The Impact of Deferred Taxation on Banking Profitability and Capital Adequacy. Evidence from the Greek Banking System

Kyriazopoulos Georgios1*

Makriyiannis Georgios2

Logotheti Maria-Rafailia3

1,3University of Western Macedonia, Greece. |

AbstractThe need for a unified approach to businesses involved in the global economy and in particular in the financial markets around the world has been addressed by International Financial Reporting Standards (IFRSs), which are increasingly adopted by countries and especially in the banking field, which is also the main point of our research interest. In this paper we will look at one of the most important International Financial Reporting Standards, International Accounting Standard 12 (IAS 12), which deals with the accounting treatment of deferred income tax. We will present how IAS 12 accounts for deferred tax liabilities and receivables, and examine its application to the banking sector. Finally, we will investigate and compare with the help of the published financial statements of the Greek systemic banks and with the principle of application of International Financial Reporting Standards, deferred taxation and its effects on profitability and capital adequacy. So we will refer to the Greek case and see how the Greek banking system calculated and used deferred taxation. |

Licensed: |

|

Keywords: JEL Classification: |

|

|

Accepted: 26 August 2019 Published:5 September 2019 |

|

| (* Corresponding Author) |

Funding:This study received no specific financial support. |

Competing Interests: The authors declare that they have no competing interests. |

1. Introduction

The economic crisis of the last decade has had a very significant negative impact on Europe's overall economic situation and far more negative on our country. One of the sectors that have been under tremendous pressure and faced many problems during these years was the banking sector, which, following a series of almost mandatory mergers and acquisitions shrank significantly.

The economic crisis of the last decade has had a very significant negative impact on Europe's overall economic situation and far more negative on our country. One of the sectors that have been under tremendous pressure and faced many problems during these years was the banking sector, which, following a series of almost mandatory takeovers and mergers shrank significantly. Specifically, in Greece from 2002 until 2018 there were 5 commercial banks of which 4 are systemic banks. We refer to the year 2002 as the year Greece adopted the Euro as its own currency, as it entered the Eurozone.

Deferred taxation is an existing concept in the accounting practice of businesses in general and banks in particular, its use in which we will deal with this work. Of particular interest is its use as a policy tool and its consequences on Greek credit institutions in recent years as a result of the economic crisis, and in particular given the significant capital adequacy problems that have arisen as a result of the participation of Greek banks in the Greek credit restructuring program. Government debt and the swelling problem of red loans in times of crisis.

We will try to approach the issue from the standpoint of International Financial Reporting Standards and more specifically International Accounting Standard 12 which refers to corporate income tax and is the standard through which deferred tax is accounted. We will examine their application in the banking sector in general and in the Greek banking sector in particular under the relevant legislation. We will in fact present a detailed presentation of International Accounting Standard 9 and 12 "Income Taxes" and its interpretations, a template that includes the concept of deferred taxation. We will look at the concepts of accounting and tax base, temporary differences and will conclude with what is called Deferred Tax Liability and Deferred Tax Liability and how this is reflected in the Financial Statements of the Entities.

At the second chapter of this paper we talk about the relevant IFRS that concern the deferred taxation of banks. The definition of deferred taxation is also given. Then we give the definitions of mergers and acquisitions. We also display how a lot of Greek Banks from the year 2002 remained only 5 commercial banks and 4 of them are systemic banks after all mergers and acquisitions those 17 years.

2. Literature Review

According to Basel III, therefore, deferred tax assets that depend on the future profitability of each credit institution should be deducted from the calculation of the Common Equity Tier 1. Deferred tax assets can be offset against deferred tax liabilities only if they arise from taxes only if they arise from the same tax authority. When deferred tax assets relate to temporary differences, they are not entirely deducted from supervisory funds but retained as a proportion of them. In all other cases, for example, deferred tax assets arising from operating losses or unused tax profits (or losses), they should then be deducted from their total regulatory capital.

Amir, Kirschenheiter, and Willard (1997) divide deferred taxation into individual components and show that this provides clearer information to investors. They find that each of the individual categories may have different consequences. For example, the deferred tax asset that relates to depreciation and amortization shows to prospective investors that the business intends to invest in fixed assets and will find it difficult to reverse that liability in the future. In addition, the net realizable value of deferred tax liabilities and receivables that are carried forward is negatively correlated with the share price of a business.

Amirr and Sougiannis (1999) examine how equity analysts and investors incorporate information regarding a specific source of deferred taxes, tax carry forwards, into earnings forecasts and share prices. The authors find evidence supporting both the measurement and information effects. Specifically, they find that analysts consider the earnings of firms with tax carry forwards to be less persistent, consistent with the idea that the presence of tax carry forwards is a signal about the potential for future losses. Furthermore, the authors find that equity investors value the tax loss carry forwards as assets, consistent with the notion that they will provide future tax benefits.

Burgstahler, Brooke, and Hanlon (2002) examine the extent to which companies are examining the opportunities available for deferred tax accounting in order to make a profit and avoid losses. What they find is that companies with low profitability reduce the rate of deferred taxation in their results compared to those of the previous year, while the opposite is true for companies with small losses. No correlation was found between the increase in profits through the use of deferred taxation and the future increase in taxable income.

Poterba, Rao, and Seidman (2007) used a sample of 73 very large US companies to investigate the significance of deferred tax assets and liabilities. What has been concluded is that for 40% of these businesses at least 5% of equity consists of deferred tax assets, which means that possible changes in government policy on deferred taxation can have significant consequences for deferred taxation these companies.

Armstrong, Barth, Jagolinzer, and Riedl (2008) examine the response of markets to the adoption of IFRS in Europe, looking at sixteen events related to this adoption. Their findings include a positive impact on the quality of financial information, which they reportedly expected from the companies that adopted them. In the banking sector, they note that this positive effect has been more gradual. Generally, the cost of adopting IFRS was less than the benefits that came with it.

