Relationship between Export, Imports and Economic Growth: An Export-led Growth Strategy for the Gambia Using The Granger Causality Test

Ebrima K. Ceesay1*

Christopher Belford2

Momodou Mustapha Fanneh3

Habibatou Drammeh4

1,2,3School of Business and Public Administration, Department of Economics, University of the Gambia, The Gambia |

AbstractThe paper investigates the relationship between exports, imports and economic growth in the Gambia using Granger causality analysis. The data was obtained from the World Development Indicator (WDI) and the periods covered were 1980-2017. The main aim of the study was to identify the relationship between import, export and growth in the Gambia. We added the exchange rate to have more views of their relationship with growth. The method used was Granger-Causality tests. According to the results, there is a causal relationship between growth rate and imports and imports and growth rate (bidirectional relationship). Exports do not Granger cause growth. Based on the outcome of the causality test, change in economic growth does not help explain the changes in exports, but it does for the change in imports of The Gambia. Exchange rate Granger causes growth in the Gambia. These provide evidence that imports is a source of economic growth in The Gambia. Overall import and exchange rate have a positive effect on growth. |

Licensed: |

|

Keywords: |

|

|

|

| (* Corresponding Author) |

Funding: This study received no specific financial support. |

Competing Interests:The authors declare that they have no competing interests. |

1. Introduction

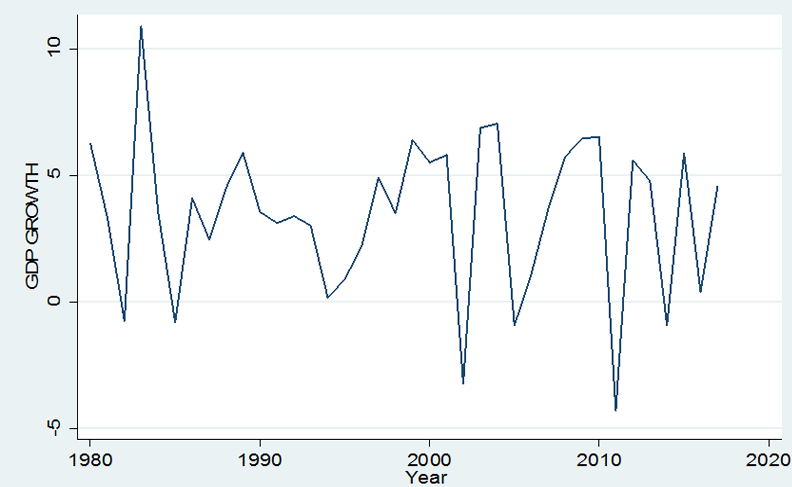

The Gambia is situated at the extreme end of West Africa, surrounded by Senegal on three sides (north, south and east) whiles on the west side by the Atlantic Ocean. The country is strategically located which makes it easily accessible and therefore can serve as a well-positioned trading route to Europe, America, and Asia. The Gambia is one of the smallest economies in Africa, with an average Gross Domestic Product (GDP) growth rate of 3 to 5% annually, the country is one of the poorest countries in mainland Africa. Heavily rely on tourism, remittances and rain-fed agriculture which make the country prone to external shocks. According to the Gambia Bureau of Statistics (GBoS) population and housing census 2013 report, the population of The Gambia is estimated at 1.8 million with an average of 3.3% per annual, thus making the country populous because of its meager resources. Given its current relative political stability following the political impasse that occurred after the elections of December of 2016, the country now enjoys numerous opportunities to capitalize from and spur growth and development given the “goodwill” The Gambia relish of recent times.

In the 3rd quarter of 2017, The Gambian economy slightly recovered, following years of sluggish performance as a result of internal factors such as poor governance, fiscal indiscipline, and external shock such as the recent Ebola outbreak in West Africa in 2015. The Ebola outbreak affected the country’s tourism sector which is a key driver of the economy. The recovery in 2017 was driven mainly by the services sector which saw an increased arrival of tourist during the 3rd quarter of 2017. However, the agricultural sector performance was less impressive due to the poor rainfall experienced that year, noting that the country heavily depends on rain-fed agriculture. In 2017, fiscal discipline and donor support reduced the nation’s fiscal deficit from 6.5% of GDP in 2016 to 5.4% of GDP in 2017. As a result, domestic net borrowing improved from 8.4% of GDP in 2016 to -.05% in 20171 .

