Can Female Directors Improve Performance Consequences of Executives’ External Pay Gap? Evidence from China

Zhang Changzheng1*

Wang Zhenghao2

1,2School of Economics &Management, Xi’an University of Technology, China. |

AbstractDrawing on the perspectives of the tournament theory and critical mass theory, the paper investigates the moderating mechanism of female directors’ participation in the board on the relationship between executives’ external pay gap (EEPG) and firm performance. An unbalanced panel data consisting of 21082 firm-year observations from 2783 non-financial listed companies in Shanghai and Shenzhen Stock Exchange of China from 2008 to 2018 is selected as the research sample, and multiple regression analysis, robustness test and endogenous test are taken as the statistical methods. Theoretical analysis and empirical data conclude that EEPG has an inverted U-shaped impact on firm performance, and a mass level of female directors, i.e., exceeding 1/3 in proportion or 3 in number, would change the curve relationship into a positive linear one by enhancing the positive effects and constraining the negative effects of larger EEPG. The paper adds new knowledge to the literature on consequences of female directors and antecedents of firm performance, specifically by providing a comprehensive understanding how and why female directors improve EEPG’s performance consequences. |

Licensed: |

|

Keywords: |

|

Received: 10 June 2022 |

Funding: This research is supported by the National Social Science Fund Project (Grant number: 20BGL147). |

Competing Interests: The authors declare that they have no competing interests. |

1. Introduction

In the context of China's pursuit of common prosperity, the legitimacy of the widening pay gap has attracted a growing attention from the public and scholars. Compared with the massive literature on the performance consequences of the pay gap within Chinese enterprises, like pay gap among executives and executive-employee pay gap, the research on the performance consequences of the executives’ external pay gap (EEPG) is evidently insufficient. Moreover, there is a significant controversy in existing studies related to this topic. Therefore, it is theoretically urgent and practically necessary to apply the latest sample data of China to further clarify the performance consequences of EEPG and explore the specific mechanism.

Simultaneously, with the continuous improvement of the social status and education attainments of Chinese women, a mushrooming number of women have broken through the career ceiling and begin to play an increasingly important role in the board of directors. In view of the fact that large number of studies have found that female directors are more compassionate, more fair and friendly, more risk averse, and have a human capital composition that is very different from that of men (Saleh & Sun, 2021) lots of scholars argue that increasing the participation of female directors can change the supervision function of the board of directors and the effectiveness of its decision-making, and then such participation exerts a substantial impact on corporate performance (Campbell & Mínguez-Vera, 2008). However, in the existing studies, the research on female directors' performance consequences has not reached a consensus conclusion. And even for the literature that supports the performance promotion effect of female directors, its effect intensity is far less than the theoretical expectation. This research dilemma forces researchers to deeply reflect on the research perspective of the direct effect of female directors on corporate performance. And they increasingly realize that female directors, as the vulnerable groups in reality, are more likely to achieve the impact on corporate performance indirectly through their organic cooperation with some other specific governance mechanisms or institutional arrangements. The EEPG directly determines executives' perception of fairness, and female directors have higher fairness sensitivity. Hence, the matching of the two may have a more substantial impact on corporate performance. In view of this, it is necessary to include female directors into the relationship model between EEPG and firm performance.

Based on the above discussion, this paper intends to take the tournament theory and critical mass theory as the research perspectives, and take the data of Chinese A-share listed companies from 2008 to 2018 as samples to explore whether female directors can change the performance consequences of EEPG. The research findings would enrich the research on the performance consequences of pay gap, expand the research boundary of the effects female directors, and provide more firmly evidence from Chinese background for the tournament theory and critical mass theory. In addition, by demonstrating the effect of female directors’ human capital characteristics on EEPG's performance consequences, the research findings will provide managers and company stakeholders with practical insights for further optimizing the gender structure of the board. The remainders are arranged as follows: section II is literature review and hypotheses; section III is methodology design; section IV is empirical results; the final section is the conclusions.

2 Literature and Hypotheses

2.1. Literature Review

A. Performance Consequences of EEPG

Research results show that the EEPG has a diversified impact on corporate performance, which can be divided into four categories, namely, positive effect, negative effect, nonlinear effect and zero effect.

(1) Views of positive effect. A part of the research provides evidence for the views of the tournament theory, which believes that the competitive atmosphere brought by EEPG can stimulate staff' work enthusiasm and satisfaction, and proves that EEPG, as an motivation mechanism, would improve firm performance. For an instance, the results of Rajiv, Bu, and Mehta (2016) significantly support the tournament theory, proving that EEPG plays a positive motivating role and further claiming that corporate performance is largely driven by the pay premium of senior executives' talents.

(2)Views of negative effect. Some other studies provide a basis for the viewpoint of behavior theory, which believes that two high EEPG makes non-executive employees in the enterprise feel unfair, exploited and other negative emotions. Such feelings would frustrate the work enthusiasm of non-executive employees in the responding enterprise, and thus have a negative impact on enterprise performance. For an example, Dong and Zhang (2017) focusing their research samples on Chinese service companies, have found that the relationship between EEPG and corporate performance is more inclined to be a negative linear link.

(3) Views of curve effect. With the advancement of the research on the performance consequences of EEPG, a considerable number of scholars have gradually realized that, when analyzing the relationship between EEPG and enterprise performance, due to the complexity of the management situations and organizational structure in reality, it is not simply a positive or negative linear relationship. The relationship between the two cannot be explained by a single theory, but both the tournament theory and behavioral theory are applicable. Hence, it shows as a nonlinear inverted U-shaped relationship. For an instance, Sun and Xia (2018) have found that EEPG has an inverted U-shaped relationship with firm performance, that is, EEPG first promotes the improvement of firm performance, but when it exceeds a certain threshold, it will hinder the improvement of firm performance. In addition, they have further found the reverse moderating effect of the growth rate of enterprise performance.

(4)Views of zero effect. Very a few scholars believe that EEPG is of no importance in determining enterprise performance. For an example, Wei (2016) by systematically integrating 113 empirical studies all over the world as samples, have reached a conclusion that the main effect of EEPG on firm performance is not significant by adopting the Meta-analysis Method.

