Remittance Flows and Health Outcomes in Nigeria: Implication for Economic Growth

Emmanuel Chika Paul1

Ambrose Nnaemeka Omeje2*

1,2Department of Economics, University of Nigeria, Nsukka, Nigeria. |

AbstractRemittance flows have usually been channelled to the improvement of health outcomes among its recipients in different countries of the world. Its implication for the overall wellbeing of the people and growth of the economy has been tremendous. This study therefore examined remittance flows and health outcomes in Nigeria and its implication for economic growth. Using time series data set from 1980 to 2019, VAR-granger causality approach, and VAR-impulse response function method, it was found that personal remittances granger causes out-of-pocket health expenditure. The results of the VAR-impulse response function indicated that shocks to life expectancy exert positive significant impact on economic growth. Similarly, shocks to mortality rate have positive significant influence on economic growth. However, shocks to personal remittances exert significant negative impact on the Nigerian economic growth. Policies that support the free flow of remittances should be put in place by the government. Again, households should use their remittance receipts largely on expenditures that promote their health and well-being. |

Licensed: |

|

Keywords: |

|

Received: 6 June 2022 |

Funding: This study received no specific financial support. |

Competing Interests:The authors declare that they have no competing interests. |

1. Introduction

Health is among the key components in the measurement of human development index, and it is also said to be the focal point of human overall wellbeing; this is why there has been increasing global concern over the years towards the interface between health outcomes captured by rate of life expectancy and rate of mortality, and the economic growth; and the concern to create more investments for worldwide health security, where there should be a free flow of remittances, so that the poor citizens and low-income earners can use these remittances that can serve as out-of-pocket expenditure to access healthcare services, since government healthcare expenditure could not cater for that. Therefore, the role of Personal Remittances in achieving positive health outcomes such as higher rate of Life Expectancy and Lower rate of Mortality may be seen as compelling factor to a quality and productive labour force, which strongly affects the economic growth of a country.

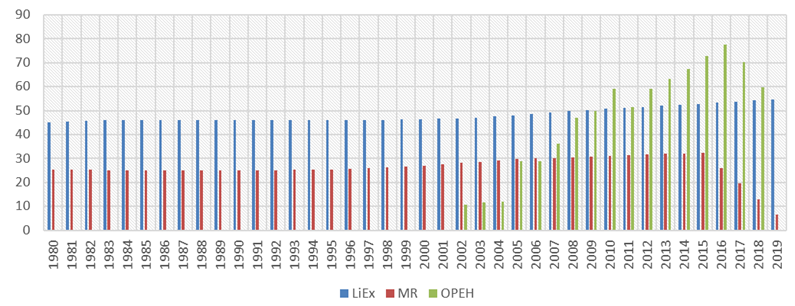

During the Nigeria independence period in 1960, the common life expectancy was 37 years more than some other African and Asian countries (New African Magazine, 2020). As the rate of life expectancy doubles globally, one would have thought that Nigeria would have the rate of life expectancy ranging between 70 and 74. But unfortunately, our progress was recorded to be minimal as compared to other developed and developing countries; this is shown in the graph (Figure 1), where the Life Expectancy Rate (represented as LiEx) stood between the range of about 45.0 in 1980, and 49.8 in 2008, but it only increased to a reasonable rate from 50.2 in 2009 to 54.5 in 2019.

According to Bloom, Canning, and Sevilla (2004) and World Bank (2016), health of the general public is to be the basic stimuli to economic growth and economic development in a country, by its potential: increase in labour productivity, cutting down losses in production due to workers’ illness, earning incomes for savings for retirement due to increased life expectancy, moderating mortality rate, bring about quality demographic structure, etc. The reality might be different from the reports in Nigeria as her mortality rate is higher compared to that of the developed countries and other developing countries. This could be seen on the graph in Figure 1: where the adult mortality rate (represented as MR) had stood within the range of 25.0 in 1980 till 1997, except in 1988 when it reduced to 24.0 and maintained that range till 1990. The mortality rate increased to 26.0 in 1998 and remained in that range till 2000; this increasing rate goes in serial order till 33.9 in 2019.