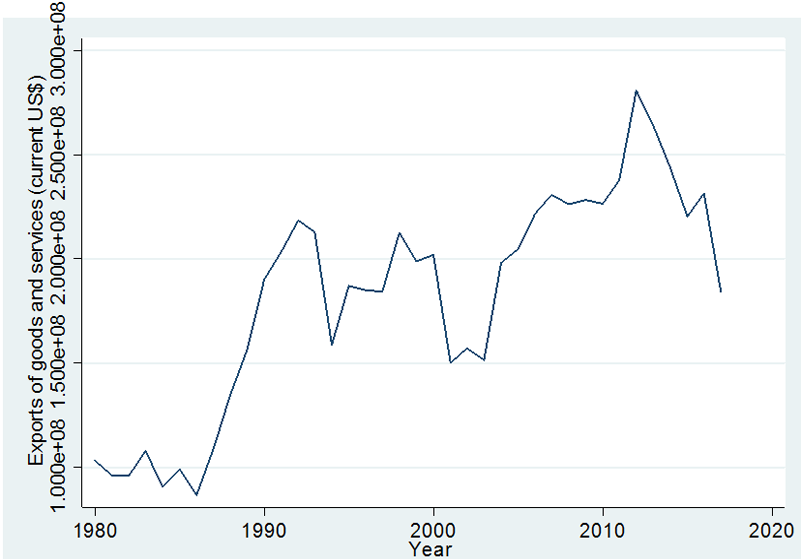

In 2018, inflation decreased to an estimated 6.2% from 8% in 2017. Gross international reserves increased to 3.1 months of import cover in 2018 from 2.9 months of import cover in 2017. This position was attained due to support and increased financial assistance from development partners and the international community. The country’s current account deficit remains high, estimated at 19% of GDP in 2018, which is a slight improvement from 2017. For the first half of 2018, total imports rose by 9.2% compared with the first half of 2017, while total exports increased by 8.5% to $54.9 million. The export basket contains mainly primary commodities, including groundnuts (55.6%), fish and fishery products (21.6%), and cashew nuts (10.6%). Short-term economic prospects are expected to steadily improve over the medium term. Real GDP is projected to grow by 5.4% in 2019 and by 5.2% in 20202 . Whiles, there is some progress made towards economic recovery and growth, but there is still much to be done, due to the country’s high-level poverty rate and meager resources.

The aim of this paper, therefore, is to investigate the relationship between imports, exports and economic growth of The Gambia, using yearly data for the period 1980-2017. It intends to answer the following questions: Does exports lead economic growth; does imports lead economic growth; or does economic growth lead to exports and imports.

2. Literature Review

2.1. Theoretical Review

The theory of Mercantilism holds that a country should encourage export and discourage import. It stated that a country’s wealth depends on the balance of export minus import. According to the theory, the government should play an important role in the economy by encouraging export and discouraging import by using subsidises and taxes, respectively. In those days, gold was used for trading goods between countries. Thus export was treated as “good” as it helps in earning gold whereas, import was treated as “bad” as it led to the outflow of gold. This is why mercantilism was called zero-sum game as only one player benefited from it.

The theory of Absolute Advantage given in 1776 by Adam Smith the father of economic criticised the mercantilist theory. He stated that under mercantilism, it was impossible for nations to become rich simultaneously. He also stated that wealth of countries does not depend upon gold reserves, but upon goods and services available to their citizens. He also stated that trade would be beneficial if country A exports goods it can produce at a lower cost than country B and import goods which country B can produce at a lower cost than it.

Theory of Comparative Advantage given by David Ricardo stated that a nation like a person, gains from trade by exporting the goods or services in which it has its greatest comparative advantage in productivity and importing those in which it has the least comparative advantage.

Many theories, also state the importance of export in an economy. Exports help a country to gain hard currency to import commodities manufactured more cheaply elsewhere. The recent mathematical study showed that export-led growth is where wage growth is repressed and linked to productivity growth of non-tradable goods in a country with undervalue currency.

Export-led growth is important for two main reasons, the first is that export-led growth improves the country’s foreign currency reserves, as well as surpassed their debt as long as the facilities and materials for exports exist. The second is that increased export growth can trigger greater productivity, thus creating even more exports in a positive upward spiral cycle.