B. Literature on Characteristics of Female Directors

Based on literature review, it can be found that the differences in behavioral characteristics, leadership styles and human capital nature between female and male directors caused by gender difference itself are mainly reflected in the following aspects:

First, female directors hold more conservative risk preferences. Based on the psychological characteristics of women that are quite different from men, some studies believe that female directors are more inclined to a conservative and cautious decision-making style, and show a strong risk control ability and safety-favoring tendency during the strategic decision-making process of enterprises. For an instance, Saleh and Sun (2021) by taking Malaysian listed companies as samples and investigating the mediating effect of cautiousness on the relationship between the proportion of female directors and the company's investment efficiency, have confirmed that the increase in the proportion of female directors helps the board of directors to make more prudent decisions, thereby improving the company's investment efficiency.

Second, female directors hold a more strict supervision style. Based on different research objects and theoretical perspectives, a large number of scholars believe that female directors are more diligent and responsible than male directors in playing the supervision responsibility, showing stronger willingness to supervise. Hence, female directors can better represent the interests of shareholders by alleviating the principal-agent problem. For an example, Zalata, Ntim, Choudhry, Hassanein, and Elzahar (2019) by taking American enterprises as samples, have found that female directors can better exercise their supervision and monitoring roles, which can inhibit the opportunistic behavior of top executives to a certain extent. In addition, Ain, Yuan, Javaid, Usman, and Haris (2021) by taking Chinese listed companies as samples, have found that because female directors can better perform their supervisory functions, they can reduce agency costs and improve corporate governance structure by reducing information asymmetry and manager opportunistic behavior.

Third, female directors show ethical and moral characteristics of higher bottom line. Some scholars also believe that there are significant differences between women and men in moral orientation, which is specifically reflected in that women are more loving, compassionate and humanistically caring, and their judgment standards of behavior tend to be more ethical. Similarly, it is believed that female directors attempt to be compassionate about the impact of their decisions on others’ well-being, and tend to establish cooperative and friendly relationships. Hence, female directors tend to take the behavior, which is of the features of being more moral, fair and just (Lv, Wang, & An, 2014). For an example, Liang, Zhang, Zhan, and Wang (2022) based on the perspectives of female care ethics theory and social role theory, have argued that in the strategic decision-making process of corporate social responsibility, female directors would give play to their caring, empathy and other female-natured characteristics, and thus promote the performance of corporate social responsibility.

2.2. Hypotheses

A. Analysis on the Performance Consequences of EEPG

At present, with the continuous improvement of the executive compensation disclosure system of Chinese listed companies and the rapid development of information technology, the transparency of executive compensation has also been strengthened. Executives can timely and comprehensively understand the pay level and other information of their industry, which makes it easy for executives to compare their own pay with that of other enterprises' executives in the same industry. Hence, EEPG arises. It should be noted that in order to explain the influence mechanism of EEPG more intuitively, this paper defines EEPG as the ratio of the cash pay level of top three executives to the industry-averaged cash pay level of top three executives.

In the first phase, when EEPG is at a relatively lower level, with the gap widening, EEPG plays a performance-enhancing role. Reasons are listed as follows.

First, based on the tournament theory, an increase in EEPG releases a signal that top executives are performing towards a favored orientation by the board and shareholders, and further provides a implicit promise of higher pay-relative performance sensitivity to top executives. Hence, facing the increase of EEPG, executives would be motivated to go all out to compete with their peers of the other enterprises in the same industry, and ultimately improve corporate performance.

Second, based on the efficiency wage theory, with the growth of EEPG, the pay level higher than the industry average level can promote the improvement of production efficiency. That is, a moderate increase in EEPG can generate effective pay incentives for senior executives, which is conducive to improving enterprise performance. Simultaneously, for an enterprise, if its executive pay is higher than the average level in the industry, the enterprise enjoys a competitive advantage in the talent market. Hence, it can not only attract more high-qualified managers, constantly adding new vitality into the enterprise, but also reduce the loss of outstanding talents of the enterprise. According to this logic, the efficiency wage theory argues a moderate increase in EEPG can promote the long-term competitive edge of the enterprise.

Finally, based on the social identity theory, team members' cognition of their membership and the emotional identity attached to this cognition can form a sense of group belonging consistent with the group mission. Hence, when executives realize that they are paid higher than the average level of the industry, they will feel the recognition towards the value of their human capital by the enterprise, and further stimulate their "gratitude" nature with a high possibility. In this case, executives' sense of belonging and loyalty to the enterprise are strengthened, and they would be more diligent and dedicated in their work. In addition, such executives would take measures to improve the consistency between their own interests and the interests of the enterprise, which may be the critical alleviation of the principal-agent problem to a good extent.

However, in the second phase, when EEPG is large enough, an unreasonable increase of EEPG would produce significant negative performance consequences. Two possible reasons are listed as follows.

First, based on the principle of diminishing marginal utility, though EEPG may mainly manifest an incentive effect in the initial stage, its marginal incentive effect will decrease with the widening of EEPG. For senior executives, a too higher pay than the industry average may make their needs nearly fully met. Even if higher pay is given, the marginal utility of senior executives will decrease, making it difficult to continuously stimulate their work enthusiasm (Sun & Xia, 2018). Hence,the so-called "excessive incentives" arise, which will lead to the consequences of excessively seeking benefits while counteracting losses.

In addition, when executives pay is generally higher than the industry average, there would be a lack of competitive atmosphere in the enterprise, and the senior executives may be unable to "be prepared for danger in times of peace" (Liu & Zhang, 2020). Such a fact would result in their indifference to the organizational goals and lack of motivation to acquiring diversified decision-making information, which would reduces the operation efficiency and even the whole enterprise performance. In this case, if the incentive cost increases continuously due to the enlargement of EEPG, the benefits brought by pay gap incentive will not offset the incentive cost, resulting negative net effects on firm performance.Second, with the unreasonable increase of EEPG, the pay gap between executives and non-executive employees within the enterprise would be enlarged to an unacceptable level, since the pay level of non-executive employees would not be raised with the same rate. A growing number of studies, all across the world, have recognized that a too high executive-employee pay gap would do harm to firm performance, due to the sense of unfairness and being exploited, which is argued by the behavioral theory. In this case, if the performance-enhancing effect of rewarding executives does not outweigh the performance-dampening impact caused by the loss of a sense of fairness among ordinary employees, then this will be reflected in a decline in corporate performance.

To sum up, this paper believes that with the widening of EEPG, the change of enterprise performance shows as a curve with the increase of EEPG. To be specific, there is an inverted U-shaped relationship between EEPG and enterprise performance. Hence, H1 is proposed as follows.

H1: There is an inverted U-shaped relationship between EEPG and corporate performance.