Agostino, Drago, and Silipo (2011) attempted to examine whether IFRSs are applicable affect the market value of financial institutions listed on European stock exchanges. They find that the introduction of IFRSs increased the information provided both on profitability and on the book value of banks because IFRSs require a greater degree of transparency. According to their research, there is a growing impact of earnings on share prices as a result of the mandatory adoption of IFRSs.

Chen, Tang, Jiang, and Lin (2010) explore the role of IFRS in accounting information quality, examining the quality of accounting information for listed companies in fifteen EU Member States before and after the adoption of IFRS. They conclude that, when the other factors related to business remain stable, the adoption of IFRS can reduce the speculative behavior of the administrations and the disposition to manipulate the profits that they may present.

Gebhardt and Novotny‐Farkas (2011) examine the impact of the adoption of IFRSs in Europe, in terms of the quality of accounting in the banking sector. Specifically, using a sample of banks from 12 European Union countries examining how changes in the recognition and measurement of operating income and the recognition of forecasts have affected the profitability and the timely presentation of losses. They concluded that the impact is smaller in countries where the regulatory framework is stricter and in cases where bank ownership is not in the hands of a few shareholders. They also concluded that the adoption of IFRSs. led to less timely recognition of accounting losses.

Gallemore (2012) explores the relationship between deferred tax assets and banks' regulatory capital. It examines whether the likelihood of bankruptcy is increasing as the proportion of regulatory capital consisting of such requirements increases, whether market participants take this risk into account, and whether existing rules encourage risk-taking by banks. Using a sample of US banks concludes that the proportion of regulatory capital consisting of deferred tax assets is positively correlated with the risk of bankruptcy of a credit institution and that although market participants take this risk into account when assessing the credit risk of a bank, it does not defer taxation by banks that are under-capitalized to take excessive risks. Gallemore (2012) find that proportion of regulatory capital composed of DTA is positively associated with the risk of bank failure. Furthermore, market participants appear to incorporate the increased risk of failure associated with the DTA component of capital when assessing bank credit risk. Finally, Gallemore (2012) find that the rules governing the inclusion of DTA into regulatory capital seem to have incentivized poorly capitalized banks to engage in increased risk-taking.

Tsalavoutas, André, and Evans (2012) compared the book value of shares of Greek listed companies and their relationship to their net profits before and after the adoption of IFRSs and they do not find that there is any change in their relationship after this development. However, they also conclude in the Greek case that the introduction of IFRSs helped improve the quality of accounting information, especially to investors. We will then present literature on deferred taxation.

Onali and Ginesti (2014) examine the impact of the introduction of IFRS. 9 in a sample of 5,400 listed companies from all over Europe. More specifically, they examine the impact that the most significant IFRS announcements have had 9 in the markets when they were made and find that there was generally a positive reaction. This adoption, according to the survey, is particularly beneficial for company shareholders in countries where legislation has been looser and the differences between domestic accounting plans and the previous standard (IAS 39) smaller. Investors according to the survey were particularly optimistic that the IFRS would be a good option. IFRS 9 will be able to solve problems arising from the deficiencies of IAS 39.

Hytis (2015) examines the role and significance of deferred taxation in ATHEX listed financial statements companies, with a sample of both financial institutions and other companies. As far as banks are concerned, there has been a discrepancy between accounting and taxable profits since 2009, with the latter being less. With respect to other companies, deferred tax liabilities are those that predominate and arise mainly from tangible fixed assets and investments in subsidiaries. Where there are deferred tax assets, these arise mainly from payroll and employer contributions, etc.

In particular, regarding deferred taxation in the Greek banking sector investigated the changes resulting from the application of International Accounting Standard 12 in the financial statements of ATHEX listed companies. of Greek banks for the years 2004-2009. They find that in all the financial years under consideration deferred tax assets are higher than deferred tax liabilities and raise doubts about the possibility of future offsetting with taxable profits. They do not find any relation between deferred taxation and the stock market price of the banks concerned.

Pascan (2015) conducted a study of the methods used by various researchers to measure the impact on the quality of accounting depictions from the transition from national accounting plans to IFRSs. He found that the quality of accounting statements is influenced by accounting standards but also by factors such as legislation and political systems. It concludes that the conclusions should be interpreted in the light of the circumstances of the country or company concerned.

Ladas, Negkakis, and Samara (2017) conducted a survey to show the relationship between capital structure, risk of stock market collapse and deferred taxation for a sample of banks based in the Eurozone. The main purpose of the research was to investigate whether the use of deferred taxation could lead to the collapse of the stock market price. Their results have shown that if banks have high levels of deferred tax assets in their financial statements, there is an increased risk of a stock market crash. An interesting finding is that this relationship does not exist in banks based in countries affected by the financial crisis.

In relation to risk-taking, it is of interest to Skinner, Akiba, Akov, and Suzuki (2006) research on the use of deferred tax on Japanese banks' regulatory capital and its role in the collapse of some of them and the country's 10-year banking crisis. Since 1998, when the use of deferred taxation by banks in Japan has been allowed, in 2003 it has made up 29% of banks' capital. The author states that the license to use deferred taxation by banks was a form of Japanese government assistance to the then sub-capitalized Japanese banks. According to the survey, the worst-performing banks recognized very large, unrealistic, tax claims with extremely unpleasant results.

Papadeas, Hyz, and Kossieri (2017) examine the consequences of the adoption of IFRSs and in particular IAS 12 to the Greek systemic banks. Noting that the cost of a bankruptcy would be enormous socially and economically for a country like Greece, they find a positive relationship between the definitive cleared tax claims and the profitability ratio of the Greek systemic banks. The National Bank, according to the study, is more dependent on deferred tax assets, followed by Piraeus Bank, Eurobank and lastly Alpha Bank.