2.2. Empirical Review

Chemeda (2001) Study The Role Of Export On Economic Growth with Reference to Ethiopian Country. The result of the finding supports the idea that the rate of growth of real export has a positive effect on the rate of economic growth in the context of the Ethiopian economy. Even a strong positive relationship exists between real export and real growth domestic product per capita long run rather than in the short run when it is compared real exports and that of (I/Y). He concluded that the contribution of real export to economic growth in the context of Ethiopian economic is greater in the long run than in the short run.

Bouoiyour (2003) involved cointegration and Granger-causality tests to examine the relationship between trade and economic growth in Morocco over the period 1960-2000 using the VEC model. The empirical results of the study indicate that both exports and imports enter with positive signs in the cointegration equation. Also the results show that imports and exports Granger caused GDP and imports Granger caused exports.

Aisha, Abu-Salah, Darwis, and Abdul Majid (2009) Study the Role of Exports, Inflation and Investment on Economic Growth in Pakistan the results revealed that exports and investment both have a significant positive impact on economic growth. However, inflation has a significant negative impact on economic growth in the short-run. In the long-run, if there is one percent increase in the total investment, economic growth increases by almost 0.179 percentage, while inflation has a negative impact on economic growth by almost 0.032 percentage. This analysis demonstrates that, in the long-run, exports led growth hypothesis does not hold in Pakistan, as exports are reported as an insignificant factor to advance economic growth. The ECM results indicate the convergence of the model and it’s implying that about 68% adjustments take place every year.

Ewetan and Okodua (2010) Study the Econometric Analysis of Exports and Economic Growth in Nigeria the estimation results obtained from the co-integration test and Granger Causality test within the framework of a VAR model did not support the Export-Led Growth hypothesis for Nigeria. The paper concludes that the government must diversify the product base of the economy, promote non-oil exports, and build up an efficient service infrastructure to drive private domestic and foreign investment.

Care (2011) the Role of Exports in African Economic Development: A Comparative Study of Mauritius and Tunisia. Using the Granger causality approach, they find strong evidence for export-led growth in Mauritius, but no significant evidence of any causal relationship in Tunisia. On the basis of a broader analysis they argue that exports were still important in both countries, but appear to have been more central to the growth process in Mauritius. This broader analysis also highlights that other factors – such as a strong institutional environment – were important in facilitating or directly contributing to such consistent growth.

Fullerton, Kababie, and Boehmer (2012) investigated the nexus between exports, imports and economic growth in Mexico for the period 1980 – 2007, by using causality test and vector error correction methods, show that imports play a more critical role than exports do for economic growth in Mexico.

Gibba (2012) studied exports as a determinant of economic growth in the Gambia. According to the empirical results, the R-squared is found to be 63.49%. This statistically implies that The Gambia’s economic growth (GDP) can be explained by its total export at a rate of 63.49%, showing that total export growth is a good determinant of economic growth. The main conclusion that can be drawn from the ECM is the negative relationship between GDP and exports from 2003 to 2010. The reasons for the negative relationship were domestic and international, social and economic changes, which includes the fiscal deficit trends. Thus, it is a signal that more efforts are needed for the revitalization of the export industry policy target.

Shihab and Soufan (2014) Study The Causal Relationship between Exports and Economic Growth in Jordan. The study found that there is a causal relationship going from the economic growth to Export, and not vice versa. Based on the outcome of causality tests, the changes in the economic growth help explain the changes that occur in the Export.

Mayasa, Burhan, and Stabua (2014) analyze the effect of trade liberalization on economic growth in Tanzania. The empirical findings indicated that trade openness had a positive and significant effect on economic growth in Tanzania.

Chigamba and Mudenda (2014) study the Role of Export Diversification on Economic Growth in South Africa Results of the study reveal that export diversification and trade openness are positively related to economic growth while real effective exchange rate, capital formation and human capital have negative long-run relationships with economic growth. The study recommends the continual implementation of trade liberalisation by the South African government. The South African government is also encouraged to promote the production of a diversified export basket through subsidisation and promotion of innovation and production of new products.