B. Analysis on The Correction Effect of Female Directors on EEPG'S Performance Consequences

Due to the physiological and psychological characteristics of women, which are quite different from men, and the differentiated growth background, female directors own different human capital, cognitive concepts, ways of thinking and so on. These heterogeneous endowments improve the supervising and advisory functions of the board of directors, and then indirectly affects the relationship between EEPG and corporate performance.

(1) Female Directors and the Board's Advisory Function

On the one hand, the "flexibility" of female directors determines that they can better perform their consulting duties subjectively. First of all, the ethical characteristics of "empathic care" embodied by female directors can help them be more trusted by senior executives (Zalata et al., 2019). Such a fact can strengthen the information exchange between the board of directors and senior executives. Hence, for the incentive effect of EEPG, the board can receive timely and accurate feedback from the executives, which can promote the board of directors to perform its advisory function.

Secondly, the flexible characteristics of female directors' attention to detail and fairness also determine that they have a sharper perception of unfairness (Carlsson, Daruvala, & Johansson-Stenman, 2005). Such a fact means, when facing the unfairness caused by the salary gap, the gender-diversified board can more sensitively capture the dissatisfaction of relevant employees, and female directors' relatively conservative risk preference can help them to further predict the possible damage more accurately.

Finally, due to the friendly relationship-oriented and democratically participatory leadership style of female directors (Post, Ketchen, & Wowak, 2021), the communication between the board of directors and the senior executives can be strengthened, which can effectively alleviate the problem of information asymmetry in the policy-making and decision-making processes of the board of directors. Moreover, female directors tend to create an atmosphere encouraging cooperation and information exchange that is necessary to the board's advisory function. Hence, female directors' participation is conducive to the board of directors to play an effective advisory role in the formulation of salary incentive policies.

On the other hand, female directors would strengthen the diversification degree of the board of directors, thereby objectively improving its advisory function. Based on the resource dependence theory, diversified organizations can effectively avoid group thinking and improve the quality of strategic decision-making by integrating information resource and relationship networks, and enriching views, professional knowledge and skills (An, Chen, Wu, & Zhang, 2021). Likewise, the human capital theory argues that female directors have a diverse and distinctive stock of human capital, which can bring different perspectives to the board's decision-making process, thereby contributing to active board communication (Ali, Kostov, & Aghab, 2021). Therefore, a gender-diversified board can improve its consulting capability by enhancing the heterogeneity of the board's cognition composition, and further enhance the advisory role of the board in multiple decisions of the enterprise, especially in pay system formulation. In brief, by helping the board of directors perform the advisory function better, women directors can effectively reduce the possibility of performance reduction caused by EEPG. In this case, the positive performance effect of EEPG can be extended, and the performance consequences of EEPG would be optimized.

In principal-agent theory, information asymmetry is one of the main reasons for excessive motivation. In practice, by improving the board's consulting function, the communication between the board and top executives can be improved. And better communication would effectively alleviate the problem of information asymmetry in the policy-making and decision-making processes of the board. That is, female directors can promote the board of directors to perform the consulting function in a better manner, leading to that the board can capture, more timely and accurately, the real incentive effect of EEPG. Hence, the gender-diversified board can flexibly and actively adjust the pay incentive system. Hence, female directors can effectively reduce the possibility of performance reduction caused by an excessive EEPG by helping the board in performing its advisory function, which can extend the performance promotion effect of EEPG and optimize its performance consequences.

(2) Female Directors and The Board's Monitoring Function

First, literature from the perspective of risk aversion theory believes that women directors' strong sense of responsibility and willingness to supervise determine that they are more strict, diligent and responsible in performing their supervision functions (Liang & Lin, 2016) which will also promote the independence of the board of directors, and further strengthen their objective supervision ability (Zhang, Yang, & Yang, 2021). When performing the supervision function, female directors with the characteristics of conservatism will pay more attention to the phenomena having a negative impact on performance, such as vicious competition, rent-seeking by misusing managerial power, employee slack, and so on. Female directors' reactions to such phenomena are stronger, and they would intervene in the phenomena through their superior supervision ability. Hence, they can stop losses in time. In short, the participation of female directors can promote the board of directors to play its supervisory function more effectively, reduce the cost of supervision, and effectively curb the opportunistic behavior of the management (Ain et al., 2021).

Secondly, according to the resource dependence theory and information decision-making theory, heterogeneous teams have information advantages, and such teams can further realize the complementarity and integration of social networks, and other resources, based on obtaining rich and qualified information through communication among members (Pan, He, & Li, 2019). Hence, the distinctive social capital and independence characteristics of female directors can promote the diversification of human capital and social capital of the gender-diversified board, which is conducive to the divergence of the decision-making thinking of the board, expanding the scope of access to information and resources (Post et al., 2021). In this case, the independence and objective supervision ability of the board would be enhanced.

Great difficulties in supervision lead to the enterprises adopt higher pay gap to exert strong incentives. However, an excessive incentive would arise when the enterprises show too heavy reliance on higher pay gap. Female directors can optimize the implementation of the board's supervisory function, strengthen the controlling ability of the board over the incentive effect, ensure the maximization of the long-term interests of shareholders, and further heighten the threshold of excessive incentives.

In short, female directors can optimize the advisory and supervisory functions of the board of directors, and further strengthen the effectiveness of the board governance. Simultaneously, based on the critical Mass theory (Zhang et al., 2021) when the proportion of female directors reaches or exceeds 1/3, female directors can really have a substantial influence in the board of directors. And before that, their unique role in corporate governance, in fact, cannot be reflected in the firm performance level. Hence,this paper believes that female directors who reach the critical mass can improve the performance consequences of EEPG. That is, a mass of female directors can promote the symmetry axis of the inverted U-shaped curve between EEPG and corporate performance to shift to the right, or change the inverted U-shaped relationship into a positive correlation. Based on the above, H2 is proposed as follows.

H2: Female directors who reach the critical mass can improve the performance consequences of EEPG.

3. Methodology

3.1. Sample and Data

All the A-share listed companies in Shanghai and Shenzhen Stock Exchange of China from 2008 to 2018 are selected as the sample framework. The following steps are executed to screen the final research sample: (1) ST and PT listed companies should be excluded due to their abnormal financial data; (2) Financial listed companies should be excluded due to their distinctive rules in building financial statements; (3) Listed companies with abnormal/incorrect data in the responding sampling year, including listed companies whose directors number is less than 3, executive-employee pay ratio is less than 1, or asset liability ratio is higher than 1, etc., should be excluded; (4) Listed companies with missing data of key variables investigated in this study should be excluded.

