Ownership Structure and Performance of Companies: Exploratory Study via a Systematic Review of the Literature

Khalil El Kouiri1*

Jamal Agouram2

Abdillah Kadouri3

1,3Laboratory of Research in Organizational Management Sciences, ENCG Kenitra, University ibnTofail, Morocco. |

AbstractThis article aims to understand the general context of research on the impact of ownership structure and performance of firms through a systematic review of references that include the keywords "ownership structure" and "performance" in their titles and that are published in English between 1990 and June 2020. For this purpose, we used articles published in journals indexed in the Scopus database. The uploaded articles are organized by the Mendeley Desktop tool and then transferred to the NVivo10 tool, in order to make a textual analysis of the elements contained in the articles. Data concerning the article, the characteristics of the study population, were collected. Our initial bibliographic search covered 229 articles published in 141 journals registered in more than 30 databases. It was found that the journals have published on this subject belongs to several disciplines related to governance, finance, and management and that they come from Anglo-Saxon countries. Our work can be considered as a support in the study of the scientific literature review related to ownership structure and performance. |

Licensed: |

|

Keywords: |

|

Received: 19 January 2021 |

|

| (* Corresponding Author) |

Funding: This study received no specific financial support. |

Competing Interests:The authors declare that they have no competing interests. |

1. Introduction

The ownership structure is a topic that is part of corporate governance research, of which the literature is relatively recent (Borochin & Yang, 2017; Chaganti & Damanpour, 1991; Graves & Waddock, 1994) . This topic has been the subject of research by several researchers since the last century and has been investigated from several complementary and contradictory viewpoints. Indeed, the correlation between ownership structure and company performance has been an important topic and many researchers have devoted a great deal of interest to it. The debate on the existence of a relationship between the ownership structure and the performance of the firm is a recurrent theme. While some research supports the presence of a link between ownership structure and the efficiency of governance (Gillan & Starks, 2000; Hartzell & Starks, 2003) others confirm the absence of a relationship be (Agrawal & Knoeber, 1996; Barber & Odean, 2008; Nagel, 2005). Several researchers have carried out work to highlight the relationship between the ownership structure and the performance of firms. In particular, financial literature has devoted a considerable degree of attention to this relationship (Agouram, Anoualigh, & Lakhnati, 2020; Agouram & Lakhnati, 2015, 2016; Agouram., Harabida, Radi, & Lakhnati, 2020; Jamal & Lakhnati, 2015). First, several works study the relationship between the concentration of capital and the performance of firms. Berle and Means (1933) were the ones who first launched this debate on the ownership structure of firms and their impact on the performance of the firm. They showed that the ownership structure was considered an exogenous variable in their research and argued that the link between the diffusion of ownership and the performance of the firm should be studied in a negative way. Demsetz (1983) opposes Berle and Means' conclusion and argues that the ownership structure of a firm should be considered endogenous. Hill and Snell (1988), based their study on firms in the United States of America. While Leech and Leahy (1991), tested this relationship on firms in the United Kingdom. While Morck, Nakamura, and Shivdasani (2000), have studied Japanese firms. Finally, Gorton and Schmid (2000) and Lehmann and Weigand (2000) have examined German firms. The results of previous research on the relationship between ownership and business performance are very different. In general, there are about five types of conclusions that can be drawn: positive linear relationship (Alonso-Bonis & de Andrés-Alonso, 2007), negative linear relationship (La Porta, Lopez-de-Silanes, Shleifer, & Vishny, 1998; Shleifer & Vishny, 1997) no significant relationship (Demsetz. & Villalonga, 2001), some combine opinions of the positive and negative linear relationship. In addition, some authors obtain mixed results from the findings for all of the variables they examined. This research paper seeks to explore how the literature review of firm ownership structure and performance has been approached by researchers throughout this period. For this reason, we have chosen to work on a systematic literature review related to this thematic.