Figure 1. Graph of LiEx, MR and OPEH in Nigeria from 1980 to 2019. |

Nigeria’s poor health outcomes like low rate of life expectancy and high rate of mortality may be due to the fact that the country has a lot of health issues, with poor healthcare services arising substantively from low government and individual out-of-pocket healthcare expenditure, and that can be the major player in the low rate of life expectancy and high life expectancy rate. For instance, Nigeria individuals’ out-of-pocket healthcare expenditure (represented as OPEH in the graph of Figure 1) stood at $59.0 million in 2018 from $70.0 million in 2017. It only recorded progressive increase where it stood between $10.0 million and $28.0 million in 2002 and 2006, respectively. There is a reasonable increase from that of $28.0 million in 2006 to $46.0 million in 2008. Also, there was a more substantial increase from $59.0 million in 2010 to an all-time high of about $77.0 million, despite that there were decreases from that $59.0 million in 2010 to $51.0 million in 2011 and $58.0 million in 2012. These contrarieties in the indicators of health have been said to be the repercussions of poor investments in health and the nation’s human capital. While the developed world enjoys better quality-healthcare facilities and better health outcomes because they invest more on health; the developing world experience poor health indicators due to their poor investments in health and/or human capital. Every investment in health would result in discounted returns as an increased productivity of labour and efficiency, increased earning and savings, balanced condition for investments, and economic growth and development (Alhassan & Abdu, 2017).

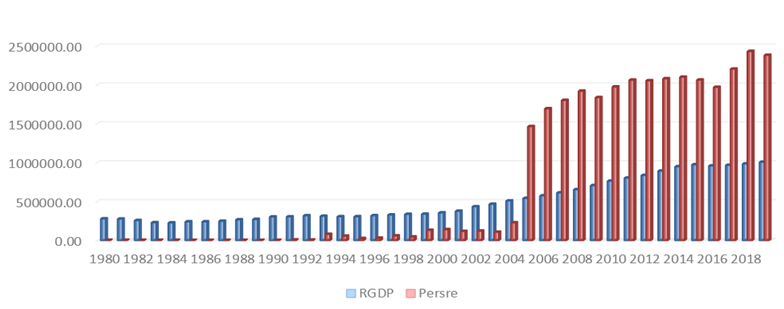

Workers' remittances have become a major source of income for developing countries. Existing research studies suggest that remittances are used to cover essential things: access to food, school fees or housing expenses, and healthcare expenses. And to the government, the remittances, in form of grants from the international community and institutions, aid in the capital health expenditure of her health sector. Data obtained from the Knoema (2020) revealed that the personal remittances (Persre) rose by 10.3% when it increased from $22.0 million in 2017 to $24.0 million in 2018; though it reduced to $23.0 million in 2019. The flow of remittance in Nigeria has recorded increases (as shown on the graph in Figure 2); this shows the enormous importance of remittance to the household and the government, as it has been shown to contribute immensely to the economic growth of Nigeria. Sadly, due to the outbreak of the recent COVID-19 virus, there was decline in the inflow of remittance in 2020 to $17.0 million (Knoema, 2020). The flow of remittance alongside the real GDP in Nigeria could be shown below:

Figure 2. Graph of RGDP and Persre in Nigeria from 1980 to 2019. |

Personal remittance in Nigeria is said to currently account for the 5.30% of the gross domestic product (GDP) in Nigeria (Knoema, 2020); this has increased from a decade ago. This growth in the magnitude of these international transfers has raised inquiries as to what impact it has on household recipients in the country?; Is there any causal relationship between personal remittances and out-of-pocket health expenditure in Nigeria?, which would be answered using Granger causality approach; What are the responses of personal remittances and health outcomes to economic growth in Nigeria?, which would be answered using the vector autoregressive impulse response function (VAR-IRF) model.

2. Literature Review

Health is said to be a form of human capital that affects the productivity of labour and the overall economic growth and development. Status of health and the level of productivity in the country have correlation. This is true because healthier population can work to earn income that contributes to the economic growth. This is evidence in existing research studies that established that there is relationship between health and incomes. Therefore, ill-health or negative health outcomes can reduce the efficiency or even reduce the longevity of the labour force, which will also jeopardize productivity level of a nation.

2.1. Relevant Theory

2.1.1. Gary Becker’s Human Capital Development Theory

This theory is based on Friedman (1953) theory of human capital. Gary (1993) popularized this theory in his published book Monograph “Human Capital”, which states that a growth in economic output is as a result of investment in human capital. That could be true because in the past, economic strength was so much dependent on investment in capital equipment which increases the value output. It should be to noted that healthy persons working productively and efficiently is due to human capital development, with full potential; and contribute better in the development of the country of the country. However, given the human capital investment on quality education and improved health security, there would be eventually increases in the economic output of a nation, hence an increased longevity rate of the people.