Accordingly, an unbalanced panel sample consisting of 21082 firm-year observations from 2783 listed companies have been finally obtained . All the data required by the study are drawn from China Stock Market & Accounting Research Database(CSMAR). In addition, in order to prevent the distortion effect of extreme values in the sample, all continuous variables are subject to 1% tailing treatment according to Winsorize Rule. This paper mainly uses excel2019, spss26.0 and stata16.0 as the tools of data analysis.

3.2. Measures

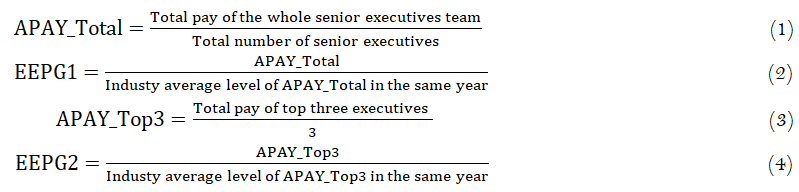

(1) Explanatory variable: EEPG. Referring to the ideas in existing literature on EEPG (Liu & Zhang, 2020) it is believed that the industry average level of executive pay is the external reference benchmark with which the top executives to compare their pay. The industry average level can not only reflect the job opportunity cost of the executives to a large extent, but also serve as an important reference benchmark for the evaluation of their current and future pay level by the top executives. Hence, the ratio of top executives' average pay level to industry average level of top executives' average pay level in the same year (EEPG1) is used to measure EEPG. Based on the research of Luan and Ji (2020) EEPG of core executives (EEPG2) is used as an alternative measure for robustness test. The specific calculation method is defined as follows:

(2) Explained variable: Firm performance (ROA). Tobin Q and other market-based performance indicators are not suitable for Chinese listed companies due to Chinese capital market's weak effectiveness (Yang & Chen, 2021). Hence, referring to the mainstream practice in the literature on Chinese firm performance, accounting performance indicators would be used to measure firm performance. Return on total assets (ROA) not only reflects the overall profitability of the enterprise, but also reflects the management level of senior executives and the future development potential of the enterprise to a good extent (Sun & Xia, 2018). Based on this view, ROA is selected to measure firm performance in this study, and return on net assets (ROE) is used as an alternative measure for the subsequent robustness test.

(3) Moderating variable: Female directors’ participation (FDP). Referring to Ruobing, Dongrong, and Yating (2021) the proportion of female directors' number in the total number of directors on the board (FDP) is used to measure female directors' participation degree.

(4) Control variables. Referring to literature on the determination mechanisms of firm performance (Gao & Lu, 2015; Li & Jiao, 2021; Sun & Xia, 2018) this paper selects the following control variables from three levels, respectively organizational characteristics, governance features and external environment. Control variables of organizational characteristics include firms age(Age), firm size(Size), property rights nature(PRN), Leverage ratio (LEV), and growth rate(Grow); Control variables of governance features include board size(BOA), equity concentration degree(ECD), board independence (IND), and CEO duality(DUAL); Control variables of external environment include marketization index (MARI), which can control the impact of regional economic development, and the industry dummy variable (Industry) and the year dummy variable (Year). Table 1 shows the definition of the above research variables.

| Categories | Names | Codes | Definitions |

| Explanatory Variables | External pay gap of all executives | EEPG1 | See Equation 1, Equation 2 |

| External pay gap of top three executives | EEPG2 | See Equation 3, Equation 4 | |

| Explained variables | Firm performance | ROA | Net profit/[(Total assets at the beginning of the year + total assets at the end of the year)/2] |

| ROE | Net profit/[(Net assets at the beginning of the year + net assets at the end of the year)/2] | ||

| Moderating variable | Female directors participation | FDP | Number of female directors/Total number of directors |

| Control variables | Firm age | AGE | LN(Accounting year - year of establishment) |

| Property rights nature | PRN | Dummy variable: PRN is 1 when the sample firm is state-owned;otherwise, PRN is 0 | |

| Board size | BOA | LN(total number of directors) | |

| Equity concentration degree | ECD | Number of shares held by the first largest shareholder / total number of shares | |

| Board independence | IND | Number of independent directors/board size | |

| CEO duality | DUAL | Dummy variable: DUAL is 1 when CEO also takes the position of Chairman, otherwise, DUAL is 0 | |

| Leverage ratio | LEV | Total debt at the end of the year/Total assets at the end of the year | |

| Firm size | Size | LN(Total assets at the end of the year) | |

| Growth rate | Grow | (current operating income-previous operating income) / previous operating income | |

| Marketization index | MARI | The marketization index from 2008 to 2016 comes from "Report on China's Provincial Marketization Index (2018)" by Fan Gang, and the index from 2017 to 2018 are obtained through using simple exponential smoothing method. | |

| Industry | Industry | Dummy variable of industry | |

| Year | Year | Dummy variable of year |

3.3. Empirical Models

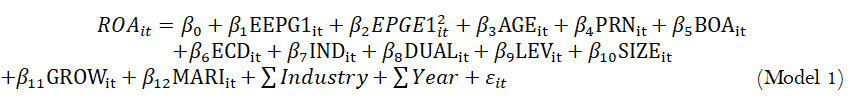

In order to explore the direct impact of EEPG on firm performance, a multiple regression model (See Model 1) based on Ordinary Least Squares (OLS) by taking ROA as the explanatory variable and EEPG1 as the explained variable is built to test H1.

In Model 1, “i” refers to a specific sample firm, “t” refers to a specific sample year, and ϵ is the random error term. According to H1, it is expected that, in the regression results of Model 1, β1>0, while β2<0.

In addition, based on the critical mass theory, when the proportion of female directors reaches 1/3 or even higher, female directors will actually play its governance effect which is very different from that of males. Hence, in order to explore the moderating role of female directors, H2 would be tested by adopting Grouping Regression Method. According to the critical mass standard, i.e., whether the proportion of female directors reaches 1/3, the paper builds a sub-sample of higher female directors’ participation (HFDP_Sample) and a sub-sample of lower female directors’ participation (LFDP_Sample). By respectively fitting Model 1 with the two sub-samples, the two results would be compared with each other with the purpose of testing H2.

3.4. Descriptive Statistics

Descriptive statistical analysis of the research variables in the whole sample is carried out by adopting Statistical Product and Service Solutions (SPSS). Table 2 shows the results.