Andrews (2015) examined the relationship between export, import and GDP for Liberia, using historical data from 1970 to 2011. The study confirmed the existence of bidirectional causation between GDP and imports and uni-directional causation between exports and GDP and exports and imports. The results showed that Liberia is not driven by exports alone but rather a mixture of exports and imports, with the latter having a long-run impact.

Saaed and Hussain (2015) found unidirectional causality between exports and imports and between exports and economic growth in Tunisia for the period from 1977 to 2012. According to them growth in Tunisia was propelled by a growth -led import strategy. Imports are thus seen as the source of economic growth in Tunisia.

Masoud and Suleiman (2016) investigated the nexus between exports, imports and economic growth in Malaysia, using annual data for the period 1967- 2010. Cointegration analysis, VAR and Granger causality tests were employed in the empirical analysis. The results show that there is a causal relationship from exports to economic growth and from exports to imports.

Jelilov, Abdulrahman, and Isik (2016) study the impact of tax reforms on the economic growth of Nigeria. The result shows that export is positively and significantly related to economic growth and that Export indeed causes economic growth.

Ali, Ali, and Dalmar (2017) studied the impact of Imports and Exports Performance on the Economic Growth of Somalia. By using Augmented Dickey-Fuller (ADF) and Phillip-Peron (PP) stationarity test, the variables proved to be integrated of the order one 1(1) at first difference. Johansen test of co-integration was used to determine if there is a long run association in the variables. To determine the direction of causality among the variables, both in the long and short run, the Pair-wise Granger Causality test was carried out. It was found that economic growth does not Granger Cause Export but was found that export Granger Cause GDP. So this implies that there is unidirectional causality between exports and economic growth. Also, there is a bi-directional Granger Causality between import and export. The results show that economic growth in Somalia requires an export-led growth strategy, as well as export led import. Imports and exports are thus seen as the source of economic growth in Somalia.

Study Impact of Exports and Imports on Economic Growth: New Evidence from Panama. According to the result of the analysis, it was determined that there is no relationship between exports, imports and economic growth in Panama. On the other hand, we found that there is strong evidence of bidirectional causality from imports to economic growth and from exports to economic growth. These results provide evidence that exports and imports, thus, are seen as the source of economic growth in Panama.

Kılavuz and Topcu (2012) studied Export and Economic Growth in the Case of the Manufacturing Industry. According to the results of the first model, the analysis of which included variables such as high and low-tech manufacturing industry exports, investment and population, it was found that only two variables, high-tech manufacturing industry export and investment, have a positive and significant effect on growth. In addition to the first model which included the analysis of all variables, the second model investigated the effect of high and low-tech manufacturing industry imports on growth. The findings revealed that only high-tech manufacturing industry export, investment and low-tech manufacturing industry import have a positive and significant effect on growth.

3. Methodology

3.1 Data

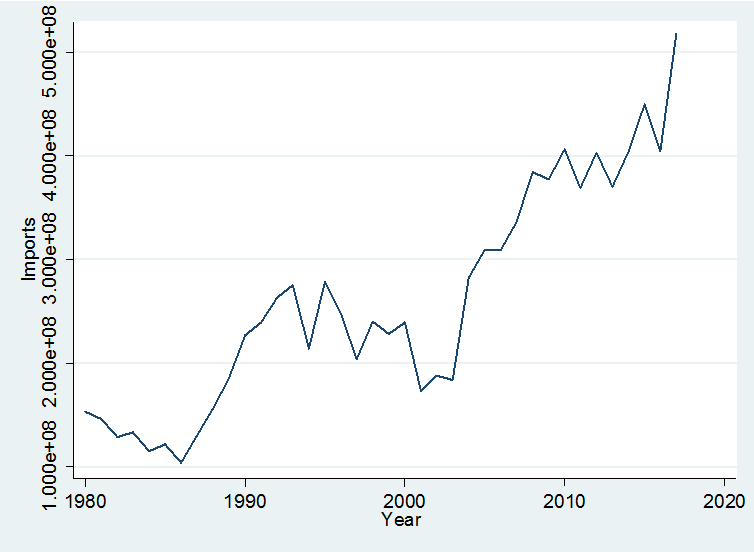

The data generated for this paper was generated from WDI. The periods covered from 1980 to 2017. The variables study are; Growth rate, export, import and exchange rate (proxy real effective exchange rate). We used growth rate the dependent variable and export, import and exchange rate as the independent variables.

