The Relationship between Domestic Credit, Financial Development and Economic Growth in the Gambia

Ismaila Y Jammeh

Department of Economics, Management and Industrial Engineering, University of Aveiro, Aveiro, Portugal. |

AbstractThis study examines the relationship between domestic credit availability to the private sector, financial development and economic growth in the Gambia from 1967 to 2020. Financial development has been a crucial driver of economic growth by channelling funds from those with financial resources, who lack the business investment ideas to those with investment decisions but lack the resources to kick start their investment ideas. The development of this sector will not only promote economic growth but will create confidence for lenders in providing funds to investors and these funds will be monitored to ensure they’re used in productive projects to prevent defaults and financial crises. The study employed a VAR analysis to examine the relationship between these variables. However, given the lack of data on financial development, the ratio of broad money to GDP and the ratio of domestic credit to the private sector to GDP was used as a measure of financial development. The result shows that financial development has a direct impact on the changing amount of domestic credit available for the private sector. Although the availability of domestic credit to the private sector has little impact on economic growth, this seemingly small impact will significantly improve further economic growth in the Gambia. Therefore, policymakers should put more effort into developing and improving the credibility of the financial sectors in the Gambia which will create confidence in lenders and thus monitor the activities of credit borrowers if those credits are used productively. |

Licensed: |

|

Keywords: |

|

Received: 5 May 2022 |

Funding: This study received no specific financial support. |

Competing Interests:The author declares that there are no conflicts of interest in publishing this article. |

1. Introduction

Financial development has been a fundamental driver of modern economic growth and development and a crucial factor in minimizing corruption and embezzlement. The role financial development plays in international trade and channelling funds from lenders to investors cannot be ignored. The catastrophic impact of the global financial crisis revealed that weak financial development can be detrimental to sectoral performance and economic growth. This catastrophic event also illustrated that financial development goes beyond having numerous financial intermediaries and infrastructure. In addition, it is crucial to have robust policies in place for supervision and regulation of the financial sector and investment decisions of borrowers.

According to the World Bank (2012) the financial sector is comprised of a set of institutions, markets and regulatory frameworks which reduces costs in the financial system by facilitating transactions. Reducing the cost of transactions in this sector will provide information, monitor investments and make trading easier, efficient and encourage savings. Financial development promotes economic growth by channelling savings to investors who have business ideas but lack the funds to implement those ideas or expand their existing businesses. Without the appropriate funds, some of the basic benefits of business, including employment opportunities, capital accumulation and technological progress may not be possible. Another benefit of the development of the financial sector is the inflows of foreign investment. This benefit has great potential to alleviate poverty and reduce inequality by providing access to finance enterprises which has a crucial role in economic development in emerging economies (World Bank, 2012).

Sipahutar, Oktaviani, Siregar, and Juanda (2016) also support the view that credit provided by banks and other financial institutions has a positive correlation with productivity and capital per worker. It was also stated by Gozgor (2014) that domestic credit is a major determinant of private investment in developing countries. Since most small and medium enterprises are labour intensive, growth in this sector means the creation of more job opportunities which will stimulate economic growth and development.

Hu (2010) found that SMEs growth is fundamental when it comes to job creation in less developed countries. On the other hand, in more developed countries, society promotes entrepreneurship activities, and these businesses have a positive and significant impact on economic growth. Countries that have larger shares of SMEs enjoy more economic growth rate. Neneh and Vanzyl (2014) also found that the growth of firms in terms of sales growth and asset growth has been a significant contributor to economic growth in South Africa. The lack of SMEs credit in Ireland has led to a significant reduction in SMEs investment which also enormously affected firm’s employment level Gerlach-Kristen, O'Connell, and O'Toole (2015).

1.1. Credit, Finance and Growth in the Gambia

Micro, small and medium-sized enterprises play a significant role in the economy of the Gambia through production, employment and income generation. They also made up a majority of all enterprises, contributing about 60% of the urban labour force between the age of 15 to 64. These businesses are a crucial source of work for youth from 18 to 35 years who owned more than 40% of SMEs in the wholesale and retail sector (62%) followed by manufacturing (16%) and other sectors. In addition, these SMEs also play a vital in regional development, providing community services and their flexibility and low cost incurred in changing business environments make them key contributors to regional equality (Njie, 2013). Despite the significant contribution of this sector to economic growth in the Gambia, they faced a huge setback in obtaining credits from financial and non-financial institutions which prevent their establishment, development and limited access to capital for start-ups.

As mentioned by Harvie and Lee (2005) SMEs in developing countries faced difficulties in obtaining credits due to the high risk of failing loans, low profitability and the high collateral required to obtain loans. While according to the World Bank (2010) the lack of access to credits is a consequence of weak banking institutions, a lack of capital market and an inefficient legal framework regarding credit and collateral assessment. In a country with poor financial development, characteristics of most African countries make it difficult for creditors to provide credits to the private sector. This means asymmetric information arises between the creditors and the borrowers about their investment projects, if these credits are used in non-productive investments leading to default will not only affect the financial institution that provided the credit but will also affect every sector of the economy. This is a cause of the global financial crisis which affected credit availability. The improvement in financial development promotes savings and investment, more efficient capital accumulation and movement (De Gregorio & Guidotti, 1995; Duican & Pop, 2015). On the other hand, an environment with improper financial regulation may lead to a lack of efficiency in investment and the improvement in investment efficiency will have a greater impact in low and middle-income countries (De Gregorio & Guidotti, 1995).

2. Literature Review

2.1. Finance and Growth

Research has been conducted on the crucial impact of financial development and economic growth and how providing domestic credit can stimulate economic growth which are given in this part of the paper. Other studies also challenged the idea that the level of economic growth also determines the development of the financial sector and how this also will determine the amount of credit available to the private sector.

Pagano (1993) found that financial development has a positive impact on economic growth through financial intermediation by encouraging savings which are put in investment or social marginal productivity of investment. He further argues that the effects of financial development on economic growth will be limited if there is an improvement in household credit sharing and the household’s credit market which may affect overall savings.

Benhabib and Spiegel (2000) also examine the role that financial development plays in stimulating economic growth and investment in Argentina, Chile, Indonesia, and Korea from 1965-1985. Their study found that financial development stimulates both total factor productivity and rate of investment in these countries and the improvement in financial development will promote the accumulation of physical capital.

Hsu, Tian, and Xu (2014) use a fixed effect identification strategy to examine how financial market development can improve innovation activities in a sample of thirty-two developed and emerging countries. The study found that innovation increases disproportionally in high technological industries with developed equity markets that depend on external finance but the development of the credit market disincentives innovation in these countries.

The relationship between finance and growth has also been studied by King and Levine (1993) as to how financial development can stimulate economic growth. The research observed a sample of 80 countries from the period 1960 to 1989 by using a pooled time-series approach. The results found an improvement in financial development to have a positive relationship with a faster economic growth rate before and after controlling for countries policies. From their studies, they also believe that the improvement in financial development will promote future growth of capital accumulation.

Calderón and Liu (2003) found that financial development and economic growth affect each other. Financial development promotes economic growth by increasing capital accumulation and growth in productivity. The impact of financial development on economic growth has more impact in developing countries. This study was done with a panel analysis of Pooled data of 109 developing and industrial economics from 1960 to 1994.

Moreover, Hassan, Sanchez, and Yu (2011) studied the relationship between financial development and economic growth in 168 Low and middle-income countries from 1980 to 2007 using a panel data approach and VAR variance decomposition to test for Granger causality. They found a positive relationship between financial development and economics in developing countries. In examining this relationship in the short run, they found a bidirectional causality between financial development and economic growth and in the poorest countries, growth stimulates financial development. They concluded that a well-functioning financial system is a necessary, but not sufficient condition to reach steady financial growth in developing countries.

De Gregorio and Guidotti (1995) studied this relationship in the Latin American countries from 1950 to 1985 and hundreds of cross countries samples from 1960 to 1985. They found that financial development has a positive effect on economic growth from the cross-sample, but the impact of financial development to economic growth was found to change with region, time and income level. Their study also found that financial development will lead to long-run growth in GDP per capita in middle- and low-income countries but in high income, it will not lead to growth in GDP per capita. This is due to financial development happening largely outside the banking sector. From their sample of the Latin American countries, they found a statistically significant negative relationship between financial development and growth, which they also believed that improved financial institutional regulations will determine the efficiency of the investment credits, the negative effect of the financial development on economic growth in Latin America is the result of financial freedom in an improper environment.

In contrast, other empirical studies found that financial development is independent to economic growth, implying that an improved financial sector will not affect economic growth or economic growth leading to improved financial development.