In Table 2, the average proportion of female directors is about 13.4%, the minimum value is 0, and the maximum value is 46.2%. The fact indicates that female directors have occupied a certain proportion in the board of directors of Chinese listed companies, and the composition of the board gradually shows a trend of higher gender diversity. However, in general, the proportion of female directors in Chinese listed companies is still far lower than that of male directors, just like most western countries. The descriptive statistical results of the control variables are within the reasonable range, implicating that the data quality of this paper is reliable.

| Variables | Minimum |

Maximum |

Average |

S.D. |

| EEPG1 | 0.203 |

4.208 |

0.992 |

0.684 |

| FDP | 0 |

0.462 |

0.134 |

0.116 |

| ROA | -0.122 |

0.212 |

0.047 |

0.050 |

| AGE | 0 |

3.932 |

2.595 |

0.428 |

| PRN | 0 |

1 |

0.410 |

0.491 |

| BOA | 1.609 |

2.890 |

2.285 |

0.241 |

| ECD | 8.770 |

74.960 |

35.227 |

14.975 |

| IND | 0.250 |

0.600 |

0.380 |

0.071 |

| DUAL | 0 |

1 |

0.760 |

0.429 |

| LEV | 0.051 |

0.863 |

0.431 |

0.204 |

| SIZE | 18.589 |

25.473 |

21.472 |

1.409 |

| GROW | -0.492 |

2.402 |

0.192 |

0.389 |

| MARI | -0.230 |

10.830 |

7.944 |

1.838 |

3.5. Correlation analysis

Table 3 reports the results of the correlation analysis of the research variables. The results show that the correlations between variables basically conform to the theoretical expectations, preliminarily proving the reliability of the collected data in this study. Variance Inflation Factor (VIF) values of all variables in the subsequent regressions are less than 10, indicating that there is no serious multicollinearity problem, which further ensures the accuracy of the research results.

(Lower-left triangle: Pearson correlation; Upper-right triangle: Spearman correlation) |

| Variables | EEPG |

FDP |

ROA |

AGE |

PRN |

BOA |

ECD |

IND |

DUAL |

LEV |

SIZE |

GROW |

MARI |

| EEPG1 | 1 |

-0.05*** |

0.25*** |

-0.03*** |

0.01 |

-0.03*** |

-0.02** |

-0.01* |

0.02*** |

0.06*** |

0.36*** |

0.09*** |

0.15*** |

| FDP | -0.05*** |

1 |

0.03*** |

0.09*** |

-0.20*** |

-0.08*** |

-0.04*** |

0.06*** |

-0.10*** |

-0.09*** |

-0.13*** |

0.01* |

0.11*** |

| ROA | 0.23*** |

0.02*** |

1 |

-0.11*** |

-0.15*** |

-0.06*** |

0.09*** |

0.02*** |

-0.07*** |

-0.40*** |

0.00 |

0.31*** |

0.06*** |

| AGE | -0.02*** |

0.07*** |

-0.10*** |

1 |

0.05*** |

0.04*** |

-0.11*** |

-0.01 |

0.02*** |

0.08*** |

0.10*** |

-0.07*** |

0.21*** |

| PRN | 0.01** |

-0.20*** |

-0.12*** |

0.04*** |

1 |

0.22*** |

0.21*** |

-0.13*** |

0.28*** |

0.30*** |

0.32*** |

-0.11*** |

-0.23*** |

| BOA | -0.01 |

-0.07*** |

-0.05*** |

0.03*** |

0.23*** |

1 |

-0.01* |

-0.13*** |

0.14*** |

0.14*** |

0.21*** |

-0.03*** |

-0.05*** |

| ECD | -0.03*** |

-0.04*** |

0.10*** |

-0.12*** |

0.21*** |

-0.01 |

1 |

0.01* |

0.04*** |

0.08*** |

0.19*** |

-0.00 |

-0.02*** |

| IND | -0.01 |

0.06*** |

0.02*** |

-0.01* |

-0.13*** |

-0.14*** |

0.03*** |

1 |

-0.11*** |

-0.06*** |

-0.06*** |

0.02*** |

0.06*** |

| DUAL | 0.02** |

-0.10*** |

-0.05*** |

0.02*** |

0.28*** |

0.14*** |

0.05*** |

-0.11*** |

1 |

0.15*** |

0.17*** |

-0.06*** |

-0.14*** |

| LEV | 0.09*** |

-0.09*** |

-0.37*** |

0.09*** |

0.31*** |

0.15*** |

0.08*** |

-0.06*** |

0.15*** |

1 |

0.53*** |

0.02*** |

-0.11*** |

| SIZE | 0.39*** |

-0.14*** |

0.03*** |

0.07*** |

0.33*** |

0.22*** |

0.21*** |

-0.04*** |

0.16*** |

0.52*** |

1 |

0.09*** |

0.01* |

| GROW | 0.02*** |

0.01 |

0.22*** |

-0.03*** |

-0.09*** |

0.00 |

0.01* |

0.01 |

-0.04*** |

0.04*** |

0.07*** |

1 |

0.02*** |

| MARI | 0.11*** |

0.10*** |

0.03*** |

0.18*** |

-0.22*** |

-0.06*** |

-0.03*** |

0.06*** |

-0.14*** |

-0.11*** |

0.01* |

0.00 |

1 |

Note: *., **. and ***. respectively represents the coefficients are significant at the level of 0.1, 0.05 and 0.01(Bilateral). |

4 Empirical Results

4.1. Test of the Impact of EEPG on Firm Performance

Column(1) of Table 4 reports the regression results of Model 1 with the whole sample. Under the condition of considering rich control variables and the fixed effects of industry and year, it can be known that the coefficient of EEPG1 on ROA is 0.025(P<0.01), and the coefficient of EEPG12 is -0.003(P<0.01). Moreover, UTEST results have found that the extreme point of the inverted U-shaped curve (EEPG1=3.71) is within the sample range. Hence, the relationship between EEPG and firm performance (ROA) is significantly inverted U-shaped. H1 has been confirmed.