3. IFRS 9 and IFRS 12

In 1973, the professional accounting agencies of Australia, Canada, France, Germany, Japan, Mexico, Ireland, the United Kingdom and the United States of America set up the International Accounting Standards Committee - IASC). In 1989, the committee first published an international conceptual framework for the presentation of financial statements. In 1999 the G7 (the union of the seven most powerful economies on the planet) asked the IASC for a proposal for a wide range of internationally recognized accounting standards in order to strengthen the international financial system.In 2000, the committee was reorganized and the International Accounting Standards Board (IASB), which is also part of the newly established International Accounting Standards Board (IASC Foundation), was established and in 2003 the first International Financial Reporting Standard was issued. 2005, the first year of IFRS in the European Union, 7,000 companies from 25 countries transitioned from national accounting standards to IFRS. As of 2007, more than 100 countries have permitted or required financial entities operating in their use of IFRS and in 2009 G20 leaders emphasize the need for a rapid transition to global accounting standards. In 2010 the Foundation's Articles of Association were revised and renamed to the International Financial Reporting Standards Foundation (IFRS Foundation). In 2015, the European Union makes a positive assessment of the first ten years of applying IFRSs and more than 144 of the 166 officially recognized accounting standards entities use IFRS.

The IFRS Foundation has as primary goals (Grant, 2016):

- The creation of a single set of comprehensible, applicable and high quality globally accepted accounting standards for the common interest requiring transparent, comparable and high quality information in the Financial Statements and other financial reports to assist global equity participants; and other users in their financial decisions.

- Promoting the use and rigorous application of those standards.

- An assessment of the specific needs of small and medium-sized entities and emerging economies; (d) promoting and facilitating the adoption of IFRS through the convergence of national accounting standards and IFRS.

The IFRS Foundation has adopted a three-tiered governance structure, comprising at the first level the International Accounting Standards Board – IASB (International Accounting Standards Board - IASB).

The European Parliament and the Council of the European Union, moving towards the harmonization of financial information and ensuring a high level of transparency and comparability of financial statements, and with a view to the effective functioning of the capital markets, adopted Regulation 1606/2002 which provided that ... " for each financial year beginning on or after 1 January 2005, the companies governed by the law of a Member State shall draw up the consolidated accounts them in accordance with International Accounting Standards ... if at the date of the balance sheet, their securities are admitted to trading on any regulated market of a Member State ... '.

The above Regulation was introduced into Greek law by Law 3229/2004 "Private Insurance Supervision, Gambling Supervision, and Control, Implementation of International Accounting Standards and Other Provisions", which added Law 2190/1920 "On Societies Limited" Chapter 15. This chapter states that from the beginning of 2005 listed companies, including credit institutions must necessarily comply with regulation 1606/2002 and draw up their balance sheets in accordance with IAS and also that unlisted public limited companies and limited liability companies may if they so wish, follow IAS.

IFRS 9 represents the response of the International Accounting Standards Board to the financial crisis and the challenges it has posed to financial institutions. IFRS 9 replaces the pre-existing IAS 39. The statutory effective date is January 1, 2018. Its purpose is to improve the accounting for financial assets and liabilities.

Under IFRS 9 the International Accounting Standards Board (IASB) introduces significant changes in areas that have very significant implications for financial institutions. More specifically it introduces changes:

- The classification and measurement of financial instruments.

- The introduction of a new expected impairment framework.

- Reforming hedge accounting models so that their accounting treatment can be better adapted to risk management activities.

IFRS impairment methodology 9 applies to all financial assets that are not measured at fair value through profit or loss. IFRS 9 requires each entity to recognize anticipated credit losses in all:

- Financial assets recognized at amortized cost.

- Financial assets recognized at fair value through other comprehensive income.

- Lease receivables in accordance with IAS 17.

- Revenue from contracts with customers under IFRS 15.

- Borrowings not recognized at fair value through profit or loss.

- Financial guarantee contracts.

IFRS 9 requires a provision to be recognized for each of the above categories of financial instruments, but it specifies three different approaches depending on the type of financial instrument, one general that applies to most financial assets and two exceptions. IFRS 9 first introduces a general three-stage credit risk recognition model as follows:

- Stage 1: - Financial Data Served Without Exacerbating Credit Risk.

- Stage 2: - Financial Assets Served with Exacerbated Credit Risk.

- Stage 3: - Non-performing Financial Statements.

According to a survey conducted by Moody's Credit Rating Company (2015) with a view to applying IFRS 9, the banks will be forced to adapt their operations to the following categories:

- Funds, Lending, Undertaking and Origin of Financial Instruments.

- Reclassification, reconciliation and measurement of financial instruments.

- Cooperation between financial and credit product and risk management units.

- Calculation and measurement of loan portfolio impairment.

- Data, systems, processes, reports and automation.

Finally, it is worth noting that the changes made to IFRS 9 will measure and classify financial assets, and will also have an impact on the amounts of deferred taxation affected by them, which will be more visible in the coming years given its effective date of 1 January 2018.

The main focus of our interest in this work is deferred taxation and its use in the banking sector. Its accounting treatment of International Financial Reporting Standards is set out in International Accounting Standard 12, Income Taxes. IAS 12 was set up to determine the appropriate accounting treatment for income tax and more specifically how to keep track of current and future tax liabilities. IAS IFRS 12 applies to all entities that prepare their financial statements using IFRSs with regard to income taxes. Its effective date is January 1, 1998. The standard includes income taxes on all taxation on an entity, as well as taxes levied abroad on the basis of taxable profits. It also includes taxes payable by a subsidiary or an entity related to an entity when it is in control of the distribution of profits. The basic principles of IAS 12 are the following (Grant, 2016):

- By recognizing an asset or a liability, the reporting entity expects to recover or settle the carrying amount of that asset. If recovery or settlement of the carrying amount of the asset is likely to reduce or increase future tax payments (relative to those that would have been had the recovery or settlement had no tax impact) then the entity should recognize a deferred tax asset or liability.