2.1.2. The Grossman Model (Grossman, 1972)

The Grossman model was first posited by Grossman (1972); Grossman (2000). Contoyannis, Jones, and Rice (2004) popularized this model, by calling it the demand for health models. This model conceptualizes that by virtue of health capital demand, the status of health, people’s saving and income, longevity of the people and education influence the production of health. This model explains that people demand for health, and that it cannot be directly purchased from the market; health is produced by purchased medical inputs with time. Another feature of this model is that just like other capital stock or goods that can depreciate, health can depreciate over time; therefore, health should be treated as investment and consumption goods. Grossman (1972); Grossman (2000) model stresses that health being treated as investment good yields net returns on outcomes of health as high rate of life expectancy and low rate of mortality over time; these net returns translate to economic growth. This means that personal remittances being used as an out-of-pocket healthcare expenditure is an investment on health goods, which will yields net returns on outcomes of health, such as high rate of life expectancy and low rate of adult mortality, hence, an influence on the economic growth of a nation.

Furthermore, many input factors in health production show the channels of health indicators, hence the need to explain the Grossman Model in this study. However, this work shall represent this function as a production function of health, where the broad Health output is thus:

Equation 1 presents the broad health output of the Grossman Model. Where; “Health” measures the individuals health output and “Input Factor” is a vector of individual inputs to the health production function f. The Grossman theoretical analysis regards of health production at micro level; Fayissa and Gutema (2005) regard it at macro level by recognizing the input factors as social, economic and environmental factors, thus:

Equation 2 presents the Grossman Model by recognizing the input factors of economic, social, and environmental factors. Where; Eco, Soc, and Env indicates per capita Economic, Social, and Environmental variables. Each of the variables has several components. Due to the availability of the data, this paper used real GDP, personal remittances and out-of-pocket-health-expenditures, and treated them as the economic vector, the social vector taken as rate of life expectancy and mortality rate of adults. To modify the model in line with the aim of the study, it becomes:

Equation 3 presents the modified Grossman health model in line with the objective of the study. Where; RGDP represents real GDP, PERSRE represents personal remittances, OPHE indicates out-of-pocket-health-expenditures, LIEX stands for life expectancy, while MR stands for mortality rate of adults.

2.2. Empirical Evidence

There have been lots of research works done on the impact of remittance on the health outcomes and on the economic growth. Among these is the study made by Bloom et al. (2004) that estimates the stock of capital, labour and/as human capital as aggregation of production function that result to economic growth. The broad result of the study shows that there is positive and statistically significant effect of health on economic growth. Similarly, in Nigeria, Aluko and Adeniji (2015) examined the effects of health on economic growth in Nigeria, using time series data set from 1980 to 2013. The study employed the vector error correction model (VECM) and granger causality test for the data estimation. The estimated VECM result showed harmony of all the explanatory variables to the a-priori expectation and the model satisfied the stability condition. The granger causality result confirmed a unidirectional causality from health indicators to economic growth in Nigeria. In the same vein, Onisanwa (2014) examined the impacts of indicators of health on the economic growth in Nigeria. The Cointegration and Granger Causality techniques were used to analyse the quarterly time series data set of Nigeria from 1995 to 2009. The study concluded that health indicators cause the per capita GDP; hence GDP is positively influenced by health indicators in the long run. It reveals that health indicators have a long run impact on economic growth; the impact of health is a long run phenomenon.

In the same light, to discover whether there is a nexus between status of health, productivity of labour and the growth of economy in Nigeria, Adeshina, Adewale, Elvis, and Emife (2019) conducted a study to examine the impact of health status and productivity of labour on economic growth in Nigeria, using annual time series data from 1981 to 2017. The method of empirical estimation used was an Autoregressive Distributed Lag Model, and the result of the parameters of the model show that that health status is positively significant and plays a significant role in process of economic growth, but the productivity of labour fails to positively impact on the growth process in Nigeria. The study is also supported by the research study done by Eneji, Dickson, and John (2013); the study specified the relationship between healthcare expenditure, the health status and national productivity in Nigeria. They employed a secondary time series data from 1999 to 2012, with the estimation method of OLS regression. The result showed the public health care expenditure as the predictor variable for health status, productivity in the economy and poverty reduction, stating that the casual relationship is weak in the Nigeria. The policy recommendation encourages policy makers to allocate scarce resources across the range of capital expenditures on health, education, infrastructure and recurrent expenditure preferences so as to reduce the rate of poverty and add to economic development.