| Variables | Whole Sample |

LFDP_Sample |

HFDP_Sample |

(1) |

(2) |

(3) |

|

| EGAP1 | 0.025*** (19.605) |

0.027*** (19.892) |

0.014*** (2.832) |

| EGAP1² | -0.003*** (-9.375) |

-0.004*** (-10.255) |

0.001 (0.819) |

| Age | 0.004*** (4.343) |

0.004*** (4.425) |

0.000 (0.030) |

| Soe | -0.007*** (-9.810) |

-0.007*** (-9.159) |

-0.006** (-2.047) |

| Boa | 0.001 (0.665) |

0.001 (0.744) |

0.002 (0.388) |

| ECD | 0.000*** (15.950) |

0.000*** (15.410) |

0.000*** (4.391) |

| Ind | 0.001 (0.124) |

0.003 (0.629) |

-0.015 (-0.970) |

| Dual | -0.001* (-1.845) |

-0.001 (-1.474) |

-0.002 (-0.986) |

| Lev | -0.128*** (-69.697) |

-0.127*** (-66.567) |

-0.141*** (-20.714) |

| Size | 0.008*** (24.855) |

0.007*** (23.159) |

0.011*** (8.945) |

| Grow | 0.026*** (35.096) |

0.026*** (32.728) |

0.035*** (12.757) |

| MARI | -0.000*** (-2.749) |

-0.000** (-2.514) |

-0.000 (-0.724) |

| Constants) | -0.101*** (-14.578) |

-0.102*** (-14.047) |

-0.130*** (-4.664) |

| Year | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes |

| F | 260.099 | 237.841 | 24.845 |

| R² | 0.320 | 0.320 | 0.345 |

| A-j R² | 0.318 | 0.319 | 0.331 |

| N | 21082 | 19247 | 1835 |

Note:*., **. and ***. respectively represents the significance level of 0.1, 0.05 and 0.01. |

4.2. Test of the Moderating Effect of Female Directors on the Relationship Between EEPG and Firm Performance

Columns (2) and (3) of Table 4 report the regression results of Model 1 respectively with the HFDP-Sample and LFDP_Sample. Column (2) indicates that under the condition of a lower proportion of female directors, the coefficient of EEPG1 on ROA is 0.027(P<0.01), and the coefficient of EEPG12 is -0.004 (P<0.01), which are all significant statistically. Meanwhile, Column (3) indicates that under the condition of a higher proportion of female directors, the coefficient of EEPG1 on ROA is 0.014(P<0.01), while the coefficient of EEPG12 on ROA is 0.001(P>0.1). The later is not statistically significant any more.

Comparing the regression results of the two sub-samples, it shows that higher proportion of female directors(>1/3) can change the inverted U-shaped performance consequence of EEPG into a linear positive one. Hence, it can be argued that female directors who reach the critical mass would significantly improve the performance consequences of EEPG. H2 has been confirmed.

4.3. Robustness Test

A. Robustness Test Based on Changing the Measure of the Explained Variable (I.E., Firm Performance)

By replacing ROA in Model 1 with ROE, we conduct the same regression analysis again. Column (1), (2) and (3) in Table 5 report the robustness test results.

Robustness test result of H1 is shown in Column (1). The regression coefficient of EEPG1 on ROE is 0.044(P<0.01), and the coefficient of EEPG1² on ROE is -0.005(P<0.01). This result indicates that EPEG has an inverted U-shaped relationship with firm performance measured by ROE, and H1 still holds.

Robustness test result of H2 is shown in Column (2) and (3). For the sub-sample with lower proportion of female directors (LFDP_Sample), the regression coefficient of EEPG1 is 0.046(P<0.01), the coefficient of EEPG1² on ROE is -0.005(P<0.01). While for the sub-sample with higher proportion of female directors (HFDP_Sample), the regression coefficient of EEPG1 is 0.021(P<0.01), while the coefficient of EEPG1² on ROE is insignificant. This result indicates that female directors exceeding the mass level would enhance the positive performance consequences of EEPG. And H2 still holds.

In conclusion, test results of H1 and H2 do not change with the change of the measurement method of firm performance.

| Sample | Whole Sample |

LFDP_Sample |

HFDP_Sample |

Whole Sample |

LFDP_Sample |

HFDP_Sample |

Whole Sample |

LFDP_Sample |

HFDP_Sample |

||||

| Explanatory variable | ROEt |

ROEt |

ROEt |

ROAt |

ROAt |

ROAt |

ROAt+1 |

ROAt+1 |

ROAt+1 |

||||

| Column | (1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

(9) |

||||

| EGAP1 | 0.044*** (17.565) |

0.046*** (17.788) |

0.021** (2.321) |

0.022*** (14.759) |

0.024*** (15.361) |

0.006 (1.105) |

|||||||

| EGAP1² | -0.005*** (-7.045) |

-0.005*** (-7.872) |

0.003 (1.324) |

-0.003*** (-6.842) |

-0.003*** (-7.975) |

0.003* (1.884) |

|||||||

| EGAP2 | 0.009*** (20.283) |

0.009*** (20.541) |

0.004*** (2.606) |

||||||||||

| EGAP2² | -0.0003*** (-11.100) |

-0.0004*** (-11.866) |

0.0002 (0.463) |

||||||||||

| Control | YES |

||||||||||||

| Year /Industry |

YES |

||||||||||||

| F | 159.686 |

144.623 |

16.955 |

255.944 |

234.339 |

23.961 |

133.987 |

123.643 |

12.414 |

||||

| R² | 0.224 |

0.222 |

0.264 |

0.316 |

0.317 |

0.336 |

0.198 |

0.201 |

0.202 |

||||

| Adj R² | 0.222 |

0.221 |

0.248 |

0.315 |

0.315 |

0.322 |

0.197 |

0.200 |

0.185 |

||||

| N | 21082 |

19247 |

1835 |

21082 |

19247 |

1835 |

20602 |

18694 |

1908 |

||||

Note:*., **. and ***. respectively represents the significance level of 0.1, 0.05 and 0.01. |

B. Robustness Test Based on Changing the Measure of the Explanatory Variable (EEPG)

By replacing EEPG1 with EEPG2 in Model 1, we conduct the same regression analysis as that in Section 4.1 and 4.2. Column (4)-(6) in Table 5 report the relevant robustness test results.

Robustness test result of H1 is shown in Column (4). The coefficient of EEPG2 is 0.009(P<0.01), and the coefficient of EEPG2² is -0.0003(P<0.01). It indicates that EEPG measured by EEPG2 has an inverted U-shaped relationship with firm performance. And H1 is still valid.

Robustness test results of H2 are shown in Columns (5) and (6). In the sub-sample with a lower proportion of female directors (LFDP_Sample), the coefficient of EEPG2 is 0.009(P<0.01), while the coefficient of EEPG2² is -0.0004(P<0.01); In the sub-sample with a higher proportion of female directors(HFDP_Sample), the coefficient of EEPG2 is 0.004(P<0.01), while the coefficient of EEPG2² is not significant. By comparing the two results, it can be argued that H2 still holds.

In conclusion, the empirical results do not change with the change of the measurement method EEPG.