Demetriades and Hussein (1996) are one of the studies which opposed earlier studies examining the causality relationship between financial development and economic growth This study used time-series evidence from sixteen countries that are not highly developed in 1960 and have twenty-seven continuous annual data with a population of more than one million in 1990. The study found no evidence that financial development can lead to economic growth while a bi-directional relationship was found between financial development and economic growth which varies across countries in their cross-country’s analysis.

2.2. Domestic Credit and Growth

In the study of Duican and Pop (2015), it was found that bank credit has a significant impact on economic growth at regional level in Romania, they estimated that a 1 monetary unit increment in bank credit will stimulate economic growth by 1.47 monetary value. Given the impact of bank credit on economic growth, they concluded that for bank credit to translate to higher economic growth, there must be strong institutions, particularly financial institutions that will guide bank lending and monitor if these bank credits are used in productive sectors in preventing moral hazard problems.

Nzomoi, Were, and Rutto (2012) examines how banks provision of credit to Private sector credit can enhance economic performance in the economic sectors in Kenya 2000 to 2010 using a sectoral panel data estimation. They found a positive relationship between bank credit to sectoral development. However, this impact is limited if labor and past economic performance are controlled in these sectors. The study concluded that Bank credit to private sectors is fundamental in promoting growth in these sectors.

Leitão (2012) also examines the effects of bank credit on economic growth in the EU-27 from 1990-2010 using a dynamic panel model and a System GMM estimation method. This method includes real GDP per capita as a dependent variable and lag real GDP capita, domestic credit, bilateral trade, inflation and bank credit all in logs. His studies found that economic growth is a dynamic process, an increase in domestic credit reduces economic growth and if there is a credit boom will lead to a weakening banking system and further concluded that Domestic lending by banks will discourage economic growth.

Bui (2020) examines how providing domestic credit to the private sector can stimulate economic growth in 6 ASEAN Countries from 2014 to 2017 through the Lenses of a non-linear approach and GMM style estimation method. His study uses variables such as Domestic credit in the private sector, square of domestic credit while including trade openness and Inflation as controlled variables. The non-linearity intends to capture how domestic credit to the private sector will affect economic growth over time. He found that domestic credit has a positive impact on economic growth, but after a threshold of 97.5%, domestic credit will negatively affect economic growth. Over time the more the increase in domestic credit will affect economic growth if the credit is not used in productive investment.

Yakubu and Affoi (2014) studied the effects of credit provided by commercial banks on economic growth in Nigeria from 1992 to 2012. This study found that Commercial bank credit has a significant impact on economic growth in Nigeria which provides a similar conclusion to Duican and Pop (2015) on the role of strong financial institutions that will monitor credits provided to these private sectors if there are used in productive purposes. Amoo, Eboreime, Adamu, and Belonwu (2017) further use quarterly data from 1993 to 2013 and Fully modified Least squares estimation method to examine the impact of private sector credit on economic growth in Nigeria. Their study includes trade openness, monetary policy and fiscal policy which they measure by the ratio between budget surplus and deficit to GDP, domestic investment, infrastructure, and domestic credit to the private sector as explanatory variables on GDP per capita growth rate. They found that domestic credit to private sector has a positive significant impact on economic growth in a good policy environment. In turn, domestic credit to private sector also has a positive impact on economic growth even when domestic investment, trade openness, monetary policy and power infrastructure is low. Olowofeso, Adeleke, and Udoji (2015) examine how private sector credit can stimulate economic growth in Nigeria using data from the first quarter of 2000 to the fourth quarter of 2014. In studying this effect, they employed Gregory and Hansen's co-integration test for structural and endogeneity problems and fully modified OLS estimation to help overcome endogeneity problems. Their study used log GDP as a dependent variable and growth of credit to the private sector, total Government expenditure, prime lending rate, nominal exchange rate and gross capita formation as explanatory variables. They found a significant long-run positive relationship between private sector credit and economic growth. Their study also found a structural break in the first quarter of 2012 and they conclude that failing to account for such structural breaks can lead to underestimating this relationship. They believed the reasons for a mixed relationship between private sector credit and economic growth from studies by Amoo et al. (2017); Yakubu and Affoi (2014) are a result of failing to account for these structural breaks.

Gozgor (2014) examines the factors that determine domestic credit in twenty-four emerging markets economics and how external factors are involved in domestic credit ability in these countries from 2000 to 2011 using a dynamic panel difference GMM estimation method. Gozgor’s study includes the ratio of domestic credit to GDP as the dependent variable and lag domestic credit to GDP, lag inflation, log real GDP per capita, Nominal exchange rate, and lagged deposit rate were used as independent variables. These include additional control variables such as domestic money supply (broad money), the ratio of non-performing loans to gross total loans, net domestic incurrence and foreign incurrence of liability, different between domestic lending interest rate and global lending interest rate, real interest rate, private capital flow as a percentage of GDP. The study found that the increase in money supply has a positive impact on the amount of domestic credit available in these countries. Therefore, these countries openness to trade will significantly increase domestic credit and as a result, have a positive impact on the economy.

Gozgor (2015) further focused on the causality relationship between domestic credit and economic growth in fifty-eight developed and developing countries from 1970-2010. Gozgor used the Modified Granger causality test of Hatemi-J based on bootstrapped critical values. The study found a significant causal relationship between economic growth and domestic credit in seven developing countries, a unidirectional causality between economic growth and domestic credit in ten developing and five developed countries.

Beck and Demirguc-Kunt (2006) examine the factors that determine the financing obstacles from a sample of eighty developed and developing countries from 1999 to 2000 using a unique firm-level survey of over 10,000 firms. They found that large, old and foreign firms have more access to financing opportunities and firms in countries with low GDP per capita faced financing constraints. This is a result of the difference in institutions across countries which is the most crucial factor in explaining the difference in firm's financing opportunities.

Appiah-Otoo (2020) examines how COVID-19 is affecting domestic credit in China at the aggregate and bank-level and found that the increasing number of COVID-19 cases/death significant increase domestic credit and shocks in covid-19 has a positive impact on domestic credit both in the short and long-run.

Ananzeh (2016) studied the relationship between bank credits to all sectors (industry, construction, tourism) and individual sectors in Jordan with economic growth using quarterly data from 1993-2014 employing a Granger causality test and VECM estimation method. The causality analysis indicates the availability of bank credit to agriculture and construction is determined by the level of economic growth but there is bidirectional causality between economic development and bank credit to the construction sector. This is an important sector of the economy thus credit provided by bank to the overall sector has a positive long-run impact on the development of the Jordan economy. He concluded that increasing efficiency and improving the banking credit facilities will tremendously stimulate economic growth.

Camba and Camba (2020) investigate the long-run relationship between domestic credit and economic growth in the Philippines from 1995 to 2018. They used GDP growth and GDP per capita on domestic credit to the private sector by banks, and stock market liquidity and employed the ARDL bounds testing to co-integration and Granger test on VECM which they found a long-run relationship between domestic credit and economic growth both in GDP per capita growth and GDP growth and a causal relationship between domestic credit to GDP per capita.

Begum and Aziz (2019) examine the relationship between domestic credit to the private sector by utilizing bank’s real GDP in Bangladesh from 1983 to 2017. They found a statistically significant negative relationship between real GDP and domestic credit.

Sipahutar et al. (2016) utilized a VAR approach to investigate how credit availability by banks can promote economic growth, unemployment, and poverty in Indonesia from 1990 to 2014. They found that bank credit and economic growth has a bi-directional causality. An increase in economic growth will provide more credit available to businesses and increasing credit availability also stimulates economic growth and this also improves financial development.

Based on empirical evidence, the provision of credit by banks and other financial institutions has a significant impact on economic growth by enhancing business development and decrease unemployment by increasing labour demand and income which also depends on the financial development and institutions (Duican & Pop, 2015; Yakubu & Affoi, 2014) which will lose obstacles and provide confidence to lenders and monitor if the credits are use in productive sectors.

2.3. Measurements of Financial Development

The lack of data on financial development has led to different proxies to measure the financial development of a country in many literatures. According to the World Bank (2012), earlier empirical works measuring financial development was based on a standard quantitative indicator that were available for a broad range of countries but are only for approximation purposes. These studies do not capture all aspects of financial development since the financial sector is made up of various financial institutions, markets and products.

The traditional measurement relies on the use of monetary aggregates which is the ratio the monetary aggregate such as the ratio of M3 to GDP. The World Bank (2012) measurement of financial development comprises the measurement of financial depth, access, efficiency and stability of the financial institutions. The measure of financial depth includes the ratio of the private sector to GDP, the ratio of financial institutions assets to GDP, the ratio of M2 to GDP, the ratio of deposit to GDP and the ratio of gross value added of the financial sector to GDP. According to Calderón and Liu (2003) the common measurement of financial development is the ratio between M2 to GDP and Credit to Private sector to GDP, but other measures include the ratio between Gross claim on the private sector to GDP, real interest rate and Money bank credit to the private sector to GDP. These measurements of financial institutions using monetary aggregates has been criticized by De Gregorio and Guidotti (1995) who argued that using monetary aggregates such as (M3 to GDP) to measure financial development are misleading since many monetary aggregates such as M1 or M2 may also act as a proxy for financial development. While using real interest rate, in addition, might be a poor measurement given that the effect of real interest rate on growth cannot be stated as a measure of financial development on growth.