Subsequently, these studies discovered the nexus between health expenditures, remittances, outcomes of health (such as rate of life expectancy and rate of mortality) and economic growth in Nigeria: A study that discovered the effect of life expectancy and mortality on the economic growth was done by Matteo and Uwe (2009). They investigated the causality of the life expectancy on economic growth by clearly accounting for the demographic transition role. The study used random effect panel technique and data set consisting of 47 countries for the period between 1940 and 1980. The result presented shows that after the demographic transition, the effect of life expectancy on human capital, income per capita and the population is not the same; that high rate of life expectancy leads to transition to a sustained income growth. Recommendation was made on putting policies in place to encourage programmes that increase life expectancy in every demographic transition.

Furthermore, to find out whether expenditure on health has any effect on the existing health outcomes; Nonvignon, Olakojo, and Nonvignon (2012) did a study on domestic government and private expenditure sources for health care to examine the effect on health status in the population. The study employed fixed and random panel data set from 1995 to 2010 that covers 44 countries in Sub-Saharan Africa. The results from the empirical estimation showed that both private and domestic government health care spending showed strong positive relationship with health status, but government health care spending exerts higher impact on status of health, by improving the rate of life expectancy at birth, reducing rate of infant mortality and deaths. Increasing health care expenditure will be a significant step in achieving the Millennium Development Goals; therefore, policy makers should establish and utilize an effective public-private partnership to efficiently distribute health care expenditures. Also Yuni, Omeje, and Asogwa (2013) examined determinants of remittance through a dynamic panel data generalized method of moments (GMM) analysis of 21 selected countries in Africa and found age dependency ratio and other related factors were significantly encouraging remittances.

Further evidence on the significant impact of Remittances on the growth of economy in Nigeria is shown in the research study of Sebil and Abdulazeez (2015) estimating the error correction model (ECM) approach with data from 1981 to 2011, a time series data. The estimation results show that remittances exert impact positively, on the GDP; hence the need for the economy to be open, so as to stimulate the growth. A foreign study that supports their work was done by Adela and Dietmar (2013). The study aims at observing remittances and the impact on economic growth, carrying out panel analysis on data set of 21 developing countries for the period of 1992-2012. The Albanian country recorded increase in their total remittances, compared with other regions, as the remittances have positive impact on the growth of the GDP per capita. On the other hand, the study suggests the need to tame the increasing rate of emigration, as this may have dead weight consequence on domestic labour market in such crucial sectors like the higher education, government services, science and technology, and the manufacturing, especially if those leaving to other countries are mostly skilled workers.

Summarily, all these reviewed research works on the connection between remittance, health status or outcomes and growth of economy show that there is significant effect of remittances and health outcomes, such as life expectancy rate and mortality rate on economic growth. Remittances were also found to exert impact on the health status or outcomes, such as rate of life expectancy and rate of adult or infant mortality. Furthermore, base on the reviewed studies, there was no study that shows causality between Personal Remittances and Out-of-Pocket Health Expenditure in Nigeria, so as to know whether individuals in the country use remittances as out-of-pocket health expenditure. It should be noted that causality in economics does not mean that a factor causes a phenomenon. This is true because there are other factors that have effect or that impact on such phenomenon. Locke (1960) supported this opinion in his definition of “cause”, which he stated that: cause is a factor that produces a particular phenomenon called effect. Therefore, this study shall contribute to other existing researches by employing the granger causality approach, to know if there is an influence or a causal relationship between Personal Remittances and Out-of-Pocket health expenditure in Nigeria.

Meanwhile this research study will apply the VAR-Impulse Response Function estimation, to know the response of Personal Remittances and Health outcomes (captured by Rate of Life Expectancy and Rate of Adult Mortality) on growth of economy in Nigeria, and how long the effects lasts.

3. Methodology

The relationship between health inputs in production of health outcomes as identified above are based on Barro’s theoretical framework (Barro, 1996) which is applied in this study, and is an extension of the neoclassical growth model that incorporates health status as capital and a component of the production process. According to the model, output (Y) in an economy depends on physical capital (K), labour hours (L) and human capital. Human capital consists of two factors, education (S) and health capital (H); this can be represented as:

Therefore, the model is:

Equation 4 argues that output (Y) in an economy depends on physical capital (K), labour hours (L) and human capital (M). Where; P is the index of the varying technical change overtime, held constant, K is the stock of capital, L is the labour supply and M is the human capital stock. Also, the parameters α and β are between 0 and 1 and their sum is less than one, that is (α + β) < 1, which implies a decreasing return to capital.

Personal remittances are one of the sources of income that are considered the contributing factor to health outcomes such as rate of Life Expectancy and rate of Adult Mortality; such Income influences health status through the ability to provide basic needs and makes access to basic health care services possible (Cingolani, Thomsson, & De Crombrugghe, 2015; Wang, 2003). Every investment in health would result in discounted returns as an increased productivity of labour and efficiency, increased earning and savings, balanced condition for investments, and economic growth and development (Alhassan & Abdu, 2017).