C. Robustness Test Based on Considering Hysteresis Effect

Considering that the impact of EEPG on firm performance may be of hysteresis effect (i.e., time lagging effect), ROAt in Model 1 is replaced with ROAt+1. And the regression results of the new model are reported in Columns (7)-(9) of Table 5.

Column(7) shows that the regression coefficient of EEPG1 on ROAt+1 is 0.022(P<0.01), and the coefficient of EEPG1²is -0.003(P<0.01). This result shows that H1 is still valid.

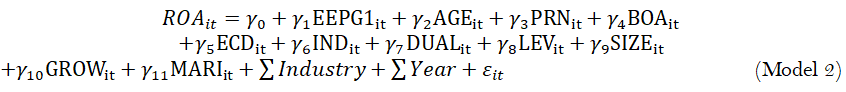

Column (8) indicates that, in the sub-sample with a lower proportion of female directors, the coefficient of EEPG1 on ROAt+1 is 0.024(P<0.01), and the coefficient of EEPG1² is -0.003(P<0.01); Column (9) indicates that, in the sub-sample with a higher proportion of female directors, the coefficient of EEPG1 is not statistically significant. By removing EEPG1²from Model 1, Model 2 has been built. Fitting Model2 with the sub-sample with a higher proportion of female directors,the result shows that the coefficient of EEPG1 on ROAt+1 is 0.016(P<0.01). Due to the need of paper simplification, the result of Model 2 is available on request. Hence, H2 still holds even considering the possible hysteresis effect.

In short, the three steps of robustness tests indicate that empirical results of this paper are of good robustness.

4.4. Endogenous Test

Empirical results have shown that the enlargement of EEPG would lead to changes in firm performance. However, whether from the perspective of theory or practice, there may be endogeneity issues due to the potential two-way causality between EEPG and firm performance. Without considering such endogeneity, the estimation results are neither unbiased nor consistent.

In order to solve such endogeneity, lots of scholars adopt the method of finding effective instrumental variables for endogenous explanatory variables. That is, the Two-Stage Least Square (2SLS) is adopted to deal with the interference of endogeneity. Generally speaking, the change of a company's pay system is continuous and slow. Hence, the current pay gap (EEPGt) has a high correlation with the previous pay gap (EEPGt-1). Referring to Zhou and Tao (2009); Yang and Chen (2021) the paper chooses EEPGt-1 and its quadratic term(EEPGt-12) as the instrumental variables of Model 1.

Table 6 reports the endogenous test results of Model 1. Among them, Column (1), Column(2) and Column(3) report the endogenous test results of H1. According to the regression results of the first stage, EEPG1t-1 and EEPG1t-12 are respectively significantly correlated with EEPG1t and EEPG1t2 at the significance level of 1%. Moreover, with the purpose of testing whether there is an endogenous problem between EEPG and firm performance in Model 1, Durbin-Wu-Hausman(DWH) test has been executed. The test result show that P value is less than 0.1, which proves that EEPG1t is an endogenous variable.

In addition, the test results of the instrumental variables’ effectiveness indicate that F statistic of the first stage regression is much larger than the critical value of 10, and Partial R² is also located within a reasonable range, indicating that the instrumental variables have a strong explanation for endogenous variables. Hence, it can be considered that there is no problem of weak instrumental variables. The second stage regression results are shown in Column (3), which is basically consistent with the baseline regression results, indicating that H1 is still acceptable even considering endogenous problems. Due to paper length limitations, Table 6 only reports the second stage regression results of the moderating effect of female directors, which can be seen in Column (4) and Column (5). It can be seen that H2 still holds even considering endogenous issues.

| Stage | First stage |

First stage |

First stage |

Second stage |

Second stage |

| Sample | Whole Sample |

Whole Sample |

Whole Sample |

LFDP_Sample |

HFDP_Sample |

| Explained Variable |

EGAP1t |

EGAP1t² |

ROA |

ROA |

ROA |

| Column | (1) |

(2) |

(3) |

(4) |

(5) |

| EEPG1t-1 | -5.050*** (-53.050) |

-42.597*** (-57.440) |

——— |

——— |

——— |

| EEPG1t-1² | 0.224*** (60.460) |

1.764*** (61.200) |

——— |

——— |

——— |

| EEPG1t | ——— |

——— |

0.020*** (8.808) |

0.021*** (7.595) |

0.017* (1.764) |

| EEPG1t² | ——— |

——— |

-0.002*** (-4.699) |

-0.002*** (-3.563) |

-0.001 (-0.984) |

| Controls | Yes |

||||

| Year /Industry |

Yes |

||||

| N | 19084 |

19084 |

19084 |

17338 |

1746 |

| Partial R² | 0.497 |

0.283 |

——— |

——— |

——— |

| R² | 0.599 |

0.344 |

0.231 |

0.233 |

0.275 |

| F | 307.841 |

67.534 |

98.565 |

90.194 |

20.629 |

Note:*., and ***. respectively represents the significance level of 0.1, and 0.01. |

5. Conclusions

Drawing on the tournament theory and critical mass theory, this study intends to address the relationship between EEPG and corporate performance, and further investigate whether and how female directors can change the performance consequences of EEPG, by taking more than 20,000 firm-year observations of non-financial A-share listed companies in China from 2008 to 2018 as the research samples. Theoretical analysis and empirical data confirm that:

(1) There is an inverted U-shaped relationship between EEPG and firm performance in Chinese listed companies. With the continuous widening of EEPG, firm performance will increase at the early stage. However, when EEPG gradually reaches the critical point of the inverted U-shaped curve, firm performance would begin to decline. At present, with the ever increasingly enlargement of EEPG, in parts of Chinese listed companies, their EEPG has exceeded the critical point of the inverted U-shaped curve. In this case, the marginal incentive effect of EEPG has turned into negative, resulting in performance inhibition effect caused by excessive incentives.

(2) In Chinese listed companies, female directors who reach critical mass can significantly improve the performance consequences of EEPG. The results show that female directors have strengthened the efficiency and effectiveness of the board governance by help the board of directors in performing consulting and supervision functions more effectively. Hence, female directors can significantly avoid the negative performance inhibition effect caused by excessive incentives, and thus optimize the performance consequences of EEPG by giving full play to the positive incentive value of EEPG to a greater extent.

The practical implications of this paper are as follows. First, when designing EEPG, Chinese listed enterprises should not only pursue efficiency first, but also give consideration to fairness. Enterprises should appropriately enlarge EEPG, which is helpful in encouraging senior executives to work harder, be more diligent and dedicated, constantly promote the consistency between their individual interests and the interests of shareholders, and also ensure their enterprises have a competitive advantage in human capital in the industry. However, enterprises should also avoid excessive EEPG and pay attention to the possible excessive incentive effect, with the purpose of motivating the management to "be prepared for danger in times of peace".