Demetriades and Hussein (1996) also mentioned that using the ratio of broad money (M3) to GDP does not reflect the volume of bank deposits rather than the currency used.

Moreover, monetary aggregates, M2 were also used by Calderón and Liu (2003) to measure financial development. Hassan et al. (2011) use domestic credit by the banking sector as a percentage of GDP, domestic credit to the private sector as a percentage of GDP and the ratio of gross domestic saving to GDP, which they believed converting savings to investment is a channel in which financial intermediation promotes growth. They also disputed the fact that using monetary aggregates such as M1 or M2 will not be a good proxy for countries with under-developed financial systems which is because these monetary aggregates measurements only capture transaction service of the financial system than the ability to channel funds.

Benhabib and Spiegel (2000) measure financial development by the ratio of liquid liabilities to GDP1 , deposit money bank domestic assets to deposit money bank assets plus central bank domestic assets and claims on the non-financial private sector to GDP (share credit funnelled via private sector). De Gregorio and Guidotti (1995) support the use of bank credit to the private sector to GDP to proxy financial development because it clearly measures the actual funds channelled to the private sector and links more to investment and growth than the other measures.

Different measurements of financial development and causality were also observed between financial development and economic growth and between domestic credit and economic growth in cross-sectional samples as per Demetriades and Hussein (1996). The study used cross-sectional studies due to different experiences of each country may be misleading in examining the relationship between financial development and economic growth. This study will be examining the relationship between domestic credit to the private sector, financial development and economic growth by using the different measurements of financial development in The Gambia.

3. Methodology

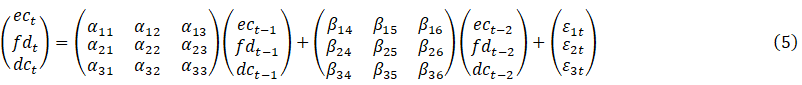

The study examines the relationship between domestic credit to the private sector, financial development and economic growth in the Gambia. To fully understand the relationship between these variables, a vector autoregression model VAR (p) was employed which is specified as,

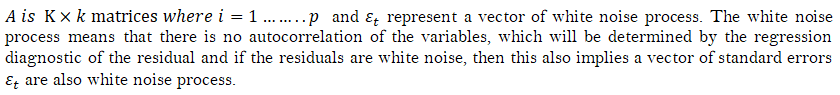

Equation 1 represents all variable that are used in the model to examine how a change in the lags of a variable affect the variable itself and the change in the lags of other variables. The variables in the model are given in Equation 2 which all act as endogenous and are regressed on their previous lags and the lags of other variables in the model.

The representation of the VAR(p) model as in Equation 1 will help to determine the relationship between these variables and the maximum number of lags ![]() is determined by the information criteria in Table 4 when we used broad money to GDP as a measure of financial development and Table 8 shows the maximum lag length when we used the ratio of domestic credit to the private sector to GDP as a measure of financial development. Furthermore, representing the model as Equation 1 will further help to determine the direction of causality between domestic credit to the private sector, financial development and economic growth which was also determined by the Granger causality test.

is determined by the information criteria in Table 4 when we used broad money to GDP as a measure of financial development and Table 8 shows the maximum lag length when we used the ratio of domestic credit to the private sector to GDP as a measure of financial development. Furthermore, representing the model as Equation 1 will further help to determine the direction of causality between domestic credit to the private sector, financial development and economic growth which was also determined by the Granger causality test.

According to the World Bank, the domestic credit to the private sector indicator measures the financial resources which are provided by depository corporations to the private sector in the form of loans, trade credits, purchase of no equity securities and other accounts receivable that have repayment claims2 .

It’s important to note that GDP per capita is used to measure economic growth in the Gambia, which is abbreviated as ![]() in the model. This is because modern economic growth is center around countries per capita GDP growth which will allow to capture scale effect in this country.

in the model. This is because modern economic growth is center around countries per capita GDP growth which will allow to capture scale effect in this country.

Moreover, in measuring financial development in the Gambia, I used both the ratio of broad money (M2) to GDP and the ratio of domestic credit to the private sector to GDP (Calderón & Liu, 2003). These sets of measurements of financial development will help to well capture the relationship between these variables and verify if the findings conform with other measures of financial development.

3.1. Model Specification

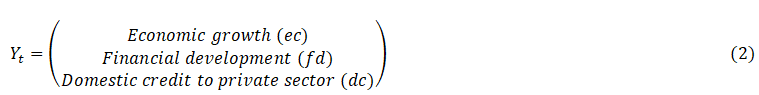

A matrix representation of the VAR (1) which is used to estimate these relationships by using the ratio of broad money to GDP as a measure of financial development in the Gambia and the model can be specified as,

More generally, Equation 3 is a matrix representation of the VAR (1) model which can be simplified by matrix multiplication to obtain Equation 4 in which all the variables act as both independent and endogenous and they are estimated simultaneously to examine how the variables in these study are affected by if previous lag and the lags of the other variables.

In Equation 4 GDP per capita, financial development and domestic credit to private sector variable in the VAR model are expressed as the first period lagged value of each variable and the first period lagged of other variables in the model and the behaviours of these variables depend on the properties as shown in Matrix A.

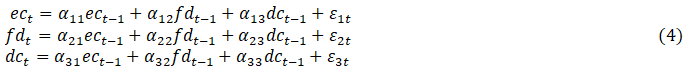

Using the ratio of broad money to GDP to measure financial development with its relationship to economic growth and domestic credit to the private sector in the Gambia, Equation 4 was used to estimate these relationships. This equation expressed each variable as a dependent variable as a linear combination of their own first-period lag and first period lag of other variables in the model and the use of this one lagged of the variables is supported by the information criteria in Table 4 which gives this model to best fit the data. While using the ratio of domestic credit to the private sector to GDP as a measure of financial development in the Gambia, the information criteria in Table 8 show that using two-period lags of the variables will provide a parsimonious model which will fit the data well. Therefore, the estimated model for the use of the ratio of domestic credit to the private sector to GDP will be given as:

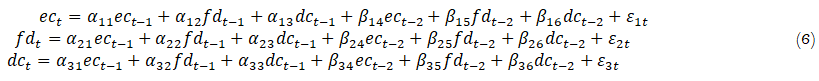

And again, by simple matrix multiplication, Equation 5 can be represented by Equation 6 which also expressed each variable as both an independent and endogenous variable and thus it examines how first and second-period lags of a variable affect the variable itself and how the first and second-period lags of other variables affect a variable which is supported by the information criteria in Table 8 to be the model of best fit model.

Moreover, given the two sets of measurement of financial development used in examining the relationship between domestic credit to the private sector, financial development and economic growth in the Gambia, the study analyses how these proxies of financial development affect domestic credit to the private sector and economic growth and examine a change in which of the variables will lead the other to change and how these variables will respond to shocks in the other variables which are reported by the impulse response functions.

4. Result and Analysis

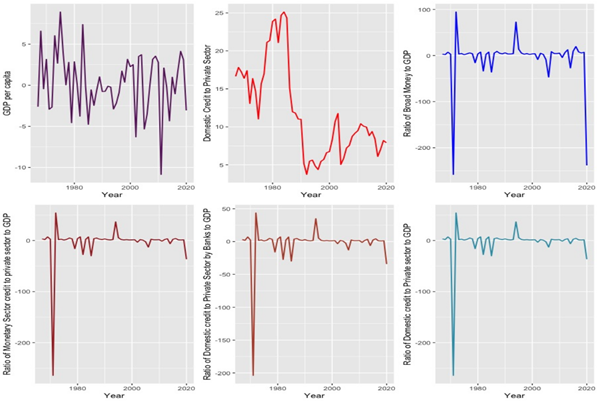

In understanding the relationship between financial development, domestic credit to the private sector and economic growth, the study visually analyses the nature and dynamics of these variables during the period of studies to employ the most appropriate estimation method for robust inference as shown in Figure 1. From the graphic analysis, the GDP per capita, the ratio of monetary sector credit to the private sector to GDP, the ratio of domestic credit to the private sector by banks to GDP and the ratio of domestic sector credit to the private sector were all found to be stationary during the period. This implies that their statistical properties (mean and variance) do not depend on time. Although we can see a significant spike in these variables in 1972, 1985, 1994 and 2020 which has been a result of low GDP growth (less than 1%) in 1972 and 1994 while negative GDP growth in 1985 and 2020.