3.2 Economic Model

Where

GDP= Gross Domestic product

F = Function of

EX = Exports

IM = Imports

RX = Exchange Rate

![]() = Error Term

= Error Term

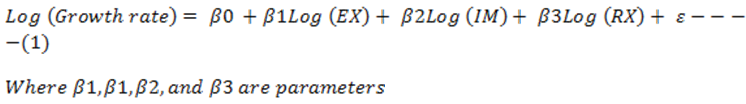

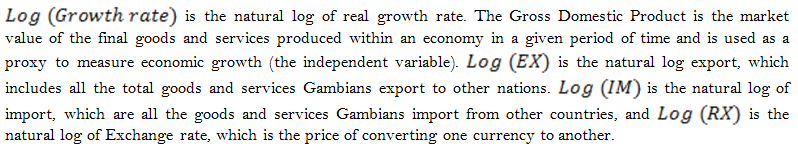

3.3 Econometric Model

We adopted Granger causality test analysis proposed by British econometrician Sir Clive William John Granger in 1969. Which investigate the causal relationship between X-granger –causes time series Y. Meaning that pattern in X for time line (graph of time series) commands are approximately repeated in Y after time lag. The past value of independent variable(s) X can predict the future values of the dependent variable Y.

The idea behind Granger causality test is that a variable X Granger-causes Y if Y can be a better predicted using the historic trend of both X and Y, than it can be predicted using the history of Y alone. For instance, in G Granger sense export, import and exchange rate are the causes of growth rate if it is useful in predicting the growth rate.

There are three main cases in which Granger causality test can be applied:

- In a simple Granger causality test there are two variables and their lags.

- In a multivariate case Granger-causality test more than two variables are identified, more than a variable can influence the other variable(s) in the study.

- The Granger-causality test can also be tested by VAR (Vector Autoregressive). In this case, all variables are included for the test of simultaneity.

A simple Granger causality testing involving variables such as GR (Growth rate, EX (Export), IM (Import) and REER (Exchange rate) is specified below:

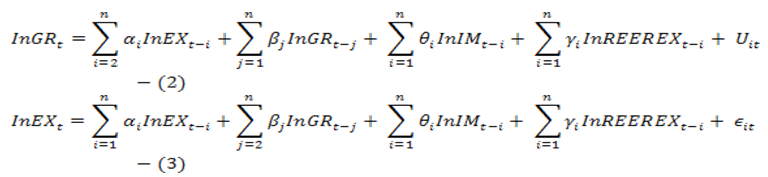

3.4. Hypothesis Testing

Note: We also applied natural logarithm for the hypothesis testing so as to be consistent with the results of our analysis.

4. Results

The data for this paper was generated from WDI for the periods 1980 to 2017. The dependent variable is the natural logarithm of growth rate of GDP and the independent variables are natural logarithm of exports, natural logarithm of imports and natural logarithm of real effective exchange rate.

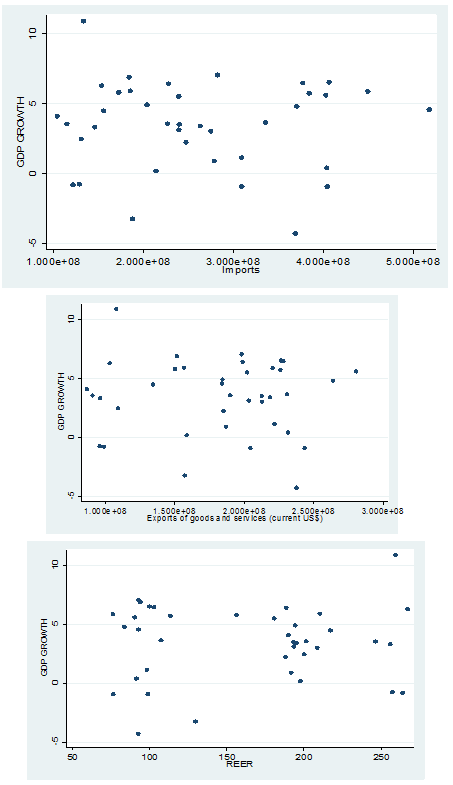

Table 1 below shows the descriptive statistics for the variables used in the study. The dependent variable is the GDP growth and the independent variables are imports, exports and exchange rate. The exchange rate has the highest mean and it is also associated with the highest variance.