In the first part, we will try to apprehend the concept of ownership structure in order to delimit the field of work of our systematic review. Thereafter, we will clarify the methodology adopted to establish our review. We will conclude our article by the presentation and analysis of the results, integrating the temporal dimension, without forgetting their interpretations, before ending with a conclusion

2. The Literature Review

2.1. Review of Narrative Literature

The literature review is an important step requiring a special effort to build a rigorous research project. Unfortunately, this stage no longer attracts the necessary attention of a large number of researchers, its importance lies in the fact that the setting up of the research project is based on the contributions of previous work such as articles published in journals, conference proceedings, or books ... etc., in order to study research questions that may be either complementary or even similar to this work, and by generating results based on the lines of research already treated to finally have the possibility of being published (Assar, 2013). In addition to its narrative and descriptive character, the literature review can be the object of a quantitative study, so the references used are considered "a population" that will be studied empirically. This is called a systematic literature review.

2.2. Systematic Review

Systematic literature review, also known as a meta-analysis, first appeared in the medical field at the beginning of the previous century, before it was adopted by other disciplines related to the humanities. It is applied exclusively to studies of an empirical nature, with the aim of statistically processing the data extracted from these studies. The difference between a systematic literature review and a narrative literature review is that the former is characterized by its comprehensiveness in collecting and analyzing published or unpublished research work on any given subject, without forgetting that this collection process is characterized by its transparency and clarity, the aim of which is to minimize bias, whereas the narrative review lacks scientific rigor, in other words, it fails to give a clear meaning to the collected contributions of the work studied (Tranfield, Denyer, & Smart, 2003).

2.3. Need For a Systematic Literature Review

The usefulness of adopting this type of literature review is to avoid the shortcomings and limitations of traditional literature reviews on the one hand. On the other hand, adopting a systematic literature review, on the other hand, provides an overview of the state of research in the subject matter of the review, making it easier for researchers in the future (Vuignier, 2016).The aim of our article is therefore to contribute to the enrichment of the literature on this subject, through the highlighting of previous work and research on ownership structure and performance and through the identification and analysis of the current state of the research location on this subject.

3. Methodology

Literature reviews already covered in a number of articles represent the entry point for establishing a systematic literature review. Adopting the systematic approach is justified by the need to refine the research on the relationship between ownership structure and performance while having a general view of the work done previously (Charlène, 2018). To initiate the process, we focused on our readings on a number of articles that have studied narrative and systematic literature reviews, on which researchers have based their literature reviews. A combination of keywords was used to define the scope of the search. We focused on the established English literature related to this topic. In other words, we limited ourselves to keywords in the English language and excluded those in other languages. This choice no longer represents discrimination of the work published in other languages, but it is justified by the fact that most of the work carried outcomes from Anglo-Saxon countries and the publications in other languages on this subject are rather meager (Carton & Mouricou, 2017). The keywords used in our research are "Ownership structure" and "performance". In order to build our sample, we tried to collect Scopus indexed articles whose theme is composed of the keywords "Ownership structure" and "performance". Several databases were searched, for example, ScienceDirect, Virtus interpress, Emerald, EJS Ebsco, Springer... The uploaded articles are published in renowned journals related to governance, finance and accounting. We also consulted the major accounting, finance, and general business journals where this type of articles is usually published (Journal of Corporate Ownership and Control, Journal of Corporate Finance, Applied Financial Economics, Strategic Management Journal, Journal of Finance, Journal of Business, Finance, and Accounting, etc.). Rigorous standards must be chosen to delineate the sample. These standards are generally linked to a selection of a number of renowned journals in a given specialty, to the quality of the journal (Ranking) or to the number of citations in a publication (Charlène, 2018). We used the SJR ranking tool, developed by the Elsevier editorial group, to rank journals (Vuignier, 2016). Since the article by Jensen and Meckling (1976), several researchers have begun to study the ownership structure. This article initiated the work devoted to the question of ownership structure, which has multiplied in recent years. The year 1990 constituted the lower bound of the period studied since the first published and indexed article, whose title clearly presents the keywords "Ownership structure" and "performance", was the article by Smith (1990). The upper bound will be the month of June 2020 (date corresponding to the completion of the bibliographical research) with the articles by Doan, Le, and Tran (2020) and Kuo, Lu, and Dinh (2020) After eliminating the journals in which no articles are published with the combination of keywords used, and with the exclusion of books, papers and web pages, we were able to build a base of 229 articles published in 141 journals.