The lack of economic progress during these periods are a result of the low productivity of capital and labour, which led to the decline of output in the key economic sectors such as the agricultural sector which had previously been a major contributor to household income and economic growth. Before the mid-1970s, the economy faced serious foreign debt, capital flight and a large public sector deficit which was due to the shortage of foreign exchange to service its debt and after this period there was a significant improvement in financing public investment. This was later affected by the lack of resources needed to operate and maintain capital created by investment (McPherson & Radelet, 1995).

The economic narrative begins to take a positive turn in the mid-1980s and the economy significantly improve from this period after the formulation of the Economic Recovery Programs in many Sub-Saharan African Countries which were devised to lay out foundations for sustainable economic growth and pull up the crumbling economic performances. Still, the economic performance is being affected by the lack of economic management and planning, declining foreign aid inflows, high international interest rate due to high external debt and the lack of sound and tangible fiscal and monetary policies that has an impact on the internal and external imbalance (McPherson & Radelet, 1995). This also explains the low credit availability to domestic investment and the government to finance infrastructural projects.

The variable on domestic credit to the private sector shows a changing mean and variance over time which is not ideal for modelling these relationships as it might lead to a “spurious regression” while all other variables are found to be stationary during these periods. Although we have seen the spikes in these ratio variables in some periods, this will not affect the stationarity of these variables given that they’ll converge to their long-run means.

Moreover, this study uses different measurements of financial development to observe its relationship with domestic credit to the private sector and per capita GDP growth in the Gambia but given that all these variables (ratio of monetary sector credit to private sector to GDP, ratio of domestic credit to private sector by banks to GDP and the ratio of domestic credit to private to GDP) all have exactly similar dynamics. This implies that using them as a measure of financial development will produce the same result thus, we can confidently say that these are equally correct measures of financial development in The Gambia. Therefore, the study will focus on the two measures of financial development, the ratio of domestic credit to the private sector to GDP and the ratio of broad money to GDP which are commonly used in other literatures (Calderón & Liu, 2003; De Gregorio & Guidotti, 1995; Hassan et al., 2011) to measure financial development of a country.

Figure 1. Dynamics of the variables.

Furthermore, Table 1 presented the Augmented Dickey-Fuller while Table 2 presented the Phillip-Perron test which are both test for non-stationarity. The advantage of performing the Phillip-Perron test is to control for both heteroscedasticity and serial correlation of the errors which will give a robust unit root testing. To verify if these tests produce similar evidence and conform with the graphical analysis, the study performed the KPSS test for stationarity as reported in Table 3.

From the test result, both Augmented Dickey-Fuller and the Phillip-Perron test indicate all the variables are stationary except the domestic credit to private sector variable which is also shown in the graphical analysis. The null hypothesis of these tests indicates the presence of unit root non-stationarity while the alternate hypothesis means the variables are stationary, and the low p-values mean we support the alternate hypothesis that they are stationary. However, the p-value of the domestic credit to the private sector is greater than this threshold which implies that it's non-stationary. The KPSS level stationarity test if these variables are stationary which also indicates a similar result as the previous test statistics, but the null hypothesis indicates stationarity while the alternate hypothesis means non-stationary. Therefore, the high p-value greater than 0.05 support the null hypothesis that the variables are stationary except the domestic credit to private sector variable. Given the KPSS tests do not indicate the number of lag length to be used, performing this test in RStudio produce an automatic truncated lag parameter of three and the result of these tests are shown below.

| Variables | Dickey-Fuller Test |

Lag order |

p-value |

| GDP Per capita | -3.830 |

2 |

0.024 |

| Domestic credit to Private Sector | -1.874 |

2 |

0.625 |

| Ratio Broad money to GDP | -4.964 |

2 |

<0.01 |

| Ratio Domestic Credit to private to GDP | -4.909 |

2 |

<0.01 |

| Difference Domestic Credit to Private Sector | -4.007 |

2 |

0.016 |

| Variables | Dickey Fuller z (Alpha) |

Truncated lag parameter |

p-value |

| GDP Per capita | -54.946 |

3 |

<0.01 |

| Domestic credit to Private Sector | -8.327 |

3 |

0.619 |

| Ratio Broad money to GDP | -61.666 |

3 |

<0.01 |

| Ratio Domestic Credit to private to GDP | -59.796 |

3 |

<0.01 |

| Difference Domestic Credit to Private Sector | -49.641 |

3 |

<0.01 |

| Variables | KPSS level |

Truncated lag parameter |

p-value |

| GDP Per capita | 0.170 |

3 |

>0.1 |

| Domestic credit to Private Sector | 0.773 |

3 |

<0.01 |

| Ratio Broad money to GDP | 0.201 |

3 |

>0.1 |

| Ratio Domestic Credit to private to GDP | 0.201 |

3 |

>0.1 |

| Difference Domestic Credit to Private Sector | 0.076 |

3 |

>0.1 |

All the variables are integrated at order zero I(0) except the variable on domestic credit to the private sector, which was found stationary after the first differencing, integrated at order one I(1). Therefore, the estimation of the domestic credit to the private sector is estimated in difference form which will have an interpretation in difference on its relationship with financial development and economic growth. Taking the difference of this variable implies that the estimated period stretches from 1967 to 2019 due to the loss of one period.

4.1. Ratio of Broad Money to GDP as a Measure of Financial Development on Economic Growth

Given the problems of selecting the optimal lag length of a VAR model, the selection of the appropriate lag length is crucial to have a parsimonious model which will give an efficient estimate of the parameters. Including more unnecessary lags will lead to a loss of a degree of freedom. The study performed a set information criterion to determine the optimal lag length in Table 4, which all indicates to use an optimal lag of one and the estimated model is given in Equation 3.

AIC(n) |

HQ(n) |

SC(n) |

FPE(n) |

1 |

1 |

1 |

1 |

12.560 |

12.736 |

13.028 |

285174.963 |

Furthermore, the study also conducted a set of post-estimation regression diagnostics to check for the serial correlation of the errors as reported in Table 5 which all shows no evidence of serial correlation in the errors. According to Hatemi (2004), these tests have strong performance in a stable VAR model, while in an unstable VAR model, the portmanteau test will have a serious size distortion and its power properties are slightly better than the LM test in both stable and unstable VAR.

I conducted the two types of portmanteau test, asymptotic and adjusted which test for the absence of serial correlation up to the lag one in a stable model. The latter is used for a small sample size with a lag that is not sufficiently high. On the other hand, the Breusch-Godfrey LM test also tests for no serial correlation up to the maximum lag by making use of the residuals and Edgerton-Shukur proposed a small-sample correction.

Moreover, there were found to be contradicting results on these tests, Both the Breusch-Godfrey and Edgerton-Shukur test support the null hypothesis that there is no serial correlation up to the lag one while the Portmanteau test supported the alternative hypothesis that there is serial correlation in the errors.

| Test Statistics | Portmanteau Test |

Breusch-Godfrey LM test |

Edgerton-Shukur F test |

|

Asymptotic |

Adjusted |

|||

| p-value | < 2.2e-16 |

< 2.2e-16 |

0.188 |

0.257 |

| Chi-square | 4.348 |

4.433 |

53.179 |

|

| F-statistics | 1.171 |

|||

| df1 | 0 |

0 |

45 |

45 |

| df2 | 95 |

|||

For the empirical estimation of the relationship between financial development, domestic credit to the private sector and economic growth, the ratio of broad money to GDP was used as a measure of financial development in The Gambia. The result shows a unit fall in the previous year GDP per capita will lead to a reduction of current GDP per capita by 0.50%, which is statistically significant at 1%. This is because a fall in last year GDP per capita means there will be reduced spending by the government in other productive sectors and low consumption spending by households which will affect firm's employment and investments as a result of low domestic savings. This also means there will be a negative lag change in the provision of domestic credit to the private sector in the previous year will have a non-significant impact on GDP per capita while lag improvement in financial development which is measured by the ratio of broad money to GDP has a positive insignificant impact on economic growth in the Gambia.

In the last period, GDP per capita also has a non-significant effect on the change in current period domestic credit to the private and the increase in the change in previous period domestic credit to the private sector had a positive impact on the change in current domestic credit to the private sector. The lag ratio of broad money to GDP as a measure of financial development has a statistically significant (at a 5% level) effect on the current change in the provision of domestic credit to the private sector, the more the financial sector develops, the more this will translate to economic growth and development. With this, the government will have more resources to finance other productive investments and households will have more income to spend on the economy. The development of the financial sector also implies financial institutions will provide more credit facilities to investors and small-medium enterprises which have growth potential and crucial drivers of competitiveness and innovation.