- Income tax is an expense recognized in the Statement of Comprehensive Income (in profit or loss or in other comprehensive income) if the transactions and events resulting from this tax effect are also recognized in the Statement of Comprehensive Income for the period considered.

- Income tax is an expense recognized directly in equity if the transactions and events that give rise to that tax impact are also recognized in equity.

- The recognition of deferred tax assets and liabilities in a business combination affects the amount of goodwill arising from that business combination or the amount of the profit of an opportunity market.

In the tax regime of many countries, including Greece, the taxable profit (loss) differs from the accounting profit (loss). This difference arises from the fact that for the purpose of measuring the accounting result, the competent authorities use rules different from those used by those responsible for calculating the tax result. Consequently, all entities that prepare financial statements in accordance with International Accounting Standards prepare a statement that describes the differences between taxable and accounting results.

According to IFRS 12 there are two categories of differences between the accounting and tax results permanent and temporary differences. Permanent differences relate to an income that has been recognized in profit or loss but will never be taxed or an expense that is similarly deducted from taxable profit. For temporary differences, they relate to amounts that affect the accounting period for the current period but are to be taxed in a subsequent period.

Entity income taxation is distinguished between current tax and deferred tax. Current taxation refers to how much is paid to the tax authorities and results from the company's annual income tax return. This amount corresponds to the taxable results of the current period and is a short term liability of the entity and is calculated using the tax rules applicable to the reference period.

IAS 12, in accordance with the general procedure for the introduction and application of standards, refers to four interpretations issued by the relevant committees. The first is SIC 25 "Income Taxes - Changes in the Tax Status of an Entity or its Shareholders", which states that changes in an entity's tax status (such as its listing) result in a change of its tax claims or liabilities. This applies to both current and deferred taxation, which, according to IAS. 12 should be recognized in profit or loss for the period. However, as this may be difficult to change, the KNU 25 allows for proportional sharing.

Second related interpretation is IFRIC 7 “Applying the Reclassification of Financial Statements under IAS 11 29 - Financial reporting in hyperinflationary economies'. It provides guidance on where the currency of the country in which an entity operates is subject to hyperinflationary pressures within a period. With respect to deferred tax, an entity shall recalculate deferred liabilities or receivables after first adjusting all balance sheet items affected by inflation at the beginning of the period. Following this adjustment, deferred tax assets or liabilities are adjusted for the amount of the change in the value of the currency over the period.

The third interpretation is IFRIC 21 “Contributions”. This interpretation applies primarily to IAS. 37 and the accounting treatment of contributions payable by law and the amount and timing of repayment are known. Exemptions under IFRIC 21 include income taxes that are within IAS. 12. Finally, IFRIC 23 "Uncertainty in the Accounting for Income Taxes" has also entered into force on 1 January 2019. This interpretation determines how IAS is. 12 must respond to any uncertainty arising in the calculation and registration of income tax. If an entity considers that the tax authorities are likely to disapprove of its tax treatment, it shall calculate any deferred tax liabilities or receivables on the basis of the probability that the relevant tax result will result.

Any entity that compiles its Financial Statements in accordance with IFRS should disclose in a separate way the amounts of its taxable income or expense, the relationship between its tax and accounting results, and specific financial statements disclosures of a possible deferred tax asset. As regards tax revenue (expenses), these may include:

- The current tax (debit or credit) and any adjustments to it within the period under consideration.

- Deferred tax amounts related either to temporary differences (creation and reversal), or to possible changes in tax rates and / or the imposition of new taxes.

- Amounts related to a benefit that results from current or deferred tax (expense) resulting from a tax loss that has not been previously recognized.

- Tax expense resulting from changes in accounting policies.

- Deferred tax expense resulting from depreciation or reversal of a deferred tax asset.

- With regard to disclosures about the relationship between an accounting and tax result, they should include.

- The total of current and deferred taxation that is debited (credited) directly to equity.

- Income tax related to other comprehensive income.

- Explain the relationship between tax revenue (expense) and accounting profit.

- An explanation of any change in the tax rate applied in relation to the previous year.

- Amounts of deductible temporary differences and unused tax losses and gains for which no deferred tax asset is recognized.

- The total amount of temporary differences arising from subsidiaries, branches etc. for which no deferred tax liability is recognized.

- Profits or losses from discontinued operations.

- Tax expense arising from the payment of dividends that have not been recognized as an expense in the Financial Statements.

- Any changes in the amount of the deferred tax asset of a business combination (when the entity is the acquirer). If recognition is not made at the time of the merger there must be an explanation of why this is the case.

Finally, if the entity in question discloses its deferred tax asset in the Financial Statements, it should disclose the amount of the claim and also explain the process through which it arose. This must be the case where the deferred claim depends on future taxable profits (other than a reversal of temporary differences) and when the entity has suffered loss in the same tax jurisdiction from which the claim arose.

4. Definition and Explanation of Deferred Taxation

In accordance with IAS 12, a DTA arising from temporary differences shall be recognised only to the extent that it is probable that taxable profit will be available against which the deductible temporary difference can be utilised. As such, independently of the characteristics of the transactions that gave origin to the recognition of these DTAs, no legal basis is available to justify granting an exemption from deducting these assets from CET1.

As we have already mentioned, the accounting result differs from the tax result due to the different rules used by the accounting and tax authorities to calculate the results. Some of these differences may be temporary, that is, the tax impact of one period's financial events can be felt in a subsequent period. Temporary differences can be reversed in contrast to permanent ones. Because of this fact, entities should recognize deferred taxation as it is essentially an accrued liability or a liability.

According to IAS 12 In order to recognize deferred tax, the accounting and tax value of an entity's assets and liabilities should be compared, and this difference will result in deferred tax. Initially, an entity should compare the carrying amount of assets and liabilities with their respective tax bases in order to calculate deferred tax.

The tax base of an asset or liability is the amount at which each asset is recognized for tax purposes. Here's a summary (Grant, 2016):

- Tax base of an asset = Book value + Future deductible amounts - Future taxable amounts.