3.1. Specification of Model

Based on the theoretical framework and objectives of this study, the models for the empirical estimation are stated thus:

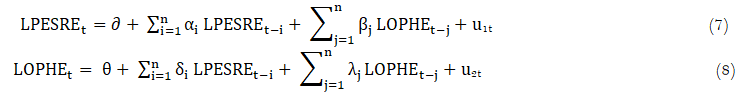

Equations 5 through 8 presents the Granger causality test which aims to establish if there is any causal relationship between personal remittances and out-of-pocket health expenditure in Nigeria (that is objective one). Where; LPERSRE is Log of personal remittance, LOPHE is the Log of out-pocket health expenditure and the “↔” sign shows the direction of Granger causality among the two variables. The variables were logged just to scale the variables of the model.

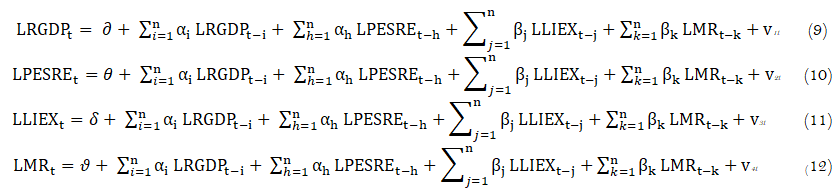

where; LRGDP = Log of real GDP, LPERSRE = Log of personal remittances, LLIEX = Log of life expectancy rate, and LMR = Log of mortality rate (measured by adult mortality rate), β0 = constant or intercept; β1, β2, β3, β4 and β5 are the parameters of the variables; μt = error term.

The annual data for this study are from 1980 to 2019 period, which are used to examine the causal relationship among personal remittances and out-of-pocket health expenditure; and the response of personal remittances and health outcomes (captured by rate of life expectancy and rate of adult mortality) on the growth of economy in Nigeria. The data were generated from the World Development Index (WDI) and Knoema.com of various issues. All the data are run in their logarithm form. The study uses the vector autoregressive approach for the Granger Causality approach to determine if there is causal relationship between remittances and out-of-pocket-expenditure on health, and impulse response function approach to know the maximum effect of personal remittances and health outcomes (captured by rate life expectancy and rate adult mortality) on the growth of economy in Nigeria. The vector autoregressive model proposed by Granger (1969) for the Granger causality test is based on this regression models, thus:

Where u1t and u2t are uncorrelated error terms. In the above specifications, according to Granger (1969) ![]() is said to Granger cause LPESRE and vice versa, if βi and δi are not equal to zero. If these two situations exist, then LOPHE and LPESRE have bi-directional causality. But if either LPESRE or LOPHE granger causes the other, then there is unidirectional causality and if none of the situation holds, there is independence of the two variables LOPHE and LPESRE. Gujarati (2009) pointed out that a causality test should suits the model specifications and the lag(s) such that there would be different results, if any relevant variable is not in the model.

is said to Granger cause LPESRE and vice versa, if βi and δi are not equal to zero. If these two situations exist, then LOPHE and LPESRE have bi-directional causality. But if either LPESRE or LOPHE granger causes the other, then there is unidirectional causality and if none of the situation holds, there is independence of the two variables LOPHE and LPESRE. Gujarati (2009) pointed out that a causality test should suits the model specifications and the lag(s) such that there would be different results, if any relevant variable is not in the model.

Impulse Response Functions following the Vector Autoregressive (VAR) approach trace the dynamic impact to the shock or change to an input over time (Cuthbertson, 2002). The VAR model for the study is specified as follows:

4. Empirical Findings

4.1. Stationarity Test

As a form of pre-estimation test, the stationarity test was conducted by the study in order to find out whether the variables of the models are stationary. In this regard, the study applied the unit root test to establish this fact as presented in Table 1 given:

| Variables | ADF T-statistic At Level |

ADF at 5% Critical Value |

ADF T statistic 1st Difference |

ADF at 5% Critical Value |

Order of Integration |

| LRGDP | 0.246 |

1.690 |

2.910 |

1.691 |

I(1) |

| LPESRE | 0.720 |

1.690 |

3.453 |

1.691 |

I(1) |

| LLIEX | 2.360 |

3.548 |

3.930 |

3.556 |

I(1) |

| LMR | 0.587 |

2.964 |

5.098 |

2.966 |

I(1) |

| LOPHE | 3.112 |

3.000 |

- |

- |

I(0) |

From the above result on the Table 1, all the variables are Stationary at first difference except LOPEH, which is stationary at level. Therefore, the result is not spurious and can be used for prediction.