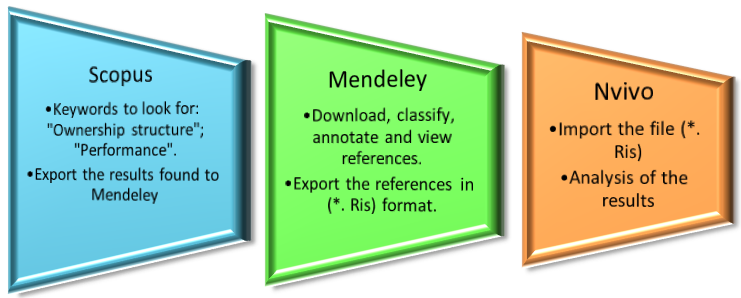

After determining the sample, we will perform a set of operations through three tools Scopus, Mendeley Desktop and NVivo. The following steps were followed to build a systematic review.

Figure-1. Steps for developing a systematic review.

In the Scopus tool, we will export the list of selected articles to the bibliographic management software "Mendeley Desktop". Afterwards, we will download the PDF version of each article in order to view, classify and complete the information of these articles. After checking and finishing, the next step is to export this list in (*. Ris) format. This file will in turn be imported into the NVivo software. The results from the search analysis tool provided by Scopus and via the text analysis functions of the NVivo software are multiple, but we choose to present them in an aggregated manner. Figure 1 schematizes the phases we are going to follow.

4. Results

4.1. Analysis by Reference

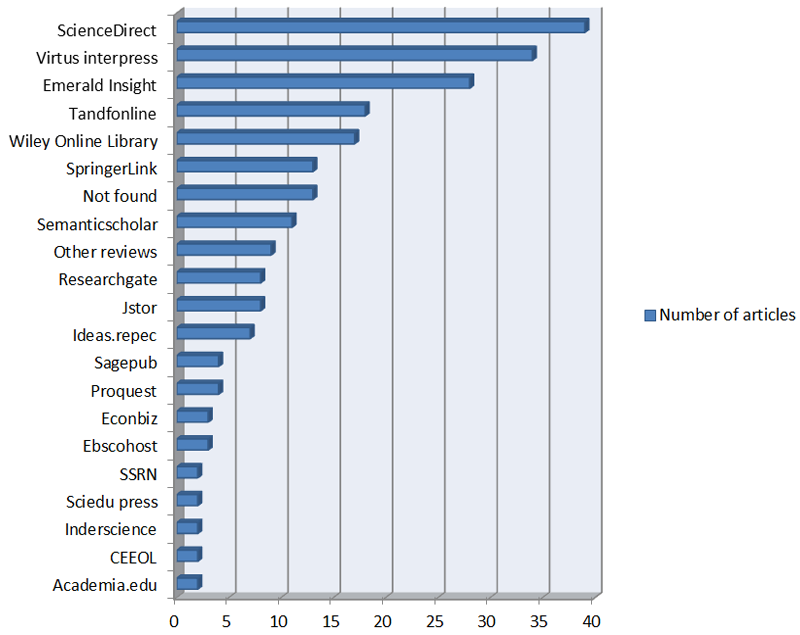

The selected articles represent 229, published in 141 journals registered in more than 30 databases. The database that represents the majority of the articles studied is "ScienceDirect", with 17% of the articles, followed by "Virtus interpress" and "Emerald insight" with successively 15% and 12%. "Tandfonline" and "Wiley Online Library" come in 4th and 5th position with successively 8 and 7%. The rest of the databases occupy percentages between 6 and 1% of the total number of articles studied Figure 2.

Figure-2. Number of articles per database.