Moreover, lag GDP per capita and the lag change in domestic credit to the private sector have a negative effect on financial development measured by the ratio of broad money to GDP while the lack of development of the financial sector in the previous year will lead to 0.61% deterioration of the financial development which also have a negative effect on economic growth and the availability of domestic credit to the private sector. The result of these analyses is presented in Table 6.

| Dependent variables: | |||

GDP Per Capita |

Domestic Credit to private Sector |

Ratio of Broad Money to GDP |

|

| Lag GDP per Capita | -0.50*** (0.12) |

-0.03 (0.07) |

-0.46 (1.71) |

| Lag Domestic Credit to Private Sector | -0.22 (0.26) |

0.09 (0.14) |

-1.63 (3.67) |

| Lag Ratio of Broad Money to GDP | 0.01 (0.01) |

0.01** (0.01) |

-0.61*** (0.14) |

| Observations | 52 |

52 |

52 |

| R2 | 0.28 |

0.08 |

0.29 |

| Adjusted R2 | 0.23 |

0.03 |

0.24 |

| Residual Std. Error (df = 49) | 4.56 |

2.47 |

64.48 |

| F Statistic (df = 3; 49) | 6.22*** |

1.47 |

6.51*** |

| Roots of the characteristic polynomial: | 0.5523 |

0.5523 |

0.07785 |

Note: significant Level : **p<0.05; ***p<0.01 Log Likelihood: -556.295. |

Furthermore, the lag of these variables has a statistically join significant effect in estimating current GDP per capita (a proxy for economic growth) and the ratio of broad money to GDP (a proxy for financial development) but their join effects do not have a significant effect in estimating the change in domestic credit to the private sector which is captured by the F Statistics of the regression analysis.

4.1.1. Granger Causality Analysis: Ratio of Broad money to GDP as a measure of Financial Development

Table 7 presents a Granger causality analysis of model 1, which uses the ratio of broad money to GDP as a measure of financial development in The Gambia. The change in domestic credit to the private sector does not lead to improve financial development and economic growth and an increase in economic growth does not mean it will promote financial development nor leads to a change in domestic credit provision to the private sector.

Moreover, improvement in financial development does not have a Granger causal effect on promoting economic growth thus causality arises between financial development and changing domestic credit to the private sector. This means that promoting financial development in The Gambia will provide more changes to the provision of credit facilities to the private sector which the empirical result also shows that previous financial development will have a statistically significant effect on the provision of domestic credit to the private sector.

| Causality | F |

Pr (>F) |

| Difference in Domestic Credit Granger Cause GDP per capita | 1.311 |

0.258 |

| Ratio of Broad money to GDP Granger Cause GDP per capita | 1.754 |

0.192 |

| GDP per capita Granger Cause Difference in Domestic Credit | 0.002 |

0.962 |

| Ratio Broad money to GDP Granger Cause ratio Difference in Domestic Credit | 4.210 |

0.046* |

| GDP per capita Granger Cause ratio Broad Money to GDP | 0.081 |

0.777 |

| Difference in Domestic Credit Granger Cause ratio of Broad money to GDP | 0.245 |

0.623 |

Note: Significant Level 0 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1. |

4.2. Ratio of Domestic Credit to Private Sector to GDP as a Measure of Financial Development

In using the ratio of domestic credit to the private sector to GDP as a proxy of financial development to investigate the relationship between, financial development, domestic credit to the private sector and economic growth, the information criteria were computed to determine the appropriate number of lags needed for a parsimonious model. The Akaike information criteria (AIC) and Akaike Final Prediction Error (FPE) all simulated a maximum lag of two to maximize model quality while Hannan-Quinn (HQ) and Schwartz (SC) information criteria give one lag parameter to fit the data. The different lag from the information criteria since the goal is to use a lag that minimized the information criteria, using more lags than needed may lead to a loss in observations due to the degree of freedom. Therefore, the study used an optimal lag length of two as given by the AIC which minimized information criteria (see Table 8).

After estimating the model with the most appropriate lag length as given in Table 8, the study performed a regression diagnostic as presented in Table 9 which produces a mixed relationship on the serial correlation of the errors.

AIC(n) |

HQ(n) |

SC(n) |

FPE(n) |

|

Lag |

2 |

1 |

1 |

2 |

1 |

10.219 |

10.396 |

10.687 |

27452.778 |

2 |

10.148 |

10.457 |

10.966 |

25690.401 |

| Test Statistics | Portmanteau Test |

Breusch-Godfrey LM test |

Edgerton-Shukur F test |

|

Asymptotic |

Adjusted |

|||

| p-value | < 2.2e-16 |

< 2.2e-16 |

0.003 |

6.336e-06 |

| Chi-square | 9.670 |

10.01 |

76.043 |

|

| F-statistics | 3.024 |

|||

| df1 | 0 |

0 |

45 |

45 |

| df2 | 83 |

|||

To estimate the relationship between financial development, change in domestic credit to the private sector and economic growth in the Gambia, the ratio of domestic credit to the private sector is used as a measure of financial development in this section of the research. The result shows that the first and second period lag GDP per capita which proxy for economic growth has a statistically significant effect on the current period GDP per capita. A 1% decline in these lag periods GDP per capita will reduce current GDP per capita by 0.69% and 0.41% respectively. While the first and second period lag ratio of domestic credit to the private sector to GDP as a measure of financial development has a very low positive insignificant effect on GDP per capita and the first and second period lag domestic credit to the private sector has an insignificant negative and positive effect on GDP per capita respectively.

The previous period lags domestic credit to the private sector to GDP (which measures financial development) was found to have a low statistically significant impact on the change in the provision of domestic credit to the private sector. A unit rate increase in financial development measured by the ratio of domestic credit to the private sector to GDP will lead to a change in domestic credit availability by 0.01% which is statistically significant at 10 % level, while the second lag period of financial development has a negative insignificant effect. The first and second period lag GDP per capita has insignificant negative and positive effects respectively while these periods lags have an insignificant positive and negative effect of the same magnitude on the change of domestic credit to the private sector.

The lags ratio of domestic credit to the private sector to GDP as a measure of financial development has a statistically significant negative effect on the ratio of domestic credit to the private sector to GDP. This shows the lack of financial development in the second period lag will reduce current financial development by 0.44% and this impact is greater in the lower lag period (first-period lag) which will lead to the decline of the financial sector development by 0.80%.

Similarly, in previous periods GDP per capita growth was found to have a positive effect on the ratio of domestic credit to the private sector to GDP (a measure of financial development), which is statistically insignificant. On the other hand, change in domestic credit to the private sector has an asymmetric effect on financial development which is positive in the previous first lag period.

The result of the estimation is given in Table 10, which also supports our earlier estimation of the measure of financial development (ratio of broad money to GDP). These variables are significant in explaining GDP per capita and the ratio of domestic credit to the private sector to GDP which measures economic growth and financial development respectively thus, this is captured by the statistically significant effect of the F statistics of the regression indicating the join significance of the regression equation. The lack of join significance of the change in domestic credit to the private sector model indicates that lags in economic growth and financial development are not crucial in explaining the change in domestic credit availability to the private sector.

| Dependent variables: | ||||

GDP Per Capita |

Domestic Credit to Private Sector |

Ratio Domestic Credit Private Sector to GDP |

||

| 1st Lag GDP per capita | -0.69*** (0.14) |

-0.03 (0.08) |

0.17 (1.59) |

|

| 1st Lag Domestic Credit to Private Sector | -0.25 (0.25) |

0.11 (0.15) |

0.73 (2.81) |

|

| 1st Lag Ratio Domestic credit to Private to GDP | 0.01 (0.01) |

0.01* (0.01) |

-0.80*** (0.14) |

|

| 2nd Lag GDP per capita | -0.41*** (0.13) |

0.003 (0.08) |

0.68 (1.50) |

|

| 2nd Lag Domestic Credit to Private Sector | -0.41*** (0.13) |

-0.11 (0.15) |

0.68 (1.50) |

|

| 2nd Lag Ratio Domestic credit to Private to GDP | 0.09 (0.25) |

-0.001 (0.01) |

-1.92 (2.76) |

|

| Observations | 51 |

51 |

51 |

|

| R2 | 0.39 |

0.11 |

0.44 |

|

| Adjusted R2 | 0.31 |

-0.01 |

0.36 |

|

| Residual Std. Error (df = 45) | 4.28 |

2.54 |

47.99 |

|

| F Statistic (df = 6; 45) | 4.84*** |

0.91 |

5.87*** |

|

| Roots of the characteristic polynomial | 0.674 |

0.582 |

0.342 |

|

Note: Significant Level *p<0.1; ***p<0.01. |

Furthermore, the different measurements of financial development used in determining its relationship with economic growth and change in the domestic credit availability to the private sector. As shown in Figure 1, using the ratio of domestic credit to the private sector to GDP has the exact effect and pattern as other potential measures of financial development such as the ratio of monetary sector credit to the private sector to GDP and the ratio of domestic credit to the private sector by banks to GDP. This indicates that the former is a good measure of financial development in the Gambia which is also supported by the higher co-efficiency of determinations (R and Adjusted-R Square) and the log-likelihood. This takes a value from negative infinity to infinity, the more positive the log-likelihood the better the model fits the data thus given that using the ratio of domestic credit to the private sector to GDP as a measure of financial development has a higher coefficient of determination and the log-likelihood is close to a positive values indicates a better measure of financial development. These measures are valid and strong measures of financial development in The Gambia.