| Variables | Observation |

Mean |

Standard deviation |

| GDPGROWTH | 38 |

3.445974 |

3.151114 |

| Imports | 38 |

2.61e+08 |

1.08e+08 |

| Exports | 38 |

1.81e+08 |

5.32e+07 |

| Exchange Rate | 38 |

163.0828 |

63.0547 |

Source: Authors’ computation by using Stata. |

4.1. Interpretation of results

4.1.1. Test of Correlation

The correlation matrix is used to determine the relationship between two variables see Table 2 below. The Pearson correlation coefficient is used to represent this relationship which ranges from -1.00 to +1.00. The results of the test of correlation show the relationship between the exports and GDP growth rate is negative (a correlation coefficient of -0.0349). Thus, if exports increase by 1%, growth rate of GDP decreases by 0.0349%.

| Variable | Log (GDP Growth Rate) |

Log (Import) |

Log (Export) |

Log (Exchange rate) |

| Log (GDP Growth Rate) | 1.00000 |

-0.0246 |

-0.0349 |

0.0663 |

| Log (Import) | -0.0246 |

1.0000 |

0.8384 |

-0.8202 |

| Log (Export) | -0.0349 |

0.8384 |

1.0000 |

-0.7593 |

| Log (Exchange Rate) | 0.0663 |

-0.8202 |

-0.7593 |

1.0000 |

Source: Authors’ computation by using Stata. |

The growth rate of GDP and the independent variable (imports) are negatively correlated with a correlation coefficient of -0.0246. Therefore, if imports increase by 1%, the growth rate of gross domestic product (GDP) decreases by 0.0246%. Finally, exchange rate is positively correlated with GDP growth rate (a correlation coefficient of 0.0663). Hence if exchange rate increases by 1%, the growth rate of gross domestic product (GDP) increases by 0.0663%.

4.1.2. Granger Causality Test

The objective of applying the Granger Causality Test is to verify whether there is a causal relationship between the different variables in our empirical investigation. The causality test indicates that exports and imports influence the GDP or GDP influences exports and exports or there is no causal relationship among GDP growth rate, exports and imports. The results are shown in Table 3 below:

Equation |

Excluded |

Direction |

P-Value |

lnGR |

lnEX |

Not Granger/Indirect |

0.111 |

lnGR |

lnIM |

Granger/Direct |

0.055** |

lnGR |

lnEXA |

Direct |

0.099** |

lnEX |

lnGR |

Indirect |

0.367 |

lnEX |

lnIM |

Direct |

0.016*** |

lnEX |

lnEXA |

Direct |

0.003*** |

lnIM |

lnGR |

Direct |

0.006*** |

lnIM |

lnEX |

Indirect |

0.148 |

lnIM |

lnEXA |

Direct |

0.000*** |

Note: * p=0.10, ** p=0.05, *** p=0.01. |

Growth rate of GDP does not Granger cause exports in The Gambia and vice versa. That means according to our results generated export does not Granger cause growth rate of GDP in The Gambia and vice versa. We failed to reject the null hypothesis that export does not Granger cause growth rate of GDP. Hence there is no causality relationship between rate of growth of GDP and exports in The Gambia. This is true because the country is heavily indebted and debt is increased through imports.

For import, import Granger cause growth rate of GDP. This relationship is direct between import and growth rate of GDP. Growth rate of GDP Granger causes imports). This relationship is direct between import and growth rate of GDP. The results show that there is bi-directional causality between growth rate of GDP and import. The Gambian economy is an import-dependent economy and hence import is the key driver of Gambian economy. This is consistent with the Gambian experience. In The Gambia, imports are the key driver of the economy not export as the case may be in most developing countries.

Imports granger causes exports and is significant at 5%. Exports do not Granger cause imports. .Since Gambia is an import dependent economy, imports has a positive effect on exports. Most of the exports depend on imported inputs.

The exchange rate between a country and the rest of the world can Granger causes growth rate of GDP in The Gambia at 5% level. As lags increases to three none of these variables will be statistically significant to growth in The Gambia.