4.2. Evolution of the Number of Publications per Year.

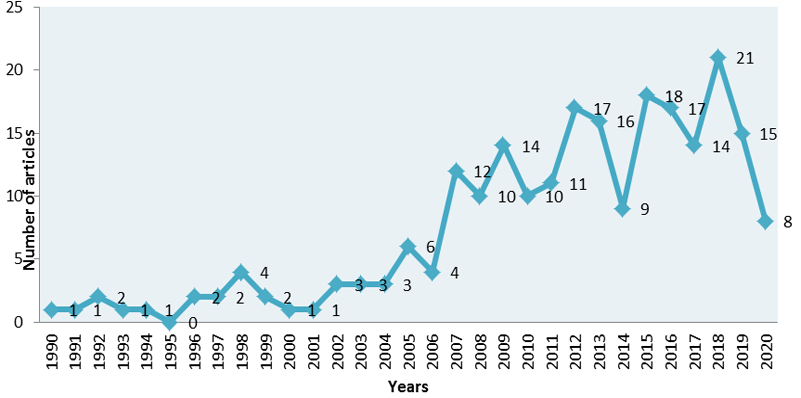

The total number of Scopus indexed scientific papers, whose title includes the keywords "Ownership structure" and "Performance" according to the results of the search algorithm performed on Scopus, between 1990 and June 2020, is growing (Graph1) especially in the last years, with 8 papers published in the first half of the current year2020, 15 in 2019. 2018 is the year that recorded the highest number of articles published, with 21 articles compared to only one article in 1990, which is the first, whose title includes the keywords "Ownership structure" and "Performance", this article is that of Smith (1990) entitled "Corporate ownership structure and performance. The case of management buyouts" Figure 3 .

Figure-3. Number of Scopus indexed articles whose title includes the keywords "Ownership structure" and "Performance" between 1990 and June 2020.

4.3. Evolution of the Number of Publications per Journal and Field of Activity

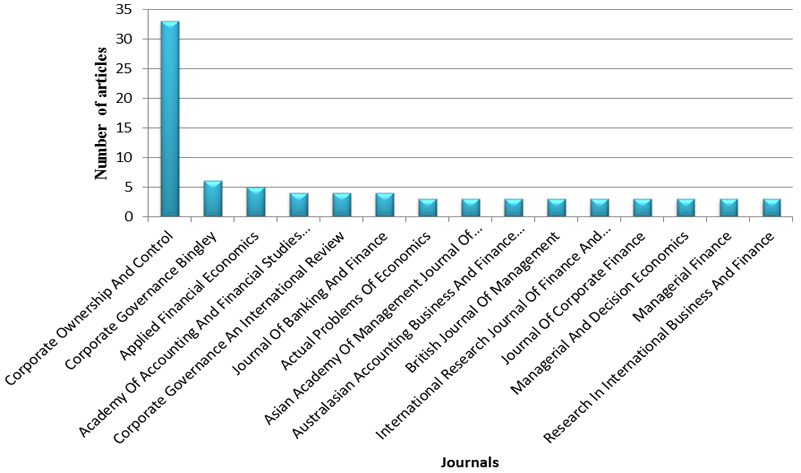

Regarding the 141 journals that have been identified, the majority of the downloaded articles are published in the journal "Corporate Ownership and Control" with 33 articles (33%), followed by "Corporate Governance Bingley" with 6 articles (2.6%), in 3rd position is the journal "Applied Financial Economics" with 5 articles (2.2%). The percentage occupied by the other journals is between 1.7 and.4% of the total number of articles in our sample Figure 4.

Figure-4. Number of articles per journal.

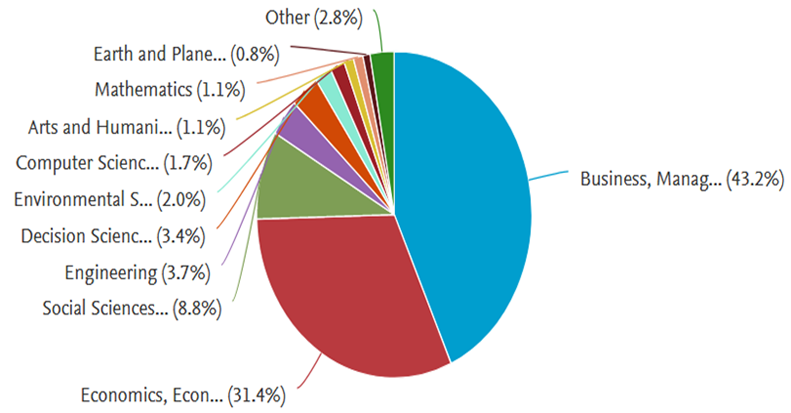

Based on the results found, our literature review agrees that the "Ownership Structure" and "performance" theme is characterized by its multidisciplinary (see Figure 2). As a result, 43.2% of articles are classified in the category "Business, Management and Accounting", followed by 31.4% in the category "Economics, Econometrics and Finance", 8.8% in "Social Sciences", 3.7% in "Engineering" and 3.4% in "Engineering". For the "Decision Sciences" domain. 9.6% are distributed among the other disciplines Figure 5.