4.2.1. Granger Causality Analysis: Ratio of Domestic Credit to Private Sector to GDP as a Measure of Financial Development

The same causality evidence is shown in Table 11 when I use the ratio of domestic credit to private to GDP as a measure of financial development in The Gambia. A change in domestic credit to the private sector will not cause economic growth. Nor will it improve financial development and an increase in economic growth will not also lead to financial development and a change in credit availability to the private sector. Thus, improving financial development will not cause economic growth but it will lead to changing domestic credit availability to the private sector which is statistically significant at 10% significant level and this causality is sensitive to the order of lag period, the lower the lag period the more significant the estimate. This also indicates that financial development if a crucial factor in determining the availability of credit to the private sector in the Gambia.

| Causality | F |

Pr (>F) |

| Change in Domestic Credit Granger Cause GDP per capita | 0.845 |

0.436 |

| Ratio of Domestic credit to GDP Granger Cause GDP per capita | 0.724 |

0.491 |

| GDP per capita Granger Cause Change in Domestic Credit | 0.028 |

0.973 |

| Ratio Domestic credit to GDP Granger Cause Change in Domestic credit | 2.592 |

0.086. |

| GDP per capita Granger Cause ratio Domestic credit to GDP | 0.101 |

0.904 |

| Change in Domestic Credit Granger Cause ratio of Domestic credit to GDP | 0.257 |

0.774 |

4.3. VAR Stability

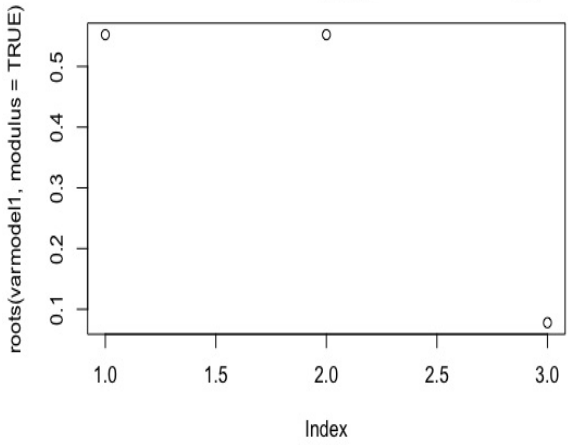

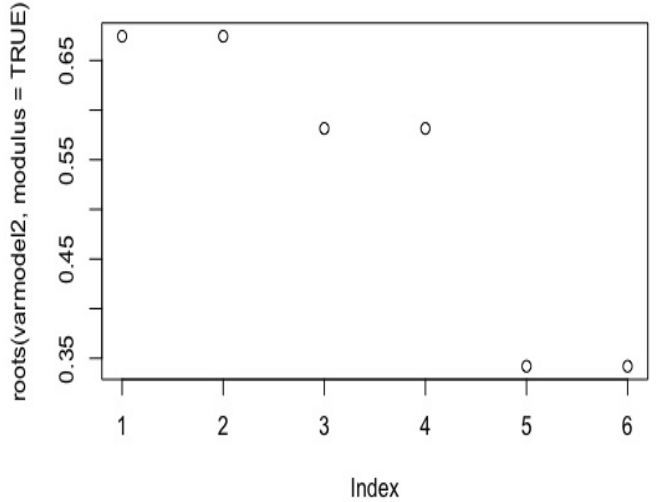

The study also checks for the stability of the VAR models, which entails stationarity of the model, and this holds if the root modulus is less than one and inside a unit circle shown in Figure 2 and Figure 3 in addition to the Roots of the characteristic polynomial of the VAR models (Table 6 and Table 10) all gives evidence of the stationarity of the VAR model.

Note that this stability of the VAR models is crucial for further analysis, if the above conditions are not met then the impulse response standard errors will not be valid.

Figure 2. Ratio of broad money to GDP as a measure of financial development.

Figure 3. Ratio of domestic credit to privet sector to GDP as a measure of financial development. |

4.4. Impulse Response Functions: Ratio of Broad Money to GDP as a measure of Financial Development

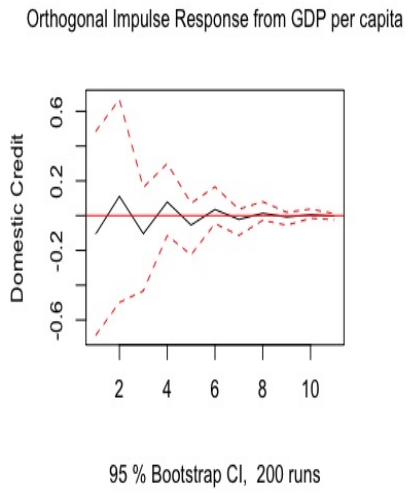

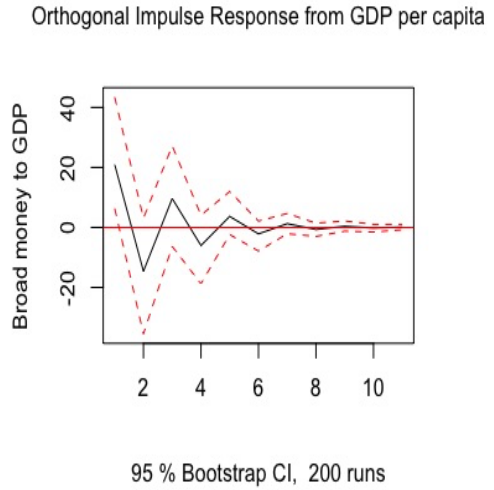

4.4.1. The Response of Change in Domestic Credit and Ratio of Broad Money to GDP on Shock to GDP per Capita

Figure 4 and Figure 5 show a change in domestic credit to the private sector and the ratio of broad money to GDP as a measure of financial development. Both have an asymmetric effect on shocks to GDP per capita up to the eighth period which later approaches a zero response effect on shocks. This implies that any unexpected disturbances that will affect per capita GDP growth in the Gambia will affect the change in the provision of domestic credit to the private sector and financial development in a positive and negative style during the early phase of shocks. However, over time the effects of the shock will subside. The effects will have little effect on the changes of domestic credit to the private sector, while their effects are more severe on financial performances.

Figure 4. Change in domestic credit response to shocks to GDP per capita. |

Figure 5. Ratio of broad money to GDP response to shocks on GDP per capita. |

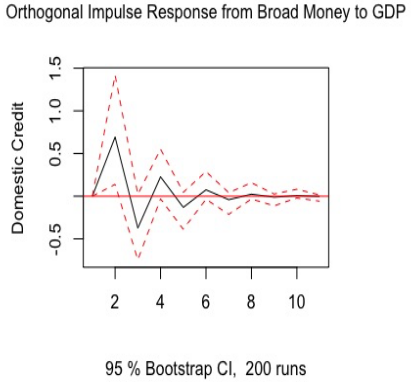

4.4.2. The Response of GDP per Capita and Ratio of Broad Money to GDP to Shocks on the change in Domestic Credit

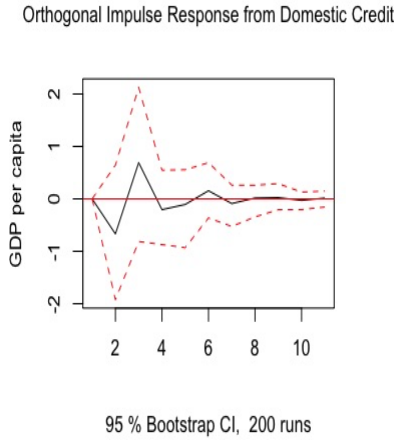

Figure 6 indicates that a shock on the change in domestic credit to the private sector has a tremendous asymmetric effect on economic growth in the early phase of the shock which will die out after some time. This effect has a more negative effect on the economy during its occurrence while Figure 7 shows the effect of shocks to affect the ratio of broad money to GDP when the shocks happen in the earlier period in which they will have any significant effect on the change in domestic credit.