In order to examine the first objective of the study (that is; to find out if there is any causal relationship between personal remittances and out-of-pocket health expenditure in Nigeria), the study presents the Granger causality Wald test results as given below in Table 2:

| Null Hypothesis | Chi-square |

Prob |

Decision | Remark |

| LPESRE does not granger cause LOPHE | 23.881 |

0.000* |

Reject Ho | Causality |

| LOPHE does not granger cause LPERE | 4.7946 |

0.187 |

Accept Ho | No Causality |

Note: (*) implies significant at (5%) level. |

The granger causality test results in Table 2 shows a uni-directional causality of Personal Remittances (PESRE) to Out-of-Pocket Health Expenditure (OPHE), but there is no causality from Out-of-Pocket Expenditure (OPHE) to Personal Remittances (PESRE). This intuitively implies that individuals or households uses or can use Personal Remittances as Out-of-Pocket Expenditure to their healthcare and other health wants.

4.2. Impulse Response Function Estimation

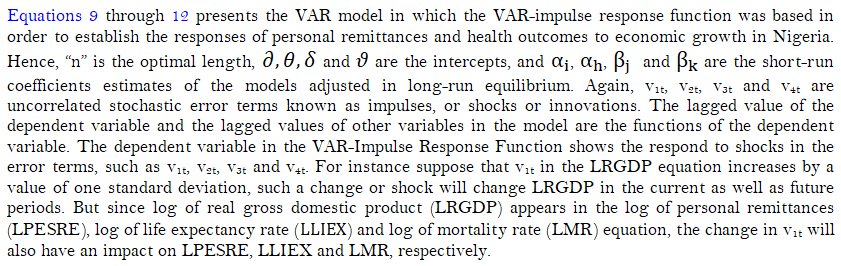

The VAR-impulse response function was adopted in order to examine the responses of personal remittances and health outcomes to economic growth in Nigeria (that is; objective two of the study). Hence, the study presents the results of the VAR-impulse response function as shown in the figures given below:

Figure 3. The response of life expectancy to economic growth.

From Figure 3, Life Expectancy Rate (LIEX) was initially stable in the zero region, but gradually increases in period 1, then it continues to rise from period 5 to period 10, within the positive region. This explains that the one standard deviation of shock to Life Expectancy Rate (LIEX) at first has an impact on the Economic Growth (RGDP) from period 1 and 5, and the response continue rising from period 5 to period 10. From the 5th period to the 10th period, Economic growth (RGDP) rises above its steady state value in the positive region. This means that shocks to Life Expectancy have a positive impact on Economic Growth (RGDP) both in short-run and long-run.

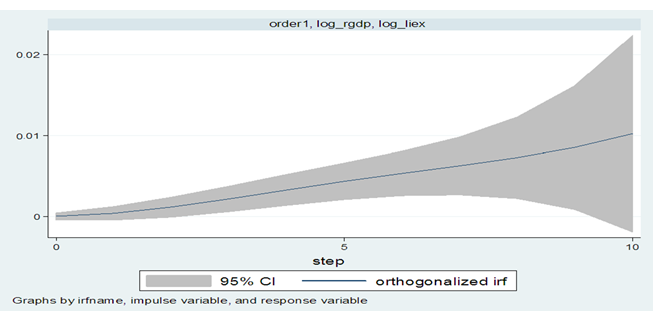

Figure 4. The response of personal remittances to economic growth.

From the Figure 4, Personal Remittances (PESRE) rises initially and continue increasing from period 1 to the 4th period above the zero region, and then becomes stable between period 4 and period 5. It starts to decline from period 5 to period 10. This shows that one standard deviation shock to Personal Remittance (PESRE) has an impact on Economic Growth (RGDP) in period 1 to period 4, and becomes stable between 4thperiod to the 5th period, and then starts declining from period 5 to period 10. From the period 5 to the 10th period, Economic Growth (RGDP) declines below its state value in the negative region. This means that shocks to Personal Remittances (PESRE) in the short-run and long-run have negative impact on Economic Growth (RGDP).