Figure-5. Classification of articles according to discipline or field of activity.

4.4. Evolution of the Number of Publications per Author.

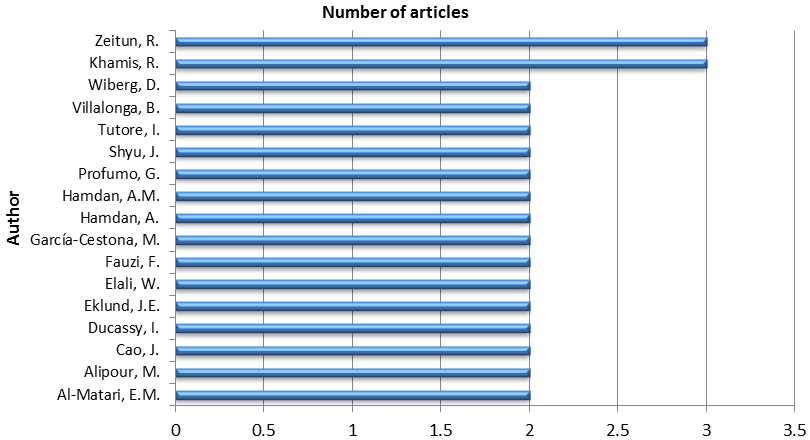

For the authors having published the largest number of articles on this topic are Khamis Reem and Zeitun Rami M. For the other authors, they have not published more than two articles as shown in Figure 6 .

Figure-6. Number of articles per author.

4.5. Evolution of the Number of Publications per Country

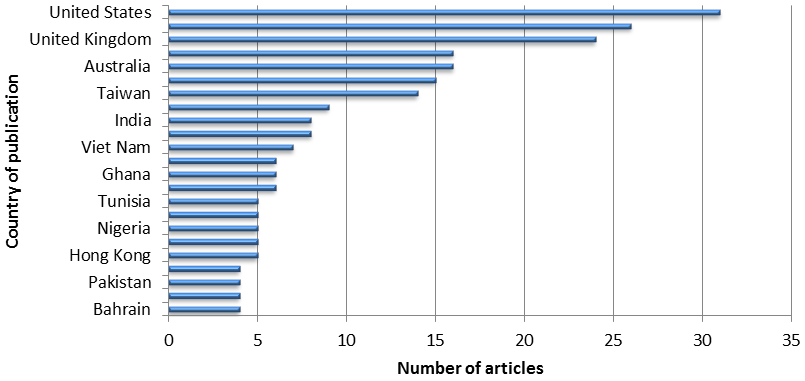

For the countries with a large number of publications, we have the United States with 32 articles representing 14% of the publications, followed by China with 26 articles representing 11.35% of the articles and in third position we have the United Kingdom with 24 articles representing 10.48%. The other countries register a percentage of less than 8% of the total number of publications Figure 7.

Figure-7. Number of articles per country.

4.6. Word Analysis (Word Cloud)

Through the Nvivo software, we can generate a query that will allow us to visualize the frequencies of words cited in the articles under study. Thus, they are represented according to their importance, the more a word is present, the more it will appear in large dimensions and are positioned in the center of the cloud, which allows us to detect the most used keywords in the cited references Figure 8

Figure-8. Clouds of words.

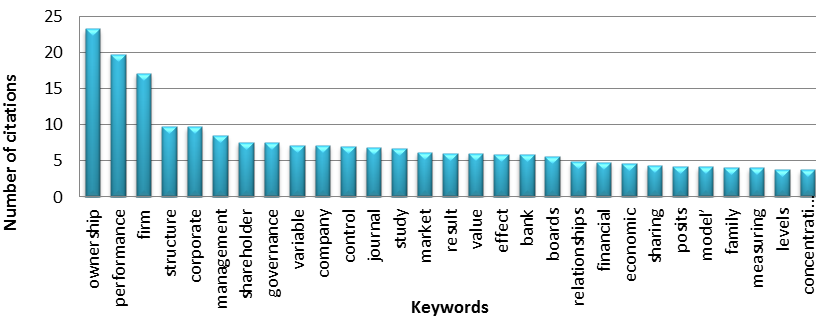

The most cited keywords in the selected articles are "Ownership" and "Performance", we also have the word "Firms" followed by "Structure" "corporate". Around these words, we can add others with almost the same dimensions, namely "Governance", "Management", "Value" Figure 9.