Figure 6. GDP per capita response to shocks on change in domestic credit. |

Figure 7. Ratio of broad money to GDP response to shocks on the change in domestic credit. |

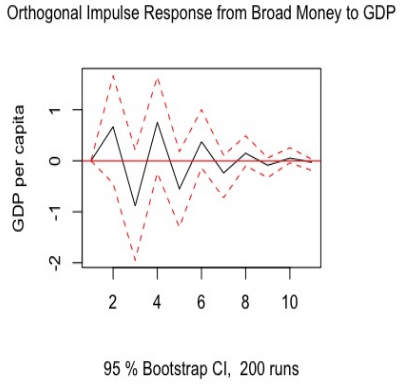

4.4.3. The Response of GDP per Capita and Change in Domestic credit to Shocks on the Ratio of Broad Money to GDP

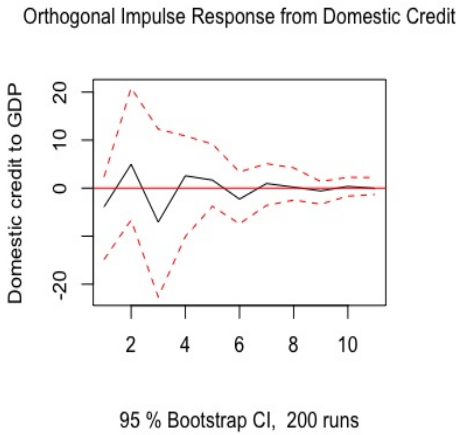

Shocks to financial development (ratio of broad money to GDP) will have a larger asymmetric effect on both economic growth (Figure 8) and the change in domestic credit to the private sector (Figure 9). This effect significantly affects the change of domestic credit availability to the private sector which will disappear after the eighth period. However, the effects of random disturbances on the development of the financial sector will affect economic growth for a longer period before its effect will die out.

Figure 8. GDP per capita response to shocks on broad money to GDP ratio. |

Figure 9. Change in domestic credit response to shocks on broad money to GDP ratio. |

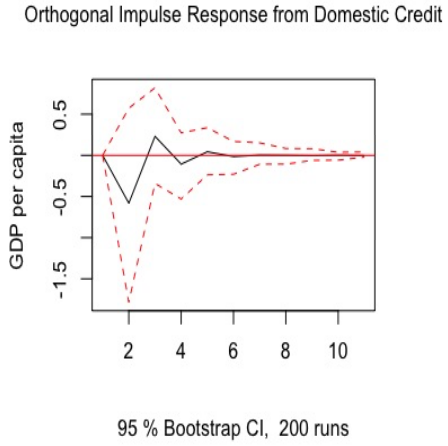

4.5. Impulse Response Functions: Ratio Domestic Credit to GDP as a Measure of Financial Development

4.5.1. Response of Change in Domestic Credit and Ratio of Domestic Credit to GDP to Shocks on GDP per Capita

In using the ratio of domestic credit to GDP as a measure of financial development, Figure 10 and Figure 11 shows a shock on GDP per capita will have both negative and positive effect on the change in domestic credit and financial development respectively. Over time, these effects will gradually approach zero. The effects of GDP per capita shocks will have a larger impact on financial development than the change in domestic credit availability to the private sector, which has a small-scale shock on GDP per capita.

Figure 10. Change in domestic credit response to shocks on GDP per capita.

Figure 11. Ratio of domestic credit to GDP response to shocks on GDP per capita.

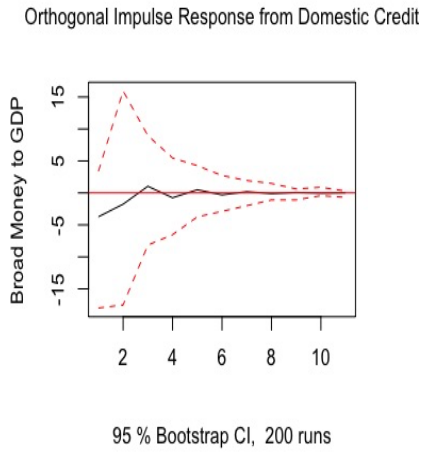

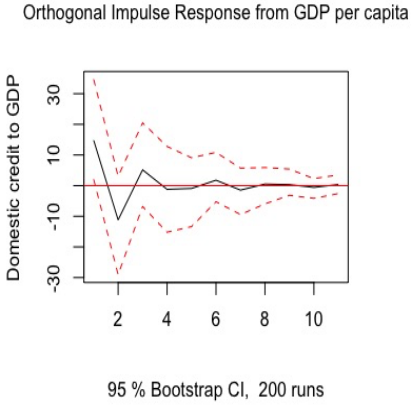

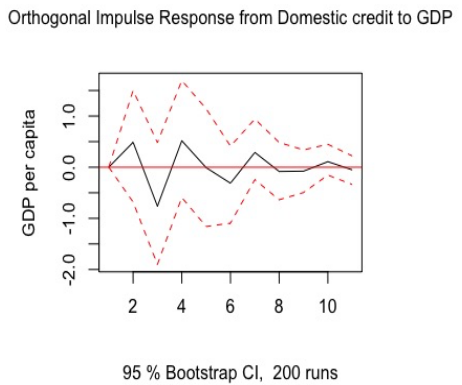

4.5.2. Response of GDP per capita and the ratio of Domestic Credit to GDP shocks on Change in Domestic Credit

Figure 12 and 13 also indicates an unexpected disturbance that affects the change in domestic credit availability to the private sector. This also has an asymmetric effect on both GDP per capita and financial development respectively from the third to fourth period this effect has a high positive impact on economic growth. However, over time this will die out in both the variables. In addition, the effects of the shocks on domestic credit almost have the same duration between these variables before their effects disappear.

Figure 12. GDP per capita response to shocks on the change domestic credit.

Figure 13. Ratio of domestic credit to GDP response to shocks on the change in domestic credit.

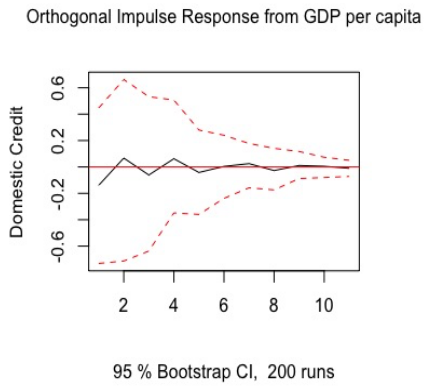

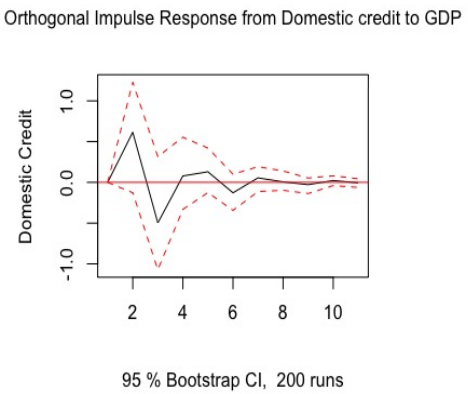

4.5.3. Response of GDP per Capita and Domestic Credit to Shocks on Ratio of Domestic Credit to GDP

Finally, GDP per capita and domestic credit have a similar response when using the ratio of domestic credit to the private sector to GDP as a measure of financial development, similar to the earlier measure (ratio of broad money to GDP). Shocks in financial development will have a large asymmetric impact on both economic growth and domestic credit availability to the private sector (Figure 14 and Figure 15 respectively) which will take a longer period before its effect on economic growth disappears. This also provides evidence that financial development is fundamental to economic growth in the Gambia, poor financial development will have a lasting effect on economic growth.

Figure 14. GDP per capita response to shocks on domestic credit to GDP ratio.

Figure 15. Change in domestic credit response to shocks on domestic credit to GDP ratio. |

5. Conclusions

The study examines the relationship between financial development, domestic credit to the private sector and economic growth in the Gambia from 1967 to 2020. Financial development has been a crucial driver of sustainable economic growth. This is also related to the economic growth of a country, as the more the economy grows, the more the availability of resources to the private sector in financing small-medium enterprises. This has growth potential and is a crucial driver of competitiveness and innovation. In addition, this will further promote economic growth and financial development. The interrelation between these variables motivates this study, which employed a VAR analysis to examine its relationship in the Gambia. Moreover, given the lack of data availability on financial development, there have been numerous measurement of financial development, and some has received criticisms on their abilities to fully capture the financial sector.

This study employed the two measurements of financial development such, as the ratio of broad money to GDP and the ratio of domestic credit to the private sector to GDP which are the most widely used measurements of financial development of a country. Thus, in The Gambia, the other measurements of financial development as shown in Figure 1 are exactly similar to the later measurement, which indicated these measurements have extensive potential in capturing financial development in The Gambia.