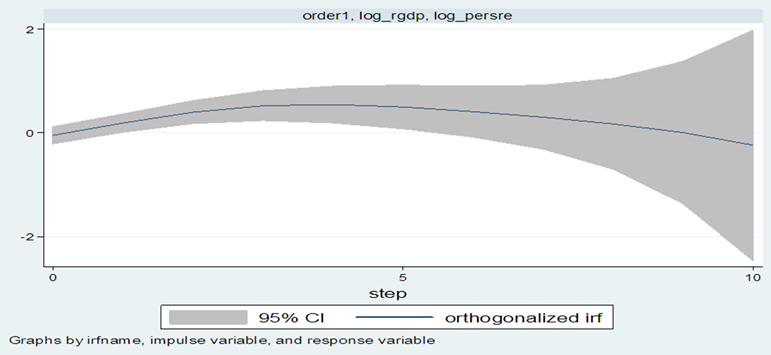

Figure 5. The response of mortality rate to economic growth

From Figure 5 , Mortality Rate (MR) is stable initially and from the period 1 to period 4, it continues to be at stable state at the zero region. Then from period 5 it starts to gradually increase and continues rising to period 10, being positive above the zero region. This shows that the one standard deviation shock to Mortality Rate (MR) initially has a noticeable impact on the economic growth (RGDP) initially from period 1 to period 4, and from the period 5 it starts increasing gradually to period 10. From period 5 to period 10, economic growth (RGDP) rises above its state value in the positive region. This means that shocks to mortality rate (MR) have both short-run and long-run positive impact on economic growth (RGDP).

4.3. The VAR-Stability Test

The VAR-stability tests tries to establish whether the vector autoregressive processes were stable and/or whether the VAR process satisfies the stability condition. In line with this, the study conducted the VAR stability test by utilising the Eigen stability test presented in Table 3 given:

Eigen Value |

Modulus |

0.622 |

0.622 |

0.998 +0.046i |

0.999 |

0.998 - 0.046i |

0.999 |

0.557 + 0.397i |

0.684 |

0.557 - 0.398i |

0.684 |

0.452 + 0.036i |

0.453 |

0.452 - 0.036i |

0.453 |

-0.145 |

0.145 |

Note: "i” represents imaginary root of the eigenvalue. All the eigenvalues lie inside the unit circle. VAR satisfies stability condition. |

From the above Table 3, the values under the modulus are greater than 5% critical value, which shows that all the values are significant. And all the eigenvalues lie inside the unit circle; hence, VAR satisfies stability condition; meaning that the VAR model is rightly stated.

5. Conclusion and Recommendation

This study ascertains the impact flow of remittances and health outcomes on economic growth in Nigeria during the period of 1980 to 2019. Unlike the previous studies which could not find out the causality between remittances and out-of-pocket-expenditure on health; to know whether individuals or households use the remittances for their healthcare expenditure and their other health wants, this study analyses the casual relationship among personal remittances and out-of-pocket health expenditure, using Granger Causality approach, and it is evident that personal remittances granger causes out-of-pocket health expenditure. The study also estimated responses of personal remittances and health outcomes to economic growth in Nigeria, using the VAR Impulse Response Function approach. The results stationary test conducted using the Augmented Dickey Fuller test show that all the variables are stationary at first difference except LOPHE, which is stationary at level. The VAR-Stability test shows that the VAR models are stable, that is the models are rightly specified. From the result on the VAR-Impulse Response function conducted, it is evident that in short-run and long-run, shocks to Life Expectancy positively impact on economic growth (RGDP). This intuitively and in line with theories shows that health outcome or status as life expectancy rate has positive effect on the economic growth. Also, in short-run and long-run, shocks to personal remittances (PESRE) negatively create impact on economic growth (RGDP); this is in-line with the theories. For the response of mortality rate to RGDP, in short-run and long-run, the shocks to mortality rate (MR) have positive impact on economic growth (RGDP); which does not satisfy the intuitive idea and theories, as mortality rate should not have a positive response on the economic growth. The study prescribes that both the government and households should take responsibility for positive health outcomes in the society, so that there will be a sustained healthy population that will remain productive to the economy, while having a higher life expectancy and low mortality rate: this could done when policies to support the free flow of remittances is put in place by the government and that households should use the remittances largely on expenditures that promote their health and well-being.

References

Adela, S., & Dietmar, M. (2013). Remittances and their impacts on the economic growth. Social and Management Sciences, 21(1), 3-19.

Adeshina, K. F., Adewale, O. H., Elvis, O., & Emife, N. S. (2019). Heath status, labour productivity and economic growth in Nigeria. Journal of Energy Management and Technology, 23(1), 1-2.

Alhassan, A., & Abdu, M. (2017). Socio-economic determinants of health status in Nigeria: A case study of Ilorin Metropolis. Lafia Journal of Economics and Management Sciences, 2(1), 277-292.