- Tax liability of a liability = Book value + Future taxable amounts - Future deductible amounts.

IAS 12 to determine the amount of deferred tax uses the liability method. That is, it compares the book value of assets and liabilities with their tax base in order to calculate the temporary differences and then to calculate the resulting deferred tax. In brief, we have the following steps:

- Accounting Value - Tax Base = Provisional Difference.

- Temporary Difference X Tax Rate = Deferred Tax Claim or Obligation.

4.1. Deferred Tax Asset

The DTAs relates to a revenue (collected through a single cash payment) which is included in the taxable profit of the year where it is perceived, whereas, in accounting, the revenue is taken to profit or loss over a certain number of subsequent years.

Apart from the DTAs covered by Article 39 CRR, which do not rely on future profitability (conversions into tax credits) and are not to be deducted from CET1, the CRR does not recognise any other type of DTAs resulting from the application of the accounting framework as DTAs that do not rely on future profitability. This implies that all the DTAs resulting from the application of the accounting framework [temporary differences (revenue taxed, not yet recognised in accounting or expense recognised in accounting not yet deductible)], except those DTAs arising from temporary differences where all the conditions of Article 39(2) CRR are met, are subject to deduction from CET1 in the terms of Articles 36(1) (c), 38 and 48 CRR.

A deferred tax asset is an asset on a company's balance sheet that may be used to reduce its taxable income. It can refer to a situation where a business has overpaid taxes or taxes paid in advance on its balance sheet. These taxes are eventually returned to the business in the form of tax relief, and the over-payment is, therefore, an asset for the company. A deferred tax asset can conceptually be compared to rent paid in advance or refundable insurance premiums; while the business no longer has cash on hand, it does have comparable value, and this must be reflected in its financial statements. A deferred tax asset is the opposite of a deferred tax liability, which can increase the amount of income tax owed by a company (https://www.investopedia.com/terms/d/deferredtaxasset.asp).

Deferred tax assets arise when there are deductible temporary differences between the accounting and the taxable income. Deductible are the temporary differences that will result in deductible amounts in calculating the taxable profit (tax loss) that will arise in future periods when the carrying amount of the asset (or liability) is recovered (settled). Deductible temporary differences in accordance with International Accounting Standard 12 arise when:

Book value of assets <Tax basis or Accounting value of liability> Tax base.

Here are some examples of events that can create deductible temporary differences:

- Deductible temporary differences in accordance with International Accounting Standard 12 arise when.

Book value of assets <Tax basis or Accounting value of liability> Tax base.

Here are some examples of events that can create deductible temporary differences:

- Transactions affecting earnings (losses) for the period.

- Fair value adjustments and adjustments.

- Business combinations.

Deferred tax assets allow an entity the right to pay less tax in the future, provided that it is sufficient to have sufficient taxable income in the future. This may arise from the entity's future profitability or from a pre-existing recognition of deferred tax liability. If a tax receivable is recognized, corresponding tax revenue is recognized only if the entity is certain of its recovery. It is also noted that if there are not sufficient deferred tax liabilities to offset or no future profits are expected, deferred tax assets cannot be recognized.

4.2. Deferred Tax Liability

Deferred tax liability is a tax that is assessed or is due for the current period but has not yet been paid. The deferral comes from the difference in timing between when the tax is accrued and when the tax is paid. A deferred tax liability records the fact the company will, in the future, pay more income tax because of a transaction that took place during the current period, such as an installment sale receivable (https://www.investopedia.com/terms/d/deferredtaxliability.asp).

Deferred tax liabilities arise for an entity when it discloses taxable temporary differences. This definition means those differences that will result in taxable amounts in determining the taxable profit (loss) of future periods as the carrying amount of the asset is recovered (or settled). This is the difference between the book value and the tax base which will lead to less taxes being paid in the future. That is, we have according to IAS 12:

Book value of assets>Tax base or Book value of liability<Tax base

When the carrying amount of the assets is greater than their tax base then the expense deducted from the accounting profits when the asset is sold will be greater than the tax deductions that these assets will have, thus resulting in a higher tax profit accounting and necessarily have to pay higher income tax. Therefore, a future tax liability arises that is recognized as deferred.

We will see below some examples of transactions that create taxable temporary differences, which in turn lead to the recognition of a deferred tax liability.

- Transactions that affect the profits (losses) of the period.

- Transactions affecting the Statement of Financial Position.

- Fair value adjustments and adjustments.

- Business combinations and consolidations.

Deferred tax assets and liabilities are disclosed in separate items in the Balance Sheet of an entity and independently of any other liability or claim, as defined in IAS 1 which sets out the principles for the presentation of the Financial Statements. In particular, deferred tax assets must be recognized in non-current assets and deferred tax liabilities in the line of long-term liabilities.

The valuation of both deferred tax assets and deferred tax liabilities should be carried out taking into account the expected tax rates at their expected recovery or settlement. Also, given that any estimates of future taxable profit may have changed in each Balance Sheet, the carrying amount of any deferred tax asset should be reviewed and adjusted accordingly. Finally, deferred tax is part of the tax related profit or loss and should be shown in the income statement.

A common source of deferred tax liability is the difference in depreciation expense treatment by tax laws and accounting rules. The depreciation expense for long-lived assets for financial statements purposes is typically calculated using a straight-line method, while tax regulations allow companies to use an accelerated depreciation method. Since the straight-line method produces lower depreciation when compared to that of the under accelerated method, a company's accounting income is temporarily higher than its taxable income. Another common source of deferred tax liability is an installment sale, which is the revenue recognized when a company sells its products on credit to be paid off in equal amounts in the future. Under accounting rules, the company is allowed to recognize full income from the installment sale of general merchandise, while tax laws require companies to recognize the income when installment payments are made. This creates a temporary positive difference between the company's accounting earnings and taxable income, as well as a deferred tax liability (https://www.investopedia.com/terms/d/deferredtaxliability.asp).