Figure-9. Ranking of keywords by number of citations.

5. Conclusion

Literature review is a subject of great importance in the scientific research community, it plays a major role in the perfection of scientific knowledge.

As a result, a systematic review of 229 scientific articles published in English between 1990 and June 2020 in 141 journals registered in more than 30 databases was carried out. We analyzed the side related to references and the side related to word frequency. It was found that the journals that published work on this topic belong to several disciplines that touch on governance, finance and management. Also, as our search is focused on articles published in English, most of the publications come from Anglo-Saxon countries.

Our work can be considered as a support in the study, review of scientific literature related to the structure of ownership and performance, despite its limitations, and which can be perfected through the expansion of the types of references studied (book, act of communication), published in other languages in addition to English (French, Spanish, Arabic ...) and in other reference base (Web of science or Google scholar).Like other research works, our work can be criticized for several reasons. The bibliographical study we have carried out is limited, we have used only articles and we have eliminated books and conference proceedings. Also, we have made fair use of Scopus indexed articles, and other indexing bases (Web Of Science and Google Scholar) have been excluded. Similarly, we limited ourselves to references published in English, which limited the scope of our work.

References

Agouram, J., Anoualigh, J., & Lakhnati, G. (2020). Capital asset pricing model (CAPM) study in mean-gini model. International Journal of Applied Economics, Finance and Accounting, 6(2), 57-63.Available at: https://doi.org/10.33094/8.2017.2020.62.57.63.

Agouram, J., & Lakhnati, G. (2015). A comparative study of mean-variance and mean Gini portfolio selection using VaR and CVaR. Journal of Financial Risk Management, 4(02), 72-81.Available at: https://doi.org/10.4236/jfrm.2015.42007.

Agouram, J., & Lakhnati, G. (2016). Mean-Gini and mean-extended gini portfolio selection: An empirical analysis. Risk Governance & Control: Financial Markets and Institutions, 6(3-1), 59-66.

Agouram., J., Harabida, M., Radi, B., & Lakhnati, G. (2020). An empirical comparison of different two-factor models in the context of portfolio optimisation. Advances in Science, Technology and Engineering Systems Journal, 5(5), 717-726.

Agrawal, A., & Knoeber, C. R. (1996). Firm performance and mechanisms to control agency problems between managers and shareholders. The Journal of Financial and Quantitative Analysis, 31(3), 377-397.Available at: 10.2307/2331397.

Alonso-Bonis, S., & de Andrés-Alonso, P. (2007). Ownership structure and performance in large Spanish companies. Empirical evidence in the context of an endogenous relation. Corporate Ownership and Control, 4(4), 206-216.

Assar, S. (2013). For a rigorous and systematic review of the MIS literature: Comparative and multidisciplinary study. AIM Workshop Research Methods in IS (RMiIS), April 2013, 1–15.

Barber, B. M., & Odean, T. (2008). All that glitters: The effect of attention and news on the buying behavior of individual and institutional investors. Review of Financial Studies, 21(2), 785–818.Available at: https://doi.org/10.1093/rfs/hhm079.

Berle, A. A., & Means, G. C. (1933). The modern corportation and private property (pp. 428): Transaction Publishers.

Borochin, P., & Yang, J. (2017). The effects of institutional investor objectives on firm valuation and governance. Journal of Financial Economics, 126(1), 171–199.Available at: https://doi.org/10.1016/j.jfineco.2017.06.013.

Carton, G., & Mouricou, P. (2017). What is management research for? A systematic analysis of the Anglo-Saxon literature on the rigor-relevance debate (1994-2013). AIMS/M@n@gement, 20(2), 166–203.Available at: https://doi.org/10.3917/mana.202.0166.

Chaganti, R., & Damanpour, F. (1991). Institutional ownership, capital structure, and firm performance. Strategic Management Journal, 12(7), 479–491.Available at: https://doi.org/10.1002/smj.4250120702.

