of agricultural listed companies from 2011 to 2016, this paper empirically verifies the relationship between the profitability and the level of assets and liabilities, the degree of equity concentration , the level of primary business operation, the intensity of tax subsidies, the intensity of income subsidies and high-level agricultural modern listed companies and the results turn out that: firstly, there is a significant negative correlation between the agricultural listed company’s profitability and its balance sheet; secondly, a significant positive correlation exists between agricultural listed company’s profitability and its ownership concentration; thirdly, the agricultural listed company’s profitability is significantly and positively correlated the intensity of tax subsidies; fourthly, there exists a significant positive correlation between agricultural listed company’s profitability and high-level agricultural modern listed companies; finally, agricultural listed company’s profitability is not relevant to the level of primary business operation or the intensity of income subsidies. According to the above conclusions, this paper puts forward the following suggestions to improve the profitability of China’s agricultural listed companies:

(1). To optimize the ownership structure and capital structure and to reduce the operating risk of agricultural listed companies.

At the corporation level, agricultural listed companies should further enhance the ownership concentration and reduce their debt ratio. The market capitalization of agricultural listed companies is generally low and the agriculture is seasonal, so that agricultural listed companies are relatively weak in avoiding risks, resulting in the need of a relatively concentrated ownership structures to ensure the effectiveness of business decisions and to timely response to market risks and unexpected situations. Simultaneously, enterprises should rationally allocate various types of assets and capital, improve their capital structure, reduce their debt ratio, collect information from multiple sources and seek more financing channels.

(2). To focus on primary business and improve the modernization level of agricultural listed companies.

Since the improvement of the agricultural modernization level of agricultural listed companies is one of the crucial guarantees for its long-term stable development. Therefore, agricultural listed companies should be combined with agricultural development status and their own actual situation and not blindly conduct non-agricultural diversification. As a representative of advanced agricultural productive forces, agricultural listed companies should seize the opportunity for the development of the transformation and upgrading of agriculture at this stage and highlight the agricultural primary businesses with their own advantages. It is necessary to constantly introduce agricultural machinery and equipment and advanced technologies, to endeavor to raise the level of modernization of agricultural listed companies from various aspects, to fully exploit their own potential for development and to enhance their core competitiveness.

(3). To perfect preferential tax policies in hopes to promote the innovation and development of agricultural listed companies.

From the perspective of the government subsidies effects, taxation subsidies are better than income subsidies. Though income subsidies also contribute to raise the profits of listed companies, it will increase the dependence of agricultural listed companies on the government to some extent and it is not conducive to the long-term development of agricultural listed companies. Therefore, the government should change the current form of subsidies on agricultural listed companies, reduce government income subsidies, improve the tax preferential policies at the same time to encourage agricultural listed companies to continuously innovate, assist agricultural listed companies to develop in their own, and then enhance their long-term and stable profitability.

6. Acknowledgements

Supported by Project of National Natural Science Foundation (71573098 & 71173085); the Fundamental Research Funds for the Central Universities(Program No.2662016PY072; Social Science Foundation for the Excellent Youths of Huazhong Agricultural University

References

Du, B. W. E. B., & Marable, M. (2015). Souls of black folk: Routledge.

Gao, X., & Peng, Y. (2018). Research on fiscal policy effects and time-varying of China’s new energy vehicles-empirical analysis based on the a-share listed companies of new energy vehicles. Economic Issues, 49(8), 49-56.

Gu, Y. (2015). An empirical study on the impacts of ownership structure of China’s security corporations on profitability. Systems Engineering, 33(2), 82-86.

He, H., & Liu, J. (2016). Property right, government subsidies and profitability -- an empirical test based on machinery, equipment and instrument listed companies. Journal of Central South University (Social Science), 22(2), 76-83.

Huang, C. (2008). Empirical analysis of China’s agricultural listed companies profitability and its influencing factors. Anhui Agricultural Sciences, 36(4), 1626-1628.

Leng, J., & Wang, K. (2006). Research on the impact of ownership structure of Chinese agricultural listed companies on the profitability of corporations. Qiusuo, 15(4), 15-18.

Liu, S., Sun, X., & Liu, N. (2003). Ultimate property theory, ownership structure and corporate performance. Economic Research Journal, 15(4), 51-62.

Qiu, J., & Zou, F. (2004). Research on content analysis method. Chinese Library Science, 30(150), 14-19.

Southmoney Website. (2004). Analysis of the agricultural modernization of listed companies [EB / OL]. Retrieved from http: //www.southmoney.com/fenxi/201407/121994.html .

State Council’s Notice on Issuance of the National Agricultural Modernization Plan. (2016). [EB / OL]. 2016-10-17.Retrieved from http: //www.gov.cn/zhengce/content/2016-10/20/content.5122217.htm .

Tan, A., Li, W., & Xie, F. (2011). Index system design of agricultural modernization in China. Journal of Arid Land Resources and Environment, 25(10), 7-14.

Wang, J., & Zhang, Y. (2015). Analysis of the relationship between capital structure and profitability - Empirical evidence from listed companies in real estate industry. Dongyue Tribune, 36(2), 140-146.

Wu, D., Wang, Y., & Ma, C. (2017). Green development model and process of agricultural modernization in the Great Northern Wilderness. Agricultural Modernization, 38(3), 367-374.

Yang, Y., & Yi, B. (2012). An empirical study of the relationship between asset structure, capital structure and profitability--take listed companies in Hunan province as an example. Journal of Central South University (Social Science Edition), 18(4), 111-116.