5. Deferred Taxation of Banks the Case of Greek Banking System

Basel III enables banks to calculate in the Common Equity Tier 1 a percentage of deferred tax assets arising from the existence of temporary differences. Specifically, it is stipulated that up to 15% of such funds may consist of a total (without any of these funds being able to exceed 10% of the credit institution's ordinary shares and any surplus amount deducted from supervisory funds):

- Shares of non-consolidated financial institutions (eg banks, insurance companies, etc.).

- Mortgage rights of service.

- The aforementioned deferred tax assets.

To calculate the exact amount to be entered in the Common Equity Tier 1, multiply the total amount resulting from the above categories, after all the adjustments provided, by 17.65% (which in turn results from the participation rate of this 15% to the remaining 85%).

When the carrying amount of the assets is greater than their tax base then the expense deducted from the accounting profits when the asset is sold will be greater than the tax deductions that these assets will have, thus resulting in a higher tax profit accounting and necessarily have to pay higher income tax. Therefore, a future tax liability arises that is recognized as deferred.

Paragraph 2 of Article 27A (as amended by Article 5 of Law 4303/2014) provided conditionality for Greek banks to convert their deferred tax assets into final and outstanding claims against the Greek State. In order for credit institutions to proceed with this conversion, starting from the fiscal year 2015, accounting losses had to be incurred and the deferred tax assets related to the remaining unamortized amount of the debit difference from PSI participation and accumulated provisions from loan impairment. According to the law, the amount of Definitive Tax Claims (DTCs) will be calculated as follows:

Years |

Amount in million Euros |

2006 |

129 |

2007 |

156 |

2008 |

174 |

2009 |

82 |

2010 |

366 |

2011 |

1,000 |

2012 |

1,085 |

2013 |

2,189 |

2014 |

3,855 |

2015 |

4,906 |

2016 |

4,906. |

2017 |

4,906. |

2018 |

4,906 |

| Source: Authors' calculations from published financial statements of National Bank of Greece. |

Where EDTAs: the Eligible Deferred Tax Assets as mentioned above. In this way, the credit institution making use of this provision may offset future tax profits with existing tax loss.

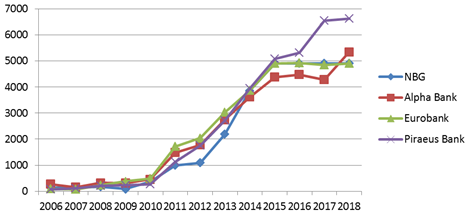

In the following 4 tables, we record the deferred tax assets of the four Systemic Greek Banks during the time period 2006-2018 according to the directives and the laws of Basel Committee III.

In the table 1 we calculated the deferred assets taxation of National Bank of Greece. In the second table, we calculated the deferred assets taxation of Alpha Bank. In the third table we calculated the deferred assets taxation of Eurobank and in the fourth table we calculated the deferred assets taxation of Piraeus Bank.

Years |

Amount in million Euros |

2006 |

261 |

2007 |

158 |

2008 |

316 |

2009 |

314 |

2010 |

456 |

2011 |

1,488 |

2012 |

1,780 |

2013 |

2,741 |

2014 |

3,604 |

2015 |

4,372 |

2016 |

4,477 |

2017 |

4,282 |

2018 |

5,340 |

| Source: Authors' calculations from published financial statements of Alpha Bank. |

Years |

Amount in million Euros |

2006 |

88 |

2007 |

71 |

2008 |

228 |

2009 |

375 |

2010 |

487 |

2011 |

1,708 |

2012 |

2,037 |

2013 |

3,024 |

2014 |

3,871 |

2015 |

4,902 |

2016 |

4,918 |

2017 |

4,846 |

2018 |

4,903 |

| Source: Authors' calculations from published financial statements of Eurobank. |

Years |

Amount (in millions of Euro) |

2006 |

80 |

2007 |

113 |

2008 |

216 |

2009 |

232 |

2010 |

272 |

2011 |

1,132 |

2012 |

1,757 |

2013 |

2,706 |

2014 |

3,950 |

2015 |

5,074 |

2016 |

5,318 |

2017 |

6,542 |

2018 |

6,615 |

| Source: Authors' calculations from published financial statements of Piraeus Bank. |

According to Figure 1 we can see that before the world financial crisis enter into the Greek Economy during the years 2006-2010, the Systemic Greek Banks have minimum and similar deferred tax assets. After the world financial crisis invades into the Greek Economy the Systemic Greek Banks had more differences in deferred tax assets and started to increase rapidly every year the deferred tax assets. As we can also see the bank that had the hugest amount of deferred tax assets is Piraeus Bank. As it is said in this paper the deferred tax assets helped banks in their recapitalization.

We will then present to each bank a table showing the amount of Deferred Tax Assets (DTAs), as well as those that may be converted into definitive and cleared claims against the Greek State under applicable law (Deferred Tax Credit) - DTC). We will also be presenting Common Equity Tier 1 (CET1) and Risk Weighted Assets (RWAs), so that we can see the definitive and cleared claims as a percentage and determine whether they are affected the banks' supervisory funds from deferred taxation.

These figures make sense after the PSI is implemented and so the tables that we will present are for the last five years (2014-2018), namely the publication of the Act of 36/23.12.2013 of the Executive Board of the Bank of Greece, which abolished the deduction of part of deferred taxation from regulatory capital and Regulation 575/2013, which gradually introduced Basel III provisions.

In all banks and in every financial year, the audit firms that are in charge of overseeing the Financial Statements emphasize the importance of deferred taxation. It is emphasized everywhere that it is an important issue of scrutiny and depends on the sound judgment and correctness of the assumptions of the administrations regarding future profitability. They note in all cases without exception that any failure in these judgments and assumptions may have adverse effects on the capital adequacy of the credit institutions concerned. Bank administrations, for their part, recognize the importance of deferred tax assets being included in the regulatory capital of their institutions and note that in the event that the legal / regulatory framework changes, there will be a problem with such regulatory capital.