Charlène, L. (2018). Innovation in a traditional context: A systematic literature review. Paper presented at the XXVII International Conference on Strategic Management.

Demsetz, H. (1983). The structure of ownership and the theory of the firm. The Journal of Law and Economics, 26(2), 375–390.Available at: https://doi.org/10.1086/467041.

Demsetz., H., & Villalonga, B. (2001). Ownership structure and corporate performance Journal of Corporate Finance, 7(3), 209–233.Available at: https://doi.org/10.1016/S0929-1199(01)00020-7.

Doan, A., Le, A., & Tran, Q. (2020). Economic uncertainty, ownership structure and small and medium enterprises performance. Australian Economic Papers, 59(2), 102–137.Available at: https://doi.org/10.1111/1467-8454.12174.

Gillan, S. L., & Starks, L. T. (2000). Corporate governance proposals and shareholder activism: The role of institutional investors. Journal of Financial Economics, 57(2), 275–305.Available at: https://doi.org/10.1016/S0304-405X(00)00058-1.

Gorton, G., & Schmid, F. A. (2000). Universal banking and the performance of German firms. Journal of Financial Economics, 58(1–2), 29–80.Available at: https://doi.org/10.1016/s0304-405x(00)00066-0.

Graves, S. B., & Waddock, S. A. (1994). Institutional owners and corporate social performance. Academy of Management Journal, 37(4), 1034–1046.Available at: https://doi.org/10.2307/256611.

Hartzell, J. C., & Starks, L. T. (2003). Institutional investors and executive compensation. The Journal of Finance, 58(6), 2351–2374.Available at: https://doi.org/10.1046/j.1540-6261.2003.00608.x.

Hill, C. W. L., & Snell, S. A. (1988). External control, corporate strategy, and firm performance in research-intensive industries. Strategic Management Journal, 9(6), 577–590.Available at: https://doi.org/10.1002/smj.4250090605.

Jamal, A., & Lakhnati, G. (2015). Mean-Gini portfolio selection: Forecasting VaR using GARCH models in Moroccan financial market. Journal of Economics and International Finance, 7(3), 51-58.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.Available at: https://doi.org/10.1016/0304-405X(76)90026-X.

Kuo, K.-C., Lu, W.-M., & Dinh, T. N. (2020). Firm performance and ownership structure: Dynamic network data envelopment analysis approach. Managerial and Decision Economics, 41(4), 608–623.Available at: https://doi.org/10.1002/mde.3124.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. W. (1998). Law and finance. Journal of Political Economy, 106(6), 1113–1155.Available at: https://doi.org/10.1086/250042.

Leech, D., & Leahy, J. (1991). Ownership structure, control type classifications and the performance of large British companies. The Economic Journal, 101(409), 1418-1437.Available at: https://doi.org/10.2307/2234893.

Lehmann, E., & Weigand, J. (2000). Does the governed corporation perform better? Governance structures and corporate performance in Germany. Review of Finance, 4(2), 157-195.

Morck, R., Nakamura, M., & Shivdasani, A. (2000). Banks, ownership structure, and firm value in Japan. The Journal of Business, 73(4), 539–567.Available at: https://doi.org/10.1086/209654.

Nagel, S. (2005). Short sales, institutional investors and the cross-section of stock returns. Journal of Financial Economics, 78(2), 277–309.Available at: https://doi.org/10.1016/j.jfineco.2004.08.008.

Shleifer, A., & Vishny, R. W. (1997). A survey of corporate governance. Journal of Finance, LII(2), 737–783.Available at: https://doi.org/10.1017/CBO9781107415324.004.

Smith, A. J. (1990). Corporate ownership structure and performance. The case of management buyouts. Journal of Financial Economics, 27(1), 143–164.Available at: https://doi.org/10.1016/0304-405X(90)90024-T.

Tranfield, D., Denyer, D., & Smart, P. (2003). Towards a methodology for developing evidence-informed management knowledge by means of systematic review. British Journal of Management, 14(3), 207–222.Available at: https://doi.org/10.1111/1467-8551.00375.

Vuignier, R. (2016). Place marketing and place branding: A systematic (and tentatively exhaustive) literature review. HAL Working Papers, (hal-01340352).