In using the ratio of broad money to GDP as a measure of financial development in The Gambia, the result shows that financial development has a strong impact on the change in the provision of domestic credit availability to the private sector in the Gambia. The lack of financial development will further have a greater impact on the future financial sector development. Although the improvement of financial development has a non-significant impact on per capita economic growth, an increase in this variable will positively impact current per capita economic growth. In addition, this result conforms with the other measurement of financial development which uses the ratio of domestic to the private sector to GDP. This measure also shows that financial sector development has a strong impact on the changing domestic credit availability to the private sector and on the future improvement of the financial sector. The improvement in the financial sector will lose a direct impact on per capita economic growth, but increasing economic growth will have a strong significant impact on future per capita economic growth in the Gambia. The ratio of broad money to GDP is more statistically significant when it comes to the changing domestic credit availability to the private sector than the later measurement. However, all have a similar impact on the relationships between these variables. These results are solidified by the Granger causality test shows a strong causal relationship between financial development and both measures of financial development.

Using the ratio of broad money to GDP as a measure of financial development, the Granger causality test indicates a 1% statistically significant relationship with a change in the domestic credit availability to the private sector while the ratio of domestic credit to the private sector to GDP as a measure of financial development indicates a 5% significant level.

Furthermore, a shock on the ratio of broad money to GDP has a large asymmetric effect on the change in domestic credit availability which means that a disruption in the financial sector development will affect the changing domestic credit available for the private sector which will also affect per capita economic growth and future development of the financial sector and this can lead to a loss of confidence in the financial sector. This also has a similar effect when we used the ratio of domestic credit to the private sector to GDP as a measure of financial development. A disruption in this variable will also have an asymmetric impact on the changing domestic credit availability to the private sector which may all last for a long period and with a similar duration before their effects die out.

Finally, financial development has a direct, strong, and statistically significant relationship on the changing domestic credit availability to the private sector and future improvement of the financial sector by providing more confidence in the financial sector. The changing credit availability to the private sector will have little impact on per capita economic growth but the increasing per capita economic growth will have a strong and significant impact on future growth in this variable, which is because per capita economic growth will promote consumption spending and investment in the economy and government will have the income to finance other investment projects.

Therefore, government and policymakers in The Gambia should focus their efforts on promoting development in the financial sector and building more confidence in the financial sector. As a result, this will create incentives for people to save and promote investment in the economy. Without improving the credibility and the development of the financial sector, investments and economic growth will suffer.

6. Limitation

This study examines the relationship between domestic credit to the private sector, financial development and economic growth in the Gambia. Given the lack of data availability on financial development, the study uses two sets of proxies of financial development to capture the contribution of financial development in The Gambia. It was found that financial development is a crucial factor in determining the change in domestic credit to the private sector and economic growth in this country and the direction of causality comes from financial development. This leads to the changing domestic credit availability to the private sector and economic growth in the Gambia. Due, to the lack of financial data availability, future research has to be done to complement and/or verify the relationship between these variables.

References

Amoo, G., Eboreime, M. I., Adamu, Y., & Belonwu, M. C. (2017). The impact of private sector credit on economic growth in Nigeria. CBN Journal of Applied Statistics, 8(2), 1-22.

Ananzeh, I. E. N. (2016). Relationship between bank credit and economic growth: Evidence from Jordan. International Journal of Financial Research, 7(2), 53-63.Available at: https://doi.org/10.5430/ijfr.v7n2p53.

Appiah-Otoo, I. (2020). Does COVID-19 affect domestic credit? Aggregate and bank level evidence from China. Asian Economics Letters, 1(3), 18074.Available at: https://doi.org/10.46557/001c.18074.

Beck, T., & Demirguc-Kunt, A. (2006). Small and medium-size enterprises: Access to finance as a growth constraint. Journal of Banking & Finance, 30(11), 2931-2943.Available at: https://doi.org/10.1016/j.jbankfin.2006.05.009.

Begum, H. M., & Aziz, S. I. (2019). Impact of domestic credit to private sector on gross domestic product in Bangladesh. IOSR Journal of Economics and Finance, 10(1), 45-54.

Benhabib, J., & Spiegel, M. M. (2000). The role of financial development in growth and investment. Journal of Economic Growth, 5(4), 341-360.

Bui, T. N. (2020). Domestic credit and economic growth in ASEAN countries: A nonlinear approach. International Transaction Journal of Engineering, Management, & Applied Sciences & Technologies, 11(2), 1-9.

Calderón, C., & Liu, L. (2003). The direction of causality between financial development and economic growth. Journal of Development Economics, 72(1), 321-334.Available at: https://doi.org/10.1016/s0304-3878(03)00079-8.

Camba, J. A. C., & Camba, A. L. (2020). The dynamic relationship of domestic credit and stock market liquidity on the economic growth of the Philippines. The Journal of Asian Finance, Economics and Business, 7(1), 37-46.

De Gregorio, J., & Guidotti, P. E. (1995). Financial development and economic growth. World Development, 23(3), 433-448.

Demetriades, P. O., & Hussein, K. A. (1996). Does financial development cause economic growth? Time-series evidence from 16 countries. Journal of Development Economics, 51(2), 387-411.Available at: https://doi.org/10.1016/s0304-3878(96)00421-x.

Duican, E. R., & Pop, A. (2015). The implications of credit activity on economic growth in Romania. Procedia Economics and Finance, 30, 195-201.Available at: https://doi.org/10.1016/s2212-5671(15)01286-1.

Gerlach-Kristen, P., O'Connell, B., & O'Toole, C. (2015). Do credit constraints affect SME investment and employment? The Economic and Social Review, 46(1, Spring), 51-86.

Gozgor, G. (2014). Determinants of domestic credit levels in emerging markets: The role of external factors. Emerging Markets Review, 18, 1-18.Available at: https://doi.org/10.1016/j.ememar.2013.11.003.

Gozgor, G. (2015). Causal relation between economic growth and domestic credit in the economic globalization: Evidence from the Hatemi-J's test. The Journal of International Trade & Economic Development, 24(3), 395-408.Available at: https://doi.org/10.1080/09638199.2014.908325.

Harvie, C., & Lee, B. C. (2005). 13. Public policy and SME development. Sustaining Growth and Performance in East Asia, 31(11.3), 301.

Hassan, M. K., Sanchez, B., & Yu, J.-S. (2011). Financial development and economic growth: New evidence from panel data. The Quarterly Review of Economics and Finance, 51(1), 88-104.Available at: https://doi.org/10.1016/j.qref.2010.09.001.

Hatemi, J. A. (2004). Multivariate tests for autocorrelation in the stable and unstable VAR models. Economic Modelling, 21(4), 661-683.Available at: https://doi.org/10.1016/j.econmod.2003.09.005.

Hsu, P.-H., Tian, X., & Xu, Y. (2014). Financial development and innovation: Cross-country evidence. Journal of Financial Economics, 112(1), 116-135.Available at: https://doi.org/10.1016/j.jfineco.2013.12.002.

Hu, M.-W. (2010). SMEs and economic growth: Entrepreneurship or employment. ICIC Express Letters, 4(6), 2275-2280.

King, R. G., & Levine, R. (1993). Finance and growth: Schumpeter might be right. The Quarterly Journal of Economics, 108(3), 717-737.Available at: https://doi.org/10.2307/2118406.

Leitão, N. (2012). Bank credit and economic growth: A dynamic panel data analysis. Economic Research Guardian, 2(2), 256-267.

McPherson, M. F., & Radelet, S. C. (1995). Economic recovery in the Gambia: Insights for adjustment in Sub-Saharan Africa: Harvard University Press.

Neneh, B. N., & Vanzyl, J. (2014). Growth intention and its impact on business growth amongst SMEs in South Africa. Mediterranean Journal of Social Sciences, 5(20), 172.Available at: https://doi.org/10.5901/mjss.2014.v5n20p172.

Njie, A. (2013). Mapping study of micro small and medium enterprises. Ministry of Trade and Regional Integration and Employment and Social Development Fund Report.

Nzomoi, J. N., Were, M., & Rutto, N. (2012). Assessing the impact of private sector credit on economic performance: Evidence from sectoral panel data for Kenya.

Olowofeso, E. O., Adeleke, A. O., & Udoji, A. O. (2015). Impact of private sector credit on economic growth in Nigeria. CBN Journal of Applied Statistics, 6(2), 81-101.

Pagano, M. (1993). Financial markets and growth: An overview. European Economic Review, 37(2-3), 613-622.

Sipahutar, M. A., Oktaviani, R., Siregar, H., & Juanda, B. (2016). Effects of credit on economic growth, unemployment and poverty. Journal of Development Economics: Study of Economics and Development Problems, 17(1), 37-49.

World Bank. (2010). Doing business 2011: Making a difference for entrepreneurs: The World Bank.

World Bank. (2012). Global financial development report 2013: Rethinking the role of the state in finance. The World Bank. Retrieved from: https://doi.org/10.1596/978-0-8213-9503-5.

Yakubu, Z., & Affoi, A. (2014). An analysis of commercial banks’ credit on economic growth in Nigeria. Current Research Journal of Economic Theory, 6(2), 11-15.Available at: https://doi.org/10.19026/crjet.6.5531.