As is clear from the tables 5-8 above, a very large proportion of the total deferred tax asset of all Greek systemic banks can be converted into a definitive and settled claim against the Greek State and thus may be included in their regulatory funds. Alpha Bank has shown the lowest percentage of deferred tax assets in its regulatory assets over time, while other banks alternate in the following positions. As for the last published financial year (2018), Eurobank is the one with the highest participation rate (85.9%). Banks also in many of their uses recognize deferred tax assets as a factor that has affected the profitability of that particular year.

| Years | 2014 |

2015 |

2016 |

2017 |

2018 |

| Deferred tax assets (DTA) (amounts in millions Euros) |

3,855 |

4,906 |

4,906 |

4,906 |

4,906 |

| Deferred tax credit (DTC) (amounts in millions Euros) |

3,300 |

4,906 |

4,800 |

4,700 |

4,600 |

| Common equity tier 1 (CET1) (amounts in millions Euros) |

6,058 |

7,000 |

6,700 |

6,300 |

5,600 |

| Risk weighted assets (RWA) (amounts in millions Euros) |

56,685 |

40,300 |

41,100 |

37,300 |

35,000 |

| DTC/CET1 (%) | 54.4 |

70.0 |

71.6 |

74.6 |

82.1 |

| DTC/RWA (%) | 5.8 |

12.1 |

11.7 |

12.6 |

13.1 |

| Source: Authors' calculations from published financial statements of National Bank of Greece. |

| Years | 2014 |

2015 |

2016 |

2017 |

2018 |

| Deferred tax assets (DTA) (amounts in millions Euros) |

3,689 |

4,398 |

4,477 |

4,282 |

5,340 |

| Deferred tax credit (DTC) (amounts in millions Euros) |

3,200 |

3,417 |

3,342 |

3,296 |

3,248 |

| Common equity tier 1 (CET1) (amounts in millions Euros) |

7,555 |

8,701 |

8,631 |

8,994 |

8,273 |

| Risk weighted assets (RWA) (amounts in millions Euros) |

52,780 |

52,243 |

50,535 |

49,060 |

47,640 |

| DTC/CET1 (%) | 42.3 |

39.2 |

38.7 |

36.7 |

39.2 |

| DTC/RWA (%) | 6.0 |

6.5 |

6.6 |

6.7 |

6.8 |

| Source: Authors' calculations from published financial statements of Alpha Bank. |

| Years | 2014 |

2015 |

2016 |

2017 |

2018 |

| Deferred tax assets (DTA) (amounts in millions Euros) |

3,871 |

4,902 |

4,918 |

4,846 |

4,903 |

| Deferred tax credit (DTC) (amounts in millions Euros) |

3,204 |

4,065 |

4,015 |

3,952 |

3,927 |

| Common equity tier 1 (CET1) (amounts in millions Euros) |

4,820 |

5,969 |

6,033 |

6,173 |

4,568 |

| Risk weighted assets (RWA) (amounts in millions Euros) |

39,062 |

33,445 |

32,113 |

32,189 |

34,436 |

| DTC/CET1 (%) | 66.5 |

68.1 |

66.5 |

64.0 |

85.9 |

| DTC/RWA (%) | 8.2 |

12.1 |

12.5 |

12.3 |

11.4 |

| Source: Authors' calculations from published financial statements of Eurobank. |

| Years | 2014 |

2015 |

2016 |

2017 |

2018 |

| Deferred tax assets (DTA) (amounts in millions Euros) |

3.951 |

5.075 |

5.318 |

6.543 |

6.615 |

| Deferred tax credit (DTC) (amounts in millions Euros) |

3,600 |

4,100 |

4,100 |

4,000 |

3,938 |

| Common equity tier 1 (CET1) (amounts in millions Euros) |

6,885 |

9,449 |

9,031 |

7,711 |

6,489 |

| Risk weighted assets (RWA) (amounts in millions Euros) |

55,720 |

50,277 |

49,877 |

50,981 |

47,554 |

| DTC/CET1 (%) | 52.2 |

43.4 |

45.4 |

51.9 |

60.6 |

| DTC/RWA (%) | 6.5 |

8.1 |

8.2 |

7,8 |

8.3 |

| Source: Authors' calculations from published financial statements of Piraeus Bank. |

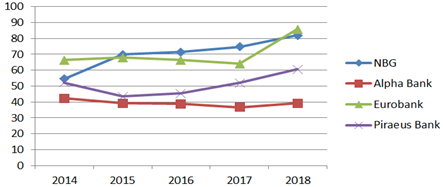

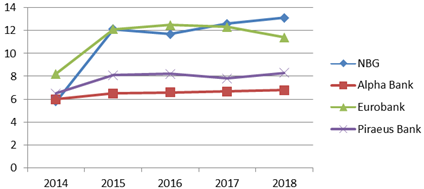

Taking into account the information set out in Tables 5, 6, 7, 8 above, Figure 2 and 3 are plotted below. Both charts show Alpha Bank's best financial position as it holds the lowest rates in both DTC / CET1 and DTC / RWA. We also note that both NBG and Eurobank have high rates of DTC / CET1 and DTC / RWA which condemns probably their significant exposure to Greek government bonds and toxic bonds.

6. Conclusion

According to the Greek Law, banks, leasing companies, and factoring companies can turn into certain and their outstanding claim against the Greek State against the deferred tax asset in the following cases (Skouzos & Dafouli, 2018):

- The debt arising from the exchange of Greek government bonds or corporate bonds with Greek government guarantees.

- The credit risk debt arising from the debtors' write-off, sale or contribution of loans or credits or their transfer to a financial or credit institution or to another company or legal entity provided that they are managed by a credit institution or a Debt and Debt Management Company and debt or credit write-offs.