Furthermore, the exchange rates move in different direction with imports and exports and have a positive effect on growth in The Gambia. The exports and imports move indirectly with growth in The Gambia. Overall exchange rate variable Granger causes import to rise in The Gambia according to our results.

5. Conclusion and Recommendation

The variables import and real effect exchange rate (proxy for exchange rate) Granger cause the growth rate to rise in the Gambia. The positive direction between growth and import is due to The Gambia’s dependence on the importation of goods and services. That is why the country is an import based economy. Import is the key driver of the economy of The Gambia as opposed to most developed nations where exports are key economic drivers. Exports do not Ganger causes growth to rise in The Gambia. Likewise exchange rate has a positive effect on growth (exchange rate granger causes the rate of growth of GDP).

We hereby proffer 5 policy recommendations to improve The Gambia’s export and spur economic growth:

- Provide attractive incentives such as tax breaks, subsidies etc. for the productive base of the economy to encourage increase productivity and exports

- Streamline and simplify regulations in agriculture, fisheries and forestry sectors to boost exports

- Encourage creditors and banks to fund and support Micro Small and Medium Enterprises (MSME) that are engaged in export and re-export trade

- Reduce the cost of energy, which is a major production cost so the Gambia products/exports will be competitive internationally

- Encourage producers to engage in value-added activities for their output attracting competitive prices when products are exported.

References

Aisha, A., Abu-Salah, K., Darwis, Y., & Abdul Majid, A. (2009). Screening of antiangiogenic activity of some tropical plants by rat aorta ring assay. International Journal of Pharmacology, 5(6), 370-376.

Ali, A. A., Ali, Y. S. A., & Dalmar, M. S. (2017). The Impact of Imports and Exports Performance on the Economic Growth of Somalia. International Journal of Economics and Finance, 10(1), 110-119.

Andrews, A. P. (2015). Exports, imports, and economic growth in Liberia: Evidence from causality and cointegration analysis. Journal of Management Policy and Practice, 16(3), 95-109.

Bouoiyour, J. (2003). Trade and GDP growth in Morocco: Short-run or long-run causality? Brazilian Journal of Business and Economics, 3(2), 14-21.

Care, S. M. (2011). The role of exports in African economic development: A comparative study of mauritius and Tunisia.

Chemeda, F. E. (2001). The role of exports in economic growth with reference to Ethiopian country (No. 374-2016-19785).

Chigamba, C., & Mudenda, C. (2014). The role of export diversification on economic growth in South Africa. Mediterranean Journal of Social Sciences, 5(9), 705-712.

Ewetan, O., & Okodua, H. (2010). Econometric analysis of exports and economic growth in. Department of Economics and Development Studies Covenant University.

Fullerton, J. T. M., Kababie, K., & Boehmer, C. R. (2012). International trade and economic growth in Mexico. Empirical Economics Letters, 11(9), 869-876.

Gibba, J. M. (2012). A study on exports as a determinant of economic growth in the Gambia. Doctoral School of Management & Business Administration, Szent Istvan University, Godollo, Hungary.

Jelilov, G., Abdulrahman, S., & Isik, A. (2016). The impact of tax reforms and economic growth of Nigeria. Department of Economics, Nigerian Turkish Nile University Nigeria.

Kılavuz, E., & Topcu, B. A. (2012). Export and economic growth in the case of the manufacturing industry: Panel data analysis of developing countries. International Journal of Economics and Financial Issues, 2(2), 201-215.

Masoud, A. M., & Suleiman, N. N. (2016). The relationship among export, import, capital formation and economic growth in Malaysia. Journal of Global Economics, 4(2), 1000186.

Mayasa, M. H., Burhan, A. M., & Stabua, A. B. (2014). The impact of trade liberalization on economic growth in Tanzania. International Journal of Academic Research in Business and Social Sciences, 4(5), 514-532.

Saaed, A. A. J., & Hussain, M. A. (2015). Impact of exports and imports on economic growth: Evidence from Tunisia. Journal of Emerging Trends in Economics and Management Sciences, 6(1), 13-21.

Shihab, R. A., & Soufan, T. (2014). The causal relationship between exports and economic growth in Jordan. Global Journal of Management and Business Research: B Economics and Commerce, 14(3), 17-22.

Appendix

Figure-1. GDP Growth vs real Effective Exchange Rate.

Figure-2. Exports of Goods and Services over time.