Aluko, O. O., & Adeniji, S. (2015). Exploring the effect of health on economic growth in Nigeria: A vector error correction model approach. International Journal of Economics, Commerce and Management, 3(9), 659-678.

Barro, R. J. (1996). Determinants of economic growth: A cross-country empirical study. National Bureau of Economic Research. No. w5698.

Bloom, D. E., Canning, D., & Sevilla, J. (2004). The effect of health on economic growth: A production function approach. World Development, 32(1), 1-13.Available at: https://doi.org/10.1016/j.worlddev.2003.07.002.

Cingolani, L., Thomsson, K., & De Crombrugghe, D. (2015). Minding Weber more than ever? The impacts of state capacity and bureaucratic autonomy on development goals. World Development, 72, 191-207.Available at: https://doi.org/10.1016/j.worlddev.2015.02.016.

Contoyannis, P., Jones, A. M., & Rice, N. (2004). The dynamics of health in the British household panel survey. Journal of Applied Econometrics, 19(4), 473-503.

Cuthbertson, W. F. J. (2002). Are the effects of dietary fruits and vegetables on human health related to those of chronic dietary restriction on animal longevity and disease? British Journal of Nutrition, 87(2), 187-188.

Eneji, M. A., Dickson, V. J., & John, O. B. (2013). Health care expenditure, health status and national productivity in Nigeria (1999-2012). Journal of Economics and International Finance, 5(7), 258-272.Available at: https://doi.org/10.5897/jeif2013.0523.

Fayissa, B., & Gutema, P. (2005). Estimating a health production function for Sub-Saharan Africa (SSA). Applied Economics, 37(2), 155-164.Available at: https://doi.org/10.1080/00036840412331313521.

Friedman, M. (1953). Choice, chance, and the personal distribution of income. Journal of Political Economy, 61(4), 277-290.Available at: https://doi.org/10.1086/257390.

Gary, B. (1993). The economic way of looking at behavbiour. Journal of Political Economy, 101(3), 385-409.

Granger, C. W. (1969). Investigating causal relations by econometric models and cross- spectral methods. Econometrica: Journal of the Econometric Society, 37(3), 424-438.Available at: https://doi.org/10.2307/1912791.

Grossman, M. (1972). The demand for health: A theoretical and empirical investigation. NBER Working Paper, New York.

Grossman, M. (2000). On the concept of health capital and the demand for health. Journal of Political Economy, 80(2), 223-255.Available at: https://doi.org/10.1086/259880.

Gujarati, D. N. (2009). Basic econometrics (5th ed.). New York: U.S: McGraw Hill.

Knoema. (2020). Personal remittances, received in current prices. Knoema.com Publications. Retrieved from: https://knoema.com/atlas/topics/Economy/Balance-of-Payments-Current-accounts/Personal-remittances-received.

Locke, J. (1960). Two treatises of government, Peter Laslett (ed.). Cambridge: Cambridge University Press.

Matteo, C., & Uwe, S. (2009). Life expectancy and economic growth: The role of the demographic transition. IZA Journal of Economics and Labour. Paper No. 4160.

New African Magazine. (2020). New African economy. Retrieved from https://newafricanmagazine.com.

Nonvignon, J., Olakojo, S., & Nonvignon, J. (2012). The effects of public and private health care expenditure and health status in Sub-Saharan Africa: New evidence from panel data analysis. Health Economics Review, 2(1), 1-8.Available at: https://doi.org/10.1186/2191-1991-2-22.

Onisanwa, I. (2014). The impact of health on economics growth in Nigeria. International Journal of Innovation and Sustainable Development, 5(19), 159-166.

Sebil, O. O., & Abdulazeez, A. B. (2015). Impact of remittances on economic growth in Nigeria: Further evidence. Economics Bulletin, 35(1), 247-258.

Wang, L. (2003). Determinants of child mortality in LDCs: Empirical findings from demographic and health surveys. Health Policy, 65(3), 277-299.Available at: https://doi.org/10.1016/s0168-8510(03)00039-3.

World Bank. (2016). Health, nutrition and population data. World Health Statistics Reports. The World Bank Group, Washington, D.C., U.S.

World Development Indicators – WDI. (2019). World bank's development indicators. The World Bank, IBRD - IDA, The World Bank Group, Washington, D.C., U.S. Retrieved from: http://wdi.worldbank.org/tables.

Yuni, D. N., Omeje, A. N., & Asogwa, H. T. (2013). Determinants of remittance: Panel evidence from selected countries in Africa. Journal of Economics and Sustainable Development, 4(20), 52-57.