- The amount of accumulated provisions and other generally credit-risk losses for which a deferred tax asset has or will be accounted for, in accordance with the provisions of IFRSs and IFRSs.

This claim is offset by the Greek State's requirement to pay taxes. In the event that this requirement is not sufficient, then such legal persons shall proceed increase of the share capital or cooperative capital in favor of the Greek State, which the Greek State acquires the right to convert. In essence, this provision of deferred tax assets is granted to financial institutions tax advantage and increase their capital liquidity, which is the most important.

The use of International Financial Reporting Standards has enabled more detailed and easily comparable financial statements between entities operating in different regions. Particularly in the financial sector, where the market is almost completely globalized, the adoption of common standards has made it possible to have the appropriate information available to everyone when making their investment choices.

At the same time, the use of IFRS has introduced concepts such as deferred taxation that have also been used in our work.

In general, we conclude that the issue of deferred taxation is of particular importance to Greek banks and affects their operating framework and their potential for participation in the development of the Greek economy. The total of Class 1 Common Equity Funds is € 24.93 billion for the fiscal year 2018, of which $ 19.14 billion relates to deferred tax assets and of which approximately $ 16 billion can be converted into final and outstanding public debt claims.

One solution to the problem may be the Bank of Greece's proposal for the management of non-performing exposures and deferred tax assets. The Bank of Greece deems that deferred tax assets (which accounted for 57% in mid-2018) of regulatory capital are a major problem and aim to reduce them to at least 30%. Within the Bank of Greece's proposals is the creation of a Special Purpose Vehicle Company, which will transfer a significant portion of the Non-performing exposures (red loans) and deferred tax assets. This will free the banks from the legal limitation imposed by them on loss-making, as their regulatory capital will be substantially free of the definitive and cleared claims against the Greek State.

The Bank of Greece's proposal, if accepted, concerns the removal of 7.4 billion euros in final and outstanding tax receivables from banks' balance sheets. Thus, depending on the contribution of this fund to the supervisory funds of each institution, banks will consolidate their balance sheets as markets do not consider these funds to be of very high quality. In addition, the Greek State will suffer a temporary loss, which it could possibly recover through the proceeds from the securitization and sale of the non-performing exposures mentioned above, but will not continue to fear compulsory participation in share capital increases of the loss-making banks and banks will be able to more effectively manage the remainder of the red loans.

Implementation of this proposal is subject to its acceptance by the Greek government and the institutions of the European Union, but maybe a step towards resolving this problem, which is made clear by the presentation of the data for all Greek systemic banks are one of the most important problems to manage.

Therefore, a deferred tax credit for banks acts as a permanent incentive for banks to maintain a profitable course and to implement their restructuring plans faster.

References

Agostino, M., Drago, D., & Silipo, D. B. (2011). The value relevance of IFRS in the European banking industry. Review of Quantitative Finance and Accounting, 36(3), 437-457.

Amir, E., Kirschenheiter, M., & Willard, K. (1997). The valuation of deferred taxes. Contemporary Accounting Research, 14, 597-622.

Amirr, E., & Sougiannis, T. (1999). Analysts’ interpretation and investors’ valuation of tax carry forwards. Contemporary Accounting Research, 16, 1-33.

Armstrong, C., Barth, M., Jagolinzer, A., & Riedl, E. (2008). Market reaction to the adoption of IFRS in Europe. Boston: Harvard Business School.

Burgstahler, D., Brooke, E. W., & Hanlon, M. (2002). How firms avoid losses: Evidence of use of the net deferred tax assets. Washington.: University of Washington Working Paper.

Chen, H., Tang, Q., Jiang, Y., & Lin, Z. (2010). The role of international financial reporting standards in accounting quality: Evidence from the European Union. Journal of International Financial Management & Accounting, 21(3), 220-278.

Gallemore, J. (2012). Deferred tax assets and bank regulatory capital. SSRN Electronic Journal.

Gebhardt, G. u., & Novotny‐Farkas, Z. (2011). Mandatory IFRS adoption and accounting quality of European banks. Journal of Business Finance & Accounting, 38(3‐4), 289-333.

Grant, T. (2016). Women in business: Turning promise into practice. London.

Hytis, E. (2015). Deferred tax assets from unused tax losses under the prism of financial crisis. Paper presented at the Conference: International Conference on Business & Economics of the Hellenic Open University At: Athens.

Ladas, A. C., Negkakis, C. I., & Samara, A. D. (2017). Accounting quality deferred tax and risk in the banking industry. International Journal of Banking, Accounting and Finance, 8(1), 1-19.

Moody's Credit Rating Company. (2015). Retrieved from: https://www.moodys.com/. [Accessed 12/2/2019].

Onali, E., & Ginesti, G. (2014). Pre-adoption market reaction to IFRS 9: A cross-country event-study. Journal of Accounting and Public Policy, 33(6), 628-637.

Papadeas, P., Hyz, A. B., & Kossieri, E. (2017). IAS Basel: The Contribution of Losses to the Banks' Capital Adequacy. International Journal of Business and Social Research, 7(2), 01-12.

Pascan, I.-D. (2015). Measuring the effects of IFRS adoption on accounting quality: A review. Procedia Economics and Finance, 32, 580-587.

Poterba, J., Rao, N., & Seidman, J. (2007). The significance and composition of deferred tax assets and liabilities. Cambridge (MA): NBER Working Paper Series, National Bureau of Economic Research.

Skinner, D. J., Akiba, K., Akov, N., & Suzuki, J. (2006). The role of deferred tax accounting in the Japanese banking crisis.

Skouzos, T., & Dafouli, E. (2018). What is deferred tax credit for banks. Naftrmporiki Economic News Greece November 2018.

Tsalavoutas, I., André, P., & Evans, L. (2012). The transition to IFRS and the value relevance of financial statements in Greece. The British Accounting Review, 44(4), 262-277.