Secondly, enterprises should make full use of the unique attributes of female directors and their heterogeneous social/human capital to strengthen the advisory and supervisory functions of the board of directors, which can improve the internal governance mechanism. According to the conclusions of this paper, only women directors who reach the critical mass can play their expected role. However, the proportion of women directors in most listed companies in China is still below this standard. Hence, when selecting and appointing directors, enterprises should reasonably promote the gender diversity of the board of directors on the basis of their actual situation. Enterprises should attempt to break the "glass ceiling" in female promotion by actively hiring female directors. In addition, enterprises should pay attention to creating a fair competition environment to reduce the environmental constraints on the ability of female directors, and give full play to their heterogeneous human resources advantages to the greatest extent, by providing more opportunities for outstanding female directors to display their talents.

The last but not the least, given the low percentage of female directors in China, female directors should be more brave enough to break away from stereotypes, prejudices and gender discrimination. More importantly, they should focus more on realizing career commitment, constantly exploring and expanding their potential, grasping opportunities and striving to gain influence in the board. In daily work, female directors should make full use of their excellent communication skills, sense of responsibility, willingness to monitor, and favor over fairness and cooperation, and other positive female-natured attributes to proactively participate in corporate governance, which can improve the effect of board governance.

References

Ain, Q. U., Yuan, X., Javaid, H. M., Usman, M., & Haris, M. (2021). Female directors and agency costs: Evidence from Chinese listed firms. International Journal of Emerging Markets, 16(8), 1604-1633.Available at: https://doi.org/10.1108/ijoem-10-2019-0818.

Ali, A., Kostov, P., & Aghab, E. (2021). Does female human capital constrain earning management: The case of the United Kingdom. Business Ethics, the Environment & Responsibility, 30(4), 588-603.Available at: https://doi.org/10.1111/beer.12360.

An, H., Chen, C. R., Wu, Q., & Zhang, T. (2021). Corporate innovation: Do diverse boards help? Journal of Financial and Quantitative Analysis, 56(1), 155-182.Available at: https://doi.org/10.1017/s0022109019001005.

Campbell, K., & Mínguez-Vera, A. (2008). Gender diversity in the boardroom and firm financial performance. Journal of Business Ethics, 83(3), 435-451.Available at: https://doi.org/10.1007/s10551-007-9630-y.

Carlsson, F., Daruvala, D., & Johansson-Stenman, O. (2005). Are people inequality-averse, or just risk-averse? Economica, 72(287), 375-396.Available at: https://doi.org/10.1111/j.0013-0427.2005.00421.x.

Dong, S., & Zhang, Q. (2017). The impact of executive pay gap on corporate performance in listed companies in the service industry. Communication of Finance and Accounting(20), 38-41.

Gao, L., & Lu, J. (2015). Reserach on asymmetric incentive effect of internal pay dispersion- threshold panel model based on manufacturing firm data. China Industrial Economy, 33(8), 114-129.

Li, Q., & Jiao, H. (2021). Pay dispersion in top management team and enterprise performance: The dual perspective of customer demand uncertainty and enterprise growth. Business and Management Journal, 43(6), 53-68.

Liang, Q., Zhang, J.-M., Zhan, Y.-X., & Wang, B. (2022). Does female director promote corporate social responsibility?—Moderating effect of gender equality and family business context. R&D Management, 34(1), 120-132.

Liang, S., & Lin, Z. (2016). Female directors, overinvestment and variability of corporate performance: From the perspective of prudency. Management Review, 28(7), 165-178.

Liu, W.-Q., & Zhang, Y. (2020). External salary comparison and firm performance — based on management and ordinary employees. China Soft Science, 35(5), 104-117.

Luan, F., & Ji, Y. (2020). Executive external compensation gap, corporate governance quality and enterprise innovation. Economic Survey, 37(1), 114-122.

Lv, Y., Wang, Z.-B., & An, S.-M. (2014). A literature review of theoretical foundation and empirical study of the effect of women directors on corporate social responsibility. Foreign Economics & Management, 36(8), 14-22.

Pan, Z., He, S. Y., & Li, J. (2019). Female executives, pay gap and corporate strategic deviance. Business and Management Journal, 41(2), 122-138.

Post, C., Ketchen, J. D. J., & Wowak, K. D. (2021). Should governments mandate more female board representation? Possible intended and unintended consequences. Business Horizons, 64(3), 379-384.Available at: https://doi.org/10.1016/j.bushor.2021.02.003.

Rajiv, B. D., Bu, D., & Mehta, M. N. (2016). Pay gap and performance in China. Abacus, 52(3), 501-531.Available at: https://doi.org/10.1111/abac.12082.

Ruobing, L., Dongrong, Z., & Yating, M. (2021). Gender structure, management interaction, and corporate value of listed companies. Management Review, 33(12), 200.

Saleh, M. N., & Sun, X. W. (2021). The influence of female directors proportion on investment efficiency: The mediating role of caution. Gender in Management: An International Journal, 37(3), 289-304.Available at: https://doi.org/10.1108/gm-09-2020-0295.

Sun, L., & Xia, T. (2018). Performance growth rate, external pay gap and firm performance. Finance and Accounting Monthly, 39(6), 90-96.

Wei, X. (2016). A meta-analysis of the effects of pay level and pay dispersion on firm operational outcomes. Advances in Psychological Science, 24(7), 1020.Available at: https://doi.org/10.3724/sp.j.1042.2016.01020.

Yang, J., & Chen, L.-X. (2021). Research on executive internal pay gap and company performance under the background of high-quality development—new evidence from Chinese a-share listed manufacturing industry. Journal of Harbin University of Commerce (Social Science Edition), 37(5), 3-14+30.

Zalata, A. M., Ntim, C. G., Choudhry, T., Hassanein, A., & Elzahar, H. (2019). Female directors and managerial opportunism: Monitoring versus advisory female directors. The Leadership Quarterly, 30(5), 101309.Available at: https://doi.org/10.1016/j.leaqua.2019.101309.

Zhang, C., Yang, F., & Yang, G. (2021). Tenure-based determining mechanism of CEO compensation: The compensation correction effect of female directors. China Soft Science, 36(S1), 348-356.

Zhou, L., & Tao, J. (2009). Government size, market development and corruption. Economic Research Journal, 44(1), 57-69.